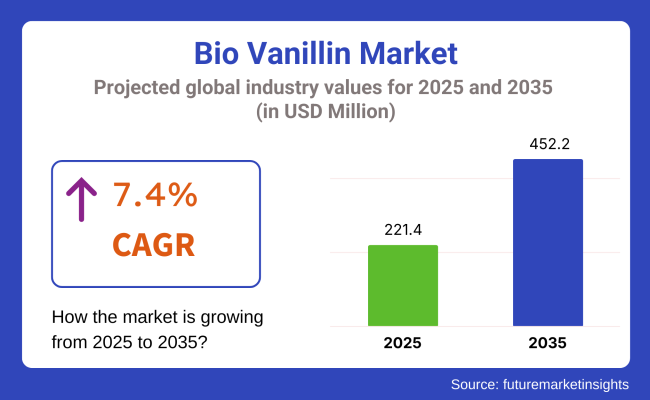

The global bio vanillin market is projected to reach USD 452.2 million by 2035, growing from USD 221.4 million in 2025, at a compound annual growth rate (CAGR) of 7.4% over the forecast period. This growth is driven by increasing consumer demand for natural and sustainable ingredients in the food and beverage industry, rising health consciousness, and the growing adoption of bio vanillin as an eco-friendly alternative to synthetic vanillin.

Bio vanillin, derived from renewable natural resources such as lignin or ferulic acid, offers the same rich, sweet aroma and flavor profile as its synthetic counterpart but with a significantly lower environmental impact. As consumers become more aware of the benefits of natural and clean-label ingredients, there is an increasing preference for bio vanillin in the production of food, beverages, and even personal care products. The growing demand for clean-label and sustainable products is a key factor driving the growth of the bio vanillin market.

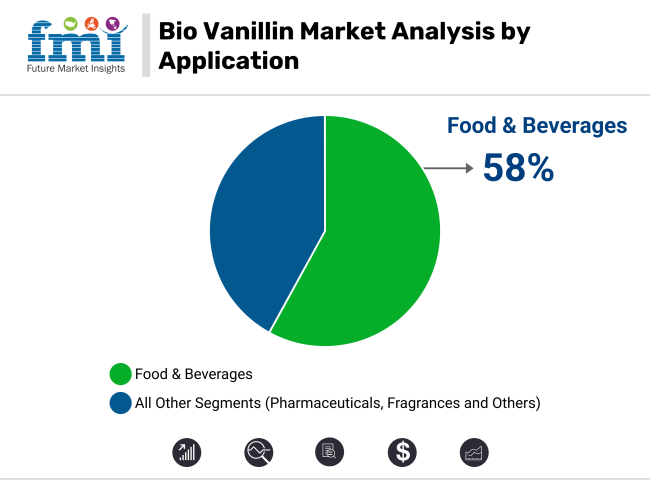

The food and beverage industry remains the largest end-use sector, where bio vanillin is used in the flavoring of confectionery, dairy products, baked goods, and beverages. Additionally, the growing popularity of natural ingredients in cosmetics, fragrances, and pharmaceuticals is also contributing to market expansion. Bio vanillin is increasingly being recognized as a sustainable alternative to synthetic vanillin, which is typically derived from petrochemicals.

North America and Europe are expected to remain dominant markets, with increasing consumer preference for natural and sustainable ingredients driving market growth. However, the Asia Pacific region is expected to register the fastest growth, driven by a rapidly expanding middle class, increased disposable incomes, and greater demand for natural products in countries such as China, India, and Japan.

Evolva (SIX: EVE), a leader in natural molecules and industrial biotech, has secured a major deal with a top CMO partner, guaranteeing Vanillin supply to a global Flavors & Fragrances (F&F) customer for approximately CHF 35 million through 2026. This multi-year agreement underscores Evolva’s capabilities, leveraging its precision-fermentation platform to deliver high-quality Vanillin at competitive pricing. The deal demonstrates the company’s success in scaling up production from laboratory development to industrial scale, solidifying Evolva’s position in the F&F industry and advancing its commercialization efforts in natural ingredients, which are increasingly in demand globally.

With increasing consumer awareness of sustainability and a shift towards natural, clean-label products, the bio vanillin market is poised for steady growth through 2035.

Food & beverages lead the market with a 58% share in 2025, driven by the growing demand for natural and sustainable flavoring solutions. Cosmetics account for 12%, while North America and Western Europe dominate regional growth due to strong consumer preference for clean-label products.

The food & beverages segment is projected to capture a significant 58% share of the bio vanillin market by 2025, fueled by the growing consumer demand for natural, clean-label ingredients. Bio vanillin, a sustainable alternative to synthetic vanillin, is increasingly used in a variety of food products, including ice cream, bakery goods, chocolate, and other confectioneries. As consumers become more health-conscious, there is a marked shift toward natural ingredients, which has propelled bio vanillin’s adoption in the food industry.

Bio vanillin is highly valued in the food and beverage sector due to its ability to provide a rich, natural vanilla flavor without the use of harmful chemicals or synthetic additives. Its increasing popularity in premium products, such as organic or vegan offerings, further supports market growth. As the demand for healthier, eco-friendly products continues to rise, bio vanillin is expected to remain a key ingredient in food and beverage formulations, helping brands meet consumer expectations for sustainability and quality.

The cosmetics segment is expected to hold a 12% share of the bio vanillin market in 2025, driven by the growing preference for natural and sustainable ingredients in skincare, perfumes, and fragrances. Bio vanillin, known for its pleasant fragrance and skin-soothing properties, is increasingly being used in cosmetic formulations such as lotions, creams, and facial products. Its natural origin and hypoallergenic profile make it an appealing choice for environmentally-conscious consumers seeking products that align with clean beauty trends.

In fragrances, bio vanillin serves as a natural aromatic compound, enhancing the scent profiles of perfumes, body sprays, and other scented products. As the clean beauty and eco-friendly movement gains momentum, consumers are gravitating towards brands that incorporate natural ingredients, including bio vanillin, into their product lines.

With the rise of ethical consumerism and growing awareness around the harmful effects of synthetic chemicals in beauty products, the demand for bio vanillin in cosmetics and fragrances is expected to grow steadily, contributing to the overall expansion of the bio vanillin market.

North America and Western Europe are projected to lead regional growth in the bio vanillin market, driven by the rising consumer demand for natural and sustainable ingredients in food, beverages, and cosmetics. These regions have a well-established preference for clean-label products and are increasingly adopting sustainable practices in manufacturing. In North America, the growing popularity of organic, non-GMO, and plant-based products has bolstered the demand for bio vanillin, particularly in premium food items, cosmetics, and fragrances.

Similarly, Western Europe’s focus on environmental sustainability and health-conscious living has made it a significant market for bio vanillin. Regulations in these regions also encourage the use of natural ingredients, with stringent food safety and cosmetic labeling laws pushing manufacturers to adopt bio vanillin in their products. As both regions continue to lead in the adoption of green technologies and consumer-driven demand for ethical products, bio vanillin is expected to see strong market growth, cementing its position as a key ingredient in various applications.

Challenges

High Production Costs and Limited Scalability

One of the challenges confronting the bio vanillin market is the high production cost of bio vanillin as compared to the petrochemical-based synthetic vanillin. Bio vanillin which is manufactured from natural sources such as lignin, ferulic acid, or microbial fermentation needs complex and resource consuming manufacturing processes. The extraction, purification, and fermentation processes require advanced bioengineering, which contributes to production costs. Consequently, bio vanillin is significantly costlier than synthetic vanillin, which renders it unappealing to price-sensitive industries such as mass-market food, beverages, and pharmaceuticals.

Scalability is a major challenge, too. Synthetic vanillin can be safely produced at a large scale using advanced chemical methods, but bio vanillin isn't available yet. Obstacles such as a lack of production facilities and inefficient supply chains have presented full commercialization and resulted in supply shortages and price variations. Additionally, varying sources of raw materials and microbial conditions of fermentation hinder bio vanillin from maintaining a uniform quality and stability.

My background will certainly help companies invest in low-cost biotechnological improvement, maximize fermentation yield and efficiency in the supply chain to solve these challenges. Potential collaborations among food/fragrance manufacturers, biotechnology companies, and research institutions could be enough to propel innovations that reduce production costs and make bio vanillin competitive with synthetic substitutes.

Opportunity

Rising Demand for Natural and Sustainable Ingredients

The demand for bio vanillin is also rising rapidly due to consumers' preference for natural and sustainable products. With consumers more conscientious than ever about what goes into their food, drinks and cosmetics and personal care products, artificial flavours and synthetic chemicals are falling out of favour. This has led to food and fragrance manufacturers seeking natural substitutes for synthetic vanillin.

Regulatory bodies and food safety organizations are also driving this shift. Towel paper e-commerce has become a hot spot in reed industry development, with the growth of e-commerce companies paying more attention to the high-end genetic industrial production of bio elements. Demand for bio vanillin on account of natural flavouring agents is further being favoured due to the strong regulatory framework laid by the European Union and North America pertaining to labelling and safety.

The growing plant-based food sector and clean-label movement also create new avenues for growth. As more consumers look for plant-origin, less processed ingredients, bio vanillin is increasingly popular in sectors including dairy alternatives, organic confectionery, and functional beverages. Heralding the sustainable sourcing narrative, companies that prioritize this collective ethos will benefit from a serious competitive advantage.

The USA bio vanillin market is witnessing a robust growth on account of increasing consumer preference for naturally produced & sustainable edible ingredients. The food and beverage industry is moving away from synthetic alternatives and towards bio-based vanillin as a replacement, thanks to clean label trends and rigorous FDA limitations. Additionally, the market players with their stronghold in the market are concentrating on developing biotech-based fermentation processes with the intent to lower manufacturing costs and meet the growing demand for flavouring agents that are natural and organic. Bio vanillin is also relevant to the pharmaceutical and cosmetics industries due to its antioxidant and antimicrobial properties, making the market even more relevant.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 7.6% |

The demand for bio vanillin in the UK is increasing as there is a growing shift towards plant-based and natural food ingredients in the country. But consumers are demanding sources, be it in their bakery, confectionery, or dairy products. In addition, the country’s regulatory authorities are promoting the minimization of synthetic additives in food and personal care products, which in turn is boosting the market. Bio vanillin is also being considered in the cosmetics and fragrance industries as a sustainable alternative to synthetic aroma compounds.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 7.2% |

Natural food ingredient choice & sustainability are emerging trends in food panoramas that boost the USA bio vanillin market growth. Due to clean label trends and the strictness of FDA restrictions, the food and beverage sector is replacing synthetic options with bio-based vanillin. However, the market players who have a stronghold in the market are focusing on developing biotech-based fermentation processes in order to reduce manufacturing costs and cater to the increased demand for flavoring agents, which are natural and organic. Also, its presence as an antioxidant and antimicrobial has made bio vanillin significant for pharmaceutical and cosmetics purposes also renders the market relevant.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 7.5% |

The bio vanillin market in Japan is driven by the increasing emphasis of the country on natural food ingredients of high quality. There is also a growing tendency for vanillin to be integrated into the functional food and nutraceutical sector owing to its antioxidant attributes. Moreover, Japanese cosmetic companies are using bio vanillin in perfumes and skincare products as part of the shift to natural and sustainable formulations. The growth of the market is also positively influenced by developments in the technology for producing vanillin through fermentation methods.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 7.3% |

The market in South Korea has majorly benefitted from the rising demand for natural flavours in foods and the increasing use of biov anillin as an eco-friendly ingredient. The country’s strong footprint in the skincare and beauty industry is driving the bio vanillin adoption in premium fragrance and personal care formulations. The increasing regulatory policies in support of bio-based ingredients in the food industry are also positively impacting market demand.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 7.4% |

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 221.4 million |

| Projected Market Size (2035) | USD 452.2 million |

| CAGR (2025 to 2035) | 7.4% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD million for value |

| Applications Analyzed (Segment 1) | Food & Beverages, Ice Cream, Bakery & Confectionery, Chocolate, Other Foods, Pharmaceuticals, Fragrances, Cosmetics, Others |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, South Asia & Pacific, East Asia, Middle East & Africa |

| Countries Covered | United States, Brazil, Germany, France, India, China, Japan, South Korea, UAE |

| Key Players Influencing the Market | Evolva Holding, Firmenich SA, Solvay, De Monchy Aromatics, Advanced Biotech, Givaudan, Omega Ingredients, Takasago, Suzhou Function Group, Apple Flavor & Fragrance |

| Additional Attributes | Market size, dollar sales, CAGR, share by application (food, pharma, cosmetics), regional share, key competitors, pricing trends, growth drivers, consumer demand shifts, and tech innovations. |

The Bio Vanillin Market was valued at approximately USD 221.4 million in 2025.

The market is projected to reach USD 452.2 million by 2035, growing at a compound annual growth rate (CAGR) of 7.4% from 2025 to 2035.

The demand for Bio Vanillin Market is expected to be driven by increasing consumer preference for natural and sustainable flavoring agents, rising applications in premium food and beverage products, expanding use in fragrances and cosmetics, and stringent regulations favoring bio-based ingredients over synthetic alternatives.

The top 5 countries contributing to the Bio Vanillin Market are the United States, China, France, Germany, and India.

The Food & Beverage and Fragrance Applications segment is expected to lead the Bio Vanillin market, driven by its growing adoption in bakery, confectionery, and dairy products, as well as increasing demand for natural aromatic compounds in perfumes, skincare, and personal care products.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (MT) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 4: Global Market Volume (MT) Forecast by Application, 2018 to 2033

Table 5: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 6: North America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 8: North America Market Volume (MT) Forecast by Application, 2018 to 2033

Table 9: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: Latin America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 11: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 12: Latin America Market Volume (MT) Forecast by Application, 2018 to 2033

Table 13: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Western Europe Market Volume (MT) Forecast by Country, 2018 to 2033

Table 15: Western Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 16: Western Europe Market Volume (MT) Forecast by Application, 2018 to 2033

Table 17: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Eastern Europe Market Volume (MT) Forecast by Country, 2018 to 2033

Table 19: Eastern Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 20: Eastern Europe Market Volume (MT) Forecast by Application, 2018 to 2033

Table 21: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: South Asia and Pacific Market Volume (MT) Forecast by Country, 2018 to 2033

Table 23: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 24: South Asia and Pacific Market Volume (MT) Forecast by Application, 2018 to 2033

Table 25: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: East Asia Market Volume (MT) Forecast by Country, 2018 to 2033

Table 27: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 28: East Asia Market Volume (MT) Forecast by Application, 2018 to 2033

Table 29: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 30: Middle East and Africa Market Volume (MT) Forecast by Country, 2018 to 2033

Table 31: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 32: Middle East and Africa Market Volume (MT) Forecast by Application, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 3: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 4: Global Market Volume (MT) Analysis by Region, 2018 to 2033

Figure 5: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 6: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 7: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 8: Global Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 9: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 10: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 11: Global Market Attractiveness by Application, 2023 to 2033

Figure 12: Global Market Attractiveness by Region, 2023 to 2033

Figure 13: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 14: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 15: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 16: North America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 17: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 18: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 19: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 20: North America Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 21: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 22: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 23: North America Market Attractiveness by Application, 2023 to 2033

Figure 24: North America Market Attractiveness by Country, 2023 to 2033

Figure 25: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 26: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 27: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 28: Latin America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 29: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 30: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 31: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 32: Latin America Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 33: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 34: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 35: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 36: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 37: Western Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 38: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 39: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 40: Western Europe Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 41: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 42: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 43: Western Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 44: Western Europe Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 45: Western Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 46: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 47: Western Europe Market Attractiveness by Application, 2023 to 2033

Figure 48: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 49: Eastern Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 50: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 51: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 52: Eastern Europe Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 53: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 54: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 55: Eastern Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 56: Eastern Europe Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 57: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 58: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 59: Eastern Europe Market Attractiveness by Application, 2023 to 2033

Figure 60: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 61: South Asia and Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 62: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 63: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 64: South Asia and Pacific Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 65: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 66: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 67: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 68: South Asia and Pacific Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 69: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 70: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 71: South Asia and Pacific Market Attractiveness by Application, 2023 to 2033

Figure 72: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 73: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 74: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 75: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 76: East Asia Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 77: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 78: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 79: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 80: East Asia Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 81: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 82: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 83: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 84: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 85: Middle East and Africa Market Value (US$ Million) by Application, 2023 to 2033

Figure 86: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 87: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 88: Middle East and Africa Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 89: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 90: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 91: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 92: Middle East and Africa Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 93: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 94: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 95: Middle East and Africa Market Attractiveness by Application, 2023 to 2033

Figure 96: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Biodegradable Film Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Disposable Tableware Market Size and Share Forecast Outlook 2025 to 2035

Bio-based Cutlery Market Size and Share Forecast Outlook 2025 to 2035

Bio-wax Market Size and Share Forecast Outlook 2025 to 2035

Biomass Hot Air Generator Furnace Market Size and Share Forecast Outlook 2025 to 2035

Biological Indicator Vial Market Size and Share Forecast Outlook 2025 to 2035

Bioplastic and Biopolymer Market Forecast Outlook 2025 to 2035

Biodegradable Paper and Plastic Packaging Market Size and Share Forecast Outlook 2025 to 2035

Biocatalysis and Biocatalyst Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Polyester Fiber Market Forecast and Outlook 2025 to 2035

Biopsy Device Market Forecast and Outlook 2025 to 2035

Bioliquid Heat and Power Generation Market Size and Share Forecast Outlook 2025 to 2035

Biocontrol Solutions Market Size and Share Forecast Outlook 2025 to 2035

Biocement Market Size and Share Forecast Outlook 2025 to 2035

Biomedical Refrigerator and Freezer Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Packaging Market Size and Share Forecast Outlook 2025 to 2035

Bionic Glove's Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Insulated Panel Market Size and Share Forecast Outlook 2025 to 2035

Biopotential Sensor Market Size and Share Forecast Outlook 2025 to 2035

Biomaterial Tester Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA