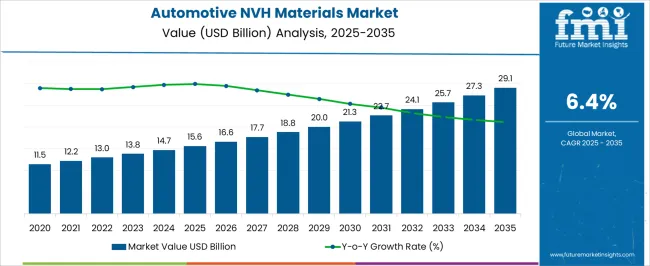

The automotive NVH materials market is projected at USD 15.6 billion in 2025 and is expected to reach USD 29.1 billion by 2035, growing at a CAGR of 6.4%. The cost structure within this market is influenced primarily by raw material sourcing, processing technologies, and integration into vehicle design. Polymers, foams, and composites form the largest share of raw material costs, and fluctuations in crude-derived inputs have a direct impact on production expenses.

Manufacturing costs include molding, cutting, and specialized lamination processes to enhance vibration and acoustic resistance, which add to the value chain complexity. The value chain begins with material suppliers, followed by processors and component fabricators who design NVH solutions tailored for OEM specifications. OEMs integrate these materials into body panels, dashboards, floorings, and engine bays, ensuring compliance with acoustic and vibration standards.

Logistics and distribution further add to costs, as NVH components are lightweight but bulky, requiring specialized handling. The aftermarket plays a supplementary role, though OEM integration remains dominant. Value is increasingly being added through advanced formulations such as lightweight NVH composites, which balance performance with efficiency. The analysis indicates that cost optimization depends on strategic raw material procurement and innovative processing methods that reduce weight without compromising acoustic performance.

| Metric | Value |

|---|---|

| Automotive NVH Materials Market Estimated Value in (2025 E) | USD 15.6 billion |

| Automotive NVH Materials Market Forecast Value in (2035 F) | USD 29.1 billion |

| Forecast CAGR (2025 to 2035) | 6.4% |

The automotive NVH materials market represents a focused part of the automotive materials industry, highlighting its role in reducing noise, vibration, and harshness across vehicle platforms. Within the wider automotive materials segment, it accounts for about 7.4%, supported by growing consumer demand for comfort and acoustic performance. In the automotive interior materials space, it holds nearly 6.1%, reflecting its direct influence on cabin quality. Across the global polymer-based automotive materials market, NVH solutions secure 4.9%, while in the lightweight vehicle materials category, they capture 3.7%.

Within the automotive soundproofing and insulation sector, this market represents 5.3%, underlining its technical relevance in both traditional and electric mobility applications. Recent developments in this market emphasize material innovation, integration, and regulatory-driven adoption. Advanced composites and engineered foams are being used to balance weight reduction with acoustic control, aligning with fuel efficiency and electric range goals. Suppliers are developing multilayer laminates and viscoelastic damping solutions to enhance vibration control without compromising structural integrity. The growth of electric vehicles has introduced new NVH challenges, such as motor whine and road noise, driving demand for specialized materials. OEMs are collaborating with material scientists to create bio-based and recyclable NVH products, ensuring compliance with environmental regulations.

Digital simulation tools are increasingly being applied in design stages, reducing prototyping costs while optimizing acoustic performance. These advancements highlight the expanding role of NVH materials as both a comfort enhancer and a regulatory compliance enabler in the automotive sector.

The market is witnessing steady growth, driven by increasing consumer demand for quieter, more comfortable, and refined vehicles. Current market trends indicate a focus on reducing noise, vibration, and harshness across all vehicle types, especially in passenger cars. Technological advancements in material science, such as lightweight polymers, composites, and advanced rubber formulations, are enhancing the ability to control acoustic performance without compromising vehicle weight or fuel efficiency.

Investment in research and development by automotive manufacturers has facilitated the integration of NVH solutions during the design stage, resulting in more efficient and cost-effective implementations. The ongoing shift toward electric vehicles is also fueling market growth, as the reduced engine noise emphasizes the importance of interior acoustic management.

Increasing regulatory standards for vehicle noise and vibration levels are further supporting the adoption of NVH materials. The future outlook is shaped by continuous innovation in absorber and insulator technologies, coupled with the rising preference for premium and comfort-focused vehicles, driving sustained demand across both developed and emerging automotive markets.

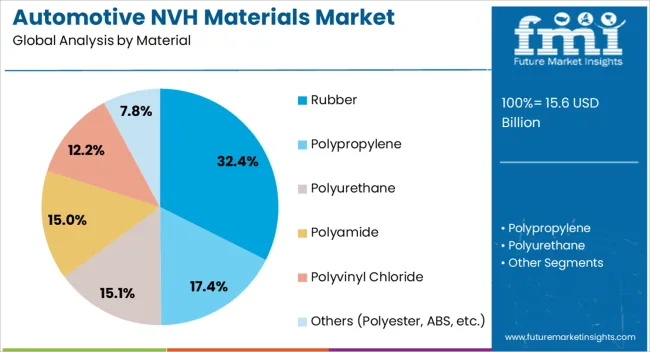

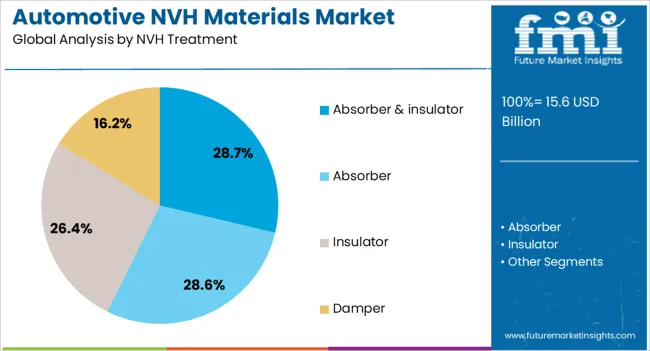

The automotive NVH materials market is segmented by material, NVH treatment, vehicle, and geographic regions. By material, the automotive NVH materials market is divided into Rubber, Polypropylene, Polyurethane, Polyamide, Polyvinyl Chloride, and Others (Polyester, ABS, etc.). In terms of NVH treatment, automotive NVH materials market is classified into Absorber & insulator, Absorber, Insulator, and Damper.

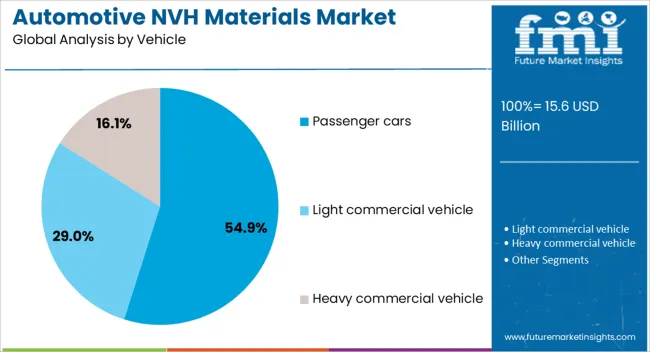

Based on vehicle, the automotive NVH materials market is segmented into Passenger cars, Light commercial vehicles, and Heavy commercial vehicles. Regionally, the automotive NVH materials industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Rubber material segment is projected to hold 32.40% of the overall Automotive NVH Materials market revenue in 2025, positioning it as the leading material type. This dominance is being attributed to rubber’s inherent elasticity, durability, and vibration damping properties, which make it highly effective in mitigating both airborne and structure-borne noise.

Rubber components can be precisely engineered to meet specific vehicle design requirements, enabling their use in gaskets, mounts, seals, and other critical areas where vibration isolation is essential. The widespread adoption of rubber is also supported by its cost-effectiveness and long lifecycle compared to other materials, allowing manufacturers to maintain high performance while controlling production costs.

As electric and hybrid vehicles become more prevalent, the importance of rubber in achieving cabin quietness is heightened due to the relative absence of engine noise. Additionally, its compatibility with both absorbers and insulators ensures that rubber-based NVH solutions remain scalable, versatile, and adaptable to various vehicle platforms, thereby reinforcing its leadership position in the market.

The Absorber and Insulator NVH treatment segment is expected to capture 28.70% of total market revenue in 2025, making it the most prominent NVH treatment category. This leadership is being driven by the segment’s ability to effectively reduce vibrations and attenuate noise across multiple vehicle components, including doors, flooring, dashboards, and wheel arches.

Absorbers and insulators are increasingly favored for their efficiency in improving cabin acoustic quality while maintaining lightweight construction, which is crucial for fuel economy and EV performance. The growth of this segment is also supported by the trend of integrating advanced composite materials into absorbers and insulators, enhancing thermal and acoustic performance simultaneously.

OEMs are adopting these treatments during early design and production stages to meet stringent regulatory noise requirements and provide superior driving experiences. The continued expansion of premium passenger car models and the rising consumer expectation for refined interiors are expected to sustain strong demand for absorber and insulator NVH treatments, reinforcing their dominant share in the market.

The Passenger Cars vehicle segment is projected to account for 54.90% of the Automotive NVH Materials market revenue in 2025, establishing it as the largest end-use segment. This prominence is being attributed to the high volume of passenger car production globally and the increasing emphasis on comfort, quietness, and refinement in this vehicle category. Passenger cars benefit significantly from NVH materials because cabin noise directly impacts perceived vehicle quality and customer satisfaction.

The segment has been supported by automakers’ efforts to differentiate vehicles through enhanced acoustic performance, particularly in mid-range and premium models. As electric and hybrid passenger cars gain popularity, NVH materials are playing a crucial role in compensating for reduced engine noise, which would otherwise highlight other sources of vibration and sound.

Additionally, the integration of absorbers, insulators, and advanced rubber components during vehicle assembly ensures optimized noise control without affecting structural integrity. Consumer demand for high-quality, quiet driving experiences and stringent regulatory standards are expected to continue driving investment in NVH solutions for passenger cars, sustaining its leadership in market revenue.

The market has been shaped by rising demand for quieter, more comfortable, and efficient vehicles. NVH materials, which include foams, rubber, composites, and acoustic barriers, are critical in minimizing noise, vibration, and harshness within vehicles. Their application spans across body panels, engine compartments, and interiors, ensuring improved ride quality and consumer satisfaction. Growing electric vehicle adoption has further intensified the need for specialized NVH materials due to the absence of engine noise, which highlights other sound sources.

The rapid growth of electric and hybrid vehicles has reshaped NVH material requirements. The absence of traditional engine noise has amplified other sources such as road, tire, and wind noise, making NVH solutions more critical. EV manufacturers are adopting high-performance damping and acoustic insulation materials to address these challenges. Lightweight NVH materials are also being developed to offset the weight of large battery packs. This evolving demand has opened new opportunities for material suppliers to design customized NVH solutions for electrified drivetrains, underscoring the strong link between vehicle electrification and NVH material innovation.

Stringent global regulations on emissions and fuel efficiency have influenced NVH material usage by encouraging lightweight and multifunctional solutions. Automakers are reducing vehicle weight to meet compliance requirements, prompting the adoption of advanced polymers, composites, and bio-based NVH materials. Suppliers are focusing on materials that combine noise reduction with lightweight properties without compromising safety or durability. Regulations have also indirectly fueled innovation by requiring solutions that balance comfort, sustainability, and cost efficiency. This trend has positioned NVH materials as a strategic element within automotive engineering, beyond their conventional role of enhancing passenger comfort.

Lightweight NVH solutions are being increasingly used to support automotive efficiency goals. Materials such as advanced foams, engineered thermoplastics, and laminated composites are replacing heavier traditional materials. These lightweight alternatives help reduce vehicle mass while delivering effective noise and vibration control. Automakers are integrating lightweight NVH systems across passenger cars and commercial vehicles to optimize performance and fuel economy. The shift toward material efficiency has also fostered strong supplier competition in developing cost-effective lightweight solutions. This ongoing transition underscores the dual role of NVH materials in both enhancing driving comfort and supporting efficiency-driven design.

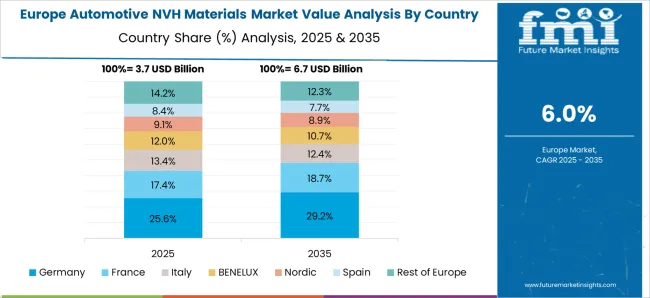

NVH material demand exhibits strong regional variations, shaped by consumer expectations and vehicle market structures. In North America and Europe, high consumer preference for quiet and comfortable vehicles has driven strong adoption of advanced NVH systems. Asia-Pacific, led by China, has witnessed rapid growth due to expanding EV production and rising consumer demand for refined driving experiences. In contrast, price-sensitive regions in Latin America and Africa still rely on basic NVH solutions due to affordability constraints. Automakers continue to tailor their NVH strategies based on regional demand, reinforcing the market’s diverse growth patterns worldwide.

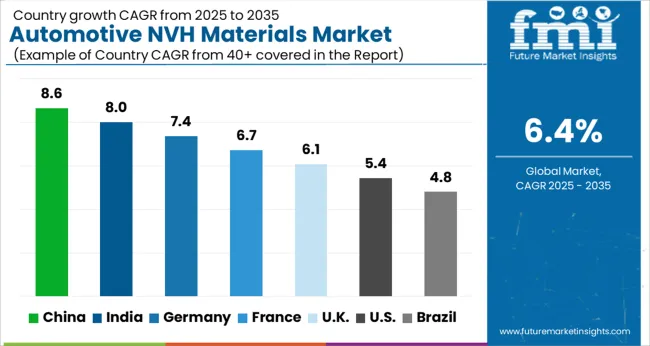

| Country | CAGR |

|---|---|

| China | 8.6% |

| India | 8.0% |

| Germany | 7.4% |

| France | 6.7% |

| UK | 6.1% |

| USA | 5.4% |

| Brazil | 4.8% |

The market is projected to advance steadily as demand for quieter and more comfortable vehicles rises across global markets. China holds 8.6%, supported by large-scale vehicle manufacturing and the adoption of lightweight damping materials. India secures 8.0%, driven by rapid automotive production growth and increased use of insulation technologies. Germany records 7.4%, where precision engineering and premium segment vehicles emphasize advanced acoustic solutions. The United Kingdom achieves 6.1%, with noise control integration progressing in both passenger and commercial fleets. The United States marks 5.4%, influenced by stronger emphasis on customer comfort and innovations in vibration absorption products. Collectively, these leading countries represent diverse approaches that strengthen the adoption of NVH materials in automotive systems. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is projected to record a CAGR of 8.6%, driven by rapid expansion in passenger and commercial vehicle production. Automakers are focusing on improving cabin comfort by reducing noise and vibration levels, which has created strong demand for advanced NVH materials. Lightweight composites, foams, and insulation products are being increasingly used to enhance ride quality while meeting regulatory standards for vehicle efficiency. Domestic manufacturers are expanding production capacity to meet the needs of both local and international automakers. With electric vehicle adoption gaining momentum, NVH solutions are expected to play an even greater role in future vehicle design.

India is anticipated to grow at a CAGR of 8.0%, supported by rising demand for comfort-focused vehicles in both urban and rural regions. The market is witnessing an increasing shift toward the use of noise-dampening materials in compact cars, two-wheelers, and commercial vehicles. Domestic and global suppliers are introducing cost-effective NVH solutions to meet local automaker requirements. With government initiatives promoting electric mobility, the need for NVH materials to address high-frequency noise from electric powertrains is expected to increase. Growing exports of Indian-manufactured vehicles also contribute to stronger adoption of NVH materials.

Germany is forecast to grow at a CAGR of 7.4%, supported by its leadership in automotive engineering and focus on premium vehicle quality. German automakers have long prioritized advanced NVH materials to ensure superior ride comfort and cabin silence. Rising electric vehicle production is accelerating innovation in lightweight NVH solutions to manage motor and road noise. R&D efforts are focused on integrating sustainable and recyclable NVH products in line with stricter European regulations. With premium brands exporting globally, the influence of German NVH technologies continues to shape international market standards.

The United Kingdom is expected to expand at a CAGR of 6.1%, driven by increasing focus on passenger comfort and evolving regulatory standards. British automakers and suppliers are adopting innovative NVH solutions to address noise reduction in both traditional and electric vehicles. The market is also shaped by the demand for quieter cabins in premium vehicle segments. Lightweight foams and acoustic barriers are being utilized to enhance efficiency without compromising performance. Despite challenges in vehicle production volumes, technology adoption in NVH materials is expected to remain strong, particularly in electric and hybrid models.

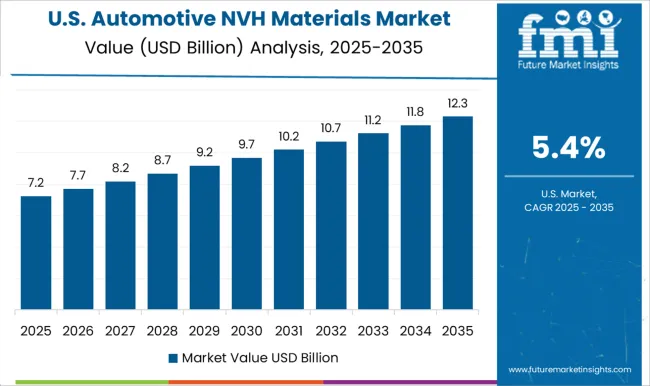

The United States is projected to grow at a CAGR of 5.4%, supported by strong demand for passenger comfort across SUVs, trucks, and premium cars. Automakers are investing in advanced NVH solutions to address rising consumer expectations for quiet cabins and smoother driving experiences. The growth of hybrid and electric vehicles is creating fresh challenges, with NVH materials required to suppress high-frequency motor noise and vibrations. Suppliers are also focusing on sustainable and recyclable materials to meet evolving environmental regulations. The presence of major automakers and large-scale production ensures steady adoption of advanced NVH materials.

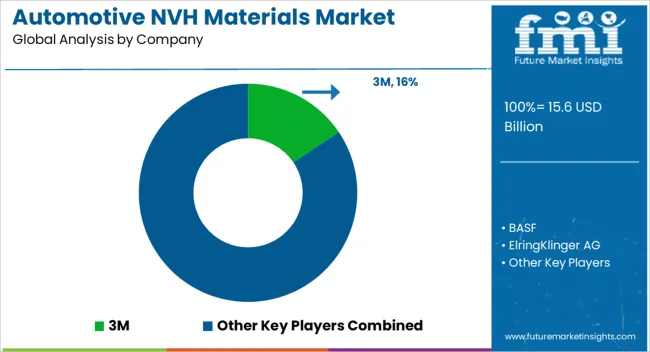

The market is driven by companies that deliver advanced solutions to improve acoustic comfort and ride quality in vehicles. 3M is a prominent player offering a wide range of lightweight damping and insulation materials that are extensively used across passenger and commercial vehicles. BASF contributes with its specialty polymers and foams that enhance noise reduction while supporting fuel efficiency. ElringKlinger AG strengthens the market with sealing and shielding solutions designed to limit vibration and reduce unwanted cabin noise. The Dow Chemical Company provides innovative elastomers and polyurethane-based NVH materials, addressing performance requirements in both electric and internal combustion vehicles.

NVH Korea is recognized for specialized damping sheets and insulation systems tailored to regional automotive manufacturers. Boyd Corporation focuses on engineered material solutions, particularly in sealing, thermal, and acoustic management. Vibroacoustic AG adds value with its expertise in soundproofing technologies for structural vehicle components. Fostek Corporation supplies advanced foams for sound absorption, while Sumitomo Riko is a key supplier of vibration isolation systems and polymer-based components. Covestro AG plays a vital role with polyurethane materials that combine durability with acoustic insulation properties. Autins contributes with lightweight nonwoven and foam-based NVH materials that are widely integrated into vehicle interiors.

| Item | Value |

|---|---|

| Quantitative Units | USD 15.6 Billion |

| Material | Rubber, Polypropylene, Polyurethane, Polyamide, Polyvinyl Chloride, and Others (Polyester, ABS, etc.) |

| NVH Treatment | Absorber & insulator, Absorber, Insulator, and Damper |

| Vehicle | Passenger cars, Light commercial vehicle, and Heavy commercial vehicle |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | 3M, BASF, ElringKlinger AG, The Dow Chemical Company, NVH Korea, Boyd Corporation, Vibroacoustic AG, Fostek Corporatio, Sumitomo Riko, Covestro AG, and Autins |

| Additional Attributes | Dollar sales by material type and vehicle category, demand dynamics across passenger and commercial vehicles, regional trends in acoustic and vibration control adoption, innovation in lightweight composites, insulation, and damping technologies, environmental impact of material sourcing and recycling, and emerging use cases in electric vehicles and premium automotive interiors. |

The global automotive NVH materials market is estimated to be valued at USD 15.6 billion in 2025.

The market size for the automotive NVH materials market is projected to reach USD 29.1 billion by 2035.

The automotive NVH materials market is expected to grow at a 6.4% CAGR between 2025 and 2035.

The key product types in automotive NVH materials market are rubber, polypropylene, polyurethane, polyamide, polyvinyl chloride and others (polyester, abs, etc.).

In terms of NVH treatment, absorber & insulator segment to command 28.7% share in the automotive NVH materials market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Roof Rails Market Size and Share Forecast Outlook 2025 to 2035

Automotive Active Safety System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Diagnostic Scan Tool Market Size and Share Forecast Outlook 2025 to 2035

Automotive Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Dynamic Map Data Market Size and Share Forecast Outlook 2025 to 2035

Automotive Green Tires Market Size and Share Forecast Outlook 2025 to 2035

Automotive E-Tailing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Interior Market Forecast Outlook 2025 to 2035

Automotive Key Market Size and Share Forecast Outlook 2025 to 2035

Automotive Appearance Chemical Market Forecast and Outlook 2025 to 2035

Automotive Seating Market Forecast and Outlook 2025 to 2035

Automotive Domain Control Module Market Forecast and Outlook 2025 to 2035

Automotive Remote Diagnostic Market Forecast and Outlook 2025 to 2035

Automotive-grade Inertial Navigation System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Thin IGBT Module Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hydrogen Leak Detection Sensors Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hybrid IGBTs Market Size and Share Forecast Outlook 2025 to 2035

Automotive Exhaust Extraction Hose Reels Market Size and Share Forecast Outlook 2025 to 2035

Automotive Electroplating Service Market Size and Share Forecast Outlook 2025 to 2035

Automotive Manufacturing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA