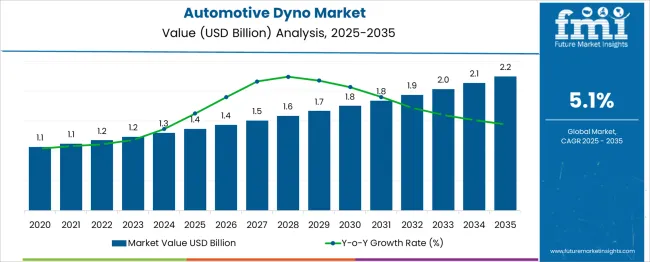

The Automotive Dyno Market is estimated to be valued at USD 1.4 billion in 2025 and is projected to reach USD 2.2 billion by 2035, registering a compound annual growth rate (CAGR) of 5.1% over the forecast period. This phase benefits from the growing emphasis on vehicle efficiency, fuel economy, and reduced emissions, prompting automakers and testing facilities to adopt advanced dynamometer technologies.

Between 2026 and 2030, the market is expected to expand from USD 1.4 billion to USD 1.8 billion, supported by advancements in dynamometer precision, automation, and integration with digital data analytics. The rise of electric vehicles (EVs) and hybrid powertrains necessitates specialized dyno systems capable of evaluating complex powertrains, boosting market demand. From 2031 to 2035, growth accelerates, with the market advancing from USD 1.9 billion to USD 2.2 billion. This phase is characterized by increased adoption of real-time testing capabilities, remote diagnostics, and IoT-enabled monitoring systems, enhancing vehicle development and quality assurance processes. Emerging markets contribute to growth due to expanding automotive production and the establishment of new testing facilities. Overall, the automotive dyno market is positioned for sustained growth through 2035, fueled by technological innovation, regulatory mandates, and the evolving landscape of automotive propulsion systems.

| Metric | Value |

|---|---|

| Automotive Dyno Market Estimated Value in (2025 E) | USD 1.4 billion |

| Automotive Dyno Market Forecast Value in (2035 F) | USD 2.2 billion |

| Forecast CAGR (2025 to 2035) | 5.1% |

The Automotive Dyno market is progressing steadily as vehicle manufacturers, testing agencies, and component suppliers emphasize precision, performance optimization, and emissions compliance. Growth in this market has been supported by the increasing complexity of modern powertrains, including hybrid and electric configurations, which demand highly accurate diagnostic and testing capabilities.

Regulations concerning fuel efficiency, carbon emissions, and vehicle safety continue to evolve, prompting greater investment in advanced dynamometer systems. The shift toward electric mobility and connected vehicles is further enhancing the demand for flexible, modular testing platforms that can adapt to varying drivetrains and software updates.

Additionally, the market is benefitting from global investments in R&D centers and automotive testing facilities that aim to reduce development cycles and improve overall vehicle quality. As innovation in propulsion technologies accelerates, the Automotive Dyno market is expected to experience sustained growth, driven by the critical role these systems play in product validation, certification, and performance benchmarking across the automotive value chain.

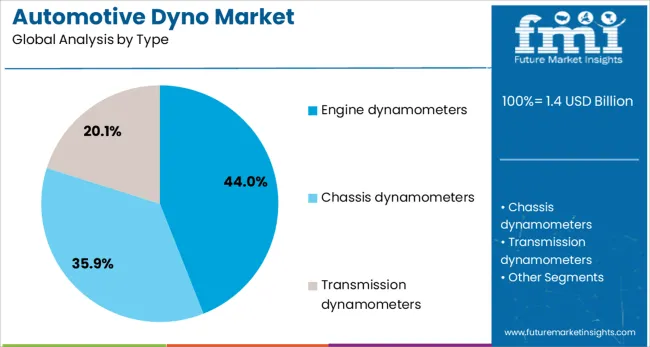

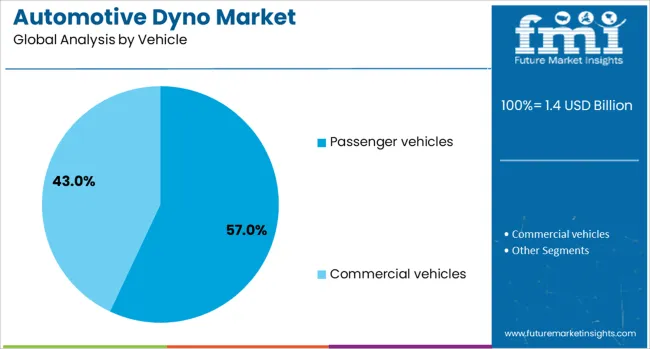

The automotive dyno market is segmented by type, vehicleend use, and geographic regions. By type of the automotive dyno market is divided into Engine dynamometers, Chassis dynamometersTransmission dynamometers. In terms of type of the automotive dyno market is classified into Engine dynamometers, Chassis dynamometersTransmission dynamometers. Based on vehicle of the automotive dyno market is segmented into Passenger vehiclesCommercial vehicles. By end use of the automotive dyno market is segmented into Automotive OEMs, Aftermarket service providers, Motorsport teamsCommercial vehicles. Regionally, the automotive dyno industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The engine dynamometers type segment is projected to hold 44% of the Automotive Dyno market revenue share in 2025, making it the leading type segment. This dominance has been driven by the high precision these systems provide in measuring torque, power output, and fuel efficiency of internal combustion engines. Engine dynamometers have continued to be favored in both research and quality assurance environments due to their ability to isolate and test engines independently from the vehicle chassis.

Their application in calibrating engines to meet global emissions standards and in validating powertrain durability has reinforced their demand. As regulatory bodies enforce stricter compliance protocols, engine-level testing remains a critical function in the vehicle development lifecycle.

The adaptability of engine dynamometers to both conventional and hybrid engine types has also played a vital role in maintaining their relevance. Their integration with digital controls and automation platforms has further enhanced test repeatability and data accuracy, enabling manufacturers to accelerate time-to-market for new engine technologies..

The passenger vehicles segment is expected to account for 57% of the Automotive Dyno market revenue share in 2025, positioning it as the leading vehicle segment. This leadership position has been established by the high volume of passenger vehicle production globally, which demands extensive testing to ensure performance, efficiency, and regulatory compliance.

Original equipment manufacturers and testing facilities have increasingly relied on dynamometers to evaluate engine behavior, fuel economy, and emissions under simulated real-world driving conditions. The proliferation of advanced driver assistance systems, connectivity features, and hybrid powertrains in passenger vehicles has expanded the testing parameters required, thereby reinforcing the demand for comprehensive dynamometer solutions.

The ability of dynamometers to support multi-configuration vehicle testing, including electric and plug-in hybrid systems, has made them an essential component in modern vehicle development. As consumer expectations for reliability and efficiency continue to rise, the use of dynamometer testing within the passenger vehicle segment remains a critical aspect of product validation and market readiness..

Automotive dynos are indispensable for precise vehicle performance evaluation and adaptation to evolving powertrain technologies. Their role in data-driven design refinement ensures continued relevance across global automotive manufacturing.

Automotive dynos are gaining heightened adoption as manufacturers focus on delivering vehicles that meet stringent performance, safety, and emissions benchmarks. These systems provide controlled environments to measure torque, horsepower, and engine response under varying loads, ensuring precise calibration before mass production. Their role in reducing prototype errors and enhancing engine efficiency has strengthened their relevance across passenger cars, commercial vehicles, and specialty performance segments. With the growing emphasis on powertrain optimization, both chassis and engine dynamometers are becoming critical in detecting mechanical inefficiencies early. This ability to simulate real-world driving conditions without road-based testing is viewed as a strategic advantage for OEMs, as it shortens development cycles while maintaining competitive performance standards.

The transition toward electric and hybrid powertrains is expanding the scope of automotive dyno applications. These systems are now essential for evaluating electric motors, battery packs, and regenerative braking systems under simulated driving loads. Manufacturers are leveraging dynos to monitor energy efficiency, thermal management, and drivetrain durability across various speed and torque ranges. As EVs and hybrids require different validation parameters compared to combustion vehicles, dynamometers are being adapted with specialized software and control systems. This capability allows precise replication of urban and highway cycles, enabling accurate range estimation and performance consistency checks. The resulting data supports design refinement, ensures compliance with evolving regulations, and strengthens market readiness for next-generation mobility solutions.

Automotive dyno testing is evolving through the integration of advanced data acquisition tools, enabling real-time monitoring of critical parameters such as vibration, temperature, fuel efficiency, and emissions output. These systems provide engineers with detailed analytics, allowing them to identify micro-level issues that could affect long-term vehicle reliability. With enhanced connectivity between dynamometers and analysis software, multi-parameter testing can be conducted without extended downtime. This integration also improves repeatability of results, an essential factor in ensuring product consistency across multiple production batches. As competitive pressure in the automotive sector intensifies, the ability to access actionable performance data in reduced timeframes is seen as a decisive factor for maintaining engineering precision and competitive positioning.

Despite their benefits, automotive dynos face challenges due to high initial costs, ongoing maintenance expenses, and the need for specialized operators. These systems require significant investment in both hardware and calibration infrastructure, which can be a barrier for smaller workshops or emerging market participants. Skilled technicians are essential to interpret complex data and ensure the accuracy of results, making training a necessary yet costly undertaking. Operational downtime during system upgrades or repairs can also hinder productivity. While larger OEMs absorb these costs more effectively, smaller players often rely on outsourced testing facilities. Addressing cost efficiency and operator training gaps remains critical for expanding adoption beyond high-budget automotive development centers.

| Country | CAGR |

|---|---|

| China | 6.9% |

| India | 6.4% |

| Germany | 5.9% |

| France | 5.4% |

| UK | 4.8% |

| USA | 4.3% |

| Brazil | 3.8% |

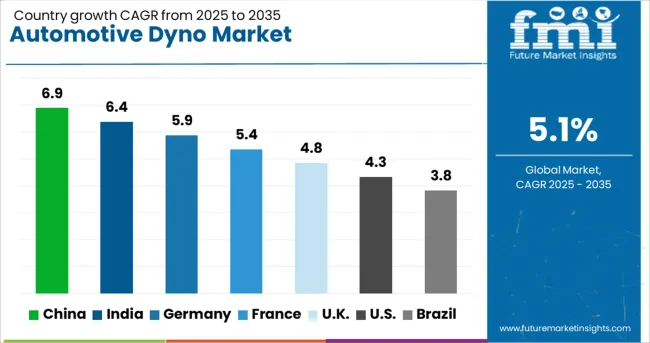

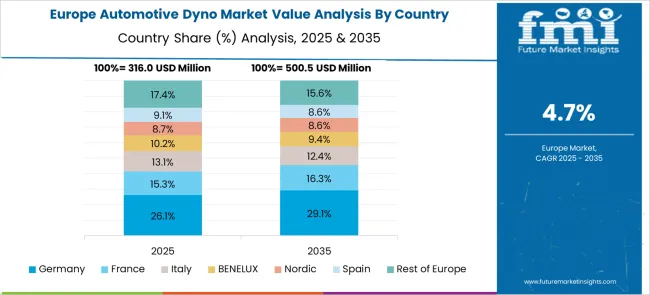

The automotive dyno market is projected to grow globally at a CAGR of 5.1% from 2025 to 2035, supported by the need for precise vehicle performance testing, emissions validation, and drivetrain optimization. China leads with a CAGR of 6.9%, fueled by expanding automotive production, electric vehicle development, and advanced R&D facilities. India follows at 6.4%, driven by growth in passenger and commercial vehicle manufacturing and increased investment in powertrain testing capabilities. France grows at 5.4%, benefiting from regulatory compliance testing and EV drivetrain validation. The United Kingdom stands at 4.8%, with gains linked to motorsport engineering and specialist testing centers, while the United States reaches 4.3%, reflecting steady adoption in OEM testing and aftermarket performance tuning. This comparative assessment highlights Asia-Pacific as the primary growth hub for automotive dynos while underlining steady momentum in European engineering-driven testing markets.

China is projected to post a CAGR of 6.9% during 2025–2035, above the global 5.1%. This performance is expected from sustained investments in powertrain labs, acceptance of chassis and engine dynos by domestic OEMs, and deeper use of software-in-the-loop and hardware-in-the-loop validation. Demand is reinforced by EV motor, inverter, and gearbox testing where high-load duty cycles must be reproduced with accuracy. Volume production of passenger vehicles and light commercial vehicles supports steady capacity additions at third-party labs. Tier suppliers have prioritized torque, efficiency, and thermal behavior verification, which places dynos at the center of design gates. China is judged to hold the most scalable test infrastructure among emerging hubs for component and drivetrain benchmarking.

India is forecasted to post a CAGR of 6.4% for 2025–2035, outpacing the global 5.1%. Momentum is supported by growth in passenger and commercial vehicle assembly, rising exports of engines and transmissions, and wider adoption of durability cycles for BS VI and successor norms. Test service providers have increased chassis dyno beds for endurance and emissions cycles, while OEM proving grounds are using integrated data acquisition for torque, vibration, and energy-use analytics. Performance tuning in pickup and utility segments adds aftermarket demand. India’s suppliers are moving toward correlation between bench tests and road cycles to tighten calibration loops. The market is viewed as cost-competitive for outsourced validation across Asia, which sustains equipment orders and maintenance contracts.

France is expected to grow at 5.4% during 2025–2035, modestly above the global 5.1%. This outcome is linked to powertrain innovation in compact cars, battery-electric validation programs, and test cycles aimed at efficiency and drivability. French engineering centers have favored high-precision load control, transient response capture, and noise-vibration assessment on dyno rigs. The presence of battery and e-axle pilot lines stimulates integrated drivetrain rigs where inverter, motor, and reducer are validated as a system. Regulatory pressure for verifiable emissions and energy-use data continues to anchor spend on measurement hardware and software. The market is judged to reward providers that deliver fast changeovers, tight repeatability, and traceable data chains for audit-ready projects.

The United Kingdom is projected to reach a CAGR of 4.8% during 2025–2035, below the global 5.1% yet on an improving path from earlier years. The 2020–2024 period is estimated at 3.9% CAGR. The rise to 4.8% in 2025–2035 is attributed to renewed capex at specialist labs, consolidation within motorsport engineering, and greater use of correlation studies between bench and track. Powertrain electrification programs require torque, efficiency, and thermal characterization under repeatable duty cycles, which lifts hours on engine, e-motor, and chassis dynos. Outsourced validation from EU and USA clients adds steady bookings. Supply chain stability and parts availability have improved, which reduces downtime and allows higher utilization of existing rigs.

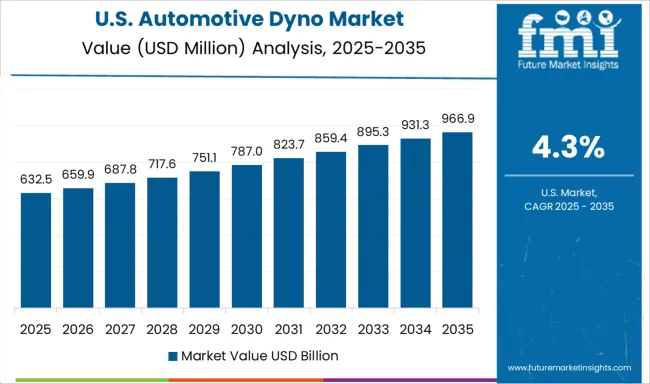

The United States is anticipated to post a CAGR of 4.3% during 2025–2035, trailing the global 5.1%. Growth is supported by OEM and Tier programs that prioritize durability, thermal management, and emissions compliance, together with steady demand from performance tuning networks. Investment has favored high-capacity dynamometers with advanced control systems for transient cycles and altitude or climate simulation. Battery-electric projects require repeatable energy-use and regeneration studies, which keeps multi-axle chassis dynos in demand. The market is viewed as mature with long replacement cycles, so service contracts, calibration upgrades, and software expansions form a meaningful share of spend. Independent labs benefit from defense and commercial vehicle testing that keeps benches booked.

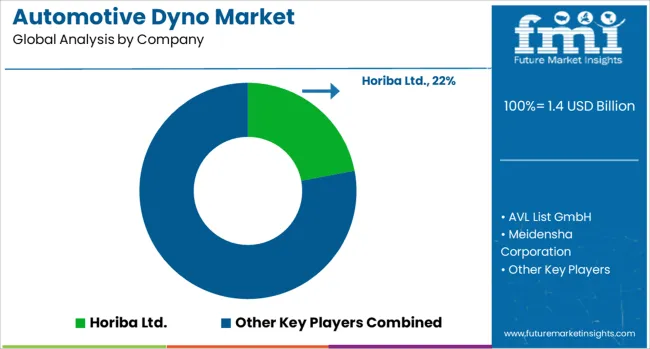

The automotive dyno market is led by globally recognized testing and measurement solution providers such as Horiba Ltd., AVL List GmbH, Meidensha Corporation, SAKOR Technologies, and Mustang Advanced Engineering. These companies compete on parameters including accuracy, adaptability for various powertrains, integration with advanced control systems, and global technical support networks. Horiba Ltd. maintains a strong position with a comprehensive range of chassis and engine dynamometers, supported by sophisticated data acquisition systems and proven expertise in emissions testing. AVL List GmbH is known for its precision engineering and tailored dyno solutions for internal combustion, hybrid, and electric powertrains, enabling manufacturers to meet stringent performance and compliance standards.

Meidensha Corporation offers advanced dynamometer systems with high-load capacity and efficient thermal management, catering to heavy-duty and industrial vehicle testing. SAKOR Technologies specializes in modular test systems, providing flexibility for R&D environments and aftermarket performance applications. Mustang Advanced Engineering has carved a niche in motorsport and high-performance automotive testing, delivering solutions optimized for speed, torque, and transient load replication. The competitive landscape is defined by product innovation in high-efficiency motor control, seamless integration with simulation software, and development of scalable test rigs to meet evolving automotive demands. Strategic collaborations, turnkey installation capabilities, and localized service support remain critical factors in strengthening market positions.

Manufacturers are prioritizing integration of advanced data acquisition systems, software-driven control platforms, and multi-powertrain adaptability. Rising adoption of outsourced testing by smaller automakers, motorsport engineering programs, and aftermarket tuning specialists is boosting utilization rates. Strategic collaborations with research institutes and expansion of service support networks are enhancing customer retention and broadening global market reach.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.4 Billion |

| Type | Engine dynamometers, Chassis dynamometers, and Transmission dynamometers |

| Type | Engine dynamometers, Chassis dynamometers, and Transmission dynamometers |

| Vehicle | Passenger vehicles and Commercial vehicles |

| End Use | Automotive OEMs, Aftermarket service providers, Motorsport teams, and Commercial vehicles |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Horiba Ltd., AVL List GmbH, Meidensha Corporation, SAKOR Technologies, and Mustang Advanced Engineering |

| Additional Attributes | Dollar sales, share by product type and end use, regional demand patterns, competitor benchmarking, emerging applications in EV and hybrid testing, pricing trends, regulatory impacts, and growth opportunities in OEM and aftermarket segments. |

The global automotive dyno market is estimated to be valued at USD 1.4 billion in 2025.

The market size for the automotive dyno market is projected to reach USD 2.2 billion by 2035.

The automotive dyno market is expected to grow at a 5.1% CAGR between 2025 and 2035.

The key product types in automotive dyno market are engine dynamometers, chassis dynamometers and transmission dynamometers.

In terms of type, engine dynamometers segment to command 44.0% share in the automotive dyno market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Direct Liquid Cooling IGBT Module Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hoses and Assemblies Market Size and Share Forecast Outlook 2025 to 2035

Automotive Network Testing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Performance Part Market Size and Share Forecast Outlook 2025 to 2035

Automotive Carbon Ceramic Brake Market Size and Share Forecast Outlook 2025 to 2035

Automotive Camshaft Market Size and Share Forecast Outlook 2025 to 2035

Automotive Stamping Industry Analysis in India Size and Share Forecast Outlook 2025 to 2035

Automotive Cylinder Liner Market Size and Share Forecast Outlook 2025 to 2035

Automotive Microcontroller Market Size and Share Forecast Outlook 2025 to 2035

Automotive Roof Rails Market Size and Share Forecast Outlook 2025 to 2035

Automotive Active Safety System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Diagnostic Scan Tool Market Size and Share Forecast Outlook 2025 to 2035

Automotive Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Dynamic Map Data Market Size and Share Forecast Outlook 2025 to 2035

Automotive Green Tires Market Size and Share Forecast Outlook 2025 to 2035

Automotive E-Tailing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Interior Market Forecast Outlook 2025 to 2035

Automotive Key Market Size and Share Forecast Outlook 2025 to 2035

Automotive Appearance Chemical Market Forecast and Outlook 2025 to 2035

Automotive Seating Market Forecast and Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA