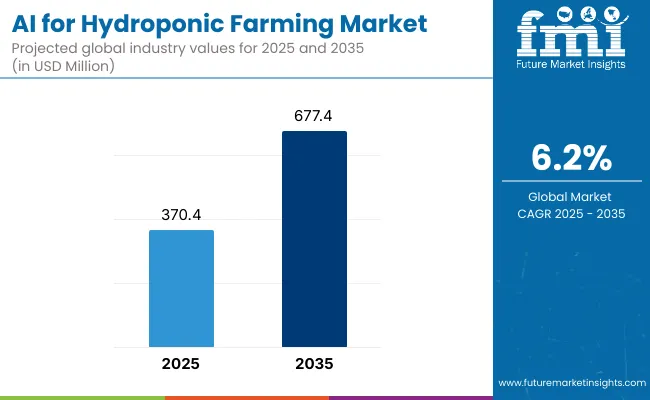

The AI for Hydroponic Farming Market is expected to record a valuation of USD 370.4 million in 2025, reaching USD 677.4 million by 2035, reflecting a 6.2% CAGR over the forecast period. Growth during 2025 to 2030 will be supported by increasing adoption of farm management platforms and predictive analytics software, with the market projected to add nearly USD 123.6 million in incremental value over this half-decade. This expansion will be driven by the need for nutrient optimization, yield forecasting, and real-time monitoring of crop health.

AI for Hydroponic Farming Market Key Takeaways

| Metric | Value |

|---|---|

| AI for Hydroponic Farming Market Estimated Value In (2025 E ) | USD 370.4 Million |

| AI for Hydroponic Farming Market Forecast Value In (2035f) | USD 677.4 Million |

| Forecast CAGR (2025 to 2035) | 6.2% |

Between 2030 and 2035, growth is expected to accelerate further, generating an additional USD 183.4 million in market value. The rapid scale-up of bio-controlled greenhouses and vertical farms, combined with widespread use of AI-powered climate and nutrient management systems, will reinforce adoption. Resource efficiency modules focusing on water and energy optimization will also play a vital role, aligning with sustainability targets.

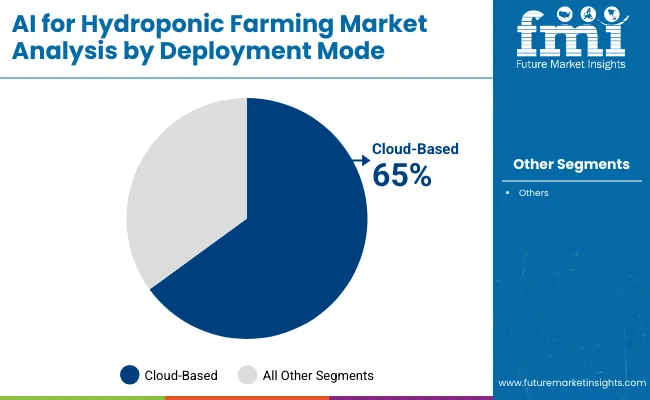

Deployment preferences strongly favor cloud-based platforms, which account for 65.0% share in 2025 and are expanding at a 7.1% CAGR, supported by scalability, ease of integration, and cost efficiency. On-premise models retain niche importance in research institutes and smaller-scale farms but grow more modestly.

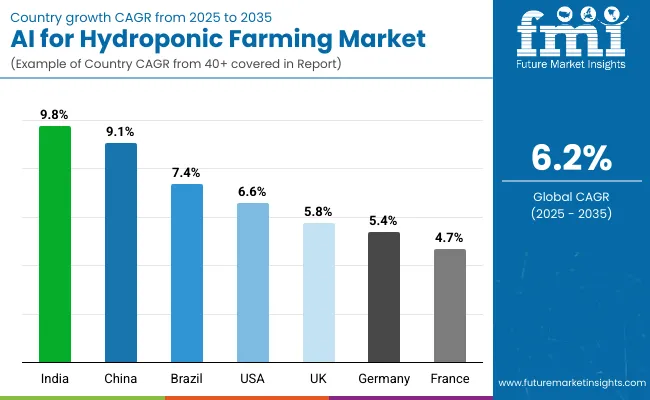

Regionally, the highest growth rates are expected in India (9.8% CAGR) and China (9.1% CAGR), where modernization of agriculture is advancing rapidly. While the United States remains the largest single market with 20% share in 2025, its dominance will ease to 18% by 2035, as Asia-Pacific strengthens its position in technology-driven farming solutions.

From 2020 to 2024, AI adoption in hydroponic farming grew steadily, driven by advances in farm automation and predictive analytics. In 2025, the market is valued at USD 370.4 Million, supported by demand for real-time monitoring and nutrient optimization. By 2035, it is expected to reach USD 677.4 Million, with cloud-based solutions and AI-driven applications in crop monitoring, climate control, and yield forecasting defining the competitive landscape.

Growth momentum will increasingly shift toward Asia-Pacific, where India and China are accelerating agricultural modernization. Competitive advantage will move beyond software availability toward integration strength, ecosystem partnerships, and AI-driven sustainability performance.

The expansion of the AI for Hydroponic Farming Market between 2025 and 2035 is being driven by the increasing reliance on predictive analytics, automation, and sustainability-focused farming practices. AI-based crop monitoring and imaging software are enabling growers to detect stress, disease, and nutrient deficiencies with greater accuracy, reducing losses and enhancing yield quality.

Cloud-based platforms are further accelerating adoption by providing scalable, cost-efficient solutions that integrate seamlessly with existing farm infrastructure. Governments and private investors are prioritizing water-efficient and energy-optimized systems, positioning AI-enabled resource management as a cornerstone of sustainable agriculture.

In addition, the rising need for continuous food production in urban centers is fueling investment in vertical farms and greenhouses, where AI plays a central role in climate control and nutrient management. Collectively, these advancements are ensuring that AI integration evolves from being an efficiency tool into a strategic enabler of long-term productivity, resilience, and sustainability in hydroponic farming.

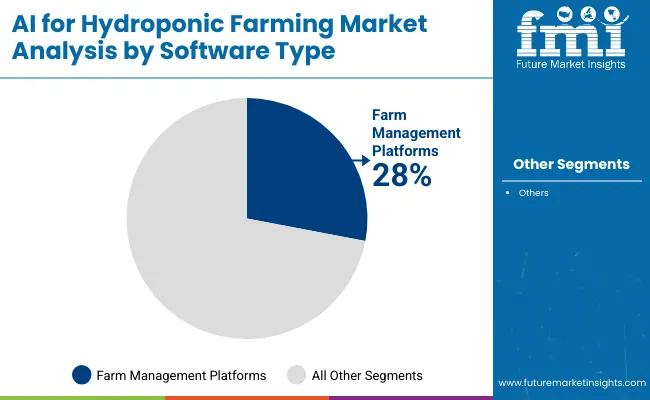

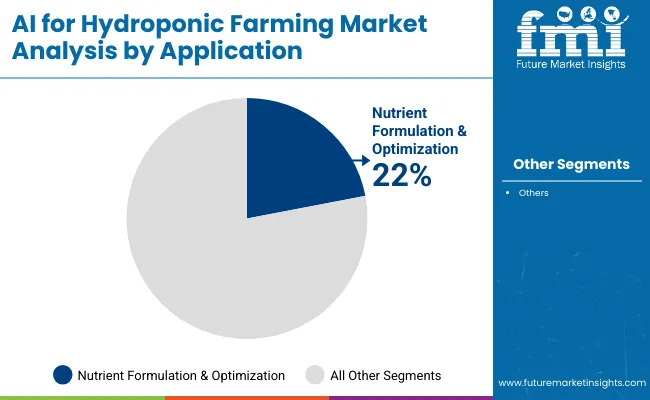

The AI for Hydroponic Farming Market is segmented across software type, deployment mode, and application, each reflecting unique growth drivers and adoption trends. Software categories highlight the central role of farm management platforms, predictive analytics, and imaging tools in reshaping precision farming. Deployment mode analysis underscores the growing preference for cloud-based systems, reflecting scalability and cost efficiency, while on-premise solutions retain relevance for research and specialized use cases.

Application trends reveal nutrient optimization, yield forecasting, and crop health monitoring as the most transformative areas of adoption. Together, these segments illustrate how digital ecosystems, sustainability imperatives, and AI-driven decision-making are driving structural change, enabling hydroponic farms to achieve greater efficiency, productivity, and resilience across global markets.

Farm management platforms dominate with 28.0% share in 2025, expanding at 5.2% CAGR, reflecting their central role in resource tracking, scheduling, and performance analytics. Predictive analytics software, with 18.0% share, is expected to grow faster at 6.9% CAGR, as farmers increasingly rely on AI-driven forecasting for crop yield optimization.

Crop monitoring and imaging software, representing 20.0% share, grows at the highest pace of 7.3% CAGR, underlining the importance of early stress detection and health monitoring. Nutrient management tools, growing at 7.8% CAGR, further reinforce efficiency gains in vertical farming and greenhouse systems. While specialized software solutions are expanding, farm management platforms remain the dominant backbone, anchoring integrated operations across farm networks.

| Software Type | Market Value Share, 2025 |

|---|---|

| Farm Management Platforms | 28.00% |

| Others | 72.00% |

Cloud-based platforms lead the market with 65.0% share in 2025, expanding at 7.1% CAGR, supported by scalability, affordability, and accessibility across geographies. They allow real-time updates, integration with IoT sensors, and remote monitoring, making them the preferred choice for commercial growers and agri-tech companies.

On-premise solutions, holding 35.0% share, grow more modestly at 4.5% CAGR, retaining demand in research institutes and niche farming setups that prioritize data sovereignty and offline control. Over the decade, cloud-based platforms will dominate further as AI integration scales, particularly in Asia-Pacific, where farm digitization is accelerating rapidly.

| Deployment Mode | Market Value Share, 2025 |

|---|---|

| Cloud-Based | 65.00% |

| Others | 35.00% |

Nutrient formulation and optimization leads with 22.0% share in 2025, growing at 7.2% CAGR, reflecting its importance in ensuring yield consistency and resource efficiency in controlled farming environments. Yield prediction and forecasting, expanding at 7.5% CAGR, is the fastest-growing application, driven by the rising need for AI-driven demand planning and crop output assurance.

Crop health monitoring, with 18.0% share, supports early detection of diseases and pests, integrating seamlessly with imaging technologies. Climate and environmental control remains essential, accounting for 20.0% share, supported by greenhouse and vertical farm adoption. While multiple applications strengthen adoption, nutrient optimization anchors the market, reinforcing AI’s role in securing sustainable, resource-efficient farming outcomes.

| Application | Market Value Share, 2025 |

|---|---|

| Nutrient Formulation & Optimization | 22.00% |

| Others | 78.00% |

The AI for Hydroponic Farming Market is being shaped by accelerating adoption drivers, structural restraints, and technology-led trends. These forces collectively influence adoption pathways, regional competitiveness, and the transition of hydroponic farming toward data-driven, sustainable, and efficiency-focused production models across the next decade.

Driver: Advancements in Predictive Analytics and Crop Forecasting

A key driver of market growth is the increasing reliance on predictive analytics and yield forecasting software, projected to expand at 6.9% CAGR between 2025 and 2035. AI-powered predictive models allow hydroponic farmers to anticipate crop yields with higher accuracy, reducing risks associated with fluctuating demand and climate uncertainties. This capability supports efficient resource allocation, enabling growers to optimize nutrient delivery, lighting cycles, and water usage based on projected needs.

Predictive analytics is particularly valuable in large-scale vertical farms and greenhouses, where operational efficiency directly impacts profitability. Integration with IoT sensors and imaging platforms further enhances forecasting, as real-time data inputs are continuously analyzed to refine predictions. The growing importance of demand planning in urban agriculture is also driving adoption, as retailers and distributors seek reliable supply chains for fresh produce.

In emerging economies such as India and China, where agricultural modernization is progressing rapidly, predictive analytics offers a solution to scale urban food production sustainably. Over the next decade, predictive analytics is expected to become indispensable, not only for production efficiency but also for enhancing resilience in hydroponic farming systems against market volatility and environmental stressors.

Restraint: High Capital Costs and Integration Challenges

Despite strong adoption potential, high capital costs and integration complexity remain significant restraints in the AI for Hydroponic Farming Market. Hydroponic systems already require substantial investment in infrastructure, climate control, and nutrient delivery technologies.

The integration of advanced AI platforms adds additional costs for software licensing, IoT hardware, data storage, and analytics support. Smaller growers and hobbyist farmers face barriers to entry, as affordability remains limited to large-scale commercial operations and agri-tech companies. Furthermore, integrating AI platforms with existing hydroponic infrastructure requires technical expertise, often necessitating external consulting and training services. On-premise solutions, while preferred in research institutes, also impose costs linked to server maintenance and system upgrades.

Data management challenges further complicate adoption, as continuous monitoring generates vast datasets that require robust analytics pipelines to extract actionable insights. These barriers disproportionately affect adoption in developing regions, where resource constraints limit access to advanced technologies.

While cloud-based deployment lowers some financial hurdles by reducing upfront infrastructure investment, long-term affordability and return on investment remain concerns for smaller operators. Unless addressed through subsidies, public-private partnerships, or modular low-cost AI solutions, high capital intensity and integration hurdles will continue to restrain widespread adoption of AI in hydroponic farming.

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 9.10% |

| India | 9.80% |

| Germany | 5.40% |

| France | 4.70% |

| UK | 5.80% |

| USA | 6.60% |

| Brazil | 7.40% |

Adoption of AI in hydroponic farming is evolving at different paces across regions, shaped by agricultural modernization, sustainability priorities, and investment capacity. In Asia-Pacific, rapid growth is being recorded as governments and private players scale vertical farming and controlled-environment agriculture to address food security challenges. India, with a forecast CAGR of 9.8%, and China, at 9.1%, are the fastest-expanding national markets, reflecting strong policy support, urban population pressures, and rising venture capital investment in agri-tech startups.

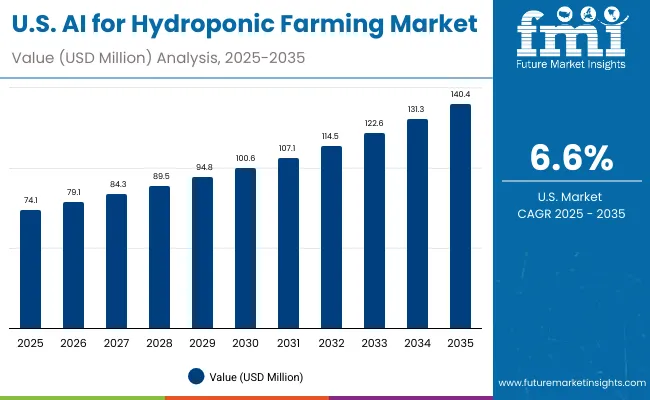

In North America, the United States retains dominance, holding 20% share in 2025, though this is projected to moderate to 18% by 2035 as Asia’s share rises. Growth in the U.S., at 6.6% CAGR, remains tied to commercial hydroponic farms, adoption of predictive analytics, and strong integration of AI-based climate and nutrient optimization platforms.

Europe demonstrates steady but compliance-led growth. Germany and France, with projected CAGRs of 5.4% and 4.7% respectively, emphasize sustainability compliance and data security in AI-enabled farms. The UK, expanding at 5.8% CAGR, is leveraging AI for precision farming and resource efficiency in greenhouse production.

Latin America and the Middle East show emerging opportunities, led by Brazil at 7.4% CAGR, where investment in indoor vertical farming and urban agriculture is creating new adoption pathways.

| Year | USA Market (USD Million) |

|---|---|

| 2025 | 74.1 |

| 2026 | 79.1 |

| 2027 | 84.3 |

| 2028 | 89.5 |

| 2029 | 94.8 |

| 2030 | 100.6 |

| 2031 | 107.1 |

| 2032 | 114.5 |

| 2033 | 122.6 |

| 2034 | 131.3 |

| 2035 | 140.4 |

A CAGR of 6.6% has been projected for the United States, reflecting expansion in a mature but innovation-driven market. Market share is expected to decline from 20% in 2025 to 18% by 2035, as faster growth in Asia-Pacific reshapes global balances. Adoption is being driven by commercial hydroponic farms integrating AI for predictive analytics, nutrient optimization, and climate control.

Cloud-based platforms dominate due to scalability, while on-premise systems retain relevance in research and institutional applications. High compliance with food safety and traceability requirements reinforces the importance of AI in ensuring consistency and transparency. Despite moderating global share, the U.S. will remain critical as a hub for technological innovation, supported by investments from agri-tech companies and partnerships between AI providers and growers.

A CAGR of 5.8% has been projected for the United Kingdom, highlighting steady adoption in a compliance-focused and sustainability-driven market. Market share is forecast to decline from 6% in 2025 to 5% in 2035, as Asia-Pacific gains stronger momentum. The UK market is shaped by greenhouse farming and vertical farms using AI-powered climate control and nutrient management systems.

Demand for crop health monitoring and pest management software is strengthening, as growers align production with clean-label and sustainable food standards. Cloud-based platforms remain the preferred deployment mode, offering integration with IoT-based monitoring systems that support scalability for mid-sized farms. While overall expansion is moderate, the UK retains significance through innovation-led adoption and strong emphasis on resource efficiency in greenhouse production.

A CAGR of 5.4% has been projected for Germany, reflecting steady growth in a market shaped by strict sustainability standards and compliance requirements. Market share is expected to decline from 7% in 2025 to 6% in 2035, as faster adoption in Asia-Pacific offsets Europe’s maturity. German growers are emphasizing AI applications in nutrient formulation and environmental control to align with the European Union’s green transition policies.

On-premise deployment retains relevance due to stringent data security preferences, though cloud-based platforms are steadily gaining ground. Greenhouses form the backbone of AI integration, particularly in vegetables and herbs, where efficiency and quality assurance remain essential. Germany is expected to retain influence through its leadership in precision farming technologies, despite slower growth compared to Asian markets.

A CAGR of 9.1% has been projected for China, positioning it as one of the fastest-expanding national markets globally. Market share is expected to rise from 16% in 2025 to 21% in 2035, overtaking the United States as the largest contributor. Adoption is being driven by rapid scaling of vertical farms and container-based systems in urban centers, supported by government incentives for food security and sustainable farming.

AI-powered predictive analytics and crop imaging solutions are increasingly integrated, enabling farmers to monitor and optimize yields in real time. Cloud-based platforms dominate deployment, offering scalability and cost-effectiveness for large commercial growers. With strong investment in agri-tech startups and advanced indoor farming ecosystems, China is forecast to play a central role in shaping the future of AI-driven hydroponic farming.

A CAGR of 9.8% has been projected for India, making it the fastest-growing market globally. Market share is expected to rise from 9% in 2025 to 12% in 2035, reflecting accelerated modernization of agriculture and urban food systems. The surge is being driven by commercial adoption of nutrient optimization and yield forecasting software, which enable scalability in large hydroponic farms supplying urban centers.

Cloud-based platforms dominate, supported by lower infrastructure costs and wide scalability, while AI-powered pest management and crop health monitoring are gaining prominence. Government initiatives promoting sustainable farming and private investment in agri-tech startups are strengthening the ecosystem. By 2035, India is expected to emerge as a key hub for AI-driven hydroponic farming, bridging efficiency, affordability, and scalability.

A CAGR of 6.0% has been projected for Japan, reflecting balanced growth in a mature but innovation-focused market. Ethanol and imaging-driven AI applications in vertical farms and greenhouses support adoption, while nutrient management software records the fastest expansion at 8.2% CAGR. Market share is forecast to grow slightly from 8% in 2025 to 9% in 2035, supported by strong investment in urban farming technologies.

Cloud-based platforms dominate deployment, while advanced imaging and automation tools reinforce precision in crop management. Japan’s reputation for technological sophistication positions it as a leader in premium, innovation-led adoption of AI for hydroponics.

| Software Type | Market Value Share, 2025 |

| Farm Management Platforms | 30.00% |

| Others | 70.00% |

A CAGR of 5.6% has been projected for South Korea, reflecting steady growth in a market focused on sustainability and digital integration. Cloud-based platforms dominate adoption, accounting for 68.0% share in 2025, and are expanding rapidly at 7.6% CAGR due to scalability and integration with smart farming ecosystems. On-premise deployment, with 32.0% share, grows more modestly at 4.2% CAGR, but retains importance in research institutions and farms prioritizing data sovereignty.

AI applications in crop monitoring, nutrient optimization, and climate control are reinforcing efficiency across vertical farms and greenhouses, aligning with South Korea’s national carbon neutrality goals. The market’s growth is expected to be shaped by innovation-driven adoption, partnerships between technology providers and local farms, and strong alignment with smart agriculture policies.

| Deployment Mode | Market Value Share, 2025 |

|---|---|

| Cloud-Based | 68.00% |

| Others | 32.00% |

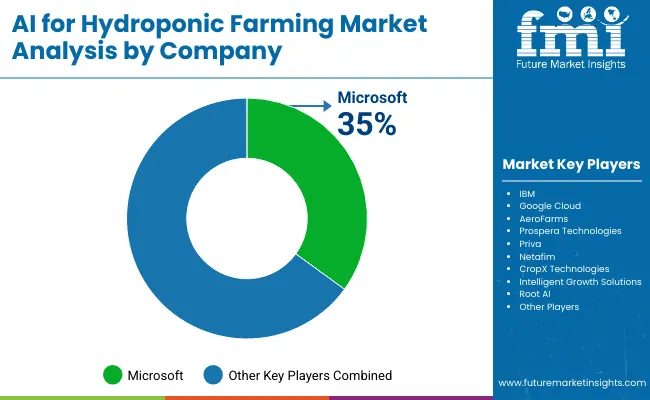

| Company | Global Value Share 2025 |

|---|---|

| Microsoft | 35 .0% |

| Others | 65 .0% |

The AI in Hydroponic Farming Market is characterized by a blend of global technology leaders, agri-tech innovators, and specialized solution providers. Established players such as Microsoft, IBM, and Google Cloud are extending their AI platforms into agriculture, offering predictive analytics, imaging solutions, and resource optimization tools tailored for hydroponic systems.

Agri-tech specialists including Prospera Technologies, AeroFarms, Priva, and Netafim have gained recognition through integration of AI with nutrient optimization, crop monitoring, and climate automation. Mid-sized firms and startups are increasingly influential, particularly in Asia-Pacific, where companies such as CropX Technologies and Intelligent Growth Solutions are innovating with cloud-based monitoring platforms and remote AI support services.

Competitive advantage is progressively shifting from standalone software provision to ecosystem integration, where AI solutions are bundled with IoT sensors, automation modules, and real-time data analytics. Partnerships between technology firms and commercial growers are reinforcing adoption, as integrated systems deliver measurable improvements in yield, quality, and resource efficiency.

Subscription-based service models, including remote monitoring and AI-assisted farm management, are gaining traction, providing scalability and accessibility to mid-sized growers. Over the next decade, competitive positioning will increasingly depend on the ability to deliver sustainability-driven, AI-enabled platforms that combine affordability, reliability, and innovation in controlled-environment farming.

Key Developments in AI for Hydroponic Farming Market

| Item | Value |

|---|---|

| Market Size, 2025 | USD 370.4 Million |

| Market Size, 2035 | USD 677.4 Million |

| Absolute Growth (2025 to 2035) | USD 307.0 Million |

| CAGR (2025 to 2035) | 6.20% |

| Value Added 2025 to 2030 | USD 123.6 Million |

| Value Added 2030 to 2035 | USD 183.4 Million |

| Software Type (2025) | Farm Management Platforms: 28.0% (USD 103.7 Million); Others: 72.0% |

| Deployment Mode (2025) | Cloud-Based: 65.0% (USD 240.8 Million); Others: 35.0% |

| Application (2025) | Nutrient Formulation & Optimization: 22.0% (USD 81.5 Million); Others: 78.0% |

| Farm Type (2025) | Indoor Vertical Farms: 40.0%; Greenhouses: 38.0% |

| Key Growth Regions (CAGR) | India 9.8%; China 9.1%; South Asia & Pacific 7.8%; East Asia 7.2% |

| Regions Covered | North America, Latin America, Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | United States, United Kingdom, Germany, France, China, India, Japan, South Korea, Brazil |

| Key Companies Profiled | Microsoft, IBM, Google Cloud, AeroFarms , Prospera Technologies, Priva , Netafim, CropX Technologies, Intelligent Growth Solutions, Root AI |

| Additional Attributes | Integration of AI with IoT sensors, cloud-based scalability, nutrient optimization, and sustainability alignment drive ado ption. |

The market is valued at USD 370.4 Million in 2025, led by strong adoption of farm management platforms and cloud-based solutions.

The market is expected to reach USD 677.4 Million by 2035, reflecting an absolute growth of USD 307.0 Million.

The market is forecast to expand at a 6.2% CAGR during 2025 to 2035.

Farm management platforms dominate the software category, holding 28.0% share in 2025.

Cloud-based deployment leads with 65.0% share in 2025 and grows at a 7.1% CAGR, supported by scalability and integration with IoT.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

AI-powered Spinal Surgery Market Size and Share Forecast Outlook 2025 to 2035

AI-Powered Sleep Technologies Market Size and Share Forecast Outlook 2025 to 2035

AI-Powered Gait & Mobility Analytics Market Size and Share Forecast Outlook 2025 to 2035

AI-Powered Behavioral Therapy Market Size and Share Forecast Outlook 2025 to 2035

AI-Enabled Behavioral Therapy Market Size and Share Forecast Outlook 2025 to 2035

AI-powered In-car Assistant Market Forecast and Outlook 2025 to 2035

Airborne Molecular Contamination Control Services Market Forecast and Outlook 2025 to 2035

Airflow Balancer Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Cabin Environment Sensor Market Forecast and Outlook 2025 to 2035

AI-defined Vehicle Market Forecast and Outlook 2025 to 2035

AI in Oil and Gas Market Forecast and Outlook 2025 to 2035

Aircraft Flight Control System Market Size and Share Forecast Outlook 2025 to 2035

Airborne Radar Market Size and Share Forecast Outlook 2025 to 2035

AI-driven Predictive Maintenance Market Forecast and Outlook 2025 to 2035

AI Animation Tool Market Forecast Outlook 2025 to 2035

Aircraft Electric Motor Market Forecast Outlook 2025 to 2035

AI in Packaging Market Forecast Outlook 2025 to 2035

Airport Ground Transportation Market Forecast and Outlook 2025 to 2035

AI Waste Sorting Robots Market Forecast and Outlook 2025 to 2035

AI Image Editor Market Forecast and Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA