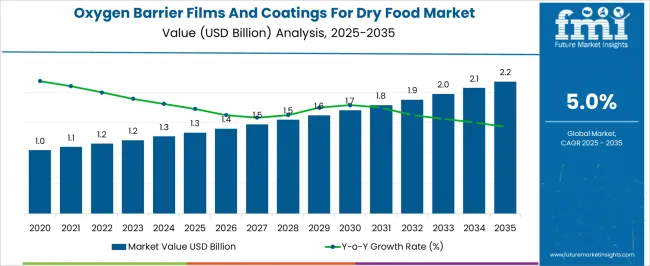

The Oxygen Barrier Films And Coatings For Dry Food Market is estimated to be valued at USD 1.3 billion in 2025 and is projected to reach USD 2.2 billion by 2035, registering a compound annual growth rate (CAGR) of 5.0% over the forecast period. The market growth indicates consistent year-over-year expansion, underpinned by rising demand for packaging that preserves freshness, prevents oxidation, and extends shelf life. Early years show moderate growth, reaching USD 1.6 billion by 2028, followed by stronger acceleration beyond 2030 as adoption broadens across dry food categories.

The YoY growth curve trends downward, suggesting the market will gradually mature, though absolute dollar expansion remains steady. Drivers include the rising consumption of packaged dry foods, regulatory pressure on packaging safety, and growing retail penetration in emerging economies. Manufacturers are focusing on advanced multilayer barrier films, bio-based coatings, and recyclable structures to meet consumer expectations and industry compliance.

| Metric | Value |

|---|---|

| Oxygen Barrier Films And Coatings For Dry Food Market Estimated Value in (2025 E) | USD 1.3 billion |

| Oxygen Barrier Films And Coatings For Dry Food Market Forecast Value in (2035 F) | USD 2.2 billion |

| Forecast CAGR (2025 to 2035) | 5.0% |

The oxygen barrier films and coatings market for dry food is undergoing rapid expansion, driven by the growing need to extend shelf life, preserve product integrity, and meet evolving packaging sustainability goals. Increased demand for lightweight, recyclable, and high-barrier materials from food processors and CPG brands has accelerated the shift toward advanced multilayer films and eco-friendly coatings.

Regulatory frameworks emphasizing reduction of food waste and plastic usage are compelling manufacturers to innovate with bio-based and solvent-free coatings. Adoption of mono-material laminates and improved oxygen transmission rates are key developments reshaping material choices across dry food categories.

Additionally, the expansion of e-commerce and long-haul logistics has elevated the importance of packaging that offers superior protection against oxidation, moisture, and mechanical damage. Looking ahead, industry players are expected to invest in circular economy-compatible films and functional coatings to meet performance, safety, and environmental benchmarks simultaneously.

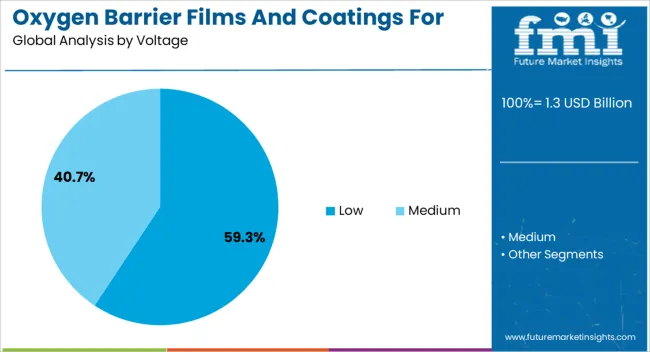

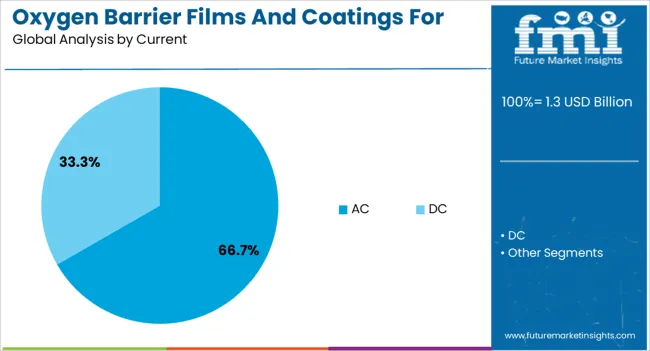

The oxygen barrier films and coatings for the dry food market are segmented by voltage, current, and geographic regions. By voltage, the oxygen barrier films and coatings for the dry food market are divided into Low and Medium. The current of oxygen barrier films and coatings for the dry food market is classified into AC and DC. Regionally, the oxygen barrier films and coatings for the dry food industry are classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Low voltage-based equipment is anticipated to account for 59.30% of the market share in 2025, positioning it as the dominant configuration within oxygen barrier film production systems. This preference is driven by the lower energy requirements and enhanced safety standards offered by low-voltage systems, which are widely used in film extrusion and coating operations.

Their compatibility with modular manufacturing lines and adaptability to varying film thicknesses and coating speeds support high-efficiency output without compromising barrier integrity. Manufacturers are increasingly standardizing on low-voltage infrastructure to align with workplace safety protocols, reduce operational costs, and improve machine uptime.

Moreover, advancements in low-voltage control systems and automated monitoring have further optimized their use in the food packaging industry, especially for dry food applications that demand consistent barrier performance and material stability.

AC current systems are projected to represent 66.70% of the total market share in 2025, emerging as the preferred electrical input mode in the oxygen barrier film and coating market. The widespread adoption of AC current is attributed to its reliability in high-output industrial machinery and lower transmission losses across production setups.

AC systems facilitate smoother integration with heating, drying, and lamination units commonly found in multilayer film manufacturing. The ability to operate heavy-duty extruders, coaters, and plasma treatment units using AC current has reinforced its relevance in barrier material production.

Additionally, AC-powered setups enable flexible voltage modulation, which is essential for precision coating applications involving oxygen-sensitive dry food categories. As the demand for food-safe, durable, and lightweight barrier films grows, AC infrastructure is expected to remain integral to production scale-up and technological upgrades.

Oxygen barrier films and coatings are advancing through improvements in design, materials, and performance for dry food applications. Demand is expanding across retail and e-commerce, supported by quality retention and compliance-driven packaging innovation.

Oxygen barrier films and coatings are increasingly applied in dry food packaging to maintain product quality, extend shelf life, and protect flavor integrity. Their ability to limit oxygen ingress prevents staleness, rancidity, and nutrient loss in products such as cereals, powdered milk, coffee, and snack foods. Packaging converters are incorporating high-barrier layers into flexible pouches, sachets, and laminated cartons to meet brand owner requirements for longer distribution cycles. The expansion of global e-commerce for packaged dry foods has reinforced demand, as products must maintain freshness during extended transit. This segment benefits from the balance of functional protection and aesthetic appeal, allowing for clear branding and product visibility without compromising barrier performance.

Manufacturers of oxygen barrier films and coatings are increasingly investing in mono-material solutions that are easier to recycle while retaining high-barrier properties. These packaging formats integrate barrier coatings or specialized layers into polyethylene or polypropylene substrates, enabling compatibility with existing recycling streams. The shift is supported by brand owner initiatives to reduce packaging complexity while preserving shelf stability for dry foods. Paper-based packaging with advanced oxygen coatings is also gaining traction in snack, confectionery, and powdered food applications. This transition reflects both regulatory and retailer preferences for recyclable options, prompting R&D into coating adhesion, printability, and long-term barrier retention under varying storage conditions.

The oxygen barrier segment is experiencing material enhancements through precision coating deposition, improved polymer blends, and integration of nanocomposite particles to boost oxygen resistance. These developments enable manufacturers to create thinner films that maintain or surpass the barrier performance of traditional multilayer structures, reducing material usage and shipping weight. Improved adhesion between layers enhances durability during production, filling, and transportation. Packaging converters are also focusing on coatings that remain effective after folding, creasing, or flexing during handling. This level of engineering is particularly valued in high-volume food production where operational efficiency, consistent sealing, and film performance are critical to meeting commercial requirements.

Oxygen barrier films and coatings are gaining a stronger foothold in e-commerce packaging for dry foods, where extended delivery times and varied environmental conditions increase the need for protective solutions. The rise in direct-to-consumer snack and pantry item subscriptions has expanded opportunities for high-barrier flexible pouches and mailer-ready cartons. Packaging with integrated oxygen barriers helps brands maintain customer satisfaction by ensuring freshness upon arrival. These formats also enable lightweight, space-efficient packing, lowering logistics costs. Growth is further driven by the ability to combine oxygen protection with tamper-evident designs, resealable closures, and high-quality graphics, creating functional yet marketable packaging solutions suited for online retail channels.

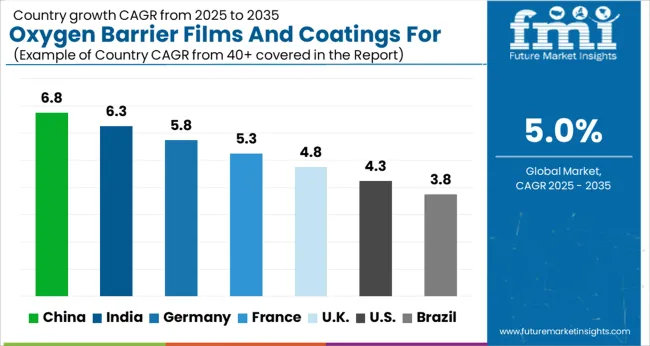

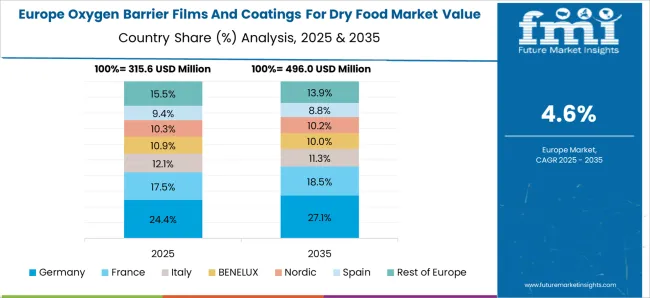

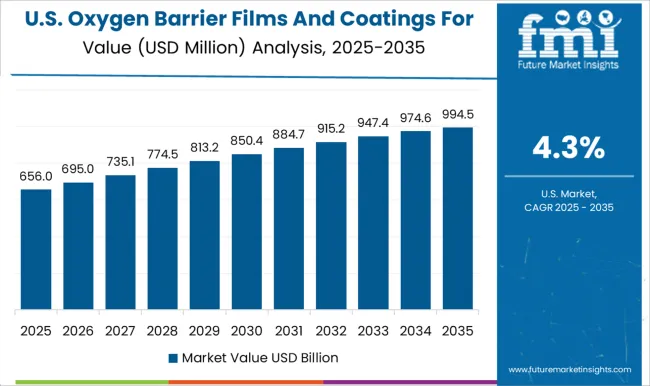

The oxygen barrier films and coatings for dry food market is projected to grow globally at a CAGR of 5.0% from 2025 to 2035, supported by rising packaged food consumption, longer distribution cycles, and brand-owner preference for shelf-life extension. China leads with a CAGR of 6.8%, driven by its expansive food processing industry, growing e-commerce grocery sales, and adoption of high-barrier flexible packaging. India follows at 6.3%, benefiting from rapid packaged snack growth, improved cold-chain distribution for dry foods, and increased investment in mono-material barrier solutions. France grows at 5.3%, fueled by bakery, confectionery, and premium dry food packaging demand. The United Kingdom stands at 4.8%, focusing on brand differentiation and compliance with stringent food contact material standards, while the United States posts 4.3%, reflecting stable demand in mature markets driven by e-commerce distribution and private-label expansion. The analysis identifies these regions as strategic benchmarks for capacity planning, technology deployment, and regional distribution optimization to strengthen competitiveness in the evolving global packaged dry food sector.

China is projected to post a CAGR of 6.8% for 2025–2035, up from an estimated 5.9% during 2020–2024, well above the global average of 5.0%. This improvement is attributed to strong expansion in the country’s packaged dry food industry, rapid growth of e-commerce grocery platforms, and increasing adoption of high-barrier flexible films for extended shelf life. Large-scale investment in advanced coating lines and multilayer film extrusion has improved domestic capacity while reducing dependency on imports. Demand is further supported by bakery, snack, and dehydrated food categories targeting both domestic and export markets. The integration of recyclable mono-material barrier solutions is also driving adoption in compliance-focused supply chains.

India is expected to achieve a CAGR of 6.3% for 2025–2035, rising from about 5.4% in 2020–2024, outperforming the global rate of 5.0%. The uptick comes from accelerated consumption of packaged snacks, cereals, and powdered foods, alongside retail and e-commerce expansion into rural markets. Barrier coatings in mono-material pouches have gained traction due to brand-owner preference for recyclable options. Growing investment in domestic film converting and coating facilities has enhanced supply reliability, reducing costs for local food processors. Strategic collaborations between packaging producers and dry food brands are enabling customized barrier solutions for specific shelf-life requirements, further reinforcing market growth.

France is set to record a CAGR of 5.3% for 2025–2035, an increase from approximately 4.6% between 2020–2024, maintaining steady momentum within the European market. This growth is linked to the rising demand for premium dry food packaging in bakery, confectionery, and specialty grocery categories. French converters are adopting high-clarity oxygen barrier films that preserve product visibility while protecting freshness. Regulatory emphasis on food contact safety and recyclability is accelerating investment in solvent-free coating technologies. Partnerships between film manufacturers and high-end food brands are shaping differentiated packaging formats that combine strong shelf appeal with extended protection.

The UK is forecasted to post a CAGR of 4.8% for 2025–2035, up from around 4.0% during 2020–2024, closely tracking the global average of 5.0%. The rise reflects greater penetration of oxygen barrier films and coatings in both branded and private-label dry food packaging. Growth has been aided by improvements in high-barrier mono-material films compatible with existing recycling streams. Supply chain resilience has improved post-pandemic, enabling faster delivery to retailers and e-commerce distribution hubs. The adoption of resealable and portion-control packaging formats for cereals, snacks, and dehydrated meals is also enhancing consumer convenience while maintaining freshness.

The USA is projected to record a CAGR of 4.3% for 2025–2035, up from roughly 3.7% during 2020–2024, marking steady progress in a mature market. Incremental growth comes from e-commerce grocery sales, private-label expansion, and targeted upgrades to high-barrier packaging for cereals, coffee, and snack categories. Food manufacturers are seeking coating solutions that maintain barrier performance under varied storage and transport conditions. Investments in domestic coating plants and multilayer film capacity have improved lead times and product consistency. Market competitiveness is further strengthened by collaborations between converters and food brands on recyclable barrier formats that balance performance with regulatory compliance.

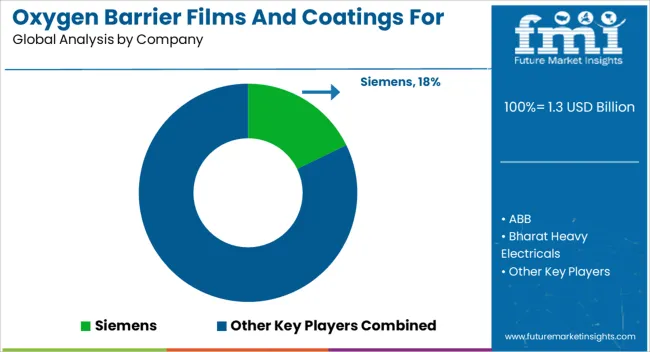

The oxygen barrier films and coatings for dry food market features a combination of global packaging leaders and specialized electrical and industrial solution providers transitioning capabilities into high-performance food packaging applications, including Siemens, ABB, Bharat Heavy Electricals, CG Power and Industrial Solutions, CHINT Group, Eaton, Fuji Electric, General Electric, HD Hyundai Electric, Hitachi, Hyosung Heavy Industries, Lucy Group, Mitsubishi Electric, Ormazabal, Schneider Electric, Skema, and Toshiba. These companies compete on the basis of barrier material technology integration, manufacturing scalability, and compliance with global food safety standards. Siemens and ABB are recognized for leveraging process automation and precision coating systems to improve film uniformity and oxygen resistance. Bharat Heavy Electricals and CG Power and Industrial Solutions utilize their engineering expertise to design large-scale production infrastructure for coating and lamination lines.

CHINT Group and Eaton focus on modular machinery solutions for flexible packaging converters, enabling faster production changeovers. Fuji Electric and General Electric provide advanced control systems for temperature and humidity management in coating processes, ensuring barrier integrity. HD Hyundai Electric, Hitachi, and Hyosung Heavy Industries support industrial-scale energy and power requirements for continuous high-speed manufacturing. Lucy Group and Mitsubishi Electric offer integrated automation platforms for film extrusion and coating applications. Ormazabal, Schneider Electric, Skema, and Toshiba emphasize energy-efficient machinery, quality monitoring, and predictive maintenance systems to enhance operational reliability. The competitive environment is defined by continuous R&D in coating application methods, development of recyclable mono-material barrier structures, and adoption of digital monitoring for real-time quality assurance. Strategic objectives include expanding regional production footprints, integrating energy-efficient manufacturing technologies, and forming partnerships with food brands to deliver high-performance, regulation-compliant oxygen barrier solutions.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.3 Billion |

| Voltage | Low and Medium |

| Current | AC and DC |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Siemens, ABB, Bharat Heavy Electricals, CG Power and Industrial Solutions, CHINT Group, Eaton, Fuji Electric, General Electric, HD Hyundai Electric, Hitachi, Hyosung Heavy Industries, Lucy Group, Mitsubishi Electric, Ormazabal, Schneider Electric, Skema, and Toshiba |

| Additional Attributes | Dollar sales, share, regional demand growth, competitive landscape, end-use application trends, pricing and margin analysis, raw material cost outlook, regulatory compliance impact, technology adoption rates, capacity expansions, distribution channel performance. |

The global oxygen barrier films and coatings for dry food market is estimated to be valued at USD 1.3 billion in 2025.

The market size for the oxygen barrier films and coatings for dry food market is projected to reach USD 2.2 billion by 2035.

The oxygen barrier films and coatings for dry food market is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types in oxygen barrier films and coatings for dry food market are low and medium.

In terms of current, ac segment to command 66.7% share in the oxygen barrier films and coatings for dry food market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Oxygen-free Copper Market Size and Share Forecast Outlook 2025 to 2035

Oxygen Scavenger Masterbatch Market Size and Share Forecast Outlook 2025 to 2035

Oxygen Indicator Labels Market Size and Share Forecast Outlook 2025 to 2035

Oxygen Conservation Devices Market Analysis – Size, Share & Forecast 2025 to 2035

Market Leaders & Share in Oxygen Indicator Labels Manufacturing

Oxygen Therapy Equipment Market Insights – Trends & Forecast 2024 to 2034

Oxygen Delivery Units Market

Oxygen Scavenger Market

Oxygen Market

Oxygen Barrier Films Market

Trace Oxygen Analyzer Market Analysis - Size, Share & Forecast 2025-2035

Nasal Oxygen Cannula Market

Muscle Oxygen Monitors Market Size and Share Forecast Outlook 2025 to 2035

Active Oxygens Market Analysis by Product Type, Application and Region: Forecast for 2025 to 2035

Global Portable Oxygen Concentrator Market Analysis – Size, Share & Forecast 2024-2034

Aircraft Oxygen System Market

High-Flow Oxygen Therapy Devices Market Analysis – Size, Share & Growth 2025–2035

Dissolved Oxygen Meters and Controllers Market Size and Share Forecast Outlook 2025 to 2035

Hyperbaric Oxygen Therapy Devices Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Industrial Oxygen Market Report - Growth, Demand & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA