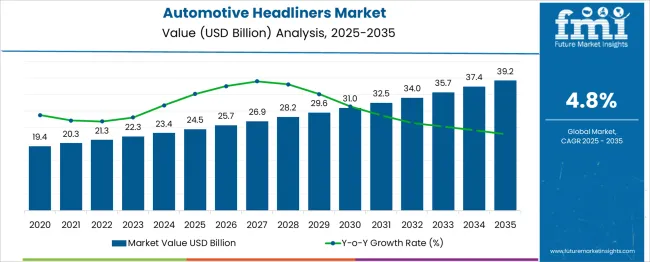

The Automotive Headliners Market is estimated to be valued at USD 24.5 billion in 2025 and is projected to reach USD 39.2 billion by 2035, registering a compound annual growth rate (CAGR) of 4.8% over the forecast period.

| Metric | Value |

|---|---|

| Automotive Headliners Market Estimated Value in (2025 E) | USD 24.5 billion |

| Automotive Headliners Market Forecast Value in (2035 F) | USD 39.2 billion |

| Forecast CAGR (2025 to 2035) | 4.8% |

The Automotive Headliners market is experiencing consistent growth supported by increasing consumer demand for enhanced cabin aesthetics, improved acoustic performance, and lightweight materials in vehicles. The current market scenario reflects a strong focus on integrating sustainable and recyclable materials, as highlighted in automotive manufacturer press releases and investor presentations.

Advancements in production technologies and rising investments in vehicle interior innovation are driving the adoption of premium headliners. Additionally, annual reports of key industry players have emphasized the growing role of headliners in improving occupant comfort and contributing to vehicle weight reduction, which aligns with fuel efficiency regulations.

The future outlook remains positive as electric vehicle adoption and luxury vehicle sales continue to expand, creating opportunities for innovative headliner designs. Growing awareness of sustainable manufacturing practices and rising customer expectations for high-quality interiors are expected to further fuel market growth, positioning headliners as a critical component in modern vehicle design.

The automotive headliners market is segmented by material, vehicledistribution channel, and geographic regions. By material of the automotive headliners market is divided into FabricsPlastic. In terms of vehicle of the automotive headliners market is classified into Passenger Cars, LCVHCV.

Based on distribution channel of the automotive headliners market is segmented into OEMAftermarket. Regionally, the automotive headliners industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

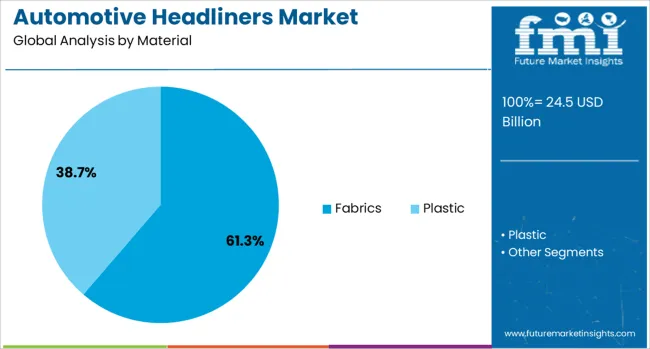

The fabrics material segment is anticipated to account for 61.3% of the Automotive Headliners market revenue share in 2025, making it the largest material segment. This leading position is being driven by the superior design flexibility, lightweight properties, and cost-effectiveness of fabrics, as highlighted in supplier product announcements and trade publications.

Fabrics have been preferred for their ability to support intricate designs and enhance the visual appeal of vehicle interiors. Their excellent acoustic dampening properties and compatibility with sustainable manufacturing processes have also reinforced their adoption across diverse vehicle categories.

Investor briefings have noted that automakers increasingly opt for fabric-based headliners to meet both regulatory and consumer requirements for eco-friendly and visually appealing materials. Additionally, the widespread availability of advanced fabric composites that offer durability and ease of maintenance has strengthened the segment’s position in the market.

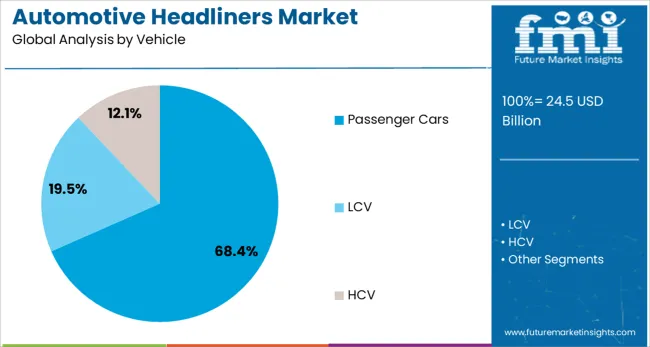

The passenger cars segment is projected to hold 68.4% of the Automotive Headliners market revenue share in 2025, retaining its dominance among vehicle categories. This leadership is being influenced by the rising production and sales of passenger cars globally, as reported in automotive industry journals and company statements.

Headliners in passenger cars are being adopted for their contribution to improved cabin aesthetics, thermal insulation, and noise reduction, which enhance overall passenger experience. Press releases from automakers have highlighted increasing consumer preference for premium interiors in mass-market vehicles, which has fueled the demand for high-quality headliners.

The segment’s growth is further supported by the strong focus on lightweight components to meet fuel efficiency targets and reduce emissions. Furthermore, the expanding middle-class population and growing urbanization have been observed to boost passenger car sales, thereby sustaining the demand for innovative headliner solutions in this segment.

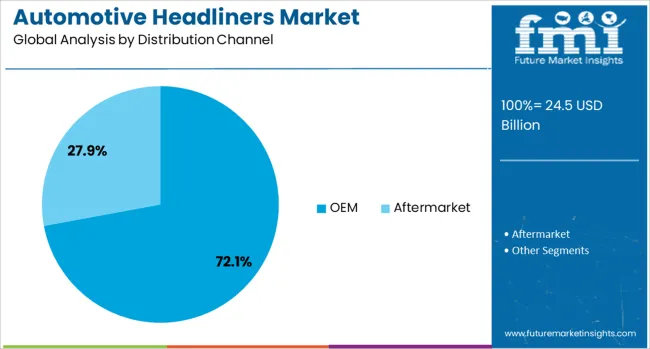

The OEM distribution channel is expected to dominate with a 72.1% share of the Automotive Headliners market revenue in 2025, securing its position as the leading channel. This prominence is being driven by the direct integration of headliners during vehicle manufacturing, which ensures precise fit and quality, as noted in manufacturer annual reports and technology updates.

Automakers are increasingly relying on OEM-supplied headliners to maintain brand standards, adhere to regulatory requirements, and deliver consistent interior performance. Corporate presentations have highlighted that OEMs benefit from established supply chains and economies of scale, making them the preferred choice for headliner procurement.

Furthermore, the rising complexity of headliner designs and integration with other interior components has reinforced the need for close collaboration between OEMs and suppliers. These factors, along with the emphasis on cost optimization and high-volume production capabilities, have contributed to the OEM segment’s leadership in the market.

Automotive headliners are becoming a focal point for comfort, functionality, and brand differentiation. Material innovation, integrated features, and advanced manufacturing are driving their role in enhancing vehicle interiors.

Automotive headliners are increasingly viewed as an essential element in creating a refined and comfortable cabin environment. Consumers expect interiors that deliver a combination of visual appeal, tactile comfort, and functional integration. Headliners contribute to noise reduction, thermal insulation, and an overall premium feel, making them a focus area for OEMs targeting higher customer satisfaction. Automakers are introducing advanced textures, stitched finishes, and integrated lighting systems to elevate cabin aesthetics. The rising demand for panoramic sunroofs and advanced infotainment integration is influencing headliner design complexity. This trend is particularly strong in luxury, SUV, and crossover models, where interior differentiation is a competitive advantage for both domestic and global markets.

The use of lightweight yet durable materials in automotive headliners is expanding as manufacturers look to optimize vehicle efficiency without compromising performance or aesthetics. Materials such as composite laminates, molded polyurethane foams, and recycled fabrics are being adopted to reduce weight while maintaining structural integrity. Lighter headliners not only improve fuel efficiency but also help lower the center of gravity, enhancing ride quality. The flexibility of these materials allows for more intricate designs, accommodating integrated features like ambient lighting or advanced safety components. This balance of reduced mass and improved functionality is becoming a decisive factor in OEM purchasing strategies and supplier competitiveness.

Headliners are evolving beyond their traditional role to include embedded safety and convenience features. Advanced designs now incorporate components such as curtain airbags, concealed speakers, ambient lighting systems, and climate-control elements. Integration of these features requires precise engineering to maintain structural strength while meeting safety regulations. OEMs are working closely with suppliers to develop headliner systems that can accommodate wiring harnesses, control modules, and acoustic dampening layers without increasing weight. This multifunctional approach is proving valuable for creating sleek, clutter-free interiors that appeal to consumers while meeting strict industry safety and performance standards across global vehicle platforms.

Manufacturing processes for automotive headliners are adapting to meet growing customization demands from both automakers and consumers. Flexible production lines, modular tooling, and improved molding techniques are enabling suppliers to deliver varied designs in smaller batches. Customization includes color matching, texture variations, and tailored designs for specific trims or special editions. The ability to integrate branding elements or unique design patterns within headliners is also gaining popularity. Suppliers that can balance cost efficiency with high customization capability are in a stronger position to win OEM contracts. These manufacturing advancements are helping automakers differentiate their models and cater to regional preferences more effectively.

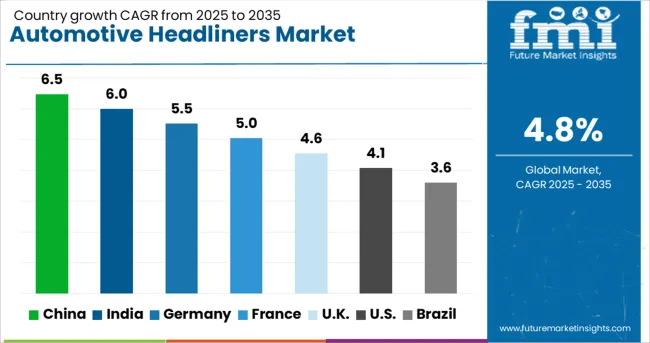

| Country | CAGR |

|---|---|

| China | 6.5% |

| India | 6.0% |

| Germany | 5.5% |

| France | 5.0% |

| UK | 4.6% |

| USA | 4.1% |

| Brazil | 3.6% |

The automotive headliners market is projected to expand globally at a CAGR of 4.8% from 2025 to 2035, supported by rising demand for premium cabin finishes, lightweight materials, and integrated functional components in both passenger and commercial vehicles. China leads with a CAGR of 6.5%, driven by strong growth in SUV and premium sedan production, alongside increased adoption of advanced textile and composite headliners. India follows at 6.0%, supported by expanding automotive manufacturing, rising consumer preference for upgraded interiors, and localization of headliner production to meet domestic demand. Germany records 5.5% CAGR, benefitting from its luxury vehicle segment and advanced material R&D for lightweight yet durable headliner solutions. The United Kingdom grows at 4.6%, supported by customization trends in premium and performance models, while the United States reaches 4.1%, influenced by steady demand in pickup trucks, SUVs, and aftermarket upgrades. The analysis underscores Asia-Pacific as the key growth hub for headliner adoption, while Europe and North America maintain relevance through luxury vehicle innovation and customization-focused production strategies.

China is projected to post a CAGR of 6.5% during 2025-2035, placing it above the global 4.8% trajectory for headliners. Momentum is expected from strong SUV and premium sedan output, where acoustic comfort, aesthetics, and integrated lighting lift headliner value per unit. Localized supply chains have been scaled to deliver molded polyurethane foams, composite laminates, and advanced textiles with consistent quality. Panoramic roof penetration is rising, which requires sunroof-compatible modules and precise tolerance control. Tier suppliers are investing in tooling flexibility that supports frequent trim changes and regional color preferences. Replacement demand in commercial fleets supports steady aftermarket orders. Partnerships between OEM engineering centers and material specialists have been used to improve sag resistance, scratch performance, and cleanability, which drives higher specification rates in new models.

India is forecasted to achieve a 6.0% CAGR in 2025-2035, supported by rising multi-utility and compact SUV production, where headliner acoustic damping and surface finish quality influence purchase decisions. Localization of textile laminates and substrate foams has lowered cost-to-serve, encouraging wider adoption of premium textures in mid-range models. Growth in shared mobility and fleet registrations sustains volume for durable, easy-to-clean headliners in entry categories. Export programs to Africa, Middle East, and Latin America have been expanded, which improves capacity utilization at tier suppliers. The retrofit segment, including van conversions and people movers, contributes incremental demand. Quality audits by OEMs emphasize odor control, VOC thresholds, and color fastness, which raises the bar for suppliers. These requirements have been met through tighter process controls, adhesive optimization, and in-line inspection systems that stabilize yields.

Germany is expected to record a 5.5% CAGR over 2025-2035, supported by luxury and performance vehicle programs where refined textures, precise stitching, and integrated ambient lighting are prioritized. Headliner specification levels remain high due to stringent NVH targets and cabin refinement goals. Growth is aided by composite substrates that deliver weight reduction with high dimensional stability. Supplier collaboration with OEM studios has been used to execute low-tolerance cutouts for sensors, microphones, and concealed speakers. Panoramic roof growth requires reinforced frames and low-sag constructions to preserve fit and finish over long service life. Premium derivatives extend headliner customization into limited editions and sport packages, which increases variants per platform. Process improvements in adhesive laydown and thermoforming temperature windows have lowered scrap, which supports competitive pricing without compromising quality benchmarks.

The United Kingdom is projected to register a 4.6% CAGR during 2025-2035, up from an estimated 3.8% in 2020-2024. The earlier period was moderated by supply volatility, subdued model launches, and limited sunroof take-rates outside premium lines, which capped value content growth. The rise to 4.6% is explained by recovery in premium and performance derivatives, higher adoption of panoramic roofs, and stronger NVH targets that elevate acoustic laminates. Motorsport-derived craftsmanship has been adapted to road cars, improving stitch precision and seam durability. Aftermarket van and camper conversions add consistent retrofit demand. Supplier capabilities now include shorter changeovers and color-matched trims for limited runs, which suits the UK model mix. Price realization has improved through elevated content per unit, while procurement has favored stable vendors with proven cosmetic quality and odor control.

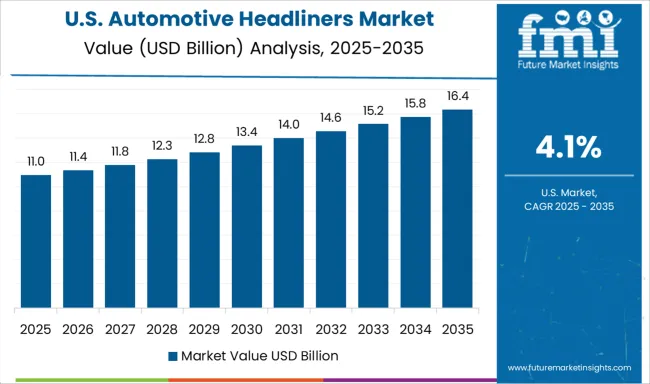

The United States is anticipated to reach a 4.1% CAGR for 2025-2035, slightly below the global 4.8%, yet supported by durable demand in pickups, SUVs, and large crossovers. These segments require larger headliner formats with reinforced structures, which sustain material throughput at tier suppliers. Panoramic roof fitments have expanded, prompting greater use of low-sag composites and precise cutouts for shades and switches. Fleet and commercial vehicles prioritize stain resistance and easy maintenance, which shapes material choices toward tougher surface layers. The aftermarket remains meaningful in van upfits, ride-hailing fleets, and refurbishment of high-mileage vehicles. Process control improvements at North American plants have reduced scrap and improved seam consistency, which stabilizes delivery performance to OEMs. Suppliers that offer quick service on color and texture variants have benefited from frequent trim updates in popular nameplates.

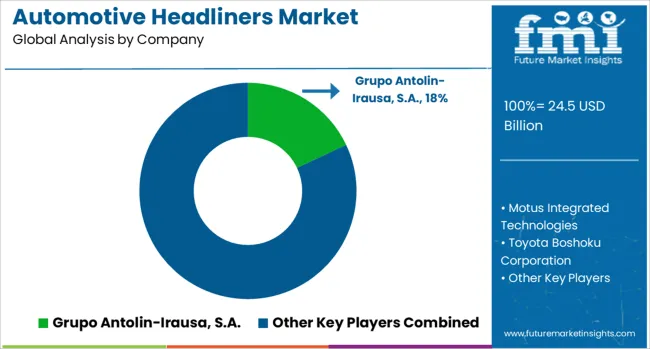

The automotive headliners market is led by prominent global interior component manufacturers and specialized suppliers such as Grupo Antolin-Irausa, S.A., Motus Integrated Technologies, Toyota Boshoku Corporation, International Automotive Components (IAC) Group SA, Johns Manville, Kasai North America, Inc., SA Automotive, Howa Co., Ltd., Hayashi Telempu Corporation, Inteva Products, LLC., UGN, Inc., and Acme Auto Headlining Co.

These companies compete on material innovation, acoustic performance, integration of functional features, and lightweight design capabilities to meet evolving OEM requirements. Grupo Antolin-Irausa, S.A. commands a leading position through its wide range of textile and composite-based headliners, supplying both standard and premium vehicle segments globally.

Motus Integrated Technologies emphasizes high-quality molded headliners with advanced acoustic and thermal insulation properties. Toyota Boshoku Corporation integrates its headliners with broader interior trim systems, optimizing design harmony and manufacturing efficiency. IAC Group leverages global production capabilities and customization expertise to cater to diverse regional preferences.

Johns Manville focuses on advanced fiber and insulation technologies, enhancing noise reduction and climate comfort. Kasai North America, Howa Co., Ltd., and Hayashi Telempu Corporation deliver specialized lightweight and eco-friendly solutions, while Inteva Products, UGN, Inc., and Acme Auto Headlining Co. strengthen their market presence through OEM partnerships and regional manufacturing proximity.

Competitive strategies center on developing multi-functional headliners with integrated lighting, sunroof compatibility, and concealed safety components, as well as scaling production in Asia-Pacific and North America. Long-term competitiveness will rely on material advancements, modular design flexibility, and alignment with OEM preferences for premium cabin finishes and acoustic optimization.

OEMs are focusing on localized production to reduce lead times and costs, while suppliers invest in advanced molding and lamination techniques to enhance fit, finish, and acoustic performance. Growing SUV and luxury vehicle sales, coupled with customization trends, are further supporting market expansion, as headliners become a key differentiator in enhancing interior comfort and brand identity.

| Item | Value |

|---|---|

| Quantitative Units | USD 24.5 Billion |

| Material | Fabrics and Plastic |

| Vehicle | Passenger Cars, LCV, and HCV |

| Distribution Channel | OEM and Aftermarket |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Grupo Antolin-Irausa, S.A., Motus Integrated Technologies, Toyota Boshoku Corporation, International Automotive Components (IAC) Group SA, Johns Manville, Kasai North America, Inc., SA Automotive, Howa Co., Ltd., Hayashi Telempu Corporation, Inteva Products, LLC., UGN, Inc., and Acme Auto Headlining Co. |

| Additional Attributes | Dollar sales, share by material type and vehicle segment, regional demand trends, OEM procurement strategies, competitive benchmarking, pricing dynamics, integration of functional features, and growth opportunities in premium interior upgrades. |

The global automotive headliners market is estimated to be valued at USD 24.5 billion in 2025.

The market size for the automotive headliners market is projected to reach USD 39.2 billion by 2035.

The automotive headliners market is expected to grow at a 4.8% CAGR between 2025 and 2035.

The key product types in automotive headliners market are fabrics and plastic.

In terms of vehicle, passenger cars segment to command 68.4% share in the automotive headliners market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Direct Liquid Cooling IGBT Module Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hoses and Assemblies Market Size and Share Forecast Outlook 2025 to 2035

Automotive Network Testing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Performance Part Market Size and Share Forecast Outlook 2025 to 2035

Automotive Carbon Ceramic Brake Market Size and Share Forecast Outlook 2025 to 2035

Automotive Camshaft Market Size and Share Forecast Outlook 2025 to 2035

Automotive Stamping Industry Analysis in India Size and Share Forecast Outlook 2025 to 2035

Automotive Cylinder Liner Market Size and Share Forecast Outlook 2025 to 2035

Automotive Microcontroller Market Size and Share Forecast Outlook 2025 to 2035

Automotive Roof Rails Market Size and Share Forecast Outlook 2025 to 2035

Automotive Active Safety System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Diagnostic Scan Tool Market Size and Share Forecast Outlook 2025 to 2035

Automotive Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Dynamic Map Data Market Size and Share Forecast Outlook 2025 to 2035

Automotive Green Tires Market Size and Share Forecast Outlook 2025 to 2035

Automotive E-Tailing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Interior Market Forecast Outlook 2025 to 2035

Automotive Key Market Size and Share Forecast Outlook 2025 to 2035

Automotive Appearance Chemical Market Forecast and Outlook 2025 to 2035

Automotive Seating Market Forecast and Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA