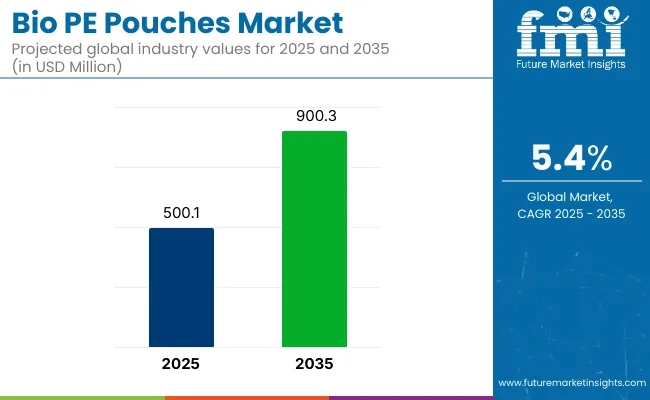

The bio PE pouches market is projected to grow from USD 500.1 million in 2025 to USD 900.3 million by 2035, registering a CAGR of 5.4% during the forecast period. Sales in 2024 crossed USD 400 million, underscoring the sector's resilience and growing demand across food & beverage, personal care, and pharmaceutical industries. This growth is attributed to the increasing need for biodegradable, durable, and sustainable packaging solutions that ensure product integrity while reducing environmental impact.

| Metric | Value |

|---|---|

| Market Size in 2025 | USD 500.1 million |

| Projected Market Size in 2035 | USD 900.3 million |

| CAGR (2025 to 2035) | 5.4% |

Companies are investing in expanding their production capacities and enhancing product offerings to meet the growing demand for bio-PE pouches. In May 2025, Amcor, a global leader in developing and producing responsible packaging solutions, and forestry industry company Metsä Group, announced a collaboration to develop three-dimensional molded fiber packaging solutions with lidding and liner for a variety of food applications. The collaboration underscores Amcor and Metsä Group’s commitment to sustainability and innovation by creating recycle-ready packaging solutions.

Ilya Syshchikov, Amcor’s Vice President, Global Fiber, said, “I am excited about this collaboration with our good partner Metsä. Both parties bring a wealth of materials, packaging and market knowledge to deliver more sustainable solutions to our customers with exceptional quality, functionality and efficiency”.

The shift towards sustainable and eco-friendly packaging solutions is influencing the bio-PE pouches market. Manufacturers are focusing on developing pouches that are biodegradable, recyclable, and made from renewable resources. Innovations include the integration of barrier properties to enhance shelf life and the use of water-based inks for printing to reduce environmental impact. These advancements align with global sustainability goals and regulatory requirements, making bio-PE pouches an attractive option for environmentally conscious businesses.

The bio-PE pouches market is poised for significant growth, driven by increasing demand in food & beverage, personal care, and pharmaceutical industries. Companies investing in sustainable materials, innovative designs, and eco-friendly production processes are expected to gain a competitive edge. As global supply chains expand and environmental regulations become more stringent, the adoption of bio-PE pouches is anticipated to rise, offering cost-effective and sustainable packaging solutions.

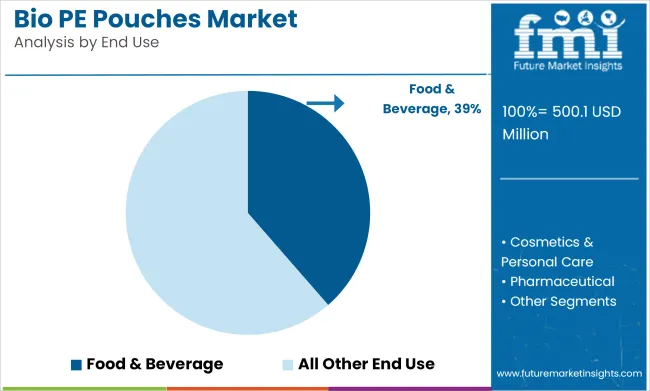

The food & beverage industry is projected to account for over 38.6% of the global Bio-PE pouch market by 2025, making it the largest end-use segment for this sustainable packaging solution. As consumer and regulatory pressures intensify around eco-friendly packaging, food brands are increasingly transitioning to bio-based polyethylene (Bio-PE) pouches to reduce reliance on fossil fuels and lower their carbon footprint.

Bio-PE pouches, derived from renewable feedstocks like sugarcane ethanol, offer similar performance characteristics to conventional polyethylene-such as flexibility, sealability, and barrier protection-while delivering up to 70% lower greenhouse gas emissions over their lifecycle. These advantages make them particularly suitable for packaging snacks, dry goods, frozen foods, sauces, dairy, and ready-to-eat products.

With governments in regions such as Europe and North America mandating stricter single-use plastic restrictions and extended producer responsibility (EPR) programs, food & beverage companies are shifting toward recyclable and bio-based flexible formats like Bio-PE. Major players in the F&B sector are also leveraging Bio-PE’s compatibility with existing packaging lines to make cost-effective, low-impact material transitions.

Additionally, innovations in multilayer Bio-PE films with enhanced oxygen and moisture barriers are enabling longer shelf life and improved product preservation, further accelerating adoption in convenience and retail food packaging. As the global market for green packaging surpasses USD 200 billion, the food & beverage segment is expected to remain a primary growth engine for Bio-PE pouch demand.

Spout pouches are anticipated to lead the product type segment in the bio-PE pouches market, accounting for approximately 35.6% market share by 2025, due to their rising popularity in liquid, semi-liquid, and refillable product categories. These pouches combine the flexibility of traditional pouches with the convenience of a resalable spout, making them an ideal solution for beverages, baby food, personal care, and household cleaning products.

Spout pouches made from bio-based and blended polymers are gaining adoption as brands shift toward refillable and lower-waste formats that reduce reliance on rigid plastic bottles. Their lightweight nature and reduced material use translate into lower transportation emissions and cost savings, while offering end users enhanced portability and portion control.

In the circular economy landscape, spout pouches also support refill models, enabling consumers to buy concentrates or bulk formats in reusable containers. Technological advances in pouch-spout sealing and tamper-evidence have further enhanced the integrity and safety of these packages for sensitive contents

As e-commerce, urban living, and sustainability reshape consumer packaging preferences, spout pouches provide a high-performance, low-impact alternative to conventional rigid plastic formats-positioning them as a critical format in the bio-PE pouch portfolio going forward.

High Production Costs and Limited Raw Material Availability

High production cost and low raw material availability of bio-based materials are some threats that the Bio PE Pouches Market is facing. Of the renewable plastics commonly used today, bio-polyethylene (Bio PE) is produced from renewable feed stocks like sugarcane, making it an expensive yet volatile commodity dependent on regional supply chains. Moreover, shifting from traditional plastic pouches to bio-based pouches will require a massive investment in production infrastructure and technology.

Regulatory Compliance and Performance Limitations

Biodegradable and Compostable Compliance around the World. Bio-PE pouches have certain environmental regulations and are long tests in certifications. Successful alternatives such as bio-based pouches also had limitations as compared to traditional plastic; these have not proven as renewable, durable, or long-lasting and therefore do not see mainstream adoption

Growing Demand for Sustainable Packaging Solutions

As consumers become ever more aware of their waste and new regulations push for greener packaging, the environment presents a huge opportunity for Bio PE Pouches Market growth. Brands want to reduce their carbon footprint and reach their sustainability goals, thus increasing the demand for biodegradable and recyclable pouches. This will benefit companies in new bio-based materials and sustainable

Advancements in Biopolymer Technology and Circular Economy Initiatives

Boosting consumer awareness and regulatory focus on environmentally sustainable packaging is creating massive opportunity for expansion of Bio PE Pouches Market. Brands are also mindful of the need to meet their sustainability goals, fueling the increased demand for biodegradable and recyclable pouches in the era of climate change. This change will benefit businesses that focus on new bio-based materials and sustainable extraction processes.

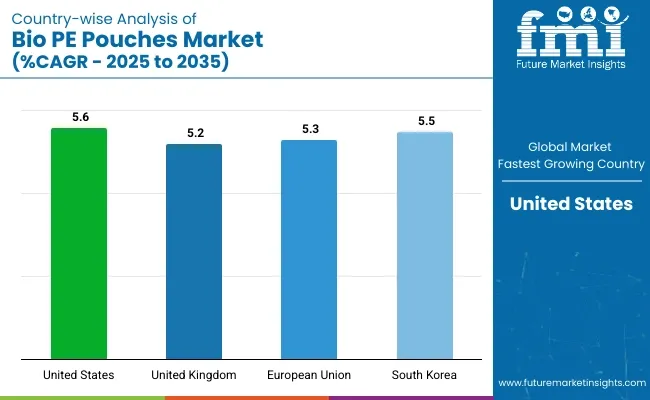

The USA Bio PE Pouches market is expanding due to rising environmental concerns, government regulations promoting sustainable packaging, and increasing consumer preference for biodegradable and recyclable packaging solutions across various industries.

| Region | CAGR (2025 to 2035) |

|---|---|

| United States | 5.6% |

The UK market is witnessing growth driven by stringent plastic waste reduction policies, advancements in bio-based packaging materials, and increased adoption of sustainable alternatives in the food and beverage sector.

| Region | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 5.2% |

The European Union is leading in the adoption of Bio PE Pouches due to strict sustainability mandates, increasing corporate responsibility initiatives, and growing demand for eco-friendly packaging solutions in retail and consumer goods.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 5.3% |

South Korea’s Bio PE Pouches market is expanding as the country intensifies efforts to reduce plastic waste, implement sustainable packaging laws, and promote bio-based materials in the cosmetics and personal care industries.

| Region | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.5% |

The Bio PE Pouches market is witnessing steady growth worldwide, driven by increasing regulatory support, consumer demand for green packaging, and advancements in biopolymer technology.

The global Bio PE pouches market is experiencing strong growth due to increasing demand for sustainable and eco-friendly packaging solutions. The shift towards biodegradable and compostable materials, coupled with stringent environmental regulations, is driving market expansion. Industries such as food & beverage, cosmetics, pharmaceuticals, and personal care are adopting Bio PE pouches as a viable alternative to traditional plastic packaging.

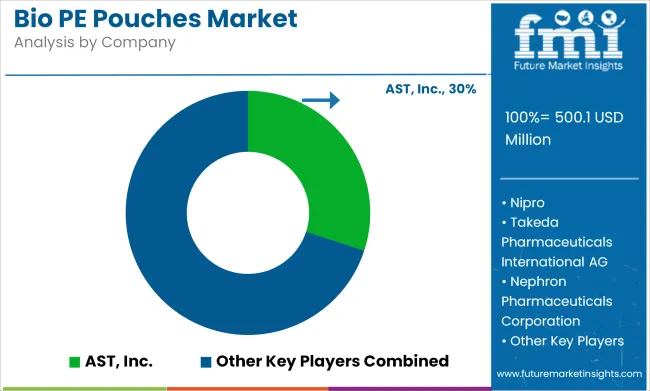

Amcor Plc (20-25%)

Bio PE pouches are a leading product line for Amcor, and offers innovative, high-barrier, recyclable solutions to industries.

Mondi Group (15-20%)

Mondi Develops Sustainable, Biodegradable Pouch Packaging to Meet Growing Eco-Friendly Consumer Demand

Sealed Air Corporation (12-16%)

The Bio PE pouches from Sealed Air are strong and moisture-resistant pouches designed to increase the shelf life of packaged products.

Coveris Holdings S.A. (8-12%)

We focus on customized and high-performance Bio PE pouches that meet the need to be environmentally friendly while providing a high level of safety for the product.

Berry Global Inc. (5-9%)

Berry Global also develops lightweight, compostable Bio PE packaging focusing material innovation and recyclability.

Other Key Players (30-40% Combined)

The Bio PE pouches market is diversified due to the presence of several manufacturers and packaging companies, among them:

The overall market size for Bio PE Pouches market was USD 500.1 million in 2025.

The Bio PE Pouches market is expected to reach USD 900.3 million in 2035.

The demand for Bio PE Pouches will grow due to rising adoption of block bottom, side gusset, bottom gusset, and spout pouches for sustainable packaging. Capacity preferences range from less than 50 OZ for convenience to over 150 OZ for bulk storage. Increased usage in food & beverage, cosmetics, pharmaceuticals, agriculture, homecare, and other consumer goods sectors will drive market.

The top 5 countries which drives the development of Bio PE Pouches market are USA, European Union, Japan, South Korea and UK.

Food & Beverage Industry demand supplier to command significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Bio-wax Market Size and Share Forecast Outlook 2025 to 2035

Biomass Hot Air Generator Furnace Market Size and Share Forecast Outlook 2025 to 2035

Biological Indicator Vial Market Size and Share Forecast Outlook 2025 to 2035

Bioplastic and Biopolymer Market Forecast Outlook 2025 to 2035

Biocatalysis and Biocatalyst Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Polyester Fiber Market Forecast and Outlook 2025 to 2035

Biopsy Device Market Forecast and Outlook 2025 to 2035

Bioliquid Heat and Power Generation Market Size and Share Forecast Outlook 2025 to 2035

Biocontrol Solutions Market Size and Share Forecast Outlook 2025 to 2035

Biocement Market Size and Share Forecast Outlook 2025 to 2035

Biomedical Refrigerator and Freezer Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Packaging Market Size and Share Forecast Outlook 2025 to 2035

Bionic Glove's Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Insulated Panel Market Size and Share Forecast Outlook 2025 to 2035

Biopotential Sensor Market Size and Share Forecast Outlook 2025 to 2035

Biomaterial Tester Market Size and Share Forecast Outlook 2025 to 2035

Biocompatible Materials Market Size and Share Forecast Outlook 2025 to 2035

Bio Based Paraxylene Market Size and Share Forecast Outlook 2025 to 2035

Biosimilar Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Biostimulants Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA