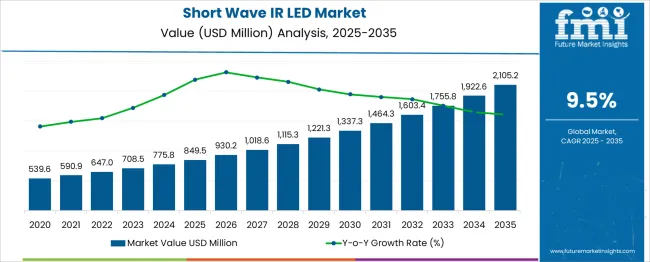

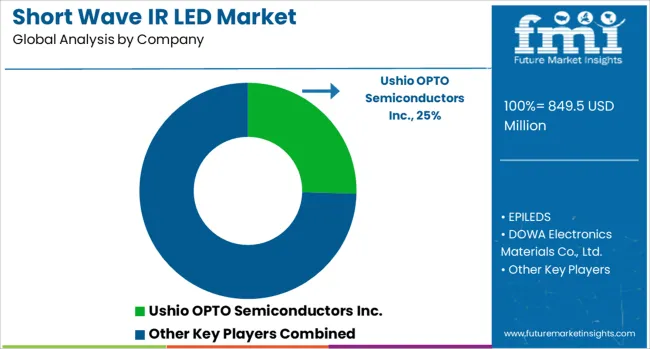

The Short Wave IR LED Market is estimated to be valued at USD 849.5 million in 2025 and is projected to reach USD 2105.2 million by 2035, registering a compound annual growth rate (CAGR) of 9.5% over the forecast period.

| Metric | Value |

|---|---|

| Short Wave IR LED Market Estimated Value in (2025 E) | USD 849.5 million |

| Short Wave IR LED Market Forecast Value in (2035 F) | USD 2105.2 million |

| Forecast CAGR (2025 to 2035) | 9.5% |

The short wave IR LED market is progressing steadily as industries increasingly adopt infrared technology for various applications. The demand for precise and efficient infrared light sources has grown particularly in the medical field, where non-invasive diagnostic and therapeutic devices rely heavily on these LEDs.

Technological advancements have enhanced device performance while maintaining compact form factors, enabling their integration into portable and wearable medical equipment. Additionally, increased healthcare focus on early diagnosis and patient monitoring has supported growth.

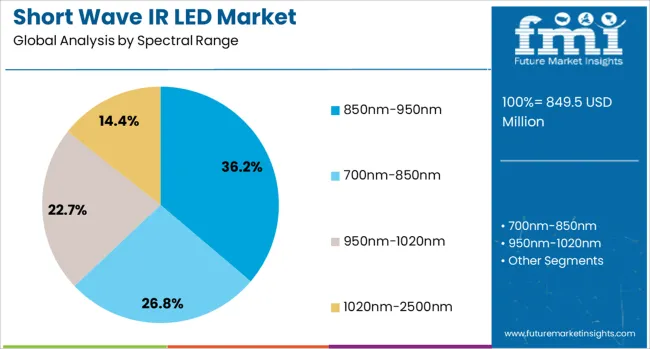

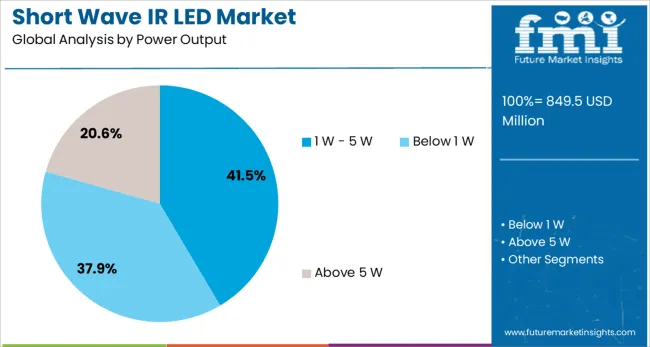

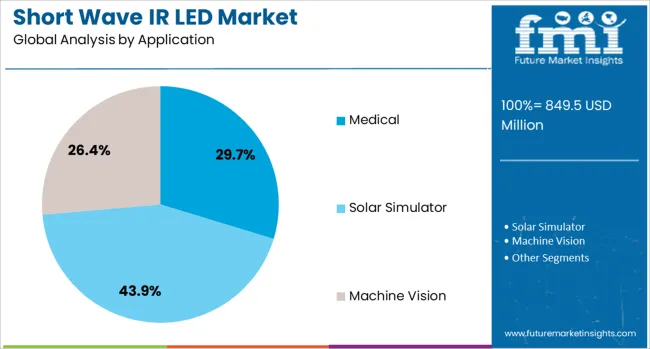

The market is further influenced by expanding applications in security, industrial sensing, and communication systems. With continuous improvements in LED efficiency and lifespan, the market outlook remains positive. Segmental growth is expected to be led by LEDs operating within the 850nm-950nm spectral range, power outputs between 1 W and 5 W, and medical applications due to their critical role in healthcare technology.

The short wave ir led market is segmented by spectral range, power output, application, and end-use and geographic regions. By spectral range of the short wave ir led market is divided into 850nm-950nm, 700nm-850nm, 950nm-1020nm, and 1020nm-2500nm. In terms of power output of the short wave ir led market is classified into 1 W - 5 W, Below 1 W, and Above 5 W. Based on application of the short wave ir led market is segmented into Medical, Solar Simulator, Machine Vision, Optical Sorting, Biometrics, Imaging, Lighting, Remote Sensing, and Surveillance. By end-use of the short wave ir led market is segmented into Healthcare, Aerospace & Defense, Automotive, BFSI, Consumer Electronics, Education, Industrial, Retail, and Others. Regionally, the short wave ir led industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The 850nm-950nm spectral range segment is projected to account for 36.2% of the short wave IR LED market revenue in 2025, holding a leading position. This range is favored for its optimal balance between penetration depth and energy efficiency, making it suitable for applications requiring deep tissue imaging and infrared sensing.

Medical devices have widely adopted this spectral band for diagnostics and therapeutic procedures due to its ability to penetrate biological tissues effectively without causing damage. The segment’s popularity is reinforced by its compatibility with standard optical sensors and cameras, which simplifies system integration.

As applications demand more precise and reliable infrared illumination, the 850nm-950nm range is expected to maintain strong demand.

The 1 W to 5 W power output segment is forecasted to contribute 41.5% of the market revenue in 2025, leading power categories. This power range offers a versatile output suitable for both low and moderate-intensity applications, balancing energy consumption with performance.

It is especially preferred in medical settings for devices such as phototherapy lamps, imaging systems, and pulse oximeters where consistent and controlled light emission is essential. Technological improvements have enhanced the reliability and thermal management of LEDs within this power range, encouraging broader adoption.

The balance of efficiency and output power supports the sustained preference for this segment.

The medical application segment is projected to hold 29.7% of the short wave IR LED market revenue in 2025, establishing it as a significant end-use area. Growth in this segment has been fueled by the increasing utilization of infrared LEDs in diagnostic and therapeutic medical devices.

These include non-invasive imaging tools, wound healing systems, and patient monitoring equipment, where precise infrared light is crucial for accuracy and safety. Rising healthcare investments and technological integration in medical devices have accelerated adoption rates.

The medical segment benefits from strict regulatory standards that encourage the use of reliable and high-performance IR LEDs. As the demand for advanced healthcare solutions continues to rise, the medical application segment is expected to remain a key driver for the market.

Short Wave IR LEDs are increasingly used in medical imaging, biometrics, automotive safety, and industrial inspection, driving integration in advanced devices. Manufacturers focus on performance improvements, cost optimization, and strategic partnerships to expand adoption across defense, surveillance, and specialized applications.

The Short Wave IR LED market has been driven by its adoption in imaging and sensing applications across multiple sectors. Medical diagnostics and biometric systems rely on these LEDs for accurate detection and imaging functions. Automotive applications are utilizing short-wave IR for driver monitoring and advanced safety systems, while industrial operations benefit from their role in inspection and quality control processes. Consumer electronics have also emerged as a growing segment where these LEDs support enhanced camera performance. These developments have positioned short-wave IR LEDs as a critical component in systems that demand precision, compact design, and energy efficiency, leading to higher integration within next-generation devices.

The competitive environment has been influenced by manufacturers focusing on improving performance attributes such as thermal stability, wavelength efficiency, and long operational life. Vendors are strengthening their positions through advancements in packaging techniques, miniaturization, and cost optimization strategies. Growing interest from defense and surveillance sectors continues to boost adoption for security applications, while industrial users prioritize these solutions for non-destructive testing and material analysis. Partnerships between component makers and system integrators have been observed as a key trend to deliver application-specific designs, ensuring wider penetration into automotive safety systems and medical diagnostics platforms.

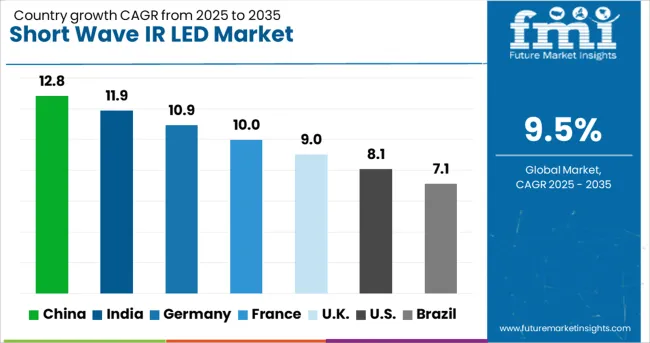

| Country | CAGR |

|---|---|

| China | 12.8% |

| India | 11.9% |

| Germany | 10.9% |

| France | 10.0% |

| UK | 9.0% |

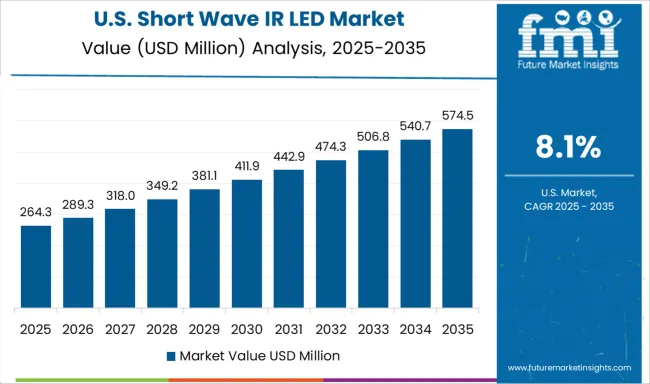

| USA | 8.1% |

| Brazil | 7.1% |

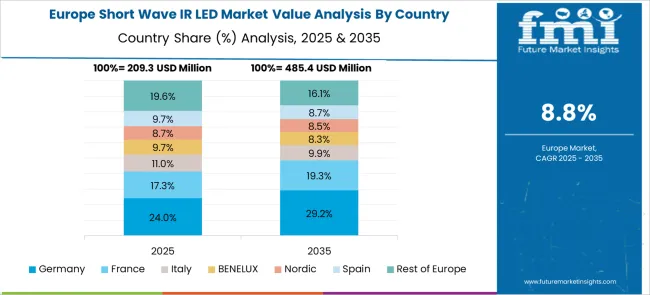

The Short Wave IR LED market, projected to expand at a global CAGR of 9.5% from 2025 to 2035, is witnessing strong growth momentum across multiple regions. A 12.8% CAGR is being recorded in China, a BRICS member, driven by expanding electronics manufacturing and significant adoption in automotive and industrial imaging. India is reporting an 11.9% CAGR, supported by its growing semiconductor ecosystem and increasing investment in defense and biometric applications. Germany is experiencing a 10.9% CAGR as part of the OECD, benefiting from advanced automotive technology and industrial automation needs. Moderate yet steady growth is observed in the United Kingdom at 9.0%, with robust demand in automotive safety systems and consumer electronics. The United States, an OECD member, is registering an 8.1% CAGR, where strong R&D capabilities and medical imaging applications are reinforcing market penetration. High-growth opportunities are concentrated in Asia, particularly in China and India, while OECD economies maintain steady adoption through innovation-driven industrial and healthcare sectors. The report includes an in-depth analysis of over 40 countries, with the top five shared here for reference.

The CAGR in China advanced from nearly 9.8% in the 2020–2024 period to approximately 12.8% between 2025 and 2035, supported by the widespread adoption of imaging solutions in industrial automation and biometric security. Increased production of electronic components and strategic investments in automotive LiDAR contributed to this acceleration. Domestic suppliers leveraged local supply chains and government-backed semiconductor initiatives to enhance production efficiency. Partnerships with global players enabled faster transfer of technology, boosting product reliability and scaling exports. Integration of short-wave IR LEDs into smart surveillance networks drove incremental demand. The electronics manufacturing clusters in Guangdong and Jiangsu further improved output levels, aligning with rising domestic and export requirements.

The CAGR in India improved from about 8.9% in 2020–2024 to 11.9% between 2025 and 2035, fueled by demand in defense, healthcare imaging, and biometrics. Investments in semiconductor fabrication facilities have provided a strong foundation for domestic production. Increased government expenditure on digital identity programs and surveillance networks created substantial opportunities for market players. Healthcare systems adopted near-infrared solutions in diagnostic equipment, driving additional procurement. E-commerce platforms facilitated access to consumer electronics integrated with short-wave IR LEDs, adding momentum in non-industrial sectors. Collaborative ventures between local manufacturers and global technology firms contributed to capacity expansion and skill development within the market ecosystem.

The CAGR in Germany climbed from nearly 8.6% in 2020–2024 to 10.9% during 2025–2035, driven by advanced automotive safety systems and industrial automation. Manufacturers implemented IR-based imaging in quality control for high-precision sectors such as electronics and pharmaceuticals. Expanding production of LiDAR-enabled vehicles strengthened demand for LEDs within automotive frameworks. Healthcare adoption included diagnostic and monitoring systems incorporating IR-based sensors for improved accuracy. German firms emphasized advanced thermal management and packaging solutions to extend component life. Government-backed programs supporting energy-efficient electronics further stimulated R&D efforts. Strategic partnerships between technology firms and automotive OEMs enabled faster integration into next-generation vehicle platforms.

The CAGR in the United Kingdom rose from about 7.6% during 2020–2024 to 9.0% in 2025–2035, accelerated integration in automotive safety systems and industrial inspection processes. Early adoption in biometric security solutions during the initial phase contributed to stable demand, but growth accelerated post-2025 with the development of connected vehicle systems and advanced driver-assistance features. Integration within healthcare diagnostics expanded through collaborative programs linking public hospitals with technology providers. Consumer electronics brands emphasized camera performance enhancement using IR LEDs, strengthening penetration across retail channels. Domestic initiatives promoting localized assembly reduced lead times and improved product availability for niche applications in the security and defense sectors.

The CAGR in the United States moved from roughly 7.1% between 2020–2024 to 8.1% between 2025–2035, supported by strong demand from healthcare imaging and security infrastructure upgrades. Initial growth was moderate, dominated by industrial and research applications, but the period after 2025 marked a wider penetration in automotive LiDAR and consumer electronics. Defense programs incorporating short-wave IR solutions for advanced targeting and surveillance offered consistent procurement opportunities. Major technology firms focused on cost-optimized miniaturization to enhance compatibility with integrated electronic systems. Strategic alliances between LED manufacturers and system integrators enabled the development of customized products tailored to USA automotive and medical device requirements.

In the Short Wave IR LED market, leading players are focusing on performance optimization, thermal stability, and wavelength efficiency to support applications in automotive safety, medical diagnostics, surveillance, and industrial imaging. Companies such as Ushio OPTO Semiconductors Inc., EPILEDS, and DOWA Electronics Materials Co., Ltd. are investing in advanced fabrication processes and packaging methods to enhance component durability and energy efficiency. Everlight Electronics Co., Ltd and Lite-On Inc. are expanding their portfolios to cater to consumer electronics and security systems, while ROHM Semiconductor and Lumileds are emphasizing miniaturization for seamless integration in compact device architectures. These companies are also forming strategic partnerships with automotive OEMs and healthcare technology providers to deliver application-specific solutions and accelerate adoption in emerging markets. Their approach combines technical innovation with large-scale manufacturing capability, enabling consistent quality across industrial and defense sectors.

In June 2024, ROHM Semiconductor announced a novel VCSELED™ infrared light source; consumer samples available immediately, and automotive mass production planned for 2025

| Item | Value |

|---|---|

| Quantitative Units | USD 849.5 Million |

| Spectral Range | 850nm-950nm, 700nm-850nm, 950nm-1020nm, and 1020nm-2500nm |

| Power Output | 1 W - 5 W, Below 1 W, and Above 5 W |

| Application | Medical, Solar Simulator, Machine Vision, Optical Sorting, Biometrics, Imaging, Lighting, Remote Sensing, and Surveillance |

| End-use | Healthcare, Aerospace & Defense, Automotive, BFSI, Consumer Electronics, Education, Industrial, Retail, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Ushio OPTO Semiconductors Inc., EPILEDS, DOWA Electronics Materials Co., Ltd., Everlight Electronics Co Ltd, Lite-On Inc., ROHM Semiconductor, and Lumileds |

| Additional Attributes | Dollar sales, share by wavelength segments, regional demand outlook, competitive positioning, pricing benchmarks, growth drivers in automotive and healthcare, emerging application opportunities, and regulatory compliance trends for optical components. |

The global short wave ir led market is estimated to be valued at USD 849.5 million in 2025.

The market size for the short wave ir led market is projected to reach USD 2,105.2 million by 2035.

The short wave ir led market is expected to grow at a 9.5% CAGR between 2025 and 2035.

The key product types in short wave ir led market are 850nm-950nm, 700nm-850nm, 950nm-1020nm and 1020nm-2500nm.

In terms of power output, 1 w - 5 w segment to command 41.5% share in the short wave ir led market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Short Path Evaporator for Food Market Size and Share Forecast Outlook 2025 to 2035

Short-Term Rental Platform Market Size and Share Forecast Outlook 2025 to 2035

Shortenings Market Size, Growth, and Forecast for 2025 to 2035

Short sleep syndrome Treatment Market Growth & Demand 2025 to 2035

Short-Term Vacation Rental Market Trends – Growth & Forecast 2025 to 2035

Short-Acting Beta-Agonists Market – Trends, Demand & Forecast 2025 to 2035

Short-read Sequencing Market by Product, Workflow, and Region from 2025 to 2035

Short-chain Fructooligosaccharides Market Analysis – Growth, Applications & Outlook 2025-2035

Shortening Powder Market

Short Circuit Isolator Market Size and Share Forecast Outlook 2025 to 2035

Shortwave Infrared (SWIR) Market Size and Share Forecast Outlook 2025 to 2035

Ultra Short Base Line (USBL) Positioning Systems Market Size and Share Forecast Outlook 2025 to 2035

Icing Shortening Market Size, Growth, and Forecast for 2025–2035

Frying Shortening Market Size and Share Forecast Outlook 2025 to 2035

Flaked Shortening Market

Specialty Shortenings Market Size and Share Forecast Outlook 2025 to 2035

Vegetable Shortening Market Trends and Forecast 2025 to 2035

Emulsified Shortenings Market Size and Share Forecast Outlook 2025 to 2035

High Ratio Shortening Market Trends – Growth & Applications 2025 to 2035

Dairy Free Shortening Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA