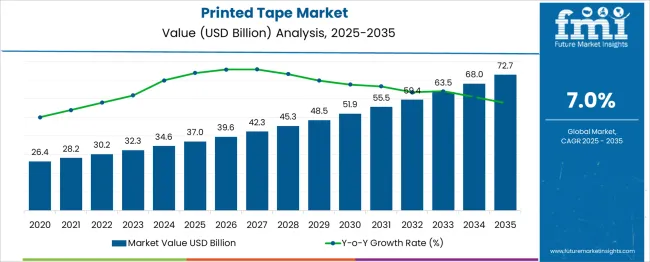

The Printed Tape Market is estimated to be valued at USD 37.0 billion in 2025 and is projected to reach USD 72.7 billion by 2035, registering a compound annual growth rate (CAGR) of 7.0% over the forecast period. During the initial phase from 2020 to 2025, the market value rises from USD 26.4 billion to USD 37.0 billion, driven by expanding demand across packaging, labeling, and industrial sectors. This phase benefits from increased adoption of advanced printing technologies and materials that enhance durability, customization, and brand visibility.

The rising importance of product differentiation and regulatory requirements for labeling accuracy contribute to market expansion. Between 2026 and 2030, the market is expected to expand from USD 39.6 billion to USD 51.9 billion, supported by growing e-commerce activities, automation in packaging lines, and innovations in eco-friendly and sustainable printing solutions. Manufacturers focus on improving adhesive properties and print quality to meet diverse application needs. From 2031 to 2035, growth accelerates, with the market advancing from USD 55.5 billion to USD 72.7 billion. This phase is characterized by increased integration of smart labeling technologies such as QR codes and RFID, enabling enhanced product tracking and consumer engagement. Emerging markets contribute significantly due to rising industrialization and retail modernization. Overall, the Printed Tape Market is positioned for sustained expansion through 2035, fueled by technological innovation, evolving consumer demands, and expanding applications across various industries.

| Metric | Value |

|---|---|

| Printed Tape Market Estimated Value in (2025 E) | USD 37.0 billion |

| Printed Tape Market Forecast Value in (2035 F) | USD 72.7 billion |

| Forecast CAGR (2025 to 2035) | 7.0% |

The printed tape market is expanding steadily, driven by increasing demand for brand visibility, product traceability, and tamper-evident packaging across various industries. As e-commerce and logistics sectors scale, businesses are using printed tapes not only for secure packaging but also as low-cost advertising mediums.

The rise in customization options—including barcodes, logos, and handling instructions—has further enhanced demand across food & beverage, electronics, and consumer goods sectors. Moreover, printed tapes provide operational efficiency in inventory tracking and reduce the need for additional labeling.

As sustainability becomes a key procurement criterion, manufacturers are investing in recyclable substrates and eco-friendly adhesives to align with shifting environmental standards.

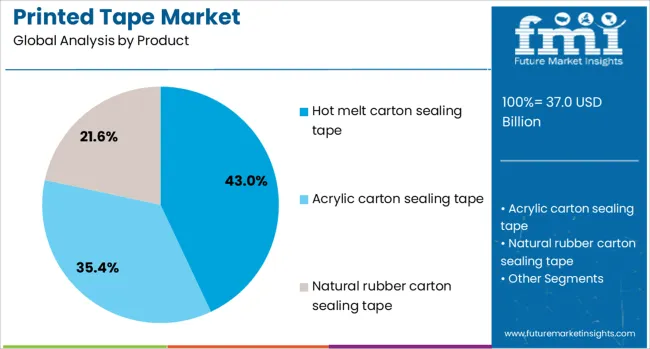

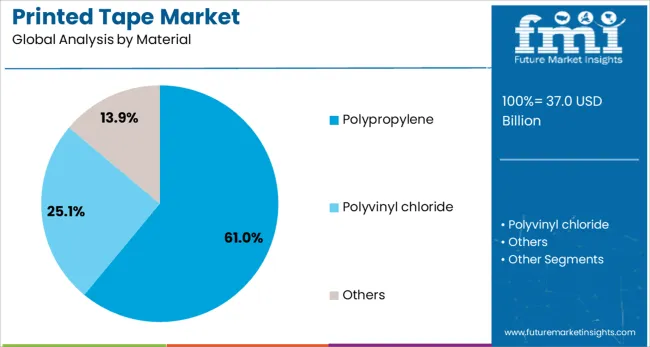

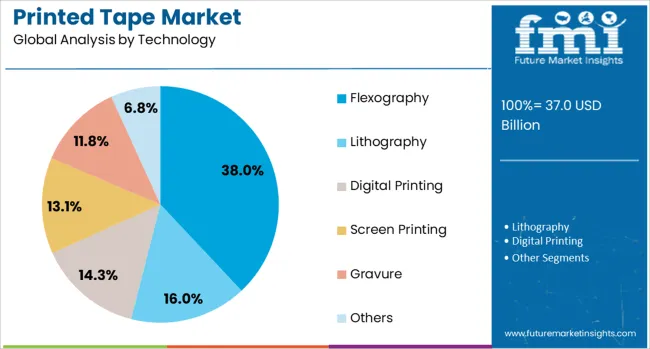

The printed tape market is segmented by product, material, technology, printing ink application, and geographic regions. The product of the printed tape market is divided into Hot melt carton sealing tape, Acrylic carton sealing tape, and Natural rubber carton sealing tape. In terms of material, the printed tape market is classified into Polypropylene, Polyvinyl chloride, and Others. The printed tape market is segmented into Flexography, Lithography, Digital Printing, Screen Printing, Gravure, and Others. The printing ink of the printed tape market is segmented into Water-based, Solvent-based, and UV curable. By application, the printed tape market is segmented into Food & Beverage, Consumer Durables, Transportation & Logistics, and Others. Regionally, the printed tape industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Hot melt carton sealing tape is anticipated to dominate the printed tape market with a 43.00% revenue share in 2025. Its strong adhesive properties, fast application speed, and superior holding power make it ideal for corrugated packaging in high-volume shipping environments.

Industries such as e-commerce, retail, and manufacturing prefer hot melt variants due to their resistance to humidity and temperature changes. The ability to support high-speed carton sealing equipment also boosts their adoption in automated packaging lines.

With businesses prioritizing both brand reinforcement and secure sealing, hot melt printed tapes have become the preferred choice across supply chains.

Polypropylene is expected to hold the leading position in the printed tape market with a 61.00% share in 2025. This dominance is driven by the material’s excellent tensile strength, durability, and cost-efficiency.

Polypropylene supports high-quality print clarity and color retention, which are essential for branding and warning applications. Additionally, its compatibility with various adhesive systems including acrylic and hot melt enhances its adaptability across different climates and industries.

The lightweight nature of polypropylene also contributes to reduced transportation costs, while its recyclability supports corporate sustainability goals.

Flexography is projected to account for 38.00% of the market share in 2025, making it the leading printing technology for printed tapes. This technology is preferred for its speed, efficiency, and suitability for large-volume runs.

Flexographic printing offers quick drying times, enabling rapid processing and reduced turnaround for customized orders. It is particularly advantageous for printing on non-porous materials like polypropylene and polyethylene, commonly used in printed tape manufacturing.

As demand grows for high-resolution logos and multi-color branding on tapes, flexography remains the go-to solution for scalable, high-quality output.

Printed tape remains a strategic packaging element for branding and security, fueled by customization trends and e-commerce growth. Compliance-driven material innovations will shape future market positioning.

Printed tape is increasingly valued as a dual-purpose solution for both packaging security and brand visibility. Businesses across retail, e-commerce, and FMCG sectors are leveraging printed tapes to deliver brand messaging on shipping cartons and protective packaging. Their cost-effectiveness compared to printed boxes makes them a preferred branding tool for businesses seeking high exposure with minimal investment. The ability to integrate logos, promotional texts, and product details directly onto tapes enhances consumer trust and strengthens recognition during transit. With the rise of global shipping and competitive retail environments, printed tapes are being adopted to differentiate packaging, streamline identification, and improve operational efficiency for distribution and warehouse management systems.

Demand for customization has significantly shaped the printed tape industry. Manufacturers are introducing advanced printing capabilities to allow multi-color, intricate designs, and variable messaging for diverse applications. Short lead times and small batch production have become critical, enabling brands to tailor packaging for seasonal campaigns and limited-edition products. This flexibility provides businesses a strategic edge, especially in promotional marketing and targeted campaigns. Additionally, customization aids in quick identification of packages during logistics operations, reducing errors in bulk shipments. This trend is expected to accelerate as businesses increasingly prioritize packaging as a key branding tool without incurring high production costs for fully customized boxes.

E-commerce growth has had a direct impact on printed tape consumption due to rising parcel volumes and the need for cost-effective security solutions. Printed tapes offer tamper-evidence and instant brand visibility, making them indispensable in shipping and handling. Their utility extends beyond branding, as printed instructions on tapes assist in reducing damage during transit and ensuring compliance with handling guidelines. For logistics providers, printed tapes contribute to efficiency in sorting and warehouse management by incorporating tracking codes and essential identifiers. With cross-border trade expanding, printed tapes are increasingly deployed to maintain consistent branding across diverse distribution channels and packaging formats.

The printed tape market faces scrutiny related to material selection and environmental compliance. Traditional PVC-based and solvent adhesive tapes are under pressure due to restrictions in multiple regions. This has created opportunities for polypropylene and paper-based tapes offering similar performance with reduced ecological concerns. Manufacturers are investing in advanced coating techniques and inks that meet packaging safety regulations while maintaining print quality. Additionally, tamper-evident features and improved adhesion on recyclable substrates are gaining attention, aligning with corporate priorities to minimize operational risks. As compliance requirements become stricter, suppliers offering innovative formulations are expected to capture market share through product differentiation and reliability.

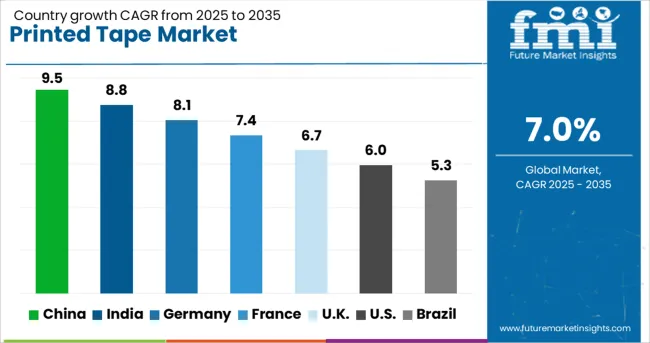

| Country | CAGR |

|---|---|

| China | 9.5% |

| India | 8.8% |

| Germany | 8.1% |

| France | 7.4% |

| UK | 6.7% |

| USA | 6.0% |

| Brazil | 5.3% |

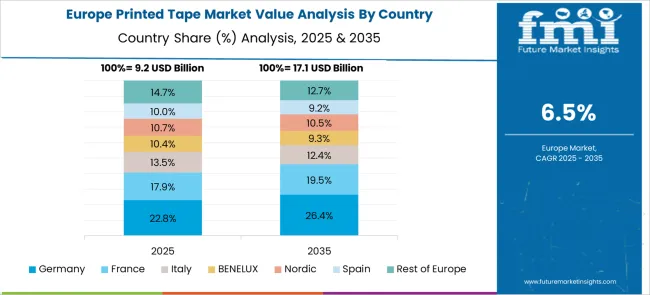

The printed tape market is expected to expand globally at a CAGR of 7.0% from 2025 to 2035, driven by demand for branded packaging solutions, e-commerce expansion, and cost-efficient customization. China leads with a CAGR of 9.5%, supported by large-scale manufacturing, growing logistics activity, and increased use of tamper-evident packaging. India follows at 8.8%, reflecting the surge in online retail and adoption of printed tapes for cost-effective branding among small and medium enterprises. France records 7.4%, leveraging growth in consumer goods and premium packaging segments. The United Kingdom grows at 6.7%, driven by retail consolidation and compliance-focused packaging needs, while the United States reaches 6.0%, with incremental gains linked to automation in warehouse operations and demand for security labeling. This comparative outlook underscores the strategic importance of Asia-Pacific as the dominant growth hub while highlighting opportunities in Europe for compliance-driven innovation and e-commerce-aligned printed tape solutions.

China is projected to record a CAGR of 9.5% during 2025-2035, an increase from approximately 8.4% achieved in 2020–2024, surpassing the global average of 7.0%. The stronger growth trajectory reflects extensive demand from e-commerce packaging, bulk logistics, and retail branding strategies. Expansion in domestic manufacturing and rising investments in automated packaging lines further boost adoption of printed tapes for cost-effective brand visibility and tamper-proofing. Digital printing adoption in packaging has created opportunities for mass customization, making China a key hub for printed tape innovation and scale. Integration with advanced packaging automation systems ensures operational efficiency and faster turnaround for high-volume shipments.

India is forecasted to post a CAGR of 8.8% for 2025-2035, rising from nearly 7.6% in 2020–2024, outpacing global averages. This increase reflects exponential growth in online retail, logistics modernization, and demand for affordable branding tools among SMEs. Cost-effective customization enabled by improved printing technologies is enhancing penetration in the domestic market. The continued rise in small parcel shipments and tier-II and tier-III city connectivity has amplified the need for tamper-evident and branded packaging. Domestic converters are investing in high-speed printing equipment to meet time-sensitive e-commerce cycles, enabling rapid order fulfillment and boosting competitiveness in regional markets.

France is expected to grow at a CAGR of 7.4% for 2025-2035, compared to 6.5% in 2020–2024, signaling a moderate yet steady rise. This upward trend is supported by premiumization in packaging for consumer goods and strong demand for tamper-evident solutions in logistics. The shift toward high-quality printing techniques for promotional packaging campaigns in retail adds to the growth momentum. Compliance with EU directives on packaging materials has driven innovation in water-based inks and recyclable tape substrates, ensuring wider adoption across environmentally conscious brands. France’s well-established distribution networks and emphasis on brand differentiation ensure continued investment in printed packaging formats.

The United Kingdom is projected to achieve a CAGR of 6.7% during 2025-2035, higher than the estimated 5.8% during 2020–2024. The increase can be attributed to rising investments in automated packaging for e-commerce and compliance-driven branding in regulated industries like pharmaceuticals and food. Growth in cross-border shipments has elevated the use of tamper-evident tapes integrated with security features. Importantly, the expansion of direct-to-consumer models among retailers has elevated reliance on branded tapes for cost-efficient identity reinforcement. Improved printing quality for smaller runs has made personalized solutions viable, even for mid-scale businesses, ensuring market resilience despite price sensitivity in the region.

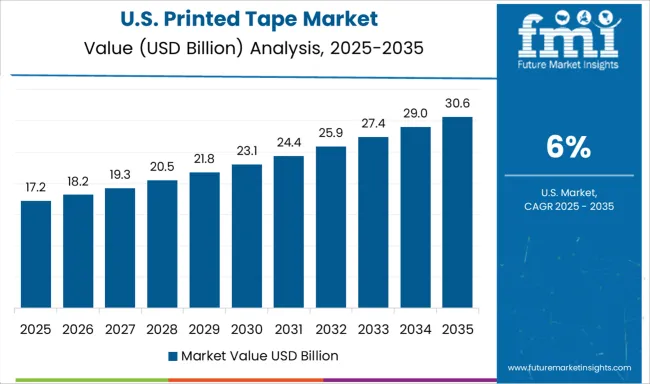

The United States is anticipated to grow at a CAGR of 6.0% for 2025-2035, up from around 5.2% in 2020–2024, reflecting modest but stable growth. The upward shift stems from increasing adoption of custom packaging by e-commerce giants and subscription-based delivery services. Security and compliance labeling in healthcare and electronics sectors contributes additional demand. Automation in large distribution centers has also enabled higher utilization of printed tapes integrated with QR codes for quick scanning and process tracking. Domestic manufacturers are emphasizing advanced ink adhesion and heat-resistant properties to meet diverse packaging conditions in logistics and warehousing environments.

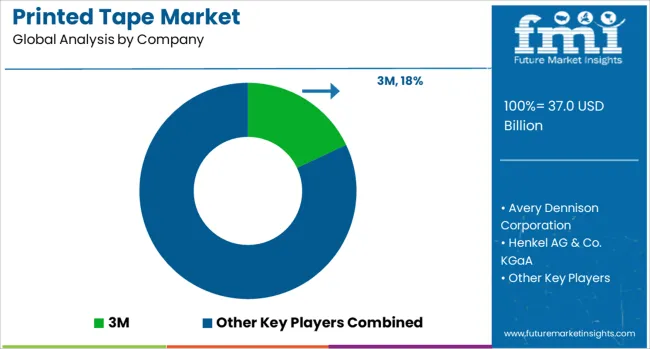

The printed tape market is dominated by globally established adhesive and packaging solution providers such as 3M, Avery Dennison Corporation, Henkel AG & Co. KGaA, Scapa, Tesa SE, Intertape Polymer Group Inc., and Nitto Denko Corporation. These players compete on the basis of printing technology, customization capabilities, material innovation, and global distribution reach. 3M holds a leading position with a strong portfolio of high-performance printed tapes, leveraging its advanced adhesive technologies and robust global supply chain to serve diverse industries including logistics and retail. Avery Dennison Corporation emphasizes innovation in pressure-sensitive adhesives and sustainable substrates, offering customized printed tape solutions for branding and security applications.

Henkel AG & Co. KGaA brings expertise in specialty adhesives, catering to industrial-grade applications and integrating tamper-evident features for high-value packaging segments. Scapa and Tesa SE focus on delivering high-quality printing and durability solutions for automotive, healthcare, and e-commerce packaging sectors, ensuring compliance with strict performance standards. Intertape Polymer Group Inc. has strengthened its position by investing in advanced printing technologies for short-run and promotional packaging needs, while Nitto Denko Corporation continues to expand its reach in Asia and North America through premium-grade printed tapes and enhanced design flexibility. The competitive landscape is characterized by product differentiation through digital printing integration, development of recyclable and high-adhesion substrates, and strategic partnerships to expand regional footprints. These companies are prioritizing fast turnaround times, small batch customization, and compliance-driven innovation to capture emerging opportunities in e-commerce, retail branding, and industrial packaging segments.

In May 2025, 3M Corporation launched ScotchBlue PROSharp Painter’s Tape featuring Edge‑Lock+ Technology, doubling hold strength and delivering exceptionally sharp lines during painting tasks.

| Item | Value |

|---|---|

| Quantitative Units | USD 37.0 Billion |

| Product | Hot melt carton sealing tape, Acrylic carton sealing tape, and Natural rubber carton sealing tape |

| Material | Polypropylene, Polyvinyl chloride, and Others |

| Technology | Flexography, Lithography, Digital Printing, Screen Printing, Gravure, and Others |

| Printing Ink | Water-based, Solvent-based, and UV curable |

| Application | Food & Beverage, Consumer Durables, Transportation & Logistics, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | 3M, Avery Dennison Corporation, Henkel AG & Co. KGaA, Scapa, Tesa SE, Intertape Polymer Group Inc., and Nitto Denko Corporation |

| Additional Attributes | Dollar sales, share by region and application, competitive pricing benchmarks, demand from e-commerce and industrial sectors, raw material trends, regulatory compliance, innovations in printing, and growth opportunities for customization-driven packaging solutions. |

The global printed tape market is estimated to be valued at USD 37.0 billion in 2025.

The market size for the printed tape market is projected to reach USD 72.7 billion by 2035.

The printed tape market is expected to grow at a 7.0% CAGR between 2025 and 2035.

The key product types in printed tape market are hot melt carton sealing tape, acrylic carton sealing tape and natural rubber carton sealing tape.

In terms of material, polypropylene segment to command 61.0% share in the printed tape market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Pre-Printed Tape Market Size and Share Forecast Outlook 2025 to 2035

Industry Share & Competitive Positioning in Pre-Printed Tape

Custom Printed Tape Market Size and Share Forecast Outlook 2025 to 2035

Printed Electronics Market Size and Share Forecast Outlook 2025 to 2035

Printed Labels Market Size and Share Forecast Outlook 2025 to 2035

Printed Chipless RFID Radio Frequency Identification Market Size and Share Forecast Outlook 2025 to 2035

Printed Sensors Market Size and Share Forecast Outlook 2025 to 2035

Printed Circuit Board (PCB) Assembly Market Size and Share Forecast Outlook 2025 to 2035

Printed Antenna Market Size and Share Forecast Outlook 2025 to 2035

Printed Electronics Devices Market Size and Share Forecast Outlook 2025 to 2035

Printed Aluminium Foil Packaging Market Size and Share Forecast Outlook 2025 to 2035

Printed and Flexible Sensors Market Report - Growth & Demand 2025 to 2035

Printed Circuit Boards (PCB) Market Trends - Demand & Forecast 2025 to 2035

Printed Plastic Films Market Insights - Growth & Forecast 2025 to 2035

Printed Boxes Market Analysis – Trends, Demand & Forecast 2025 to 2035

Industry Share & Competitive Positioning in Printed Aluminium Foil Packaging

Market Share Distribution Among Printed Carton Manufacturers

3D Printed Dental Brace Market Size and Share Forecast Outlook 2025 to 2035

3D-Printed Prosthetic Implants Market Size and Share Forecast Outlook 2025 to 2035

3D Printed Maxillofacial Implants Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA