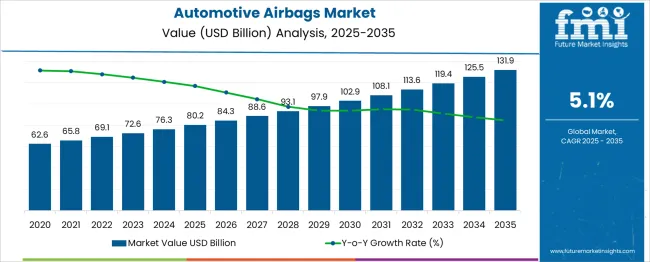

The automotive airbags market is poised for substantial and steady growth, expanding from USD 62.6 billion in 2020 to approximately USD 131.9 billion by 2035, which marks an increase of USD 69.3 billion over the 16-year period. Between 2020 and 2024, the market rises from USD 62.6 billion to USD 72.6 billion, representing about 17.4% of the total projected growth. This initial phase is driven by stricter safety regulations globally, growing consumer awareness about vehicle safety, and rising production of passenger vehicles. The adoption of advanced airbag systems including side, curtain, and knee airbags has enhanced occupant protection, prompting increased market penetration. From 2025 to 2030, the market further advances from USD 76.3 billion to USD 97.9 billion, supported by technological innovations aimed at improving airbag deployment times, sensitivity, and overall effectiveness. Emerging economies contribute significantly during this period as expanding automotive industries and rising disposable incomes drive demand for enhanced vehicle safety features. The final stage from 2031 to 2035 accelerates, with the market reaching USD 131.9 billion from USD 102.9 billion. This phase benefits from the integration of airbags into connected and autonomous vehicles, as well as growing mandates for comprehensive occupant protection across vehicle segments. Overall, the automotive airbags market demonstrates a robust upward trajectory, fueled by regulatory enforcement, continuous product innovation, and increasing vehicle sales worldwide, ensuring sustained growth through 2035.

| Metric | Value |

|---|---|

| Automotive Airbags Market Estimated Value in (2025 E) | USD 80.2 billion |

| Automotive Airbags Market Forecast Value in (2035 F) | USD 131.9 billion |

| Forecast CAGR (2025 to 2035) | 5.1% |

The automotive airbags market is witnessing sustained momentum driven by evolving safety regulations, new vehicle technologies and rising consumer expectations in global markets. Demand is being propelled by increasingly stringent crash safety standards that mandate multiple airbag systems across collision zones. OEMs are prioritizing innovation in airbag design to align with advanced driver assistance systems and autonomous driving roadmaps.

The shift toward electric and hybrid passenger vehicles is opening opportunities for tailored airbag modules that account for unique cabin layouts and packaging considerations. Material science breakthroughs are enabling the development of lighter and more durable airbag fabrics while reducing system mass. In addition the growing emphasis on pedestrian protection is influencing the design of exterior airbags and header module solutions.

As regulations expand in emerging markets alongside higher vehicle standards demand for airbags is expected to remain robust. Future growth will be supported by integration of smart sensing technologies and multi stage inflation systems designed to optimize occupant and pedestrian safety in real world crash scenarios.

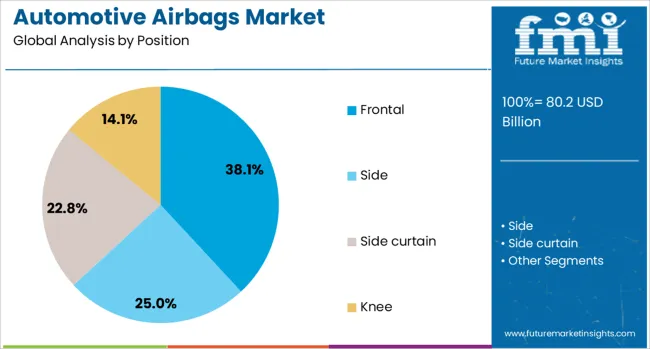

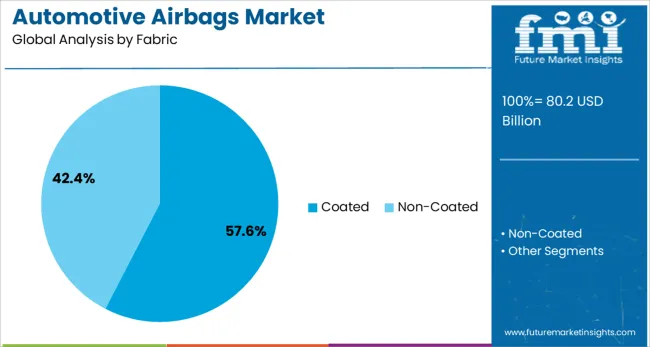

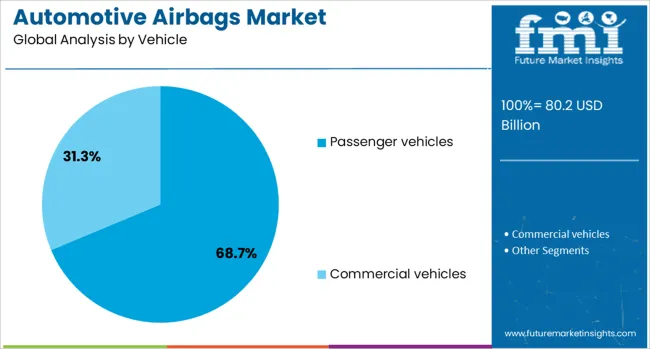

The automotive airbags market is segmented by position, fabric, vehicle distribution channel, and geographic regions. By position of the automotive airbags market is divided into Frontal, Side, Side curtain Knee. In terms of fabric of the automotive airbags market is classified into Coated Non-Coated. Based on vehicle of the automotive airbags market is segmented into Passenger vehicles Commercial vehicles. By distribution channel of the automotive airbags market is segmented into OEM Aftermarket. Regionally, the automotive airbags industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The frontal airbag segment is projected to hold 38.1% of total airbag module revenue in 2025 making it the leading position category. Its dominance is being driven by universal regulatory requirements for frontal impact protection across major automotive markets. Frontal systems are implemented across nearly all passenger vehicle models as a primary safety feature monitored by collision avoidance systems and crash detection sensors.

This segment’s continued leadership is supported by advancements in multi stage inflation technology and occupant sensing to mitigate injury based on collision severity and passenger size. Additionally frontal airbags have been heavily integrated with seatbelt pretensioners enhancing overall restraint effectiveness.

Investment by OEMs into smart coupling with advanced driver assistance systems has reinforced the segment’s share. As electrified platforms continue to evolve frontal design optimization for battery evasion and interior packaging constraints will further sustain and potentially expand its market dominance.

The coated fabric segment is estimated to capture 57.6% of total automotive airbag fabric market revenue by 2025 making it the preferred choice. This advantage is attributed to the ability of coated materials to enhance impermeability heat resistance and mechanical strength while maintaining optimal deployment speed and consistency across varied crash scenarios. Coated fabrics are molded to meet diverse module shapes while ensuring low leakage.

Their performance reliability has made them the standard in passenger vehicle airbags across different positions. Material innovation has also improved fabric longevity and compatibility with sensor embedded modules.

OEMs have adopted these fabrics to meet strict quality and durability protocols required for airbags. As advanced occupant sensing systems and multi stage inflation strategies gain traction coated fabric is set to remain the dominant material format due to its robustness performance and design flexibility.

The passenger vehicle segment is forecast to hold 68.7% of automotive airbag market revenue in 2025 positioning it as the dominant category. This leadership is being driven by high global production volumes and stricter safety regulations being applied to passenger cars across all regions. Electrification trends are prompting tailored airbag designs that are suited to compact interior layouts and advanced architecture.

Passenger vehicle OEMs have been investing in comprehensive safety packages that bundle multiple airbags with sensor networks and crash avoidance systems. Rising consumer expectations for safety ratings have led to frontal knee side curtain and center airbags becoming standard in mainstream models.

Market expansion is also supported by emerging market adoption of developed market safety regulations and retrofit programs. The combination of regulatory compliance volume scale and continuous investment in airbag innovation ensures passenger vehicles will continue to dominate airbag installation and revenue share.

The automotive airbags market is being shaped by regulatory mandates, integration with vehicle safety systems, consumer-driven demand, and product innovation. These dynamics collectively ensure continued growth and diversification of applications.

The automotive airbags market continues to expand under the influence of stringent safety regulations enforced by governments and international agencies. Mandatory inclusion of frontal airbags in most passenger and commercial vehicles has set a strong baseline for demand. Side-impact, curtain, and knee airbags are increasingly being mandated in regions prioritizing higher crash safety ratings. Compliance with safety assessment programs such as NCAP and IIHS encourages OEMs to integrate multiple airbag systems as standard features. This push is especially evident in emerging automotive markets, where safety standards are being aligned with global benchmarks. As regulatory frameworks evolve, automakers are focusing on designing airbag systems that meet both domestic requirements and export market specifications.

Automotive airbags are no longer stand-alone systems but are integrated into broader vehicle safety architectures. Coordination with sensors, seatbelt pre-tensioners, and collision detection units ensures timely and precise deployment. Integration with advanced driver assistance systems enhances occupant protection by enabling staged or adaptive inflation based on crash severity. Vehicle manufacturers are adopting modular airbag designs that allow flexibility in placement and deployment logic. This approach is becoming increasingly important in electric and hybrid vehicles, where cabin layouts differ from conventional models. Such integration also supports cost optimization by allowing shared components across different vehicle platforms while maintaining consistent safety performance.

Consumer awareness regarding vehicle safety features is playing a critical role in driving airbag adoption. Safety ratings have become a selling point in vehicle marketing, with airbags being prominently highlighted in brochures and advertisements. Buyers in both developed and developing regions are prioritizing models equipped with comprehensive airbag packages. This trend is reinforced by insurance incentives and resale value benefits for vehicles with higher safety scores. Public awareness campaigns, crash test demonstrations, and digital safety education have amplified understanding of the importance of airbags. As consumer expectations evolve, manufacturers are positioning airbag systems not just as compliance measures but as value propositions in competitive market segments.

Ongoing product innovation is extending the scope of airbag applications beyond conventional seating positions. The development of pedestrian airbags, center airbags to prevent occupant collisions, and motorcycle airbags is diversifying the market. Lightweight fabrics, advanced inflator mechanisms, and compact folding designs are enabling installation in smaller vehicles without compromising space. These advancements are particularly relevant in markets with growing demand for compact SUVs and crossovers. OEM partnerships with material science companies are helping create more efficient airbag deployment systems. The focus on specialized airbag solutions for different vehicle categories ensures that adoption continues to grow in both traditional and emerging automotive segments.

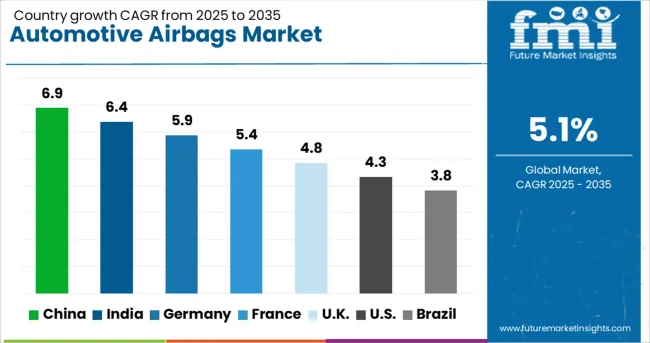

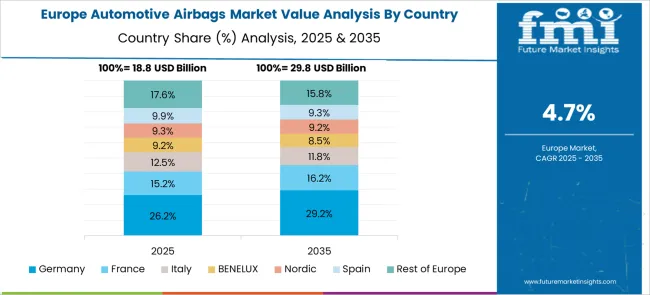

The automotive airbags market is projected to grow globally at a CAGR of 5.1% from 2025 to 2035, supported by regulatory mandates, consumer awareness, and the integration of advanced occupant safety systems. China leads with a CAGR of 6.9%, driven by expanding vehicle production, government-led safety regulations, and increasing adoption of multi-airbag configurations in mass-market and premium vehicles. India follows at 6.4%, benefiting from stricter crash safety norms, growing automotive manufacturing, and rising consumer preference for vehicles with enhanced safety packages. France posts a 5.4% CAGR, influenced by compliance with Euro NCAP standards and higher penetration of side and curtain airbags. The United Kingdom achieves 4.8% growth, aided by safety-focused vehicle upgrades and consumer demand for comprehensive restraint systems. The United States maintains a 4.3% CAGR, supported by steady replacement demand, recalls, and advanced deployment systems tailored for SUVs and trucks. This growth outlook positions Asia-Pacific as a leading hub for airbag adoption, with Europe and North America continuing steady uptake based on safety compliance and evolving consumer expectations.

The CAGR for the automotive airbags market in the United Kingdom was around 4.2% during 2020–2024 and improved to 4.8% for 2025–2035. The earlier phase remained constrained by model cycles and delayed refreshes in volume segments, which curbed faster standardization of side and curtain airbags. A stronger trajectory has been projected for 2025–2035 as OEMs expand multi-airbag packages to meet higher consumer safety expectations and Euro NCAP target scores. Integration with seatbelt pre-tensioners and occupancy sensing has been prioritized to lift real-world outcomes and reduce injury severity. Replacement demand in SUVs and LCVs is expected to stay steady, supported by repair volumes and insurance-led parts procurement. This market is judged to be on firm footing as premium brands push center and knee airbags deeper into mid-range trims, raising per-vehicle content across the fleet.

China’s automotive airbags market starts from a position of strength as local and global OEMs escalate safety content across compact and mid-size vehicles. A 6.9% CAGR for 2025–2035 has been estimated, supported by rising multi-airbag configurations and wider adoption of curtain and knee airbags in value-priced trims. Domestic suppliers have scaled inflator and fabric capacity, improving cost curves and shortening lead times. Safety ratings influence purchase decisions in large urban centers, which has encouraged manufacturers to standardize higher airbag counts in high-volume nameplates. Replacement flows from accident repairs and recalls sustain a healthy aftermarket base. The competitive field favors suppliers that deliver lightweight modules and efficient folding patterns that fit compact cabins without sacrificing deployment performance.

India’s market displays clear momentum as safety awareness rises and regulatory requirements tighten. A 6.4% CAGR for 2025–2035 has been indicated, supported by progressive model updates that bring dual frontal, side, and curtain airbags into mainstream hatchbacks and compact SUVs. OEMs are using platform commonization to spread module costs over large volumes, which is viewed as the right strategy for India’s price-sensitive buyer base. Supplier localization has improved module affordability and increased resilience against currency swings. Fleet purchases in ride-hailing and corporate mobility favor higher safety specifications, pushing fitment higher in entry trims. Replacement activity remains modest but steady, with organized networks handling calibrated repairs under strict quality protocols.

France is positioned for consistent expansion at a 5.4% CAGR through 2035 as OEMs emphasize occupant protection across compact crossovers and electrified models. Euro NCAP targets have steered manufacturers toward multi-airbag strategies, including center airbags in vehicles with wider cabins and bench-style rears. The supply base benefits from strong European manufacturing of inflators, textiles, and gas generators, which stabilizes lead times. Replacement flows remain supported by insurance-approved channels that favor certified modules and traceable serials. Exports of French-built models with richer safety content lift aggregate module demand beyond domestic registrations. The landscape rewards suppliers demonstrating reliable deployment curves across a wide range of seating positions and occupant sizes, a capability that has become a commercial differentiator.

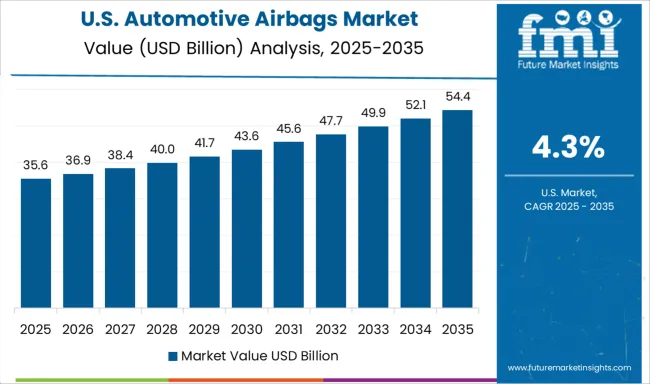

The United States shows a measured yet durable path at 4.3% CAGR for 2025–2035. Pickup trucks and SUVs dominate sales, and these segments carry high airbag content per vehicle, supporting stable module demand even when total volumes soften. Regulatory oversight and test protocols maintain pressure for continuous improvements in deployment timing, out-of-position protection, and child-seat compatibility. Replacement demand is structurally firm due to high vehicle miles traveled and insurance-driven repairs. Suppliers with strong traceability, diagnostics, and recall execution win preference among major OEMs. A gradual mix shift toward advanced side-curtain designs with extended coverage areas has been observed, which lifts value per unit and strengthens revenue quality across the supply chain.

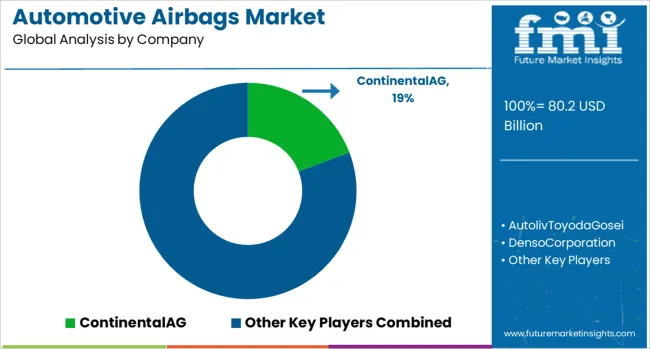

The automotive airbags market is shaped by a blend of global automotive safety leaders and specialized component manufacturers delivering high-performance occupant protection systems. Continental AG leverages its deep expertise in integrated safety solutions, offering advanced airbag control units and deployment algorithms to meet evolving crash standards. Autoliv and Toyoda Gosei maintain strong global footprints, providing multi-airbag modules and inflator technologies tailored for diverse vehicle segments, with a focus on cost-efficiency and reliability. Denso Corporation combines sensor technology with precision inflator systems to enhance deployment accuracy, particularly in coordination with ADAS platforms. Hyundai Mobis delivers a wide range of airbag products for both domestic and global OEMs, emphasizing compact designs and high-volume production capabilities. Delphi Automotive PLC contributes advanced electronics and restraint control systems to complement airbag module functionality.

Robert Bosch GmbH integrates sensor fusion, deployment logic, and occupant detection systems, strengthening the connection between passive and active safety technologies. Key competitive strategies include partnerships with OEMs for model-specific airbag integration, localized manufacturing to reduce lead times, and R&D investment in adaptive and lightweight airbag modules. Manufacturers are also advancing electronic control systems to coordinate airbags with other safety mechanisms, ensuring compliance with global crash standards. A focus on modular architecture, rapid deployment precision, and cost optimization continues to define competitive differentiation, while aftermarket support and recall management remain critical for brand reputation and customer trust.

Key Developments

In February 2025, ZF Lifetec unveiled the Active Heel Airbag, the world’s first foot airbag designed to complement knee airbags and enhance occupant protection. By stabilizing the heel in the footwell during crashes, it ensures the knee enters the airbag at the most effective angle, allowing the thigh to absorb a larger proportion of crash energy. This improves the performance of knee airbags even when occupants are in relaxed seating positions, providing better overall safety. The technology can be integrated into any vehicle type.

| Item | Value |

|---|---|

| Quantitative Units | USD 80.2 Billion |

| Position | Frontal, Side, Side curtain, and Knee |

| Fabric | Coated and Non-Coated |

| Vehicle | Passenger vehicles and Commercial vehicles |

| Distribution Channel | OEM and Aftermarket |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ContinentalAG, AutolivToyodaGosei, DensoCorporation, HyundaiMobis, DelphiAutomotivePLC, and RobertBoschGmbH |

| Additional Attributes | Dollar sales, share, regional demand trends, OEM vs aftermarket split, regulatory impact, competitor product portfolios, pricing benchmarks, supply chain risks, raw material cost trends, emerging airbag technologies, replacement cycle analysis. |

The global automotive airbags market is estimated to be valued at USD 80.2 billion in 2025.

The market size for the automotive airbags market is projected to reach USD 131.9 billion by 2035.

The automotive airbags market is expected to grow at a 5.1% CAGR between 2025 and 2035.

The key product types in automotive airbags market are frontal, side, side curtain and knee.

In terms of fabric, coated segment to command 57.6% share in the automotive airbags market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Manufacturing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Pressure Sensor Market Size and Share Forecast Outlook 2025 to 2035

Automotive Vacuum Brake Booster Market Size and Share Forecast Outlook 2025 to 2035

Automotive Smart Antenna Market Size and Share Forecast Outlook 2025 to 2035

Automotive Actuator Market Size and Share Forecast Outlook 2025 to 2035

Automotive Exhaust Manifold Market Size and Share Forecast Outlook 2025 to 2035

Automotive Roof Rails Market Size and Share Forecast Outlook 2025 to 2035

Automotive Resonator Market Size and Share Forecast Outlook 2025 to 2035

Automotive Counter Shaft Market Size and Share Forecast Outlook 2025 to 2035

Automotive Wheel Coating Market Size and Share Forecast Outlook 2025 to 2035

Automotive Water Separation Systems Market Size and Share Forecast Outlook 2025 to 2035

Automotive Refinish Coating Market Size and Share Forecast Outlook 2025 to 2035

Automotive Emission Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Tire Market Size and Share Forecast Outlook 2025 to 2035

Automotive Glass Market Size and Share Forecast Outlook 2025 to 2035

Automotive Wire & Cable Material Market Size and Share Forecast Outlook 2025 to 2035

Automotive Camshaft Market Size and Share Forecast Outlook 2025 to 2035

Automotive DC-DC Converter Market Size and Share Forecast Outlook 2025 to 2035

Automotive Key Blank Market Size and Share Forecast Outlook 2025 to 2035

Automotive Tensioner Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA