The chickpea protein market is moderately fragmented with various levels of competition. The market is dominated by multinational companies, which command about 45% of the world share. The reasons for this include advanced production technologies, vast distribution networks, and significant investments in product innovation. Ingredion, ADM, and Roquette Frères are some examples.

Regional leaders are ChickP Ltd. of Israel and InnovoPro of Israel, taking a 30% market share due to a focus on regional preferences and innovation in new application formulations like plant-based dairy and meat alternatives. Niche players with start-up positions contribute another 25% of market share; these entities easily adapt to and cater to a health conscious as well as environmentally friendly consumer. Private labels do not operate within this space mainly because of the niche of products chickpea protein comprises.

Market Share by Key Players

| Market Share, 2025 | Industry Share% |

|---|---|

| Top Multinational Players (Ingredion, ADM, Roquette Frères, PURIS, BENEO) | 40% |

| Regional Leaders (ChickP Ltd., InnovoPro, Nutriati, Shandong Jianyuan Group, Gushen Biotech) | 35% |

| Startups and Niche Brands (Plantible Foods, The Green Labs LLC, Farbest Brands, Bioway Biotech, Axiom Foods) | 25% |

There are considerable opportunities for new entrants and regional players to capture the market share, as the market is moderately fragmented.

The chickpea protein market is globally segmented into several types of products, which include isolates (30%), concentrates (25%), texture (20%), and hydrolyzed (25%). Highly concentrated isolates have a minimum protein concentration of 90% and are popularly used in the production of sports nutrition and performance-enhancing products.

Concentrations containing 65-85% protein are more affordable, which makes them suitable for mass consumption in applications for food and beverages, like fortified snacks and baked products. Textured chickpea protein can be processed into meat-like structures and textures and is important for the increasingly booming plant-based meat alternatives market. Hydrolyzed chickpea protein, with improved digestibility and absorption is used in a variety of specialized nutrition products, among others, infant formula, and medical food.

The food and beverage processing segment leads the market with a share of 40%. Consumer preference is on an upswing where it concerns products related to increasing consumption of plant-based proteins in numerous food and drink offerings. Chickpea protein can be the potential factor in high growth in terms of demand through applications in dairy and yogurt alternatives by replacing traditional types with chickpea-based milks and yogurt for consumers.

Its applications in chickpea protein improve the protein content and give better texture to breads, muffins, and other bakery items. Additionally, within dairy-free ice creams and other desserts, there is an increase in the demand for such products, which entices consumers to buy healthier, indulgent plant-based desserts. This high penetration of chickpea protein in the food and beverage industry reflects its flexibility and the huge growth potential in the market.

The year 2024 was especially important for the global chickpea protein market as companies embraced innovation, sustainability, and strategic expansion to cement their positions. Leading players such as Ingredion and Roquette Frères heavily invested in increasing production capacities and enhancing product quality.

ChickP Ltd and InnovoPro made tremendous strides with innovative formulation for vegan and clean-label products. Startups like Plantible Foods came with proprietary extraction technologies and ADM raised its stake in the Asia-Pacific market, through tie-ins with local food manufacturers.

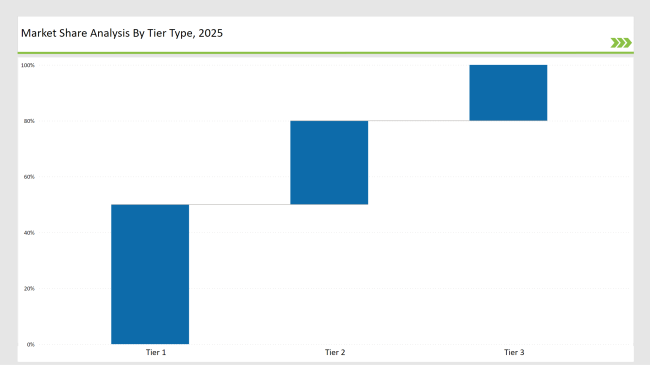

| By Tier Type | Tier 1 |

|---|---|

| Market Share (%) | 50% |

| Example of Key Players | Ingredion, ADM, Roquette Frères |

| By Tier Type | Tier 2 |

|---|---|

| Market Share (%) | 30% |

| Example of Key Players | ChickP Ltd., InnovoPro , Nutriati |

| By Tier Type | Tier 3 |

|---|---|

| Market Share (%) | 20% |

| Example of Key Players | Regional players, startups |

| Brand | Key Focus |

| Ingredion | Expanded isolated production capacity to meet growing demand in North America. |

| Roquette Frères | Built a state-of-the-art plant-based protein facility in Europe to enhance global capacity. |

| ChickP Ltd. | Developed novel solutions for plant-based dairy applications like vegan cheese and yogurt. |

| InnovoPro | Launched a high-protein chickpea concentrate targeting premium snack and beverage markets. |

| Nutriati | Partnered with leading food companies to expand gluten-free baked goods with chickpea protein. |

| ADM | Collaborated with Asian firms to integrate chickpea protein into ready-to-eat meal products. |

| PURIS | Focused on hydrolyzed proteins for infant nutrition and fortified beverage categories. |

| Gushen Biotech | Increased exports to North America and Europe, focusing on cost-competitive concentrates. |

| Plantible Foods | Introduced a proprietary protein extraction process to improve isolate functionality. |

| Axiom Foods | Added organic chickpea protein powders to its product portfolio for broader application. |

Demand for chickpea protein isolate-based plant-based dairy alternatives will grow strongly in North America and Europe. Innovating companies with quality products in this category can gain a good market share of the rapidly growing plant-based dairy market.

Functional foods, like protein-enriched snacks and beverages, will represent the future of consumer taste in developed regions. Investing in this category, with clean-label and allergen-free claims, will give manufacturers a strong competitive advantage and thus enable them to satisfy the increased demand for healthier and more nutritional choices.

The rise of e-commerce will enable manufacturers to reach niche audiences more effectively. Subscription models for protein powders and fortified snacks can help build customer loyalty and create recurring revenue streams, enabling companies to establish a stronger direct connection with their target consumers.

Consumers will stay sustainable over the next ten years. Europe and North America should watch out for investment in eco-friendly production, sourcing that is not harming the environment, and innovative packages as it draws eco-conscious customers into their portfolio while demonstrating an overall commitment to sustainability, which in this case becomes a strong point in competition.

As per Product Type, the industry has been categorized into Isolate, Concentrate, Textured and Hydrolyzed.

As per Nature, the industry has been categorized into Organic and Conventional.

As per End Use, the industry has been categorized into Food & Beverage Processing, Sports Nutrition, Infant Nutrition, Pharmaceutical Products, Personal Care Products and Animal Nutrition.

Industry analysis has been carried out in key countries of North America, Latin America, Western Europe Eastern Europe, Balkans & Baltic, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific and Middle East & Africa.

Ingredion, ADM, and Roquette Frères dominate the market, collectively holding approximately 35% of the market share, driven by advanced production and extensive distribution.

Startups and niche brands account for 25%, driven by innovation in health-focused products and sustainability initiatives.

North America leads the market, fueled by rising veganism and significant investments in R&D by companies like ADM.

Sustainability is a key driver, with consumers demanding eco-friendly production and packaging, particularly in Europe and North America.

The nutraceutical segment holds 15% of the market, with growing demand for protein supplements and sports nutrition products globally.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Chickpea Protein Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

UK Chickpea Protein Market Insights – Demand, Size & Industry Trends 2025–2035

USA Chickpea Protein Market Report – Trends, Demand & Industry Forecast 2025–2035

ASEAN Chickpea Protein Market Trends – Growth, Demand & Forecast 2025–2035

Europe Chickpea Protein Market Outlook – Size, Share & Forecast 2025–2035

Key Companies & Market Share in the Protein A Resins Market

Market Share Distribution Among Fish Protein Manufacturers

Australia Chickpea Protein Market Outlook – Demand, Trends & Forecast 2025–2035

Competitive Overview of Fungal Protein Market Share

Market Share Insights of Leading Protein Binding Assays Providers

Assessing Rapeseed Protein Market Share & Industry Trends

Industry Share Analysis for Protein Purification Resin Companies

Latin America Chickpea Protein Market Analysis – Demand, Share & Forecast 2025–2035

Competitive Landscape of Hydrolyzed Vegetable Protein Providers

A detailed global analysis of Brand Share Analysis for Animal Feed Alternative Protein Industry

Protein-Coating Line Market Forecast Outlook 2025 to 2035

Protein Labelling Market Size and Share Forecast Outlook 2025 to 2035

Protein Puddings Market Size and Share Forecast Outlook 2025 to 2035

Protein/Antibody Engineering Market Size and Share Forecast Outlook 2025 to 2035

Protein Expression Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA