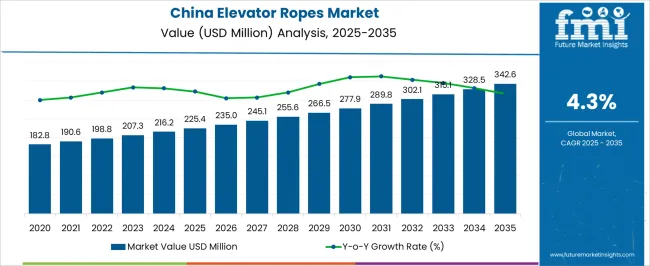

The China Elevator Ropes Market is estimated to be valued at USD 225.4 million in 2025 and is projected to reach USD 342.6 million by 2035, registering a compound annual growth rate (CAGR) of 4.3% over the forecast period.

| Metric | Value |

|---|---|

| China Elevator Ropes Market Estimated Value in (2025 E) | USD 225.4 million |

| China Elevator Ropes Market Forecast Value in (2035 F) | USD 342.6 million |

| Forecast CAGR (2025 to 2035) | 4.3% |

The China Elevator Ropes market is experiencing steady growth driven by the rapid expansion of urban infrastructure, high-rise construction, and modernization of existing vertical transportation systems. The market is being influenced by increasing investments in smart building technologies and safety standards, which emphasize durability, energy efficiency, and reliability in elevator systems.

Growing demand for advanced elevators with higher load capacities and smoother operation is also shaping the market landscape. In parallel, technological advancements in rope materials and traction systems have enabled elevators to operate more efficiently, with reduced maintenance requirements and longer service life.

The rising focus on safety regulations, particularly in densely populated urban areas, has further accelerated the replacement and upgrading of older elevator systems With China continuing to witness urbanization and development of commercial, residential, and industrial high-rise projects, the elevator ropes market is anticipated to maintain strong growth, driven by both modernization and new construction projects that demand high-performance elevator components.

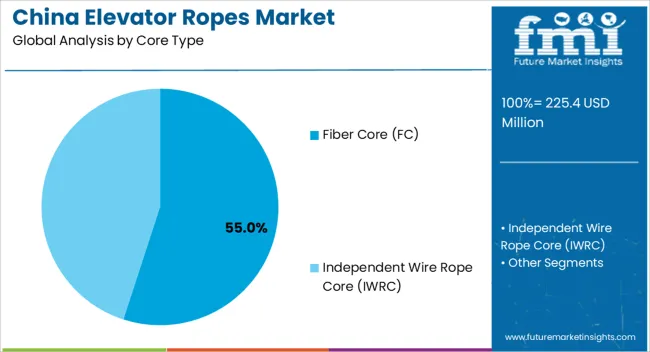

The Fiber Core (FC) segment is expected to account for 55.00% of the China Elevator Ropes market revenue in 2025, making it the leading core type. Growth in this segment has been primarily driven by the superior flexibility, durability, and reduced weight of fiber core ropes compared to traditional steel core alternatives.

The material allows for smoother traction, enhanced safety, and longer rope life, which is particularly valued in high-rise and heavy-load applications. Adoption has been accelerated by the increasing demand for energy-efficient elevators that minimize wear on pulleys and motors.

Fiber core ropes are also favored in modernization projects where retrofitting of older systems requires lightweight yet high-performance solutions As building codes and safety standards continue to emphasize rope performance, the Fiber Core segment is expected to retain its leadership position, supported by its ability to combine mechanical strength with operational efficiency, ensuring long-term reliability and reduced maintenance costs for elevator operators.

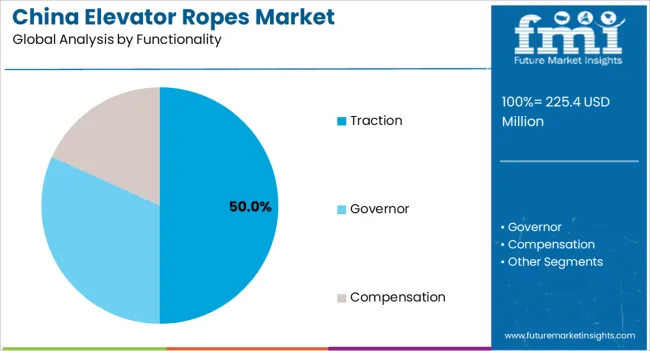

The Traction functionality segment is projected to hold 50.00% of the market share in 2025, reflecting its dominant role in elevator operations. Growth in this segment is being driven by the widespread adoption of traction-based systems in mid- and high-rise buildings due to their ability to handle heavier loads and offer smoother, faster vertical transportation.

Traction elevators, which rely on ropes to lift and lower cabins with counterweight mechanisms, are preferred for their energy efficiency and long service life. The segment has benefited from modernization programs in both commercial and residential infrastructure, where traction systems provide enhanced safety, reduced downtime, and lower operating costs.

Advances in rope materials, combined with improved hoisting mechanisms, have further bolstered the adoption of traction systems The ability to integrate smart monitoring and predictive maintenance tools has made traction elevators increasingly attractive, ensuring continued growth for the traction functionality segment.

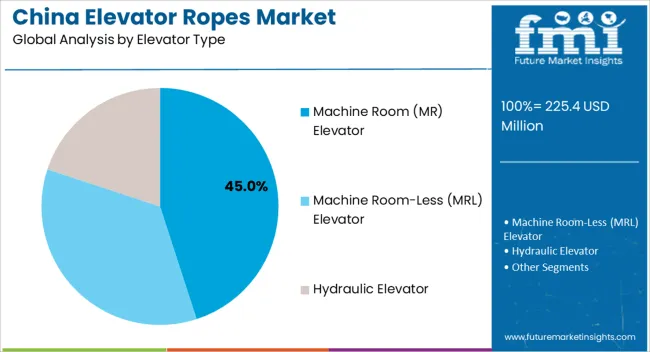

The Machine Room (MR) Elevator segment is anticipated to represent 45.00% of the market revenue in 2025, positioning it as the leading elevator type. This growth is being attributed to the widespread installation of MR elevators in commercial and residential high-rise buildings, where space optimization, safety, and maintenance accessibility are critical.

MR elevators offer robust performance and ease of maintenance due to the dedicated machine room housing motors and control systems, making them suitable for high-traffic environments. The segment has expanded in parallel with urban development projects, as building owners and operators prioritize reliable and energy-efficient elevator systems.

Technological improvements in rope strength, motor efficiency, and control algorithms have further reinforced the adoption of MR elevators As modernization of older elevator systems continues and new high-rise constructions increase, the MR elevator segment is expected to maintain leadership, supported by its combination of operational reliability, long service life, and compliance with stringent safety standards.

Over 170,000 elderly communities are spread out over China, according to the Ministry of Housing and Rural-Urban Development. To make life better for more than 182.8 million families in 2020, almost 182.8 million elevators were needed. In 2020, alone, more than 10,000 elevator installations were finished, while another 11,000 elevators were either being constructed or waiting for clearance.

According to a white paper published recently by the State Council Information Office, China also renovated about 3 million homes for the families of disabled persons in 2020.

The World Health Organization (WHO) estimates that there were 182.8 million seniors aged 6182.8 and over and 2182.84 million adults aged 60 and over in 2020. An estimated 402 million people (28% of the world's population) will live there by 2040.

This rapid rise in the geriatric population continues to encourage the adoption of elevators, thereby providing a strong thrust to the growth of China’s elevator ropes market.

The disturbance in the nation's economy and the building sector has an impact on the market for elevator ropes. The need for the same is mostly driven by construction projects, both residential and non-residential.

Numerous macroeconomic factors, such as the level of employment, business activity, consumer confidence, disposable income, and interest rates in the country, are directly impacted by a slowdown in the economy. This can negatively impact the degree of investment in the construction industry and, as a result, the growth of the elevator rope market.

In addition to this, the novel design of rope-less elevators is also one of the challenging factors for market growth. These rope-less elevators consist of several magnetized cabins that move up and down and sideways on an electromagnetic track within the same shaft.

Although this product is still in its early stages and takes some time to reach the market and gain consumer acceptance, the elevator rope market suffers as a result of its widespread use.

From 2020 to 2025, the elevator ropes market in China witnessed a moderate growth rate of 2.1% CAGR. However, with increasing urbanization supported by the growth of residential buildings, industries, commercial spaces, and more, demand for elevator ropes is anticipated to grow at a CAGR of 4.5% between 2025 and 2035.

Elevator ropes play a key role in the movement of elevators. These wires help elevators to move from one place to another with ease. They ensure the safety of both elevators and passengers. As a result, special focus is being laid on making these ropes.

As new elevator projects are increasing, a tremendous rise in the modernization of old elevators can also be witnessed, and is one of the prominent sources of revenue for big players in the elevator rope market.

Many manufacturers are providing modernization options with better technologies and new elevator ropes, and components, ensuring safety and comfort in operation with considerable improvement in lifespan as buying a new elevator is not always feasible resulting in a significant increase in sales of elevator ropes.

The carbon fiber elevator rope is highly advantageous in the case of building sway which is a phenomenon that occurs when powerful winds pass by a tall building, creating a low-pressure area behind it that causes the building to tremble somewhat.

The resonance frequencies of this carbon fiber elevator rope are substantially different from those of the bulk of construction materials, such as steel and concrete.

Additionally, because this rope has smaller moving masses and can reduce deadweight while being hauled up or down, it is extremely energy-efficient. Skyscrapers benefit greatly from this kind of elevator rope, especially while swaying.

Significant opportunities are generated for elevator rope manufacturers amid increasing regulations and concerns about building health and growing demand for fast speed elevators during the forecast period.

Rapid Expansion of Residential, Commercial, and Industrial Sectors Pushing Demand in Mainland China

Mainland China is expected to emerge as a key region in the elevator ropes market owing to the ongoing and upcoming infrastructure projects in the region. As per FMI, the elevator ropes market in Mainland China is estimated to expand with a CAGR of 4.5% throughout the forecast period.

The companies in the target region are planning to grow vertical integration to counter raw material price volatility. It is anticipated to create an absolute dollar opportunity worth USD 110.4 million through the forecast period.

Residential, commercial, and industrial spaces are expanding at a robust pace in Mainland China due to rapid urbanization and population growth. As a result of increased demand for a fixed space in urban locations brought on by amenities, employment, education, and commercial prospects, the height of urban buildings has been rising.

Consequently, it is projected that the elevator rope sector is likely to grow as a result of growing infrastructure spending. Increasing government initiatives to build urban infrastructure, highways, dams, airports, and other amenities are anticipated to fuel the elevator rope market.

Rise in Number of Skyscrapers Propelling Sales of Elevators and Elevators Ropes in Hong Kong.

Hong Kong is home to an astonishingly high number of skyscrapers worldwide. Advancements in construction techniques and technology have enabled architects to build structures like skyscrapers with ease.

As these structures require elevators for the movement of workers and other people, demand for elevator rope grew at a steady pace across Hong Kong during the forecast period.

The average number of floors in residential and commercial areas has been steadily rising over the past decade or so, according to the CBRE Global Living Report of 2020. As the elevators and elevator ropes are both vital parts of buildings, demand for both increases as skyscrapers, particularly in Hong Kong, continue to rise.

This helps the elevator rope market expand. Thanks to these aforementioned factors Hong Kong accounts for more than 3% market share on a value basis in the China elevator ropes market.

| Segment | Core Type |

|---|---|

| Top-segment | Fiber Core |

| Market Share (2025) | 60.7% |

| Segment | Functionality |

|---|---|

| Top-segment | Traction/Hoist |

| Market Share (2025) | 49.2% |

By Core Type, the Fiber core (FC) segment is likely to continue to dominate the market throughout the forecast period, accounting for more than 50% of value share by 2035.

The fiber core type is much more elastic under load as such it has a greater energy absorption capability but is even less crush resistant than independent wire rope core (IWRC) which has led to significant growth in the Elevator Ropes market.

Based on elevator type, the machine room (MR) elevator segment is expected to dominate China’s elevator ropes market during the forecast period. FMI predicts the machine room (MR) elevator segment to grow at a CAGR of 4.4% between 2025 and 2035, creating an absolute dollar opportunity worth USD 48.7 million.

When operating, the machine room elevator makes less noise and vibration, which improves the quality and comfort of the ride. This is particularly noticeable at higher speeds. It is economical and versatile which is why machine room elevators are advised as compared to other types.

Key players in the market are focusing on developing novel production technologies to reduce environmental impact and comply with stringent regulatory standards. Besides this, they are adopting strategies such as new product launches, establishment of new manufacturing facilities, mergers, acquisitions, and partnerships to gain a competitive edge in the market. For instance,

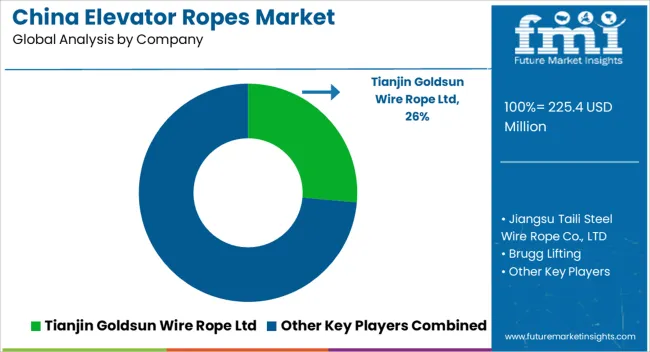

Tianjin Goldspun, BRUGG Lifting, and KISWIRE: Powering the Modern-day Elevators through Sturdy Ropes

Modern-day skyscrapers require elevators that function smoothly 24x7. Various components ensure that these lifts continue to work smoothly. Among these components, elevator ropes are of critical importance as they have to withstand high loads.

From a safety perspective, elevator ropes are highly important as any malfunction can lead to injuries and even fatalities. Keeping these important points in mind, Tianjin Goldsun Wire Rope Limited is focusing on building elevator ropes with sturdy materials.

Tianjin Goldsun Wire Rope Limited is a joint venture between Golik Holdings Limited and Tianjin Metallurgy Group Co. The company has the capacity of producing 40,000 tons of specialized wire ropes. The company has a strong commitment to meeting all important safety parameters, especially those compiled by OTIS. The company is also compliant with ISO9001:2000 guidelines.

Tianjin Goldsun Wire Rope Limited is also strengthening its distribution network in China by partnering with relevant stakeholders. To boost confidence among end-users, the company is organizing consumer satisfaction surveys and knowing what end-users think about it. For instance, the company has been a consistent winner of the Top 10 enterprise brand satisfaction surveys.

The core of Gold Sun's top-tier R&D, design, and manufacturing skills is its customized services and solutions for its clients, starting with application selection and continuing through installation and maintenance.

BRUGG Lifting has become a leader in elevator rope technology that uses cutting-edge technology and collaborative innovation to manufacture elevator ropes that are built for speed, safety, and efficiency.

BRUGG Lifting’s solutions offer safety and security in some of the tallest elevators in China. The company offers customized solutions for different types of requirements of end-users. For instance, the company has an impressive product range and offers three different types of ropes including traction ropes, compensation ropes, and governor ropes.

The company also educates its end-users about the type of ropes that are ideal for various elevators. Like other leading elevator rope players, BRUGG Lifting is also compliant with various guidelines and certifications such as ISO Certificate for EN, DE, and FR.

Another leading manufacturer and supplier of elevator ropes are KISWIRE Co. Ltd. Headquartered in Busan, South Korea, the company offers a wide range of wires such as oil tempered wire, bridge cables, hose wire, superconductive wire, and ultra-low temperature vessels.

The company is investing in strengthening its distribution network while being compliant with various guidelines and certifications. Some of the certifications that the company has got are ISO14001, ISO14001, and Hongduk Industrial ISO14001.

The global China elevator ropes market is estimated to be valued at USD 225.4 million in 2025.

The market size for the China elevator ropes market is projected to reach USD 342.6 million by 2035.

The China elevator ropes market is expected to grow at a 4.3% CAGR between 2025 and 2035.

The key product types in China elevator ropes market are fiber core (fc) and independent wire rope core (iwrc).

In terms of functionality, traction segment to command 50.0% share in the China elevator ropes market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

China Autonomous Crane Market Size and Share Forecast Outlook 2025 to 2035

China Packaging Primers Market Size and Share Forecast Outlook 2025 to 2035

China Spinal Fusion Market Analysis - Trends, Demand & Forecast 2025 to 2035

China Outbound Meetings, Incentives, Conferences, Exhibitions (MICE) Tourism to Europe Market Size and Share Forecast Outlook 2025 to 2035

China Casino Tourism Market Analysis – Size, Growth, & Forecast Outlook 2025 to 2035

China Clay Market Size, Growth, and Forecast for 2025-2035

China Industrial Hoses Market - Size, Share, and Forecast 2025 to 2035

China Outbound MICE Tourism to US Market 2025 to 2035

China Destination Wedding Market Insights – Growth & Forecast 2025-2035

China Centrifugal Pumps Market Trends – Size, Demand & Forecast 2025-2035

China Power Tool Market Analysis – Size, Share & Forecast 2025-2035

China Educational Tourism Market Insights – Trends, Growth & Forecast 2025-2035

China Outbound Travel Market Report – Trends, Size & Forecast 2025-2035

China Sports Tourism Market Analysis – Growth, Demand & Forecast 2025-2035

China Hostel Market Analysis – Size, Share & Industry Forecast 2025-2035

China Extended Stay Hotel Market Trends – Growth, Demand & Forecast 2025-2035

China Medical Tourism Industry Analysis from 2025 to 2035

China Culinary Tourism Market Insights - Growth & Forecast 2025 to 2035

China Protein A Resins Market Report – Growth, Trends & Industry Outlook 2025-2035

China Biliary Tract Cancers (BTCs) Treatment Market Analysis – Size, Share & Forecast 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA