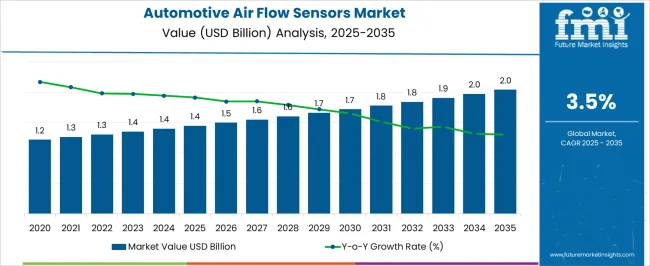

The Automotive Air Flow Sensors Market is estimated to be valued at USD 1.4 billion in 2025 and is projected to reach USD 2.0 billion by 2035, registering a compound annual growth rate (CAGR) of 3.5% over the forecast period. From 2025 to 2030, the market expands from USD 1.4 billion to approximately USD 1.7 billion, translating to around 21% total growth over the five years. This growth is supported by the persistent need for accurate air intake measurement to ensure engine efficiency, emissions control, and fuel economy in both passenger and commercial vehicles. Demand remains steady as automakers continue integrating these sensors into a broad range of engine platforms to comply with performance and regulatory requirements. During this period, replacement demand plays a vital role, as existing vehicle fleets require sensor maintenance or upgrades to sustain performance.

In addition, incremental improvements in sensor durability and measurement precision encourage gradual adoption in certain aftermarket segments. While growth is moderate compared to higher-expansion automotive components, the stability of demand reflects the essential role air flow sensors play in modern engine management systems. The 2025–2030 trajectory sets a reliable foundation for continued, albeit measured, expansion into the following decade.

| Metric | Value |

|---|---|

| Automotive Air Flow Sensors Market Estimated Value in (2025 E) | USD 1.4 billion |

| Automotive Air Flow Sensors Market Forecast Value in (2035 F) | USD 2.0 billion |

| Forecast CAGR (2025 to 2035) | 3.5% |

The automotive air flow sensors market is advancing steadily, driven by the increasing stringency of emission regulations and the rise in electronic fuel injection systems across modern vehicles. As automakers strive for enhanced engine efficiency and real-time fuel-air mixture optimization, the integration of precise air flow measurement technologies has become critical.

Technological innovation in sensor design, especially for digital signal output and thermal compensation, is improving performance in extreme operating environments. Additionally, the rapid proliferation of electric and hybrid vehicles is prompting manufacturers to adapt air management systems for cooling and ventilation use cases.

Continued investments in lightweight, compact sensor modules and the shift toward connected powertrains are expected to influence future product development and vehicle integration strategies. The market is also witnessing strong alignment with the growth of autonomous and semi-autonomous vehicles, where engine performance and emissions data play a pivotal role in system diagnostics and efficiency.

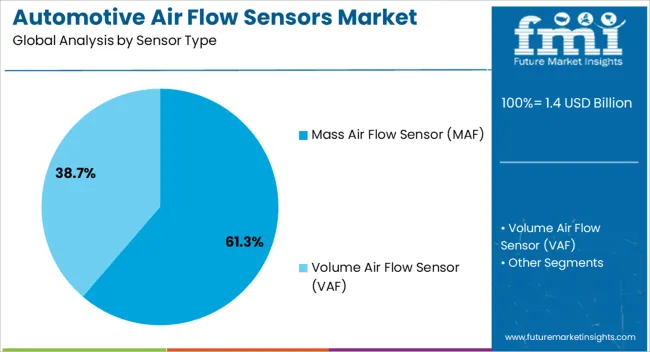

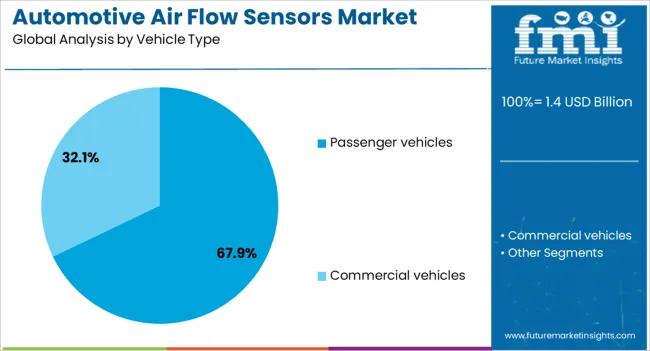

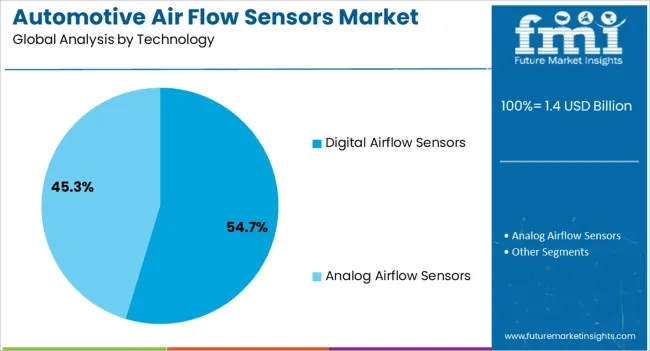

The automotive air flow sensors market is segmented by sensor type, vehicle type, technology, sales channel, application, and geographic regions. The automotive air flow sensors market is divided into Mass Air Flow Sensor (MAF) and Volume Air Flow Sensor (VAF) by sensor type. The automotive air flow sensors market is classified by vehicle type into Passenger vehicles and Commercial vehicles. The automotive airflow sensors market is segmented into Digital Airflow Sensors and Analog Airflow Sensors. The automotive air flow sensors market is segmented by sales channel into OEM and Aftermarket. The automotive air flow sensors market is segmented into Engine Control System, Exhaust Gas Recirculation (EGR) System, Turbocharging, Air Conditioning System, and Transmission System. Regionally, the automotive air flow sensors industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Mass air flow sensors are projected to account for 61.3% of the total revenue in the automotive air flow sensors market in 2025, making them the dominant sensor type. Their prevalence is being driven by their ability to provide precise real-time measurement of the air entering the engine, enabling optimal air-fuel ratio control.

This precision is crucial for meeting increasingly stringent emission norms and improving combustion efficiency. The widespread compatibility of MAF sensors with both gasoline and diesel engines has expanded their application across vehicle categories.

Technological advancements such as hot-film sensing and improved signal stability have increased reliability, supporting their use in both high-performance and economy vehicle platforms. As manufacturers continue to prioritize fuel efficiency and emissions control, MAF sensors remain a critical component in engine management systems.

Passenger vehicles are expected to contribute 67.9% of the overall revenue in the automotive air flow sensors market in 2025, positioning this segment as the largest by vehicle type. The dominance of this category is being driven by the sheer volume of global passenger vehicle production and the growing integration of electronic engine management systems.

Consumer demand for fuel-efficient, low-emission vehicles has resulted in the widespread deployment of air flow sensors to enhance combustion control. Regulatory frameworks in key markets such as the EU, USA, and China have further mandated tighter emission norms, accelerating sensor adoption across new passenger vehicle models.

In addition, premium and mid-range segments are incorporating more advanced sensing technologies for optimized driving performance and onboard diagnostics, reinforcing the critical role of air flow sensors in this vehicle category.

Digital airflow sensors are projected to capture 54.7% of the total revenue in the market by 2025, making them the leading technology type. Their rise is attributed to improved response time, greater precision, and enhanced compatibility with modern electronic control units (ECUs).

These sensors convert analog signals into high-resolution digital data, enabling faster and more accurate processing by the vehicle's engine control systems. Digital airflow sensors are also less susceptible to signal noise and temperature fluctuations, enhancing reliability under varying environmental conditions.

Automakers are increasingly favoring digital technologies due to their integration capabilities with diagnostic tools and predictive maintenance systems. As vehicle platforms become more software-defined and reliant on real-time analytics, digital airflow sensors are expected to remain the preferred choice for next-generation automotive engines.

The automotive air flow sensors market is expanding as vehicle manufacturers prioritize fuel efficiency, emissions compliance, and engine performance. These sensors measure the mass of air entering the engine, enabling precise fuel injection control. Growth is supported by rising automotive production, stricter environmental regulations, and increasing adoption of advanced engine management systems.

Challenges include sensor contamination, cost sensitivity, and integration complexities. Opportunities lie in electric and hybrid vehicle segments, improved sensor durability, and smart diagnostics features that enhance maintenance and optimize performance in both passenger and commercial vehicles.

Stricter emissions regulations worldwide are a primary factor driving demand for advanced automotive air flow sensors. By accurately measuring intake air, these sensors help optimize combustion and reduce harmful emissions, enabling compliance with Euro, EPA, and other global standards. Manufacturers are investing in high-precision, fast-response sensors that perform reliably across varying temperature and altitude conditions. Governments’ focus on sustainable transportation, combined with consumers’ expectations for better fuel economy, has made air flow sensors an essential component in modern engine management systems. This trend is particularly strong in regions with aggressive emissions targets.

One challenge for the market is sensor degradation due to dust, oil vapors, and particulates that can cause inaccurate readings over time. This can lead to poor engine performance, increased fuel consumption, and higher emissions. Harsh environmental conditions, such as extreme temperatures or humidity, further affect sensor accuracy and lifespan. Additionally, cost sensitivity in certain vehicle segments can limit the adoption of higher-end sensor technologies. Addressing these issues requires robust designs, advanced filtration systems, and coatings that resist contamination, ensuring long-term reliability and reducing replacement frequency for vehicle owners.

Modern vehicles are increasingly equipped with sophisticated electronic control units (ECUs) that rely on accurate, real-time air flow data. This has opened opportunities for intelligent air flow sensors with built-in diagnostics and adaptive calibration capabilities. These sensors can communicate directly with vehicle systems to adjust performance based on driving conditions, improving efficiency and responsiveness. Integration with onboard diagnostics systems also simplifies maintenance by alerting drivers to potential airflow-related issues. The development of compact, lightweight designs compatible with hybrid and electric powertrains further expands market opportunities in the evolving automotive landscape.

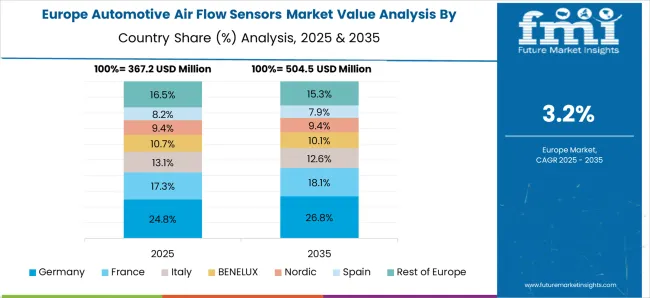

Asia Pacific leads the market due to high automotive production volumes in China, India, Japan, and South Korea. Increasing disposable incomes and urbanization are driving demand for passenger cars with improved performance and fuel economy. North America and Europe remain significant markets due to their focus on advanced emission control technologies and the presence of established automotive OEMs. In emerging economies, rising adoption of fuel-efficient technologies is creating opportunities for both global and local sensor manufacturers. Regional R&D centers and strong supplier networks further support growth in these high-potential markets.

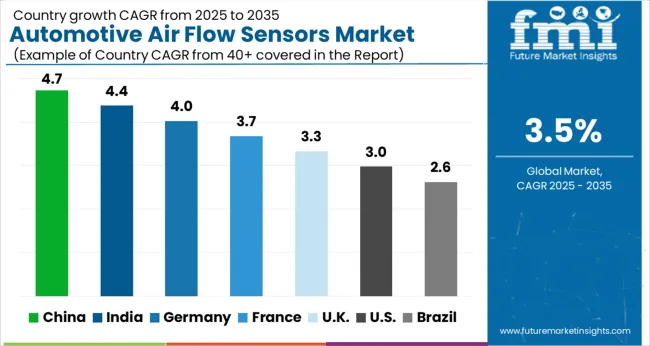

The global automotive air flow sensors market is expanding at a moderate CAGR of 3.5%, influenced by evolving automotive emission standards and demand for fuel efficiency. Among BRICS countries, China leads with 5% growth, driven by increasing vehicle production and adoption of advanced sensor technologies. India and Germany both report 4% growth, supported by growing automotive manufacturing and stringent regulatory requirements. The United Kingdom and the United States, representing mature markets, each show 3% growth, shaped by steady demand and regulatory compliance. These countries collectively steer market trends through innovations in sensor accuracy, durability, and integration with engine management systems. This report includes insights on 40+ countries; the top countries are shown here for reference.

The automotive air flow sensors market in China is growing at a 5% CAGR. Rapid growth in the automotive manufacturing sector and increasing production of internal combustion engine vehicles drive demand. Stricter emission regulations encourage adoption of precise air flow sensors to optimize engine performance and reduce pollutants. Domestic sensor manufacturers are investing in advanced technologies such as mass air flow and hot-wire sensors to meet growing quality standards. Expansion in electric and hybrid vehicle segments also increases demand for integrated sensor systems to monitor air intake and engine efficiency. Government incentives for cleaner vehicles further support market growth.

Market in India is expanding at a 4% CAGR as automotive production and sales rise steadily. Demand for fuel-efficient and emission-compliant vehicles propels the need for reliable air flow sensors. Local and international sensor manufacturers collaborate to provide cost-effective and high-performance solutions. The growing use of turbocharged and diesel engines requires advanced sensors for accurate air measurement. Government policies supporting cleaner fuel and vehicle standards positively impact market growth. Increasing replacement demand due to rising vehicle parc also supports the aftermarket segment.

The United Kingdom’s market is growing at a 3% CAGR, with steady demand driven by automotive manufacturing and aftermarket replacement. The focus on improving fuel economy and reducing emissions encourages adoption of advanced air flow sensors. UK manufacturers and suppliers emphasize quality and durability to meet customer expectations. The gradual shift towards electric vehicles impacts sensor demand, with growth in sensors for hybrid models. Aftermarket sales remain important as older vehicles require sensor replacements and upgrades.

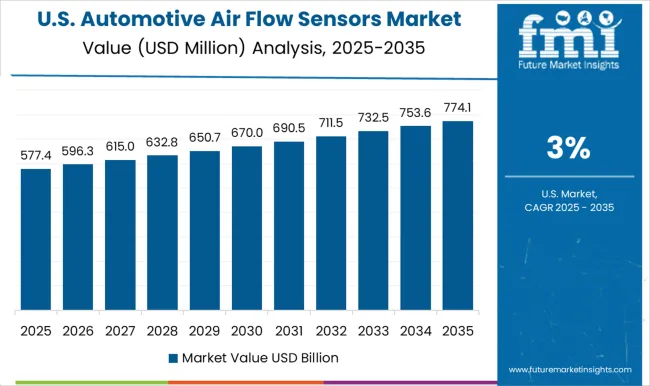

The USA market grows at a 3% CAGR, supported by a large automotive manufacturing base and replacement market. Stringent emission standards drive the use of advanced air flow sensors in combustion engines. Manufacturers adopt technologies such as hot-wire and MEMS-based sensors to improve engine control and fuel efficiency. The aftermarket segment is significant due to the high vehicle parc and maintenance needs. Increasing production of hybrid vehicles fuels demand for specialized air flow sensors compatible with complex powertrains. The market benefits from strong supplier networks and technological innovation.

The market in Germany grows at a 4% CAGR, supported by the country’s strong automotive industry and advanced engineering standards. Automotive manufacturers focus on high-precision sensors to meet rigorous emission and performance regulations. Integration of sensors with engine control units enhances vehicle efficiency and reduces emissions. German companies invest heavily in research and development to innovate sensor technologies, including smart and multi-functional air flow sensors. The rise of hybrid vehicles increases demand for specialized sensors compatible with alternative powertrains.

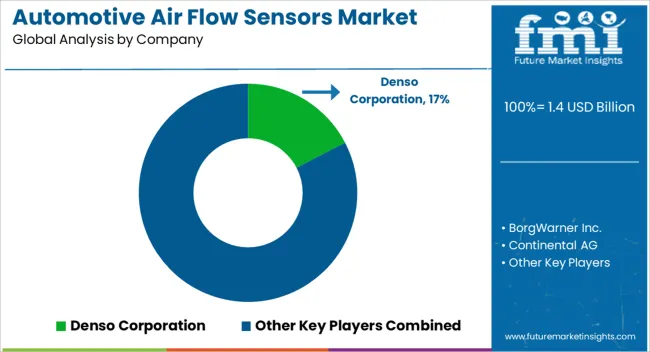

The automotive air flow sensors market is driven by major players such as Denso Corporation, BorgWarner Inc., Continental AG, HELLA GmbH & Co. KGaA, Hitachi Automotive Systems, Ltd., Infineon Technologies, Robert Bosch GmbH, Sensata Technologies Inc., TE Connectivity, and Valeo Group. These companies design and manufacture advanced mass air flow (MAF) and manifold absolute pressure (MAP) sensors, which are critical for measuring the volume and density of air entering an engine, enabling precise fuel injection and efficient combustion. Denso, Bosch, and Continental dominate with high-volume OEM supply, offering sensors integrated with temperature sensing for improved engine performance and emissions compliance.

BorgWarner and Hitachi focus on integrating air flow sensing technology with turbocharging systems to enhance responsiveness and fuel economy in modern powertrains. Infineon, TE Connectivity, and Sensata leverage semiconductor and MEMS (microelectromechanical systems) expertise to deliver compact, high-accuracy, and vibration-resistant sensors. HELLA and Valeo emphasize durability and cost-effectiveness for both OEM and aftermarket segments. Market growth is fueled by stricter global emission regulations, the rising adoption of advanced engine management systems, and the shift toward turbocharged and downsized engines, which require precise air-fuel ratio control.

In addition, the increasing integration of these sensors in hybrid and electric vehicles for thermal management and intake monitoring opens new opportunities. Competition is intensifying as suppliers explore solid-state designs, wireless sensing capabilities, and self-diagnosing features to reduce maintenance and extend sensor life. The industry is also seeing a trend toward modular sensor units combining air flow, temperature, and pressure measurements to reduce weight, cost, and installation complexity.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.4 Billion |

| Sensor Type | Mass Air Flow Sensor (MAF) and Volume Air Flow Sensor (VAF) |

| Vehicle Type | Passenger vehicles and Commercial vehicles |

| Technology | Digital Airflow Sensors and Analog Airflow Sensors |

| Sales Channel | OEM and Aftermarket |

| Application | Engine Control System, Exhaust Gas Recirculation (EGR) System, Turbocharging, Air Conditioning System, and Transmission System |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Denso Corporation, BorgWarner Inc., Continental AG, HELLA GmbH & Co. KGaA, Hitachi Automotive Systems, Ltd., Infineon Technologies, Robert Bosch GmbH, Sensata Technologies Inc., TE Connectivity, and Valeo Group |

| Additional Attributes | Dollar sales vary by sensor type, including vane (VAF) and hot-wire (MAF) technologies; by output tech, such as analog and digital sensors; by application, including engine control, EGR, turbocharging, and air-conditioning; and by region, led by Asia-Pacific, North America, and Europe. Growth is driven by emissions mandates, engine efficiency, IoT diagnostics, and ADAS integration. |

The global automotive air flow sensors market is estimated to be valued at USD 1.4 billion in 2025.

The market size for the automotive air flow sensors market is projected to reach USD 2.0 billion by 2035.

The automotive air flow sensors market is expected to grow at a 3.5% CAGR between 2025 and 2035.

The key product types in automotive air flow sensors market are mass air flow sensor (maf) and volume air flow sensor (vaf).

In terms of vehicle type, passenger vehicles segment to command 67.9% share in the automotive air flow sensors market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Air Flow Sensors Market Size and Share Forecast Outlook 2025 to 2035

Automotive Air Flow Meter Market Size and Share Forecast Outlook 2025 to 2035

Automotive Cabin Air Quality Sensors Market Size and Share Forecast Outlook 2025 to 2035

Airflow Balancer Market Size and Share Forecast Outlook 2025 to 2035

Air Flow Monitoring System Market

Airbag Sensors Market

Aircraft Sensors Market - Market Outlook 2025 to 2035

Automotive Airbags Market Size and Share Forecast Outlook 2025 to 2035

Automotive Airbag Controller Unit Market Size and Share Forecast Outlook 2025 to 2035

Automotive Air Filters Market Size and Share Forecast Outlook 2025 to 2035

Automotive Air Filter Market Growth - Trends & Forecast 2025 to 2035

Automotive Sensors Market Growth - Trends & Forecast 2025 to 2035

Automotive Air Compressor Market Growth - Trends & Forecast 2025 to 2035

Automotive Airbag Market Growth - Trends & Forecast 2025 to 2035

Automotive Air Intake Manifold Market

Automotive Air Vent Assembly Market

Automotive Repair & Maintenance Services Market Growth - Trends & Forecast 2025 to 2035

Automotive Idle Air Control Valve Market

Automotive Radar Sensors Market Size and Share Forecast Outlook 2025 to 2035

Laminar Airflow Trolley Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA