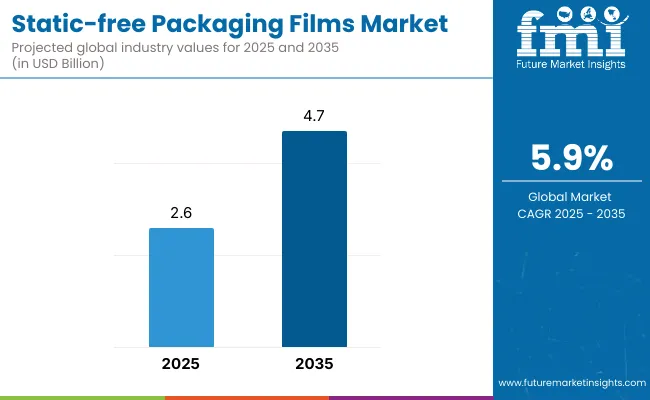

The global static-free packaging films market, also known as the anti-static film market, is projected to grow from USD 2.6 billion in 2025 to approximately USD 4.7 billion by 2035, registering a CAGR of 5.9% during the forecast period.

| Metric | Value |

|---|---|

| Market Size in 2025 | USD 2.6 billion |

| Projected Market Size in 2035 | USD 4.7 billion |

| CAGR (2025 to 2035 ) | 5.9% |

This growth is primarily attributed to the increasing demand for protective packaging solutions in the electronics and semiconductor industries, where static electricity can damage sensitive components.The market's expansion is further driven by the growing emphasis on product safety, regulatory compliance, and advancements in biodegradable and recyclable materials that enhance product performance and sustainability.

In February 2025, Toyobo Co., Ltd. announced a strategic investment to renovate its PET film production line at the Tsuruga Film Plant in Japan, aiming to boost the production capacity of COSMOSHINE SRF®, a super retardation film widely used in LCD polarizer protection. The upgrade will enable the facility to manufacture 3-meter-wide films, addressing the growing demand for large-format display screens.

This expansion is expected to increase the production volume of COSMOSHINE SRF® by approximately 30%. “We aim to meet the increasing demand for wide films with this upgraded line, which will significantly enhance our competitiveness in the global optical film market,” Toyobo stated in the official release.

Recent innovations in the static-free packaging films market have centered around enhancing sustainability, functionality, and adaptability to diverse applications. Manufacturers are increasingly adopting biodegradable and recyclable materials, such as bio-based polymers, to produce eco-friendly films that align with stringent environmental regulations and cater to the growing consumer demand for sustainable packaging solutions.

Advancements in film manufacturing technologies have led to the development of films with improved moisture resistance, UV protection, and tamper-evident features, ensuring better performance in various environmental conditions.

Additionally, the integration of smart technologies, including RFID tags and QR codes, is enabling better inventory management, product tracking, and real-time monitoring of environmental conditions, aligning with the growing trend of smart packaging and logistics.

The static-free packaging films market is expected to witness significant growth in emerging economies, particularly in the Asia-Pacific region, driven by rapid industrialization, urbanization, and infrastructural development. Countries like China, India, and South Korea are experiencing a surge in demand for efficient packaging solutions in the electronics and semiconductor industries.

The expansion of the e-commerce industry and the increasing need for efficient logistics and protective packaging solutions further propel the market's growth in these regions. Manufacturers are anticipated to focus on developing cost-effective, sustainable, and customizable static-free packaging film solutions to cater to diverse industry needs and comply with evolving regulatory standards.

Strategic collaborations, technological advancements, and investments in local production facilities are likely to play a crucial role in capturing market share and driving growth in these regions.

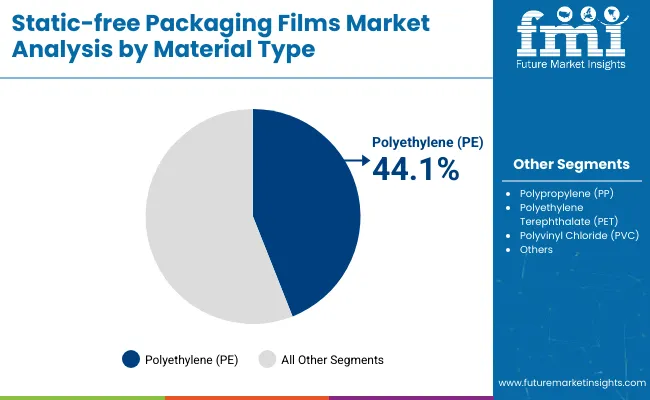

The market has been segmented based on material type, film type, end-use industry, film thickness, and region. By material type, polyethylene (PE), polypropylene (PP), polyethylene terephthalate (PET), polyvinyl chloride (PVC), and other specialty films are used to offer anti-static protection, moisture barrier, and clarity tailored for high-sensitivity packaging.

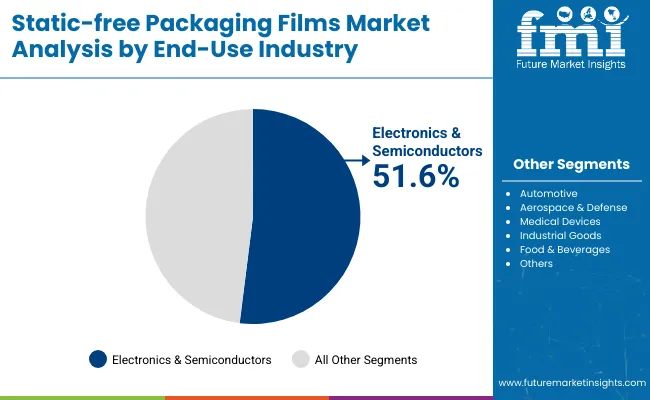

Film type segmentation includes bags & pouches, wraps & laminates, cling films, shrink films, and others serving flexible packaging applications that require static shielding, especially in automated lines. End-use industries encompass electronics & semiconductors, automotive, aerospace & defense, medical devices, industrial goods, food & beverages, and others, reflecting the broadening need for electrostatic discharge (ESD) protection across critical sectors.

Film thickness segments include below 50 microns, 51 to 100 microns, 101 to 150 microns, and above 150 microns to accommodate diverse product weights, durability requirements, and sealing strength. Regional segmentation includes North America, Europe, Latin America, Asia Pacific, and the Middle East and Africa to reflect evolving electronic manufacturing ecosystems, anti-static regulations, and packaging innovations worldwide.

The polyethylene (PE) segment is forecasted to dominate the material type category with a 44.1% share in the static-free packaging films market by 2025, owing to its versatility, lightweight properties, and reliable static dissipation performance. PE films especially in low-density (LDPE) and linear low-density (LLDPE) formats are widely utilized in anti-static packaging for their excellent process ability, flexibility, and surface conductivity when treated with anti-static agents or coextruded with conductive layers.

These films offer consistent electrostatic discharge (ESD) protection, making them highly suitable for packaging sensitive components such as printed circuit boards (PCBs), memory chips, and sensors. Additionally, PE films are compatible with various packaging types, including bags, liners, pouches, and wraps, supporting both automated and manual operations.

PE’s recyclability and adaptability for multilayer anti-static film construction, combined with its cost-efficiency further reinforce its role as the material of choice for mid- to high-volume ESD packaging applications. With rising global demand for electronics and increased emphasis on minimizing product damage during shipping and storage, the polyethylene segment is expected to remain dominant across static-free packaging innovations.

The electronics & semiconductors segment is expected to lead the end-use industry category with a 51.6% share in 2025, driven by the rapid growth of advanced electronics, 5G infrastructure, IoT devices, and EV-related components. Static-free packaging films play a crucial role in protecting sensitive devices from electrostatic discharge that can compromise performance or render components non-functional.

Semiconductor manufacturers, PCB assemblers, and OEMs rely on static-dissipative and conductive films to meet stringent quality control, yield improvement, and regulatory compliance standards. Applications include reel wraps, wafer shippers, chip trays, dry packs, and vacuum-sealed moisture-barrier bags all of which demand packaging films that provide controlled static decay, EMI shielding, and moisture resistance.

Miniaturization of devices and increasing packaging density in modern electronics, the tolerance for electrostatic exposure is decreasing, further intensifying the need for reliable static-free film packaging. Growth in electronics manufacturing hubs across East Asia (China, South Korea, Taiwan), and rising investment in semiconductor fabs in the USA and Europe, have expanded the addressable market for ESD-safe packaging materials.

Material Cost, Performance Limitations, and Disposal Concerns

The static-free packaging films market is also challenged concerning the high cost of specialty antistatic additives and polymers, which is likely to limit the scalability of these films to the price-sensitive segments. Although these films offer critical protection for sensitive electronics, performance risks associated with high and low humidity conditions or extreme temperature conditions can buy ineffective.

Another key consideration is disposability and environmental impact, where many static-dissipative films are constructed using multi-layer plastic composites that are non-biodegradable and hard to recycle, leading to regulatory scrutiny in markets with high sustainability aspirations.

Electronics Growth, ESD Compliance Demand, and Sustainable Material Innovation

This growth is occurring in the face of challenges as demand from electronics, semiconductors, automotive electronics, aerospace and medical device sectors, where electrostatic discharge (ESD) protection is mission-critical, drives the market to be a key growth area.

As integrated circuits or microelectronic components shrink or become more sensitive, there’s an increased need for static-free films that are high-performance, preventing the accumulation of charge when stored or shipped.

Bio-based antistatic films, recyclable conductive polymers, and water-based ESD coatings are evolving new opportunities. The growth is also driven by the increasing number of ESD-compliant packaging regulations and industry protocols like the ANSI/ESD S541 guidelines that mandate OEMs and contract manufacturers to use certified protective packaging.

The increasing use of automated electronics assembly lines, transport of EV batteries, and distribution of 5G components is creating opportunities for transparent, flexible, and high-barrier static-free films.

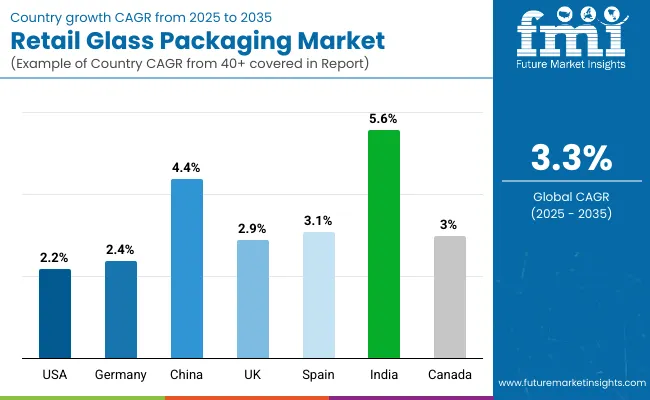

The USA market has generated a healthy demand from semiconductor fabs, aerospace electronics and medical device exporters. Manufacturers are investing in high-barrier antistatic films for better chip transport and cleanroom storage, as well as exploring sustainable film options to comply with corporate ESG mandates.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 7.5% |

Demand in the UK stems from high-value electronics manufacturing, healthcare exports and advanced packaging R&D centers. There is also competition from novel materials, including light-weight, flexible substrate for circuit boards and small sensors handbook, which is driving the adoption of a recyclable and printed antistatic films in the defense and telecom industries.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 7.2% |

EU Regions aggressively utilize static-free films across EV battery modules and used in industrial automation equipment and precision optics packaging Regulatory compression regarding plastic tow waste reduction and ESD compliance in transport, is accelerating the demand for low-emission, all-weather and high-durability films in Germany, France, the Netherlands.

| Region | CAGR (2025 to 2035) |

|---|---|

| EU | 7.4% |

Japan’s market benefits from a strong focus on microelectronics, robotics, and medical sensor exports, where packaging integrity is critical. The producers have been stressing the availability of ultra-clean, static-neutral films with moisture control properties for things like semiconductor packaging and flexible printed circuit boards.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 7.4% |

A key growth region is South Korea, backed by its exploding semiconductor, display, and EV battery materials manufacturing sectors. Movement to smart factories and ESG-friendly export is accelerating the acceptance of smart ESD packaging containing embedded charge-dissipation layers and recyclable substrates.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 7.5% |

With the growing demand for the packaging films against static load at an increased speed in electronics, semiconductor, medical device, and also aerospace sector, the static-free packaging films market is capturing momentum. Innovations in multilayer films, biodegradable anti-static coatings, and conductive polymer blends are being driven by increased use of anti-static and ESD-safe materials to protect components during handling and shipping.

They include cleanroom-capable films, RFID-integrated packaging, and worldwide ESD compliance. Customizability, sustainability, and high-barrier performance continue to be major focus areas for specialty film manufacturers and a supplier of protective packaging.

for ESD-safe packaging materials.

The overall market size for the static-free packaging films market was USD 2.6 billion in 2025.

The static-free packaging films market is expected to reach USD 4.7 billion in 2035.

The demand for static-free packaging films is rising due to growing use in electronics and semiconductor industries, increasing need to prevent electrostatic discharge damage, and advancements in flexible packaging technologies. The rising demand for safe packaging of sensitive electronic components is further boosting market growth.

The top 5 countries driving the development of the static-free packaging films market are the USA, China, South Korea, Japan, and Germany.

Polyethylene films and bags & pouches are expected to command a significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Packaging Supply Market Size and Share Forecast Outlook 2025 to 2035

Packaging Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tubes Market Size and Share Forecast Outlook 2025 to 2035

Packaging Jar Market Forecast and Outlook 2025 to 2035

Packaging Barrier Film Market Size and Share Forecast Outlook 2025 to 2035

Packaging Laminate Market Size and Share Forecast Outlook 2025 to 2035

Packaging Burst Strength Test Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tapes Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Packaging Materials Market Size and Share Forecast Outlook 2025 to 2035

Packaging Labels Market Size and Share Forecast Outlook 2025 to 2035

Packaging Equipment Market Size and Share Forecast Outlook 2025 to 2035

Packaging Resins Market Size and Share Forecast Outlook 2025 to 2035

Packaging Inspection Systems Market Size and Share Forecast Outlook 2025 to 2035

Packaging Design And Simulation Technology Market Size and Share Forecast Outlook 2025 to 2035

Packaging Suction Cups Market Size and Share Forecast Outlook 2025 to 2035

Packaging Straps and Buckles Market Size and Share Forecast Outlook 2025 to 2035

Packaging Coating Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Packaging Testing Equipment Market Analysis & Growth 2025 to 2035

Packaging Bins Market Trends - Growth & Demand 2025 to 2035

Packaging Inserts Market Insights - Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA