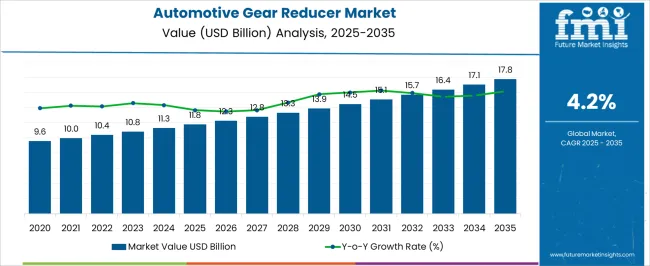

The automotive gear reducer market is estimated to be valued at USD 11.8 billion in 2025 and is projected to reach USD 17.8 billion by 2035, registering a compound annual growth rate (CAGR) of 4.2% over the forecast period.

The automotive gear reducer market is forecasted to grow from USD 11.8 billion in 2025 to USD 17.8 billion by 2035, reflecting a compound annual growth rate (CAGR) of 4.2%. The growth contribution index highlights the role played by the expanding demand for efficient power transmission systems across vehicles, particularly in electric and hybrid models where gear reducers enhance torque management and energy utilization. By 2030, the market is projected to reach USD 14.5 billion, indicating that consistent demand patterns will continue to drive stable contributions to overall growth. This progression illustrates how gear reducers remain indispensable components in improving drivability and extending vehicle performance, making them vital to long-term industry advancement.

Examining the yearly contribution reveals that growth is distributed evenly, with increments that suggest reliability rather than volatility. From 2025 to 2035, the market adds over USD 6 billion, with each growth block contributing meaningfully to the cumulative expansion. Industries relying on automotive components are expected to prioritize gear reducers not only for their efficiency benefits but also for their role in lowering operational strain on engines and motors. This underlines a market trajectory that, while moderate in pace, is steady in value creation.

It can be opined that manufacturers who focus on durability, performance consistency, and adaptable designs will secure higher shares in this expanding market. The growth contribution index thus reflects a dependable expansion pathway that underscores the ongoing relevance of automotive gear reducers in global transportation systems.

| Metric | Value |

|---|---|

| Automotive Gear Reducer Market Estimated Value in (2025 E) | USD 11.8 billion |

| Automotive Gear Reducer Market Forecast Value in (2035 F) | USD 17.8 billion |

| Forecast CAGR (2025 to 2035) | 4.2% |

The automotive gear reducer market has emerged as a defining segment across its parent industries, driven by the need for torque optimization, improved drivability, and efficiency in both electric and conventional vehicles. Within the automotive components market, gear reducers contribute about 6–8% share, reflecting their importance as a precision component in modern vehicle design. In the powertrain systems market, the share is higher at around 10–12%, since gear reducers directly influence torque transmission and energy efficiency across diverse vehicle categories.

Within the electric vehicle parts market, gear reducers occupy a substantial 20–22% share, as they are central to EV drivetrains where smooth torque transfer and compact design are critical. In the transmission systems market, gear reducers account for roughly 12–15%, highlighting their role in achieving seamless gear shifts and maintaining mechanical efficiency. Within the heavy commercial vehicle market, they contribute around 7–9%, given the requirement for durability and torque handling in demanding operations.

Although rising raw material costs and design complexities are noted challenges, the demand remains steady because gear reducers form an irreplaceable link in automotive engineering. From my perspective, the automotive gear reducer market is no longer a supportive component but a strategic enabler of vehicle performance, especially as electrification accelerates and efficiency becomes a deciding factor for manufacturers, cementing its place as a cornerstone within global mobility systems.

The automotive gear reducer market is experiencing steady expansion due to the rising demand for fuel efficient vehicles, the growing adoption of advanced transmission systems, and the focus on optimizing torque delivery in various driving conditions. Gear reducers play a critical role in enhancing performance, improving acceleration, and reducing wear on engine components, making them essential across passenger and commercial vehicles.

Technological innovations such as lightweight materials, precision engineering, and integration with hybrid and electric drivetrains are contributing to market growth. Additionally, stricter emission regulations and the push for enhanced vehicle durability are accelerating the adoption of advanced gear reducer designs.

The market outlook remains positive as manufacturers continue to invest in efficiency driven designs and integrate reducers into next generation mobility solutions.

The automotive gear reducer market is segmented by gear reducer, vehicle, technology, application, sales channel, and geographic regions. By gear reducer, automotive gear reducer market is divided into planetary gear reducers, spur gear reducers, helical gear reducers, bevel gear reducers, and worm gear reducers. In terms of vehicle, automotive gear reducer market is classified into passenger cars, commercial vehicles, off-road vehicles, and specialty vehicles. Based on technology, automotive gear reducer market is segmented into manual, automatic, electronically controlled, and adaptive. By application, automotive gear reducer market is segmented into powertrain systems, transmission systems, steering systems, suspension systems, braking systems, auxiliary systems, and electric motors. By sales channel, automotive gear reducer market is segmented into OEM and aftermarket. Regionally, the automotive gear reducer industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The planetary gear reducers segment is expected to hold 38.6% of total market revenue by 2025 within the product category, making it the leading segment. This growth is driven by the high torque density, compact size, and durability offered by planetary designs, which are particularly suitable for modern automotive architectures.

Their ability to handle high load capacity with minimal space requirements has made them popular in both conventional and electric vehicles.

Additionally, improved manufacturing techniques and material advancements have increased their efficiency and operational lifespan, further reinforcing their dominance in the market.

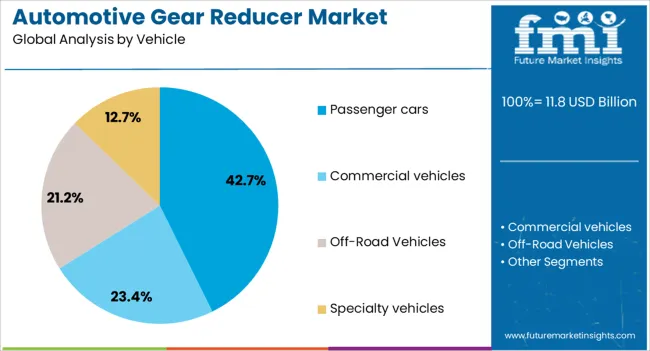

The passenger cars segment is projected to account for 42.7% of total market revenue by 2025 within the vehicle category, positioning it as the most significant segment.

This is due to the large global base of passenger vehicles, increasing consumer preference for smooth driving experiences, and the rising integration of advanced gear reducers to improve performance and fuel efficiency.

The expansion of electric and hybrid passenger cars has also amplified the need for specialized reducers capable of supporting high efficiency powertrains.

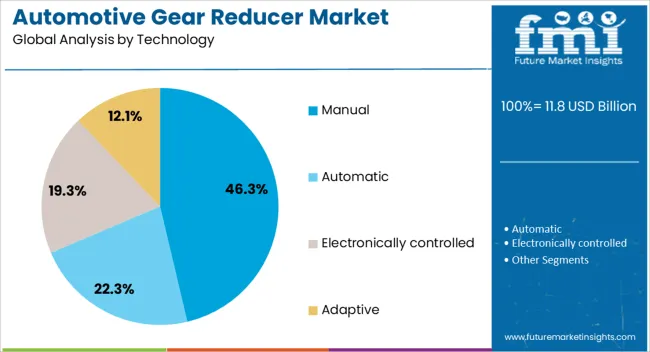

The manual technology segment is expected to contribute 46.3% of total market revenue by 2025 within the technology category, making it the leading segment. This dominance is linked to its cost effectiveness, mechanical simplicity, and ease of maintenance, which remain attractive to consumers in emerging markets.

Additionally, manual transmissions equipped with efficient gear reducers offer improved control over torque delivery, making them suitable for various driving conditions.

While automatic and CVT technologies are expanding, the manual segment maintains strong demand in regions where affordability and durability are prioritized.

The automotive gear reducer market has been driven by demand for efficiency, torque control, and drivability improvements. Opportunities are emerging in electric and hybrid vehicle applications, while trends highlight compact, noise-reducing designs. However, manufacturers face challenges linked to production complexity and cost pressures. Despite these hurdles, the market outlook remains positive as gear reducers continue to serve as an indispensable element in ensuring optimal performance of modern vehicles across traditional and electric platforms.

The demand for automotive gear reducers has been stimulated by the growing need for improved efficiency, reduced energy losses, and better torque management in vehicles. These components are critical in transferring power from engines and electric motors to the drivetrain while ensuring smooth performance. The automotive industry’s focus on producing cars with enhanced drivability and fuel optimization has placed gear reducers in a vital role. With electric vehicles entering mainstream markets, their dependence on precise torque conversion is strengthening the demand outlook.

Ample opportunities have been created as electric and hybrid vehicles increasingly rely on advanced gear reducers to manage higher torque and rotational speed variations. The unique requirements of these vehicles for compact, lightweight, and durable components offer gear reducer manufacturers a chance to expand product lines tailored to EVs. As governments support the adoption of cleaner mobility, the integration of efficient gear reducers into new vehicle platforms is expected to rise. This offers suppliers scope to differentiate through advanced materials and performance-focused designs.

A prominent trend shaping the automotive gear reducer market is the movement toward compact, lightweight designs with an emphasis on noise and vibration reduction. Automakers are demanding gear reducers that not only improve energy efficiency but also enhance overall ride comfort. The integration of high-precision gear systems with superior lubrication and material treatments is becoming common across premium and mass-market segments. This trend is setting new benchmarks in the industry, positioning gear reducers as a key enabler of smoother, quieter, and more efficient vehicle performance.

Challenges in the automotive gear reducer market have been driven by complexities in manufacturing precision parts and the high costs involved in development. Advanced gear reducers require specialized materials, rigorous testing, and precise engineering to meet automotive standards, which elevates production expenses. Price competition from low-cost manufacturers further pressures established players to balance quality and affordability. In addition, fluctuations in raw material costs and supply chain constraints present persistent hurdles. These challenges must be carefully managed to sustain market growth and industry competitiveness.

| Country | CAGR |

|---|---|

| China | 5.7% |

| India | 5.3% |

| Germany | 4.8% |

| France | 4.4% |

| UK | 4.0% |

| USA | 3.6% |

| Brazil | 3.2% |

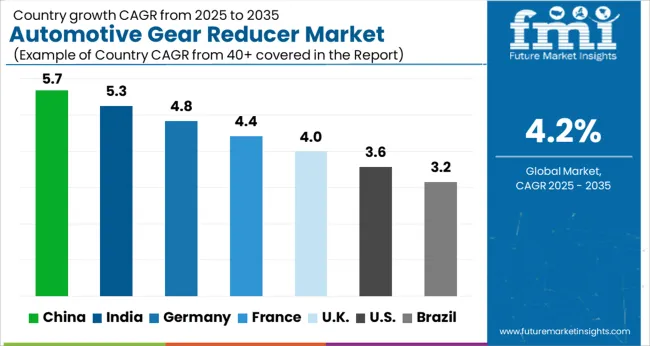

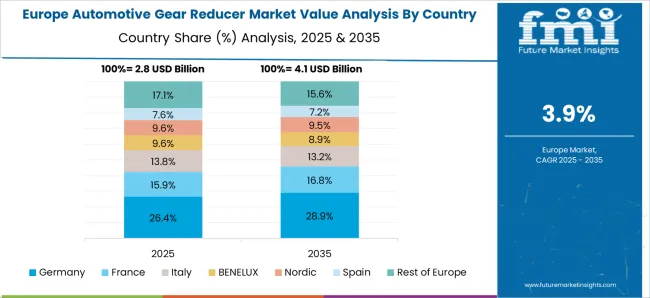

The global automotive gear reducer market is projected to grow at a CAGR of 4.2% from 2025 to 2035. China leads with a growth rate of 5.7%, followed by India at 5.3%, and France at 4.4%. The United Kingdom records a growth rate of 4%, while the United States shows the slowest growth at 3.6%. Demand for automotive gear reducers is largely driven by the growing automotive sector, particularly the demand for electric vehicles (EVs), which require efficient powertrain systems. Emerging markets like China and India benefit from increased vehicle production and rising adoption of EVs, while developed markets such as the USA, UK, and France focus on advanced technology integration, improving fuel efficiency, and meeting environmental regulations. This report includes insights on 40+ countries; the top markets are shown here for reference.

The automotive gear reducer market in China is expected to grow at a CAGR of 5.7%. As the world's largest automotive market, China is experiencing significant demand for gear reducers, especially in electric vehicles (EVs). The country’s rapidly expanding automotive production, coupled with strong government support for the EV sector, is pushing the demand for high-efficiency gear reduction systems. With investments in automotive electrification and improved manufacturing technologies, China is set to dominate the global market. Additionally, China’s focus on reducing emissions and improving energy efficiency further boosts the market for advanced automotive gear reducers.

The automotive gear reducer market in India is projected to grow at a CAGR of 5.3%. India’s rapidly expanding automotive industry, particularly in the passenger vehicle and electric vehicle segments, is boosting demand for high-performance gear reducers. As India shifts towards sustainable mobility solutions, the rise of EV production has led to increased adoption of efficient gear systems. Additionally, the government's push for local manufacturing and the development of EV infrastructure is helping to position India as a key player in the automotive gear reducer market. Rising vehicle production in both the OEM and aftermarket segments further strengthens market growth.

The automotive gear reducer market in France is expected to grow at a CAGR of 4.4%. France’s automotive industry is focused on improving fuel efficiency and meeting stricter emission regulations, driving the need for advanced gear reduction technologies. The rise of electric and hybrid vehicles is another key factor influencing market growth. The French automotive sector is also investing heavily in research and development to produce more efficient gear reducers, particularly for EVs. France’s manufacturing expertise and its role in the European automotive supply chain further drive demand for these critical components.

The automotive gear reducer market in the United Kingdom is projected to grow at a CAGR of 4%. The UK’s automotive industry is transitioning towards electric mobility, with an increasing focus on reducing carbon emissions and improving vehicle efficiency. This shift is driving demand for automotive gear reducers designed for EVs and hybrid vehicles. The UK government’s commitment to banning fossil fuel-powered vehicles by 2030 is likely to push automakers to adopt more efficient transmission and gear reduction systems. Furthermore, the growth in automotive manufacturing and R&D in the UK supports market expansion.

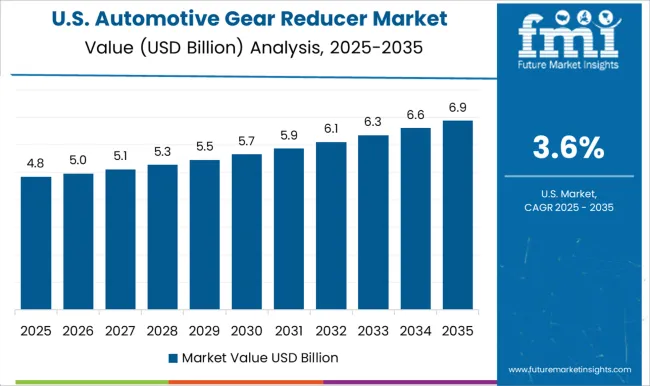

The automotive gear reducer market in the United States is expected to grow at a CAGR of 3.6%. The USA automotive sector is focusing on improving vehicle performance and fuel efficiency, which is driving demand for advanced gear reduction systems. The shift towards electric vehicles and hybrid powertrains is also fueling the market for automotive gear reducers. As automakers increasingly adopt new transmission technologies, the demand for high-efficiency, durable gear systems is expected to rise. However, the USA market is growing at a slower pace compared to China and India due to the more mature automotive sector and slower EV adoption.

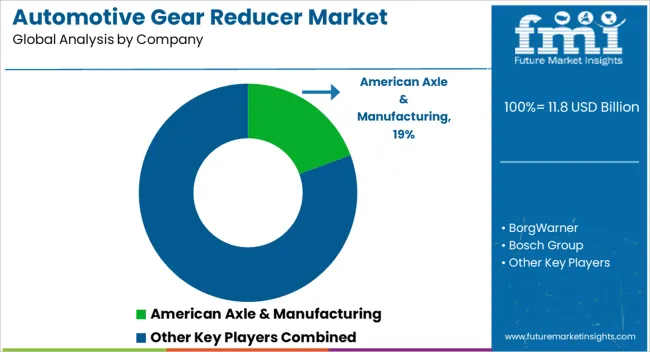

The automotive gear reducer market is defined by a mix of legacy drivetrain suppliers and specialized motion technology providers competing for OEM contracts and aftermarket demand. American Axle & Manufacturing, Dana, and Eaton emphasize their strong presence in driveline and transmission systems, where gear reducers are positioned as efficiency enablers for both internal combustion and electrified platforms. BorgWarner and Valeo leverage their expertise in hybrid and electric vehicle technologies, integrating compact gear reduction units that optimize torque transfer, improve battery efficiency, and meet the rising demand for electrified powertrains.

Bosch Group, with its diversified portfolio, markets precision-engineered gear reduction solutions that align with global automakers’ requirements for durability, reduced noise, and smoother operation. The market also features companies with a heritage in motion control and industrial drive technologies. Nidec, Regal Rexnord, SEW Eurodrive, and Sumitomo capitalize on their strengths in gear motor technologies, offering scalable solutions that adapt well to electric mobility applications, commercial vehicles, and high-torque requirements.

Their brochures typically underscore reliability, energy efficiency, and compact design, aligning with the automotive industry’s shift toward space-saving components. Competition in the gear reducer market is guided by factors such as performance durability, manufacturing cost optimization, lightweight designs, and compliance with stricter efficiency standards. As OEMs push for electrification, suppliers of gear reducers position themselves not only as drivetrain component makers but also as technology partners advancing mobility transitions.

| Item | Value |

|---|---|

| Quantitative Units | USD 11.8 billion |

| Gear Reducer | Planetary gear reducers, Spur gear reducers, Helical gear reducers, Bevel gear reducers, and Worm gear reducers |

| Vehicle | Passenger cars, Commercial vehicles, Off-Road Vehicles, and Specialty vehicles |

| Technology | Manual, Automatic, Electronically controlled, and Adaptive |

| Application | Powertrain systems, Transmission systems, Steering systems, Suspension systems, Braking systems, Auxiliary systems, and Electric motors |

| Sales Channel | OEM and Aftermarket |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | American Axle & Manufacturing, BorgWarner, Bosch Group, Dana, Eaton, Nidec, Regal Rexnord, SEW Eurodrive, Sumitomo, and Valeo |

| Additional Attributes | Dollar sales by reducer type (planetary, harmonic, spur, bevel) and application (electric vehicles, hybrid vehicles, conventional vehicles) are key metrics. Trends include rising demand for compact, high-efficiency transmission systems, growth in EV and hybrid adoption, and increasing preference for lightweight driveline components. Regional adoption, technological advancements, and regulatory compliance are driving market growth. |

The global automotive gear reducer market is estimated to be valued at USD 11.8 billion in 2025.

The market size for the automotive gear reducer market is projected to reach USD 17.8 billion by 2035.

The automotive gear reducer market is expected to grow at a 4.2% CAGR between 2025 and 2035.

The key product types in automotive gear reducer market are planetary gear reducers, spur gear reducers, helical gear reducers, bevel gear reducers and worm gear reducers.

In terms of vehicle, passenger cars segment to command 42.7% share in the automotive gear reducer market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Performance Part Market Size and Share Forecast Outlook 2025 to 2035

Automotive Carbon Ceramic Brake Market Size and Share Forecast Outlook 2025 to 2035

Automotive Camshaft Market Size and Share Forecast Outlook 2025 to 2035

Automotive Stamping Industry Analysis in India Size and Share Forecast Outlook 2025 to 2035

Automotive Cylinder Liner Market Size and Share Forecast Outlook 2025 to 2035

Automotive Microcontroller Market Size and Share Forecast Outlook 2025 to 2035

Automotive Roof Rails Market Size and Share Forecast Outlook 2025 to 2035

Automotive Active Safety System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Diagnostic Scan Tool Market Size and Share Forecast Outlook 2025 to 2035

Automotive Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Dynamic Map Data Market Size and Share Forecast Outlook 2025 to 2035

Automotive Green Tires Market Size and Share Forecast Outlook 2025 to 2035

Automotive E-Tailing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Interior Market Forecast Outlook 2025 to 2035

Automotive Key Market Size and Share Forecast Outlook 2025 to 2035

Automotive Appearance Chemical Market Forecast and Outlook 2025 to 2035

Automotive Seating Market Forecast and Outlook 2025 to 2035

Automotive Domain Control Module Market Forecast and Outlook 2025 to 2035

Automotive Remote Diagnostic Market Forecast and Outlook 2025 to 2035

Automotive-grade Inertial Navigation System Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA