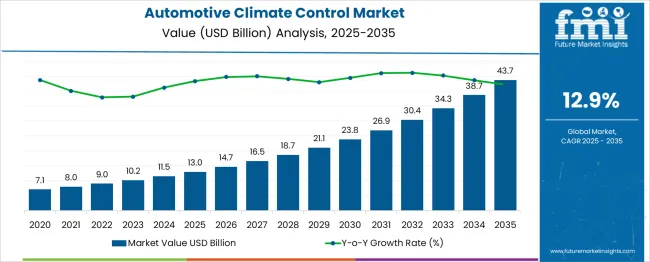

The Automotive Climate Control Market is estimated to be valued at USD 13.0 billion in 2025 and is projected to reach USD 43.7 billion by 2035, registering a compound annual growth rate (CAGR) of 12.9% over the forecast period. From 2020 to 2030, the market grows steadily from USD 7.1 billion to around USD 21.1 billion, driven by increasing consumer demand for enhanced in-vehicle comfort, stricter emission regulations, and widespread adoption of advanced climate control technologies in both passenger and commercial vehicles. The rise of electric and hybrid vehicles further propels market expansion as these require innovative climate management systems to optimize energy efficiency and passenger comfort.

Between 2030 and 2035, the market accelerates from USD 23.8 billion to USD 43.7 billion, supported by advancements in smart climate control solutions, integration with connected car platforms, and the use of environmentally friendly refrigerants meeting regulatory standards. Rapid vehicle ownership growth in emerging economies and fleet upgrades in developed regions boost demand. Increasing emphasis on air quality and passenger wellness stimulates the adoption of advanced air purification and ventilation features. The automotive climate control market is poised for robust and sustained growth through 2035, fueled by technological innovation, evolving consumer preferences, and regulatory pressures.

| Metric | Value |

|---|---|

| Automotive Climate Control Market Estimated Value in (2025 E) | USD 13.0 billion |

| Automotive Climate Control Market Forecast Value in (2035 F) | USD 43.7 billion |

| Forecast CAGR (2025 to 2035) | 12.9% |

The automotive climate control market is evolving rapidly in response to shifting consumer expectations for comfort, safety, and energy efficiency in vehicles. Advancements in automotive electronics, growing adoption of electric vehicles, and regulatory requirements for environmental compliance are shaping the trajectory of this market. As thermal management systems play a critical role in both cabin comfort and component protection, manufacturers are investing in intelligent climate control technologies that can optimize energy consumption without compromising user experience.

Increasing demand for personalized and automated comfort solutions, particularly in passenger vehicles, is accelerating the integration of sensor-based and software-driven systems. Innovations in smart actuators, temperature sensors, and microcontrollers have enhanced system precision, enabling real-time environmental adjustments.

These developments, coupled with growing awareness of in-vehicle air quality, are expected to fuel further expansion. The convergence of digital interfaces, energy-efficient HVAC components, and connected features is setting the foundation for sustained growth across diverse vehicle segments and powertrains..

The automotive climate control market is segmented by technology, vehicle, fuel, component, end-use, and geographic regions. The technology of the automotive climate control market is divided into Automatic and Manual. In terms of vehicles, the automotive climate control market is classified into Passenger cars and Commercial vehicles.

The automotive climate control market is segmented by fuel type into Gasoline, Diesel, All-electric, and PHEVHEV. The automotive climate control market is segmented into Compressors, Condensers, Evaporators, Control panels, Sensors, and Others. The end-use of the automotive climate control market is segmented into OEM and market. Regionally, the automotive climate control industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

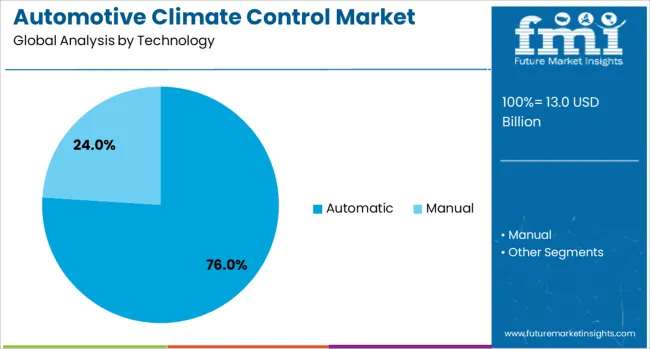

The automatic technology segment is projected to hold 76% of the Automotive Climate Control market revenue share in 2025, establishing it as the dominant technology type. Growth in this segment has been driven by rising consumer expectations for intelligent, responsive comfort systems that operate without manual intervention. Automatic climate control systems utilize sensors and microprocessors to regulate temperature, humidity, and airflow in real time, improving passenger comfort and reducing driver distraction.

Automotive manufacturers have prioritized the integration of these systems in both premium and mass-market models, reflecting a shift toward advanced in-cabin technologies. The adoption has been reinforced by the ability of automatic systems to optimize energy usage, especially in vehicles with complex power management requirements such as hybrids and electric vehicles.

Additionally, advancements in digital interfaces and smart climate algorithms have contributed to the broader appeal of automatic systems. As vehicle buyers increasingly associate automation with luxury and convenience, this segment is expected to maintain its leadership position in the years ahead..

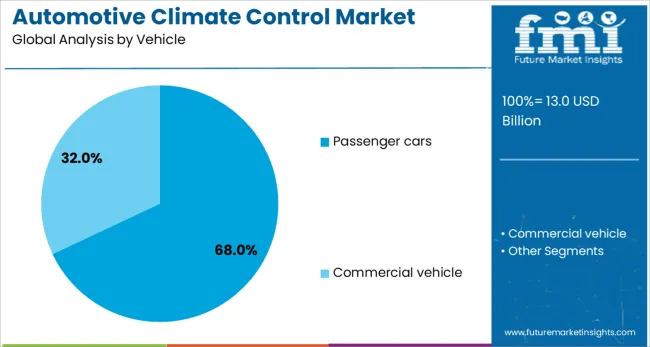

The passenger cars segment is anticipated to account for 68% of the Automotive Climate Control market revenue share in 2025, making it the leading vehicle category. The dominance of this segment has been influenced by the large global volume of passenger vehicle production and the rising inclusion of comfort-focused features across various price points. Increased consumer awareness around cabin quality, air filtration, and personalized climate zones has reinforced the demand for advanced climate control systems in passenger cars.

Original equipment manufacturers have been equipping even compact and mid-size vehicles with automated climate solutions to differentiate their offerings in a competitive market. Moreover, urbanization and rising vehicle ownership in emerging economies have accelerated demand for vehicles equipped with high-efficiency HVAC systems.

As passenger cars continue to serve as the primary mode of personal transportation globally, their consistent sales volume has sustained investment in thermal innovation. Continuous integration of digital interfaces and energy-efficient components is expected to further strengthen the segment’s market share..

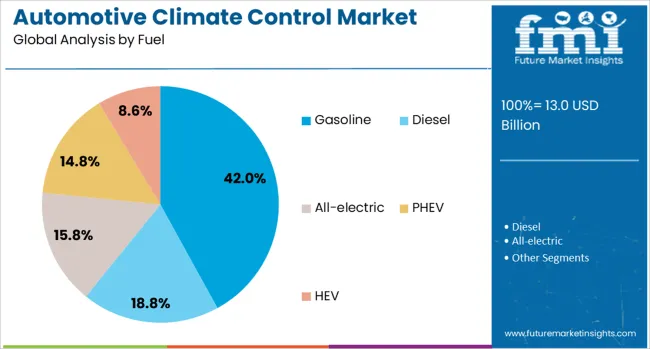

The gasoline fuel segment is expected to hold 42% of the Automotive Climate Control market revenue share in 2025, positioning it as the leading fuel category. This leadership has been sustained by the continued global dominance of gasoline-powered passenger vehicles, especially in markets where infrastructure for alternative fuels remains underdeveloped. Gasoline engines generate excess heat, necessitating efficient thermal management solutions that can simultaneously enhance comfort and support engine performance.

The segment has benefited from extensive compatibility with traditional HVAC system designs, allowing manufacturers to deploy proven solutions at scale. Additionally, the widespread availability of gasoline vehicles across various price brackets has ensured consistent demand for reliable and cost-effective climate control technologies.

While electric and hybrid vehicles are gaining traction, the sheer volume of gasoline vehicles in use and ongoing production have solidified this segment's position. Investments in lightweight components and refrigerant efficiency improvements are being prioritized to ensure regulatory compliance, reinforcing the segment’s relevance in the evolving automotive landscape..

The automotive climate control market is evolving through regulatory compliance, EV efficiency demands, connected car integration, and luxury-driven feature expansion. These dynamics are shaping future product designs and OEM competitive strategies.

The automotive climate control market is increasingly shaped by regulations that mandate improved in-cabin air quality. Governments and safety agencies are enforcing stricter limits on particulate matter, harmful gases, and allergens, pushing OEMs to integrate filtration and purification systems into HVAC units. This trend is accelerating the adoption of multi-layer filters, ionizers, and humidity control features across both premium and mid-range vehicles. Compliance with air quality standards has also led to climate control systems being marketed as health-enhancing features, influencing buyer preferences. Manufacturers are developing systems that balance regulatory requirements with energy efficiency, ensuring minimal impact on fuel economy or EV range while maintaining passenger comfort and safety.

Electric and hybrid vehicles are redefining requirements for climate control systems, with a focus on reducing energy consumption to preserve driving range. Heat pump technology, advanced insulation, and intelligent airflow management are increasingly being deployed to optimize thermal efficiency. Automakers are integrating pre-conditioning functions that allow the cabin to be heated or cooled while the vehicle is charging, minimizing battery drain during driving. In cold and hot climates, these systems play a crucial role in ensuring passenger comfort without compromising performance. As EV adoption grows, climate control solutions designed for low power usage and fast response times are becoming a key differentiator for OEMs.

Automotive climate control systems are now linked with connected car platforms, allowing remote operation through mobile apps or voice assistants. This integration enables drivers to pre-set temperature preferences, initiate defrosting, or adjust airflow before entering the vehicle. Connected systems also collect usage data to optimize climate control performance and predict maintenance needs. In fleet applications, these features enhance operational efficiency by ensuring vehicles are ready for service under optimal cabin conditions. The growing use of over-the-air updates allows climate control software to be refined post-purchase, improving performance over time. This capability is expanding user expectations and influencing OEM feature strategies.

The premium and luxury vehicle segments remain at the forefront of climate control feature development, pushing advanced configurations into mainstream markets. Multi-zone climate systems, seat-integrated heating and cooling, and personalized microclimate controls are becoming increasingly common. Cabin air scenting, humidity balance, and noise-reducing airflow systems are marketed as comfort and wellness features, enhancing brand differentiation. These advancements often debut in high-end models before cascading into mid-range offerings as production costs decrease. The competitive push in this segment is compelling OEMs to offer climate control as a value-adding component rather than a standard utility, increasing its role in influencing purchase decisions.

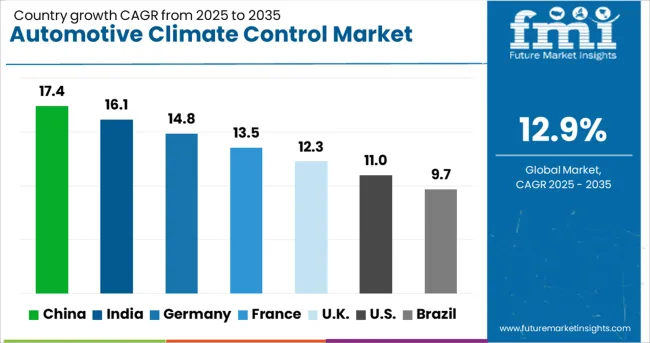

| Country | CAGR |

|---|---|

| China | 17.4% |

| India | 16.1% |

| Germany | 14.8% |

| France | 13.5% |

| UK | 12.3% |

| USA | 11.0% |

| Brazil | 9.7% |

The automotive climate control market is projected to expand globally at a CAGR of 12.9% from 2025 to 2035, driven by heightened consumer demand for comfort, advanced in-cabin air quality solutions, and integration with connected vehicle technologies. China leads with a CAGR of 17.4%, supported by strong passenger vehicle sales, rapid EV adoption, and premium segment expansion incorporating advanced HVAC systems. India follows at 16.1%, fueled by rising mid-segment vehicle demand, tropical climate conditions, and OEM investments in localized climate control manufacturing. France records 13.5%, boosted by EV integration, government incentives, and smart climate features. The United Kingdom grows at 12.3%, supported by premium vehicle demand and connected climate technologies, while the United States records 11.0%, reflecting steady replacement demand and adoption of advanced features in both ICE and EV segments. The report features insights for more than 40 countries, highlighting evolving market strategies, regional demand drivers, and emerging technology trends shaping the future of climate control solutions in vehicles worldwide.

China is projected at 17.4% CAGR during 2025–2035, well above the global 12.9% path. During 2020–2024 the market expanded at about 14.2%, supported by rising passenger car output, stronger comfort features in mid trims, and rapid EV penetration that required efficient heat pump architectures. The next phase is expected to benefit from multi-zone systems, cabin purification, and pre-conditioning features bundled with connected services. Localized compressor and HVAC module sourcing is improving cost and shortening lead times, which lifts fitment in entry models. Fleet sales in ride-hailing and corporate mobility keep demand steady for durable systems designed for heavy usage cycles and wide climate variability.

India is estimated at 16.1% CAGR for 2025–2035, versus about 13.1% during 2020–2024. Early growth came from higher AC fitment in compact cars and compact SUVs, supported by hot climate operation and rising time-in-vehicle. The outlook improves as OEMs introduce energy-efficient compressors, improved refrigerants, and rear-row vents across more variants. Supplier localization for evaporators, condensers, and electronic control units is lowering price points, which widens adoption in cost-sensitive segments. Aftermarket service networks are expanding coverage into Tier-2 and Tier-3 cities, raising replacement and maintenance activity. As EV volumes scale, heat pumps and smart pre-conditioning are expected to become common, protecting range and improving daily usability.

France records 13.5% CAGR for 2025–2035, compared with about 11.0% during 2020–2024. Early progress was shaped by premium trim upgrades and improved pollen and particulate filtration. The forward view is supported by EV program launches, cold-weather heat pump fitment, and integration with connected apps that allow timed heating and cooling. Euro NCAP focus on cabin well-being has increased OEM attention to humidity management and fast demist performance. The fleet channel remains influential as leasing firms specify multi-zone control and durable compressor designs to reduce service visits. Suppliers with compact HVAC packages and low power draw are expected to gain volume across small crossovers and fleet hatchbacks.

The United Kingdom is set at 12.3% CAGR in 2025–2035. Using proportional scaling to the 12.9% global benchmark, the 2020–2024 CAGR is estimated near 10.0%. Earlier growth was tempered by slower model refresh cycles and limited heat pump use outside premium EVs. The rise to 12.3% is explained by a higher SUV mix, broader adoption of multi-zone controls, and EV expansion that pushes energy-efficient HVAC into mainstream trims. Connected pre-conditioning and air quality improvements are being marketed as comfort and wellness features, lifting take rates. Leasing and fleet managers are prioritizing quick demist, durable compressors, and low-maintenance filters, which sustains recurring service demand across business fleets.

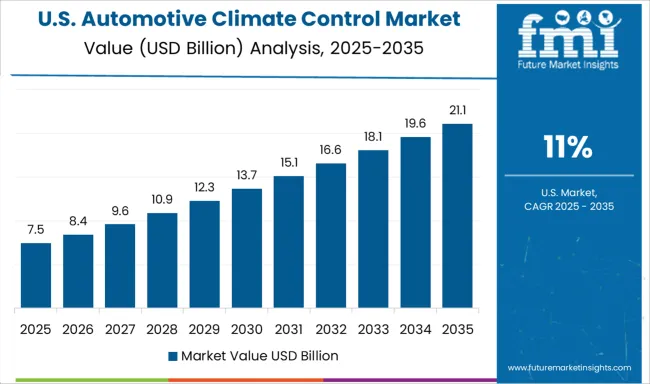

The United States posts 11.0% CAGR for 2025–2035, compared with about 9.0% during 2020–2024. Steady gains came from strong sales of SUVs and pickups that require higher-capacity systems, along with improved filtration in family vehicles. Growth ahead is expected to come from wider use of seat-level heating and ventilation paired with precise cabin temperature control. EV launches increase the need for heat pumps and intelligent thermal routing that balances comfort with range. The aftermarket remains important due to high vehicle miles traveled and longer ownership periods, which drive compressor, condenser, and blower replacements. Suppliers offering compact, low-power modules and fast defog performance are likely to capture share.

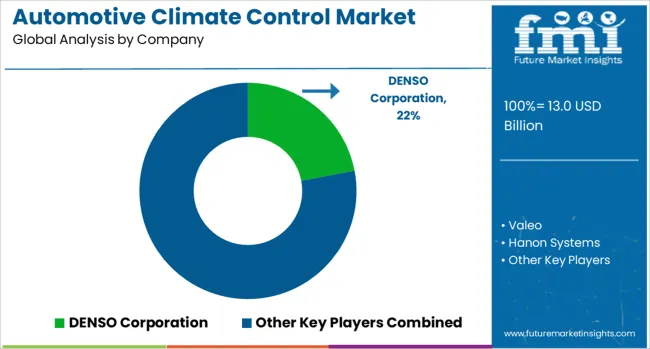

The automotive climate control market is defined by strong competition among established component suppliers and emerging innovators, each focusing on delivering efficient thermal management systems for diverse vehicle segments. DENSO Corporation leads with a wide portfolio of HVAC systems, compressors, and heat pump technologies designed for both ICE and electric vehicles. Valeo leverages its strength in thermal systems to provide energy-efficient solutions, particularly for EVs requiring optimized battery temperature control. Hanon Systems emphasizes compact, lightweight modules integrating advanced refrigerants to meet tightening environmental standards. MAHLE GmbH invests in integrated thermal systems, combining cabin climate control with powertrain cooling for improved energy use.

Keihin Corporation maintains its market relevance through high-precision HVAC components and eco-friendly air conditioning systems aimed at fuel efficiency. Sanden Holdings Corporation is recognized for its electric compressors and modular HVAC units tailored for various vehicle platforms. Competitive strategies include localized production, strategic alliances with automakers, and R&D investments in low-GWP refrigerants. Vendors are also focusing on smart climate control integration with connected car platforms, enabling predictive cabin conditioning. Future growth is expected to favor suppliers offering scalable solutions that cater to EV thermal demands, cost efficiency, and evolving regional regulatory frameworks.

In October 2024, DENSO announced the expansion of its manufacturing operations in Athens, Tennessee, adding 200 jobs and new production space for cleaner mobility components.

| Item | Value |

|---|---|

| Quantitative Units | USD 13.0 Billion |

| Technology | Automatic and Manual |

| Vehicle | Passenger cars and Commercial vehicle |

| Fuel | Gasoline, Diesel, All-electric, PHEV, and HEV |

| Component | Compressors, Condensers, Evaporators, Control panels, Sensors, and Others |

| End-Use | OEM and Aftermarket |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | DENSO Corporation, Valeo, Hanon Systems, MAHLE GmbH, Keihin Corporation, and Sanden Holdings Corporation |

| Additional Attributes | Dollar sales, share, regional demand trends, competitive landscape, OEM vs aftermarket growth, technology adoption, pricing analysis, regulatory impact, and future growth forecasts. |

The global automotive climate control market is estimated to be valued at USD 13.0 billion in 2025.

The market size for the automotive climate control market is projected to reach USD 43.7 billion by 2035.

The automotive climate control market is expected to grow at a 12.9% CAGR between 2025 and 2035.

The key product types in automotive climate control market are automatic and manual.

In terms of vehicle, passenger cars segment to command 68.0% share in the automotive climate control market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA