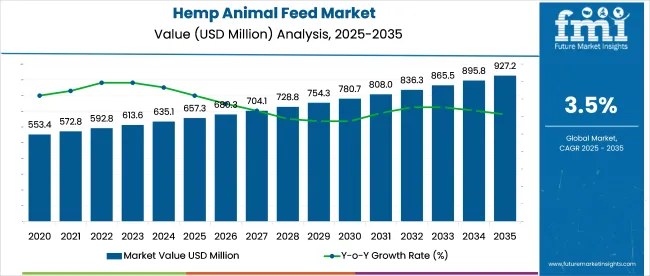

The global hemp animal feed market is projected to expand from USD 657. 3 million in 2025 to USD 927.2 million by 2035, growing at a CAGR of 3.5%. Growth is being shaped by increased use of hemp seed cake, high-fiber stalk meal, and cannabinoid-regulated biomass in ruminant and aquaculture diets.

| Metric | Value |

|---|---|

| Market Size in 2025 | USD 657. 3 million |

| Projected Market Size in 2035 | USD 927.2 million |

| CAGR (2025 to 2035) | 3.5% |

North American suppliers are scaling co-product processing, while European buyers demand strict traceability and residue compliance. Inclusion rates of 10-18% in cattle feed trials have shown improved digestibility and omega profile. Challenges remain around THC thresholds, inconsistent supply chains, and lack of pelleting infrastructure for mass-market integration.

In September 2024, growing interest in hemp as a livestock feed ingredient was accompanied by mounting regulatory caution, particularly around the use of cannabidiol (CBD). “What we have seen is the early indications of liver toxicity there are also data related to reproductive toxicity for males that comes from a rat study in which the male offspring of rats that were given amounts of CBD have significantly decreased testicular sizes and function,” said Norman Birenbaum, Senior Public Health Advisor at the FDA’s Center for Drug Evaluation and Research, during the National Association of State Departments of Agriculture annual meeting.

The hemp animal feed market, valued under 250 million in 2025, remains a minor yet growing part of broader feed sectors. In the global animal feed market, its share is just 0.04-0.05%, limited by regulation and supply issues. Within plant-based feed, hemp contributes 0.6-0.8%, while in functional feed, its share is 0.5-0.7%, tied to digestive and anti-inflammatory benefits.

Hempseed cake holds 1.5-2% of the oilseed meal market. In the natural and organic feed segment, hemp accounts for 2-3%, driven by its traceability, non-GMO appeal, and nutritional profile, especially in poultry, aquafeed, and small livestock applications.

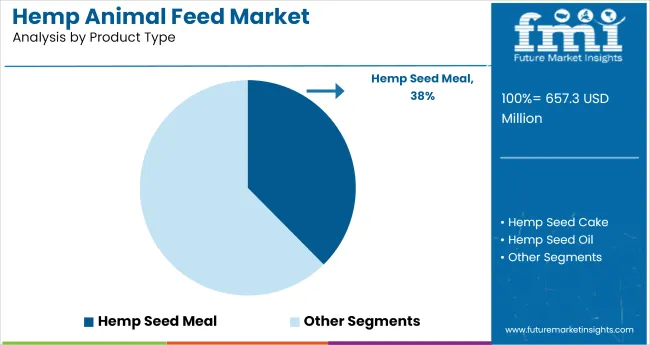

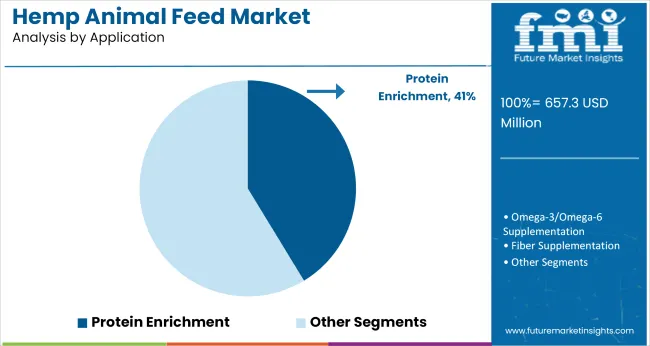

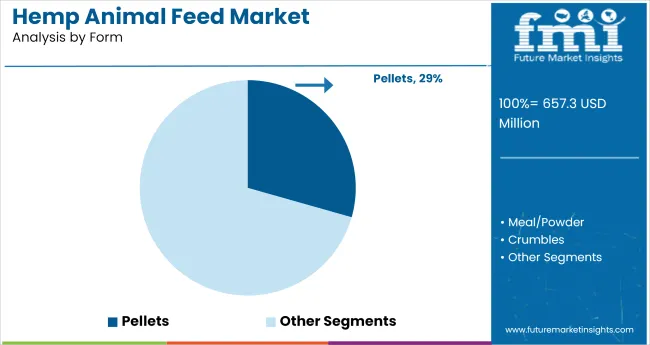

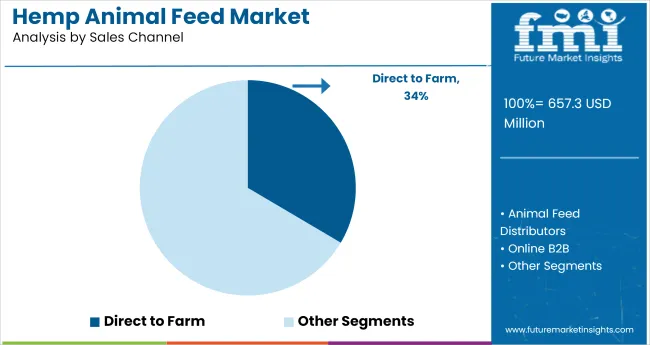

The hemp animal feed market is led by hemp seed meal under product type with a 38% share. Ruminants (cattle, sheep, goats) dominate livestock consumption with a 32.8% share. Protein enrichment leads functional applications at 41% share. Pellets account for 29% share in form-based demand. Direct-to-farm channels contribute 34% share of sales.

Non-GMO certified hemp feed holds a 29.2% share, while commercial livestock farms represent the largest end-use category with a 35.7% share. Strongest regional demand is noted across North America, Western Europe, and South Asia & Pacific.

Hemp seed meal held a 38% share of the hemp animal feed market in 2025. This cold-pressed byproduct, sourced after oil extraction, has been favored for its high protein concentration, residual essential fatty acids, and digestibility. It is commonly integrated into dairy, poultry, and goat feed rations.

Countries like Canada, Poland, and India have expanded domestic production of hemp meal for contract feed mills. Its amino acid profile supports lean growth, while its fiber assists gut function. Demand has grown in compound feed systems for ruminants and poultry where consistency and oil retention are prioritized over raw seed inclusion.

Ruminants accounted for a 32.8% share of total hemp feed consumption in 2025. Hemp-based feed is used in TMR systems, silage supplementation, and grain-based blends. Its lignin and fiber structure promotes rumen activity, while residual oil enhances milk fat content.

Major dairy and goat producers in France, New Zealand, and the USA have incorporated hemp as a functional fiber and energy additive. Feed trials across Europe have shown better feed efficiency and output consistency, especially in meat goat and organic dairy sectors. Hemp’s integration has aligned with the shift toward non-pharmaceutical gut modulation across small and large-scale ruminant farms.

Protein enrichment led the functional claims category with a 41% share in 2025. Hemp’s high lysine and methionine content, coupled with digestibility, made it ideal for piglets, calves, and poultry. Feed manufacturers have used hemp protein as an alternative to soy and fish meal in growth-stage diets.

Results from trials in Vietnam and the Netherlands reported improved weight gain and intestinal development. The protein component has also shown compatibility with mineral premixes and probiotic additives. Preference for hemp as a clean-label protein source has grown across commercial livestock farms focused on reducing metabolic waste and improving nitrogen efficiency.

Pelletized hemp feed accounted for a 29% share of total volume in 2025. Pellets offer enhanced stability, long storage life, and ease of dosing in automated feeding systems. The low-heat process used in pelletization retains bioactive oil fractions and protein integrity. Pellets are particularly favored in coastal and humid regions where moisture control is a concern.

Australia, Germany, and the USA have seen rising demand for pellet lines tailored by species and age group. Feed manufacturers have used this format to improve logistical efficiency, ensure formulation accuracy, and reduce product loss during transport and bulk storage.

Direct-to-farm supply routes commanded a 34% share in 2025, as livestock operators prioritized flexibility, traceability, and cost control. This model allowed hemp processors to bypass traditional distribution chains and work directly with farmers to optimize feed rations by lifecycle and forage profile. Regional suppliers in the USA, Brazil, and Ukraine have used subscription logistics to supply hemp mash, pellets, and meal in bulk.

The channel has also enabled on-site feed formulation adjustments and real-time feedback loops. Farmer cooperatives and contract producers have especially embraced direct procurement models for consistent quality and custom feed application.

Non-GMO certified hemp feed held a 29.2% share of the market in 2025. With increased attention to feed traceability and compliance in Western Europe and North America, non-GMO certification has become a standard among large livestock producers. Hemp processors in Austria, Canada, and South Korea have invested in verification systems and third-party lab testing to meet feed and meat labeling requirements.

These products are particularly in demand by meat and dairy suppliers serving non-GMO and antibiotic-free market segments. Regulatory pressure and buyer preferences are expected to further increase adoption of verified hemp inputs in export-led livestock supply chains.

Commercial livestock farms held a 35.7% share in 2025, driven by the integration of hemp feed into controlled, high-throughput animal rearing systems. These farms use standardized rations, and hemp’s inclusion has improved feed conversion ratios (FCR), gut resilience, and protein absorption. Producers in the USA, China, and Chile have piloted hemp formulations in beef, poultry, and aquaculture settings.

Trials have shown strong compatibility with antibiotic-free and export-compliant production strategies. Hemp’s consistent nutrient profile and fiber content make it suitable for integration into proprietary feed formulas managed at scale with minimal formulation volatility.

The hemp-based animal feed industry is experiencing rapid expansion. Growth is supported by the nutritional density of hemp inputs and growing interest in alternative, functional ingredients across livestock, aquaculture, and companion animals. Still, uncertainties around THC thresholds, inconsistent biomass processing, and regional regulatory delays continue to pose structural barriers.

Nutritional Advantages Driving Adoption in Feed Applications

Hemp seed meal, oil, and residual biomass are being explored for their high protein content, omega fatty acid ratios, and anti-inflammatory bioactives. These feed components have shown potential to enhance animal health, product quality, and feed conversion metrics, especially in ruminants, poultry, and aquaculture sectors. Their integration into premium pet foods and livestock diets is expanding in North America and Europe.

Regulatory & Supply Chain Constraints Limiting Penetration

Despite performance advantages, widespread use is constrained by lack of standardized approvals across species and jurisdictions. THC carryover risks and residue testing thresholds have slowed adoption in food-producing animals. Many producers lack infrastructure for microbial stabilization and traceability, limiting global scalability. USA approvals for food animals only progressed post-2021, with other regions lagging behind.

| Countries | CAGR (2025 to 2035) |

|---|---|

| India | 5.8% |

| Germany | 5.3% |

| China | 4.9% |

| United Kingdom | 4.6% |

| South Korea | 4.4% |

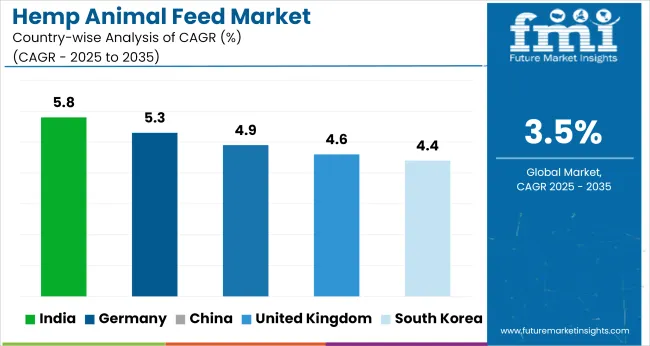

The global hemp animal feed market is projected to grow at a 3.5% CAGR from 2025 to 2035. The report covers detailed analysis of 40+ countries, with the top five shared as a reference. India, a BRICS member, leads with 5.8% growth, driven by expanded hemp seed cake processing and regulatory easing in livestock feed trials.

Germany and the United Kingdom, both OECD countries, follow at 5.3% and 4.6% respectively, supported by traceability-led formulations and regional protein substitution goals. China, also part of BRICS, records 4.9% as feed-grade hemp fiber is scaled in aquaculture applications.

South Korea posts 4.4%, with controlled THC-certified hemp biomass gaining traction in pet and poultry diets. All five countries exceed the global average, signaling accelerated adoption across both emerging and developed economies.

The hemp animal feed market in India is projected to expand at a CAGR of 5.8% between 2025 and 2035. Between 2020 and 2024, hemp-based nutrition remained largely absent from commercial feed due to legal ambiguity and low-volume production. After hemp cultivation frameworks were introduced in Uttarakhand and Himachal Pradesh, the sector opened to structured pilot programs.

From 2025, dairy cooperatives and feed mills began adopting hempseed meal and fiber for cattle and poultry rations. Performance benefits such as improved protein absorption and omega-3 content led to trial-based expansion. Feed integration gained further ground with new licensing formats supporting controlled processing. Nutritional validation reports have accelerated procurement from regulated hemp growers.

The hemp animal feed market in Germany is projected to expand at a CAGR of 5.3% between 2025 and 2035. From 2020 to 2024, adoption was restricted to boutique organic farms and pet nutrition brands experimenting with hemp protein for gut and joint health. After regulatory approvals in 2025 expanded permissible hemp feed derivatives, feed manufacturers began large-scale formulation trials.

Use of dehulled hempseed cake gained popularity in monogastric livestock, supported by favorable EU digestibility metrics. Strategic partnerships formed between hemp cooperatives and compound feed producers enabled steady raw material access. Germany’s emphasis on feed traceability and clean-label inputs pushed demand for certified hemp inclusion.

Demand for hemp animal feed in China is forecast to expand at a CAGR of 4.9% through 2035. From 2020 to 2024, market development was slow due to fragmented policy and minimal local processing. Between 2025 and 2035, provinces such as Heilongjiang and Yunnan have been approved for industrial hemp use in livestock rations.

Feed firms began integrating hempseed protein in aquaculture and poultry applications after functional data validated omega fatty acid profiles and amino acid content. Collaboration between domestic agritech firms and veterinary nutrition labs has enabled hemp-based formulations in antibiotic-reduced diets. Government endorsements and feed safety certifications have accelerated domestic product clearance.

Sales of hemp animal feed in the United Kingdom are projected to witness a CAGR of 4.6% through 2035. Between 2020 and 2024, usage remained marginal, tied to artisanal sheep farms and natural pet food labels. After 2025, demand shifted as feed suppliers began replacing soy and flax inputs with hemp protein meal in ruminant and poultry mixes.

Regulatory adjustments facilitated local cultivation in Scotland and Wales, enhancing traceable raw material pipelines. Product claims focused on digestibility and fiber content gained traction in supermarket-aligned meat and dairy supply chains. Branded feed offerings targeting gut health and feed efficiency helped scale volumes within cooperatives and retail-aligned producers.

Demand for hemp animal feed in South Korea is forecast to expand at a CAGR of 4.4% through 2035. From 2020 to 2024, legal prohibitions and supply limitations kept hemp-based ingredients out of commercial feed. Post-2025, with government pilot schemes in Jeju and North Chungcheong, licensed processors began supplying hemp hulls and seedcake to native cattle and poultry feed trials.

Inclusion was driven by growing interest in high-fiber and antioxidant-rich ingredients within functional livestock nutrition. Smart farms using precision feed systems helped validate performance metrics in growth and immunity outcomes.

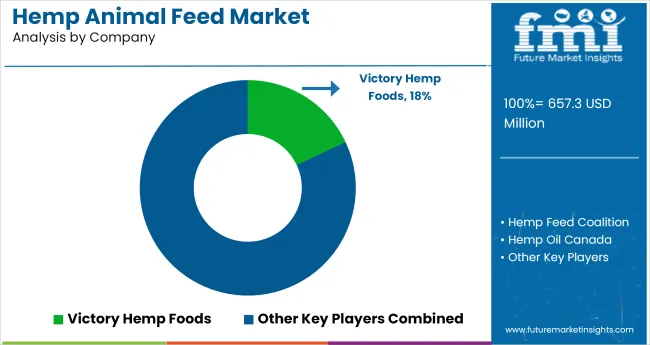

The hemp animal feed market is structured around vertically integrated producers, consortium-led advocacy, and a few multinational-backed processors. The Hemp Feed Coalition operates as both a regulatory body and an industry alliance, driving legal approvals, feed safety standards, and inter-supplier collaboration across North America and Europe.

Victory Hemp Foods (USA) leads in hemp protein concentrate formulations for ruminant and poultry feed, leveraging domestic processing capacity and supply agreements. Hemp Oil Canada, under Unilever’s Fresh Hemp Foods Ltd., focuses on compliant hempseed cake and oil for feed blends, with distribution linked to legacy natural food networks.

Blue Sky Hemp Ventures (Canada) combines whole-plant utilization with carbon-focused traceability models in cattle and poultry segments. Z-Company (Netherlands) supplies organic-certified hemp feed ingredients across the EU, often through private-label and bulk foodservice contracts.

Leading Company - Victory Hemp FoodsMarket Share - 18%

Recent Industry News

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 657.3 million |

| Projected Market Size (2035) | USD 927.2 million |

| CAGR (2025 to 2035) | 3.5% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD million for value and thousand metric tons for volume |

| Product Types Analyzed (Segment 1) | Hemp Seed Meal, Hemp Seed Cake, Hemp Seed Oil, Hemp Hulls, Whole Hemp Seeds |

| Livestock Types Analyzed (Segment 2) | Ruminants (Cattle, Sheep, Goats), Poultry (Broilers, Layers, Turkeys), Swine, Equine, Aquaculture, Pets |

| Applications Analyzed (Segment 3) | Protein Enrichment, Omega-3/Omega-6 Supplementation, Fiber Supplementation, Anti-inflammatory Support, Gut Health, Skin & Coat Health (Pets) |

| Forms Analyzed (Segment 4) | Pellets, Meal/Powder, Crumbles, Oil, Blended Mixes (with other feed ingredients) |

| Sales Channels Analyzed (Segment 5) | Direct to Farm, Animal Feed Distributors, Online B2B, Retail (Pet Stores, Specialty Feed Shops) |

| Certifications/Claims Analyzed (Segment 6) | Non-GMO, Organic, Sustainable Sourcing, THC-Free (<0.3%), Cold-Pressed (for oils) |

| End Uses Analyzed (Segment 7) | Commercial Livestock Farms, Pet Food Manufacturers, Equine Nutrition, Aquafeed Producers, Specialty Animal Feed Brands |

| Regions Covered | North America, Latin America, Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Italy, Spain, China, India, Japan, South Korea, Australia, Brazil, Mexico, Argentina, Saudi Arabia, UAE, South Africa |

| Key Players | Hemp Feed Coalition, Victory Hemp Foods, Hemp Oil Canada (Fresh Hemp Foods Ltd.), Blue Sky Hemp Ventures, Z-Company |

| Additional Attributes | Dollar sales, share by product type and livestock segment, adoption of hemp meal and oil in equine and pet nutrition, non-GMO and THC-free compliance influencing buyer preference, growth in blended hemp feed mixes for aquaculture and ruminants |

This includes Hemp Seed Meal, Hemp Seed Cake, Hemp Seed Oil, Hemp Hulls, and Whole Hemp Seeds.

The segment covers Ruminants (Cattle, Sheep, Goats), Poultry (Broilers, Layers, Turkeys), Swine, Equine, Aquaculture, and Pets.

This segment includes Protein Enrichment, Omega-3/Omega-6 Supplementation, Fiber Supplementation, Anti-inflammatory Support, Gut Health, and Skin & Coat Health (Pets).

The segment is categorized into Pellets, Meal/Powder, Crumbles, Oil, and Blended Mixes (with other feed ingredients).

The industry is segmented into Direct to Farm, Animal Feed Distributors, Online B2B, and Retail (Pet Stores, Specialty Feed Shops).

This includes Non-GMO, Organic, Sustainable Sourcing, THC-Free (<0.3%), and Cold-Pressed (for oils).

This segment covers Commercial Livestock Farms, Pet Food Manufacturers, Equine Nutrition, Aquafeed Producers, and Specialty Animal Feed Brands.

The industry is projected to reach USD 657.3 million in 2025.

The industry is expected to grow at a CAGR of 3.5% from 2025 to 2035.

Hemp seed meal is expected to lead with a 38% share in 2025.

India is projected to register the highest CAGR of 5.8% from 2025 to 2035.

The industry is projected to reach USD 927.2 million by 2035.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Hemp-based Packaging Market Size and Share Forecast Outlook 2025 to 2035

Hemp Seed Oil Moisturizers Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Hemp Protein Skincare Market Size and Share Forecast Outlook 2025 to 2035

Hemp Oil Infused Skincare Market Size and Share Forecast Outlook 2025 to 2035

Hemp Seed Oil Market Trends - Growth, Demand & Forecast 2025 to 2035

Analysis and Growth Projections for Hempseed Milk Business

Hemp Milk Market Analysis by Variant, Type, End Use, and Sales Channel Through 2035

Industry Share Analysis for Hemp Fiber Producers

Hemp Protein Powder Market – Growth, Demand & Health Benefits

Hemp Paper Bag Market Trends & Industry Growth Forecast 2024-2034

Organic Hemp Market Size and Share Forecast Outlook 2025 to 2035

Demand for Hemp Seed Oil in EU Size and Share Forecast Outlook 2025 to 2035

Industrial Hemp Market

Animal External Fixation Market Size and Share Forecast Outlook 2025 to 2035

Animal Antibiotics and Antimicrobials Market Size and Share Forecast Outlook 2025 to 2035

Animal Auto-Immune Disease Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Animal Disinfectants Market Size and Share Forecast Outlook 2025 to 2035

Animal Health Software Market Size and Share Forecast Outlook 2025 to 2035

Animal Antimicrobials and Antibiotics Market Size and Share Forecast Outlook 2025 to 2035

Animal Sedative Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA