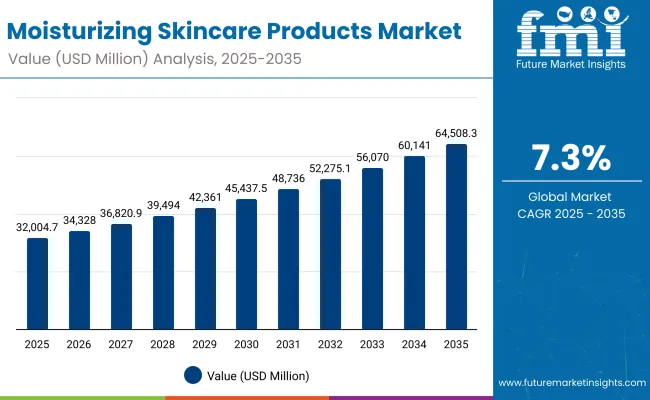

The Moisturizing Skincare Products Market is expected to record a valuation of USD 32,004.7 million in 2025 and USD 64,508.3 million in 2035, with an increase of USD 32,503.6 million, which equals a growth of 202.8% over the decade. The overall expansion represents a CAGR of 7.3% and a 2X increase in market size.

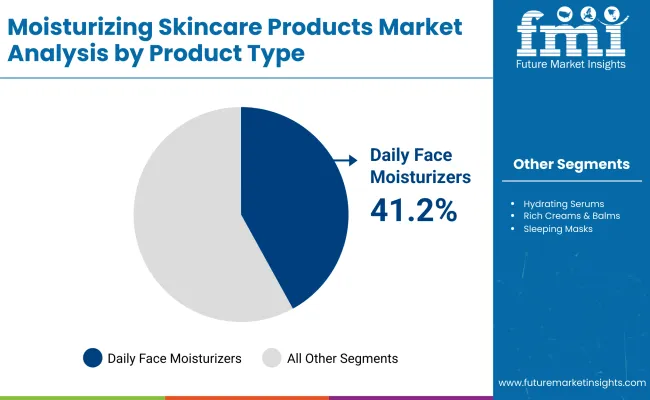

During the first five-year period from 2025 to 2030, the market increases from USD 32,004.7 million to USD 45,437.5 million, adding USD 13,432.8 million, which accounts for 41.3% of the total decade growth. This phase records steady adoption in daily face moisturizers and hydrating serums, driven by expanding consumer awareness of barrier repair and hydration layering. Daily face moisturizers dominate this period as they cater to over 41.2% of total applications requiring high emollient retention.

The second half from 2030 to 2035 contributes USD 19,070.8 million, equal to 58.7% of total growth, as the market jumps from USD 45,437.5 million to USD 64,508.3 million. This acceleration is powered by widespread adoption of multi-molecular hyaluronic formulations, ceramide-infused creams, and AI-personalized moisturizer recommendations in retail and e-commerce channels. Hydrating serums and sleeping masks together capture a larger share above 58.8% by the end of the decade. Digital skin diagnostic tools and cloud-linked skincare analysis platforms add recurring service revenue, increasing the software-driven personalization share beyond 20% in total market value.

Moisturizing Skincare Products Market Key Takeaways

| Metric | Value |

|---|---|

| Moisturizing Skincare Products Market Estimated Value in (2025E) | USD 32,004.7 million |

| Moisturizing Skincare Products Market Forecast Value in (2035F) | USD 64,508.3 million |

| Forecast CAGR (2025 to 2035) | 7.3% |

From 2020 to 2024, the Moisturizing Skincare Products Market grew steadily as dermatologist-endorsed hydration brands expanded their global distribution footprint. During this period, the competitive landscape was dominated by established clinical brands controlling nearly 70-75% of revenue, with leaders such as CeraVe, Neutrogena, and Eucerin focusing on barrier-repair and hyaluronic acid-based formulations. Competitive differentiation relied on clinical validation, dermatological trust, and affordable mass-premium pricing, while digital engagement remained secondary. Service-driven personalization models had limited presence, contributing less than 10% of total market value.

Demand for Moisturizing Skincare Products will expand to USD 32,004.7 million in 2025, and the revenue mix will shift as digital personalization and AI-driven skin diagnostics grow to over 20% share. Traditional leaders face competition from emerging digital-first brands leveraging data-based recommendations and subscription refill models. Major brands are pivoting toward hybrid ecosystems integrating e-commerce, tele-dermatology, and smart skin analytics to retain relevance. New entrants offering cloud-linked skin tracking and AR-based consultation platforms are gaining share, as competitive advantage shifts from ingredient innovation alone to digital connectivity, scalability, and recurring engagement streams.

The growing awareness of skin barrier health and hydration balance is fueling demand for moisturizing skincare products. Consumers increasingly prefer multi-functional formulations featuring humectants like hyaluronic acid, glycerin, and ceramides that restore and retain moisture. Expanding dermatological endorsements, combined with visible efficacy claims and adaptive textures for diverse climates, are amplifying product adoption. This demand shift is supported by the expansion of clinical skincare brands and enhanced product availability through online and offline retail channels.

The market’s growth is accelerated by digital transformation and personalized skincare ecosystems. Online platforms, influencer-led content, and AI-based skin analysis tools are enabling precise product recommendations and stronger consumer engagement. Subscription-based models and digital refill programs are expanding repeat purchase behavior across emerging markets. Additionally, the surge in virtual dermatology consultations and social commerce trends has strengthened product visibility and consumer trust, positioning digital-first brands and established players for long-term market expansion.

The Moisturizing Skincare Products Market is segmented by product type, key ingredients, skin type, distribution channel, end user, and region. By product type, the market includes daily face moisturizers, hydrating serums, rich creams & balms, and sleeping masks, representing the core hydration formats across mass and premium categories.

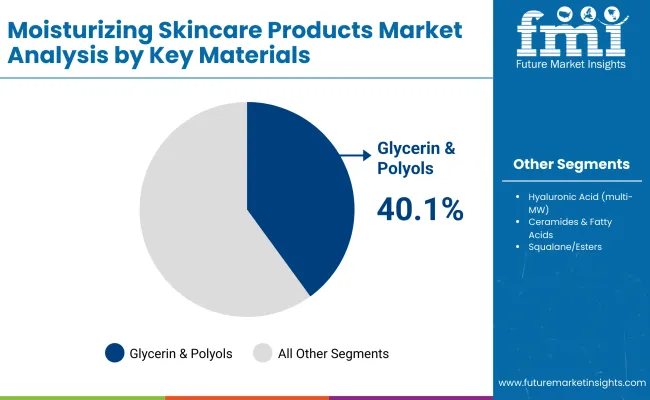

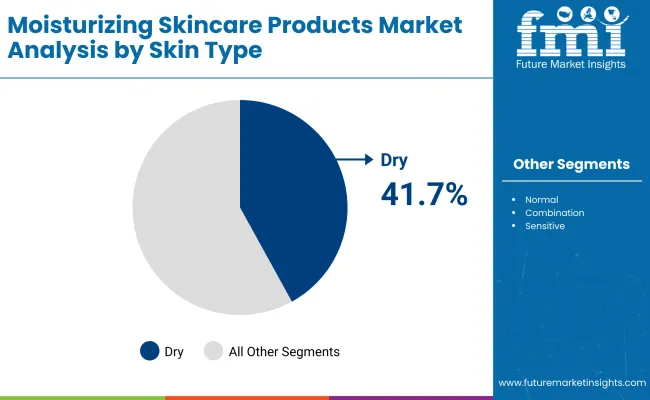

By key ingredients, segmentation covers glycerin & polyols, hyaluronic acid (multi-MW), ceramides & fatty acids, and squalane/esters, which define product efficacy and texture. By skin type, the market is divided into dry, normal, combination, and sensitive skin formulations tailored to moisture retention and barrier repair.

Distribution channels include pharmacies/drugstores, e-commerce, supermarkets & hypermarkets, and specialty beauty retail, reflecting both clinical and retail-driven consumer access. End users encompass women, men, unisex family care, and senior skin, capturing demographic and lifestyle-specific hydration needs.

Regionally, the market spans North America, Europe, East Asia, South Asia & Pacific, Latin America, and the Middle East & Africa, with China, India, Japan, and the USA emerging as key growth centers through 2035.

| Product Type | Value Share % 2025 |

|---|---|

| Daily face moisturizers | 41.2% |

| Others | 58.8% |

The hydrating serums segment is projected to contribute 58.8% of the Moisturizing Skincare Products Market revenue in 2025, maintaining its lead as the dominant product category. Growth is driven by the widespread consumer shift toward lightweight, fast-absorbing, and high-hydration formulas that cater to multiple skin types.

Serums containing multi-molecular hyaluronic acid and niacinamide are preferred for their visible results and compatibility with layered skincare routines. The segment’s growth is also supported by innovation in texture technology and enhanced ingredient stability. With rising dermatological validation and expanding online sales channels, hydrating serums are expected to remain at the core of the moisturizing skincare portfolio.

| Key Materials | Value Share % 2025 |

|---|---|

| Glycerin & polyols | 40.1% |

| Others | 59.9% |

The hyaluronic acid (multi-MW) segment is forecasted to hold 58.8% of the market share in 2025, led by its extensive use in high-performance moisturizers and serums. Its superior water-retention ability, skin-plumping effect, and proven biocompatibility have made it a preferred ingredient for daily hydration and anti-aging care.

Multi-weight formulations combining low and high molecular weights enhance penetration and lasting moisture, appealing to both mass and premium consumers. As demand for clinically backed ingredients increases, hyaluronic acid remains the gold standard in advanced moisturizing formulations, fueling consistent market expansion through 2035.

| Skin Type | Value Share % 2025 |

|---|---|

| Dry | 41.7% |

| Others | 58.3% |

Products targeting normal and combination skin are projected to account for 59.9% of the Moisturizing Skincare Products Market revenue in 2025, establishing them as the leading skin-type category. This dominance reflects consumer demand for versatile, all-season moisturizers that balance hydration without heaviness. Gel-cream hybrids, oil-free emulsions, and adaptive barrier formulations are widely used in this category, offering comfort and breathability.

Advancements in skin microbiome research and personalized skincare diagnostics are further propelling demand. As climate-adaptive and multi-functional moisturizers gain traction, products catering to normal and combination skin are expected to sustain leadership across global markets.

Rising Focus on Skin Barrier Health and Hydration Science

Growing consumer awareness of the skin barrier’s role in overall dermatological health is propelling the demand for moisturizing skincare products. Modern consumers seek formulations enriched with humectants, ceramides, and fatty acids that restore hydration while reinforcing the lipid barrier.

The clinical endorsement of barrier-repair products by dermatologists and increased inclusion of active ingredients like multi-molecular hyaluronic acid are amplifying adoption. This shift from cosmetic to functional skincare is also driving premiumization, as consumers increasingly associate hydration with anti-aging and long-term skin health benefits.

Expansion of E-Commerce and Personalized Skincare Platforms

The rapid rise of digital retail channels, AI-driven skin analysis tools, and influencer marketing has transformed how moisturizing skincare products are discovered and purchased. E-commerce platforms now enable hyper-personalized recommendations based on skin type, age, and climate conditions.

Subscription-based delivery models and refill systems further enhance customer retention and sustainability appeal. Leading brands leverage data analytics to tailor product suggestions, while digital dermatology consultations accelerate adoption. This seamless integration of technology and skincare retail is driving strong revenue growth, particularly across Asia-Pacific and North American online marketplaces.

Ingredient Sensitivity and Product Compatibility Concerns

While demand for moisturizers continues to expand, ingredient-related sensitivities and allergic reactions present a key restraint to market growth. Formulations containing synthetic emollients, fragrances, or alcohol-based compounds can trigger irritation among sensitive users. This challenge is heightened by the lack of standardized labeling for hypoallergenic claims across regions.

As consumers increasingly seek dermatologically tested and fragrance-free alternatives, brands must balance efficacy with tolerance. Regulatory scrutiny over ingredient safety and rising expectations for clean formulations may limit certain product innovations, impacting speed-to-market for new moisturizing solutions.

Hybrid Moisturizers with Functional and Aesthetic Benefits

A defining trend shaping the market is the emergence of hybrid moisturizers that combine hydration with targeted skin benefits such as brightening, firming, or sun protection. Consumers prefer multi-functional products that simplify skincare routines while delivering visible results.

These formulations often integrate actives like niacinamide, peptides, and SPF agents, merging skincare and cosmetic performance. Additionally, sustainable packaging and refillable jars are gaining traction among eco-conscious consumers. The convergence of dermatological efficacy, sensorial texture, and environmental responsibility is setting a new standard for innovation in the moisturizing skincare segment.

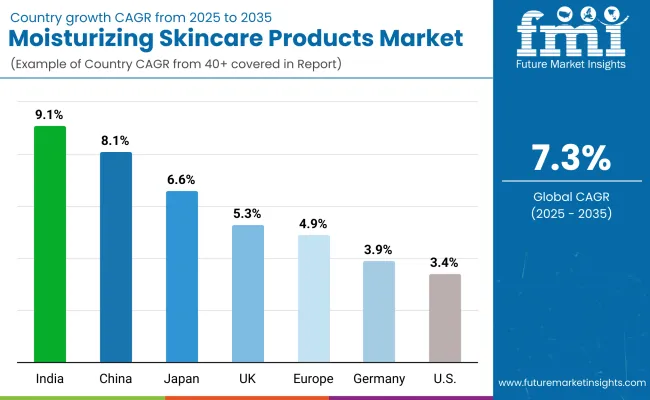

| Country | Estimated CAGR (2025 to 2035) |

|---|---|

| China | 8.1% |

| USA | 3.4% |

| India | 9.1% |

| UK | 5.3% |

| Germany | 3.9% |

| Japan | 6.6% |

| Europe | 4.9% |

The global Moisturizing Skincare Products Market demonstrates significant regional variations in consumer adoption, driven by demographic structure, climate conditions, and evolving beauty standards. Asia-Pacific stands out as the fastest-growing region, anchored by India at 9.1% CAGR and China at 8.1% CAGR, supported by a youthful population, expanding middle-class income, and rapid urbanization.

India’s growth is propelled by mass-market affordability and the popularity of herbal and hybrid moisturizers, while China’s demand is led by premium hydration serums and clinical skincare brands. Japan (6.6%) maintains momentum through innovation in water-based emulsions and minimalist beauty routines emphasizing moisture balance.

Europe, led by the UK (5.3%) and Germany (3.9%), shows steady expansion supported by clean beauty formulations, regulatory compliance on ingredient safety, and high consumer trust in dermatological products. The USA market (3.4%) grows moderately, reflecting maturity and saturation in the premium segment, though innovation in hybrid moisturizers and online retail personalization continues to sustain value growth.

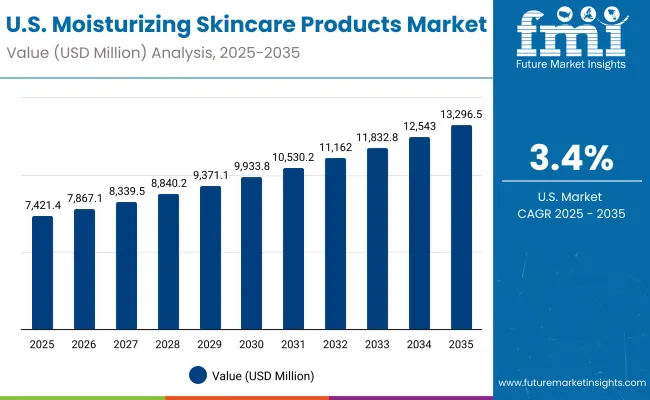

| Year | USA Moisturizing Skincare Products Market (USD Million) |

|---|---|

| 2025 | 7421.48 |

| 2026 | 7867.12 |

| 2027 | 8339.51 |

| 2028 | 8840.27 |

| 2029 | 9371.10 |

| 2030 | 9933.80 |

| 2031 | 10530.29 |

| 2032 | 11162.60 |

| 2033 | 11832.87 |

| 2034 | 12543.39 |

| 2035 | 13296.58 |

The Moisturizing Skincare Products Market in the United States is projected to grow at a CAGR of 3.4%, led by strong consumer preference for dermatologist-endorsed brands and premium hydration formulations. Growth is driven by expanding demand for barrier-repair creams, oil-free gels, and sensitive-skin moisturizers. E-commerce remains a dominant channel, supported by influencer marketing and personalized skincare recommendations. Premium and clinical brands like CeraVe, Cetaphil, and Neutrogena continue to lead, while AI-based skin analysis tools are reshaping product discovery and retention strategies.

The Moisturizing Skincare Products Market in the United Kingdom is expected to grow at a CAGR of 5.3%, supported by increasing adoption of clean-beauty formulations and fragrance-free moisturizers. The market benefits from growing awareness of hydration-led anti-aging care and dermatologist-recommended brands. Retailers are expanding eco-conscious offerings with recyclable packaging and refillable skincare jars. Online beauty platforms and pharmacy chains are integrating digital skin diagnostic tools to improve product matching. The regulatory emphasis on ingredient safety and transparent labeling continues to reinforce consumer confidence.

India is witnessing rapid growth in the Moisturizing Skincare Products Market, which is forecast to expand at a CAGR of 9.1% through 2035. Rising disposable income, climate-adaptive formulations, and social media-driven beauty trends are key growth drivers. Domestic brands are capitalizing on herbal, ayurvedic, and hybrid moisturizer formulations, catering to local climatic needs. Increasing penetration in tier-2 and tier-3 cities through e-commerce and direct-to-consumer channels has broadened market access. Multinational brands are also localizing formulations for tropical humidity and diverse skin tones.

The Moisturizing Skincare Products Market in China is expected to grow at a CAGR of 8.1%, the highest among major global economies. Growth is driven by surging demand for high-performance hydrating serums and K-beauty-inspired formulations. Domestic innovation, premium imports, and influencer-led marketing have made moisturizers a daily essential across demographics. Government initiatives promoting domestic cosmetic R&D and clean formulation standards further support industry growth. Expanding e-commerce ecosystems like Tmall and Douyin are central to product visibility and recurring sales.

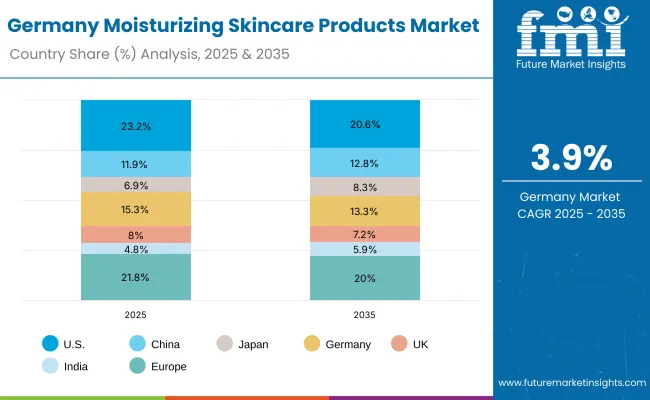

| Country | 2025 Share (%) |

|---|---|

| USA | 23.2% |

| China | 11.9% |

| Japan | 6.9% |

| Germany | 15.3% |

| UK | 8.0% |

| India | 4.8% |

| Europe | 21.8% |

| Country | 2035 Share (%) |

|---|---|

| USA | 20.6% |

| China | 12.8% |

| Japan | 8.3% |

| Germany | 13.3% |

| UK | 7.2% |

| India | 5.9% |

| Europe | 20.0% |

The Moisturizing Skincare Products Market in Germany is projected to grow at a CAGR of 3.9%, supported by high consumer preference for dermatologically tested, fragrance-free, and sensitive-skin-friendly formulations. German consumers emphasize product safety, clinical efficacy, and ingredient transparency, driving growth for pharmacy-based brands such as Eucerin, Nivea, and La Roche-Posay.

Moisturizers enriched with ceramides, fatty acids, and glycerin are favored due to their proven barrier-repair benefits. Regulatory rigor under EU cosmetic standards promotes clean-label formulations and eco-friendly packaging. The country’s mature yet innovation-driven beauty retail ecosystem continues to support premium skincare expansion.

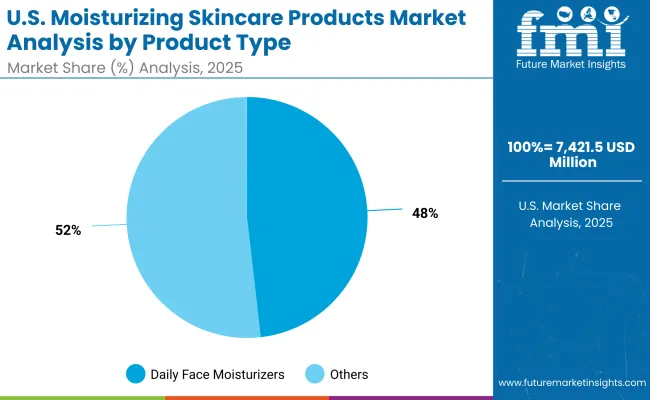

| USA By Product Type | Value Share % 2025 |

|---|---|

| Daily face moisturizers | 48.2% |

| Others | 51.8% |

The Moisturizing Skincare Products Market in the United States is projected at USD 7,421.5 million in 2025. Daily face moisturizers contribute 48.2%, while other product types collectively hold 51.8%, reflecting a balanced consumer preference across lightweight and intensive hydration formats. This slight edge toward diversified formulations arises from the rising demand for multitasking serums, barrier-repair creams, and hybrid moisturizer-serum blends.

Premium pharmacy brands and dermatologist-backed labels continue to dominate, emphasizing clinical efficacy and sensitive-skin compatibility. Growth is reinforced by personalization tools, AI-powered product recommendations, and clean-label transparency shaping modern skincare decisions.

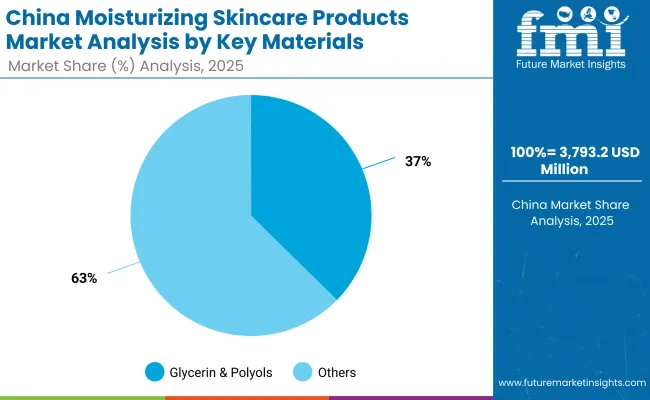

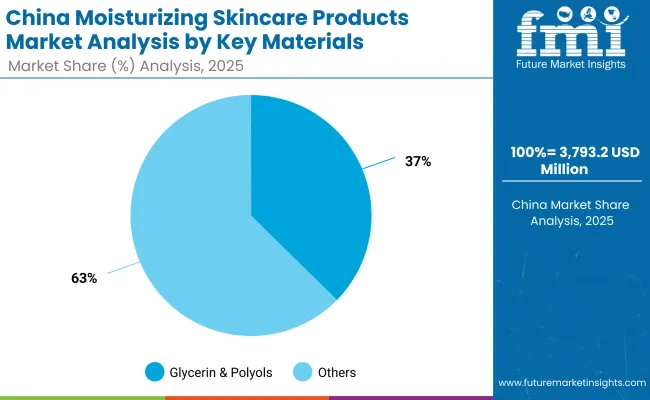

| China By Key Materials | Value Share % 2025 |

|---|---|

| Glycerin & polyols | 37.4% |

| Others | 62.6% |

The Moisturizing Skincare Products Market in China is valued at USD 3,793.2 million in 2025, with formulations based on hyaluronic acid and other advanced actives holding 62.6%, followed by glycerin and polyols at 37.4%. The dominance of hyaluronic formulations reflects China’s growing appetite for high-efficacy hydration products emphasizing deep moisture retention and skin elasticity.

This preference is amplified by the popularity of K-beauty-inspired layering routines and the influence of clinical skincare brands. Rapid innovation by local manufacturers, integration of AI-based skin testing, and extensive use of e-commerce platforms such as Tmall and Douyin are creating scalable market opportunities.

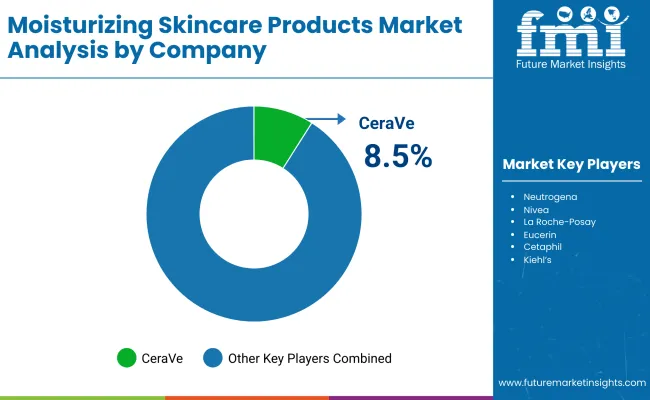

| Company | Global Value Share 2025 |

|---|---|

| CeraVe | 8.5% |

| Others | 91.5% |

The Moisturizing Skincare Products Market is moderately fragmented, featuring a mix of global leaders, dermatology-backed brands, and niche premium innovators competing across diverse consumer segments. Global market leaders such as CeraVe, Neutrogena, and Nivea hold significant share, supported by dermatologist endorsements, clinical validation, and barrier-repair formulations rich in ceramides and hyaluronic acid. Their strategies emphasize science-backed claims, clean-label transparency, and digital retail expansion through pharmacy and e-commerce channels.

Mid-tier brands including Eucerin, La Roche-Posay, and Cetaphil focus on sensitive-skin and therapeutic moisturizers, expanding reach through dermatologist networks and sustainability-certified packaging. Emerging premium players such as Kiehl’s, Olay, and The Ordinary are redefining value perception through personalized routines, active-rich compositions, and hybrid serum-moisturizer launches.

Competitive differentiation is shifting toward AI-powered skin analysis, AR-based virtual try-ons, and data-driven product customization, marking a transition from traditional brand loyalty to performance-based consumer engagement. Subscription skincare programs, digital consultations, and cross-platform retail strategies are expected to define long-term growth dynamics.

Key Developments in Moisturizing Skincare Products Market

| Item | Value |

|---|---|

| Quantitative Units | USD 32,004.7 Million |

| Product Type | Daily face moisturizers, Hydrating serums, Rich creams & balms, Sleeping masks |

| Key Ingredients | Glycerin & polyols, Hyaluronic acid (multi-MW), Ceramides & fatty acids, Squalane/esters |

| Skin Type | Dry, Normal, Combination, Sensitive |

| Channel | Pharmacies/drugstores, E-commerce, Supermarkets & hypermarkets, Specialty beauty retail |

| End User | Women, Men, Unisex family care, Senior skin |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | CeraVe, Neutrogena, Nivea, La Roche-Posay, Eucerin, Cetaphil, Kiehl’s, Olay, The Ordinary, Clinique |

| Additional Attributes | Dollar sales by product type and key ingredient segment, adoption trends across dermatology clinics, retail pharmacies, and e-commerce platforms, rising demand for hydration-focused formulations with clinically validated actives, sector-specific growth in women’s skincare, men’s grooming, and senior skin hydration, revenue segmentation by premium and mass-market price tiers, integration of AI-based skin diagnostics, AR-enabled virtual skin analysis, and personalized product recommendation platforms, regional growth trends influenced by digital beauty ecosystems and sustainability-driven packaging innovations, and advancements in multi-molecular hyaluronic acid, ceramide complexes, and squalane-based moisturizing technologies. |

The global Moisturizing Skincare Products Market is estimated to be valued at USD 32,004.7 million in 2025.

The market size for the Moisturizing Skincare Products Market is projected to reach USD 64,508.3 million by 2035.

The Moisturizing Skincare Products Market is expected to grow at a 7.3% CAGR between 2025 and 2035.

The key product types in the Moisturizing Skincare Products Market are daily face moisturizers, hydrating serums, rich creams & balms, and sleeping masks.

In terms of product range, Daily face moisturizers are expected to command a 41.2% share in the Moisturizing Skincare Products Market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Skincare Products Market Size and Share Forecast Outlook 2025 to 2035

Men’s Skincare Products Market Size, Growth, and Forecast for 2025 to 2035

Buffering Skincare Products Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Anti-Fatigue Skincare Products Market Size and Share Forecast Outlook 2025 to 2035

Incontinence Skincare Products Market Analysis by Product Type, Price, End-User, Sales Channel and Region 2025 to 2035

Anti-Inflammatory Skincare Products Market Size and Share Forecast Outlook 2025 to 2035

Allantoin Extract for Skincare Products Market Analysis – Trends, Growth & Forecast 2025 to 2035

Moisturizing Body Creams Market Size and Share Forecast Outlook 2025 to 2035

Skincare Supplement Market Size and Share Forecast Outlook 2025 to 2035

Skincare Oil Market Size and Share Forecast Outlook 2025 to 2035

Moisturizing Agents Market Size and Share Forecast Outlook 2025 to 2035

Skincare Nutritional Serum Market Size and Share Forecast Outlook 2025 to 2035

Products from Food Waste Industry Analysis in Korea Size, Share and Forecast Outlook 2025 to 2035

Products from Food Waste in Japan - Size, Share, and Forecast Outlook 2025 to 2035

Skincare Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Products from Food Waste Market Analysis - Size, Growth, and Forecast 2025 to 2035

Skincare Packaging Market Size, Share & Forecast 2025 to 2035

Skincare Industry in India – Trends & Growth Forecast 2024-2034

Global Skincare Treatment Market Analysis – Size, Share & Forecast 2024-2034

USA Products from Food Waste Market Growth – Trends, Demand & Outlook 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA