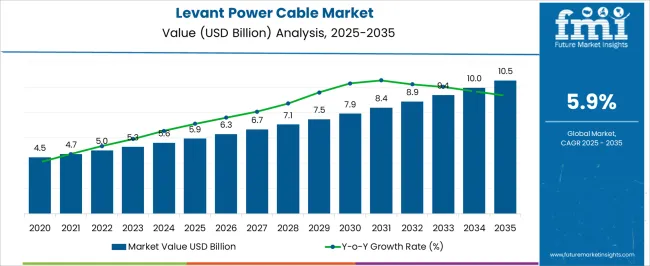

The levant power cable market, valued at USD 5.9 billion, is projected to reach USD 10.5 billion, reflecting a compound annual growth rate of 5.9%. A rolling CAGR analysis highlights steady expansion over the forecast period, with incremental annual growth reflecting consistent demand across power generation, transmission, and distribution projects. Increasing investment in energy infrastructure, including renewable energy integration, grid modernization, and urban electrification, supports this steady growth.

Year-to-year variations in the rolling CAGR show slight acceleration during periods of major project commissioning or government-driven initiatives, particularly in high-demand regions within the Levant. Deceleration phases are observed when project approvals or funding cycles temporarily slow, yet long-term growth remains unaffected due to continuous infrastructural requirements. Regional dynamics are significant, with countries in the Levant investing in high-voltage and medium-voltage cable systems to enhance reliability and expand grid reach.

Technological innovations, including improved insulation materials, fire-resistant designs, and low-loss conductors, also contribute to incremental CAGR gains by making new installations more efficient and cost-effective. The rolling CAGR pattern illustrates a stable upward trajectory with minor fluctuations, indicating sustained market expansion driven by infrastructure development, technological adoption, and ongoing power sector investments.

| Metric | Value |

|---|---|

| Levant Power Cable Market Estimated Value in (2025 E) | USD 5.9 billion |

| Levant Power Cable Market Forecast Value in (2035 F) | USD 10.5 billion |

| Forecast CAGR (2025 to 2035) | 5.9% |

The levant power cable market is driven by five primary parent markets with specific shares. Energy transmission and distribution lead with 40%, as high-capacity cables are required to deliver electricity efficiently across urban and regional grids. Construction and infrastructure account for 25%, supporting residential, commercial, and industrial building projects. Renewable energy projects contribute 15%, connecting wind farms, solar parks, and hydroelectric plants to the grid.

Oil and gas pipelines represent 10%, requiring power cables for monitoring, control, and safety systems. Telecommunications and industrial automation hold 10%, where specialized cables support data transmission and equipment operation. These markets collectively define demand for levant power cables. Recent developments in the Levant power cable market focus on enhanced durability, efficiency, and advanced technology integration. Manufacturers are developing high-voltage, fire-resistant, and low-loss cables for improved energy transmission. Adoption of cross-linked polyethylene (XLPE) insulation and biodegradable materials is increasing to meet regulatory and environmental standards. Smart monitoring and diagnostic systems are being integrated for predictive maintenance and real-time performance tracking. Growth in renewable energy, urban infrastructure expansion, and industrial automation is driving demand for high-capacity and specialized cables.

The Levant power cable market is witnessing steady growth, driven by the increasing demand for reliable and efficient electrical infrastructure across utility, commercial, and industrial sectors. Investment in grid expansion, modernization of aging infrastructure, and the integration of renewable energy sources are contributing to heightened adoption of advanced power cable solutions. The market is being shaped by technological advancements in insulation materials, conductor performance, and cable design that enhance reliability, safety, and operational efficiency.

Rising electricity consumption across residential, industrial, and utility networks is further encouraging the deployment of medium and high-performance power cables. Regulatory frameworks promoting energy efficiency, grid resilience, and safety compliance are influencing procurement decisions and driving market expansion.

Manufacturers are focusing on providing cables that meet regional standards and withstand challenging environmental conditions while reducing energy loss and maintenance requirements. As governments in the Levant region invest in expanding and modernizing electricity networks, the market is expected to experience long-term growth, with opportunities emerging across product types, voltage classes, and utility applications.

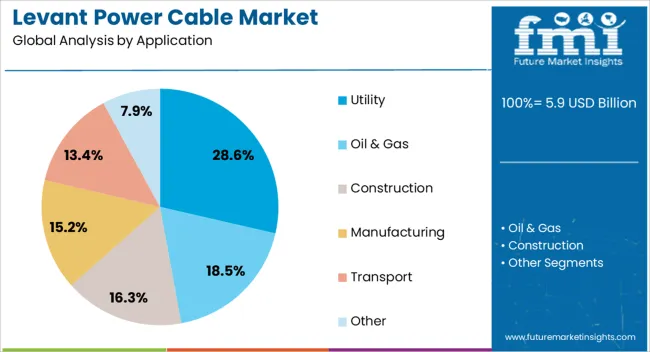

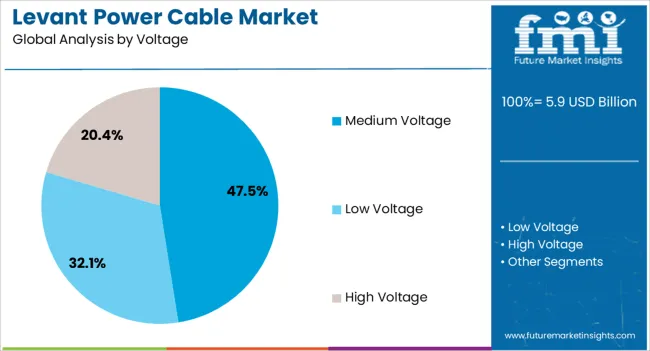

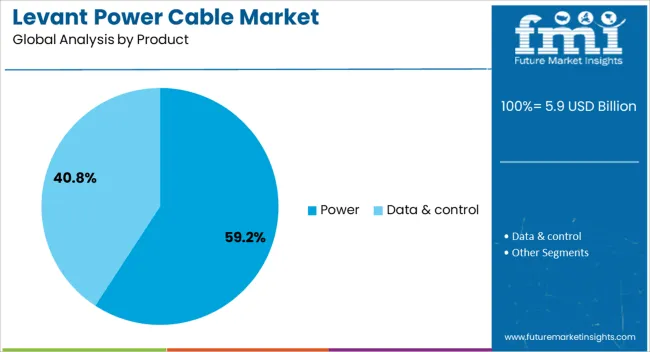

The levant power cable market is segmented by application, voltage, product, and geographic regions. By application, levant power cable market is divided into Utility, Oil & Gas, Construction, Manufacturing, Transport, and Other. In terms of voltage, levant power cable market is classified into Medium Voltage, Low Voltage, and High Voltage. Based on product, levant power cable market is segmented into Power and Data & control. Regionally, the levant power cable industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The utility application segment is projected to hold 28.6% of the Levant power cable market revenue share in 2025, establishing it as the leading application area. This leadership is being driven by the growing need for reliable and efficient power transmission and distribution networks to support expanding electricity demand.

Cables deployed in utility networks are required to deliver high performance under continuous load and variable environmental conditions, making quality and durability critical factors. The segment is further benefiting from ongoing government and private sector investments in grid modernization, renewable energy integration, and urban infrastructure development.

Power cables in utility applications are increasingly being optimized for energy efficiency, reduced losses, and long-term reliability, which reinforces their adoption As infrastructure projects expand, the preference for high-quality utility-grade cables that comply with regional and international standards is strengthening, ensuring sustained demand and market leadership for this application segment.

The medium voltage segment is anticipated to account for 47.5% of the Levant power cable market revenue share in 2025, making it the dominant voltage class. Its leading position is being supported by widespread adoption in urban power distribution, industrial complexes, and renewable energy integration projects. Medium voltage cables offer a balance between capacity, reliability, and cost-effectiveness, making them suitable for a wide range of infrastructure projects.

They are preferred for their ability to handle higher loads than low voltage cables while maintaining manageable installation and maintenance requirements. The segment’s growth is being reinforced by increasing demand for energy-efficient distribution systems and adherence to international and regional electrical standards.

Advancements in insulation technology and conductor design are further improving performance, enhancing safety, and minimizing energy losses Rising infrastructure investments and expansion of electricity networks in residential, commercial, and industrial sectors are expected to continue driving the adoption of medium voltage power cables, consolidating their position as the largest segment by revenue.

The power product segment is projected to hold 59.2% of the Levant power cable market revenue share in 2025, establishing it as the leading product category. Its dominance is being driven by the segment’s critical role in transmitting and distributing electricity across utility, commercial, and industrial networks. Power cables are designed for high current carrying capacity, durability, and compliance with stringent safety and performance standards, which makes them essential for reliable energy delivery.

The segment benefits from increasing investments in large-scale infrastructure projects, renewable energy plants, and grid modernization initiatives. Technological advancements in insulation, conductor materials, and cable design are enhancing operational efficiency, reducing energy losses, and improving service life.

As energy demand grows and regulatory focus on safety and efficiency intensifies, power cables continue to be the preferred choice for high-performance electrical networks. The combination of performance, reliability, and versatility ensures that the power product segment maintains its leading share within the Levant power cable market.

The Levant power cable market is witnessing substantial growth due to increasing investments in electricity infrastructure and the rising demand for reliable power in countries including Lebanon, Jordan, and Syria. The market is fueled by rapid urbanization, industrial expansion, and population growth, which are driving electricity consumption upward. Integration of renewable energy sources such as solar and wind into national grids further increases demand for high-performance transmission and distribution cables.

Governments are implementing projects to modernize aging electrical networks and expand coverage to rural areas, enhancing grid stability. Advanced cable technologies, including medium and high-voltage insulated cables, are increasingly adopted to improve efficiency and reduce transmission losses. Investments in smart grid deployment and electrification of industrial zones also contribute to sustained market growth in the region.

The growth of the Levant power cable market is primarily driven by the rising demand for electricity across residential, industrial, and commercial sectors. Countries like Jordan and Lebanon are expanding power generation capacities to meet the needs of growing urban populations. Renewable energy projects, including large-scale solar and wind farms, require modern transmission and distribution networks equipped with durable, high-capacity cables. Energy efficiency initiatives, such as reducing grid losses and implementing smart meters, have created demand for advanced insulated power cables. Industrial sectors, particularly manufacturing and construction, are upgrading facilities with high-voltage cable networks to ensure uninterrupted supply. Investments in reliable infrastructure, combined with regulatory support for cleaner energy integration, are fueling adoption of medium and high-voltage power cables that ensure operational efficiency, safety, and long-term sustainability.

Emerging technological advancements provide significant opportunities for the Levant power cable market. The adoption of eco-friendly insulating materials and flame-retardant polymers increases safety and environmental compliance while improving cable longevity. Smart cables equipped with sensors allow real-time monitoring of temperature, load, and potential faults, reducing downtime and enabling predictive maintenance. Renewable energy integration and grid modernization efforts create demand for high-capacity cables capable of handling variable loads from solar and wind farms. Additionally, the expansion of data centers, industrial parks, and smart cities requires robust transmission and distribution networks. Companies focusing on R&D, localized manufacturing, and partnerships with utility providers can capture new revenue streams. Sustainable cable solutions supporting energy efficiency, reduced carbon footprints, and grid reliability are expected to drive market expansion in the Levant countries over the next decade.

Innovations in cable manufacturing and design are transforming the Levant power cable market. Advanced extrusion and polymer technology improve insulation quality, thermal resistance, and mechanical strength, ensuring reliable long-term operation. Medium and high-voltage cable designs with optimized conductor sizes reduce energy losses during transmission. Integration of digital monitoring technologies enables real-time tracking of current, voltage, and load conditions, supporting predictive maintenance and minimizing disruptions. Modular and pre-fabricated cable solutions accelerate installation in urban and industrial areas, while hybrid cables allow simultaneous power and data transmission for smart infrastructure. These technological improvements enhance operational efficiency, reliability, and scalability, making power cable networks more resilient. They also enable utilities and industrial operators to meet growing energy demands while reducing maintenance costs and improving grid performance across the Levant region.

The Levant power cable market faces several challenges that may hinder rapid adoption. Geopolitical tensions and conflicts in parts of Syria, Lebanon, and other countries can disrupt supply chains, delay infrastructure projects, and increase project costs. Economic constraints, limited access to financing, and currency fluctuations reduce the ability of governments and private entities to invest in large-scale power projects. Installation and maintenance require skilled engineers and technical expertise, and shortages in qualified personnel can affect project timelines.

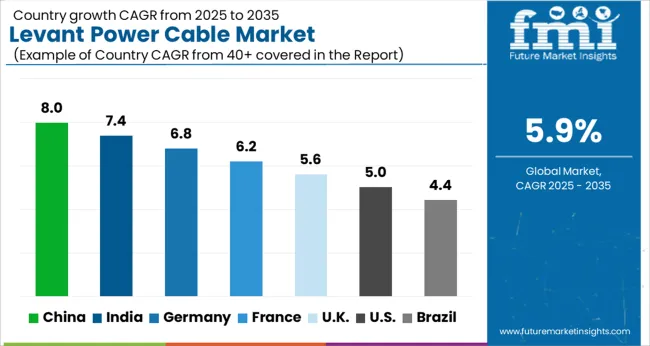

| Country | CAGR |

|---|---|

| China | 8.0% |

| India | 7.4% |

| Germany | 6.8% |

| France | 6.2% |

| UK | 5.6% |

| USA | 5.0% |

| Brazil | 4.4% |

The Levant power cable market is projected to grow at a global CAGR of 5.9% through 2035, driven by increasing power transmission projects, urban electrification, and industrial expansion. China leads at 8.0%, a 1.35× multiple over the global benchmark, supported by BRICS-driven investment in energy infrastructure, industrial facilities, and grid modernization. India follows at 7.4%, a 1.25× multiple of the global rate, reflecting growth in urban power distribution, industrial electrification, and renewable energy integration. Germany records 6.8%, a 1.15× multiple, shaped by OECD-backed innovation in high-efficiency cables, smart grid technology, and industrial applications. The United Kingdom posts 5.6%, 0.95× the global rate, with adoption concentrated in commercial and industrial power distribution. The United States stands at 5.0%, 0.85× the benchmark, with steady uptake in transmission, industrial facilities, and energy projects. BRICS economies drive most of the market volume, OECD countries emphasize technological advancement and efficiency, while ASEAN markets contribute through expanding industrial and urban electrification initiatives. This report includes insights on 40+ countries; the top markets are shown here for reference.

Demand for Levant power cables in China is projected to grow at a CAGR of 8.0%, driven by infrastructure development, industrial expansion, and renewable energy projects. Leading manufacturers such as Southwire China, Nexans China, and Jiangsu Hengtong are increasing production of high-voltage, medium-voltage, and low-voltage power cables. Adoption is concentrated in transmission networks, industrial facilities, and renewable energy integration projects. Technological trends include improved insulation, enhanced conductor materials, and higher thermal stability. Government initiatives for smart grid implementation and urban infrastructure development support market growth. Export demand for high-performance power cables further strengthens China’s position as a global supplier.

The Levant power cable market in India is expected to grow at a CAGR of 7.4%, supported by industrial, commercial, and renewable energy projects. Companies such as KEI Industries, Polycab, and Havells India are expanding production of high-voltage, medium-voltage, and low-voltage cables. Adoption is concentrated in industrial plants, transmission grids, and renewable energy integration projects. Technological trends focus on high-quality insulation, thermal stability, and long-term durability. Government initiatives for rural electrification, infrastructure development, and smart grid implementation are reinforcing demand. Export opportunities for medium and high-voltage cables further support market growth in India.

Demand for Levant power cables in Germany is projected to grow at a CAGR of 6.8%, driven by industrial, commercial, and renewable energy sector requirements. Manufacturers such as Nexans Germany, Prysmian, and Siemens supply high-voltage, medium-voltage, and low-voltage cables. Adoption is concentrated in transmission networks, industrial facilities, and utility-scale renewable projects. Technological developments emphasize insulation efficiency, conductor durability, and thermal performance. Government policies promoting clean energy, energy-efficient infrastructure, and grid modernization further support market expansion. Export demand for high-performance power cables contributes to Germany’s role as a European hub for cable technology.

The Levant power cable market in the United Kingdom is projected to grow at a CAGR of 5.6%, supported by demand in transmission networks, industrial facilities, and renewable energy projects. Companies focus on high-voltage, medium-voltage, and low-voltage cable production. Adoption is concentrated in industrial plants, utility-scale renewable projects, and smart grid implementations. Technological trends include enhanced insulation, improved thermal performance, and durability optimization. Government initiatives for energy security and renewable integration reinforce market growth. Export-oriented production further strengthens the United Kingdom market. Industrial and renewable energy applications continue to dominate consumption patterns.

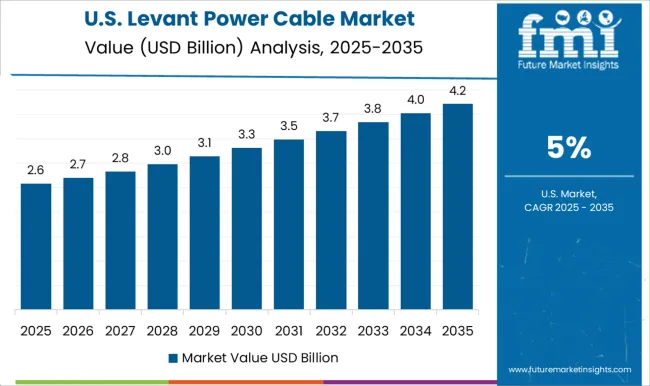

Demand for Levant power cables in the United States is projected to grow at a CAGR of 5.0%, supported by industrial, transmission, and renewable energy infrastructure projects. Key producers such as Southwire, Prysmian, and General Cable supply high-voltage, medium-voltage, and low-voltage cables. Adoption focuses on industrial facilities, transmission networks, and utility-scale renewable installations. Technological developments emphasize improved insulation, conductor durability, and thermal performance. Industrial, commercial, and renewable energy applications remain primary growth drivers, while export demand for high-performance cables supports market expansion.

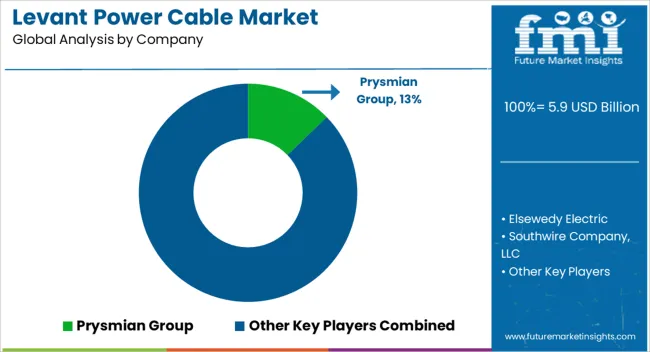

Competition in the Levant power cable sector is being shaped by reliability, electrical performance, and compliance with regional standards for energy transmission, industrial, and construction applications. Prysmian Group and Elsewedy Electric are being advanced with high-voltage, medium-voltage, and low-voltage cables engineered for durability, conductivity, and safety in urban and industrial networks. Southwire Company, LLC and DUCAB are being represented with solutions optimized for thermal stability, mechanical strength, and long-term operational efficiency. Bahra Advanced Cable Manufacture, Riyadh Cables, and Sumitomo Electric Industries are being promoted with specialized cables designed for harsh environmental conditions, energy infrastructure, and industrial installations. KEI Limited, Oman Cables Industry SAOG, and MESC are being applied with flexible, high-performance cables for commercial, renewable, and utility projects. Midal Cables Ltd., Belden Incorporated, Ozguven Kablo, Liban Cables, and Saudi Cables are being highlighted with products focusing on insulation quality, fire resistance, and load handling capacity to ensure reliable power delivery.

| Item | Value |

|---|---|

| Quantitative Units | USD 5.9 Billion |

| Application | Utility, Oil & Gas, Construction, Manufacturing, Transport, and Other |

| Voltage | Medium Voltage, Low Voltage, and High Voltage |

| Product | Power and Data & control |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Prysmian Group, Elsewedy Electric, Southwire Company, LLC, DUCAB, Bahra Advanced Cable Manufacture, Riyadh Cables, Sumitomo Electric Industries, KEI Limited, Oman Cables Industry SAOG, MESC, Midal Cables Ltd., Belden Incorporated, Ozguven Kablo, Liban Cables, and Saudi Cables |

| Additional Attributes | Dollar sales by transformer type and end use, demand dynamics across utility, industrial, and commercial power distribution, regional trends in grid modernization, innovation in insulation, efficiency, and monitoring systems, environmental impact of oil use and disposal, and emerging use cases in renewable energy integration and smart grids. |

The global levant power cable market is estimated to be valued at USD 5.9 billion in 2025.

The market size for the levant power cable market is projected to reach USD 10.5 billion by 2035.

The levant power cable market is expected to grow at a 5.9% CAGR between 2025 and 2035.

The key product types in levant power cable market are utility, oil & gas, construction, manufacturing, transport and other.

In terms of voltage, medium voltage segment to command 47.5% share in the levant power cable market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Power And Signal Cables Market

Power and Control Cable Market Growth – Trends & Forecast 2025 to 2035

Power Transmission Cables Market

Power Grid Fault Prediction Service Market Size and Share Forecast Outlook 2025 to 2035

Power Plant Boiler Market Forecast Outlook 2025 to 2035

Power Ring Rolling Machine Market Size and Share Forecast Outlook 2025 to 2035

Power Supply Equipment for Data Center Market Size and Share Forecast Outlook 2025 to 2035

Cable Line Fault Indicator Market Size and Share Forecast Outlook 2025 to 2035

Cable Tray Market Size and Share Forecast Outlook 2025 to 2035

Power Electronics Market Size and Share Forecast Outlook 2025 to 2035

Power Quality Equipment Market Size and Share Forecast Outlook 2025 to 2035

Power Generator for Military Market Size and Share Forecast Outlook 2025 to 2035

Cable Granulator Market Size and Share Forecast Outlook 2025 to 2035

Power Tools Market Size and Share Forecast Outlook 2025 to 2035

Power Supply Isolation Equipment Market Size and Share Forecast Outlook 2025 to 2035

Cable Distribution Cabinets Market Size and Share Forecast Outlook 2025 to 2035

Power Window Lift Motor Market Size and Share Forecast Outlook 2025 to 2035

Powered Surgical Staplers Market Size and Share Forecast Outlook 2025 to 2035

Power Distribution Component Market Size and Share Forecast Outlook 2025 to 2035

Power Over Ethernet (PoE) Controllers Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA