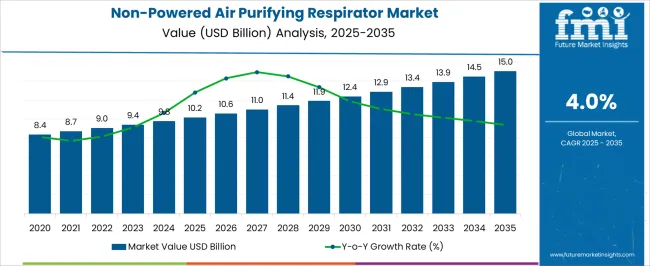

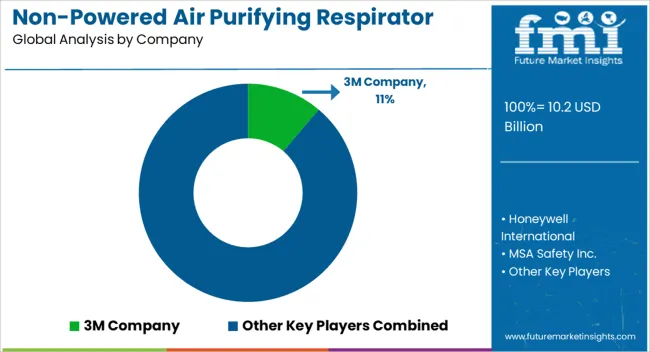

The non-powered air purifying respirator market is estimated to be valued at USD 10.2 billion in 2025 and is projected to reach USD 15.0 billion by 2035, registering a compound annual growth rate (CAGR) of 4.0% over the forecast period. The relatively modest growth rate indicates that the market has already achieved widespread penetration in key industrial and occupational safety sectors, with early adopters and mainstream users largely established. Incremental value additions over the forecast period are expected to stem from product enhancements such as improved filtration efficiency, ergonomic design, and compliance with evolving regulatory standards, rather than disruptive innovations.

The adoption lifecycle suggests that initial introduction and early growth phases have already stabilized, with demand driven primarily by regulatory enforcement, workplace safety requirements, and replacement cycles. The gradual increase from USD 10.2 billion in 2025 to USD 15.0 billion in 2035 reflects a steady but moderate expansion, consistent with products that have achieved high market visibility but limited room for radical market share gains. Opportunities for growth lie in geographic expansion to regions with emerging industrial sectors, targeted customization for specialized applications, and incremental cost reductions that enhance accessibility.

The market is positioned in a mature stage where incremental adoption is gradual, technology improvements are evolutionary, and expansion is largely guided by regulatory compliance, occupational safety mandates, and incremental product differentiation within an established user base.

| Metric | Value |

|---|---|

| Non-Powered Air Purifying Respirator Market Estimated Value in (2025 E) | USD 10.2 billion |

| Non-Powered Air Purifying Respirator Market Forecast Value in (2035 F) | USD 15.0 billion |

| Forecast CAGR (2025 to 2035) | 4.0% |

The non-powered air purifying respirator market represents a specialized segment within the global personal protective equipment industry, emphasizing respiratory safety, compliance, and workplace protection. Within the broader personal protective equipment sector, it accounts for about 5.8%, driven by demand from industrial, construction, and healthcare applications. In the respiratory protection devices segment, its share is approximately 6.2%, reflecting reliance on respirators for filtering airborne particles, dust, and contaminants. Across the industrial safety equipment market, it holds around 4.7%, supporting occupational safety and regulatory compliance.

Within the healthcare and emergency response category, it represents 4.3%, highlighting use in pathogen control and hazardous material exposure scenarios. In the occupational hygiene solutions sector, the market contributes about 3.9%, emphasizing adoption in workplaces requiring high safety standards and certified filtration devices. Recent developments in the market have focused on comfort, filtration efficiency, and ergonomic design. Innovations include multi-layer filter cartridges, lightweight materials, and adjustable sealing systems to enhance fit and user compliance. Key players are collaborating with industrial safety organizations, healthcare providers, and regulatory bodies to improve certification, performance, and adoption.

Adoption of reusable and replaceable filter designs is gaining momentum to reduce operational costs and environmental impact. The integration with monitoring systems and clear communication features is being deployed for improved safety in complex work environments. These trends demonstrate how innovation, comfort, and regulatory adherence are shaping the market.

The non-powered air purifying respirator market is experiencing consistent growth due to heightened awareness around respiratory protection across industrial, medical, and public safety environments. The market is being driven by increasing focus on occupational health and safety regulations, particularly in sectors involving exposure to airborne particulates and infectious agents. Rising concerns about pandemic preparedness, infection control, and air pollution in urban centers have further reinforced demand.

Manufacturers are focusing on innovations in filter efficiency, comfort, and extended wearability to meet evolving consumer expectations. Additionally, supportive government policies and procurement programs in both developed and developing countries are contributing to greater product availability. Growth is being further sustained by the use of these respirators in medical and healthcare facilities, manufacturing plants, and emergency response operations.

With growing investments in public health infrastructure and workplace safety compliance, the market is poised for steady expansion The increasing prioritization of personal protective equipment by both individuals and institutions is expected to create favorable conditions for long-term demand across regions and industries.

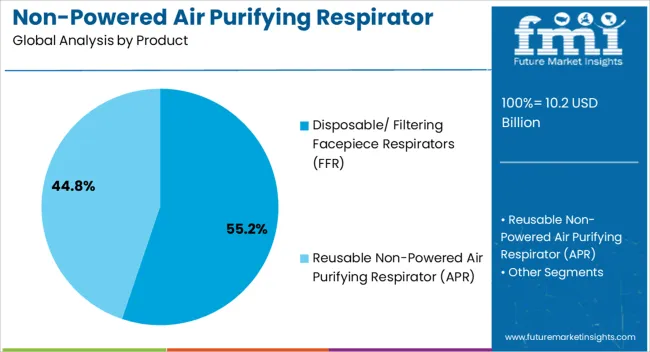

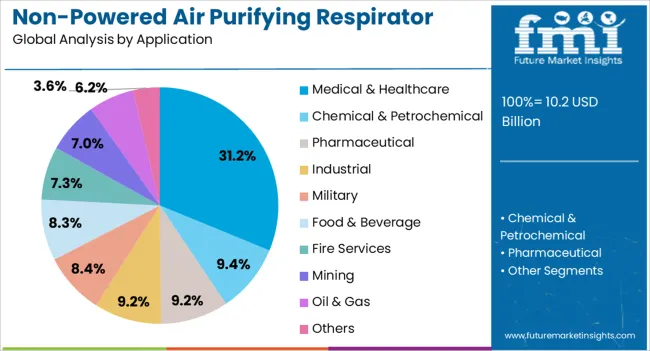

The non-powered air purifying respirator market is segmented by product, application, distribution channel, and geographic regions. By product, non-powered air purifying respirator market is divided into Disposable/ Filtering Facepiece Respirators (FFR) and Reusable Non-Powered Air Purifying Respirator (APR). In terms of application, non-powered air purifying respirator market is classified into Medical & Healthcare, Chemical & Petrochemical, Pharmaceutical, Industrial, Military, Food & Beverage, Fire Services, Mining, Oil & Gas, and Others.

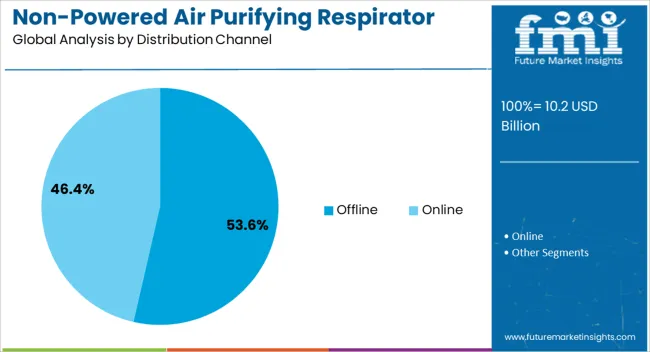

Based on distribution channel, non-powered air purifying respirator market is segmented into Offline and Online. Regionally, the non-powered air purifying respirator industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The disposable or filtering facepiece respirators segment is projected to hold 55.2% of the non-powered air purifying respirator market revenue share in 2025, positioning it as the leading product category. This leadership is being driven by their cost-effectiveness, wide availability, and ease of use across multiple sectors. These respirators are preferred in environments that require single-use protective equipment with minimal training, particularly in healthcare, construction, and manufacturing settings.

The segment benefits from high-volume production capabilities, ensuring a consistent supply during periods of elevated demand, such as health emergencies or environmental crises. Lightweight design, comfortable fit, and reliable filtration performance are key attributes contributing to their widespread adoption.

Additionally, the regulatory approval of various models for use in both medical and industrial environments has reinforced their credibility and expanded their user base. The convenience of use and disposal, combined with growing public health awareness and stricter air quality standards, are expected to keep this segment at the forefront of the market in the forecast period.

The medical and healthcare segment is anticipated to account for 31.2% of the non-powered air purifying respirator market revenue share in 2025, establishing itself as the primary application segment. This segment’s dominance is being attributed to the critical need for respiratory protection among frontline healthcare professionals and support staff. The use of non-powered respirators in clinical and surgical settings ensures defense against airborne pathogens, especially during procedures that generate aerosols.

Heightened awareness following global health emergencies has accelerated the incorporation of personal protective equipment into daily healthcare operations. Moreover, regulatory mandates and infection control protocols have made respirator use a standard requirement in hospitals, clinics, and diagnostic centers. Investments in healthcare infrastructure, including stockpiling and contingency planning, are contributing to sustained demand.

Continued training programs and preparedness initiatives are further reinforcing usage patterns. As healthcare systems prioritize workforce safety and infection prevention, the demand for non-powered respirators within this segment is expected to maintain its upward trajectory in the years ahead.

The offline distribution channel is expected to represent 53.6% of the non-powered air purifying respirator market revenue share in 2025, making it the leading sales channel. This dominance is being supported by the long-standing presence of brick-and-mortar retailers, medical supply distributors, and industrial safety equipment vendors that offer immediate product access and tailored customer support. Offline purchasing is often preferred by institutions and businesses that require bulk procurement, product demonstrations, and compliance documentation.

Moreover, the ability to physically evaluate product quality, fit, and certification details before purchase enhances trust and ensures correct product selection. In regions where digital infrastructure is limited or regulatory approval for certain products is required at the point of sale, offline channels continue to hold strategic importance.

The presence of established supplier networks and strong relationships with procurement departments further contributes to sustained channel performance. As organizations maintain conservative purchasing behavior for critical safety equipment, offline distribution is expected to remain a vital and dominant channel across industrial and healthcare sectors.

The market has experienced notable growth as industrial safety, occupational health regulations, and environmental awareness continue to evolve. These respirators, which rely on filtration rather than mechanical or electrical assistance, are widely used across manufacturing, construction, chemical, and healthcare sectors. Their effectiveness in protecting workers from dust, fumes, and airborne pathogens has made them essential in workplace safety programs. Increasing regulatory requirements for respiratory protection, growing concerns about air quality, and the need for cost-effective safety solutions have driven adoption. Technological improvements in filter media, ergonomic design, and fit customization have enhanced usability, comfort, and protection levels.

Advancements in filter media have become a significant driver for non-powered APR adoption, improving their capability to capture fine particulate matter, chemical vapors, and biological contaminants. High-efficiency particulate air (HEPA) filters, activated carbon layers, and multi-stage filtration systems allow precise targeting of hazardous substances while minimizing breathing resistance. Research on nanofiber and electrostatic filter materials has enhanced particle capture efficiency and extended service life. Improved filter technology has enabled compliance with stringent occupational safety standards while maintaining user comfort. These innovations are critical in industries such as pharmaceuticals, chemicals, and mining, where consistent respiratory protection is essential for workforce safety. Manufacturers are increasingly offering interchangeable filters and modular designs to address diverse workplace hazards.

User comfort and ergonomic design play an essential role in the adoption of non-powered APRs. Lightweight materials, adjustable straps, flexible face seals, and optimized airflow pathways reduce fatigue during extended use. Respirators with enhanced fit testing capabilities ensure secure and uniform sealing across various facial structures, increasing protection levels. Comfort improvements encourage consistent usage, which is a critical factor in workplace safety compliance. Additionally, anti-fogging and moisture management features have been integrated into mask designs to improve visibility and comfort during prolonged exposure. Industries with high physical activity or long working hours increasingly rely on respirators that combine effective protection with ergonomic features, influencing purchasing decisions and market growth.

The market is heavily influenced by regulatory frameworks and workplace safety standards that mandate the use of respiratory protection. Agencies such as OSHA, NIOSH, and EN standards enforce specific performance, filtration efficiency, and labeling requirements. Compliance with these regulations ensures worker safety, reduces occupational illness, and mitigates liability risks for employers. Certifications for particulate, chemical, and biological hazard protection dictate design and testing criteria, guiding manufacturers in product development. The stringent regulatory environment has also spurred innovations in testing methods, quality assurance, and product labeling. Companies offering certified respirators gain competitive advantage, as compliance and safety assurances remain decisive factors in procurement decisions.

Despite their widespread use, non-powered APRs face challenges related to filter replacement, lifespan limitations, and operational maintenance. Filters must be replaced periodically based on contaminant exposure, which incurs recurring costs and requires careful inventory management. Users may neglect timely maintenance, leading to compromised protection. The respirator fit and seal degradation over time can reduce efficacy, requiring regular inspections. Price sensitivity in small and medium enterprises may limit adoption, particularly in emerging markets. Addressing these challenges through modular designs, reusable masks with replaceable filters, and cost-effective maintenance solutions can encourage wider adoption, ensuring both safety compliance and operational efficiency across industries.

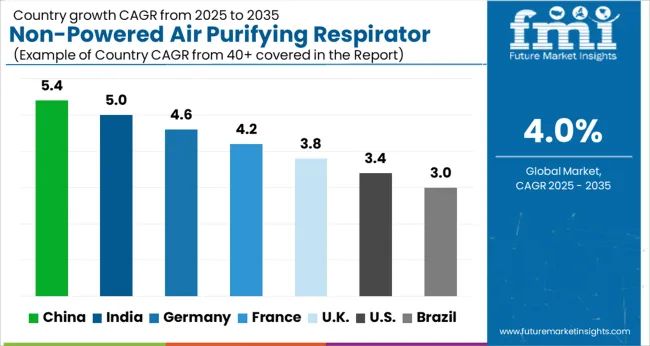

| Country | CAGR |

|---|---|

| China | 5.4% |

| India | 5.0% |

| Germany | 4.6% |

| France | 4.2% |

| UK | 3.8% |

| USA | 3.4% |

| Brazil | 3.0% |

The market is projected to grow at a CAGR of 4.0% from 2025 to 2035. Germany recorded 4.6%, reflecting consistent demand in industrial safety and healthcare applications. India reached 5.0%, driven by increasing awareness of occupational health standards. China led with 5.4% as manufacturing and industrial expansion supported higher adoption. The United Kingdom stood at 3.8% with gradual integration across commercial and medical sectors, while the United States reached 3.4% due to steady replacement and upgrade of existing protective equipment. These countries play a crucial role in production, scaling, and innovation within the market. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is projected to grow at a CAGR of 5.4%, driven by expanding industrialization, strict enforcement of workplace safety standards, and rising awareness about occupational health. Demand is reinforced by adoption in construction, manufacturing, mining, and chemical sectors, where exposure to dust, fumes, and particulate matter is high. Domestic manufacturers are increasingly producing cost effective, high efficiency respirators with ergonomic designs for comfort during long shifts. Integration with filtration media capable of capturing fine particulate and chemical hazards supports widespread adoption. The export demand for certified respirators has increased due to rising global safety requirements.

India is expected to grow at a CAGR of 5.0%, supported by government initiatives for workplace safety, industrial growth, and growing adoption in construction, chemical, and pharmaceutical sectors. Demand is reinforced by the need for reliable, lightweight, and ergonomically designed respirators. Domestic and international manufacturers supply both disposable and reusable models compliant with BIS and global safety standards. Safety audits and industrial certification programs are driving adoption across SMEs and large scale industrial operations. E-commerce and retail distribution channels also contribute to market expansion.

Germany is forecast to expand at a CAGR of 4.6%, driven by regulatory compliance in chemical, pharmaceutical, and construction sectors. Adoption is reinforced by demand for reusable, ergonomic respirators with advanced filter cartridges capable of capturing ultra-fine particles and chemical vapors. Industrial and workplace safety programs emphasize proper protective equipment and routine inspections, which further support growth. Manufacturers focus on combining durability, comfort, and certified performance to meet stringent EU standards.

The United Kingdom is expected to grow at a CAGR of 3.8%, supported by construction, industrial manufacturing, and healthcare adoption. Compliance with HSE regulations and occupational safety programs reinforces demand. Focus is on both disposable and reusable respirators with ergonomic designs, advanced filtration media, and ease of use. Integration of lightweight materials and enhanced comfort features improves adoption across extended work shifts. Industrial and commercial safety programs drive consistent replacement cycles for respirators.

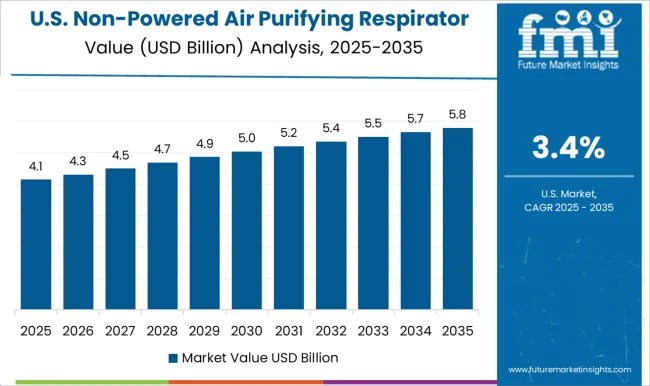

The United States is projected to grow at a CAGR of 3.4%, driven by OSHA regulations, industrial safety mandates, and growing awareness among workers in construction, chemical, and healthcare sectors. Demand is reinforced by adoption of high efficiency filtration respirators with comfort and ergonomic features. Manufacturers focus on hybrid disposable and reusable models, with advanced particulate and chemical filtration. Expansion of industrial, manufacturing, and healthcare facilities with strict compliance policies sustains market growth. Technological innovations include improved mask fit, adjustable straps, and integrated sensors for performance monitoring.

The NAPR market comprises a mix of global safety leaders and specialized regional manufacturers, providing respiratory protection solutions for industrial, medical, and emergency response applications. 3M Company, Honeywell International, and MSA Safety Inc. dominate the market with a broad portfolio of respirators, filters, and accessories designed for high performance, comfort, and regulatory compliance across diverse industries. DuPont de Nemours and Kimberly-Clark Corporation focus on high-quality disposable respirators and protective gear, emphasizing chemical resistance, filtration efficiency, and ergonomic design. Avon Protection, Delta Plus Group, Moldex Metric Inc., and Protective Industrial Products deliver specialized solutions for military, firefighting, and industrial safety applications, combining durability with enhanced comfort and adaptability.

Smaller and regional players such as Alpha Protech, Polison Corporation (Blue Eagle Safety), Shigematsu Works Co Ltd., RSG Safety BV, The Gerson Company, Prestige Ameritech, Imbema, Scandia Gear Europe BV, Cam Lock Ltd., Shanghai Dasheng Health Products Manufacture Co Ltd., ED Bullard Company, and ERB Industries Inc. differentiate through cost-effective solutions, niche product customization, and targeted regional distribution. Innovation trends include advanced filter media, reusable designs, improved facial seal technologies, and integration with safety monitoring systems to enhance user protection and compliance. This market is highly competitive, driven by regulatory standards, workplace safety mandates, and increasing demand for respiratory protection across industrial, healthcare, and environmental sectors.

| Item | Value |

|---|---|

| Quantitative Units | USD 10.2 Billion |

| Product | Disposable/ Filtering Facepiece Respirators (FFR) and Reusable Non-Powered Air Purifying Respirator (APR) |

| Application | Medical & Healthcare, Chemical & Petrochemical, Pharmaceutical, Industrial, Military, Food & Beverage, Fire Services, Mining, Oil & Gas, and Others |

| Distribution Channel | Offline and Online |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | 3M Company, Honeywell International, MSA Safety Inc., DuPont De Nemours, Kimberly Clark Corporation, Avon Protection, Delta Plus Group, Moldex Metric Inc., Protective Industrial Products, Alpha Protech, Polison Corporation (Blue Eagle Safety), Shigematsu Works Co Ltd., RSG Safety BV, The Gerson Company, Prestige Ameritech, Imbema, Scandia Gear Europe BV, Cam Lock Ltd., Shanghai Dasheng Health Products Manufacture Co Ltd., ED Bullard Company, and ERB Industries Inc |

| Additional Attributes | Dollar sales by respirator type and application, demand dynamics across healthcare, industrial, and emergency response sectors, regional trends in personal protective equipment adoption, innovation in filtration efficiency, comfort, and ergonomic design, environmental impact of disposable components and material recycling, and emerging use cases in hazardous material handling, infectious disease control, and occupational safety programs. |

The global non-powered air purifying respirator market is estimated to be valued at USD 10.2 billion in 2025.

The market size for the non-powered air purifying respirator market is projected to reach USD 15.0 billion by 2035.

The non-powered air purifying respirator market is expected to grow at a 4.0% CAGR between 2025 and 2035.

The key product types in non-powered air purifying respirator market are disposable/ filtering facepiece respirators (ffr), _n class, _r class, _p class, reusable non-powered air purifying respirator (apr), _elastomeric full facepiece respirators, _elastomeric full facepiece respirators and _cartridges/filters.

In terms of application, medical & healthcare segment to command 31.2% share in the non-powered air purifying respirator market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Air Struts Market Size and Share Forecast Outlook 2025 to 2035

Airless Paint Spray System Market Size and Share Forecast Outlook 2025 to 2035

Air Caster Skids System Market Size and Share Forecast Outlook 2025 to 2035

Airborne Molecular Contamination Control Services Market Forecast and Outlook 2025 to 2035

Airflow Balancer Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Cabin Environment Sensor Market Forecast and Outlook 2025 to 2035

Aircraft Flight Control System Market Size and Share Forecast Outlook 2025 to 2035

Airborne Radar Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Electric Motor Market Forecast Outlook 2025 to 2035

Airport Ground Transportation Market Forecast and Outlook 2025 to 2035

Airless Sprayer Accessories Market Size and Share Forecast Outlook 2025 to 2035

Air Purge Valve Market Size and Share Forecast Outlook 2025 to 2035

Air Flow Sensors Market Size and Share Forecast Outlook 2025 to 2035

Air Separation Plant Market Size and Share Forecast Outlook 2025 to 2035

Air Cooled Turbo Generators Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Cooling Turbines Market Size and Share Forecast Outlook 2025 to 2035

Air Conditioning Compressor Market Size and Share Forecast Outlook 2025 to 2035

Air Measuring Equipment Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Smoke Detection and Fire Extinguishing System Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Hose Fittings Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA