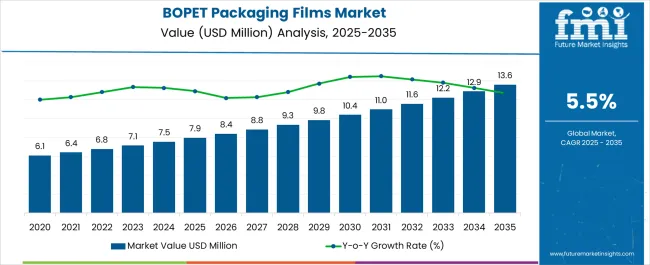

The BOPET Packaging Films Market is estimated to be valued at USD 7.9 million in 2025 and is projected to reach USD 13.6 million by 2035, registering a compound annual growth rate (CAGR) of 5.5% over the forecast period.

| Metric | Value |

|---|---|

| BOPET Packaging Films Market Estimated Value in (2025 E) | USD 7.9 million |

| BOPET Packaging Films Market Forecast Value in (2035 F) | USD 13.6 million |

| Forecast CAGR (2025 to 2035) | 5.5% |

The BOPET packaging films market is witnessing robust expansion driven by increasing demand for durable, lightweight, and sustainable packaging solutions across diverse industries. The material’s superior mechanical strength, thermal stability, and barrier properties against moisture and gases have positioned it as a preferred choice for both food and non food applications.

Growing consumer awareness of product safety and freshness has further encouraged adoption in flexible packaging formats. Additionally, advances in coating and metallization technologies are enhancing the performance of BOPET films, making them suitable for high barrier packaging needs.

Regulatory support for recyclable materials and the shift toward eco friendly packaging alternatives are reinforcing market growth. The outlook remains positive as manufacturers continue to innovate in thin gauge films and specialty grades tailored to high performance packaging, ensuring compliance with evolving industry standards and sustainability goals.

The below 15 micron BOPET packaging films segment is expected to represent 41.70% of total revenue by 2025 within the thickness category, establishing it as the leading segment. This dominance is being driven by its widespread use in flexible packaging where lightweight films provide cost efficiency and reduced material consumption.

Their ability to deliver strong tensile strength, excellent clarity, and compatibility with laminations has expanded their role in multilayer packaging structures. Demand for thin gauge films has been reinforced by brand owners seeking sustainability through source reduction while maintaining packaging performance.

These advantages have positioned this thickness range as the most widely adopted format in the BOPET packaging films market.

The labels application segment is projected to account for 38.60% of total market revenue by 2025, making it the leading application area. Growth is being fueled by the demand for durable, high quality labels that can withstand temperature variations, moisture exposure, and frequent handling.

BOPET films are being valued for their dimensional stability, printability, and resistance to shrinkage, ensuring consistent branding and product information visibility. Increasing regulatory emphasis on clear labeling and traceability in industries such as food and beverages, pharmaceuticals, and consumer goods has further accelerated adoption.

Their contribution to premium labeling applications has reinforced the leadership of this segment within the market.

The food end use industry segment is anticipated to contribute 44.90% of total market revenue by 2025, positioning it as the most prominent sector. This leadership is attributed to the growing reliance on BOPET films for packaging perishable and processed food products due to their superior barrier performance and extended shelf life capabilities.

Rising consumer preference for packaged convenience foods and ready to eat meals has further boosted demand. Food manufacturers are increasingly adopting BOPET films for their ability to maintain product integrity, resist contamination, and enable attractive packaging designs.

As food safety and sustainability remain critical drivers, the food industry continues to anchor its position as the largest end use sector in the BOPET packaging films market.

Over the period of 2020 to 2025, the global BOPET packaging films market has been thriving at a 4.9% CAGR.

BOPET films are orientated films that are commonly used in the packaging of products such as food and beverages, electrical and electronics, pharmaceuticals, and cosmetic and personal care products.

BOPET packing films are suitable for a variety of applications. BOPET films can be used to make bags and pouches, wraps, laminates, labels, and tapes. Food continues to be the most important end-use industry for BOPET packaging films.

BOPET packaging films are used in the packaging of fresh produce, meat, confectionary, and dairy products. Through the printing and laminating operations, BOPET packaging remains sturdy. As a result, they are highly attractive for high-quality graphic packaging applications.

Biaxially oriented polyethylene terephthalate packaging films are reshaping the market environment for flexible packaging. Business profit margins are anticipated to climb along with capacity increases by top companies as capacity utilization levels are seeing a noticeable boost.

The USP that continues to be a significant growth driver of the market, BOPET films are promoted as the next generation of recyclable packaging. A number of major players are going after markets including fresh meat, snacks, and coffee by lowering bopet film prices and offering weight reduction.

BOPET packaging film producers are putting up new production lines in response to the upcoming opportunities in growing markets. A convergence of themes, including the focus on sustainable materials and the transition away from high-volume technical applications towards commodities, continue to have an impact on adoption in these areas.

Although BOPET film manufacturers of raw materials continue to seek new customers, BOPET packaging filmmakers are devising cost-effective procurement strategies. To capitalize on advances in the recyclable packaging market, leading BOPET film manufacturers are focusing their efforts on investment and substitution prospects.

BOPET packaging film sales may increase as the emphasis on the total recyclability of flexible packaging goods increases, with no influence on quality or shelf-life.

The global BOPET packaging films industry is to advance at a 5.5% CAGR between 2025 and 2035.

| Attributes | Details |

|---|---|

| BOPET Packaging Films Market CAGR (From 2025 to 2035) | 5.5% |

| BOPET Packaging Films Market Size (2025) | USD 7.14 billion |

| BOPET Packaging Films Market Size (2035) | USD 12.31 billion |

| BOPET Packaging Films Market Size (2025) | USD 6,765.5 million |

The market is expanding due to rising packaging demand. BOPET packaging films can extend product shelf life, and the rising consumer base for high-barrier packaging solutions is fueling market expansion. Increasing food safety concerns are projected to drive market expansion.

The primary driver pushing biaxially oriented polyethylene terephthalate packaging films demand is growing cosmetics demand, which is driven by a growing population, changing lifestyles, and rising per capita disposable income. Cosmetics have a limited shelf life and must be carefully preserved. Many replacements, such as aluminum foil, are more expensive than BOPET packaging films, which drives market expansion.

Cosmetics' Short Shelf Life to Power Positive Market Growth

The accelerated demand for cosmetics, as well as rising concerns about their safety, is projected to be important drivers of the BOPET packaging films market. Cosmetics' short shelf life is to propel growth in the BOPET packaging films industry.

The market's high mechanical strength and thermal qualities are leading to the growth, while its superior transparency and stiffness are attracting new purchasers. In the near future, the BOPET packaging films market to be driven by expanding pharmaceutical demand, rising fast-food demand, and trends such as multi-layered packaging solutions.

| Attributes | Labels |

|---|---|

| Market CAGR | 6.0% |

| Market size - 2025 | USD 775.8 million |

| Market Share - 2025 | 10.9% |

| Attributes | Tapes |

|---|---|

| Market CAGR | 6.3% |

| Market size - 2025 | USD 941.4 million |

| Market Share - 2025 | 13.2% |

| Attributes | Wraps |

|---|---|

| Market CAGR | 5.3% |

| Market size - 2025 | USD 1,858.1 million |

| Market Share - 2025 | 26.0% |

| Attributes | Bags & Pouches |

|---|---|

| Market CAGR | 5.7% |

| Market size - 2025 | USD 2,362.0 million |

| Market Share - 2025 | 33.1% |

| Attributes | Laminates |

|---|---|

| Market CAGR | 4.5% |

| Market size - 2025 | USD 1,208.1 million |

| Market Share - 2025 | 16.9% |

Increasing Bag and Pouches Sales to Drive Good Business Outlook

Bags and pouches continue to be the primary revenue generator for industry participants, accounting for 33.1% of the BOPET packaging films market.

Waterproof bags and pouches can be printed with high-resolution graphics. They perform admirably with paper bag filling machines. Bags and pouches are growing increasingly popular since they are inexpensive and 100% recyclable, making them environmentally beneficial.

Bags and pouches have a high creative appeal that adds a commercial touch to the things they hold. These bags and pouches are stackable and have outstanding tensile and barrier properties.

One of the most lucrative BOPET packaging films industry is known to exist in the bags and pouches category. They are frequently employed to create pouches, including retort pouches. BOPET packing films are preferred because retort stabilization needs base films that are dimensionally stable. In the upcoming years, this is anticipated to support the need for biaxially oriented polyethylene terephthalate packaging films.

| Attributes | Food |

|---|---|

| Market CAGR | 6.0% |

| Market size - 2025 | USD 3,736.0 million |

| Market Share - 2025 | 52.3% |

| Attributes | Meat |

|---|---|

| Market CAGR | 6.2% |

| Market size - 2025 | USD 1,021.6 million |

| Market Share - 2025 | 27.3% |

| Attributes | Fresh Produce |

|---|---|

| Market CAGR | 6.7% |

| Market size - 2025 | USD 1,222.0 million |

| Market Share - 2025 | 32.7% |

| Attributes | Confectionery |

|---|---|

| Market CAGR | 5.7% |

| Market size - 2025 | USD 492.2 million |

| Market Share - 2025 | 13.2% |

| Attributes | Dairy |

|---|---|

| Market CAGR | 4.8% |

| Market size - 2025 | USD 237.1 million |

| Market Share - 2025 | 6.3% |

| Attributes | Others |

|---|---|

| Market CAGR | 5.2% |

| Market size - 2025 | USD 763.3 million |

| Market Share - 2025 | 20.4% |

| Attributes | Beverages |

|---|---|

| Market CAGR | 5.2% |

| Market size - 2025 | USD 1,152.6 million |

| Market Share - 2025 | 16.1% |

| Attributes | Cos. & Per. Care |

|---|---|

| Market CAGR | 4.8% |

| Market size - 2025 | USD 684.7 million |

| Market Share - 2025 | 9.6% |

| Attributes | Electronics |

|---|---|

| Market CAGR | 5.3% |

| Market size - 2025 | USD 576.5 million |

| Market Share - 2025 | 8.1% |

| Attributes | Pharmaceuticals |

|---|---|

| Market CAGR | 4.2% |

| Market size - 2025 | USD 535 million |

| Market Share - 2025 | 7.5% |

| Attributes | Other Ind. |

|---|---|

| Market CAGR | 5.1% |

| Market size - 2025 | USD 460.3 million |

| Market Share - 2025 | 6.4% |

Food Industry's Growing Adoption of BOPET Packing Sheets Is a Significant Trend

The most common uses for biaxially oriented polyethylene terephthalate packaging films include pouches like stand-up and retort pouches, lidding films, and metallized film used for food packing. The demand for BOPET packaging films in the food industry has increased as a result of growing worries about extended shelf life and the need to decrease food waste across the supply chain.

As the popularity of snacking increases, more single-serve and resealable flexible packaging options are being used. As a result, development is predicted to be fueled by rising packaged food consumption as well as the advantages of BOPET packaging films for sustainability.

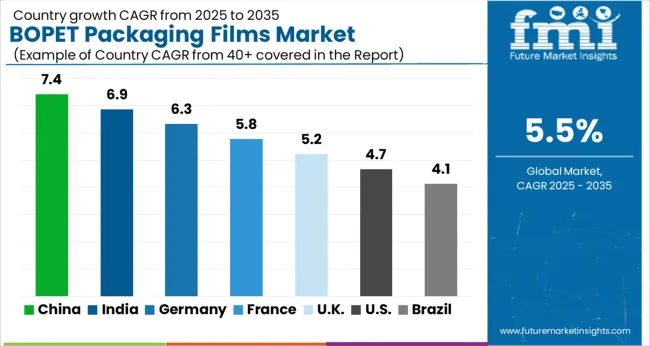

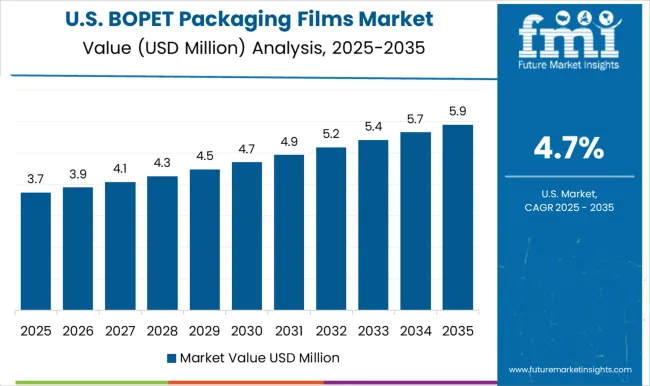

| Country | United States |

|---|---|

| HCAGR (From 2020 to 2025) | 4.3% |

| CAGR (From 2025 to 2035) | 4.6% |

| Country | Canada |

|---|---|

| HCAGR (From 2020 to 2025) | 4.8% |

| CAGR (From 2025 to 2035) | 5.5% |

| Country | India |

|---|---|

| HCAGR (From 2020 to 2025) | 6.2% |

| CAGR (From 2025 to 2035) | 7.1% |

| Country | China |

|---|---|

| HCAGR (From 2020 to 2025) | 6.2% |

| CAGR (From 2025 to 2035) | 7.1% |

| Country | Japan |

|---|---|

| HCAGR (From 2020 to 2025) | 6.4% |

| CAGR (From 2025 to 2035) | 5.2% |

| Country | United Kingdom |

|---|---|

| HCAGR (From 2020 to 2025) | 4.1% |

| CAGR (From 2025 to 2035) | 4.5% |

| Country | Germany |

|---|---|

| HCAGR (From 2020 to 2025) | 4.6% |

| CAGR (From 2025 to 2035) | 4.5% |

| Country | Spain |

|---|---|

| HCAGR (From 2020 to 2025) | 4.3% |

| CAGR (From 2025 to 2035) | 5.0% |

| Country | Italy |

|---|---|

| HCAGR (From 2020 to 2025) | 3.6% |

| CAGR (From 2025 to 2035) | 3.9% |

| Attributes | Details |

|---|---|

| United States Market Size (USD million/ billion) by End of Forecast Period (2025) | USD 1,302.6 million |

| United States Market Share (2035) | 90.8% |

Accelerated Demand for BOPET Polyester Films in the United States

Demand for BOPET packaging films has increased significantly over the world, particularly in the United States. The high demand generated by the food, cigarette, and label industries is projected to benefit BOPET packaging film producers the most.

Among all biaxially-oriented films, BOPET polyester films promise to provide superior performance at low thickness while maintaining high stiffness, strong heat resistance, and a fair balance of oxygen and moisture barrier. These characteristics have benefited biaxially oriented polyethylene terephthalate packaging films in increasing market share in the United States.

| Attributes | Details |

|---|---|

| China Market Size (USD million/ billion) by End of Forecast Period (2035) | USD 1,515.5 million |

| China Market Share (2035) | 74.9% |

Chinese market growth may be fueled by advancements in packaging films.

A significant market share in the world belongs to China, one of the top producers and consumers of packaging films. China has become one of the major BOPET packaging films market among the South Asian nations. To keep up with the increased global demand, most industry competitors are increasing their production capabilities.

Due to the existence of numerous organized and unorganized companies, the Chinese biaxially oriented polyethylene terephthalate packaging films market has become extremely competitive and is anticipated to grow at a rapid rate throughout the forecast period.

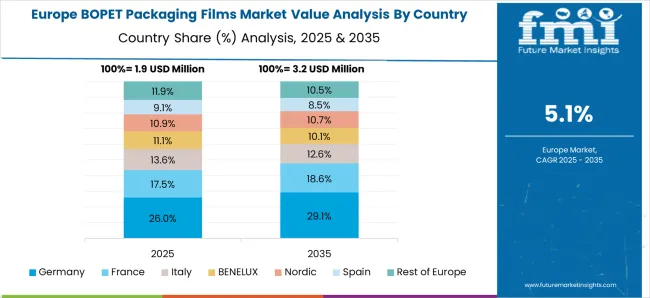

| Country | Europe |

|---|---|

| Market Size - 2025 | USD 491.8 million |

| Market Share - 2025 | 28.9% |

| Country | Germany |

|---|---|

| Market Size - 2025 | USD 171.1 million |

| Market Share - 2025 | 10.1% |

| Country | Italy |

|---|---|

| Market Size - 2025 | USD 206.8 million |

| Market Share - 2025 | 12.2% |

| Country | France |

|---|---|

| Market Size - 2025 | USD 269.9 million |

| Market Share - 2025 | 15.9% |

| Country | United Kingdom |

|---|---|

| Market Size - 2025 | USD 164.7 million |

| Market Share - 2025 | 28.9% |

| Country | Spain |

|---|---|

| Market Size - 2025 | USD 491.8 million |

| Market Share - 2025 | 28.9% |

| Country | Russia |

|---|---|

| Market Size - 2025 | USD 141.7 million |

| Market Share - 2025 | 8.3% |

Growing Demand for Flexible Food Packaging Sheets is Expanding the European Market

Europe offers BOPET packaging film suppliers a sizable new market opportunity. This can be ascribed to the region's rising demand for packaged and processed foods. Flexible food packaging films are a popular option for making labels and tapes because of their excellent sealing capabilities and heat resistance.

The barrier qualities of flexible food packaging sheets are being improved by the packaging converters by including elements like metallization, coatings, and more. While Germany is anticipated to maintain its lead in terms of market share and new opportunities in the European market, Spain is anticipated to experience considerably higher increase in BOPET packaging film demand.

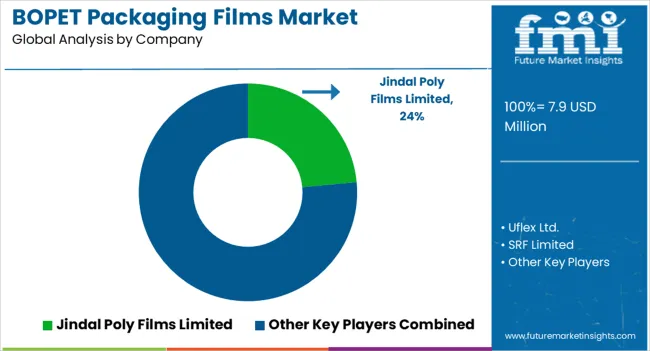

Due to the presence of various regional competitors, the worldwide BOPET packaging films industry is considered a fragmented field. Leading BOPET packaging film manufacturers are increasing production capacity and investing in existing manufacturing facilities to boost their worldwide market position.

Newest Events:

| Date | February 2024 |

|---|---|

| Company | Jindal Poly Films |

| Details | Jindal Poly Films approved a USD 99.4 million investment for the expansion of the company's activities in India, including the addition of a BOPET film line and a BOPP film line. |

The global bopet packaging films market is estimated to be valued at USD 7.9 million in 2025.

The market size for the bopet packaging films market is projected to reach USD 13.6 million by 2035.

The bopet packaging films market is expected to grow at a 5.5% CAGR between 2025 and 2035.

The key product types in bopet packaging films market are below 15 micron bopet packaging films, 15-30 micron bopet packaging films, 30-50 micron bopet packaging films and above 50 micron bopet packaging films.

In terms of application, labels segment to command 38.6% share in the bopet packaging films market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Retort grade BOPET Films Market

North America BOPET Films Market Trends – Growth & Forecast 2024-2034

Packaging Supply Market Size and Share Forecast Outlook 2025 to 2035

Packaging Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tubes Market Size and Share Forecast Outlook 2025 to 2035

Packaging Jar Market Forecast and Outlook 2025 to 2035

Packaging Barrier Film Market Size and Share Forecast Outlook 2025 to 2035

Packaging Laminate Market Size and Share Forecast Outlook 2025 to 2035

Packaging Burst Strength Test Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tapes Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Packaging Materials Market Size and Share Forecast Outlook 2025 to 2035

Packaging Labels Market Size and Share Forecast Outlook 2025 to 2035

Packaging Equipment Market Size and Share Forecast Outlook 2025 to 2035

Packaging Resins Market Size and Share Forecast Outlook 2025 to 2035

Packaging Inspection Systems Market Size and Share Forecast Outlook 2025 to 2035

Packaging Design And Simulation Technology Market Size and Share Forecast Outlook 2025 to 2035

Packaging Suction Cups Market Size and Share Forecast Outlook 2025 to 2035

Packaging Straps and Buckles Market Size and Share Forecast Outlook 2025 to 2035

Packaging Coating Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Packaging Testing Equipment Market Analysis & Growth 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA