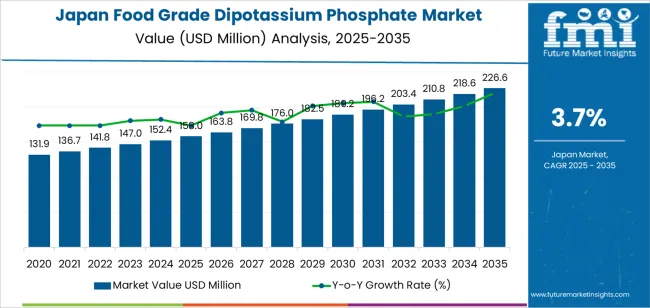

The demand for food grade dipotassium phosphate in Japan is projected to grow from USD 158 million in 2025 to USD 226.6 million by 2035, reflecting a CAGR of 3.7%. Dipotassium phosphate (DKP) is widely used in the food industry as a phosphorus source, buffering agent, and stabilizer in various products such as processed foods, dairy, beverages, and nutritional supplements. Its application is particularly critical in improving texture, taste, and shelf life, making it a vital ingredient for both manufacturers and consumers seeking safe, long-lasting, and high-quality food products.

The rise in health-conscious eating and the demand for clean-label products will continue to drive the demand for DKP in food products, especially in Japan, where there is a high demand for safe and nutritionally balanced ingredients. Advancements in food processing techniques, coupled with increasing consumer awareness regarding nutritional fortification and food safety, are expected to contribute to the continued adoption of dipotassium phosphate in food production. Furthermore, the regulatory focus on quality control and ingredient transparency will likely promote the use of high-quality additives like DKP in food formulations.

The breakpoint analysis for food grade dipotassium phosphate in Japan reveals distinct growth shifts over the forecast period, with key periods of acceleration and stabilization.

From 2025 to 2030, the demand will grow from USD 158 million to USD 189.2 million, contributing USD 31.2 million in value. This early phase of growth will experience acceleration, driven by increasing demand in processed food, beverage, and dairy industries. As the trend toward healthier, longer-lasting products grows, the use of DKP as a stabilizer and nutrient fortifier will continue to rise. The breakpoint during this period is expected to occur around 2027 when significant adoption takes place across new product categories due to the rising demand for processed foods and nutritional supplements in the Japanese market. The growth rate will see sharp increases as manufacturers continue to use DKP to extend the shelf life and enhance the quality of their products.

From 2030 to 2035, the market will grow from USD 189.2 million to USD 226.6 million, adding USD 37.4 million in value. While the demand will remain strong, growth will moderate as the market reaches saturation in certain industries. During this phase, the focus will shift from rapid adoption to consistent demand driven by regulatory compliance and long-term stability in ingredient usage. The breakpoint in this phase will occur as the adoption of DKP in food products reaches a more mature stage, with market growth reflecting incremental demand driven by the stabilization of market trends and increased reliance on ingredient standardization and quality consistency in food production.

| Metric | Value |

|---|---|

| Industry Sales Value (2025) | USD 158 million |

| Industry Forecast Value (2035) | USD 226.6 million |

| Industry Forecast CAGR (2025 to 2035) | 3.7% |

Demand for food grade dipotassium phosphate (DKP) in Japan is gaining momentum as food manufacturers require additives that enhance texture, maintain stability and extend shelf life in processed foods. The country’s strong processed food sector-covering categories such as dairy, bakery, confectionery and ready to eat meals-relies on functional ingredients like DKP for emulsification, buffering and nutrient fortification. With growing emphasis on food quality and convenience, Japanese producers are adopting DKP to support manufacturing efficiency and product appeal.

Another important driver is the rising consumer interest in fortified, clean label and health oriented products. DKP, rich in potassium and phosphorus, fits the nutritional signalling seen across Japanese food brands seeking to differentiate. Additionally, material innovation and regulatory alignment allow manufacturers to use DKP as a reliable processing aid while meeting food safety standards. Despite this growth, some constraints remain-these include raw material cost fluctuations, regulatory scrutiny of additive levels and competition from alternative emulsifiers. Yet, the combination of strong demand for processed food functionality, nutritional enhancement and manufacturing efficiency indicates that the market for food grade dipotassium phosphate in Japan will continue to expand at a modest pace.

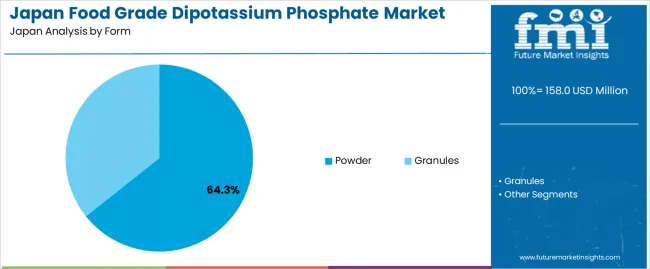

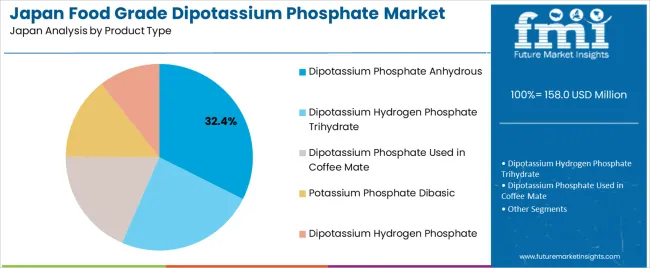

The demand for food grade dipotassium phosphate in Japan is driven by form and application. The leading form is powder, which captures 64% of the market share, while dairy is the dominant application, accounting for 36.2% of the demand. Food grade dipotassium phosphate is widely used in food processing due to its role as an emulsifier, stabilizer, and acidulant, particularly in products that require improved texture, extended shelf life, and better nutrient content. As the food industry in Japan continues to prioritize product quality and consistency, the demand for this functional ingredient remains strong.

Powder form dominates the market for food grade dipotassium phosphate in Japan, holding 64% of the demand. The powdered form is highly preferred in the food industry due to its ease of handling, precise dosing, and easy integration into various food products. Powdered dipotassium phosphate is commonly used in dairy, beverages, and processed foods where uniform distribution and stable consistency are crucial.

The demand for powdered dipotassium phosphate is driven by its ability to be efficiently mixed into food matrices, especially in powdered drink mixes, dairy products like cheese and milk, and processed foods requiring enhanced emulsification. Additionally, the powdered form facilitates storage and transport, making it an ideal choice for manufacturers. As the demand for high-quality, reliable ingredients in food processing continues to grow, the preference for powdered dipotassium phosphate is expected to remain strong in Japan.

Dairy is the leading application segment for food grade dipotassium phosphate in Japan, accounting for 36.2% of the demand. Dipotassium phosphate is widely used in dairy products, particularly in cheese, milk, and yogurt, where it helps to improve texture, prevent separation, and enhance overall quality. It is also used as an emulsifier and stabilizer, which is particularly important in the production of processed cheeses and dairy beverages.

The demand from the dairy industry is driven by the need for improved processing efficiency, product consistency, and longer shelf life, all of which dipotassium phosphate helps to achieve. Additionally, as the Japanese consumer demand for high-quality and value-added dairy products continues to rise, the use of dipotassium phosphate in dairy applications will likely increase. The ongoing focus on quality, texture, and performance in dairy products ensures that dipotassium phosphate will continue to be a key ingredient in Japan’s dairy industry.

Demand for food grade dipotassium phosphate in Japan is shaped by growing consumption of processed foods, the expanding functional ingredient trend and the role of mineral phosphates as pH regulators, emulsifiers and stabilisers in formulations. Japanese food and beverage manufacturers are reformulating bakery, dairy and nutritional products to meet health and convenience oriented consumer demands. At the same time, tight regulatory frameworks, dependence on imports and rising raw material costs moderate growth. These interacting forces underlie how food grade dipotassium phosphate is positioned in Japan’s ingredient market.

What Are the Primary Growth Drivers for Food Grade Dipotassium Phosphate Demand in Japan? Several factors support growth in the Japanese market. First, the rise in convenience food consumption, ready to eat meals and value added dairy drives use of additives such as dipotassium phosphate that improve texture, stability and shelf life. Second, rising consumer interest in fortified foods and beverages with added minerals (potassium/phosphorus) supports this phosphate salt’s use as part of nutrition enhanced formulations. Third, the ongoing trend toward clean label and plant based alternatives encourages switching to versatile, high purity additives in processed foods. Fourth, manufacturers’ investments in new product development (NPD) and production site upgrades reflect demand for functional phosphates in Japan’s competitive food processing industry.

What Are the Key Restraints Affecting Food Grade Dipotassium Phosphate Demand in Japan? Despite favourable conditions, several restraints hinder expansion. Ingredient cost volatility-particularly phosphate rock, potassium salts and purification steps-can raise formulation cost, making adoption less attractive in price sensitive segments. Strict Japanese food additive regulation, labelling obligations and consumer wariness of chemical additives can impede new uses of dipotassium phosphate. Additionally, substitute technologies (for example other buffering or emulsifying salts) may limit uptake in some applications. Finally, mature demand in traditional categories such as standard dairy or bakery formats means incremental growth depends largely on niche or reformulation activity rather than broad volume increase.

What Are the Key Trends Shaping Food Grade Dipotassium Phosphate Demand in Japan? Important trends in Japan include increased substitution of conventional emulsifiers and stabilisers with mineral based phosphates such as dipotassium phosphate in healthier label formulations. Producers are introducing specialised grades with enhanced solubility, tailored for beverages or functional foods, supporting broader adoption. There is a growing focus on potassium rich formulations in line with wellness trends, making dipotassium phosphate a dual function ingredient (functional plus mineral supply). Also, supply chain transparency and sustainable sourcing are becoming more relevant, encouraging manufacturers to seek certified and traceable phosphate additives. Finally, growth of alternative diets (plant based, dairy substitute) creates new demand routes for phosphates in non traditional food formats.

The demand for food grade dipotassium phosphate in Japan is primarily driven by its role as an essential food additive used in various food and beverage products. Dipotassium phosphate (DKP) is used as a stabilizer, emulsifier, and buffering agent, playing a critical role in the processing of dairy products, processed meats, beverages, and baked goods. As the Japanese food industry continues to innovate and meet consumer demand for processed, convenience, and functional foods, the use of food-grade additives like dipotassium phosphate is becoming more prevalent.

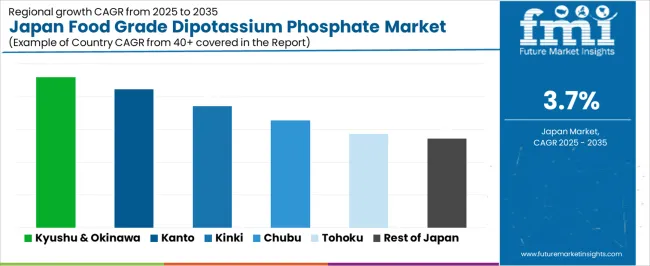

Additionally, DKP is used in fortifying foods with potassium, which supports the growing demand for health-oriented, functional foods. The Japanese market also benefits from a high level of food safety regulations, ensuring the use of safe, approved additives like dipotassium phosphate in food production. Regional demand differences can be attributed to the concentration of food manufacturing facilities, technological advancements, and local dietary habits. Below is an analysis of the demand for food grade dipotassium phosphate across different regions in Japan.

| Region | CAGR (2025-2035) |

|---|---|

| Kyushu & Okinawa | 4.6% |

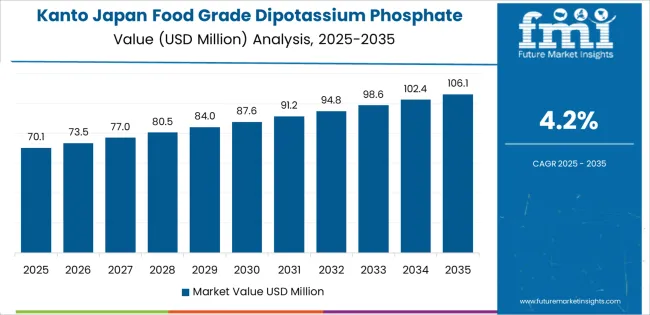

| Kanto | 4.2% |

| Kinki | 3.7% |

| Chubu | 3.3% |

| Tohoku | 2.9% |

| Rest of Japan | 2.7% |

Kyushu & Okinawa leads the demand for food grade dipotassium phosphate in Japan with a CAGR of 4.6%. This can be attributed to the region’s robust food production and processing industry, particularly in areas like agriculture and seafood. Kyushu & Okinawa’s focus on processed food production, including beverages and dairy products, has created a consistent need for food additives like dipotassium phosphate, which is used to enhance product stability and fortify foods with potassium.

The region’s growing awareness of health and wellness also contributes to the rising demand for functional foods that include additives like dipotassium phosphate to promote heart health and muscle function. As consumer demand for healthier, processed foods increases, the demand for food grade dipotassium phosphate in Kyushu & Okinawa is expected to continue its strong growth.

Kanto shows strong demand for food grade dipotassium phosphate with a CAGR of 4.2%. Kanto, which includes Tokyo and its surrounding areas, is the economic and industrial hub of Japan, with a high concentration of food manufacturing facilities, especially in the beverage, dairy, and processed food sectors. The region's demand for food additives like dipotassium phosphate is driven by the need to maintain food safety standards, product consistency, and quality control.

The food and beverage industry in Kanto is increasingly focused on producing health-conscious products, including low-sodium, fortified, and functional foods, which utilize additives like dipotassium phosphate. As Kanto continues to innovate in food processing and consumer preferences shift towards healthier options, the demand for food grade dipotassium phosphate will continue to grow steadily.

Kinki, with a CAGR of 3.7%, shows steady demand for food grade dipotassium phosphate. The region, including major cities like Osaka, Kyoto, and Kobe, is known for its significant food industry, with a particular focus on traditional foods and processed products. Kinki's demand for food additives like dipotassium phosphate is driven by its diverse food manufacturing base, including dairy, meat products, and convenience foods.

Although the growth rate in Kinki is slightly lower than in Kyushu & Okinawa and Kanto, the steady demand for food grade dipotassium phosphate is supported by the region’s continued focus on food safety, product development, and expanding functional food offerings. As health-conscious eating trends continue to grow, the use of additives like dipotassium phosphate is expected to remain an important factor in food production in Kinki.

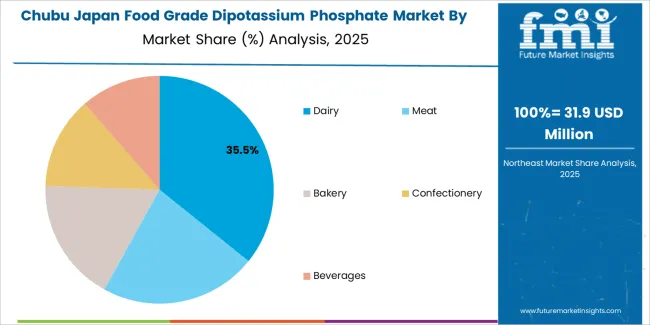

Chubu demonstrates moderate growth in the demand for food grade dipotassium phosphate with a CAGR of 3.3%. The region, which includes Nagoya and surrounding areas, is known for its strong industrial base, including automotive and electronics, but also has a notable food processing sector. The demand for food grade dipotassium phosphate in Chubu is supported by the increasing production of processed foods and beverages, particularly in the dairy and meat industries.

As Chubu’s food industry continues to modernize and innovate, the demand for food additives like dipotassium phosphate is expected to grow, albeit at a slower pace compared to other regions. The region's increasing focus on food safety and quality control, coupled with the growing trend of functional food production, will contribute to steady demand for dipotassium phosphate in the coming years.

Tohoku, with a CAGR of 2.9%, and the Rest of Japan, with a CAGR of 2.7%, show slower growth in the demand for food grade dipotassium phosphate. These regions are more rural and have fewer large-scale food manufacturing facilities compared to more industrialized regions like Kanto and Kyushu & Okinawa. While there is still demand for dipotassium phosphate in these areas, particularly for local food production, the overall growth rate is slower due to the more traditional nature of the food industries in these regions.

However, as awareness of functional and fortified foods increases across Japan, including in Tohoku and the Rest of Japan, the demand for additives like dipotassium phosphate is expected to grow gradually. As these regions modernize their food production and adopt new technologies, the adoption of food grade dipotassium phosphate will likely increase, though at a more moderate pace.

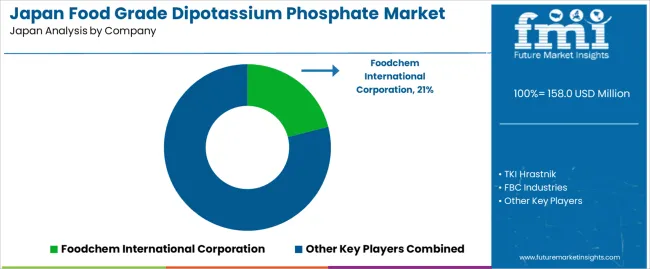

The demand for food grade dipotassium phosphate in Japan is growing, driven by its essential role as an emulsifier, stabilizer, and buffering agent in the food and beverage industry. Companies like Foodchem International Corporation (holding approximately 21% market share), TKI Hrastnik, FBC Industries, Aditya Birla Chemicals, and Haifa Chemicals Ltd. are key players in this market. Food grade dipotassium phosphate is widely used in processed foods, dairy products, beverages, and meat products to enhance texture, improve flavor stability, and act as a nutritional supplement.

Competition in this market is focused on product purity, regulatory compliance, and sustainability. Companies are working to provide high-purity dipotassium phosphate that meets Japan’s strict food safety and quality standards. Another area of competition is sustainability, with increasing demand for eco-friendly sourcing and production methods. Suppliers that offer traceable, ethically sourced ingredients are gaining a competitive advantage in Japan, where consumers are increasingly aware of the environmental impact of food products. Companies are also offering technical support and customization to meet the specific needs of food manufacturers. Marketing materials often emphasize product quality, functionality, and compliance with Japan’s food safety regulations. By aligning their offerings with the growing demand for safe, high-quality, and sustainable food ingredients, these companies aim to strengthen their position in Japan’s food grade dipotassium phosphate market.

| Items | Details |

|---|---|

| Quantitative Units | USD Million |

| Regions Covered | Japan |

| Form | Powder, Granules |

| Application | Dairy, Meat, Bakery, Confectionery, Beverages |

| Product Type | Dipotassium Phosphate Anhydrous, Dipotassium Hydrogen Phosphate Trihydrate, Dipotassium Phosphate Used in Coffee Mate, Potassium Phosphate Dibasic, Dipotassium Hydrogen Phosphate |

| End User | Individuals, Industrial, Foodservice |

| Key Companies Profiled | Foodchem International Corporation, TKI Hrastnik, FBC Industries, Aditya Birla Chemicals, Haifa Chemicals Ltd. |

| Additional Attributes | The market analysis includes dollar sales by form, product type, application, and end-user categories. It also covers regional demand trends in Japan, particularly driven by the increasing use of food-grade dipotassium phosphate in dairy, meat, and bakery products. The competitive landscape highlights key players focusing on innovations in food-grade dipotassium phosphate for different applications. Trends in the growing demand for dipotassium phosphate for emulsification and stabilization in food products are explored, along with advancements in packaging and logistics. |

The demand for food grade dipotassium phosphate in Japan is estimated to be valued at USD 158.0 million in 2025.

The market size for the food grade dipotassium phosphate in Japan is projected to reach USD 226.6 million by 2035.

The demand for food grade dipotassium phosphate in Japan is expected to grow at a 3.7% CAGR between 2025 and 2035.

The key product types in food grade dipotassium phosphate in Japan are powder and granules.

In terms of application, dairy segment is expected to command 36.2% share in the food grade dipotassium phosphate in Japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand Signal Repository Solutions Market Size and Share Forecast Outlook 2025 to 2035

Demand Side Management Market Size and Share Forecast Outlook 2025 to 2035

Demand Response Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

North America Shipping Supplies Market Trends – Innovations & Growth 2024-2034

Demand of Kozani Saffron in Greece Analysis - Size, Share & Forecast 2025 to 2035

Demand of No-acid Whey Strained Dairy Processing Concepts in European Union Size and Share Forecast Outlook 2025 to 2035

Demand for Bronte Pistachio in Italy Analysis - Size, Share & Forecast 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Japan Size and Share Forecast Outlook 2025 to 2035

Glycine Soja (Soybean) Seed Extract Market Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Yeast in Japan - Size, Share, and Forecast Outlook 2025 to 2035

Demand of Pistachio-based desserts & ingredients in France Analysis - Size, Share & Forecast 2025 to 2035

Western Europe Men’s Skincare Market Analysis – Forecast 2023-2033

Demand and Trends Analysis of Stevia in Japan Size and Share Forecast Outlook 2025 to 2035

Japan Women’s Intimate Care Market Trends – Growth & Forecast 2024-2034

Demand and Trend Analysis of Fabric Stain Remover in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand of MFGM-enriched Powders & RTDs in European Union Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA