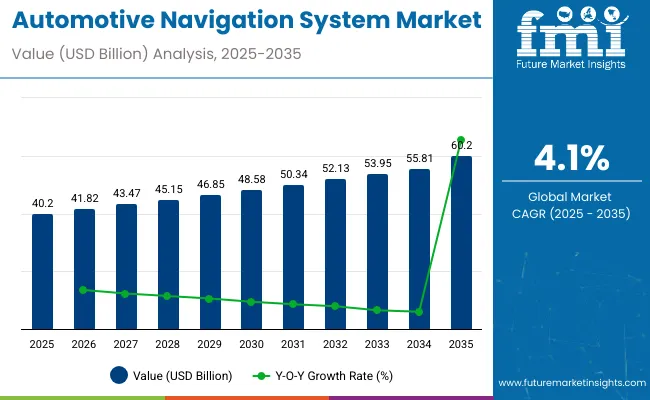

In 2025, the automotive navigation system market is valued at USD 40.2 billion and is projected to reach approximately USD 60.2 billion by 2035, reflecting a compound annual growth rate of 4.1%.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 40.2 billion |

| Industry Value (2035F) | USD 60.2 billion |

| CAGR (2025 to 2035) | 4.1% |

Breakpoint analysis indicates key thresholds where market dynamics are expected to shift, driven by technological advancements, regulatory policies, and evolving consumer preferences. The multiplying factor over the ten-year period is around 1.5, showing moderate but steady growth, with incremental value accumulation each year as automotive manufacturers integrate advanced navigation features in both passenger and commercial vehicles.

From 2025 to 2035, several breakpoints are likely to influence market adoption. Initial growth is expected from enhanced GPS functionality, real-time traffic updates, and integration with in-vehicle infotainment systems. Mid-period breakpoints may arise from wider deployment of connected car technologies, over-the-air map updates, and integration with autonomous driving assistance systems, boosting demand for sophisticated navigation solutions.

Towards 2035, adoption is anticipated to be further driven by AI-enabled predictive navigation, smart city connectivity, and seamless integration with mobility-as-a-service platforms. The absolute dollar opportunity over this period emphasizes the cumulative incremental revenue potential for system providers, software developers, and vehicle manufacturers. These breakpoints collectively outline the evolving trajectory of the automotive navigation system market, highlighting stages where growth accelerates due to technological and market-driven triggers.

The automotive navigation system market is supported by five parent markets with varying contributions. Automotive electronics accounts for approximately 35%, supplying hardware, sensors, and navigation modules. Automotive infotainment contributes around 25%, integrating multimedia systems with GPS and real-time traffic updates. The global automotive market represents about 20%, driving adoption through new vehicle sales and fleet upgrades.

Telecommunication and connectivity account for roughly 15%, enabling 4G/5G connections, satellite navigation, and vehicle-to-infrastructure communication. Information and communication technology (ICT) contributes nearly 5%, supporting cloud platforms, mapping services, and software updates. These markets collectively enhance the reach and functionality of automotive navigation systems worldwide.

Recent trends in the automotive navigation system market focus on AI integration, connectivity, and strategic collaborations. Key players such as Garmin, TomTom, Bosch, and Continental are developing cloud-based navigation platforms with real-time traffic prediction, route optimization, and lane-level guidance. Integration with autonomous driving and advanced driver assistance systems is increasing, while over-the-air updates and IoT-enabled connectivity improve accuracy and functionality.

Companies are forming partnerships with telecommunication providers and automotive manufacturers to expand connected car services. Smart navigation solutions, voice-activated controls, and multi-modal routing strategies are reshaping the market, driving adoption across passenger vehicles, commercial fleets, and electric mobility platforms.

The automotive navigation system market is expanding rapidly due to rising vehicle production and growing demand for advanced driver assistance systems. Global installation of navigation systems exceeded 80 million units in 2024, with Asia Pacific and North America accounting for nearly 65% of total adoption.

Increasing consumer preference for in-car connectivity, real-time traffic updates, and integrated infotainment systems is driving market penetration. OEMs are introducing advanced GPS, AI-enabled route optimization, and voice-controlled navigation features to enhance user experience. The growth of electric vehicles and connected cars further boosts demand for integrated navigation systems.

Rising vehicle production and consumer preference for connected cars are primary drivers. On average, 70-85% of mid to high-end vehicles in North America and Europe are equipped with factory-fitted navigation systems. Increasing adoption of electric vehicles, which rely on accurate route planning and charging station location data, further accelerates market growth.

Fleet operators are integrating navigation systems to optimize delivery routes, reduce fuel consumption by up to 15%, and improve operational efficiency. Government initiatives for smart transportation networks and infrastructure upgrades in Asia Pacific also contribute to demand. Manufacturers are integrating real-time traffic, weather, and hazard alerts to improve navigation reliability and overall driving safety.

Advanced AI and cloud connectivity are transforming navigation systems into intelligent vehicle companions. Real-time traffic analysis, predictive routing, and integration with infotainment systems enhance travel efficiency. Autonomous and semi-autonomous vehicles rely heavily on precise navigation systems with centimeter-level GPS accuracy.

Software updates over-the-air enable map and firmware updates for millions of vehicles, reducing maintenance downtime by 10-12%. Increasing integration with smartphones, IoT devices, and vehicle telematics expands functionality, including parking guidance, hazard alerts, and fuel-efficient routing. Modular navigation systems compatible with multiple vehicle models allow OEMs to reduce production complexity. Manufacturers are investing in augmented reality-based heads-up displays to improve driver decision-making and safety.

Asia Pacific is witnessing rapid adoption due to rising vehicle production, smart city initiatives, and increased use of electric vehicles. Annual growth in China, India, and Japan ranges between 6-9%. EV manufacturers incorporate advanced navigation to optimize charging station access and route efficiency. High smartphone penetration supports integration with connected navigation apps for real-time traffic and hazard alerts.

Fleet management solutions in logistics and ride-hailing services rely on AI-based navigation to improve delivery times by up to 20%. Government investments in intelligent transportation systems and smart highways also support navigation system deployment. Compact and affordable systems for small passenger vehicles are increasing adoption in semi-urban and tier-2 cities.

Advanced automotive navigation systems require significant investment, with prices ranging from USD 300 to 1,200 per unit depending on features and compatibility. Software maintenance, including map updates, firmware patches, and AI algorithm calibration, adds 8-10% annually to operating costs. Integration challenges arise when retrofitting vehicles without factory-fitted systems.

Hardware and sensor calibration errors can reduce routing accuracy by 5-8%, affecting customer satisfaction. Regulatory requirements for location data privacy in Europe, North America, and Asia Pacific add operational complexity. Manufacturers must balance upfront costs, software reliability, and integration efficiency to ensure system performance and customer satisfaction while keeping total cost of ownership competitive across vehicle segments.

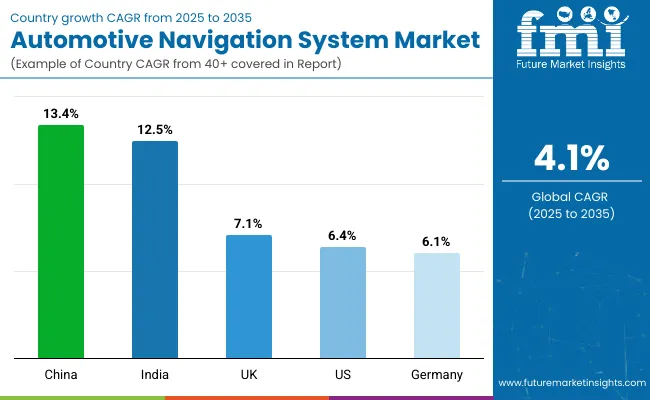

The global automotive navigation system market is expected to expand at a CAGR of 4.1% from 2025 to 2035. China leads with 13.4%, surpassing the global average by +227%, supported by widespread adoption of smart vehicles and brics-driven digital transport programs. India follows at 12.5%, or +205% above the global rate, driven by asean-linked initiatives and rising demand for connected mobility solutions.

The United Kingdom registers 7.1%, a +73% premium, reflecting gradual integration of advanced navigation systems within oecd markets. The United States grows at 6.4%, or +56% higher than the global benchmark, fueled by infrastructure upgrades and vehicle technology enhancements. Germany posts 6.1%, +49% above the global level, supported by systematic deployment of in-vehicle navigation solutions and automotive innovation. The trend indicates faster adoption in brics countries, while oecd economies are progressing at a moderate but steady pace.

The automotive navigation system market in China is growing at a CAGR of 13.4%, driven by rapid adoption of connected cars, smart mobility solutions, and integration of AI-powered navigation features. Increasing vehicle production and rising consumer interest in in-car technology accelerate market expansion. Manufacturers are focusing on developing advanced navigation systems with real-time traffic updates, voice-assisted controls, and integration with smart city infrastructure.

Premium and mid-range vehicles are increasingly equipped with navigation systems as standard features, enhancing driver convenience and safety. The market is also supported by government initiatives to improve road network management and digital mapping infrastructure.

The demand of automotive navigation system in India is expanding at a CAGR of 12.5%, supported by increasing vehicle sales and rising demand for connected car technologies. Consumer preference for vehicles with advanced infotainment and navigation features drives adoption across passenger and commercial vehicles.

Manufacturers are introducing affordable navigation systems with real-time traffic updates, cloud-based mapping, and mobile integration. Rapid expansion of national highways and improved road infrastructure further encourage system deployment. Fleet operators are investing in GPS-enabled navigation to optimize routes and reduce travel time, particularly for logistics and ride-hailing services.

The automotive navigation system market in the United Kingdom is growing at a CAGR of 7.1%, fueled by consumer demand for in-car connectivity and smart navigation solutions. Vehicle manufacturers are equipping new cars with integrated GPS and AI-assisted navigation features. Increased adoption of electric vehicles with navigation optimization for charging stations contributes to market growth. Connectivity solutions allowing smartphone integration and real-time route optimization are gaining traction. Both private and commercial vehicle segments are upgrading fleets with advanced navigation systems to improve efficiency and driver convenience.

The automotive navigation system industry in Germany is expanding at a CAGR of 6.1%, driven by a strong automotive industry and the adoption of connected vehicles. Luxury and mid-range vehicles increasingly feature advanced navigation systems with real-time traffic monitoring, lane guidance, and predictive route planning. Integration with vehicle safety systems and infotainment modules enhances consumer experience. Automotive navigation adoption is also driven by smart highway systems and increasing use of digital maps for logistics and fleet operations. German manufacturers are focusing on combining autonomous driving support with navigation system enhancements.

The demand of automotive navigation system in the United States is growing at a CAGR of 6.4%, driven by high penetration of connected vehicles and increasing demand for driver assistance technologies. Navigation systems with AI-enabled traffic prediction, voice control, and over-the-air updates are becoming standard features in new cars.

Fleet operators are integrating GPS and telematics-enabled navigation solutions to improve route efficiency. Growing adoption of electric vehicles and hybrid cars with navigation-optimized charging routes supports market expansion. Consumer preference for vehicles with integrated infotainment and navigation features also contributes to growth.

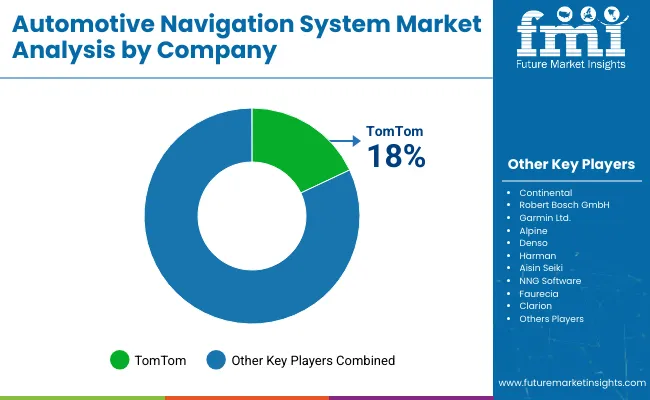

The automotive navigation system market is driven by established players and emerging companies, each leveraging distinct strategies to strengthen their presence. TomTom focuses on expanding its mapping and navigation services through regular product launches and partnerships with vehicle manufacturers.

Continental invests in research and development to enhance system accuracy and integration with in-vehicle infotainment, while Alpine targets premium automotive segments with advanced multimedia and navigation solutions. Robert Bosch GmbH emphasizes connected mobility platforms, offering navigation systems that integrate with driver assistance and fleet management tools. Faurecia has been exploring collaborations with automakers to provide tailor-made navigation solutions that enhance driver convenience and operational efficiency.

Other key players such as Clarion, Garmin Ltd., NNG Software, Denso, Aisin Seiki, and Harman are actively enhancing their offerings to meet evolving customer expectations. Clarion has introduced high-resolution navigation displays for improved usability, while Garmin invests in map updates and connected vehicle features to support real-time guidance.

NNG Software provides software platforms that allow automakers to customize navigation functions for diverse markets. Denso and Aisin Seiki continue to develop integrated navigation modules for electric and hybrid vehicles, and Harman focuses on seamless infotainment and navigation system integration. Collectively, these companies strengthen their market presence through product enhancements, strategic partnerships, and global distribution networks, maintaining competitiveness in the automotive navigation system industry.

Recent Industry Developments

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 40.2 billion |

| Projected Market Size (2035) | USD 60.2 billion |

| CAGR (2025 to 2035) | 4.1% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value |

| Device Types Analyzed (Segment 1) | In-Dash Navigation System, Portable Navigation System, Mobile Navigation System |

| Propulsion Types Analyzed (Segment 2) | Electric Vehicle, ICE |

| Vehicle Types Analyzed (Segment 3) | Passenger Car, Light Commercial Vehicles, Heavy Commercial Vehicles |

| Sales Channels Analyzed (Segment 4) | OEM, Aftermarket |

| Regions Covered | North America; Latin America; Europe; Asia Pacific; Middle East & Africa |

| Countries Covered | United States, Canada, Brazil, Mexico, Germany, United Kingdom, France, Italy, China, Japan, India, UAE, South Africa |

| Key Players Influencing the Market | TomTom, Continental, Robert Bosch GmbH, Garmin Ltd., Alpine, Denso, Harman, Aisin Seiki, NNG Software, Faurecia, Clarion |

| Additional Attributes | Dollar sales by system type and vehicle segment, demand dynamics across passenger, commercial, and luxury vehicles, regional adoption trends, innovation in AI route optimization, real-time traffic updates, environmental impact of fuel savings, and emerging use in connected and autonomous cars. |

The market is expected to reach USD 60.2 billion by 2035, growing from USD 35.6 billion in 2025.

In-dash navigation units dominate with around 65% of the market due to integration in new vehicles.

AI solutions can reduce waiting time by up to 40%, enhancing consultation efficiency.

Approximately 75% of devices are app-connected, allowing real-time monitoring and alerts.

TomTom is a top player holding 18 % industry share, supplying in-dash and portable navigation solutions worldwide.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Personal Navigation Systems Market Size and Share Forecast Outlook 2025 to 2035

Automotive-grade Inertial Navigation System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Navigation Solutions Market Growth - Trends & Forecast 2025 to 2035

Automotive Brake System Market Growth - Trends & Forecast 2025 to 2035

Automotive Brake System & Components Market Growth - Trends & Forecast 2025 to 2035

Automotive Piston System Market Growth - Trends & Forecast 2025 to 2035

Automotive Washer System Market Trends - Growth & Forecast 2025 to 2035

Navigation SDK for Automotive Market Size and Share Forecast Outlook 2025 to 2035

Automotive Seating Systems Market Analysis - Size, Share & Forecast 2025 to 2035

Automotive Exhaust Systems Market Trends - Growth & Forecast 2025 to 2035

Automotive Starting System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Ignition Systems Market Size and Share Forecast Outlook 2025 to 2035

Automotive Steering System Market Growth - Trends & Forecast 2025 to 2035

Automotive Embedded System Market Growth - Trends & Forecast 2024 to 2034

Automotive Defogger System Market

Navigation satellite system Market Size and Share Forecast Outlook 2025 to 2035

Neuronavigation Systems Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Automotive Platooning System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Gear Shift System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Suspension System Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA