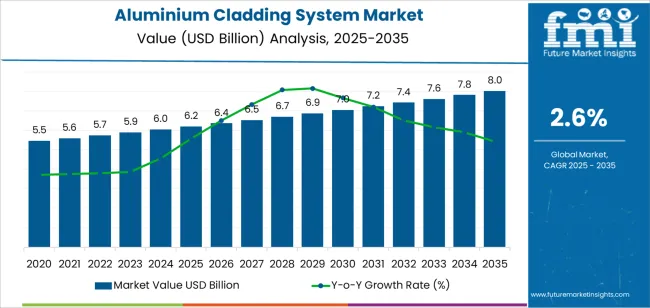

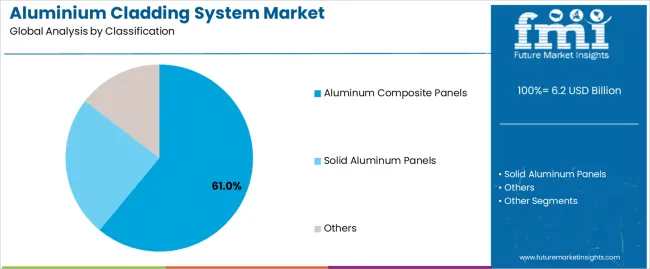

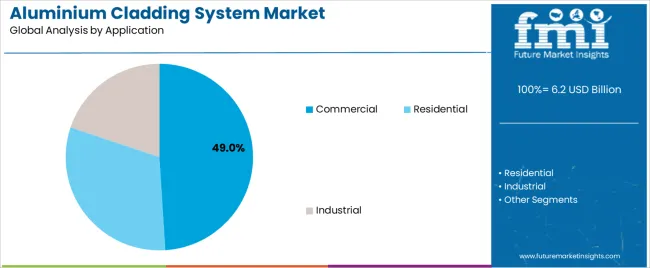

The aluminium cladding system market is valued at USD 6.2 billion in 2025 and is projected to reach USD 8.0 billion by 2035, expanding at a 2.6% CAGR as construction and architectural modernization intensify across global regions. Growth is influenced by rising demand for lightweight façade materials, corrosion-resistant exterior solutions, and energy-efficient building envelopes that support modern design and regulatory compliance. Aluminium composite panels remain the leading segment with a 61.0% share due to their strength-to-weight ratio, ease of fabrication, and durability in commercial and residential applications, while the commercial sector accounts for 49.0% of total demand as urban infrastructure and high-rise projects accelerate. Breakpoint analysis highlights a first growth surge between 2026 and 2029 driven by energy-efficient façade adoption, followed by a stabilization phase between 2031 and 2033 as installation shifts from new construction toward refurbishment and retrofits.

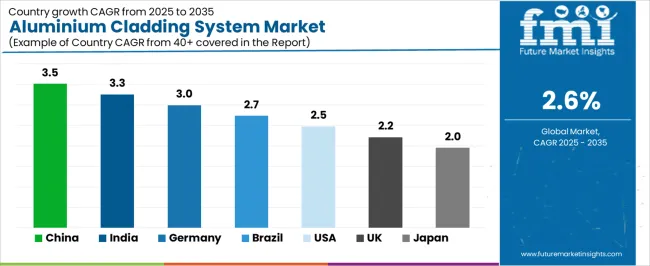

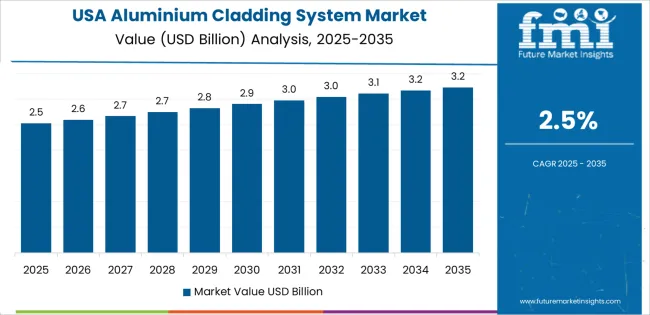

Country-level expansion shows China at 3.5% CAGR, India at 3.3%, Germany at 3.0%, Brazil at 2.7%, the United States at 2.5%, the United Kingdom at 2.2%, and Japan at 2.0%, reflecting varied momentum across construction cycles and regulatory frameworks. Market drivers include green building standards, architectural flexibility, and advances in coating and fire-retardant core technologies, while restraints stem from raw-material price volatility, fire safety compliance costs, and installation complexity. Competition is shaped by performance consistency, safety certification, and design customization, with leading companies such as Arconic, 3A Composites, Mitsubishi Chemical, Speira, Alucoil, Aludecor, and Mulk Holdings strengthening capabilities in recyclable composites, protective coatings, and high-performance façade systems to meet global construction and modernization requirements.

Asia Pacific leads global market expansion, driven by large-scale urban construction and industrial infrastructure projects in China, India, and Southeast Asia. Europe and North America maintain steady demand through refurbishment and energy retrofitting initiatives. Key market participants include Arconic, 3A Composites, Mitsubishi Chemical, Speira, Alucoil, Aludecor, and Mulk Holdings, emphasizing product quality, compliance, and architectural design integration.

Breakpoint analysis identifies two primary inflection phases in the market’s growth path. The first breakpoint, expected between 2026 and 2029, will be driven by increased construction activity and the adoption of energy-efficient building envelopes. During this period, demand will rise due to stringent green building regulations and a shift toward lightweight, corrosion-resistant exterior solutions for commercial and residential structures.

The second breakpoint, anticipated between 2031 and 2033, will mark a transition from rapid expansion to steady, maintenance-driven demand. Market growth will stabilize as large-scale infrastructure projects reach completion in major regions, while refurbishment and retrofitting activities maintain moderate consumption levels. Advances in fire-resistant composite panels and ecofriendly aluminum sourcing will maintain product relevance during this stage. The progression across these breakpoints reflects a market evolving from construction-led growth to long-term stability supported by durability, recyclability, and compliance with global building safety standards.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 6.2 billion |

| Market Forecast Value (2035) | USD 8.0 billion |

| Forecast CAGR (2025-2035) | 2.6% |

The aluminium cladding system market is expanding as global construction activity accelerates in both emerging and mature economies. Buildings increasingly favour aluminium cladding because it combines light weight, durability and flexibility in design, supporting architectural innovation and façade variety. Demand for energy-efficient and green materials promotes aluminium cladding due to its recyclability and thermal performance properties. Regulatory focus on fire safety and building performance drives specification of high-quality cladding solutions including aluminium composite and fire-rated products. Rapid urbanisation and infrastructure investment contribute to adoption of aluminium cladding in commercial, residential and public-sector buildings. Advances in manufacturing and coating technologies improve corrosion resistance, aesthetic finish and performance of cladding panels, enhancing market appeal.

Constraints include volatility in raw-material prices that impact production costs and project economics. Intense competition from alternative materials and legacy façade systems presents substitution risks. Construction sector cyclicality and regulatory variability across regions limit uniform growth. Innovation in product types, modular construction practices and green building trends open opportunities for differentiated aluminium cladding solutions.

The aluminium cladding system market is segmented by classification and application. By classification, the market is divided into solid aluminum panels, aluminum composite panels, and others. Based on application, it is categorized into residential, commercial, and industrial sectors. Regionally, the market is divided into Asia Pacific, Europe, North America, and other key regions.

The aluminum composite panels (ACP) segment holds the leading position in the aluminium cladding system market, accounting for an estimated 61.0% of total market share in 2025. ACP systems consist of two thin aluminum sheets bonded to a non-aluminum core, offering a combination of lightweight structure, mechanical strength, and design versatility. They are extensively used in modern architectural facades due to their durability, ease of fabrication, and cost efficiency compared to solid panels.

This segment’s leadership is driven by widespread adoption in building exteriors, signage, and curtain wall systems requiring aesthetic flexibility and weather resistance. Aluminum composite panels also provide enhanced thermal and acoustic insulation properties, supporting their use in energy-efficient building designs. The solid aluminum panels segment, estimated at 28.0%, remains prominent in applications demanding high fire resistance and structural integrity, such as public infrastructure and transportation hubs. The others category, including honeycomb panels and hybrid cladding systems, holds approximately 11.0% of the market.

Key factors supporting the aluminum composite panels segment include:

The commercial segment accounts for approximately 49.0% of the aluminium cladding system market in 2025. This dominance is attributed to extensive use of aluminum cladding in office buildings, retail centers, hotels, and institutional infrastructure where durability, aesthetic appeal, and low maintenance are key design priorities. The segment benefits from ongoing urbanization, large-scale infrastructure investments, and demand for contemporary façade solutions in both developed and emerging economies.

The residential segment follows, representing an estimated 33.0% market share, supported by growing application in mid- and high-rise housing projects emphasizing energy performance and modern aesthetics. The industrial segment accounts for the remaining 18.0%, driven by increasing use of aluminum cladding in factories and warehouses requiring corrosion resistance and protection against environmental exposure.

Primary dynamics driving demand from the commercial segment include:

The aluminium cladding system market is expanding due to rapid urbanization, large-scale infrastructure development, and rising investment in commercial and residential construction worldwide. Aluminium’s lightweight nature, corrosion resistance, and recyclability make it a preferred material for modern façades and building envelopes. Governments and construction authorities are promoting ecofriendly materials that improve energy efficiency and meet green building certification standards, which has increased the use of aluminium composite panels and ventilated cladding systems. Architects and builders are adopting aluminium cladding for its aesthetic versatility, allowing smooth integration of color, texture, and surface finishes suited to diverse architectural designs. Continuous improvements in coating technology and panel fabrication have also enhanced durability, weather resistance, and overall structural performance.

Aluminium’s price volatility, driven by fluctuations in global metal supply and energy costs, poses a challenge to manufacturers and contractors. The implementation of stringent fire safety regulations after several high-profile façade incidents has increased testing, certification, and design validation costs for cladding systems. Installation of aluminium panels requires skilled labor and precision engineering to ensure structural integrity and thermal efficiency, which adds to project complexity and delays in large-scale construction. In developing regions, low-cost alternatives such as vinyl or fiber cement cladding reduce the adoption rate of aluminium systems in budget-sensitive projects.

Manufacturers are focusing on modular, pre-engineered aluminium panels that reduce installation time and labor dependency. The Asia-Pacific region is witnessing strong demand due to urban infrastructure expansion, government-funded smart city projects, and refurbishment of aging buildings. Material innovations, including non-combustible aluminium composite panels and eco-friendly coatings, are strengthening the ecofriendly profile of cladding systems. Integration with energy-efficient façades, solar shading structures, and smart building technologies is redefining aluminium’s role as both an aesthetic and functional construction material, ensuring long-term market growth across global construction sectors.

The global aluminium cladding system market is expanding steadily through 2035, supported by rising construction activity, architectural modernization, and increased use of energy-efficient façade materials. China leads with a 3.5% CAGR, followed by India at 3.3%, driven by large-scale urban infrastructure projects and growing real estate investment. Germany grows at 3.0%, reflecting the adoption of green building materials and fire-resistant cladding systems. Brazil records 2.7%, supported by commercial construction and housing initiatives. The United States posts 2.5%, driven by retrofit projects and environmental compliance upgrades, while the United Kingdom (2.2%) and Japan (2.0%) maintain moderate growth through modernization of public buildings and technology-driven architectural design.

| Country | CAGR (%) |

|---|---|

| China | 3.5 |

| India | 3.3 |

| Germany | 3.0 |

| Brazil | 2.7 |

| USA | 2.5 |

| UK | 2.2 |

| Japan | 2.0 |

China’s aluminium cladding system market grows at 3.5% CAGR, driven by its expansive construction sector, rapid urbanization, and technological advancements in façade engineering. Major cities continue to deploy aluminium composite panels (ACP) in commercial, residential, and transportation infrastructure projects. Domestic manufacturers are improving production efficiency and fire safety performance through enhanced coating and lamination technologies. Government standards under the Building Energy Efficiency Action Plan support energy-efficient and recyclable façade solutions. Export demand for Chinese ACP materials also contributes to constant market growth.

Key Market Factors:

India’s market grows at 3.3% CAGR, supported by infrastructure development, commercial construction, and architectural modernization. Aluminium composite cladding is increasingly adopted in smart city projects, airports, and urban transit systems. The Smart Cities Mission and National Infrastructure Pipeline (NIP) encourage ecofriendly façade systems with weather resistance and aesthetic flexibility. Domestic manufacturers are expanding production capacity of ACP panels with advanced PVDF coatings and high thermal insulation. The government’s focus on green building certifications under LEED and GRIHA frameworks boosts demand for energy-efficient cladding systems.

Market Development Factors:

Germany’s market grows at 3.0% CAGR, reflecting its leadership in green construction materials, precision design, and safety standards. The country’s construction industry is adopting ventilated façade systems incorporating aluminium cladding for improved insulation and durability. Regulatory frameworks under the Energy Saving Ordinance (EnEV) and Building Energy Act (GEG) promote use of recyclable and fire-retardant materials. Manufacturers are focusing on high-performance anodized and powder-coated finishes. Integration with digital building information modeling (BIM) enhances precision in architectural planning and installation.

Key Market Characteristics:

Brazil’s market grows at 2.7% CAGR, supported by urban construction projects, climate-adaptive design needs, and commercial modernization. The Minha Casa Minha Vida housing program and private sector investment in retail and hospitality infrastructure drive demand for durable façade materials. Local manufacturers are producing cost-effective aluminium cladding with high corrosion resistance suitable for humid and coastal regions. Growing architectural focus on aesthetic façades in mixed-use developments is encouraging the use of composite cladding panels. Regulatory updates addressing façade safety and material quality ensure consistent product standards.

Market Development Factors:

The United States grows at 2.5% CAGR, supported by green construction trends, renovation of commercial structures, and modernization of urban infrastructure. Building codes emphasizing fire resistance and environmental sustainability have led to increased adoption of non-combustible aluminium façade systems. Manufacturers are developing high-performance cladding materials with improved UV and corrosion resistance. Retrofitting initiatives under federal and state energy-efficiency programs are boosting replacement demand. The market also benefits from expanded use in transportation, healthcare, and educational facilities.

Key Market Factors:

The United Kingdom’s market grows at 2.2% CAGR, driven by post-regulatory improvements in façade safety, energy efficiency, and material traceability. After the introduction of stricter building standards under the Building Safety Act 2022, demand for fire-compliant aluminium cladding has increased in both residential and commercial sectors. Manufacturers are introducing high-integrity, A2-rated panels meeting European fire classifications. The retrofit segment is expanding as older high-rise buildings undergo façade replacement. Government-backed sustainability initiatives are encouraging recyclable and low-carbon material adoption in public infrastructure projects.

Market Development Factors:

Japan’s market grows at 2.0% CAGR, supported by precision engineering, building modernization, and focus on disaster-resilient construction. Domestic firms are developing lightweight aluminium cladding systems optimized for seismic stability and high weather resistance. Innovation in fluorocarbon-coated and multi-layer insulation panels improves thermal control in high-rise structures. Government policies promoting green and disaster-proof construction continue to guide market demand. The focus on urban redevelopment and infrastructure renewal ensures consistent adoption of durable, low-maintenance façade materials.

Key Market Characteristics:

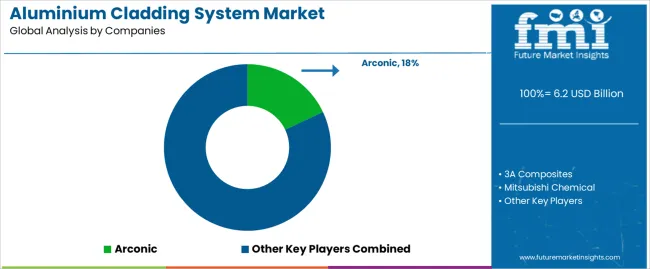

The aluminium cladding system market is moderately consolidated, with around twenty global and regional manufacturers supplying architectural façades and composite panel systems for commercial and residential construction. Arconic leads the market with an estimated 18.0% global share, supported by its long-standing expertise in aluminium sheet and coil production, advanced coating technologies, and a diversified portfolio used in high-rise and infrastructure projects. The company’s leadership is reinforced by material innovation, compliance with international fire-safety standards, and strong supply partnerships with architectural and construction firms worldwide.

3A Composites, Mitsubishi Chemical, and Speira follow as major global participants, offering high-quality aluminium composite materials (ACMs) under recognized brands used in façade, signage, and transportation applications. Their competitive advantage lies in continuous research on lightweight, durable, and weather-resistant cladding systems that meet energy efficiency and design flexibility requirements. Almeco, Alucoil, and Aludecor occupy solid mid-tier positions, focusing on decorative finishes, color consistency, and surface durability for aesthetic building designs. Regional producers such as Mulk Holdings, Guangzhou Goodsense, Shanghai Huayuan, and Jiangxi Hongtai Industry Group drive cost competitiveness and local supply reliability in Asia and the Middle East through large-scale production capacity and integrated fabrication services.

Competition in this market centers on fire resistance, surface durability, installation efficiency, and aesthetic customization. Growth is driven by rapid urban construction, renovation of aging façades, and stricter building safety codes encouraging the use of certified aluminium composite and honeycomb cladding systems with enhanced thermal and environmental performance.

| Items | Values |

|---|---|

| Quantitative Units | USD billion |

| Classification | Solid Aluminum Panels, Aluminum Composite Panels, Others |

| Application | Residential, Commercial, Industrial |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Countries Covered | India, China, USA, Germany, South Korea, Japan, Italy, and 40+ countries |

| Key Companies Profiled | Arconic, 3A Composites, Mitsubishi Chemical, Speira, Almeco, Alucoil, Aludecor, Mulk Holdings, Metawell, CEI Materials, Fairview, Jyi Shyang Industrial, JMA Aluminium, Shenyang Yuanda Aluminum Engineering, Jiangsu Pivot New Decorative Materials, Guangzhou Goodsense Decorative Building Materials, Shanghai Huayuan New Composite Materials, Dongguan Walltes Decorative Material, Jiangxi Hongtai Industry Group, Yaret, Guangdong Likeair Industry |

| Additional Attributes | Dollar sales by classification and application categories; regional adoption trends across Asia Pacific, Europe, and North America; competitive landscape of aluminum cladding and façade system manufacturers; advancements in composite panel technology and fire-resistant coatings; integration with green building design and modern architectural applications. |

The global aluminium cladding system market is estimated to be valued at USD 6.2 billion in 2025.

The market size for the aluminium cladding system market is projected to reach USD 8.0 billion by 2035.

The aluminium cladding system market is expected to grow at a 2.6% CAGR between 2025 and 2035.

The key product types in aluminium cladding system market are aluminum composite panels, solid aluminum panels and others.

In terms of application, commercial segment to command 49.0% share in the aluminium cladding system market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Aluminium Foil Zipper Pouch Market Size and Share Forecast Outlook 2025 to 2035

Aluminium Profiles for Solar Panel Market Size and Share Forecast Outlook 2025 to 2035

Aluminium Fishing Boat Market Size and Share Forecast Outlook 2025 to 2035

Aluminium Ammonium Sulphate Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Aluminium Foil Seal Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Aluminium Chloride Market Analysis - Size, Share & Forecast 2025 to 2035

Aluminium Market Analysis - Size, Share & Forecast 2025 to 2035

Aluminium-Free Deodorant Market Analysis - Trends, Growth & Forecast 2025 to 2035

Market Share Insights for Aluminium Bottle Providers

Competitive Landscape of Aluminium Foil Zipper Pouch Providers

Competitive Breakdown of Aluminium Cup Suppliers

Aluminium Cup Market Trends - Size, Growth & Demand 2025 to 2035

Aluminium Ion Battery Market Growth - Trends & Forecast 2025 to 2035

Aluminium Bottle Market Growth – Size, Demand & Forecast 2025 to 2035

Aluminium Foil Sachet Market

Aluminium Production Chemicals Market

Aluminium Composite Panels Market

Aluminium Nitride Market

USA Aluminium Bottle Market Insights – Demand, Size & Industry Trends 2025-2035

Japan Aluminium Bottle Market Insights – Growth, Demand & Trends 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA