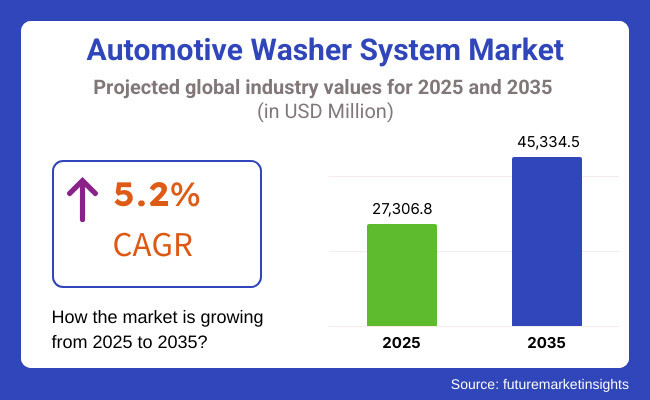

The Automotive Washer System Market is projected to grow from USD 27,306.8 million in 2025 to USD 45,334.5 million by 2035, reflecting a CAGR of 5.2% over the forecast period. This growth is driven by increasing vehicle production, advancements in safety features, and regulatory mandates for clear visibility standards.

Rising consumer preference for advanced windshield and headlamp cleaning systems, particularly in luxury and electric vehicles, is further propelling market demand. Additionally, technological advancements such as sensor-integrated washer systems and eco-friendly cleaning fluids are shaping the industry’s evolution toward improved efficiency and sustainability.

The automotive washer systems market is directly dependent on the increasing production of passenger vehicles and commercial vehicles worldwide. New rules for driver safety, such as better visibility, are motivating car manufacturers to add features like smart washer systems, which use rain sensors, heated washer nozzles, and high-pressure jets.

The growing adoption of advanced driver-assistance systems (ADAS), which require clean camera and sensor lenses for optimal performance, is further fueling the need for specialized washer systems. Luxury and electric vehicle companies are adding automated and sensor-controlled washer units with the aim to increase visibility for the drivers, and at the same time, reduce distractions. The prominence of biodegradable, environmentally friendly liquids is becoming more significant due to the global issues.

North America is experiencing a constant rise in the automotive washer system market which is fueled by the rigorous safety rules and the growing application of ADAS technologies. The regional demand for SUVs, luxury cars, and self-driving technologies directly drives the need for sophisticated washer systems, especially the sensor and camera cleaning type.

Apart from this, the long and harsh winters in Canada and the northern USA require heated nozzles of the windshield washer fluid system which should be highly effective to provide maximum visibility on the road. The aftermarket segment is also coping with advancement as other consumers ask for parts and eco-friendly washer fluids, which boost the market growth further across the region.

Europe is at the helm of the washer system adoption, which is the only issue with strictly regulated vehicle safety and emissions as is the drive behind it. The demand for headlamp washer systems is prevalent in Germany, the UK, and France mainly for luxury and high-performance cars.

The promotion of a healthier environment has made it possible for most people to use biodegradable and detoxifying washer fluids, which aligns with the region's green policies. Automobile producers have recently included sensors and cameras cleaning machines in order to boost the performance of ADAS cars. The region's love for the car tech has greatly increased the market for this sector and added yearly turnover and technical progress.

Asia-Pacific is the market with the highest expansion rate, driven by the increasing automobile product line in China, India, and Japan. The growing urban population and high-density income of the general public driving demand for decorative car washer systems, especially mid-range and premium passenger vehicles.

The financial policies of the government, which are coming alongside the automotive domestic market and public safety laws, are the true movers of this process. The rise in electric vehicle (EV) production, especially in China, will be the feeder for automated washer systems. The broader insight by the general population about the road safety issue and bad visibility due to the weather is keeping demand high for more efficient windshield washer systems in both OEM and aftermarket segments.

Latin America is staying in the game through moderate development which is mainly led by the rise in car sales in Brazil, Mexico, and Argentina. Changes in the economy and the government are the main factors for the increase in demand for simple and high-tech washer systems due to the insurance of road safety. The aftermarket section is also evolving by the need of the consumers who are after the cheap replacement loop of nozzles, blades, and fluids.

Homegrown automobile manufacturers are on their way to moving vehicle safety to a new level with cutting-edge technology which is likely to yield the result with the rising demand for sophisticated headlamp and windshield washer systems. Still, economic instabilities together with the dependency on the imported parts loom social issues thus the innovative and durable washer solutions remain the key to the success in the niche market.

The Middle East & Africa (MEA) market is up surging, especially in the GCC countries where luxury and SUV sales go high. The extreme climatic conditions like sandstorms and scorching heat are contributing to the demand for long-lasting, high-performance washer systems.

Car producers in the UAE and Saudi Arabia use luxury car models, which have incorporated advanced headlamp, and windshield washers has been proved as an essential feature. The market in Africa, largely based on the aftermarket, enjoys increased sales and the need for more parts and fluids with the rise in used car ownership. More infrastructure, the advancement of the automotive service sector, and economic growth are all expected to boost market growth in the region.

Material Costs and Supply Chain Disruptions

The breast increasing of raw materials used in plastics, rubber, and electronic components directly affecting washer system production. The chain disruptions in the supply caused by geopolitical threats, semiconductor feuds, and transportation delays that count for other reasons to augment the OEM's production costs. The difficult automotive industry's focus on quality and low weight of washer components leads to another aspect that affects the increasing costs due to the necessity of R&D.

Henceforth, the question is posed, what are the manufacturers doing to solve these issues? Well, they provide alternative materials, regionalize supply chains, and go for cost-effective production models. Nevertheless, the constantly changing in commodity prices and the continuing dependency on imports are prevailing to automotive washer assembly components' global supply safety concerns.

Environmental Regulations on Washer Fluids

Governments are stamping out a number of environmental rules like not to use chemical-based washer fluids containing methanol or other volatile organic compounds (VOCs). This is mainly the case within Europe and North America, where the demand for bio-degradable and non-toxic washer fluids are becoming the new mandate.

Even though the environmentally friendly options prevent the degradation of the environment, they, however, lead to the increase of expenses for the manufacturers and the spare parts suppliers. To add to that, the specific climatic conditions prevailing in the extreme cold regions have proven it hard to find the right washer materials to develop high-performance, environmentally friendly products. Therefore, product efficiency and sustainability regulations must balance each other for the industry to thrive.

Growing Demand for ADAS and Sensor Cleaning Systems

The growing trend of sensor technologies in vehicles coupled with the increasing establishment of autonomous driving technologies is creating a high demand for sensor and camera cleaning systems. To make sure that the lens of the cameras, LiDAR, and radar systems stay clean, the needs of the modern cars are the integration of automated Washer Systems that use high-pressure nozzles, hydrophobic coatings, and self-cleaning.

Forward-looking are the regions in North America, Europe, and China, where autonomous vehicle testing together with the sale of vehicles equipped with ADAS is surging. The arrival of the AI-driven cleaning system gives room for the development of the technology in the market.

Expansion of the Aftermarket Segment in Emerging Markets

The emerging and developing countries in Asia-Pacific, Latin America, and Africa present attractive growth opportunities in the aftermarket sector. Due to the increase in vehicle ownership, there is mounting demand for cheap compatible replacement washer components and fluids. Several car customers in these areas prefer after-market options because of their low-costs and because sometimes OEM parts are not available.

The entry of online auto parts retail platforms that are facilitating the buyers purchase washer system parts will help consumers in this regard. Local manufacturers and distributors implementing affordable, quality washer solutions will benefit from the rising demand in price-sensitive markets.

The automotive washer system market plays a key role in the automotive sector by taking care of the driver view and thus safety by providing proper wiping solutions. The market will experience steady growth in the forecast era, from USD 27,306.8 million in 2035 to USD 45,334.5 million in 2025, which corresponds to a CAGR of 5.2% in the period.

The growth is the result of the increased demand for ADAS, vehicle safety laws, and the preference of consumers in having cars that look good and are convenient to drive. The market is being reshaped by new inventions in sensor-based cleaning techniques, environmentally friendly washer fluids, and smart nozzle systems. Also, the dispatch of electric and driverless cars in the market is the ancillary reason for the expansion of considerable washer systems automated and high-performance ones.

Comparative Market Analysis

| Market Shift | 2025 (Projected) |

|---|---|

| Regulatory Landscape | More and more safety regulations are imposed that require an unobstructed view through the windshield. |

| Technological Advancements | The measures include precise nozzle integration, heated washer systems, and use of eco-friendly fluids. |

| Industry-Specific Demand | Passenger vehicles, luxury cars, and commercial fleets are the major market actors. |

| Sustainability & Circular Economy | Biodegradable washer fluids and water-efficient systems are under development. |

| Market Growth Drivers | Increase in vehicle production, and rise in the adoption of ADAS, and, consumer preference for maintenance-free solutions are the key factors. |

| Market Shift | 2035 (Forecasted) |

|---|---|

| Regulatory Landscape | More stringent rules specify ADAS-compliant washer systems, which include cleaning cameras and sensors. |

| Technological Advancements | AI-based washer control, autonomous cleaning rights, and complex hydrophobic coatings are some of the whiz innovations in the field. |

| Industry-Specific Demand | There is an ever-increasing requirement for electric and robot vehicles for multi-surface cleaning. |

| Sustainability & Circular Economy | Water recycling washers and non-toxic cleaning solutions are widely used, along with their green adoption. |

| Market Growth Drivers | Embedded washer systems in the case of mobility modules such as self-cleaning sensors and cameras. |

The USA automotive washer system market is exhibiting development due to robust vehicle production, strict safety norms, and increased need for cutting-edge washing technologies. The National Highway Traffic Safety Administration (NHTSA) requires a clear view of the windshield which in turn encourages the manufacturers to use sensor-based and heated washer systems.

The climb in electric vehicles also contributes to the necessity of specific washer solutions to clean cameras and sensors. The aftermarket segment has also benefited as washer pumps, nozzles, and wiper blades are increasingly being replaced by the consumers.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 4.6% |

The United Kingdom automotive washer system sector is experiencing steady development owing to rigid safety regulations, higher EV market penetration, and bad weather conditions. The automotive safety regulations of the UK necessitate the car manufacturers to install efficient windshield and camera washer systems.

The increase in premium and luxury cars that come with heated and automated washer systems is another factor contributing to the market expansion. The continued rainy and foggy weather conditions in the UK have led to a higher demand for superior-quality washer fluids and parts.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 4.8% |

The European car washer market is booming due to the stringent EU vehicle safety regulations, advanced adoption of the latest automotive technologies, as well as the luxury car segment's impressive performance. The Euro NCAP safety rating system requires modern cars to have high-efficiency washer and camera cleaning systems.

European manufacturers are at the forefront of integrating smart washer system solutions, for instance, the ones with high-pressure jets and rain-sensing washers. Apart from this, the growing parade of electric and self-driving vehicles is creating a niche for specialized washer solutions for LiDAR sensors, ADAS cameras, as well as headlamps.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 5.0% |

Japan’s automotive washer system market is growing due to advanced automotive technology, strong hybrid & EV production, and a focus on vehicle safety. Japan's car manufacturers are the ones at the forefront of smart washer system technology, which is the development of automatic nozzles, rain-sensing wipers, and camera-cleaning systems.

The further development of autonomous vehicles is also a contributor to the need for dedicated sensor-cleaning washer devices. Severe weather in Japan, such as heavy snowfall, is another factor that increases the demand for heated washer systems.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.9% |

South Korea’s automotive washer system market is expanding due to advanced vehicle manufacturing, rapid EV adoption, and government incentives for smart mobility solutions. Leading automakers like Hyundai and Kia are investing in sensor-based washer systems for ADAS cameras, LiDAR sensors, and windshields. Additionally, harsh winter conditions and urban pollution are increasing the need for high-performance washer fluids and components.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.2% |

Electrical Washer Systems Dominate Due to Automation and Efficiency

Electrical washer systems are the leading systems on the market due to their computerized automation, high efficiency, and incorporation with modern safety components. They can adjust water flow direction accurately to take full cleaning effect with the least amount of water possible. The electronic washer systems with the sensor to control them by themselves are incorporated into particularly advanced cars such as luxury and high-end passenger cars as they aid the driver with visibility and convenience.

ADAS integration and strict safety targets in Europe and North America are pushing forward the selling. Besides, the electrical washer systems have been found among electric and hybrid vehicles (EVs/HEVs) increasingly as they are suitable for the application of automated windscreen and headlamp cleaning which is a safety measure on the road.

Mechanical Washer Systems Continue Demand in Budget Vehicles

Even in terms of cost-performance, mechanical washer systems cope with the challenge of being relevant, especially in economy segment passenger cars and commercial vehicles. The operation of these systems relying on manual or vacuum-driven makes them preferable for regions that need cheap automotive components such as Asia-Pacific and Latin America.

They are simple and functional, but mechanical washers are more reliable and less expensive than the electrical systems. Their robustness, no complicated service, and long durability make that perfect even in the off-highway and the commercial sector, where low-tech, no-maintenance solutions are preferred to costly automated ones.

Windshield Wipers Lead as Essential Safety Components

The major part of the automotive washer system is windshield wipers, which are vital for the driver's sight in adverse weather conditions. To clean effectively and add durability to the wipers, modern vehicles are equipped with aerodynamic, multi-pressure, and heated wiper technologies. Frameless and rain-sensing wipers demand is continually growing, especially in premium and electric vehicles.

European and North American regulatory standards are focused on clear visibility, which, in turn, drives market growth. The application of ADAS technologies, which need a clean windshield for camera and sensor operation, also contributes to the demand for high-performance wipers.

Pumps Segment Gains Momentum with High-Pressure Innovations

Pumps are important parts of washer systems, including high-pressure washer pumps that are the strongest because they provide a controllable high-water amount to clean effectively. The launch of newly developed headlamp cleaning systems that work with the windshield wiper as a multi-functional washer pump is adding to the demand.

Dual energy-efficient and sensor-based pump integration is the main driving factor behind the development of multi-functional electric water pump technologies in electric cars and premium brands. The long-lasting low-noise and high-efficiency pumps are improvements seen earlier making them popular parts for cars and trucks alike.

Passenger Cars Lead with Rising Adoption of Advanced Washer Systems

The manufacturing of passenger cars is the most efficient segment of the company, as the total number of vehicles produced and the addition of advanced safety products are the main driving forces'' increasing the windscreen visibility regulatory obligation''. The automotive industry has witnessed a steady rise in the luxury and electric vehicle sector that has inspired creativity in sensor-driven, heated, and high-pressure washer systems.

Water-saving and eco-friendly solutions are priority number one for manufacturers, improving efficiency and reducing fluid wastage at the same time. The region of Europe and North America will remain the core markets while automakers are strictly adhering to safety regulations and satisfied customers with the high-quality wipers and washers. With the growth of ADAS and autonomous driving technologies, the demand for passenger vehicles equipped with automated washer systems is growing.

HCVs Rely on Robust Washer Systems for Heavy-Duty Performance

The washer system for commercial applications is heavily populated with Heavy Commercial Vehicles (HCVs) because they need high-quality and robust washer systems to clearly see in tough conditions. Operating in dusty, off-road, and hazardous environments these vehicles require powerful washer pumps, larger tanks, and stronger wipers.

Norton America and Europe are setting stringent safety regulations on the mandate for credibility to drivers in terms of cleanliness in long-haul trucks and buses. Innovations such as self-cleaning camera and sensor washers are also gaining popularity in commercial fleets, making sure that there is a better visibility of ADAS-enabled vehicles and self-driving cargo shipping with a truck app.

The automotive washer system is a segment of the vehicle safety and visibility market that is very important as it covers windshield, headlamp, and rear window washing systems. Vehicle production is increasing, driving market expansion coupled with the enactment of stringent safety measures and the development of sensor-based cleaning technologies.

The implementation of heated washer nozzles, rain-sensing wipers, and eco-friendly washer fluids is providing better performance and efficiency. Major players in the global market are Robert Bosch GmbH, Denso Corporation, Valeo SA, Mitsuba Corporation, and HELLA GmbH & Co. KGaA. Also, regional players contribute considerably to the aftermarket sales.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Robert Bosch GmbH | 18-22% |

| Denso Corporation | 14-18% |

| Valeo SA | 12-16% |

| Mitsuba Corporation | 8-12% |

| HELLA GmbH & Co. KGaA | 6-10% |

| Other Companies (combined) | 35-45% |

| Company Name | Key Offerings/Activities |

|---|---|

| Robert Bosch GmbH | Develops advanced windshield washer systems with precision nozzles and smart sensors. |

| Denso Corporation | Manufactures high-efficiency washer pumps and eco-friendly washer fluid dispensers. |

| Valeo SA | Specializes in rain-sensing wipers and integrated washer systems for enhanced safety. |

| Mitsuba Corporation | Focuses on compact and high-pressure washer motors for global automakers. |

| HELLA GmbH & Co. KGaA | Provides adaptive headlamp washer systems for premium vehicles. |

Key Company Insights

Robert Bosch GmbH

Bosch is a dominant player in the automotive washer system market, offering high-performance windshield washer solutions integrated with smart sensors. In the company`s washer nozzles are aimed to economize water through maximum cleaning efficiency and reduced fluid consumption.

Bosch is a pioneer in heated washer systems development that prevents them from freezing in cold weather. The company´s innovative and high-quality products have it as a preferred supplier for automobile manufacturers worldwide. The company is also expanding its footprint and strengthening market leadership through partnerships and acquisitions.

Denso Corporation

Denso is specialized in the production of high-efficiency washer systems with an emphasis on sustainability and lower environmental impact. The company's washer pumps and fluid dispensers are designed for efficient waste and environmental protection while providing maximum cleaning quality. Denso has also involved the implementation of sensor-based cleaning technologies which are integrated into vehicles.

These technologies allow the vehicles to detect dirt and activate the washer system accordingly. Denso is a well-known brand with a significant market presence in Asia, North America, and Europe; it is through collaborations with leading car manufacturers that it succeeds in maintaining a competitive edge in the automotive washer system market.

Valeo SA

Valeo is a well-known name for rain-sensing and adaptive washer systems where it is the market leader upscaling vehicle safety and helping the driver. This company incorporates the use of smart sensor technology to automatically activate windshield cleaning and so relieve the driver of the distraction. Valeo`s washer system is designed to work together with the vehicle's advanced driver assistance systems (ADAS), which makes the vehicle overall function better.

Another significant feature of the company's products is the focus on sustainability, biodegradable washer fluids, and energy-efficient washer pumps. The company's global production network enables it to maintain a firm supply chain, which is one of the reasons why Valeo is considered a reliable partner for automakers all over the world.

Mitsuba Corporation

Mitsuba Corporation is a main manufacturer of the compact high-pressure washer motor used in various car types. The firm is focused on lightweight and efficient designs, which help the washer system to perform better, and thus, improve visibility. A good portion of Mitsuba's business is in the Asian market, where it provides parts to OEMs and aftermarket customers.

Their constant investments in R&D have led to creative solutions (innovations) like miniaturized washer systems that still have high functionalities but consume less power. The company is dedicated to delivering low-cost and high-performance products, which is why Mitsuba is constricted in the washing machine industry.

HELLA GmbH & Co. KGaA

HELLA is a company that deals in the production and sale of headlamp washer systems, particularly for high-end and luxury automobile manufacturers. The company's adaptive washers run only the necessary cycles making them most-efficient ultimately keeping the headlamp surfaces clear and better visibility in adverse weather conditions.

The innovation this company has in integrating washer solutions with LED and a laser headlight setting it apart in the premium motor vehicle market segment. However, the company is exploring eco-friendly washer solutions to decrease liquid consumption as well. As the consumer base for ultra-modern lighting solutions continues to rise, HELLA is also growing by releasing new products in the washer system line.

Other Key Players

The global Automotive Washer System market is projected to reach USD 27,306.8 million by the end of 2025.

The market is anticipated to grow at a CAGR of 5.2% over the forecast period.

By 2035, the Automotive Washer System market is expected to reach USD 45,334.5 million.

The windshield washer system segment is expected to dominate due to increasing vehicle production, rising safety regulations, and growing demand for advanced cleaning technologies.

Key players in the market include Denso Corporation, Robert Bosch GmbH, Valeo SA, HELLA GmbH & Co. KGaA, and Continental AG.

Table 1: Global Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 4: Global Volume (Units) Forecast by Technology, 2018 to 2033

Table 5: Global Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 6: Global Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 7: Global Value (US$ Million) Forecast by Component, 2018 to 2033

Table 8: Global Volume (Units) Forecast by Component, 2018 to 2033

Table 9: Global Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 10: Global Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 11: North America Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: North America Volume (Units) Forecast by Country, 2018 to 2033

Table 13: North America Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 14: North America Volume (Units) Forecast by Technology, 2018 to 2033

Table 15: North America Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 16: North America Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 17: North America Value (US$ Million) Forecast by Component, 2018 to 2033

Table 18: North America Volume (Units) Forecast by Component, 2018 to 2033

Table 19: North America Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 20: North America Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 21: Latin America Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: Latin America Volume (Units) Forecast by Country, 2018 to 2033

Table 23: Latin America Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 24: Latin America Volume (Units) Forecast by Technology, 2018 to 2033

Table 25: Latin America Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 26: Latin America Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 27: Latin America Value (US$ Million) Forecast by Component, 2018 to 2033

Table 28: Latin America Volume (Units) Forecast by Component, 2018 to 2033

Table 29: Latin America Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 30: Latin America Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 31: Western Europe Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: Western Europe Volume (Units) Forecast by Country, 2018 to 2033

Table 33: Western Europe Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 34: Western Europe Volume (Units) Forecast by Technology, 2018 to 2033

Table 35: Western Europe Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 36: Western Europe Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 37: Western Europe Value (US$ Million) Forecast by Component, 2018 to 2033

Table 38: Western Europe Volume (Units) Forecast by Component, 2018 to 2033

Table 39: Western Europe Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 40: Western Europe Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 41: Eastern Europe Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: Eastern Europe Volume (Units) Forecast by Country, 2018 to 2033

Table 43: Eastern Europe Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 44: Eastern Europe Volume (Units) Forecast by Technology, 2018 to 2033

Table 45: Eastern Europe Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 46: Eastern Europe Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 47: Eastern Europe Value (US$ Million) Forecast by Component, 2018 to 2033

Table 48: Eastern Europe Volume (Units) Forecast by Component, 2018 to 2033

Table 49: Eastern Europe Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 50: Eastern Europe Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 51: South Asia and Pacific Value (US$ Million) Forecast by Country, 2018 to 2033

Table 52: South Asia and Pacific Volume (Units) Forecast by Country, 2018 to 2033

Table 53: South Asia and Pacific Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 54: South Asia and Pacific Volume (Units) Forecast by Technology, 2018 to 2033

Table 55: South Asia and Pacific Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 56: South Asia and Pacific Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 57: South Asia and Pacific Value (US$ Million) Forecast by Component, 2018 to 2033

Table 58: South Asia and Pacific Volume (Units) Forecast by Component, 2018 to 2033

Table 59: South Asia and Pacific Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 60: South Asia and Pacific Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 61: East Asia Value (US$ Million) Forecast by Country, 2018 to 2033

Table 62: East Asia Volume (Units) Forecast by Country, 2018 to 2033

Table 63: East Asia Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 64: East Asia Volume (Units) Forecast by Technology, 2018 to 2033

Table 65: East Asia Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 66: East Asia Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 67: East Asia Value (US$ Million) Forecast by Component, 2018 to 2033

Table 68: East Asia Volume (Units) Forecast by Component, 2018 to 2033

Table 69: East Asia Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 70: East Asia Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 71: Middle East and Africa Value (US$ Million) Forecast by Country, 2018 to 2033

Table 72: Middle East and Africa Volume (Units) Forecast by Country, 2018 to 2033

Table 73: Middle East and Africa Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 74: Middle East and Africa Volume (Units) Forecast by Technology, 2018 to 2033

Table 75: Middle East and Africa Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 76: Middle East and Africa Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 77: Middle East and Africa Value (US$ Million) Forecast by Component, 2018 to 2033

Table 78: Middle East and Africa Volume (Units) Forecast by Component, 2018 to 2033

Table 79: Middle East and Africa Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 80: Middle East and Africa Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Figure 1: Global Value (US$ Million) by Technology, 2023 to 2033

Figure 2: Global Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 3: Global Value (US$ Million) by Component, 2023 to 2033

Figure 4: Global Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 5: Global Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Volume (Units) Analysis by Region, 2018 to 2033

Figure 8: Global Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 11: Global Volume (Units) Analysis by Technology, 2018 to 2033

Figure 12: Global Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 13: Global Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 14: Global Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 15: Global Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 16: Global Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 17: Global Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 18: Global Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 19: Global Volume (Units) Analysis by Component, 2018 to 2033

Figure 20: Global Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 21: Global Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 22: Global Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 23: Global Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 24: Global Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 25: Global Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 26: Global Attractiveness by Technology, 2023 to 2033

Figure 27: Global Attractiveness by Sales Channel, 2023 to 2033

Figure 28: Global Attractiveness by Component, 2023 to 2033

Figure 29: Global Attractiveness by Vehicle Type, 2023 to 2033

Figure 30: Global Attractiveness by Region, 2023 to 2033

Figure 31: North America Value (US$ Million) by Technology, 2023 to 2033

Figure 32: North America Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 33: North America Value (US$ Million) by Component, 2023 to 2033

Figure 34: North America Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 35: North America Value (US$ Million) by Country, 2023 to 2033

Figure 36: North America Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 37: North America Volume (Units) Analysis by Country, 2018 to 2033

Figure 38: North America Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 41: North America Volume (Units) Analysis by Technology, 2018 to 2033

Figure 42: North America Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 43: North America Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 44: North America Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 45: North America Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 46: North America Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 47: North America Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 48: North America Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 49: North America Volume (Units) Analysis by Component, 2018 to 2033

Figure 50: North America Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 51: North America Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 52: North America Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 53: North America Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 54: North America Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 55: North America Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 56: North America Attractiveness by Technology, 2023 to 2033

Figure 57: North America Attractiveness by Sales Channel, 2023 to 2033

Figure 58: North America Attractiveness by Component, 2023 to 2033

Figure 59: North America Attractiveness by Vehicle Type, 2023 to 2033

Figure 60: North America Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Value (US$ Million) by Technology, 2023 to 2033

Figure 62: Latin America Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 63: Latin America Value (US$ Million) by Component, 2023 to 2033

Figure 64: Latin America Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 65: Latin America Value (US$ Million) by Country, 2023 to 2033

Figure 66: Latin America Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 67: Latin America Volume (Units) Analysis by Country, 2018 to 2033

Figure 68: Latin America Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 71: Latin America Volume (Units) Analysis by Technology, 2018 to 2033

Figure 72: Latin America Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 73: Latin America Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 74: Latin America Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 75: Latin America Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 76: Latin America Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 77: Latin America Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 78: Latin America Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 79: Latin America Volume (Units) Analysis by Component, 2018 to 2033

Figure 80: Latin America Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 81: Latin America Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 82: Latin America Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 83: Latin America Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 84: Latin America Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 85: Latin America Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 86: Latin America Attractiveness by Technology, 2023 to 2033

Figure 87: Latin America Attractiveness by Sales Channel, 2023 to 2033

Figure 88: Latin America Attractiveness by Component, 2023 to 2033

Figure 89: Latin America Attractiveness by Vehicle Type, 2023 to 2033

Figure 90: Latin America Attractiveness by Country, 2023 to 2033

Figure 91: Western Europe Value (US$ Million) by Technology, 2023 to 2033

Figure 92: Western Europe Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 93: Western Europe Value (US$ Million) by Component, 2023 to 2033

Figure 94: Western Europe Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 95: Western Europe Value (US$ Million) by Country, 2023 to 2033

Figure 96: Western Europe Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 97: Western Europe Volume (Units) Analysis by Country, 2018 to 2033

Figure 98: Western Europe Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Western Europe Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Western Europe Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 101: Western Europe Volume (Units) Analysis by Technology, 2018 to 2033

Figure 102: Western Europe Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 103: Western Europe Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 104: Western Europe Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 105: Western Europe Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 106: Western Europe Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 107: Western Europe Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 108: Western Europe Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 109: Western Europe Volume (Units) Analysis by Component, 2018 to 2033

Figure 110: Western Europe Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 111: Western Europe Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 112: Western Europe Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 113: Western Europe Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 114: Western Europe Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 115: Western Europe Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 116: Western Europe Attractiveness by Technology, 2023 to 2033

Figure 117: Western Europe Attractiveness by Sales Channel, 2023 to 2033

Figure 118: Western Europe Attractiveness by Component, 2023 to 2033

Figure 119: Western Europe Attractiveness by Vehicle Type, 2023 to 2033

Figure 120: Western Europe Attractiveness by Country, 2023 to 2033

Figure 121: Eastern Europe Value (US$ Million) by Technology, 2023 to 2033

Figure 122: Eastern Europe Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 123: Eastern Europe Value (US$ Million) by Component, 2023 to 2033

Figure 124: Eastern Europe Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 125: Eastern Europe Value (US$ Million) by Country, 2023 to 2033

Figure 126: Eastern Europe Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 127: Eastern Europe Volume (Units) Analysis by Country, 2018 to 2033

Figure 128: Eastern Europe Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: Eastern Europe Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: Eastern Europe Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 131: Eastern Europe Volume (Units) Analysis by Technology, 2018 to 2033

Figure 132: Eastern Europe Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 133: Eastern Europe Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 134: Eastern Europe Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 135: Eastern Europe Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 136: Eastern Europe Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 137: Eastern Europe Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 138: Eastern Europe Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 139: Eastern Europe Volume (Units) Analysis by Component, 2018 to 2033

Figure 140: Eastern Europe Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 141: Eastern Europe Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 142: Eastern Europe Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 143: Eastern Europe Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 144: Eastern Europe Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 145: Eastern Europe Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 146: Eastern Europe Attractiveness by Technology, 2023 to 2033

Figure 147: Eastern Europe Attractiveness by Sales Channel, 2023 to 2033

Figure 148: Eastern Europe Attractiveness by Component, 2023 to 2033

Figure 149: Eastern Europe Attractiveness by Vehicle Type, 2023 to 2033

Figure 150: Eastern Europe Attractiveness by Country, 2023 to 2033

Figure 151: South Asia and Pacific Value (US$ Million) by Technology, 2023 to 2033

Figure 152: South Asia and Pacific Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 153: South Asia and Pacific Value (US$ Million) by Component, 2023 to 2033

Figure 154: South Asia and Pacific Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 155: South Asia and Pacific Value (US$ Million) by Country, 2023 to 2033

Figure 156: South Asia and Pacific Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: South Asia and Pacific Volume (Units) Analysis by Country, 2018 to 2033

Figure 158: South Asia and Pacific Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: South Asia and Pacific Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: South Asia and Pacific Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 161: South Asia and Pacific Volume (Units) Analysis by Technology, 2018 to 2033

Figure 162: South Asia and Pacific Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 163: South Asia and Pacific Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 164: South Asia and Pacific Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 165: South Asia and Pacific Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 166: South Asia and Pacific Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 167: South Asia and Pacific Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 168: South Asia and Pacific Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 169: South Asia and Pacific Volume (Units) Analysis by Component, 2018 to 2033

Figure 170: South Asia and Pacific Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 171: South Asia and Pacific Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 172: South Asia and Pacific Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 173: South Asia and Pacific Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 174: South Asia and Pacific Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 175: South Asia and Pacific Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 176: South Asia and Pacific Attractiveness by Technology, 2023 to 2033

Figure 177: South Asia and Pacific Attractiveness by Sales Channel, 2023 to 2033

Figure 178: South Asia and Pacific Attractiveness by Component, 2023 to 2033

Figure 179: South Asia and Pacific Attractiveness by Vehicle Type, 2023 to 2033

Figure 180: South Asia and Pacific Attractiveness by Country, 2023 to 2033

Figure 181: East Asia Value (US$ Million) by Technology, 2023 to 2033

Figure 182: East Asia Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 183: East Asia Value (US$ Million) by Component, 2023 to 2033

Figure 184: East Asia Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 185: East Asia Value (US$ Million) by Country, 2023 to 2033

Figure 186: East Asia Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 187: East Asia Volume (Units) Analysis by Country, 2018 to 2033

Figure 188: East Asia Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 189: East Asia Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 190: East Asia Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 191: East Asia Volume (Units) Analysis by Technology, 2018 to 2033

Figure 192: East Asia Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 193: East Asia Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 194: East Asia Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 195: East Asia Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 196: East Asia Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 197: East Asia Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 198: East Asia Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 199: East Asia Volume (Units) Analysis by Component, 2018 to 2033

Figure 200: East Asia Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 201: East Asia Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 202: East Asia Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 203: East Asia Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 204: East Asia Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 205: East Asia Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 206: East Asia Attractiveness by Technology, 2023 to 2033

Figure 207: East Asia Attractiveness by Sales Channel, 2023 to 2033

Figure 208: East Asia Attractiveness by Component, 2023 to 2033

Figure 209: East Asia Attractiveness by Vehicle Type, 2023 to 2033

Figure 210: East Asia Attractiveness by Country, 2023 to 2033

Figure 211: Middle East and Africa Value (US$ Million) by Technology, 2023 to 2033

Figure 212: Middle East and Africa Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 213: Middle East and Africa Value (US$ Million) by Component, 2023 to 2033

Figure 214: Middle East and Africa Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 215: Middle East and Africa Value (US$ Million) by Country, 2023 to 2033

Figure 216: Middle East and Africa Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 217: Middle East and Africa Volume (Units) Analysis by Country, 2018 to 2033

Figure 218: Middle East and Africa Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 219: Middle East and Africa Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 220: Middle East and Africa Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 221: Middle East and Africa Volume (Units) Analysis by Technology, 2018 to 2033

Figure 222: Middle East and Africa Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 223: Middle East and Africa Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 224: Middle East and Africa Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 225: Middle East and Africa Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 226: Middle East and Africa Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 227: Middle East and Africa Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 228: Middle East and Africa Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 229: Middle East and Africa Volume (Units) Analysis by Component, 2018 to 2033

Figure 230: Middle East and Africa Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 231: Middle East and Africa Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 232: Middle East and Africa Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 233: Middle East and Africa Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 234: Middle East and Africa Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 235: Middle East and Africa Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 236: Middle East and Africa Attractiveness by Technology, 2023 to 2033

Figure 237: Middle East and Africa Attractiveness by Sales Channel, 2023 to 2033

Figure 238: Middle East and Africa Attractiveness by Component, 2023 to 2033

Figure 239: Middle East and Africa Attractiveness by Vehicle Type, 2023 to 2033

Figure 240: Middle East and Africa Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Windshield Washer System Market Growth – Trends & Forecast 2025 to 2035

Automotive Brake System Market Growth - Trends & Forecast 2025 to 2035

Automotive Brake System & Components Market Growth - Trends & Forecast 2025 to 2035

Automotive Piston System Market Growth - Trends & Forecast 2025 to 2035

Automotive Seating Systems Market Analysis - Size, Share & Forecast 2025 to 2035

Automotive Exhaust Systems Market Trends - Growth & Forecast 2025 to 2035

Automotive Starting System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Ignition Systems Market Size and Share Forecast Outlook 2025 to 2035

Automotive Steering System Market Growth - Trends & Forecast 2025 to 2035

Automotive Embedded System Market Growth - Trends & Forecast 2024 to 2034

Automotive Defogger System Market

Automotive Platooning System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Gear Shift System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Navigation System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Automotive Suspension System Market Growth - Trends & Forecast 2025 to 2035

Automotive Night Vision System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Active Safety System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Fuel Delivery System Market Trends - Growth & Forecast 2025 to 2035

Automotive Energy Storage System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Engine Cooling System Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA