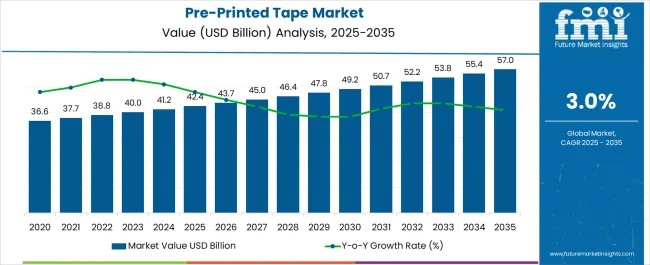

The Pre-Printed Tape Market is estimated to be valued at USD 42.4 billion in 2025 and is projected to reach USD 57.0 billion by 2035, registering a compound annual growth rate (CAGR) of 3.0% over the forecast period.

| Metric | Value |

|---|---|

| Pre-Printed Tape Market Estimated Value in (2025 E) | USD 42.4 billion |

| Pre-Printed Tape Market Forecast Value in (2035 F) | USD 57.0 billion |

| Forecast CAGR (2025 to 2035) | 3.0% |

The pre-printed tape market is growing steadily, supported by the increasing demand for branding, security, and logistics optimization across industries. Packaging sector updates and company press releases have highlighted a rising emphasis on printed tapes as tools for product identification, tamper evidence, and brand visibility. The surge in e-commerce and global trade volumes has further fueled demand, with companies prioritizing reliable and visually distinctive packaging solutions.

Advancements in printing technologies, coupled with investments in sustainable and recyclable tape materials, are also shaping the market trajectory. Additionally, manufacturers are integrating advanced adhesives and inks that ensure long-lasting print quality and adhesion under diverse shipping conditions.

Industry players have reported that automation in packaging lines has increased compatibility requirements, driving innovation in pre-printed tape formats. Looking ahead, demand is expected to be anchored by flexographic printing, polypropylene-based substrates, and acrylic adhesives, which together offer efficiency, durability, and cost-effectiveness in meeting large-scale commercial packaging needs.

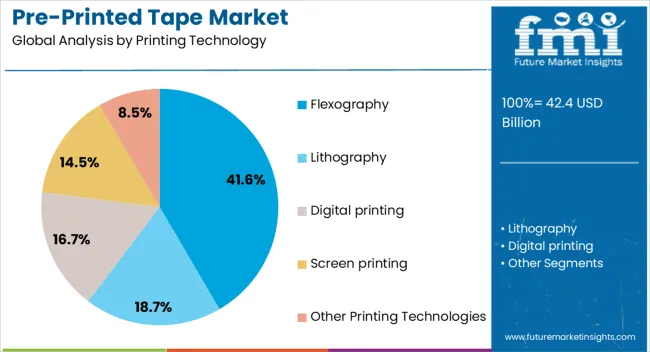

The Flexography segment is projected to contribute 41.6% of the pre-printed tape market revenue in 2025, establishing itself as the leading printing technology. This dominance has been supported by flexography’s ability to deliver high-speed printing with consistent quality across large production runs. The technology’s compatibility with a variety of inks, including water-based and UV-curable types, has enhanced its suitability for both cost-sensitive and eco-friendly applications.

Packaging industry publications have emphasized that flexography allows precise reproduction of logos, texts, and barcodes, which are critical for brand recognition and supply chain management. Additionally, flexographic presses have benefited from technological improvements such as digital plate making and automated color control systems, which have reduced setup time and improved efficiency.

The scalability and cost-effectiveness of flexography have ensured its continued adoption, particularly among companies managing high-volume packaging requirements, reinforcing its market leadership.

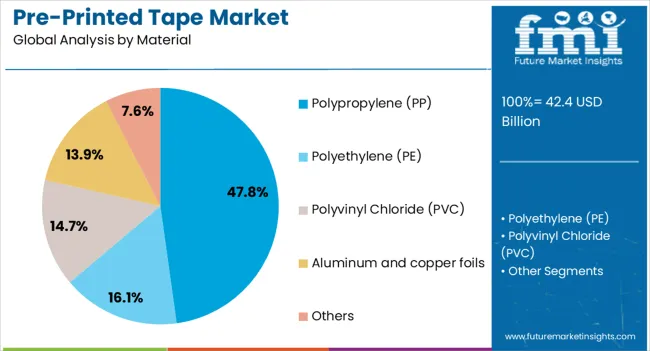

The Polypropylene (PP) segment is projected to hold 47.8% of the pre-printed tape market revenue in 2025, making it the dominant material category. Growth of this segment has been driven by PP’s favorable balance of tensile strength, cost efficiency, and printability. Reports from packaging materials suppliers have noted that PP films provide excellent clarity and surface uniformity, which enhances print adhesion and visual appeal.

Furthermore, PP-based tapes are lightweight, durable, and resistant to moisture and chemicals, ensuring secure sealing during transportation and storage. Sustainability initiatives have also boosted PP’s position, as it is more recyclable compared to alternative substrates.

Manufacturers have increasingly adopted PP in pre-printed tapes to meet both performance and environmental requirements. With its ability to support high-quality graphics while maintaining affordability, the PP segment is expected to remain the preferred choice for diverse industrial and commercial applications.

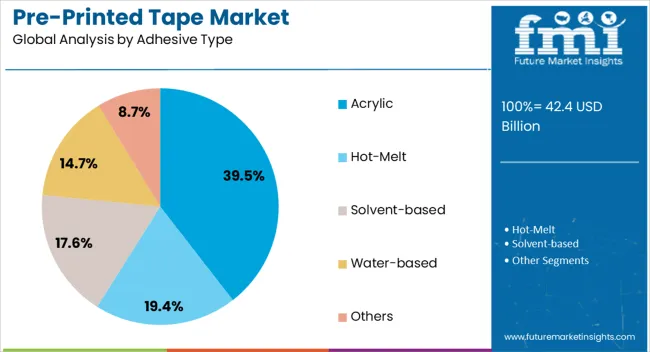

The Acrylic segment is projected to account for 39.5% of the pre-printed tape market revenue in 2025, retaining its position as the leading adhesive type. This segment’s growth has been influenced by acrylic adhesives’ strong performance across a wide range of temperatures and surfaces, making them highly versatile for packaging applications.

Industry reports have highlighted that acrylic adhesives offer superior resistance to UV light, aging, and environmental stress, which ensures long-term adhesion and prevents tape degradation during storage or transit. Additionally, acrylic-based tapes maintain consistent adhesion strength, even on corrugated and recycled cardboard, which are commonly used in e-commerce and shipping.

Advancements in water-based acrylic formulations have also supported sustainability goals by reducing solvent emissions. As packaging companies continue to prioritize reliability and sustainability in adhesive solutions, the acrylic segment is expected to sustain its leading share in the pre-printed tape market.

The global demand for pre-printed tape has received a lot of traction among industrial end users in the last couple of years. As it reduces pilferage due to its inability to be removed and resealed without detection, it reduces packaging costs significantly and is the key reason for such high sales of printed tapes in recent times.

There are some other advantages associated with it in addition to the growth in the printing industry that have accelerated the sales of pre-printed tape in the global market. Further, the demand for attractive packaging, product differentiation, and technological advances are the key drivers of the demand for pre-printed tape.

The market share is expected to accelerate with the support of digital printing, which is a cost-effective and attractive solution for manufacturing high-quality tapes. However, the high cost of this method, as well as the evaporative property of the ink may limit the demand for pre-printed tape in this section

The market share in Asia Pacific is projected to experience notable growth in the forthcoming years due to the growth of developing economies like India and China. Moreover, the sales of pre-printed tape in the Asia Pacific are projected to expand at a significant rate, mainly as a result of the growing population and consumerism.

China’s market share is the leading supplier and manufacturer of printing materials and equipment. As a result of the manufacturing and supply of printing equipment and materials in China, a portion of the sales of pre-printed tape in the global market is achieved in the Asia Pacific.

According to the market share value in North America and Europe, the demand for pre-printed tape might expand on average at a rate of 28% and 24%, respectively.

As the market expands steadily in these areas, Latin America and the Middle East & Africa are expected to witness a slow and steady growth in the demand for pre-printed tapes as well.

The sales of pre-printed tape have been experiencing significant growth in the region due to the transition of the global printing industry from conventional to digital printing machines.

In addition, pre-printed tapes are also useful for communicating handling instructions that have emerged to be a crucial factor in boosting the demand for pre-printed tape in the United States of America and Canada.

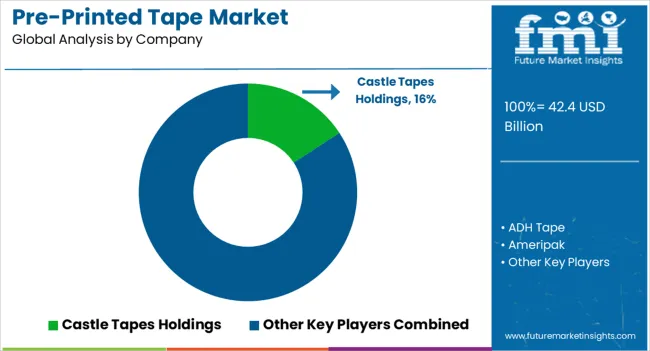

Some of the leading companies operating in the global market include Castle Tapes Holdings, ADH Tape, Ameripak, Preferred Tape, Inc., Nadco Tapes & Labels, Inc., Intertape Polymer Group, ProtoPak Engineering Corporation, and many more.

Manufacturers in the global pre-printed tapes market are expected to perceive significant opportunities as a result of growing investment by numerous large players in developed and emerging economies worldwide.

Moreover, pre-printed tapes are expected to generate substantial opportunities in the global economy as many large companies invest in developed and emerging countries.

| Attribute | Details |

|---|---|

| Growth Rate | CAGR of 3% from 2025 to 2035 |

| Base Year for Estimation | 2025 |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD million and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

| Segments Covered | By Printing Technology, By Material, By Adhesive Type, By Application, By End User, By Region |

| Regions Covered | North America; Latin America; Western Europe; Japan; The Middle East and Africa |

| Key Countries Profiled | The United States of America, Canada, Brazil, Mexico, Germany, The United Kingdom, France, Spain, Italy, Russia, Poland, Australia, New Zealand, China, India, Japan, GCC Countries, South Africa, North Africa |

| Key Companies Profiled | Castle Tapes Holdings; ADH Tape; Ameripak; Preferred Tape, Inc.; Nadco Tapes & Labels, Inc.; Intertape Polymer Group; ProtoPak Engineering Corporation |

| Customization & Pricing | Available Upon Request |

The global pre-printed tape market is estimated to be valued at USD 42.4 billion in 2025.

The market size for the pre-printed tape market is projected to reach USD 57.0 billion by 2035.

The pre-printed tape market is expected to grow at a 3.0% CAGR between 2025 and 2035.

The key product types in pre-printed tape market are flexography, lithography, digital printing, screen printing and other printing technologies.

In terms of material, polypropylene (pp) segment to command 47.8% share in the pre-printed tape market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Industry Share & Competitive Positioning in Pre-Printed Tape

Tape Unwinder Market Size and Share Forecast Outlook 2025 to 2035

Tape Dispenser Market Size and Share Forecast Outlook 2025 to 2035

Tape Dispenser Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Tape Dispenser Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Tape Measure Market Size and Share Forecast Outlook 2025 to 2035

Tape Backing Materials Market Analysis by Material Type, Application, and Region through 2025 to 2035

Tape Stretching Line Market Analysis – Growth & Trends 2025 to 2035

Tapes Market Insights – Growth & Demand 2025 to 2035

Tape Banding Machine Market Overview - Demand & Growth Forecast 2025 to 2035

Competitive Overview of Tape Dispenser Companies

Competitive Overview of Tape Backing Materials Companies

Tape & Label Adhesives Market

Tape Applicator Machines Market

UV Tapes Market Growth - Trends & Forecast 2025 to 2035

PVC Tapes Market Size and Share Forecast Outlook 2025 to 2035

Leading Providers & Market Share in PVC Tapes Industry

ESD Tapes and Labels Market from 2025 to 2035

USA Tapes Market Analysis – Growth & Forecast 2024-2034

Duct Tape Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA