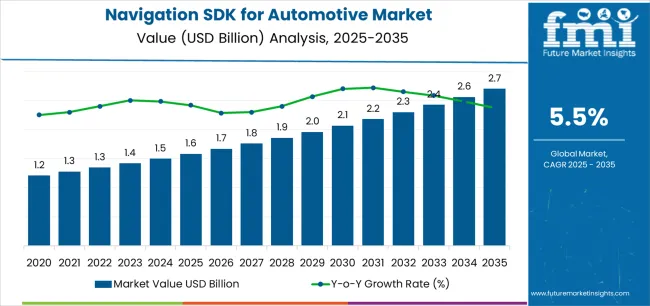

The global navigation SDK for automotive market is valued at USD 1,579.8 million in 2025 and is slated to reach USD 2,698.6 million by 2035, recording an absolute increase of USD 1,118.8 million over the forecast period. This translates into a total growth of 70.8%, with the market forecast to expand at a compound annual growth rate (CAGR) of 5.5% between 2025 and 2035. The overall market size is expected to grow by approximately 1.71X during the same period, supported by increasing demand for connected vehicle technologies, growing adoption of autonomous driving systems across global automotive markets, and rising preference for integrated navigation solutions across original equipment manufacturers and aftermarket applications.

The navigation SDK for automotive market represents a dynamic segment of the global automotive technology industry, characterized by rapid innovation in software development and growing demand for location-based services. Market dynamics are influenced by evolving automotive industry requirements, increasing integration of artificial intelligence in navigation systems, and expanding adoption of real-time traffic management solutions. Traditional navigation approaches are transforming as automotive manufacturers seek sophisticated software development kits that offer enhanced mapping capabilities, precise positioning accuracy, and seamless integration with vehicle systems.

Consumer behavior in the navigation SDK market reflects broader trends toward connected mobility solutions that provide comprehensive navigation functionality and enhanced driving experiences. The market benefits from the growing popularity of autonomous and semi-autonomous vehicles, which require advanced navigation capabilities for safe and efficient operation. Additionally, the versatility of navigation SDKs as both standalone solutions and integrated components supports sustained demand across multiple automotive applications and vehicle categories.

Regional adoption patterns vary significantly, with North American and European markets showing strong preference for advanced navigation features and real-time traffic integration, while Asian markets demonstrate increasing investment in local mapping solutions alongside global navigation platforms. The automotive landscape continues to evolve with electric vehicle manufacturers and traditional automakers integrating sophisticated navigation systems that provide route optimization, charging station location services, and predictive navigation capabilities.

The competitive environment features established technology companies alongside emerging navigation specialists that focus on automotive-specific solutions and machine learning integration. Software development efficiency and API optimization remain critical factors for market participants, particularly as automotive manufacturers require scalable solutions that can integrate with diverse vehicle architectures. Distribution strategies increasingly emphasize direct partnerships with automotive manufacturers and tier-one suppliers while maintaining compatibility with aftermarket integration requirements.

Market consolidation trends indicate that larger technology providers are acquiring specialized navigation companies to diversify their automotive portfolios and access advanced mapping technologies. Original equipment manufacturer partnerships have gained momentum as automakers seek to differentiate their vehicles while maintaining competitive development timelines. The emergence of artificial intelligence-powered navigation solutions, including predictive routing and machine learning-based traffic optimization, reflects changing automotive industry priorities and creates new market opportunities for innovative software developers.

Between 2025 and 2030, the navigation SDK for automotive market is projected to expand from USD 1,579.8 million to USD 2,031.5 million, resulting in a value increase of USD 451.7 million, which represents 40.4% of the total forecast growth for the decade. This phase of development will be shaped by increasing adoption of connected vehicle technologies, rising demand for real-time navigation services, and growing emphasis on autonomous driving capabilities with enhanced mapping accuracy. Software developers are expanding their development capabilities to address the growing demand for specialized automotive SDKs, artificial intelligence integration, and custom navigation solutions across automotive manufacturers.

| Metric | Value |

|---|---|

| Estimated Value (2025E) | USD 1,579.8 million |

| Forecast Value (2035F) | USD 2,698.6 million |

| Forecast CAGR (2025-2035) | 5.50% |

From 2030 to 2035, the market is forecast to grow from USD 2,031.5 million to USD 2,698.6 million, adding another USD 667.1 million, which constitutes 59.6% of the overall ten-year expansion. This period is expected to be characterized by the expansion of autonomous driving integration, the development of advanced machine learning capabilities, and the implementation of next-generation mapping technologies with enhanced real-time processing and predictive navigation features. The growing adoption of artificial intelligence algorithms will drive demand for navigation SDKs with superior computational capabilities and compatibility with advanced driver assistance systems across automotive manufacturing operations.

Between 2020 and 2025, the navigation SDK for automotive market experienced accelerated growth, driven by increasing demand for connected vehicle solutions and growing recognition of navigation technologies as essential components for modern automotive systems across passenger and commercial vehicle applications. The market developed as automotive manufacturers recognized the potential for navigation SDKs to provide both enhanced user experiences and critical functionality while enabling advanced autonomous driving protocols. Technological advancement in mapping accuracy and real-time processing began emphasizing the critical importance of maintaining system reliability and positioning precision in diverse driving environments.

Market expansion is being supported by the increasing global demand for connected vehicle technologies and the corresponding need for sophisticated navigation solutions that can provide superior mapping accuracy and real-time processing capabilities while enabling seamless integration and advanced autonomous driving features across various automotive and commercial vehicle applications. Modern automotive manufacturers and technology specialists are increasingly focused on implementing navigation systems that can deliver precise positioning capabilities, minimize processing latency, and provide consistent performance throughout complex driving scenarios and diverse geographic environments. Navigation SDKs' proven ability to deliver exceptional accuracy against traditional navigation methods, enable advanced driver assistance integration, and support autonomous vehicle protocols make them essential components for contemporary automotive development and manufacturing operations.

The growing emphasis on autonomous driving technologies and connected mobility solutions is driving demand for navigation SDKs that can support large-scale automotive integration, improve route optimization outcomes, and enable advanced vehicle automation systems. Automotive manufacturer preference for solutions that combine effective navigation capabilities with artificial intelligence integration and machine learning benefits is creating opportunities for innovative SDK implementations. The rising influence of electric vehicle adoption and charging infrastructure integration is also contributing to increased demand for navigation SDKs that can provide energy-efficient routing, charging station location services, and predictive range calculation across extended driving operations.

The navigation SDK for automotive market is positioned for robust growth and technological advancement. As automotive manufacturers across North America, Europe, Asia-Pacific, and emerging markets seek solutions that deliver exceptional navigation accuracy, real-time processing capabilities, and seamless vehicle integration, navigation SDKs are gaining prominence not just as mapping tools but as strategic enablers of autonomous driving and connected mobility solutions.

Rising autonomous vehicle adoption in Asia-Pacific and expanding electric vehicle initiatives globally amplify demand, while developers are leveraging innovations in artificial intelligence systems, machine learning algorithms, and real-time processing technologies.

Pathways like artificial intelligence integration, autonomous driving solutions, and specialized automotive platforms promise strong margin uplift, particularly in premium vehicle segments. Geographic expansion and technology diversification will capture volume, particularly where local mapping accuracy and real-time processing adoption are critical. Regulatory support around autonomous vehicle standards, data privacy requirements, and automotive safety give structural support.

What is the segmental analysis of the navigation SDK for automotive market?

The market is segmented by model, application, integration type, vehicle category, price segment, and region. By model, the market is divided into online operating model, offline operating model, hybrid operating model, and cloud-based model categories. By application, it covers ADAS (Advanced Driver Assistance Systems), ADS (Autonomous Driving Systems), infotainment systems, and fleet management segments. By integration type, the market includes native integration, third-party integration, and API-based integration. By vehicle category, it comprises passenger cars, commercial vehicles, and electric vehicles. By price segment, the market is categorized into premium, mid-range, and economy categories. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and the Middle East & Africa.

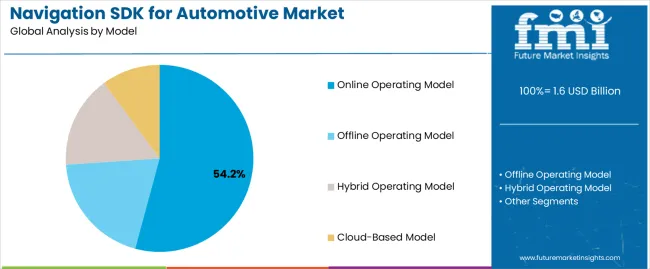

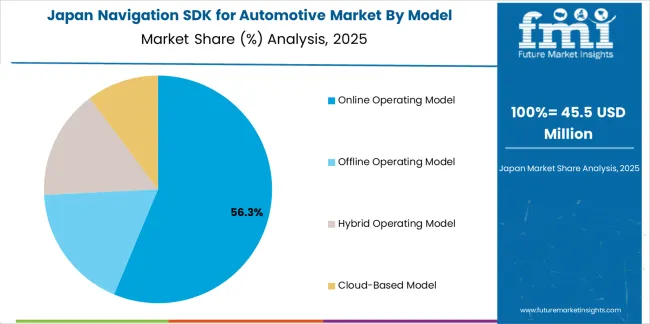

The online operating model segment is projected to account for 54.2% of the navigation SDK for automotive market in 2025, reaffirming its position as the leading model category. Automotive manufacturers and technology developers increasingly utilize online operating model solutions for their superior real-time data capabilities when operating across diverse vehicle applications, excellent connectivity integration properties, and comprehensive mapping updates in applications ranging from passenger vehicles to commercial fleet operations. Online operating model technology's advanced cloud connectivity and real-time processing capabilities directly address the automotive requirements for current traffic information in complex driving environments.

This model segment forms the foundation of modern automotive navigation systems, as it represents the approach with the greatest data accuracy and established market demand across multiple vehicle categories and application segments. Developer investments in cloud infrastructure and connectivity optimization continue to strengthen adoption among automotive manufacturers and technology integrators. With automotive companies prioritizing real-time accuracy and data reliability, online operating models align with both performance expectations and connectivity requirements, making them the central component of comprehensive automotive navigation strategies.

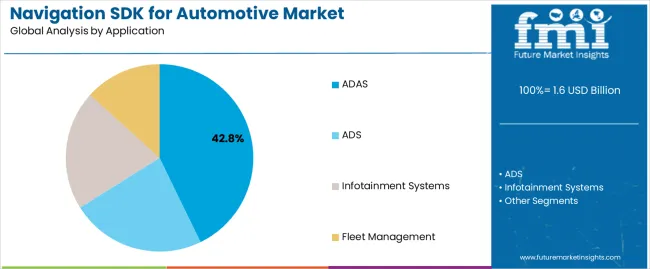

Advanced Driver Assistance Systems applications are projected to represent 42.8% of navigation SDK demand in 2025, underscoring their critical role as the primary integration channel for navigation technologies across automotive safety systems, driver assistance features, and semi-autonomous driving applications. ADAS applications prefer navigation SDKs for their exceptional precision characteristics, safety integration options, and ability to enhance vehicle safety protocols while ensuring reliable positioning accuracy throughout diverse driving conditions. Positioned as essential components for modern vehicle safety systems, navigation SDKs offer both positioning accuracy advantages and seamless integration benefits.

The segment is supported by continuous innovation in safety technologies and the growing availability of specialized ADAS solutions that enable diverse safety applications with enhanced accuracy uniformity and real-time processing capabilities. Additionally, automotive manufacturers are investing in premium safety systems to support comprehensive vehicle automation and driver assistance. As autonomous driving becomes more prevalent and safety requirements increase, ADAS applications will continue to represent a major integration market while supporting advanced automotive utilization and safety enhancement strategies.

The navigation SDK for automotive market is advancing rapidly due to increasing demand for connected vehicle technologies and growing adoption of autonomous driving solutions that provide superior navigation accuracy and real-time processing capabilities while enabling seamless integration across diverse automotive and commercial vehicle applications. The market faces challenges, including complex integration requirements, data privacy regulations, and the need for specialized development expertise and continuous updating programs. Innovation in artificial intelligence capabilities and real-time processing systems continues to influence product development and market expansion patterns.

The growing adoption of self-driving vehicle technologies, artificial intelligence integration, and connected mobility platforms is enabling developers to produce advanced navigation SDK solutions with superior autonomous driving compatibility, enhanced machine learning capabilities, and seamless vehicle integration functionalities. Advanced processing systems provide improved navigation accuracy while allowing more efficient development workflows and reliable performance across various automotive applications and driving conditions. Developers are increasingly recognizing the competitive advantages of AI-powered navigation capabilities for market differentiation and premium positioning.

Modern navigation SDK providers are incorporating advanced processing algorithms, machine learning capabilities, and predictive navigation technologies to enhance system performance, enable intelligent route optimization, and deliver value-added solutions to automotive customers. These technologies improve navigation accuracy while enabling new market opportunities, including predictive routing, traffic pattern analysis, and automated decision-making characteristics. Advanced AI integration also allows developers to support comprehensive automotive manufacturing systems and market expansion beyond traditional mapping approaches.

| Country | CAGR (2025-2035) |

|---|---|

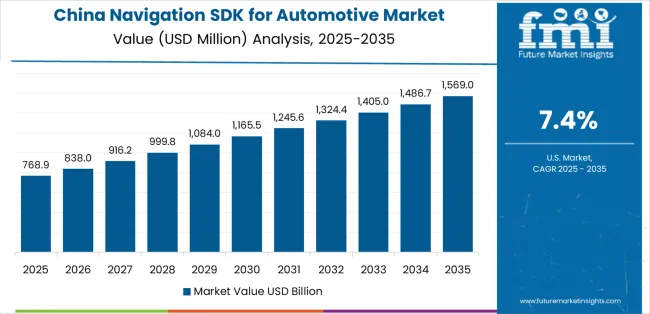

| China | 7.4% |

| India | 6.9% |

| Germany | 6.3% |

| Brazil | 5.8% |

| United States (USA) | 5.2% |

| United Kingdom (UK) | 4.7% |

| Japan | 4.1% |

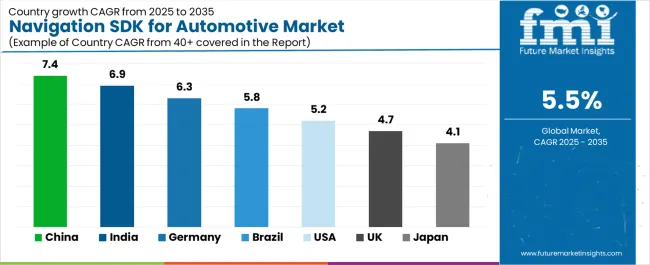

The navigation SDK for automotive market is experiencing robust growth globally, with China leading at a 7.4% CAGR through 2035, driven by expanding electric vehicle adoption, growing automotive technology investment, and significant development in autonomous driving technology programs. India follows at 6.9%, supported by increasing automotive manufacturing expansion, growing connected vehicle initiatives, and expanding domestic automotive technology development. Germany shows growth at 6.3%, emphasizing premium automotive innovation and advanced driver assistance system development. Brazil records 5.8%, focusing on expanding automotive manufacturing capabilities and technology integration modernization. The USA demonstrates 5.2% growth, prioritizing autonomous vehicle development and connected mobility advancement. The UK exhibits 4.7% growth, emphasizing automotive technology innovation and electric vehicle integration development. Japan shows 4.1% growth, supported by advanced automotive technology initiatives and precision manufacturing capabilities.

The report covers an in-depth analysis of 40+ countries, the top-performing countries are highlighted below.

Revenue from navigation SDK for automotive in China is projected to exhibit strong growth with a CAGR of 7.4% through 2035, driven by expanding electric vehicle adoption and rapidly growing autonomous driving technology supported by government initiatives promoting automotive technology development. The country's strong position in electric vehicle manufacturing and increasing investment in connected vehicle infrastructure are creating substantial demand for advanced navigation SDK solutions. Major automotive manufacturers and technology companies are establishing comprehensive development capabilities to serve both domestic automotive demand and expanding international markets.

Revenue from navigation SDK for automotive in India is expanding at a CAGR of 6.9%, supported by the country's growing automotive manufacturing sector, expanding technology development capabilities, and increasing adoption of connected vehicle solutions. The country's initiatives promoting automotive technology advancement and growing domestic manufacturing are driving requirements for advanced navigation systems. International suppliers and domestic developers are establishing extensive development and integration capabilities to address the growing demand for automotive navigation technologies.

Revenue from navigation SDK for automotive in Germany is expanding at a CAGR of 6.3%, supported by the country's automotive industry leadership, strong emphasis on premium vehicle technology, and robust demand for advanced driver assistance systems in luxury and performance vehicle applications. The nation's mature automotive sector and technology-focused operations are driving sophisticated navigation solutions throughout the automotive industry. Leading manufacturers and technology providers are investing extensively in premium development and advanced technologies to serve both domestic and international automotive markets.

Revenue from navigation SDK for automotive in Brazil is growing at a CAGR of 5.8%, driven by the country's expanding automotive manufacturing sector, growing technology integration programs, and increasing investment in connected vehicle development. Brazil's large automotive market and commitment to manufacturing advancement are supporting demand for diverse navigation solutions across multiple vehicle segments. Manufacturers are establishing comprehensive integration capabilities to serve the growing domestic automotive market and expanding technology opportunities.

Revenue from navigation SDK for automotive in the USA is expanding at a CAGR of 5.2%, supported by the country's advanced automotive technology sector, strategic focus on autonomous driving development, and established automotive manufacturing capabilities. The USA's technology innovation leadership and autonomous vehicle integration are driving demand for specialized navigation solutions in premium automotive, technology development, and advanced manufacturing applications. Developers are investing in comprehensive technology development to serve both domestic specialty markets and international premium applications.

Revenue from navigation SDK for automotive in the UK is growing at a CAGR of 4.7%, driven by the country's focus on automotive technology advancement, emphasis on electric vehicle development, and strong position in automotive innovation. The UK's established automotive technology capabilities and commitment to innovation are supporting investment in navigation technologies throughout major automotive regions. Industry leaders are establishing comprehensive technology integration systems to serve domestic automotive development and premium manufacturing applications.

Revenue from navigation SDK for automotive in Japan is expanding at a CAGR of 4.1%, supported by the country's premium automotive initiatives, growing technology advancement sector, and strategic emphasis on precision manufacturing. Japan's advanced quality control capabilities and integrated automotive systems are driving demand for high-precision navigation solutions in premium automotive, advanced manufacturing, and technology development applications. Leading manufacturers are investing in specialized capabilities to serve the stringent requirements of quality-focused automotive and precision technology industries.

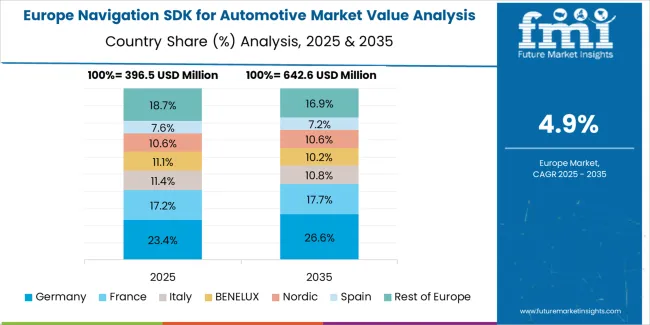

The navigation SDK for automotive market in Europe is projected to grow from USD 315.9 million in 2025 to USD 523.8 million by 2035, registering a CAGR of 5.2% over the forecast period. Germany is expected to maintain its leadership position with a 38.4% market share in 2025, declining slightly to 37.9% by 2035, supported by its strong automotive industry leadership, sophisticated vehicle technology capabilities, and comprehensive manufacturing infrastructure serving diverse navigation SDK applications across Europe.

France follows with a 21.3% share in 2025, projected to reach 21.7% by 2035, driven by robust demand for premium automotive technologies in luxury vehicle applications, advanced manufacturing programs, and automotive innovation markets, combined with established technology development infrastructure and automotive expertise. The United Kingdom holds a 16.2% share in 2025, expected to reach 16.5% by 2035, supported by strong automotive technology sector and growing electric vehicle development activities. Italy commands a 10.4% share in 2025, projected to reach 10.7% by 2035, while Spain accounts for 7.8% in 2025, expected to reach 8.1% by 2035. The Netherlands maintains a 3.1% share in 2025, growing to 3.2% by 2035. The Rest of Europe region, including Nordic countries, Eastern Europe, Belgium, Poland, and other nations, is anticipated to maintain momentum, with its collective share moving from 2.8% to 1.9% by 2035, attributed to increasing automotive technology adoption in Eastern Europe and growing premium vehicle penetration in Nordic countries implementing advanced automotive programs.

The navigation SDK for automotive market is characterized by competition among established technology companies, specialized navigation providers, and integrated automotive solution developers. Companies are investing in artificial intelligence research, mapping accuracy optimization, real-time processing system development, and comprehensive SDK portfolios to deliver consistent, high-performance, and application-specific navigation solutions. Innovation in machine learning systems, autonomous driving integration, and automotive compatibility enhancement is central to strengthening market position and competitive advantage.

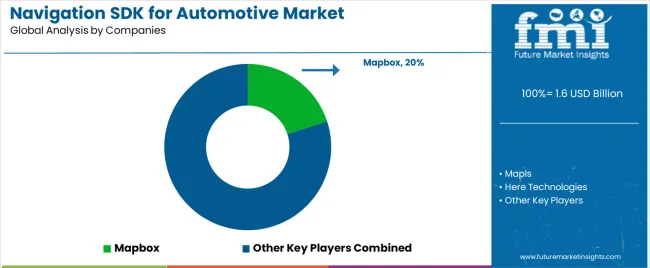

Mapbox leads the market with 20% share, offering comprehensive navigation SDK solutions including advanced mapping and real-time processing systems with a focus on automotive and developer applications. Mapls provides specialized location-based services with an emphasis on regional mapping and local navigation solutions. Here Technologies delivers comprehensive automotive navigation with a focus on autonomous driving platforms and large-scale automotive integration. TomTom specializes in navigation technology and automotive mapping solutions for connected vehicle applications. Sygic focuses on mobile navigation solutions and automotive SDK platforms. Google offers comprehensive mapping services with emphasis on AI integration and global navigation applications.

| Item | Value |

|---|---|

| Quantitative Units | USD 1,579.8 million |

| Model | Online Operating Model; Offline Operating Model; Hybrid Operating Model; Cloud-Based Model |

| Application | ADAS; ADS; Infotainment Systems; Fleet Management |

| Integration Type | Native Integration; Third-Party Integration; API-Based Integration |

| Vehicle Category | Passenger Cars; Commercial Vehicles; Electric Vehicles |

| Price Segment | Premium; Mid-range; Economy |

| End-Use Sector | Automotive Manufacturers; Technology Companies; Aftermarket Providers; Fleet Operators |

| Regions Covered | North America; Europe; East Asia; South Asia & Pacific; Latin America; Middle East & Africa |

| Countries Covered | China; India; Germany; Brazil; United States; United Kingdom; Japan; and 40+ additional countries |

| Key Companies Profiled | Mapbox; Mapls; Here Technologies; TomTom; Sygic; Google |

| Additional Attributes | Dollar sales by model and application category; regional demand trends; competitive landscape; technological advancements in artificial intelligence systems; real-time processing development; autonomous driving integration; automotive compatibility analysis |

The global navigation sdk for automotive market is estimated to be valued at USD 1.6 billion in 2025.

The market size for the navigation sdk for automotive market is projected to reach USD 2.7 billion by 2035.

The navigation sdk for automotive market is expected to grow at a 5.5% CAGR between 2025 and 2035.

The key product types in navigation sdk for automotive market are online operating model, offline operating model, hybrid operating model and cloud-based model.

In terms of application, adas segment to command 42.8% share in the navigation sdk for automotive market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Navigation Switches Market Size and Share Forecast Outlook 2025 to 2035

Navigation satellite system Market Size and Share Forecast Outlook 2025 to 2035

Navigation, Imaging and Positioning Solutions Market - Trends & Forecast 2025 to 2035

Neuronavigation Systems Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Subsea Navigation and Tracking Market Size and Share Forecast Outlook 2025 to 2035

Cranial Navigation Systems Market Size and Share Forecast Outlook 2025 to 2035

Personal Navigation Devices Market Size and Share Forecast Outlook 2025 to 2035

Surgical Navigation System Market Analysis - Growth & Forecast 2025 to 2035

Military Navigation Systems Market

Inertial Navigation System Market

Orthopedic Navigation Systems Market Analysis – Trends, Growth & Forecast 2025 to 2035

Automotive Navigation System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Automotive Navigation Solutions Market Growth - Trends & Forecast 2025 to 2035

Handheld Robotic Navigation Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Automotive Personal Navigation Systems Market Size and Share Forecast Outlook 2025 to 2035

Assured PNT (Positioning, Navigation, and Timing) Market Size and Share Forecast Outlook 2025 to 2035

Automotive-grade Inertial Navigation System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Roof Rails Market Size and Share Forecast Outlook 2025 to 2035

Automotive Active Safety System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Diagnostic Scan Tool Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA