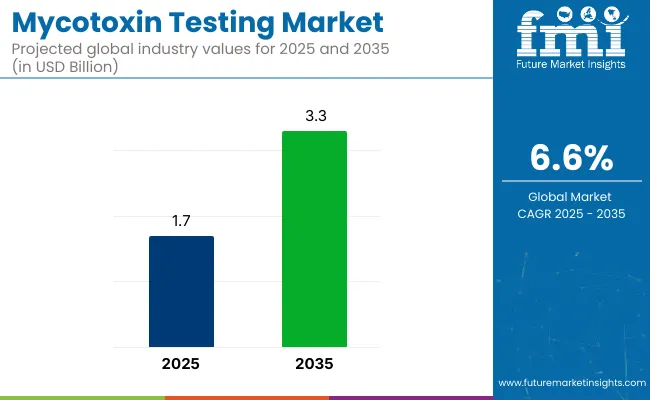

The global mycotoxin testing market is valued at USD 1.7 billion in 2025 and is slated to reach USD 3.3 billion by 2035, which shows a CAGR of 6.6%. This growth is being driven by the rising demand for toxin-free food, stringent food safety regulations by global authorities, and increased consumer awareness about health and safety.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 1.7 billion |

| Forecast Value (2035) | USD 3.3 billion |

| CAGR (2025 to 2035) | 6.6% |

Additionally, advancements in testing technologies such as LC-MS/MS and HPLC have enhanced detection accuracy and reliability, further strengthening market expansion globally.

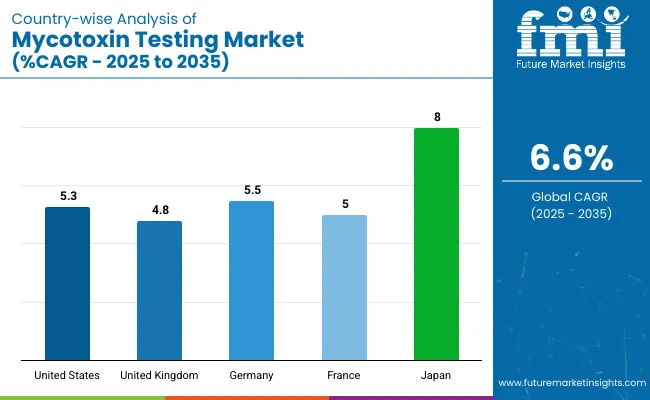

Japan is expected to grow at a CAGR of 8.0%, driven by stringent food safety regulations, while Germany is projected to grow at a 5.5% CAGR due to its advanced food processing industries, and the USA is anticipated to record a 5.3% CAGR, supported by strong regulatory frameworks and technological adoption.

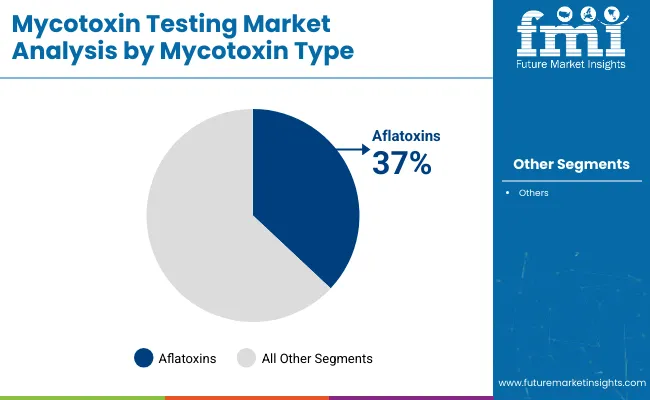

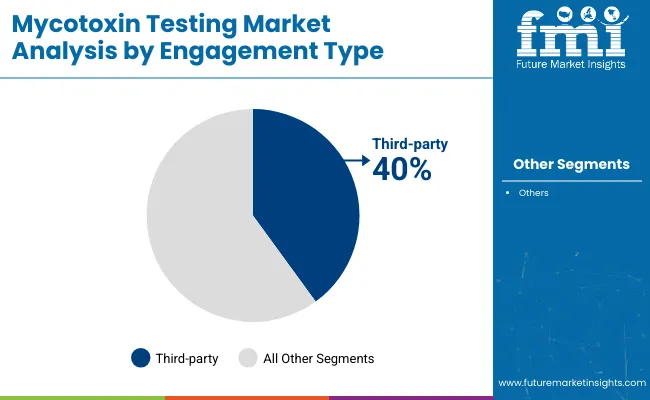

Third-party analytics services are expected to dominate the engagement type segment with over 40% market share as companies increasingly outsource testing to specialized accredited laboratories for reliable results. Additionally, aflatoxins are projected to lead the mycotoxin type segment with a 37% share, driven by their high prevalence and stringent global testing requirements.

The market holds a notable but niche share within its parent markets. It accounts for approximately 8-10% of the global food safety testing market, reflecting its critical role in detecting toxins harmful to human and animal health. Within the agricultural testing market, its share ranges from 5-7%, mainly driven by grain, cereal, and feed testing.

In the broader food and beverage testing market, it contributes around 4-6%, while its presence in the overall biotechnology analytical testing market is smaller, at 2-3%. Despite being a specialized segment, its growth remains strong due to stringent regulations and rising contamination incidents.

The market segments include mycotoxin type, type, end user, engagement type, and region. The mycotoxin type segment covers aflatoxins, deoxynivalenol, fumonisins, patulin, ochratoxin A, T-2 and HT-2 toxins, and zearalenone. The testing type segment includes high-performance liquid chromatography (HPLC), gas chromatography-mass spectrometry (GC-MS), LC-FLD method, thin layer chromatography (TLC), lateral flow assays (LFAs), polymerase chain reaction (PCR) based methods, and enzyme-linked immunosorbent assay (ELISA).

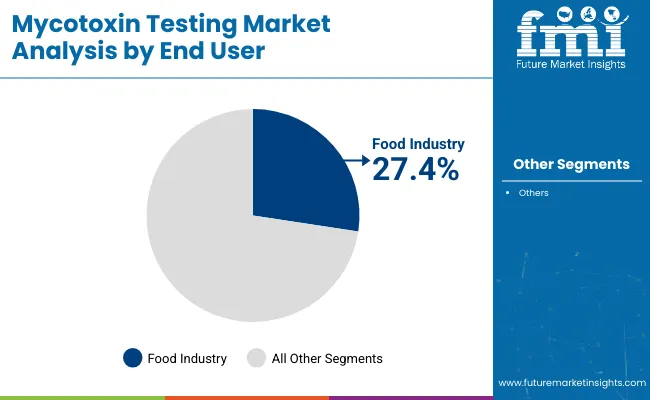

The end user segment comprises the food industry, beverage industry, agriculture industry, pharmaceutical industry, nutraceutical and dietary supplements industry, cosmetics industry, and animal feed industry (poultry, swine, ruminants, and aquaculture).

The engagement type segment includes in-house/captive testing, analytics services 3rd third-party/independent testing, and analytics service providers, further divided into one-off engagement and end-to-end outsourcing. The regional segment includes North America, Latin America, Western Europe, Eastern Europe, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and Middle East & Africa.

Aflatoxins are identified as the most lucrative segment in the mycotoxin type category, holding a 37% market share in 2025.

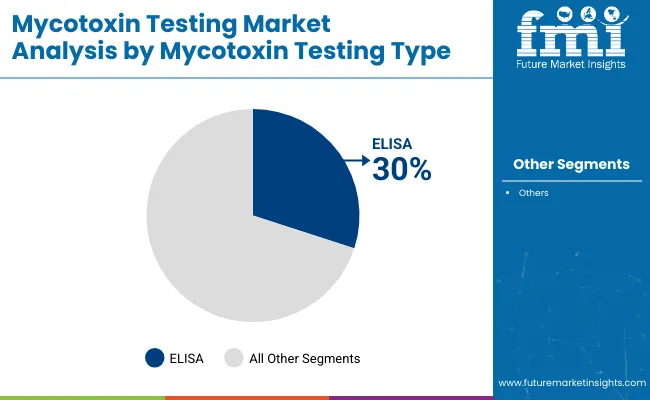

Enzyme-linked immunosorbent assay (ELISA) is identified as the most lucrative segment under the testing type category, holding a 30% market share in 2025.

The food industry is identified as the most lucrative segment under the end-user category, holding a 27.4% market share in 2025.

Third-party or independent testing services are identified as the most lucrative engagement type, holding over 40% market share in 2025.

The global market is growing steadily, driven by increasing demand for toxin-free food and feed products, stringent food safety regulations across regions, and advancements in rapid detection technologies such as ELISA and LC-MS/MS adopted by food, feed, and agricultural industries.

Recent Trends in the Mycotoxin Testing Market

Challenges in the Mycotoxin Testing Market

Japan is projected to record the fastest growth in the market with a CAGR of 8.0% from 2025 to 2035, driven by strict food safety regulations and high adoption of rapid testing technologies. Germany follows with a 5.5% CAGR, supported by its advanced food processing industries and strong regulatory framework.

The USA market is expected to grow at a 5.3% CAGR, driven by stringent FDA standards and technological advancements. France is projected to grow at nearly 5.0% CAGR due to rising demand for rapid testing kits, while the UK will grow at 4.8% CAGR, driven by strict compliance and export-focused testing demand.

The report covers an in-depth analysis of 40+ countries; five top-performing OECD countries are highlighted below.

The USA mycotoxin testing market is projected to grow at a CAGR of 5.3% from 2025 to 2035.

Sales of mycotoxin testing products in the UK are expected to grow at a CAGR of around 4.8% from 2025 to 2035.

Germany’s mycotoxin testing services revenue is projected to grow at a CAGR of 5.5% from 2025 to 2035.

Sales of mycotoxin testing products in France are expected to register a CAGR of nearly 5.0% from 2025 to 2035.

Sales of mycotoxin testing products in Japan are projected to grow at a CAGR of 8.0% from 2025 to 2035, making it one of the fastest-growing markets globally.

The global market is moderately concentrated, with key players such as Eurofins Scientific, SGS S.A., Intertek Group plc, Bureau Veritas S.A., and ALS Limited are collectively commanding approximately 60% of the market share. These companies are at the forefront of the industry, offering comprehensive testing solutions to ensure food and feed safety.

Top companies in this sector are actively competing through strategic initiatives, including mergers and acquisitions, technological advancements, and expansion into emerging markets. For instance, Eurofins Scientific has been enhancing its global footprint by acquiring regional laboratories, thereby broadening its testing capabilities and service offerings.

Recent Mycotoxin Testing Industry News

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 1.7 billion |

| Projected Market Size (2035) | USD 3.3 billion |

| CAGR (2025 to 2035) | 6.6% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Market Analysis Parameters | Revenue in USD billion/Volume (Units) |

| By Mycotoxin Type | Aflatoxins, Deoxynivalenol, Fumonisins, Patulin, Ochratoxin A, T-2 and HT-2 Toxins, Zearalenone |

| By Testing Type | High-Performance Liquid Chromatography (HPLC), Gas Chromatography-Mass Spectrometry (GC-MS), LC-FLD Method, Thin Layer Chromatography (TLC), Lateral Flow Assays (LFAs), Polymerase Chain Reaction (PCR) based methods, and Enzyme-linked immunosorbent assay (ELISA). |

| By End User | Food Industry, Beverage Industry, Agriculture Industry, Pharmaceutical Industry, Nutraceutical & Dietary Supplements Industry, Cosmetics Industry, Animal Feed Industry (Poultry, Swine, Ruminants, Aquaculture) |

| By Engagement Type | In-House/ Captive Testing, Analytics Services, 3rd Party/ Independent Testing, Analytics Service Providers (One-off Engagement, End-to-End Outsourcing) |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia |

| Key Players | Eurofins Scientific, SGS S.A., Intertek Group plc, Agilent Technologies, PerkinElmer Inc., Romer Labs, Thermo Fisher Scientific, Neogen Corporation, Merieux NutriSciences, ALS Limited, R-Biopharm AG, FOSS Analytical, BioDetection Systems B.V. |

| Additional Attributes | Dollar sales by value, market share analysis by region, and country-wise analysis. |

As per Mycotoxin type, the industry has been categorized into Aflatoxins, Deoxynivalenol, Fumonisins, Patulin, Ochratoxin A, T-2 and HT-2 Toxins, Zearalenone.

As per Mycotoxin Testing Types, the industry has been categorized into High-Performance Liquid Chromatography (HPLC), Gas Chromatography-Mass Spectrometry (GC-MS), LC-FLD Method, Thin Layer Chromatography (TLC), Lateral Flow Assays (LFAs), Polymerase Chain Reaction (PCR) based methods, Enzyme-linked immunosorbent assay (ELISA).

This segment is further categorized into Food Industry, Beverage Industry, Agriculture Industry, Pharmaceutical Industry, Nutraceutical and Dietary Supplements Industry, Cosmetics Industry, Animal Feed Industry (Poultry, Swine, Ruminants, Aquaculture).

As per Engagement Type, the industry has been categorized into In-House/ Captive Testing and Analytics Services 3rd Party/ Independent Testing and, Analytics Service Providers (One off Engagement, End to End outsourcing).

Industry analysis has been carried out in key countries of North America, Latin America, Western Europe, Eastern Europe, Balkans & Baltic, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific Europe and the Middle East & Africa.

The market is valued at USD 1.7 billion in 2025.

The market is projected to reach USD 3.3 billion by 2035.

The market is expected to grow at a CAGR of 6.6% during this period.

Aflatoxins hold the largest share, accounting for 37% in 2025.

Japan is projected to record the highest CAGR in the market, growing at a rate of 8% from 2025 to 2035

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Feed Mycotoxin Binders Market Size and Share Forecast Outlook 2025 to 2035

Feed Mycotoxin Detoxifiers Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Testing, Inspection & Certification Market Growth – Trends & Forecast 2025 to 2035

5G Testing Market Size and Share Forecast Outlook 2025 to 2035

AB Testing Software Market Size and Share Forecast Outlook 2025 to 2035

5G Testing Equipment Market Analysis - Size, Growth, and Forecast 2025 to 2035

Eye Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

HSV Testing Market Size and Share Forecast Outlook 2025 to 2035

IoT Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

HPV Testing and Pap Test Market Size and Share Forecast Outlook 2025 to 2035

GMO Testing Services Market Insights – Food Safety & Regulatory Compliance 2024 to 2034

GMP Testing Services Market

LTE Testing Equipment Market Growth – Trends & Forecast 2019-2027

Drug Testing Systems Market Size and Share Forecast Outlook 2025 to 2035

Sand Testing Equipments Market Size and Share Forecast Outlook 2025 to 2035

Tire Testing Machine Market Size and Share Forecast Outlook 2025 to 2035

Self-Testing Market Analysis - Size, Share, and Forecast 2025 to 2035

Food Testing Services Market Size, Growth, and Forecast for 2025–2035

Bend Testing Machine Market Growth - Trends & Forecast 2025 to 2035

An Analysis of the Leak testing Machine Market by Detectors and Sensors Hardware Type through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA