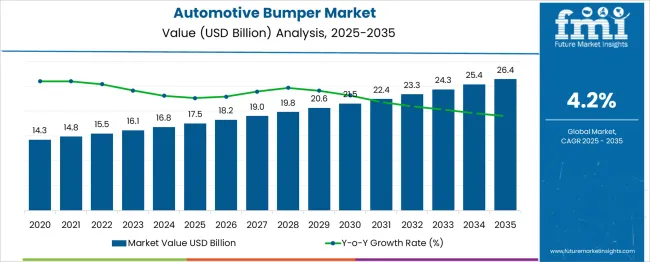

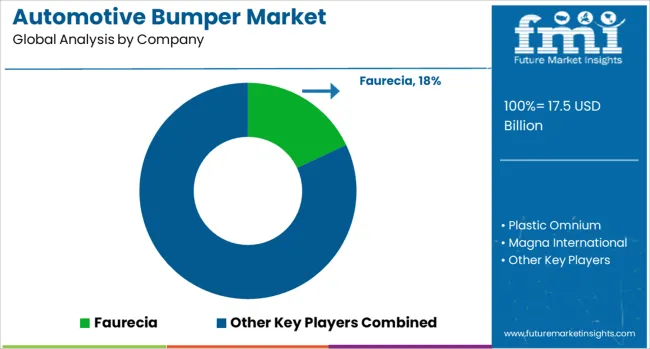

The Automotive Bumper Market is estimated to be valued at USD 17.5 billion in 2025 and is projected to reach USD 26.4 billion by 2035, registering a compound annual growth rate (CAGR) of 4.2% over the forecast period. The initial phase from 2020 to 2025 sees the market rise from USD 14.3 billion to USD 16.8 billion, driven by increasing vehicle production, stricter safety regulations, and growing demand for lightweight and impact-resistant bumper materials. This period is characterized by the adoption of advanced manufacturing techniques such as injection molding and the use of innovative materials like thermoplastic olefins and composite plastics that enhance durability and reduce weight.

Between 2026 and 2030, the market is expected to advance from USD 17.5 billion to USD 21.5 billion, supported by rising replacement demand, particularly in developed automotive markets, and integration of active safety features like sensors and cameras within bumper assemblies. The growing focus on pedestrian safety and aesthetic design also propels market expansion. The final phase from 2031 to 2035 accelerates with the market increasing from USD 22.4 billion to USD 26.4 billion. This growth is fueled by the rising penetration of electric vehicles, which require specialized bumper designs to accommodate battery packs and aerodynamic efficiency. Additionally, increasing adoption of autonomous driving systems encourages the integration of advanced bumper technologies for enhanced collision detection and mitigation. Overall, the automotive bumper market demonstrates a robust and sustained growth trajectory, driven by evolving safety standards, technological innovation, and expanding vehicle production worldwide through 2035.

| Metric | Value |

|---|---|

| Automotive Bumper Market Estimated Value in (2025 E) | USD 17.5 billion |

| Automotive Bumper Market Forecast Value in (2035 F) | USD 26.4 billion |

| Forecast CAGR (2025 to 2035) | 4.2% |

The Automotive Bumper market is gaining substantial momentum due to rising vehicle production, increasing focus on occupant safety, and the integration of advanced lightweight materials. Automotive manufacturers are prioritizing components that enhance crashworthiness without compromising design flexibility or efficiency. Regulatory standards on pedestrian safety and vehicle impact performance have pushed suppliers to innovate using energy-absorbing structures and modular designs.

The demand for bumpers is further supported by growing automotive aftermarket activity, particularly in collision repair and vehicle personalization segments. As electric vehicles and connected cars become more prevalent, bumpers are evolving to incorporate sensors, radars, and cameras, making them an essential component in next-generation vehicle design.

With cost pressures and sustainability goals, material innovation remains at the core of market expansion, while product differentiation and ease of assembly continue to drive OEM and supplier strategies. The market outlook remains strong across both mature and emerging economies as manufacturers invest in high-performance bumper solutions tailored to changing safety, regulatory, and aesthetic needs..

The automotive bumper market is segmented by material, bumper, position, vehicle, manufacturing process, end use, and geographic regions. The automotive bumper market is divided into Plastic, Metal, Carbon fiber, Composite, and others. In terms of the bumper market, it is classified into Standard bumper, Step bumper, Roll pan bumper, Deep drop bumper, and Tube bumper. Based on the position, the automotive bumper market is segmented into the Front bumper and the Rear bumper. The automotive bumper market is segmented into Passenger vehicles and commercial vehicles. The manufacturing process of the automotive bumper market is segmented into Injection molding, Reaction Injection Molding (RIM), Blow molding, and Compression molding. By end use of the automotive bumper market is segmented into OEMAftermarket. Regionally, the automotive bumper industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

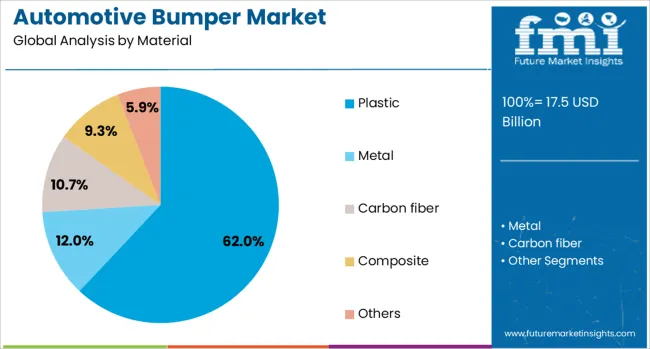

The plastic material segment is expected to account for 62% of the Automotive Bumper market revenue share in 2025, establishing it as the leading material used in bumper production. Growth of this segment has been attributed to the lightweight characteristics of plastic, which contribute to overall vehicle efficiency and fuel economy.

Plastic materials offer high design flexibility, allowing for the integration of complex shapes and features while maintaining structural integrity. The increasing adoption of thermoplastic and composite plastics has enhanced durability and recyclability, making them more desirable for automotive manufacturers aiming to meet environmental regulations.

The ability of plastic bumpers to absorb energy during collisions without permanent deformation has made them a preferred choice across both passenger and commercial vehicle categories. Furthermore, reduced manufacturing cost, ease of moldability, and compatibility with modern painting and finishing techniques have further solidified the dominance of plastic as the primary material in bumper manufacturing..

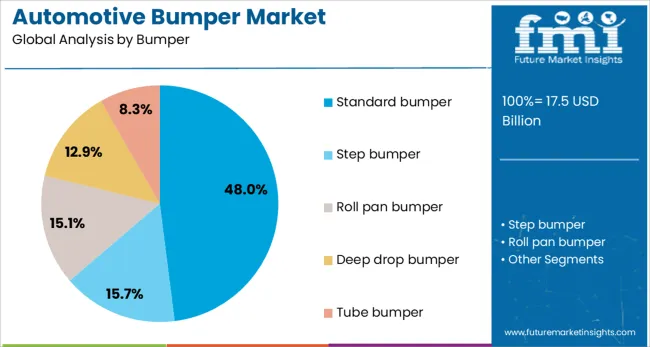

The standard bumper segment is projected to contribute 48% of the Automotive Bumper market revenue share in 2025, positioning it as the dominant product type. The segment's leadership has been supported by its widespread use across a broad range of vehicle models due to its balanced cost, safety, and performance attributes. Standard bumpers provide essential protection during low-speed impacts while maintaining aesthetic continuity with vehicle designs.

Their simplified construction and compatibility with mass manufacturing processes have made them cost-effective for original equipment manufacturers. The consistent performance of standard bumpers in compliance with safety regulations and their ability to incorporate modern features such as crumple zones and energy absorbers have enhanced their appeal.

Additionally, their suitability for integration with sensors and other vehicle electronics has made them adaptable to emerging automotive technologies. The demand for durable yet affordable bumper systems has helped maintain the strong presence of standard bumpers in both OEM and replacement markets..

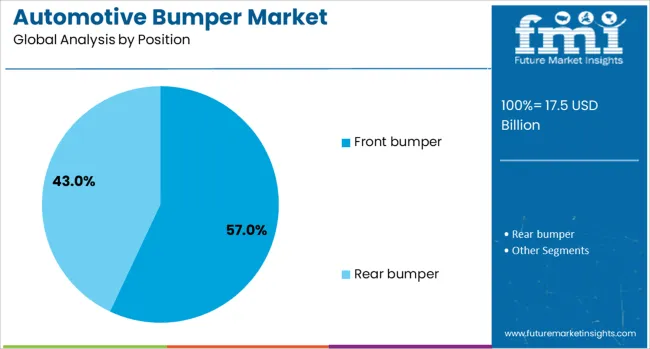

The front bumper segment is expected to hold 57% of the Automotive Bumper market revenue share in 2025, making it the leading bumper position. This dominance has been driven by the crucial role that front bumpers play in vehicle safety and impact mitigation. As the first point of contact in most collisions, front bumpers are engineered with enhanced materials and energy-absorbing features to protect both vehicle occupants and pedestrians.

The incorporation of advanced driver assistance systems into front bumpers, such as parking sensors, adaptive cruise control, and collision detection technology, has significantly increased their functional value. Additionally, stricter crash safety regulations have necessitated improvements in front-end design, encouraging manufacturers to invest in high-performance bumper solutions.

The visual prominence of front bumpers also influences vehicle aesthetics, making them a key focus in styling and branding strategies. These factors combined have ensured the sustained leadership of front bumpers within the overall bumper market..

The automotive bumper market is shaped by regulatory standards, material advancements, integration with safety systems, and aftermarket demand. These factors collectively drive innovation in design, performance, and functionality across vehicle categories.

The automotive bumper market is heavily influenced by stringent safety regulations and crash test requirements. Governments and international agencies have established impact absorption and pedestrian safety standards that OEMs must meet, leading to continuous design refinement. Bumpers are now engineered to balance strength and flexibility, ensuring effective energy dispersion during collisions while minimizing injury risk. Compliance with these standards has also driven the integration of pedestrian protection features such as deformable structures and energy-absorbing cores. Regulatory oversight varies across regions, pushing manufacturers to create modular designs that can be adapted for multiple markets. These requirements encourage innovation in both materials and manufacturing processes, as automakers seek to meet safety targets without compromising styling and aerodynamics.

Material development plays a central role in shaping bumper performance, durability, and cost efficiency. Lightweight composites, thermoplastics, and multi-layered polymer blends have been increasingly adopted to reduce overall vehicle weight while maintaining structural integrity. Metal reinforcements are still used in specific vehicle segments, especially in trucks and SUVs where strength is prioritized. Improved material properties, such as higher tensile strength and impact resistance, allow bumpers to deliver better performance under demanding conditions. These advancements support design flexibility, enabling sharper contours and seamless integration with other exterior components. Material innovation also aids in achieving better paint adhesion, improved weather resistance, and reduced production cycle times, making them more appealing to OEMs and aftermarket suppliers alike.

Bumpers have evolved from simple protective panels into complex systems integrated with advanced vehicle safety technologies. Many modern bumpers now house sensors, cameras, radar units, and LiDAR modules used for driver assistance and collision avoidance systems. Proper positioning and protection of these components are critical to maintaining their functionality during daily use and in low-speed impacts. Manufacturers are developing bumper designs that ensure sensor accuracy while offering easy access for maintenance or replacement. This integration adds value to bumpers as multifunctional components, blending passive and active safety roles. The demand for such configurations continues to rise as consumers and regulators place greater emphasis on safety performance in all driving environments.

The aftermarket segment is an important growth driver for the bumper industry, with demand generated by collision repairs, vehicle customization, and upgrades. Consumers often seek bumpers with enhanced styling, improved aerodynamics, or added protective features such as skid plates and bull bars. The availability of aftermarket designs in various finishes, materials, and configurations provides flexibility for personalizing vehicles. Insurance-driven replacements also contribute to steady aftermarket sales, particularly in regions with higher accident rates. Bumper manufacturers serving this segment focus on cost efficiency, ease of installation, and compatibility with multiple vehicle models. The combination of functional necessity and aesthetic appeal ensures that bumpers remain a high-demand component in the replacement and upgrade market.

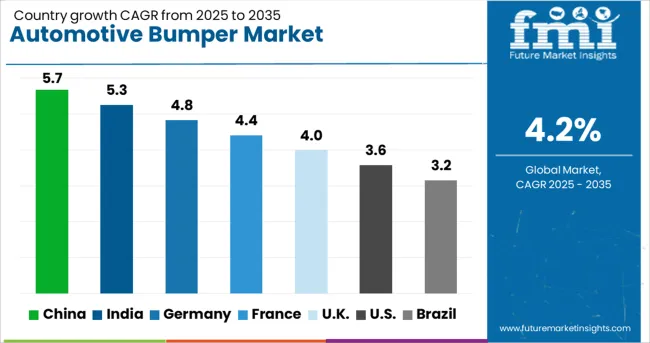

| Country | CAGR |

|---|---|

| China | 5.7% |

| India | 5.3% |

| Germany | 4.8% |

| France | 4.4% |

| UK | 4.0% |

| USA | 3.6% |

| Brazil | 3.2% |

The automotive bumper market is projected to grow globally at a CAGR of 4.2% from 2025 to 2035, supported by evolving safety standards, material advancements, and integration with advanced vehicle technologies. China leads with a CAGR of 5.7%, driven by rising vehicle production, government-led safety mandates, and higher adoption of lightweight bumper materials in mass and premium segments. India follows at 5.3%, benefiting from increased automobile manufacturing, growing demand for multi-material bumpers, and expansion of the aftermarket sector. France achieves 4.4%, influenced by compliance with Euro NCAP requirements and adoption of advanced pedestrian safety features. The United Kingdom grows at 4.0%, supported by a higher mix of SUVs and premium vehicles that demand advanced bumper systems, while the United States records 3.6%, driven by replacement demand, integration with driver-assistance sensors, and rising SUV sales. This growth outlook highlights Asia-Pacific as the primary driver, with Europe and North America maintaining consistent demand through technology integration and regulatory compliance in automotive safety components.

China is expected to achieve a CAGR of 5.7% during 2025–2035, which is notably higher than the global average of 4.2%. Between 2020–2024, the CAGR was about 4.7%, supported by steady growth in passenger vehicle production and gradual integration of advanced safety components. The higher rate projected for the next decade is attributed to government-imposed safety requirements, rapid adoption of lightweight composite bumpers, and increasing production capacity for both domestic and export markets. Expanded EV manufacturing and demand for sensor-integrated bumpers also contribute to growth momentum. The competitive edge is reinforced by local suppliers offering cost-effective, high-quality modules to major OEMs.

India’s CAGR for the automotive bumper market is projected at 5.3% for 2025–2035, compared to nearly 4.4% during 2020–2024, indicating stronger growth prospects. The earlier period saw incremental adoption of advanced bumper designs as OEMs focused on meeting new safety norms while keeping costs manageable. The acceleration in the coming decade will be driven by higher vehicle production, integration of pedestrian protection features, and increased SUV sales. Growth in the aftermarket due to collision repairs and customization will also enhance demand. Local manufacturers are scaling production capacity and material innovation to supply both domestic and export markets effectively.

France is set to record a CAGR of 4.4% during 2025–2035, compared with 3.6% during 2020–2024. The earlier growth phase was supported by steady integration of pedestrian safety features and compliance with Euro NCAP requirements. The improvement in growth rate is expected due to the adoption of smart bumpers with embedded sensors, increased EV production, and greater demand for lightweight solutions in urban vehicle fleets. OEMs are focusing on using recyclable materials to meet EU environmental targets while maintaining safety performance. The aftermarket will remain stable, driven by repair volumes and insurance-related replacements.

The CAGR for the UK automotive bumper market was about 3.3% during 2020–2024 and is forecasted to rise to 4.0% for 2025–2035. The earlier growth rate was limited by slower model refresh cycles and moderate adoption of advanced bumper technologies in mass-market vehicles. The projected increase is supported by higher SUV sales, integration of sensor-ready bumper systems, and demand for pedestrian protection features. Growth in the aftermarket, particularly in urban areas with higher collision rates, will also contribute. Manufacturers are expected to invest in modular bumper designs to accommodate different vehicle types efficiently.

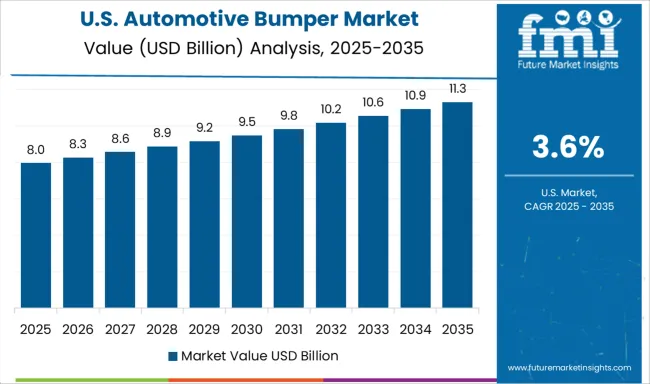

The USA automotive bumper market is forecast to grow at 3.6% CAGR from 2025–2035, up from 2.9% during 2020–2024. The initial growth phase was influenced by strong sales of pickup trucks and SUVs, which have higher bumper content per vehicle. The next decade will see demand supported by replacement needs, styling upgrades, and integration of advanced driver-assistance systems. Growth will also benefit from design upgrades aimed at improving pedestrian protection while maintaining ruggedness. The aftermarket will remain robust due to high vehicle ownership rates and continued investments in personalization.

The automotive bumper market is characterized by strong competition among global Tier-1 suppliers and specialized component manufacturers delivering advanced safety and styling solutions. Faurecia maintains a significant presence with its lightweight multi-material bumper systems designed for enhanced impact absorption and pedestrian protection, catering to both premium and volume vehicle segments. Plastic Omnium focuses on innovative composite bumpers with integrated aerodynamic features and sensor housings, supporting the shift toward connected and autonomous vehicle architectures. Magna International leverages its global manufacturing footprint to provide modular bumper assemblies that combine structural reinforcement with aesthetic customization.

Toyoda Gosei specializes in resin-based bumpers engineered for reduced weight, durability, and compatibility with advanced paint processes, serving a wide range of OEM platforms. Flex-N-Gate delivers high-strength steel and composite bumper solutions, integrating energy absorption technologies to meet diverse regional safety regulations. Key competitive strategies include investment in advanced manufacturing technologies such as precision molding, high-pressure resin transfer, and multi-material joining to optimize strength-to-weight ratios. Suppliers are expanding collaborations with automakers to co-develop bumper systems tailored for sensor integration and aerodynamic performance. Cost optimization through localized production, recyclable materials, and supply chain efficiency is a major focus, while product differentiation increasingly revolves around design flexibility, enhanced pedestrian safety, and support for electric and autonomous vehicle platforms.

Key strategies and drivers for the automotive bumper market in 2024 and 2025 include OEM focus on lightweight multi-material designs to enhance fuel efficiency and meet safety norms, integration of sensors and ADAS components into bumpers, and expansion of regional manufacturing to optimize dollar sales and share. Collision repairs, styling upgrades, and increased SUV adoption drive aftermarket growth. Regulatory mandates for pedestrian protection and crash performance continue to shape design priorities, while partnerships between automakers and suppliers support innovation in modular, recyclable, and cost-effective bumper solutions.

| Item | Value |

|---|---|

| Quantitative Units | USD 17.5 Billion |

| Material | Plastic, Metal, Carbon fiber, Composite, and Others |

| Bumper | Standard bumper, Step bumper, Roll pan bumper, Deep drop bumper, and Tube bumper |

| Position | Front bumper and Rear bumper |

| Vehicle | Passenger vehicles and Commercial vehicles |

| Manufacturing Process | Injection molding, Reaction Injection Molding (RIM), Blow molding, and Compression molding |

| End Use | OEM and Aftermarket |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Faurecia, Plastic Omnium, Magna International, Toyoda Gosei, and Flex-N-Gate |

| Additional Attributes | Dollar sales, share, regional demand growth, OEM vs aftermarket split, material trends, regulatory impact, competitor product portfolios, pricing benchmarks, supply chain risks, design innovations, sensor integration, replacement cycle analysis. |

The global automotive bumper market is estimated to be valued at USD 17.5 billion in 2025.

The market size for the automotive bumper market is projected to reach USD 26.4 billion by 2035.

The automotive bumper market is expected to grow at a 4.2% CAGR between 2025 and 2035.

The key product types in automotive bumper market are plastic, metal, carbon fiber, composite and others.

In terms of bumper, standard bumper segment to command 48.0% share in the automotive bumper market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Direct Liquid Cooling IGBT Module Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hoses and Assemblies Market Size and Share Forecast Outlook 2025 to 2035

Automotive Network Testing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Performance Part Market Size and Share Forecast Outlook 2025 to 2035

Automotive Carbon Ceramic Brake Market Size and Share Forecast Outlook 2025 to 2035

Automotive Camshaft Market Size and Share Forecast Outlook 2025 to 2035

Automotive Stamping Industry Analysis in India Size and Share Forecast Outlook 2025 to 2035

Automotive Cylinder Liner Market Size and Share Forecast Outlook 2025 to 2035

Automotive Microcontroller Market Size and Share Forecast Outlook 2025 to 2035

Automotive Roof Rails Market Size and Share Forecast Outlook 2025 to 2035

Automotive Active Safety System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Diagnostic Scan Tool Market Size and Share Forecast Outlook 2025 to 2035

Automotive Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Dynamic Map Data Market Size and Share Forecast Outlook 2025 to 2035

Automotive Green Tires Market Size and Share Forecast Outlook 2025 to 2035

Automotive E-Tailing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Interior Market Forecast Outlook 2025 to 2035

Automotive Key Market Size and Share Forecast Outlook 2025 to 2035

Automotive Appearance Chemical Market Forecast and Outlook 2025 to 2035

Automotive Seating Market Forecast and Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA