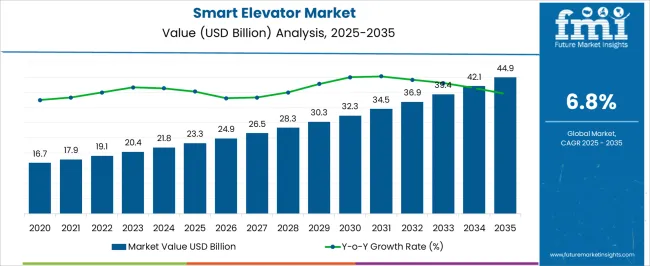

The smart elevator market is expected to grow from USD 23.3 billion in 2025 to USD 44.9 billion by 2035, with a CAGR of 6.8%. A Growth Rate Volatility Index (GRVI) analysis reveals moderate fluctuations in growth, reflecting a period of steady expansion with occasional acceleration. Between 2025 and 2030, the market grows from USD 23.3 billion to USD 32.3 billion, contributing USD 9 billion in growth with a CAGR of 8.2%. This early phase shows a higher volatility in growth due to increasing demand for energy-efficient, IoT-enabled elevators in smart buildings, rising urbanization, and ongoing construction projects. The market’s acceleration is fueled by innovations in automation, safety features, and the growing trend toward sustainable infrastructure. From 2030 to 2035, the market continues to grow at a more moderate pace, expanding from USD 32.3 billion to USD 44.9 billion, contributing USD 12.6 billion in growth with a CAGR of 5.7%. The GRVI in this phase shows less volatility, indicating a stabilization of demand as the smart elevator market matures. This slower growth is driven by increased competition, regulatory factors, and the wider adoption of smart technologies. The overall GRVI analysis demonstrates that while early-stage growth is more volatile, the market reaches a more predictable, steady pace in the later years.

| Metric | Value |

|---|---|

| Smart Elevator Market Estimated Value in (2025 E) | USD 23.3 billion |

| Smart Elevator Market Forecast Value in (2035 F) | USD 44.9 billion |

| Forecast CAGR (2025 to 2035) | 6.8% |

The smart elevator market is undergoing accelerated transformation due to increasing demand for energy-efficient, secure, and user-friendly vertical transportation systems in urban environments. Rapid urbanization, aging infrastructure in high-rise buildings, and heightened safety standards are reshaping procurement patterns among property developers and facility managers.

Government mandates supporting green building certifications and smart city frameworks are encouraging the adoption of intelligent mobility solutions. Integration of predictive maintenance, real-time performance monitoring, and seamless user interfaces has improved system uptime and building value.

As elevators evolve into connected platforms, emphasis is shifting toward long-term lifecycle optimization through data-driven control systems and retrofitting solutions. Continued investment in high-speed networks, AI-driven motion analytics, and interoperability protocols is expected to unlock additional market opportunities, particularly in commercial and mixed-use infrastructure.

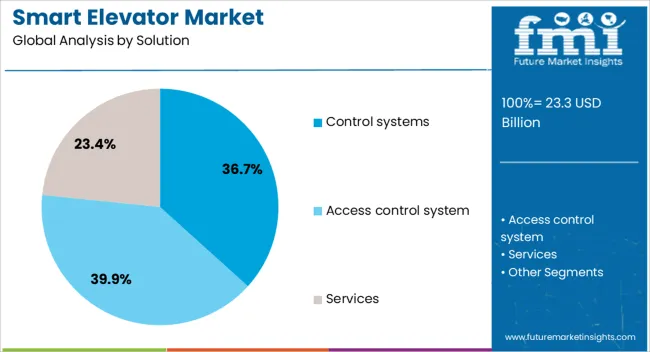

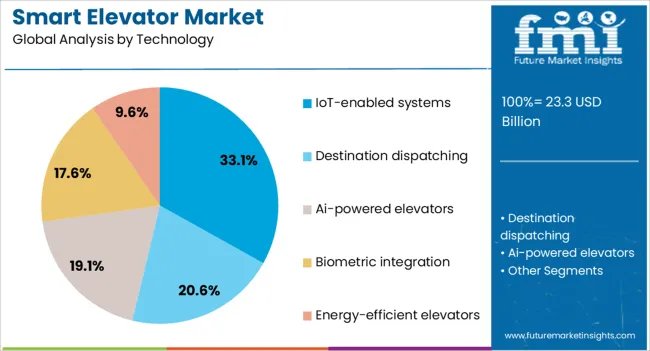

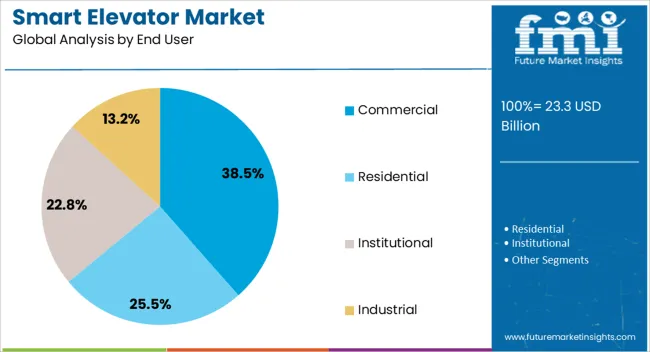

The smart elevator market is segmented by solution, technology, end user, distribution channel, and region. By solution, the market is divided into control systems, access control systems, and services. In terms of technology, it is classified into IoT-enabled systems, destination dispatching, AI-powered elevators, biometric integration, and energy-efficient elevators. Based on end user, the market is segmented into commercial, residential, institutional, and industrial. By distribution channel, it is categorized into direct sales and indirect sales. Regionally, the smart elevator industry is segmented into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Control systems are projected to account for 36.70% of the overall smart elevator market revenue in 2025, emerging as the leading solution segment. This leadership has been driven by the integration of advanced microcontrollers and real-time signal processing, which enhance ride precision, safety, and power efficiency.

Control systems play a critical role in managing elevator acceleration, deceleration, and stop-point accuracy while optimizing energy use during peak hours. Demand has risen as buildings adopt destination dispatch and smart access features, which rely heavily on intelligent control architecture.

The shift toward modular, upgradeable systems is further reinforcing the segment’s dominance, as facility owners seek scalable technology that meets both current and future regulatory expectations.

IoT-enabled systems are expected to command 33.10% of the market’s revenue share in 2025, making them the leading technology segment. Growth of this segment is being supported by rising adoption of predictive maintenance and cloud-based diagnostics, which improve asset performance while reducing operating costs.

The integration of sensors and real-time data exchange has enabled remote monitoring, fault detection, and user behavior analytics, all of which contribute to improved building intelligence. IoT connectivity also allows seamless integration with building management systems (BMS), enhancing automation and security protocols.

As building developers seek future-proof infrastructure and enhanced user experiences, IoT-based elevator technologies are becoming central to smart infrastructure design.

The commercial sector is anticipated to lead with a 38.50% revenue share in the smart elevator market by 2025, driven by strong demand from office complexes, shopping malls, and hospitality developments. This segment’s growth is supported by the need for efficient people movement, enhanced access control, and regulatory compliance with modern energy codes.

Smart elevators help reduce wait times, manage peak-hour traffic, and enable touchless operations critical features for high-footfall environments. Additionally, commercial real estate stakeholders are prioritizing differentiated tenant experiences and operational cost savings, both of which are facilitated by advanced elevator technologies.

Continued upgrades in large commercial hubs and integration with building automation platforms are expected to sustain the segment’s leadership.

The smart elevator market is experiencing growth due to increasing demand for efficient, automated, and energy-saving solutions in both residential and commercial buildings. These elevators integrate advanced technologies like IoT, AI, and machine learning to enhance safety, reduce wait times, and improve energy consumption. The rise of smart cities, urbanization, and the need for accessibility in high-rise buildings are key factors driving the adoption of smart elevators. Although challenges such as high initial investment and system integration complexity exist, opportunities are emerging through innovations in energy-efficient solutions and the expansion of infrastructure in developing regions.

The growing demand for energy-efficient and automated solutions is a key driver for the smart elevator market. As cities grow and buildings become taller, the need for smart elevators that offer advanced features such as automatic scheduling, energy savings, and real-time monitoring is increasing. Smart elevators equipped with IoT technology can optimize energy usage by adjusting operations based on building traffic patterns. Additionally, these elevators can enhance user convenience by providing faster wait times, automated destinations, and remote monitoring. As more buildings integrate smart technologies for enhanced safety and efficiency, the adoption of smart elevators is expected to increase across both commercial and residential sectors, driving market growth.

The primary challenge in the smart elevator market is the high initial investment required for the installation of these advanced systems. Smart elevators involve the integration of cutting-edge technologies, such as IoT connectivity, AI-driven algorithms, and energy-efficient mechanisms, which increases their upfront costs compared to traditional elevators. The integrating smart elevator systems into existing building infrastructures can be complex and time-consuming, especially in older buildings that may require significant retrofitting. Ensuring compatibility with other building management systems and overcoming the technical hurdles associated with system integration can delay adoption. These factors may deter some property developers, particularly in price-sensitive markets, from investing in smart elevators.

The rise of smart cities presents significant opportunities for the smart elevator market. As urbanization increases, there is growing demand for infrastructure that supports energy-efficient, automated, and connected systems. Smart elevators align with the vision of smart cities, offering efficient vertical transportation that contributes to overall energy savings and sustainability. The technological advancements in AI, machine learning, and IoT are enabling the development of smarter, more efficient elevator systems. These innovations allow for predictive maintenance, better load management, and enhanced user experiences. As more governments and developers focus on urban development and the creation of connected, eco-friendly cities, the demand for smart elevators is expected to rise, especially in emerging markets.

A prominent trend in the smart elevator market is the integration of IoT and AI technologies, which enhance the user experience and operational efficiency. IoT-enabled smart elevators allow for real-time monitoring, predictive maintenance, and remote control, providing greater convenience and safety. These elevators are also equipped with AI-powered algorithms that optimize elevator usage based on building traffic patterns, reducing wait times and improving energy efficiency. The rise of touchless control and voice-activated elevators is gaining traction in response to the growing demand for hygiene and convenience. As these technologies continue to evolve, smart elevators are becoming more intuitive, energy-efficient, and user-friendly, further driving their adoption across residential, commercial, and public infrastructure.

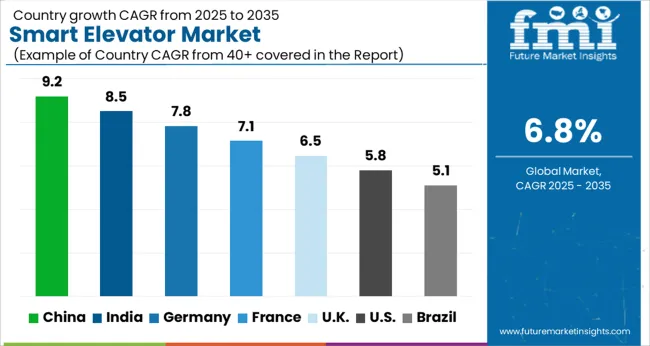

The smart elevator market is projected to grow at a CAGR of 6.8% from 2025 to 2035. China leads at 9.2%, followed by India at 8.5%, and France at 7.1%. The United Kingdom records 6.5%, while the United States stands at 5.8%. The increasing demand for efficient, safe, and automated elevator systems across BRICS nations like China and India is driving growth. In contrast, OECD countries like France, the UK, and the USA are showing steady growth due to the adoption of smart technologies for energy efficiency, space optimization, and enhanced safety features. The analysis spans over 40+ countries, with the top countries shown below.

China is projected to grow at a CAGR of 9.2% through 2035, driven by the country’s rapid urbanization, booming construction sector, and increasing demand for high-rise buildings. The rising preference for smart, energy-efficient, and safe elevator systems is pushing the demand for smart elevators. As China continues to focus on developing modern cities and urban infrastructure, there is a growing need for advanced elevator systems with features like predictive maintenance, voice activation, and enhanced energy efficiency. The large-scale investments in smart building technologies significantly contribute to the market’s growth.

India is expected to grow at a CAGR of 8.5% through 2035, driven by the rapid urbanization, construction boom, and demand for modern infrastructure. The growing need for energy-efficient and space-saving building solutions is pushing the demand for smart elevators, particularly in high-rise buildings, shopping malls, and office complexes. The growing middle class, along with government initiatives to modernize urban infrastructure, accelerates the demand for smart technologies in buildings. India’s smart city initiatives and green building standards further boost the adoption of smart elevators.

Germany is projected to grow at a CAGR of 7.1% through 2035, with demand primarily driven by technological advancements in smart building systems and increasing investments in infrastructure projects. As one of the leading countries in Europe for construction and industrial development, Germany is adopting smart technologies for elevators to improve energy efficiency and building performance. The demand for elevators with advanced features, including digital connectivity, real-time monitoring, and energy-saving capabilities, is accelerating in both residential and commercial sectors. Germany’s push for eco-friendly, energy-efficient construction further supports the adoption of smart elevator systems.

The United Kingdom is projected to grow at a CAGR of 6.5% through 2035, with demand driven by the need for modernization in building infrastructures and smart building solutions. The rise in construction of high-rise buildings, office complexes, and shopping centers in the UK is pushing the demand for advanced elevator systems that offer energy efficiency, automation, and safety features. The UK market also benefits from the growing focus on smart cities, which integrate technologies such as IoT, real-time monitoring, and predictive maintenance into buildings. This trend contributes to the market growth and adoption of smart elevator systems.

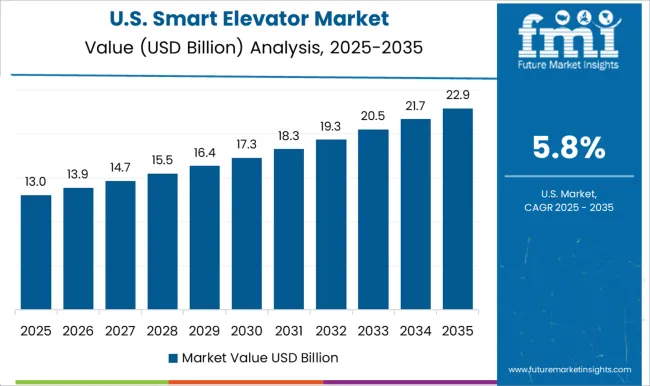

The United States is projected to grow at a CAGR of 5.8% through 2035, with demand driven by the need for modernized elevator systems in both residential and commercial sectors. The growing focus on energy efficiency, space optimization, and user safety contributes to the rise in demand for smart elevators. The adoption of smart technologies, such as IoT and predictive maintenance, is becoming crucial for improving building management. The United States’ increasing construction of high-rise buildings and smart cities, along with the shift towards automated and energy-efficient systems, is expected to drive significant growth in the market.

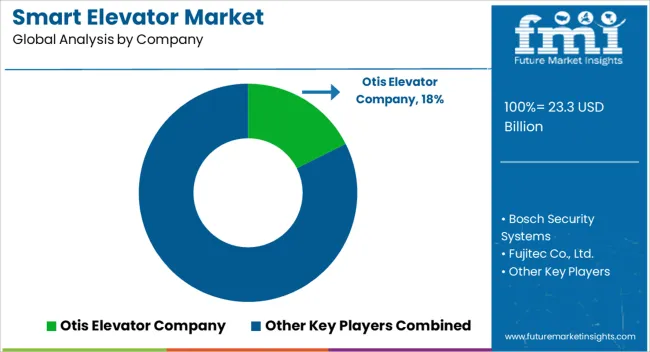

The smart elevator market is driven by global leaders in elevator and escalator systems, offering advanced solutions that integrate IoT, automation, and efficiency for modern building infrastructure. Otis Elevator Company is a dominant player, providing innovative smart elevator systems with real-time monitoring and predictive maintenance features.

KONE Corporation and Mitsubishi Electric Corporation offer cutting-edge, energy-efficient elevators with advanced connectivity and user-friendly interfaces, catering to commercial, residential, and industrial applications .Bosch Security Systems and Honeywell International Inc. focus on integrating smart security systems with elevator technologies, offering solutions that enhance safety and accessibility. Fujitec Co., Ltd. and Hitachi Ltd. specialize in developing high-speed and efficient smart elevators for skyscrapers and high-rise buildings, focusing on reducing wait times and optimizing operations.

Hyundai Elevator Co., Ltd. and Johnson Controls provide elevators with IoT integration for improved building management and seamless user experience. Savaria Corporation and Schindler Group offer a wide range of smart elevator solutions, including those designed for accessibility and people with reduced mobility, ensuring compliance with global safety standards.

| Item | Value |

|---|---|

| Quantitative Units | USD Billion |

| Solution | Control systems, Access control system, and Services |

| Technology | IoT-enabled systems, Destination dispatching, Ai-powered elevators, Biometric integration, and Energy-efficient elevators |

| End User | Commercial, Residential, Institutional, and Industrial |

| Distribution channel | Direct sales and Indirect sales |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Otis Elevator Company, Bosch Security Systems, Fujitec Co., Ltd., Hitachi Ltd., Honeywell International Inc., Hyundai Elevator Co., Ltd., Johnson Controls, KONE Corporation, Mitsubishi Electric Corporation, Otis Worldwide Corporation, Savaria Corporation, Schindler Group, Siemens AG, Thyssenkrupp AG, and Toshiba Elevator and Building Systems Corporation |

| Additional Attributes | Dollar sales by elevator type (passenger elevators, freight elevators, service elevators) and end-use segments (residential, commercial, industrial, smart buildings). Demand dynamics are driven by the increasing adoption of smart buildings, rising urbanization, and the growing focus on energy-efficient and automated solutions in vertical transportation. Regional trends show strong growth in Asia-Pacific, led by rapid urbanization and infrastructural developments in China and India, while North America and Europe focus on retrofitting existing buildings with smart elevator solutions. Innovation trends include advancements in AI for predictive maintenance, seamless building integration, and improved elevator control systems. |

The global smart elevator market is estimated to be valued at USD 23.3 billion in 2025.

The market size for the smart elevator market is projected to reach USD 44.9 billion by 2035.

The smart elevator market is expected to grow at a 6.8% CAGR between 2025 and 2035.

The key product types in smart elevator market are control systems, _security control system, _elevator control system, access control system, _maintenance systems, _communication systems, services, _support & maintenance, _new deployments and _modernization.

In terms of technology, iot-enabled systems segment to command 33.1% share in the smart elevator market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Smart Elevator Automation System Market Growth - Trends & Forecast 2024 to 2034

Smart Meeting Pod Market Size and Share Forecast Outlook 2025 to 2035

Smart Electrogastrogram Recorder Market Size and Share Forecast Outlook 2025 to 2035

Smart Aerial Work Robots Market Size and Share Forecast Outlook 2025 to 2035

Smart Bladder Scanner Market Size and Share Forecast Outlook 2025 to 2035

Smart School Bus Platform Market Size and Share Forecast Outlook 2025 to 2035

Smart Home Wireless Smoke Detector Market Size and Share Forecast Outlook 2025 to 2035

Smart Bus Platform Market Size and Share Forecast Outlook 2025 to 2035

Smart Vision Processing Chips Market Size and Share Forecast Outlook 2025 to 2035

Smart Touch Screen Scale Market Size and Share Forecast Outlook 2025 to 2035

Smart Magnetic Drive Conveyor System Market Size and Share Forecast Outlook 2025 to 2035

Smart Wheelchair market Size and Share Forecast Outlook 2025 to 2035

Smart Mining Technologies Market Size and Share Forecast Outlook 2025 to 2035

Smart Parking Market Size and Share Forecast Outlook 2025 to 2035

Smart Digital Valve Positioner Market Forecast and Outlook 2025 to 2035

Smart Card IC Market Size and Share Forecast Outlook 2025 to 2035

Smart-Tag Inlay Inserters Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Smart TV Market Forecast and Outlook 2025 to 2035

Smart/AI Toy Market Size and Share Forecast Outlook 2025 to 2035

Smart Locks Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA