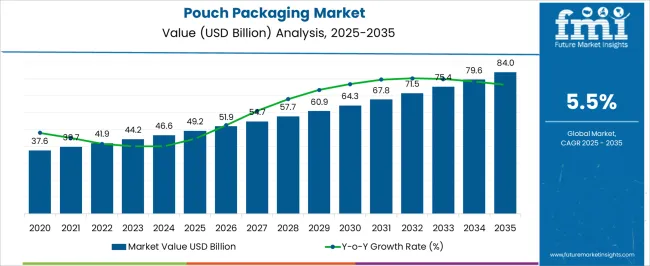

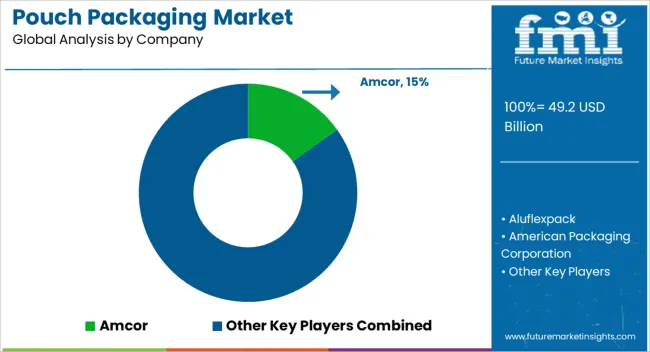

The pouch packaging market is estimated to be valued at USD 49.2 billion in 2025 and is projected to reach USD 84.0 billion by 2035, registering a compound annual growth rate (CAGR) of 5.5% over the forecast period. Between 2025 and 2030, the market is expected to rise from USD 49.2 billion to USD 64.3 billion, driven by increasing demand for flexible, lightweight, and convenient packaging solutions across food and beverage, personal care, and healthcare industries.

Year-on-year analysis shows steady growth, with values reaching USD 51.9 billion in 2026 and USD 54.7 billion in 2027, supported by consumer preference for easy-to-use and recyclable packaging formats. By 2028, the market is forecasted to reach USD 57.7 billion, advancing to USD 60.9 billion in 2029 and USD 64.3 billion by 2030. Growth is expected to be further fueled by innovations in barrier films, reclosable pouches, and environmentally friendly packaging options. These dynamics position the pouch packaging market as a key player in the global packaging industry, offering significant opportunities for innovation in sustainable and functional packaging solutions.

Converting operations require specialized pouching equipment incorporating heat sealing systems, zipper attachment mechanisms, and valve integration capabilities that accommodate diverse product viscosities and filling requirements. Production coordination involves managing film substrate specifications, barrier layer configurations, and printing registration across high-speed converting lines while maintaining consistent seal quality and dimensional accuracy. Equipment procurement decisions balance initial capital investment against operational efficiency metrics including throughput rates, waste generation levels, and changeover time requirements when transitioning between different pouch formats and customer specifications.

Material science developments focus on multi-layer film structures that combine polyethylene, polypropylene, and specialized barrier coatings to achieve optimal oxygen transmission rates, moisture vapor protection, and puncture resistance characteristics. Lamination processes utilize solventless adhesive systems, extrusion coating techniques, and metallized film integration that create packaging structures capable of extending product shelf life while reducing overall material thickness and environmental impact. Quality control procedures address bond strength testing, seal integrity validation, and barrier property verification that ensure package performance throughout distribution stress conditions and consumer handling scenarios.

Cross-functional challenges arise between marketing teams seeking distinctive package aesthetics and manufacturing groups implementing cost-effective production methods that optimize material utilization and minimize converting waste. Printing capabilities encompass rotogravure processes, flexographic systems, and digital decoration technologies that accommodate complex graphics, variable data requirements, and security features while maintaining color consistency across extended production runs. Pouch design optimization considers fill volume efficiency, display characteristics, and consumer convenience features including resealable closures, easy-open tearoffs, and portion control functionality.

| Metric | Value |

|---|---|

| Pouch Packaging Market Estimated Value in (2025 E) | USD 49.2 billion |

| Pouch Packaging Market Forecast Value in (2035 F) | USD 84.0 billion |

| Forecast CAGR (2025 to 2035) | 5.5% |

The pouch packaging market is expanding steadily, fueled by rising demand for flexible and convenient packaging solutions across the food and beverage and consumer goods industries. The increasing consumer preference for on-the-go products and single-serve packaging formats has driven the adoption of pouches.

Innovations in packaging materials and technologies have enhanced the durability and barrier properties of pouches, helping to extend product shelf life and maintain quality. Sustainability concerns have encouraged the development of recyclable and lightweight materials, influencing material selection and design.

Additionally, the growth of ready-to-eat and ready-to-drink products has contributed to increased demand for efficient filling methods such as hot-filling, which ensures product safety and flavor retention. Retail expansion and e-commerce have also improved the accessibility of pouch-packaged goods. Segmental growth is expected to be led by plastic as the preferred packaging material, stand-up pouches as the dominant product type, and hot-filling as the preferred filling method due to its efficacy in preserving product integrity.

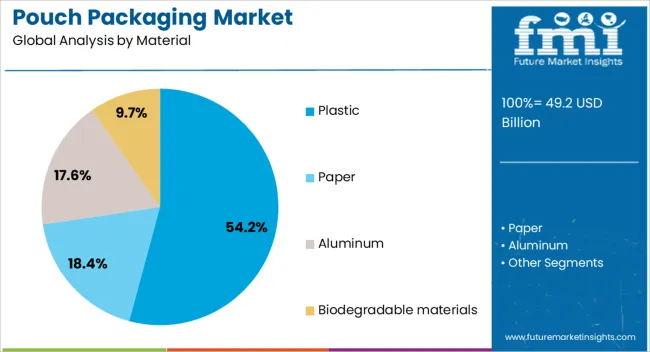

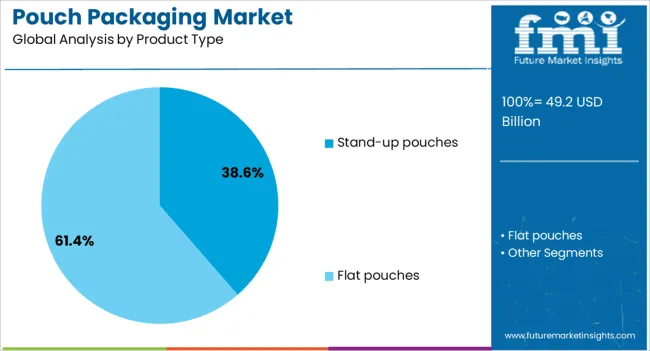

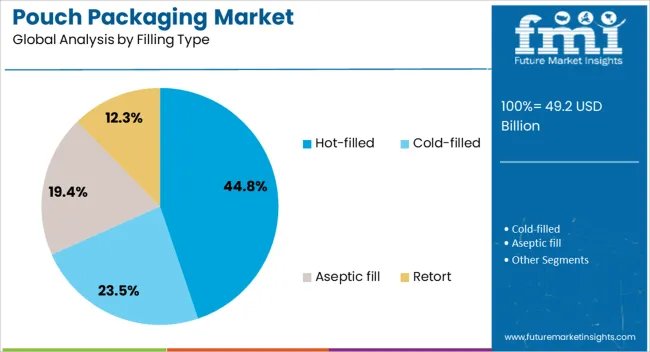

The pouch packaging market is segmented by material, product type, filling type, closure type, application, end-use industry, and geographic regions. By material, the pouch packaging market is divided into Plastic, Paper, Aluminum, and Biodegradable materials. In terms of product type, the pouch packaging market is classified into Stand-up pouches and Flat pouches. Based on the filling type, the pouch packaging market is segmented into Hot-filled, Cold-filled, Aseptic fill, and Retort.

By closure type, the pouch packaging market is segmented into Zipper, Spout, and Tear notch. By application, the pouch packaging market is segmented into Snacks & confectionery, Sauces & condiments, Dairy products, Personal care & cosmetics, Frozen foods, Pet foods, Homecare products, Fertilizers, and Others. By end-use industry, the pouch packaging market is segmented into Food & beverage, Healthcare & pharmaceutical, Consumer goods, Agriculture, and Others. Regionally, the pouch packaging industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The plastic segment is projected to contribute 54.2% of the pouch packaging market revenue in 2025, maintaining its position as the leading material type. Plastic’s flexibility, durability, and cost-effectiveness have made it the material of choice for pouch packaging across various industries.

Its excellent barrier properties help protect products from moisture, oxygen, and contamination, which is critical for food safety and quality. Manufacturers benefit from plastic’s ease of processing and compatibility with different sealing and printing technologies.

Although environmental concerns persist, plastic manufacturers are innovating with recyclable and biodegradable alternatives to address sustainability demands. Plastic pouches offer lightweight and space-saving advantages during transportation and storage, which reduce logistics costs. These factors have supported the sustained growth of the plastic segment in the pouch packaging market.

The stand-up pouches segment is expected to hold 38.6% of the market revenue in 2025, establishing itself as the dominant product type. Their popularity stems from the convenience they offer consumers including ease of storage, resealability, and attractive shelf presence.

Stand-up pouches provide stability on shelves and are suitable for a wide range of products from liquids to snacks which has contributed to their widespread adoption. Brands have increasingly used these pouches to differentiate products through custom designs and vibrant printing options.

Additionally, they allow for portion control and reduce product waste, which resonates with environmentally conscious consumers. These advantages have made stand-up pouches a preferred choice among manufacturers seeking versatile packaging solutions.

The hot-filled segment is projected to account for 44.8% of the pouch packaging market revenue in 2025, driven by its ability to preserve product quality and safety. Hot-filling involves packaging products at elevated temperatures to sterilize contents and extend shelf life without preservatives.

This method is widely used for beverages, sauces, and liquid food products that require microbial safety and flavor retention. The process is compatible with flexible pouch materials and supports high-speed production lines, which benefits manufacturers by enhancing efficiency.

Consumer demand for fresh and minimally processed products has also contributed to the preference for hot-filled packaging. As food safety regulations tighten and consumer expectations ris,e the hot-filled segment is expected to maintain a strong market position.

The pouch packaging market is driven by rising demand for convenient, lightweight packaging solutions in industries like food and beverage. Opportunities are growing with expanding applications and trends toward eco-friendly, stand-up pouches. However, high production costs and material availability remain challenges. By 2025, overcoming these barriers through cost-effective, sustainable solutions will be key to the market’s continued expansion and success.

The pouch packaging market is expanding due to the growing demand for convenient, lightweight, and cost-effective packaging solutions. Pouches offer advantages like lower shipping costs, flexibility, and easy-to-use features, making them popular in industries such as food and beverage, cosmetics, and pharmaceuticals. By 2025, the demand for flexible packaging solutions will continue to rise, particularly in e-commerce, where the focus is on lightweight, user-friendly, and eco-friendly packaging.

Opportunities in the pouch packaging market are increasing in the food and beverage industry. Pouches are increasingly being used to package snacks, beverages, and ready-to-eat meals due to their ability to preserve freshness and reduce waste. This trend is expected to continue as consumer demand for convenient, on-the-go packaging solutions grows. By 2025, the market will see significant growth in food and beverage applications, driven by innovation in pouch designs and material developments.

Emerging trends in the pouch packaging market include the rise of stand-up pouches and the increasing use of eco-friendly materials. Stand-up pouches offer improved shelf presence and are gaining popularity in food and beverage packaging for their convenience and space-saving features. Additionally, there is growing interest in biodegradable and recyclable pouch materials, as manufacturers respond to consumer demand for more sustainable packaging. By 2025, these trends will significantly shape the market, as industries focus on innovation and sustainability.

Despite market growth, challenges related to high initial investment and operational costs persist. The cost of manufacturing and installing three-phase shunt reactors can be substantial, which may limit their adoption in smaller or budget-constrained projects. Additionally, the ongoing maintenance and operational costs associated with these reactors, particularly in complex grid systems, can impact their financial feasibility. By 2025, addressing these challenges through cost-effective manufacturing and improved operational efficiency will be crucial for wider market penetration.

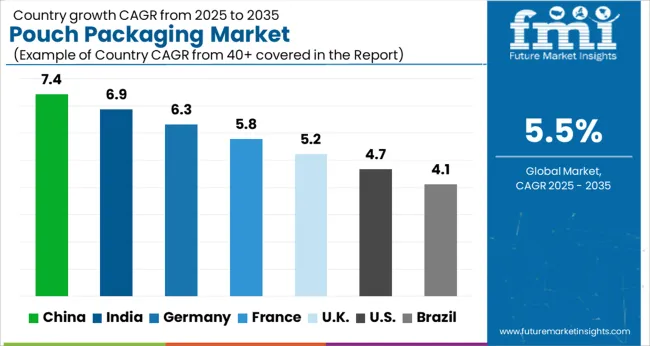

The global pouch packaging market is projected to grow at a 5.5% CAGR from 2025 to 2035. China leads with a growth rate of 7.4%, followed by India at 6.9%, and Germany at 6.3%. The United Kingdom records a growth rate of 5.2%, while the United States shows the slowest growth at 4.7%. These varying growth rates are driven by factors such as increasing demand for convenient, sustainable packaging solutions in food, beverage, personal care, and pharmaceuticals. Emerging markets like China and India are witnessing higher growth due to rapid urbanization, rising disposable incomes, and the growing demand for packaged products, while more mature markets like the USA and the UK experience steady growth driven by regulatory trends and technological advancements in packaging solutions. This report includes insights on 40+ countries; the top markets are shown here for reference.

The pouch packaging market in China is growing rapidly, with a projected CAGR of 7.4%. China’s expanding food and beverage, pharmaceutical, and personal care industries are driving strong demand for innovative and sustainable packaging solutions. The increasing preference for lightweight, space-efficient, and eco-friendly packaging, especially in ready-to-eat meals and beverages, is contributing to market growth. Additionally, China’s rising disposable incomes and increasing consumer demand for packaged products, coupled with growing awareness of sustainable packaging, are further accelerating the adoption of pouch packaging solutions.

The pouch packaging market in India is projected to grow at a CAGR of 6.9%. India’s expanding food and beverage industry, along with rising consumer demand for packaged goods, is significantly contributing to market growth. The demand for convenient, portion-controlled, and recyclable packaging in snacks, beverages, and personal care products is increasing. Additionally, India’s growing urban population, rising disposable income, and preference for on-the-go products are further driving the adoption of pouch packaging solutions. The government’s focus on sustainability and waste reduction also plays a role in accelerating the use of eco-friendly pouch packaging alternatives.

The pouch packaging market in Germany is projected to grow at a CAGR of 6.3%. Germany’s strong demand for innovative, sustainable, and efficient packaging solutions in food, beverages, and healthcare products is driving steady growth in the pouch packaging market. The increasing preference for lightweight, space-saving, and eco-friendly packaging in consumer goods is contributing to market expansion. Additionally, Germany’s stringent environmental regulations, particularly around plastic waste and recycling, are encouraging manufacturers to adopt sustainable pouch packaging materials, further accelerating market growth.

The pouch packaging market in the United Kingdom is projected to grow at a CAGR of 5.2%. The UK’s growing demand for sustainable and convenient packaging solutions in food, beverages, and personal care products is contributing to steady market growth. The increasing popularity of on-the-go packaging, along with rising consumer demand for smaller, easy-to-transport products, is fueling the adoption of pouch packaging. Additionally, the UK’s strong regulatory push for reducing plastic waste and increasing recycling is further accelerating the demand for eco-friendly pouch packaging alternatives.

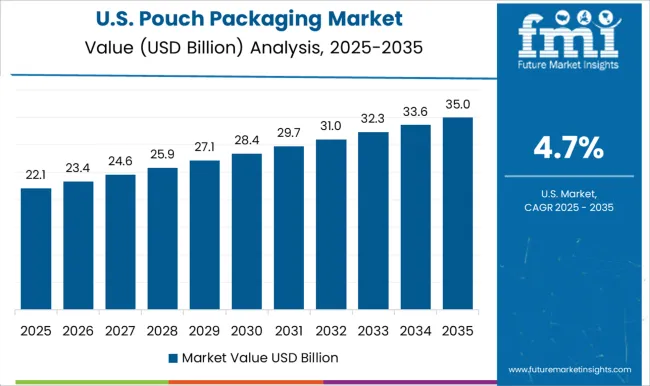

The pouch packaging market in the United States is expected to grow at a CAGR of 4.7%. The USA market remains steady, driven by rising demand for convenient, sustainable packaging solutions in food, beverage, and personal care sectors. The increasing preference for lightweight, cost-effective packaging in a variety of applications, including ready-to-eat meals, snacks, and beverages, continues to support market growth. Additionally, the USA government’s push for sustainability and reduced environmental impact is driving the adoption of eco-friendly pouch packaging materials, contributing to steady demand despite slower growth compared to emerging markets.

The pouch packaging market is growing rapidly, driven by the increasing demand for convenient, cost-effective, and sustainable packaging solutions across industries such as food and beverage, personal care, and pharmaceuticals. Leading players in the market include Amcor plc, Aluflexpack, American Packaging Corporation, Bischof + Klein SE & Co. KG, Bryce Corporation, Constantia Flexibles, Coveris Management, C-P Flexible Packaging, Flair Flexible Packaging Corporation, Glenroy Inc., Gualapack, Hood Packaging Corporation, Huhtamäki Oyj, Mondi Group, ProAmpac Holdings, Sealed Air Corporation, Shako Flexipack, Sky Flexi Pack, Smurfit Kappa, Sonoco Products Company, St. Johns Packaging, Swiss Pack, Toppan Printing Co. Ltd., and Winpak Ltd., all offering diverse pouch packaging solutions.

Amcor plc is a leader, offering flexible, recyclable pouches across multiple sectors, focusing on sustainability. ProAmpac and Constantia Flexibles provide high-quality pouches with advanced barrier properties, ensuring the freshness and safety of packaged goods. Huhtamäki Oyj and Mondi Group deliver eco-friendly pouch solutions with a focus on reducing plastic use and improving recyclability. Sealed Air Corporation and Bischof + Klein cater to the growing demand for protective and innovative pouches. With increasing consumer preference for convenience and sustainable packaging, companies are focusing on developing lightweight, recyclable, and customizable pouch options to meet evolving market demands.

| Item | Value |

|---|---|

| Quantitative Units | USD 49.2 Billion |

| Material | Plastic, Paper, Aluminum, and Biodegradable materials |

| Product Type | Stand-up pouches and Flat pouches |

| Filling Type | Hot-filled, Cold-filled, Aseptic fill, and Retort |

| Closure Type | Zipper, Spout, and Tear notch |

| Application | Snacks & confectionery, Sauces & condiments, Dairy products, Personal care & cosmetics, Frozen foods, Pet foods, Homecare products, Fertilizers, and Others |

| End-Use Industry | Food & beverage, Healthcare & pharmaceutical, Consumer goods, Agriculture, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Amcor plc; Aluflexpack; American Packaging Corporation; Bischof + Klein SE & Co. KG; Bryce Corporation; Constantia Flexibles Group GmbH; Coveris Management; C-P Flexible Packaging; Flair Flexible Packaging Corporation; Glenroy Inc.; Gualapack; Hood Packaging Corporation; Huhtamäki Oyj; Mondi Group; ProAmpac Holdings; Sealed Air Corporation; Shako Flexipack; Sky Flexi Pack; Smurfit Kappa; Sonoco Products Company; St. Johns Packaging; Swiss Pack; Toppan Printing Co., Ltd.; Winpak Ltd. |

| Additional Attributes | Dollar sales by material type and application, demand dynamics across food and beverage, pharmaceuticals, and consumer goods sectors, regional trends in pouch packaging adoption, innovation in sustainable and high-barrier films, impact of regulatory standards on product safety and environmental impact, and emerging use cases in flexible packaging and e-commerce solutions. |

The global pouch packaging market is estimated to be valued at USD 49.2 billion in 2025.

The market size for the pouch packaging market is projected to reach USD 84.0 billion by 2035.

The pouch packaging market is expected to grow at a 5.5% CAGR between 2025 and 2035.

The key product types in pouch packaging market are plastic, paper, aluminum and biodegradable materials.

In terms of product type, stand-up pouches segment to command 38.6% share in the pouch packaging market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Pouch Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Pouch-Bowl Packaging Market Size and Share Forecast Outlook 2025 to 2035

Doy Pouch Packaging Market

Foil Pouch Packaging Market Size and Share Forecast Outlook 2025 to 2035

Twin Pouch Packaging Market

Pillow Pouch Packaging Market Size and Share Forecast Outlook 2025 to 2035

Market Share Insights of Leading Pillow Pouch Packaging Providers

Pre-made Pouch Packaging Market Size and Share Forecast Outlook 2025 to 2035

Industry Share & Competitive Positioning in Pre-Made Pouch Packaging

Bag Feed Seal Pouch Packaging Machine Market Size and Share Forecast Outlook 2025 to 2035

Center Sealed Pouch Packaging Market Size and Share Forecast Outlook 2025 to 2035

Japan Premade Pouch Packaging Industry Analysis by Material Type, Closure Type, End Use, and Region through 2025 to 2035

Korea Premade Pouch Packaging Market Analysis by Closure Type, Material Type, End-Use Industry, and Province through 2035

Automatic Pre-made Pouch Packaging Machine Market

Western Europe Premade Pouch Packaging Market Analysis by Closure Type, Material Type, End-Use Industry, and Country through 2035

Spout & Non-Spout Liquid Pouch Packaging Market Size and Share Forecast Outlook 2025 to 2035

Packaging Supply Market Size and Share Forecast Outlook 2025 to 2035

Packaging Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tubes Market Size and Share Forecast Outlook 2025 to 2035

Packaging Jar Market Forecast and Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA