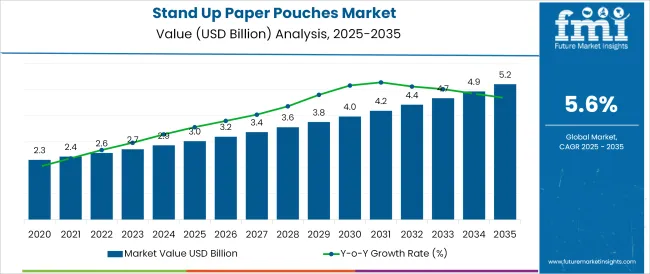

The Stand Up Paper Pouches Market is estimated to be valued at USD 3.0 billion in 2025 and is projected to reach USD 5.2 billion by 2035, registering a compound annual growth rate (CAGR) of 5.6% over the forecast period.

The stand-up paper pouches market is experiencing sustained momentum driven by the global shift toward eco-conscious packaging and increasing demand for flexible, lightweight alternatives to rigid containers. Heightened consumer awareness around plastic reduction and brand commitments to sustainability goals are accelerating adoption of paper-based pouch formats in both food and non-food sectors.

Manufacturers are investing in high-barrier coatings, recyclable laminates, and heat-sealable paper substrates to ensure product integrity without compromising on environmental performance. Additionally, advances in digital printing and pouch forming machinery have improved design flexibility and speed-to-market. Regulatory frameworks advocating compostable and recyclable materials, especially in Europe and North America, are reinforcing industry-wide transitions to paper-based packaging.

The market outlook remains positive as brands increasingly seek customizable shelf-stable solutions that enhance product visibility, preserve freshness, and align with zero waste initiatives particularly in categories like snacks, dry goods, and personal care products.

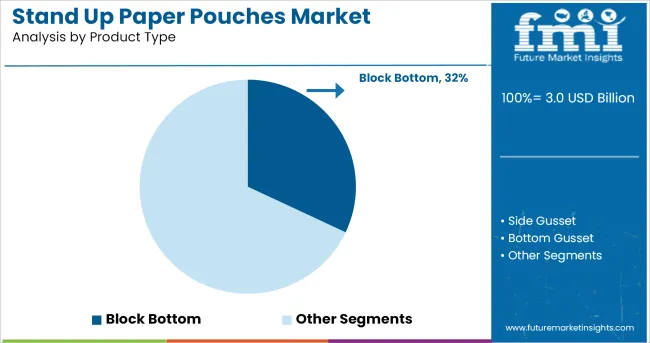

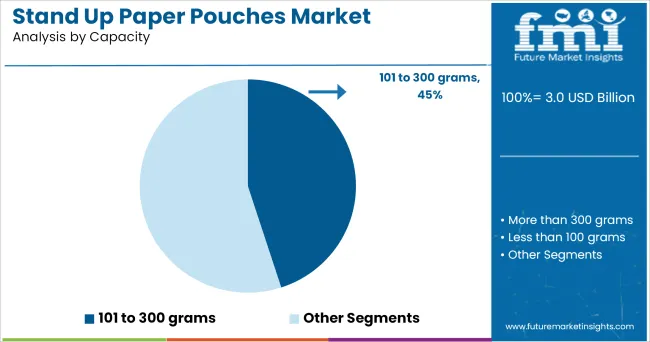

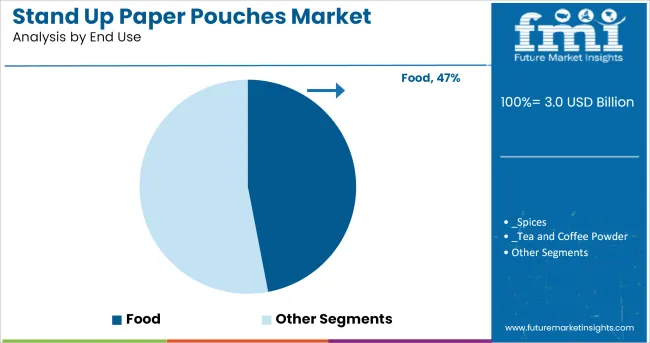

The market is segmented by Product Type, Capacity, and End Use and region. By Product Type, the market is divided into Block Bottom, Side Gusset, Bottom Gusset, and Spout Pouch. In terms of Capacity, the market is classified into 101 to 300 grams, More than 300 grams, and Less than 100 grams. Based on End Use, the market is segmented into Food, Spices, Tea and Coffee Powder, Pulses, Nuts, Others (Rice, Dry Fruits), Personal Care, Agriculture, and Others (Pharmaceutical, Beverages). Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The block bottom variant is projected to represent 32.0% of total revenue by 2025 within the product type category, positioning it as the leading segment. This is due to its superior stability and shelf presentation advantages, which enhance retail merchandising and consumer convenience.

The structure enables better stacking, optimal space utilization, and a premium look, making it highly attractive for brands across food and personal care sectors. Additionally, the block bottom configuration supports more efficient filling processes and weight distribution during logistics

It is favoured in automated packaging systems, contributing to operational efficiency. The blend of functional performance and high visual appeal has strengthened its presence across a wide range of packaging applications, establishing its dominance in the product type segment.

In terms of capacity, the 101 to 300 grams segment is expected to hold 45.0% of total market revenue in 2025, making it the most prominent sizing format. This capacity range offers a balanced solution for both single-use and multi-serve packaging, catering to the rising demand for portion-controlled, re-sealable, and convenient products.

It is especially well suited for dry food items, tea, coffee, and health supplements, where freshness and pack integrity are critical. The format allows for cost-effective production while offering ample space for branding and regulatory information.

Moreover, its compatibility with standard retail shelving and e-commerce packaging guidelines has contributed to its widespread adoption. As both premium and value-tier brands seek flexible packaging formats that minimize material waste without compromising functionality, this mid-range capacity has emerged as the preferred industry standard.

The food category is projected to account for 47.0% of market revenue by 2025 under the end use segment, making it the dominant application. This growth is being propelled by rising consumer preference for sustainable, re-sealable, and visually appealing food packaging across categories such as snacks, grains, pet food, and frozen goods. Stand-up paper pouches are increasingly replacing traditional plastic laminates due to their compostability, recyclability, and growing compatibility with barrier-enhancing technologies that preserve aroma and freshness.

Regulatory focus on food safety and sustainable labelling practices has also supported their proliferation. The pouches’ lightweight nature reduces shipping costs and environmental impact, aligning with ESG mandates from food producers and retailers.

In addition, the customization potential for digital printing has enabled food brands to engage in dynamic marketing and seasonal product launches. This confluence of functional, environmental, and branding benefits continues to position food as the largest and fastest growing end-use sector within the stand-up paper pouch landscape.

The stand up paper pouch is a flexible packaging solution commonly used in the food, personal care and agriculture industry as an efficient and user-friendly packaging solution.

Consumers and manufacturers prefer to stand up paper pouches as they are easy to store, transport and convenient solution for packaging solid items. The increasing popularity of packaged food items in sustainable packaging alternatives is boosting the market growth for stand up pouches.

The food industry is very competitive and as a result, packaging manufacturers operating in it are in constant search of innovative solutions to make their product stand out among others.

In the stand-up paper pouches market the trend of manufacturing the pouch with transparent window is gaining pace. This window enables the manufacturers to partly display the contents to attract more consumers. It also helps consumers to check the quality and keep track of the product contents.

Pouches are highly desirable flexible packaging solutions for the packaging of several items. The aversion of consumers towards the use of stand up pouches made from plastic is making manufacturers switch to stand up paper pouches.

Manufacturers are switching to stand up paper pouches not only to attract more consumers but also helps them in achieving their sustainability goals by reducing the overall carbon footprint. The increasing demand for efficient yet sustainable flexible packaging solutions is bolstering the market growth of stand up paper pouches.

While some of the stand-up paper pouches are compostable or biodegradable the resultant number of pouches ending up at composting facilities is very less. Also, most of the pouches are laminated with plastic films which are not sustainable but are used to strengthen the barrier properties.

The factors mentioned are a cause of concern as they contribute to the growing problem of waste generation and might contribute to restraining the growth of the market for stand up paper pouches.

Key global players such as

are in the stand-up paper pouches market.

In the Asian region, players like

are actively involved in the stand-up paper pouches market.

Key players in the stand-up paper pouch market are adopting a combination of strategies to increase their market share. To gain maximum markets share in the competitive market the manufacturers of stand up paper pouches are launching innovative products and establishing strategic partnerships with end-use industry manufacturers. The players are introducing stand up paper pouches targeted towards specific end-use segments to capture the attention of manufacturers.

Mondi has been at the forefront of developing sustainable packaging solutions, including stand-up paper pouches. The company launched its “EcoSolutions” initiative, focusing on reducing environmental impact through innovative products.

In the market for stand up paper pouches, the increasing demand for customized and innovative products is very high. The manufacturers in the consumer goods and food industry need attractive and customized packaging products to enhance their marketing and branding strategies.

The players in the stand-up paper pouches market have the opportunity to target these manufacturers by offering products that are digitally printed, in custom shapes and window slits to maximize their sales and reinforce the market position.

The packaged food industry in India is rapidly evolving as a result of the increasing population in the urban areas and rising per capita expenditure on packaged food.

Further, the increasing efforts of the Indian government to enhance domestic manufacturing infrastructure is anticipated to have positive effects on the packaging industry in the country. These factors are projected to generate heightened demand for the stand-up paper pouches during the foreseeable future in the Indian market.

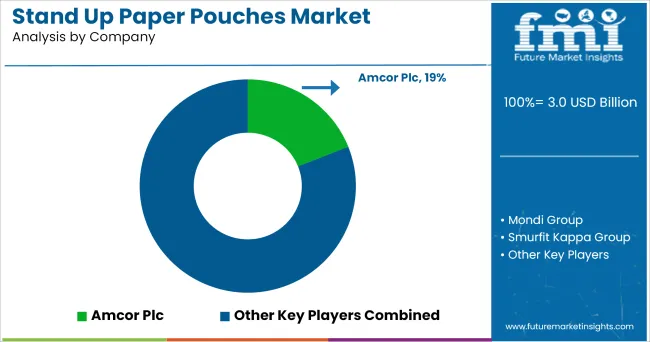

The global stand up paper pouches market is estimated to be valued at USD 3.0 billion in 2025.

The market size for the stand up paper pouches market is projected to reach USD 5.2 billion by 2035.

The stand up paper pouches market is expected to grow at a 5.6% CAGR between 2025 and 2035.

The key product types in stand up paper pouches market are block bottom, side gusset, bottom gusset and spout pouch.

In terms of capacity, 101 to 300 grams segment to command 45.0% share in the stand up paper pouches market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Standard Liner Market Size and Share Forecast Outlook 2025 to 2035

Standard High Precision Power Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Standby Generator Sets Market Size and Share Forecast Outlook 2025 to 2035

Standby Commercial Diesel Gensets Market Size and Share Forecast Outlook 2025 to 2035

Standalone Three Phase PV Inverter Market Size and Share Forecast Outlook 2025 to 2035

Standby Power Rental Market Size and Share Forecast Outlook 2025 to 2035

Standby Construction Generator Sets Market Size and Share Forecast Outlook 2025 to 2035

Standalone PV Inverter Market Size and Share Forecast Outlook 2025 to 2035

Standing Desk Market Size and Share Forecast Outlook 2025 to 2035

Standby Gas Fueled Power Rental Market Size and Share Forecast Outlook 2025 to 2035

Standby Telecom Generator Market Size and Share Forecast Outlook 2025 to 2035

Standcap Pouch Market

Stand Alone Label Applicator Market

Stand-Up Pouch Valves Market Size and Share Forecast Outlook 2025 to 2035

Stand-up Zipper Pouches Market Analysis – Trends & Forecast 2025 to 2035

LC Standard Adapters Market Size and Share Forecast Outlook 2025 to 2035

Freestanding Large Cooking Appliance Market Trends - Growth & Forecast 2025 to 2035

Home Standby Gensets Market Size and Share Forecast Outlook 2025 to 2035

Free Standing Display Units Market by Material & End-Use Forecast 2025 to 2035

Market Share Distribution Among Free Standing Display Units Providers

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA