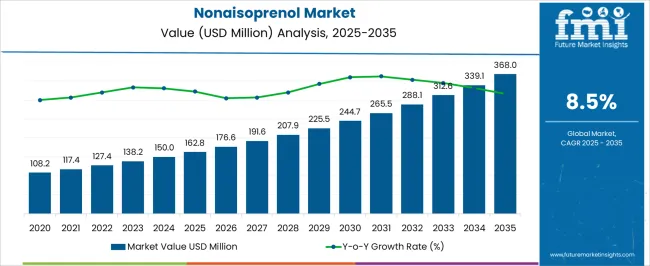

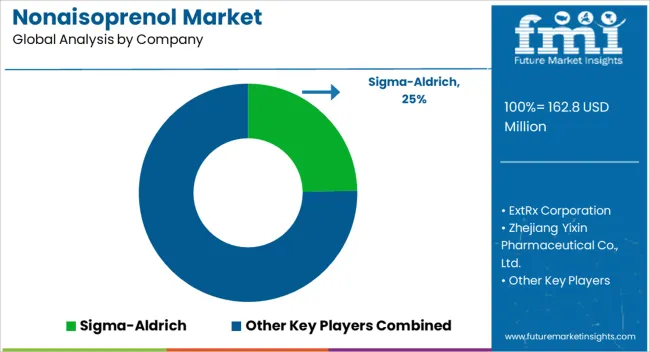

The Nonaisoprenol Market is estimated to be valued at USD 162.8 million in 2025 and is projected to reach USD 368.0 million by 2035, registering a compound annual growth rate (CAGR) of 8.5% over the forecast period.

| Metric | Value |

|---|---|

| Nonaisoprenol Market Estimated Value in (2025 E) | USD 162.8 million |

| Nonaisoprenol Market Forecast Value in (2035 F) | USD 368.0 million |

| Forecast CAGR (2025 to 2035) | 8.5% |

The Nonaisoprenol market is experiencing steady growth driven by its critical role as a key intermediate in the synthesis of high-value compounds, particularly in pharmaceutical and nutraceutical applications. The market is being influenced by increasing demand for health-promoting products, the expansion of the global pharmaceutical industry, and the growing emphasis on high-purity chemical intermediates. Production technologies have been enhanced to meet the rising need for consistent quality and scalable manufacturing, supporting long-term market expansion.

Furthermore, the adoption of Nonaisoprenol in bioactive compounds has been propelled by ongoing research and development efforts in the pharmaceutical sector, enhancing therapeutic efficacy and safety. The market is also benefiting from rising awareness among manufacturers regarding regulatory compliance and the importance of high-grade intermediates in drug synthesis.

As pharmaceutical innovation continues to accelerate, the demand for reliable, high-purity Nonaisoprenol is expected to rise, reinforcing the product’s significance in the global chemical and healthcare supply chain Continuous improvements in process optimization and purity control are anticipated to drive further growth in the coming decade.

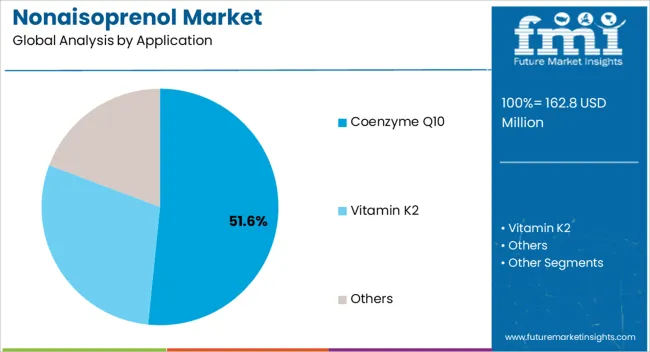

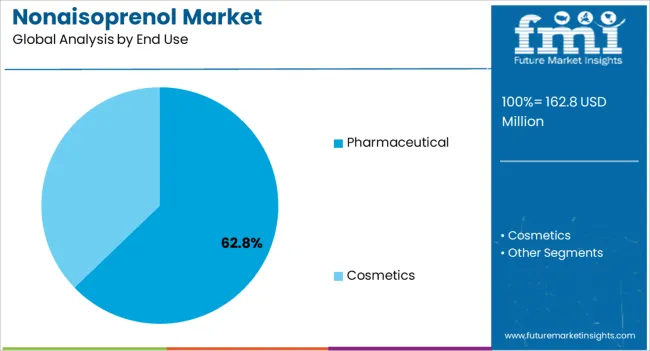

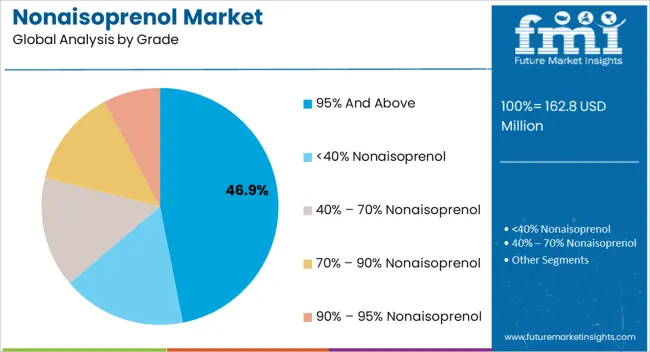

The nonaisoprenol market is segmented by application, end use, grade, and geographic regions. By application, nonaisoprenol market is divided into Coenzyme Q10, Vitamin K2, and Others. In terms of end use, nonaisoprenol market is classified into Pharmaceutical and Cosmetics. Based on grade, nonaisoprenol market is segmented into 95% And Above, <40% Nonaisoprenol, 40% – 70% Nonaisoprenol, 70% – 90% Nonaisoprenol, and 90% – 95% Nonaisoprenol. Regionally, the nonaisoprenol industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Coenzyme Q10 application segment is projected to hold 51.60% of the Nonaisoprenol market revenue share in 2025, making it the leading application. This dominance is being driven by the growing use of Coenzyme Q10 in pharmaceutical, nutraceutical, and dietary supplement products due to its well-recognized health benefits. The adoption of Nonaisoprenol in this segment has been supported by its role as a precursor in efficient and cost-effective synthesis processes.

Manufacturers are increasingly relying on high-quality intermediates to ensure product consistency and potency, which has reinforced the leading position of this application segment. Additionally, the rising consumer focus on preventive healthcare and the increasing prevalence of cardiovascular and metabolic disorders have further accelerated demand.

The scalability of production processes and the ability to meet stringent purity requirements have facilitated widespread deployment in the Coenzyme Q10 sector The combination of these factors has solidified the segment’s leadership, while ongoing advancements in pharmaceutical formulations are expected to sustain growth over the forecast period.

The pharmaceutical end-use industry is expected to account for 62.80% of the Nonaisoprenol market revenue share in 2025, positioning it as the largest end-use segment. This prominence is being driven by the growing requirement for high-purity intermediates in drug synthesis, including active pharmaceutical ingredients and specialty chemicals.

Nonaisoprenol is increasingly utilized in pharmaceutical processes due to its high reactivity, stability, and compatibility with diverse chemical reactions, making it a preferred choice for manufacturers seeking consistent quality. Demand has also been fueled by the expansion of the global pharmaceutical industry, particularly in regions emphasizing novel drug development and biosynthetic innovation.

Regulatory compliance and process validation have further reinforced reliance on high-grade Nonaisoprenol, as manufacturers aim to maintain product safety and efficacy The sustained focus on therapeutic innovation, increasing production volumes, and emphasis on process optimization are expected to support continued growth of the pharmaceutical end-use segment in the Nonaisoprenol market.

The 95% and above grade segment is projected to hold 46.90% of the Nonaisoprenol market revenue share in 2025, making it the leading grade segment. This leadership is being driven by the requirement for high-purity intermediates in sensitive applications, particularly in pharmaceuticals and nutraceuticals, where impurities can impact product efficacy and safety.

Manufacturers are increasingly prioritizing high-grade Nonaisoprenol to ensure consistent reaction outcomes and superior quality in end products. The segment’s growth has been supported by advancements in purification technologies and rigorous quality control measures, enabling the production of Nonaisoprenol at consistently high purity levels.

Additionally, the higher adoption of this grade in specialized applications, combined with strict regulatory and industry standards, has reinforced its market position As demand for reliable, high-purity intermediates continues to rise, the 95% and above grade segment is expected to maintain its leadership, supported by ongoing process improvements and growing awareness among manufacturers about the value of superior quality chemical intermediates.

Nonaisoprenol, also known as Solanesol, is a long-chain polyisoprenoid alcohol compound, which is soluble in organic compounds and insoluble in water. Nonaisoprenol is a natural product accumulated in solanaceous crops such as tomato, tobacco, eggplant, pepper plants and potato; however, it is widely extracted from tobacco leaves. Nonaisoprenol acts as a novel inhibitor in the phosphorylation of Focal Adhesion Kinase (FAK). It also inhibits AST, LDH, POR & MDA levels and increases GSH level in the human body. Nonaisoprenol is widely used as an intermediate for the synthesis of ubiquinone drugs such as Vitamin K2, Coenzyme Q10 and Vitamin E, among others.

Coenzyme Q10 is widely used in the treatment of heart diseases, ulcers and cancers. Nonaisoprenol is pegged to have great potential for growth as a drug in the coming years. Its properties such as antioxidant activity, anticancer, antifungal, antiviral, antimicrobial, anti-inflammatory and anti-ulcer activities, among others are expected to contribute towards its adoption in the pharmaceutical industry.

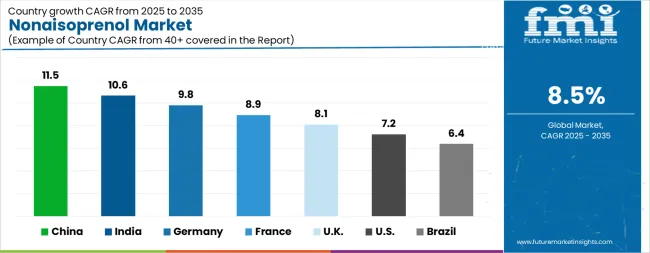

| Country | CAGR |

|---|---|

| China | 11.5% |

| India | 10.6% |

| Germany | 9.8% |

| France | 8.9% |

| UK | 8.1% |

| USA | 7.2% |

| Brazil | 6.4% |

The Nonaisoprenol Market is expected to register a CAGR of 8.5% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 11.5%, followed by India at 10.6%. Developed markets such as Germany, France, and the UkK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 6.4%, yet still underscores a broadly positive trajectory for the global Nonaisoprenol Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 9.8%. The USA Nonaisoprenol Market is estimated to be valued at USD 60.7 million in 2025 and is anticipated to reach a valuation of USD 121.9 million by 2035. Sales are projected to rise at a CAGR of 7.2% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 8.7 million and USD 5.5 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 162.8 Million |

| Application | Coenzyme Q10, Vitamin K2, and Others |

| End Use | Pharmaceutical and Cosmetics |

| Grade | 95% And Above, <40% Nonaisoprenol, 40% – 70% Nonaisoprenol, 70% – 90% Nonaisoprenol, and 90% – 95% Nonaisoprenol |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Sigma-Aldrich, ExtRx Corporation, Zhejiang Yixin Pharmaceutical Co., Ltd., TCI Chemical, Toronto Research Chemicals, Suzhou Kemfam Manufacturing Co., Ltd., Shaanxi NHK Technology Co., Ltd., and Shijiazhuang Shengkang Biotech Co., Ltd. |

The global nonaisoprenol market is estimated to be valued at USD 162.8 million in 2025.

The market size for the nonaisoprenol market is projected to reach USD 368.0 million by 2035.

The nonaisoprenol market is expected to grow at a 8.5% CAGR between 2025 and 2035.

The key product types in nonaisoprenol market are coenzyme q10, vitamin k2 and others.

In terms of end use, pharmaceutical segment to command 62.8% share in the nonaisoprenol market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA