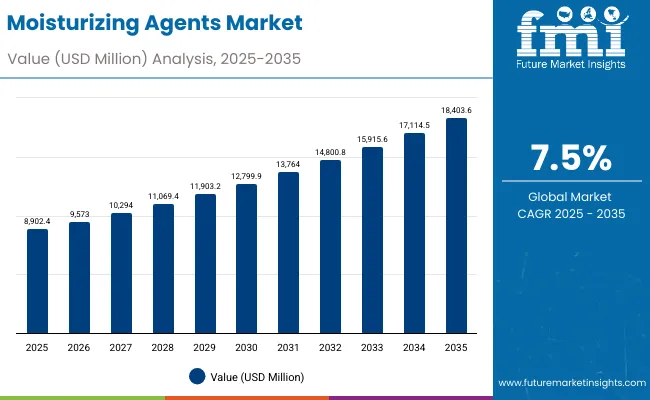

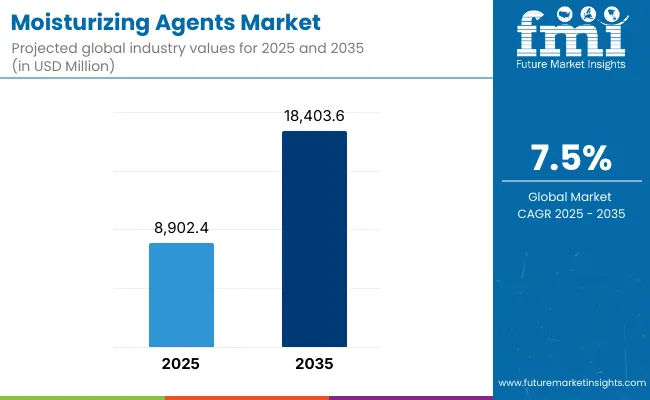

The global market for moisturizing agents has been valued at USD 8,902.4 million in 2025 and is forecasted to reach USD 18,403.6 million by 2035. This represents an addition of USD 9,501.2 million over the decade, translating into a 193% expansion in market value.

Moisturizing Agents Market Key Takeaways

| Metric | Value |

|---|---|

| Moisturizing Agents Market Estimated Value in (2025E) | USD 8,902.4 million |

| Moisturizing Agents Market Forecast Value in (2035F) | USD 18,403.6 million |

| Forecast CAGR (2025 to 2035) | 7.50% |

Growth over the period corresponds to a CAGR of 7.5%, signaling a strong demand trajectory across personal care and dermocosmetic formulations. The overall doubling of market size is expected to be underpinned by innovation in raw material functionality, preference for plant-derived inputs, and accelerated adoption in premium skincare.

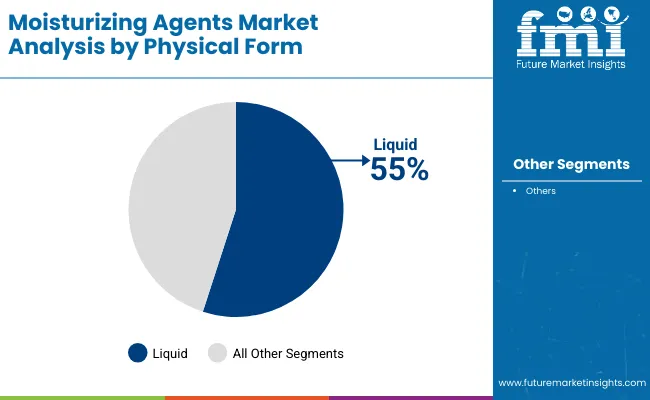

During the first five-year horizon from 2025 to 2030, the market is projected to expand from USD 8,902.4 million to USD 12,799.9 million, adding USD 3,897.5 million and accounting for 41% of the total decade growth. This phase is expected to be marked by steady uptake in mass personal care and facial care categories, where consistent demand for hydration agents will reinforce the adoption of both polyols and emollients. Liquid formats, which already account for 55.0% of the segment in 2025, are expected to maintain dominance due to ease of incorporation in emulsions and wide applicability across leave-on formulations.

The second half of the forecast period, 2030 to 2035, is anticipated to deliver USD 5,603.7 million of additional revenue, representing nearly 59% of total growth. This accelerated phase will be driven by heightened consumer alignment with sustainable and plant-based chemistries, which hold 55.7% of share in 2025. Encapsulated delivery systems and claim-driven dermocosmetic adoption are projected to reinforce higher value realization, positioning suppliers of advanced plant-based agents for stronger competitive gains.

From 2020 to 2024, steady expansion was observed in moisturizing agent demand, supported by wider adoption of hydration-focused formulations in personal care and dermocosmetics. The market is projected to advance to USD 8,902.4 million in 2025, driven by increasing reliance on plant-derived inputs and functional delivery systems. Competitive positioning has been led by diversified ingredient suppliers, with the top global player capturing 8.1% market share in 2025.

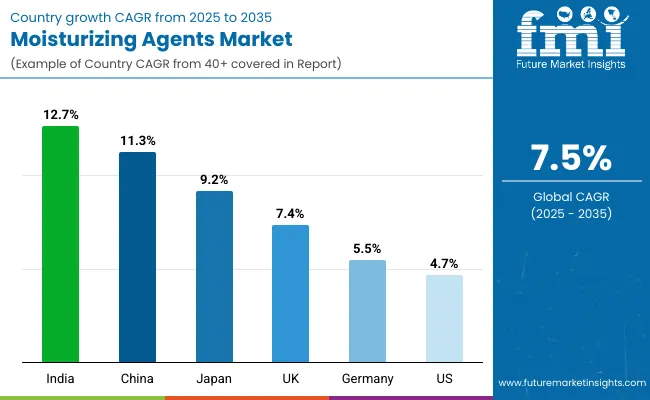

By 2035, revenue is expected to reach USD 18,403.6 million, with nearly 2X growth over the decade. Strongest growth momentum is anticipated in Asia-Pacific, where double-digit CAGRs in India (12.7%) and China (11.3%) will shape procurement strategies. As sustainability and traceability become central to buyer scorecards, differentiation is projected to shift toward bio-based chemistries, low-carbon manufacturing, and encapsulated delivery systems. The long-term competitive edge is likely to be defined less by commodity inputs and more by innovation in plant-derived performance ingredients, regulatory compliance, and turnkey formulation support.

The growth of the Moisturizing Agents Market has been attributed to the rising demand for hydration-focused ingredients across personal care, premium skincare, and dermocosmetic applications. Increasing consumer awareness of skin barrier health and long-lasting moisturization benefits has been driving higher inclusion levels of advanced agents in formulations. Plant-based and bio-aligned ingredients have been preferred as regulatory frameworks and retailer clean-label standards evolve, encouraging brand owners to reformulate with safer, traceable inputs. Delivery innovations such as encapsulation and pre-blended emulsions have been adopted to enhance efficacy and streamline formulation processes. Rapid expansion in Asia-Pacific, led by double-digit growth in China and India, has been strengthening the market outlook, supported by an expanding middle-class population and growing premium product adoption. Global suppliers have been differentiating through sustainability credentials, clinical substantiation, and turnkey support, reinforcing long-term value creation. This combination of consumer preference, regulatory pressure, and technological advancement has been expected to sustain robust growth momentum through 2035.

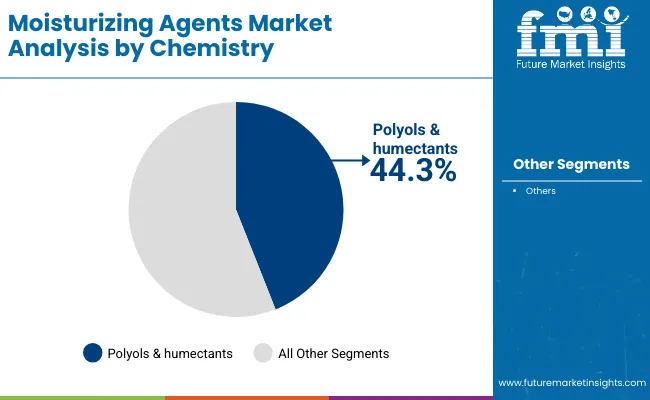

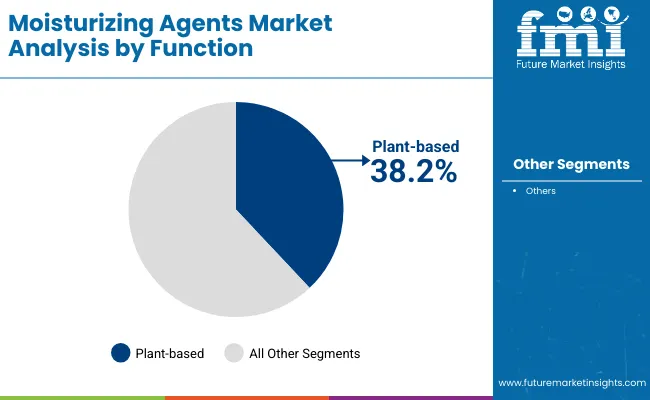

The Moisturizing Agents Market has been structured across chemistry, function, and physical form, reflecting how procurement decisions are shaped in the formulation space. Each dimension highlights the role of ingredient efficiency, sustainability, and processing convenience in driving adoption. Polyols & humectants represent the leading chemistry sub-segment owing to their proven hydration capacity and wide regulatory acceptance. On the functional side, plant-based ingredients hold a strong position as clean-label and bio-aligned solutions gain traction in premium skincare and dermocosmetics. In terms of physical form, liquids dominate due to their ease of incorporation, scalability, and compatibility with diverse formulation systems. Collectively, these leading categories are expected to sustain their influence as demand continues to shift toward performance-driven and sustainable solutions.

| Chemistry | Market Value Share, 2025 |

|---|---|

| Polyols & humectants | 44.3% |

| Others | 55.7% |

Chemistry selection has been anchored by polyols & humectants, the largest named sub-segment at 44.3% in 2025 (USD 3,943.76 million). Their leadership has been supported by proven humectancy across leave-on systems, broad regulatory acceptance, cost-effective inclusion levels, and reliable global supply. Consistent performance in water activity control and synergy with emollients has enabled use across mass and premium formulations. While the “others” bucket is numerically larger, it aggregates multiple chemistries and does not represent a single competitor; therefore leadership among identifiable options rests with polyols & humectants. Forward momentum is expected from higher-grade specifications, lower-impurity profiles, and optimized sensorial after-feel. Incremental growth is anticipated through multifunctional blends where polyols are paired with barrier-support actives to elevate long-lasting hydration claims.

| Function | Market Value Share, 2025 |

|---|---|

| Plant-based | 38.2% |

| Others | 61.8% |

Among explicitly named functional offerings, plant-based systems hold the leading position at 38.2% in 2025 (USD 3,400.72 million). Preference has been driven by clean-label positioning, renewable sourcing narratives, and alignment with retailer standards on traceability and allergens. Strong consumer resonance with botanical stories and compatibility with skin-barrier claims have supported adoption in facial care and dermocosmetic lines. Although the “others” group is larger numerically, it combines multiple system types; thus plant-based remains the largest identifiable functional route. Share resilience is expected as certifications, LCAs, and biodegradability metrics become standard in RFPs. Upgrading toward higher-purity extracts, fermentation-enabled actives, and data-backed efficacy is projected to sustain pricing power and reinforce plant-based leadership among named functional segments.

| Physical Form | Market Value Share, 2025 |

|---|---|

| Liquid | 55% |

| Others | 44.9% |

Liquid formats lead physical form with a 55.0% share in 2025 (USD 4,905.22 million). Dominance has been supported by straightforward dosing, rapid dissolution, and compatibility with standard emulsion processes, which compress batch times and reduce scrap risk. Liquids have enabled consistent sensorial outcomes, easier scale-up from pilot to commercial runs, and flexible incorporation into turnkey blends. Preference is expected to persist as processors target energy efficiency and packaging decarbonization, favoring forms that minimize heating and agitation requirements. Stability improvements and wider solvent-system options are projected to broaden use across high-actives and complex textures. Non-liquid forms will remain application-specific, but liquids are anticipated to retain the core role in moisturizing systems given their processing reliability and global regulatory familiarity.

Evolving sustainability mandates and advancing delivery technologies have redefined the dynamics of the Moisturizing Agents Market, even as cost pressures, raw material volatility, and compliance complexities continue to challenge suppliers navigating global demand for high-performance, multi-functional skin hydration systems.

Regulatory Convergence Favoring Bio-Aligned Ingredients

A powerful driver has been created by the convergence of regulatory frameworks in the USA, Europe, and Asia requiring stricter control of impurities, allergens, and residual solvents. This alignment has been anticipated to accelerate demand for bio-aligned moisturizing agents that meet multiple compliance regimes simultaneously. Suppliers offering verified life-cycle data and global dossier harmonization have been positioned to benefit disproportionately, as brand owners seek inputs that minimize reformulation risk across geographies. The shift from reactive compliance to proactive ingredient design is expected to transform procurement, rewarding suppliers that can deliver validated traceability alongside hydration efficacy. This convergence has been forecasted to establish long-term value creation by embedding sustainability as a commercial differentiator rather than a regulatory hurdle.

Capital Intensity of Advanced Delivery Systems

A key restraint has been observed in the capital intensity associated with encapsulated and controlled-release delivery formats. While demand has been rising for longer-lasting hydration and sensorial refinement, the cost of specialized equipment, microfluidization, and analytical validation has limited adoption beyond premium brands. Formulators with constrained budgets have been cautious, as upfront investment in technical infrastructure and extended validation timelines have raised barriers to scale. As a result, broader adoption of these delivery systems has been delayed, confining innovation to suppliers and brands with strong financial capacity. Unless cost curves decline through process innovation, this restraint is expected to create bifurcation between high-end formulations with advanced delivery and mainstream offerings relying on more traditional formats.

| Country | CAGR |

|---|---|

| China | 11.3% |

| USA | 4.7% |

| India | 12.7% |

| UK | 7.4% |

| Germany | 5.5% |

| Japan | 9.2% |

The Moisturizing Agents Market has exhibited varied growth patterns across major economies, shaped by consumer sophistication, regulatory standards, and innovation pipelines in skincare formulations. Asia has been positioned as the most dynamic growth hub, with India at 12.7% CAGR and China at 11.3% CAGR through 2035. India’s trajectory has been underpinned by an expanding middle class and surging demand for premium skincare, where domestic and multinational brands are intensifying raw material sourcing. In China, rapid adoption of dermocosmetic solutions and heightened focus on barrier repair have accelerated formulation upgrades, reinforcing demand for advanced moisturizing agents.

Japan has followed closely with a 9.2% CAGR, supported by a heritage of functional cosmetics and innovation in bio-fermented actives. Europe has maintained a steady profile at 6.8% CAGR, with compliance-led reformulation shaping opportunities for traceable and sustainable inputs. Within the region, Germany (5.5%) and the UK (7.4%) have shown resilience, reflecting demand for clinically substantiated, clean-label products. The USA has demonstrated a more moderate expansion at 4.7% CAGR, reflecting a mature market but one where incremental growth is expected from dermocosmetics and OTC segments. This global pattern underscores how emerging markets will spearhead volume expansion, while developed economies emphasize compliance, differentiation, and premiumization.

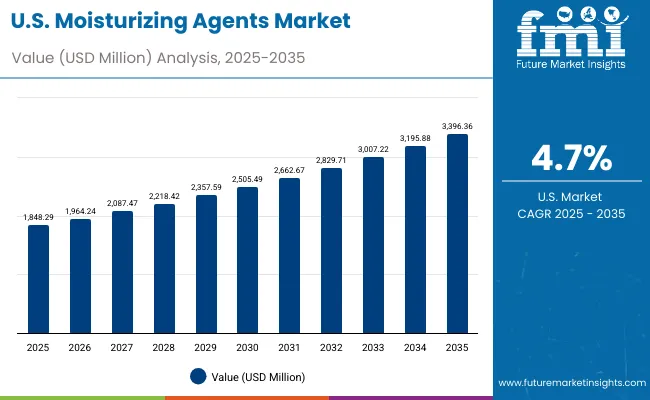

| Year | USA Moisturizing Agents Market (USD Million) |

|---|---|

| 2025 | 1848.29 |

| 2026 | 1964.24 |

| 2027 | 2087.47 |

| 2028 | 2218.42 |

| 2029 | 2357.59 |

| 2030 | 2505.49 |

| 2031 | 2662.67 |

| 2032 | 2829.71 |

| 2033 | 3007.22 |

| 2034 | 3195.88 |

| 2035 | 3396.36 |

The Moisturizing Agents Market in the United States is projected to grow at a CAGR of 4.7% from 2025 to 2035, reflecting steady but mature expansion across mass personal care, premium skincare, and dermocosmetic applications. Growth has been underpinned by consistent demand for hydration-focused formulations, with innovation increasingly directed toward clean-label, clinically substantiated, and dermatologist-recommended solutions. Premium brands have been prioritizing multifunctional and encapsulated actives, while mass-market players continue to rely on polyol and humectant systems for cost-effective scaling. Compliance with evolving regulations on traceability and sustainability is anticipated to reshape procurement, creating a gradual shift toward plant-derived and bio-aligned inputs. Supplier differentiation is expected to rely on technical service, documentation readiness, and turnkey formulation support.

The UK Moisturizing Agents Market is projected to grow at a 7.4% CAGR through 2035. Expansion is expected to be supported by dermatology-led brands, retailer clean lists, and rapid diffusion of claim-substantiated actives in facial care. Procurement preferences are anticipated to favor ingredients with strong clinical files, microplastic-safe profiles, and recyclable packaging compatibility. Private-label innovation is likely to intensify technical service needs, rewarding suppliers offering turnkey blends and accelerated regulatory documentation. Currency and energy-cost volatility are expected to keep mix discipline tight, sustaining demand for reliable polyol platforms while premium ranges adopt plant-aligned systems with measurable barrier benefits.

The India Moisturizing Agents Market is projected to grow at a 12.7% CAGR, the strongest among key countries. Growth is expected to be propelled by premium skincare penetration, rising dermocosmetic adoption, and localization of manufacturing that shortens lead times. Brand owners are anticipated to prioritize plant-derived systems supported by substantiated hydration and barrier metrics, while mass formats continue to scale with cost-efficient humectant platforms. Regulatory tightening on safety disclosures and allergen management is likely to professionalize supplier selection, placing a premium on documentation readiness and stability data under high-heat conditions. Tier-2/3 city expansion is expected to broaden the customer base for turnkey blends.

The China Moisturizing Agents Market is projected to grow at an 11.3% CAGR through 2035. Growth is expected to be underpinned by rapid upgrade cycles in facial moisturizers and serums, strong uptake of barrier-repair narratives, and fast-moving dermocosmetic pipelines. Regulatory emphasis on safety assessments and efficacy claims is anticipated to elevate suppliers with clinical evidence, traceability, and local technical service. Cross-border e-commerce dynamics are likely to amplify demand for differentiated, story-rich plant-aligned systems, while large incumbents retain scale with proven polyol frameworks. Encapsulation and controlled-release formats are expected to see earlier adoption in premium SKUs, supporting price realization.

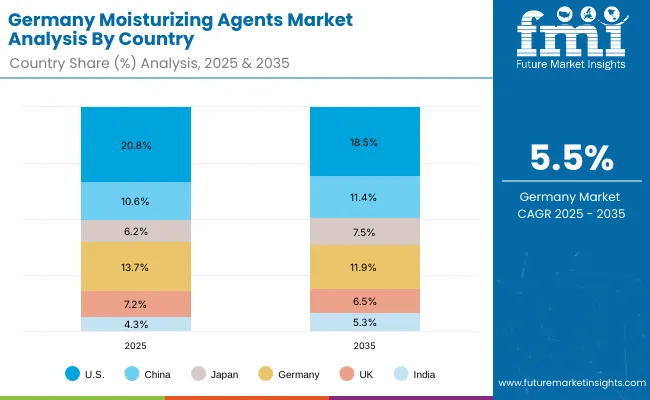

| Country | 2025 |

|---|---|

| USA | 20.8% |

| China | 10.6% |

| Japan | 6.2% |

| Germany | 13.7% |

| UK | 7.2% |

| India | 4.3% |

| Country | 2035 |

|---|---|

| USA | 18.5% |

| China | 11.4% |

| Japan | 7.5% |

| Germany | 11.9% |

| UK | 6.5% |

| India | 5.3% |

The Germany Moisturizing Agents Market is projected to grow at a 5.5% CAGR. Advancement is expected to be driven by stringent compliance culture, eco-design mandates, and a sophisticated pharmacy channel emphasizing clinically validated moisturization. Procurement teams are anticipated to require LCAs, allergen transparency, and microplastic-safe delivery, advantaging suppliers with audited sustainability data. While mass personal care will continue to rely on efficient polyol systems, premium and dermocosmetic lines are likely to increase the use of bio-aligned ingredients with TEWL reduction evidence. Process efficiency and energy optimization in manufacturing are expected to sustain demand for liquid formats that shorten batch times.

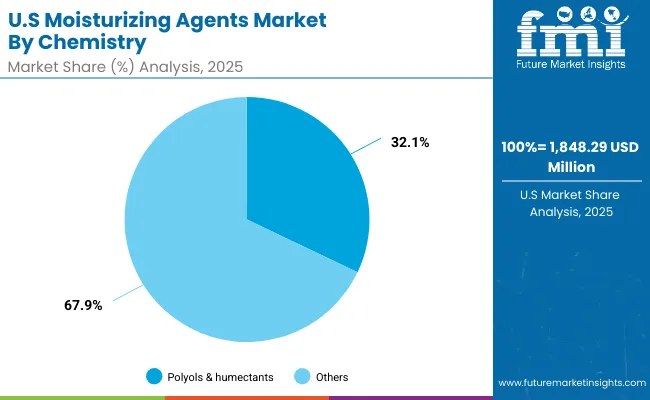

| USA By Chemistry | Market Value Share, 2025 |

|---|---|

| Polyols & humectants | 32.1% |

| Others | 67.9% |

The USA Moisturizing Agents Market is projected at USD 1,848.29 million in 2025. Within chemistry, polyols & humectants contribute 32.1%, while the broader “others” category accounts for 67.9%, underscoring the importance of diversified chemistries beyond traditional hydration systems. The dominance of “others” stems from demand for multifunctional actives such as emollients, esters, and complexes that deliver barrier repair, sensorial benefits, and premium claim alignment. These ingredients have been increasingly favored in high-value formulations where consumers seek both hydration and skin health outcomes. Polyols & humectants remain essential for scalability, regulatory familiarity, and cost efficiency, but competitive advantage has been shifting toward higher-performing blends with substantiated clinical benefits. As dermocosmetic and premium skincare channels expand, suppliers with advanced ingredient systems, clean-label certifications, and turnkey documentation are expected to capture disproportionate growth.

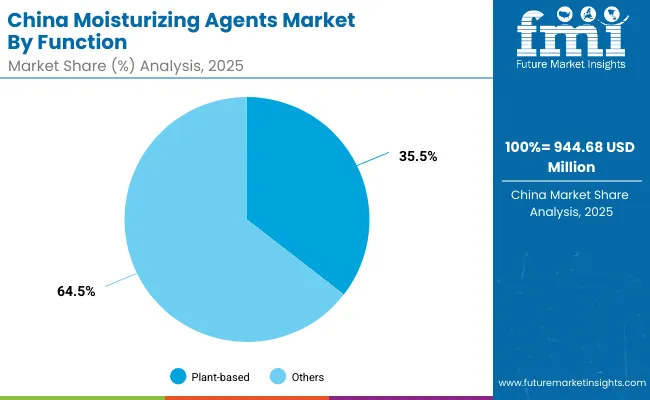

| China By Function | Market Value Share, 2025 |

|---|---|

| Plant-based | 35.5% |

| Others | 64.5% |

The China Moisturizing Agents Market is projected at USD 944.68 million in 2025. Within function, plant-based ingredients lead among the named segments with a 35.5% share, valued at USD 335.36 million. Their strong positioning has been driven by consumer alignment with natural, traceable, and bio-aligned inputs that reinforce brand claims of safety and sustainability. Demand has been further amplified by premium skincare and dermocosmetic lines, where plant-derived agents have been incorporated for both performance and storytelling value. While the broader “others” category holds a larger numerical share, its composition spans multiple systems; therefore, plant-based emerges as the dominant identifiable segment shaping market direction. Looking ahead, this category is expected to capture additional share as government regulations tighten on ingredient safety and as clean-label requirements become embedded across China’s premium beauty sector.

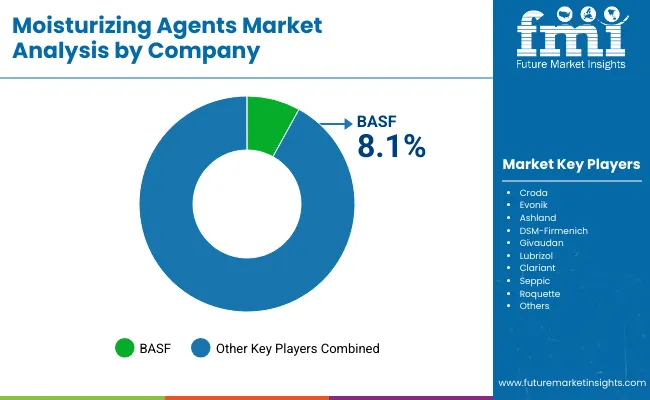

| Company | Global Value Share 2025 |

|---|---|

| BASF | 8.1% |

| Others | 91.9% |

The Moisturizing Agents Market is moderately fragmented, with global leaders, established mid-sized innovators, and regionally focused suppliers competing across diverse application areas. BASF has been recognized as the leading player, accounting for 8.1% of the global market share in 2025, driven by its broad ingredient portfolio, advanced formulation support, and strong sustainability credentials. Its strategy has been centered on integrating renewable feedstocks, low-carbon manufacturing, and turnkey formulation systems, aligning with rising demand for clean-label and traceable ingredients.

Mid-sized players such as Croda, Evonik, Ashland, DSM-Firmenich, Givaudan, and Lubrizol have been strengthening their positions by offering high-performance moisturizing agents with specialized functionalities, including encapsulated systems and bio-fermented actives. Their competitive edge has been shaped by innovation pipelines focused on clinical substantiation, sensorial enhancement, and multifunctional benefits, making them highly relevant to premium skincare and dermocosmetic markets.

Regional specialists including Clariant, Seppic, and Roquette have been addressing niche opportunities in plant-based formulations, clean-label ingredients, and bio-aligned chemistry. Their adaptability to local regulations and consumer preferences has allowed them to secure share in key regional markets such as Europe and Asia-Pacific.

Competitive differentiation is shifting away from cost-driven supply toward integrated value propositions that emphasize sustainability, evidence-backed performance, and technical service. Over the forecast horizon, leadership is expected to consolidate around players capable of offering full-package solutions combining advanced moisturizing systems, compliance documentation, and supply chain traceability.

Key Developments in Moisturizing Agents Market

| Item | Value |

|---|---|

| Market Value (2025) | USD 8,902.4 million |

| Market Forecast Value (2035) | USD 18,403.6 million |

| Forecast CAGR (2025 to 2035) | 7.50% |

| Chemistry | Polyols & humectants (44.3%, USD 3,943.76 million); Others (55.7%, USD 4,958.64 million) |

| Function | Plant-based (38.2%, USD 3,400.72 million); Others (61.8%, USD 5,501.68 million) |

| Physical Form | Liquid (55.0%, USD 4,905.22 million); Others (44.9%, USD 3,997.18 million) |

| End-use Industry | Mass personal care; Premium skincare; Dermocosmetic/OTC |

| Regions Covered | North America; Europe; Asia-Pacific; Latin America; Middle East & Africa |

| Countries Covered | United States; Canada; Germany; France; United Kingdom; China; Japan; India; Brazil; South Africa |

| Key Companies Profiled | BASF; Croda; Evonik; Ashland; DSM-Firmenich; Givaudan; Lubrizol; Clariant; Seppic; Roquette |

| Leading Player (Global Value Share 2025) | BASF - 8.1% |

| Country Snapshots (2025) | United States: USD 1,848.29 million; China: USD 944.68 million |

| Additional Attributes | Share leadership for 2025: Liquid by form (55.0%); Polyols & humectants among named chemistries (44.3%); Plant-based among named functions (38.2%). USA chemistry split: Polyols & humectants 32.1% (USD 593.30 million). China function split: Plant-based 35.5% (USD 335.36 million). Growth influenced by clean-label mandates, verified LCAs, encapsulated delivery, and turnkey blends enabling faster, compliant launches. |

The global Moisturizing Agents Market is estimated to be valued at USD 8,902.4 million in 2025.

The market size for the Moisturizing Agents Market is projected to reach USD 18,403.6 million by 2035.

The Moisturizing Agents Market is expected to grow at a CAGR of 7.5% between 2025 and 2035.

The key product types in the Moisturizing Agents Market include polyols & humectants, emollients, ceramide complexes, hyaluronic acids, and plant-based moisturizing systems.

In terms of physical form, the liquid segment will command a 55.0% share in the Moisturizing Agents Market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Moisturizing Skincare Products Market Size and Share Forecast Outlook 2025 to 2035

Moisturizing Body Creams Market Size and Share Forecast Outlook 2025 to 2035

Matting Agents Market Size and Share Forecast Outlook 2025 to 2035

Healing Agents Market (Skin Repair & Soothing Actives) Market Size and Share Forecast Outlook 2025 to 2035

Foaming Agents Market Size and Share Forecast Outlook 2025 to 2035

Firming Agents Botox-Like Market Size and Share Forecast Outlook 2025 to 2035

Heating Agents Market Size and Share Forecast Outlook 2025 to 2035

Cooling Agents Market Size and Share Forecast Outlook 2025 to 2035

Firming Agents Market Growth – Product Innovations & Applications from 2025 to 2035

Raising Agents Market Trends – Growth & Industry Forecast 2024 to 2034

Weighing Agents Market Size and Share Forecast Outlook 2025 to 2035

Draining Agents Market Size and Share Forecast Outlook 2025 to 2035

Flatting Agents Market Size and Share Forecast Outlook 2025 to 2035

Clouding Agents Market Trends - Growth Factors & Industry Analysis

Cognitive Agents Market Size and Share Forecast Outlook 2025 to 2035

Anti-Acne Agents Market Size and Share Forecast Outlook 2025 to 2035

Flavoring Agents Market Size and Share Forecast Outlook 2025 to 2035

Leavening Agents Market Analysis - Size, Growth, and Forecast 2025 to 2035

Market Share Breakdown of Anti-Slip Agents Manufacturers

Coalescing Agents Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA