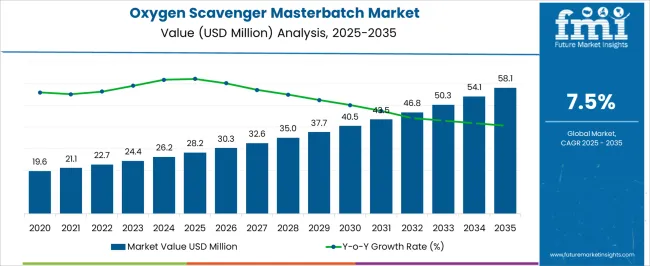

The oxygen scavenger masterbatch market is expected to grow steadily, moving from USD 28.2 billion in 2025 to nearly USD 58.1 billion by 2040, recording a compound annual growth rate (CAGR) of 7.4%. In the first phase from 2025 to 2030, the market expands from USD 28.2 billion to USD 28.2 billion, supported by rising demand in food and beverage packaging where oxygen-sensitive products require extended shelf life. Pharmaceutical packaging also contributes significantly as companies adopt oxygen barrier solutions to preserve drug stability and potency. From 2031 to 2035, the market increases from USD 30.3 billion to USD 43.5 billion, driven by growing adoption of active packaging, consumer preference for longer-lasting packaged food, and compliance with international safety standards that promote reduced food waste. By 2040, the oxygen scavenger masterbatch market achieves USD 58.1 billion, with expansion strongly influenced by advancements in high-performance barrier films, greater penetration in emerging economies, and the move towards recyclable and eco-friendly packaging formats. Integration of oxygen scavenging additives into PET bottles, flexible pouches, and multilayer containers enhances demand from beverage, dairy, and ready-to-eat meal categories. The need to maintain freshness, flavor, and nutritional value across global supply chains ensures that oxygen scavenger masterbatches become a critical enabler of packaging innovation and efficiency across industries.

| Metric | Value |

|---|---|

| Oxygen Scavenger Masterbatch Market Estimated Value in (2025 E) | USD 28.2 million |

| Oxygen Scavenger Masterbatch Market Forecast Value in (2035 F) | USD 58.1 million |

| Forecast CAGR (2025 to 2035) | 7.5% |

The Oxygen Scavenger Masterbatch market is gaining strong momentum as industries seek effective solutions to control oxidative degradation in packaged products. This shift is primarily driven by the growing need to enhance product shelf life, preserve nutritional value, and prevent microbial growth, especially in food, pharmaceutical, and nutraceutical packaging applications. Oxygen scavenger masterbatches are increasingly being adopted as a cost-effective alternative to traditional barrier films, providing greater flexibility in processing and integration with existing polymer systems.

Technological advancements in polymer chemistry and nanocomposite formulation have enhanced the reactivity and efficacy of scavenging agents, making them more effective across varying environmental conditions. Furthermore, rising regulatory scrutiny around food preservation and the phasing out of certain chemical preservatives are encouraging manufacturers to adopt embedded oxygen control mechanisms.

Market dynamics are also influenced by the rapid expansion of e-commerce-driven food and medicine delivery services, necessitating advanced packaging stability The market is poised for continued growth as manufacturers align with global sustainability goals and prioritize waste reduction through innovative active packaging solutions.

The oxygen scavenger masterbatch market is segmented by type, material used, application area, distribution channel, security rating, and geographic regions. By type, the oxygen scavenger masterbatch market is divided into Polymer-based scavengers, Iron/metal-catalyzed scavengers, Enzyme/ascorbate-based, and Others. In terms of material used, oxygen scavenger masterbatch market is classified into Steel Padlocks, Brass Padlocks, Aluminum Padlocks, and Plastic Padlocks. Based on application In terms of carrier polymer/material compatibility, the market is classified into PET, PE, PP, PA (nylon), and Others (e.g., EVOH multilayer, PLA). By distribution channel, oxygen scavenger masterbatch market is segmented into Brick-and-Mortar Stores, Online Retailers, Wholesale Distributors, and Direct Sales. By security rating, oxygen scavenger masterbatch market is segmented into Medium Security (Moderate Risks), Low Security (General Use), High Security (High Risks), and Superior Security (Specialized Applications). Regionally, the oxygen scavenger masterbatch industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

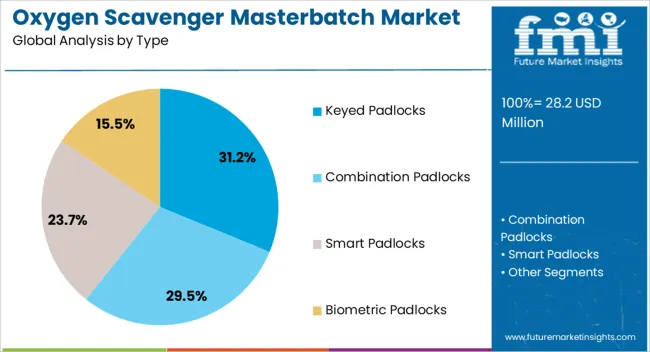

The keyed padlocks segment is expected to contribute 31.2% of the total revenue share in the Oxygen Scavenger Masterbatch market in 2025. This segment's notable share is being driven by its widespread use in controlled access packaging formats where tamper resistance and structural integrity are prioritized. The preference for keyed locking mechanisms in transport and storage packaging, particularly in pharmaceutical and specialty chemical applications, has supported consistent demand.

Integration of oxygen scavenger masterbatches within packaging structures requiring added mechanical security has enabled product freshness without compromising package strength. The segment has also gained traction due to its adaptability in multilayer film formats and compatibility with polyolefin-based materials.

Ongoing innovations in masterbatch formulations have enabled enhanced scavenging kinetics tailored for applications requiring long-term shelf stability, making the keyed format more relevant for high-value packaging systems Increased use of secured packaging in regulated supply chains and clinical trial material storage continues to support the steady dominance of this segment.

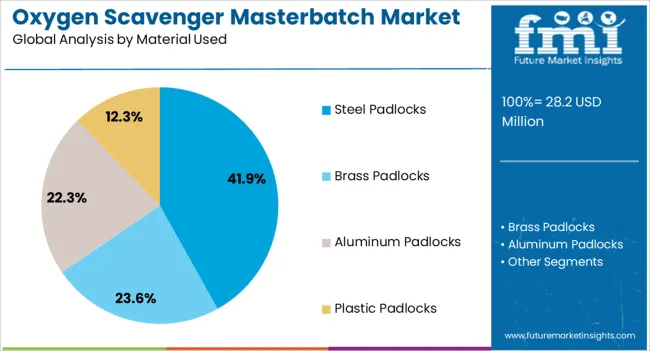

Steel padlocks are projected to account for 41.9% of the Oxygen Scavenger Masterbatch market revenue share in 2025. The segment’s leadership is attributed to the high structural durability and thermal compatibility of steel-based packaging components integrated with oxygen scavenging capabilities. Steel padlocks are frequently utilized in industrial packaging systems where high-pressure sealing and environmental resistance are essential, including bulk pharmaceuticals and agrochemical storage.

The compatibility of steel materials with high-performance scavenger masterbatches has enabled stable oxygen absorption under diverse transit and climatic conditions. Market adoption has also been influenced by innovations in reactive oxygen barrier coatings and scavenger-layered laminates suited for steel-based closures.

As industrial and institutional buyers prioritize long-lasting protective packaging for oxygen-sensitive products, the demand for masterbatch-compatible steel locking mechanisms has grown steadily Enhanced recyclability and reusability of steel structures, in conjunction with embedded scavenging technology, continue to reinforce this segment’s attractiveness in high-value protective packaging applications.

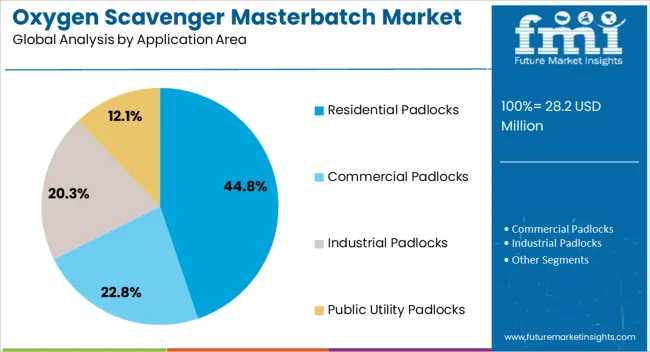

The residential padlocks segment is expected to capture 44.8% of the Oxygen Scavenger Masterbatch market revenue share in 2025, making it the leading application area. This dominance is supported by the extensive use of oxygen scavenger masterbatches in everyday packaging solutions for household consumables, such as packaged foods, supplements, and personal care products. Growing awareness of food quality preservation and the shift toward clean-label packaging solutions have reinforced the use of active packaging materials in residential consumer goods.

The demand for convenient, lightweight, and resealable packaging formats has aligned well with the functional properties of scavenger masterbatches, offering freshness protection without the need for synthetic preservatives. As urban households increasingly favor ready-to-eat and minimally processed foods, the role of oxygen control in home-use packaging has become critical.

The segment has further benefited from the incorporation of intelligent packaging indicators and QR code-enabled traceability features, driving interest among quality-conscious consumers Overall, residential usage remains a high-priority focus for packaging manufacturers leveraging oxygen scavenger technologies.

Oxygen scavenger masterbatch demand is advancing through food, beverage, and pharmaceutical sectors. Growth is underpinned by packaging innovations and wider adoption across emerging markets where shelf-life stability remains a critical priority.

Oxygen scavenger masterbatch has gained a strong foothold in food packaging applications as manufacturers aim to extend shelf life, reduce spoilage, and protect flavor integrity. Adoption is most prominent in bakery, dairy, meat, and beverage packaging where oxygen exposure accelerates degradation. The material is integrated into films, trays, and bottles, allowing packaging to actively control internal oxygen levels. Unlike passive barriers, these solutions provide dynamic protection over time, ensuring product freshness in varying storage conditions. Rising demand for packaged ready-to-eat meals and premium beverages has created strong pull factors. With retailers placing pressure on producers to minimize waste and ensure consistent quality, oxygen scavenger masterbatch is becoming a strategic material choice.

The pharmaceutical sector is adopting oxygen scavenger masterbatch to improve protection of sensitive drugs, vitamins, and diagnostic kits. Oxidation impacts product stability, reducing efficacy and shortening usable lifespan. By embedding scavenger properties within blister films, syringes, and container systems, producers ensure that drugs remain safe for longer distribution cycles. Healthcare packaging also benefits, as medical devices and biologics require oxygen control during global shipments. Regulatory compliance is pushing drug manufacturers to seek packaging that reduces risks while ensuring traceability. This demand is especially pronounced in generics and biologics, where brand reputation is tied to patient safety. Oxygen scavenger masterbatch is becoming integral to the pharma supply chain, where reliability and consistency are non-negotiable.

The beverage industry has emerged as a key driver of oxygen scavenger masterbatch demand, particularly in carbonated drinks, juices, and alcoholic beverages. PET bottles incorporating oxygen scavengers improve carbonation retention, flavor stability, and appearance over extended shelf life. Brewers and winemakers are leveraging these solutions to protect aroma and prevent oxidation-related off-flavors. Global consumption of bottled drinks has surged, and competition among brands has intensified the need for packaging that differentiates through quality preservation. Lightweight PET bottles with integrated scavenger properties are increasingly replacing traditional glass due to lower logistics costs and durability. This shift demonstrates how oxygen scavenger masterbatch adds commercial value by protecting taste profiles and reducing product recalls.

Emerging markets are showing rising investment in oxygen scavenger masterbatch, driven by food exports, domestic consumption growth, and healthcare expansion. Asia-Pacific leads with strong packaging production in China and India, where cost-effective adoption supports manufacturers competing globally. Latin America and the Middle East are also increasing uptake as packaged foods and beverages gain wider distribution. Local converters are working closely with additive producers to optimize formulations that meet regional packaging standards. The availability of affordable PET and polyethylene substrates is fueling demand for scavenger-based barrier solutions. As global supply chains expand, emerging hubs are positioning themselves as key demand centers where oxygen scavenger masterbatch adoption is accelerating rapidly.

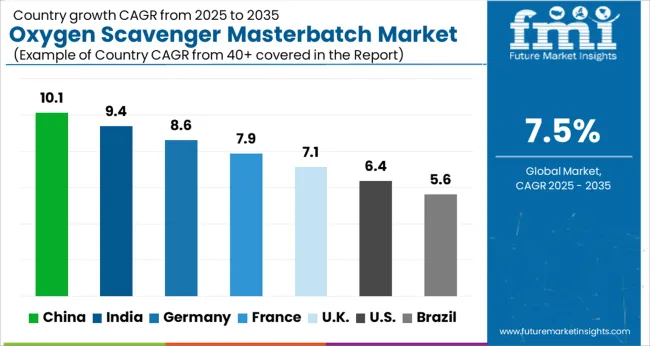

| Country | CAGR |

|---|---|

| China | 10.1% |

| India | 9.4% |

| Germany | 8.6% |

| France | 7.9% |

| UK | 7.1% |

| USA | 6.4% |

| Brazil | 5.6% |

The oxygen scavenger masterbatch market is projected to expand globally at a CAGR of 7.5% from 2025 to 2035, supported by demand for extended shelf-life packaging, rising use in pharmaceuticals, and greater adoption in beverage bottles. China leads with a CAGR of 10.1%, driven by strong food exports, rapid packaged goods growth, and high PET bottle production. India follows at 9.4%, supported by rising FMCG manufacturing, wider use of PET in bottled water and dairy packaging, and government-backed food safety initiatives. France grows at 7.9%, aided by adoption in wine, dairy, and specialty food packaging. The United Kingdom posts 7.1%, reflecting expanding use in healthcare and ready-to-eat meal packaging, while the United States stands at 6.4%, influenced by steady adoption across beverage and pharmaceutical applications in a mature market. These nations represent key growth benchmarks, enabling suppliers to tailor product development, strengthen regional partnerships, and expand distribution strategies to capture long-term demand in the active packaging additives sector.

China is projected to record a CAGR of 10.1% for 2025–2035, which is above the global average of 7.5%. During 2020–2024, the market grew at nearly 8.9%, supported by rapid demand for packaged foods, beverages, and pharmaceuticals where oxygen protection is critical. The acceleration reflects the growth of export-driven food packaging, premium beverage bottling, and strong PET usage in carbonated drinks. Investments in advanced masterbatch formulations and localized compounding plants are also expanding supply. Rising health-conscious consumer behavior, combined with expansion of e-commerce food delivery, is shaping the demand outlook. As China continues to dominate packaging exports, oxygen scavenger solutions are being embedded across multiple formats.

India is estimated to post a CAGR of 9.4% during 2025–2035, compared to nearly 8.2% between 2020–2024. Early growth was supported by rising adoption in packaged dairy, bottled water, and flexible packaging for FMCG products. The shift to higher CAGR is tied to consumer preference for longer shelf-life goods, government food safety standards, and rising PET bottle penetration. Local converters are collaborating with additive suppliers to deliver cost-effective solutions, expanding accessibility to SMEs in packaging. Increasing processed food consumption in Tier-2 and Tier-3 cities is also fueling growth. As India emerges as a food export hub, oxygen scavenger masterbatch adoption will expand across film, tray, and bottle formats.

France is expected to register a CAGR of 7.9% during 2025–2035, higher than the 6.7% growth recorded during 2020–2024. Early adoption was seen in premium wine, dairy, and specialty food packaging where oxygen sensitivity was high. The rise to a stronger CAGR is linked to increasing use in pharmaceuticals, especially blister packs and diagnostic kits, alongside expansion in the packaged gourmet food sector. France’s strict food safety and pharma regulations are pushing wider use of oxygen scavenger formulations. Growing demand for lightweight PET bottles in beverages, particularly wines and juices, has also contributed to accelerated uptake. The premiumization of French exports continues to strengthen this outlook.

The United Kingdom is projected to post a CAGR of 7.1% for 2025–2035, compared to an estimated 5.8% during 2020–2024. The earlier slower rate reflected cautious capital spending and limited deployment beyond core beverage applications. The shift to higher CAGR is driven by increasing demand for ready-to-eat meals, growing healthcare packaging requirements, and rapid adoption of convenience-focused food packaging. SMEs are investing in modified atmosphere packaging integrated with scavenger systems to maintain freshness. The healthcare sector is emphasizing drug and diagnostic safety, creating wider uptake of scavenger-based barrier films. These shifts highlight the UK’s progression from a niche market toward broader packaging integration.

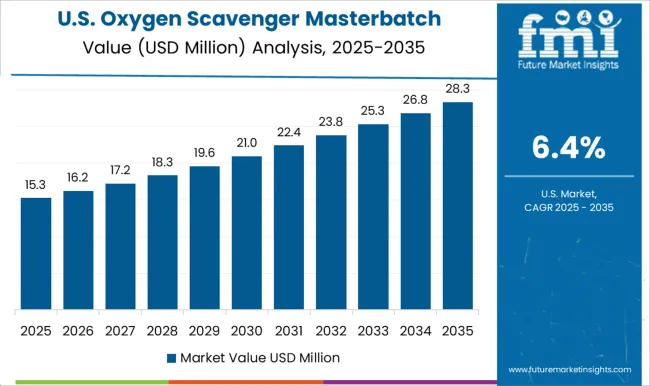

The United States is projected to grow at a CAGR of 6.4% for 2025–2035, slightly above the 5.5% recorded in 2020–2024. The earlier phase was marked by gradual penetration into beverage bottles and selective food packaging applications. The higher CAGR now reflects broader adoption in pharmaceuticals, nutraceuticals, and packaged meat where oxidation risks are significant. Strong brand competition in beverages is driving investment in shelf-life extending technologies. Medical device and drug packaging safety is another catalyst, especially as regulatory agencies emphasize integrity of packaging. Retail shifts toward pre-packed convenience products and e-commerce distribution are creating additional opportunities for oxygen scavenger masterbatch.

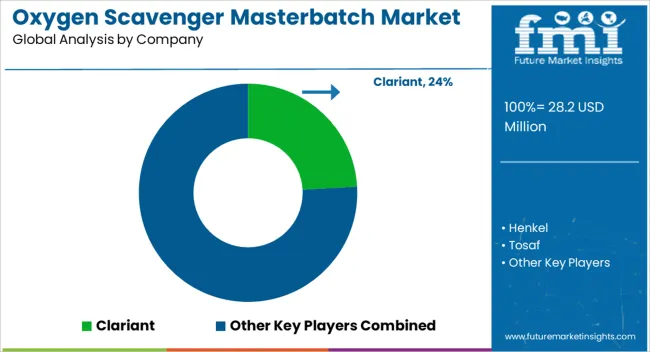

The oxygen scavenger masterbatch market features a mix of global chemical leaders and specialized additive producers delivering solutions that extend product shelf life, improve packaging performance, and ensure product safety. Clariant holds a strong position with its advanced additive formulations, focusing on packaging solutions for food, beverages, and pharmaceuticals. Its strategy emphasizes high-performance barrier masterbatches integrated with sustainability-focused materials. Henkel leverages its expertise in adhesives and functional coatings to provide packaging solutions where oxygen control is vital, particularly in healthcare and food applications.

Tosaf is recognized for its extensive masterbatch portfolio, offering customized oxygen scavenger solutions that cater to packaging converters worldwide. GabrielChemie has built a strong reputation in specialty color and additive masterbatches, with oxygen scavenger offerings tailored for PET and polyethylene applications in beverages and dairy packaging. Nano Bio Matters specializes in nanotechnology-driven additives, providing enhanced barrier properties for advanced packaging needs, particularly in active food packaging applications.

Competitive strategies in this sector focus on R&D investments to improve oxygen absorption efficiency, integration with lightweight polymers, and customized formulations that meet regional regulatory requirements. Companies are also prioritizing partnerships with packaging converters and food producers to expand adoption.

| Item | Value |

|---|---|

| Quantitative Units | USD Million |

| Type | Keyed Padlocks, Combination Padlocks, Smart Padlocks, and Biometric Padlocks |

| Material Used | Steel Padlocks, Brass Padlocks, Aluminum Padlocks, and Plastic Padlocks |

| Application Area | Residential Padlocks, Commercial Padlocks, Industrial Padlocks, and Public Utility Padlocks |

| Distribution Channel | Brick-and-Mortar Stores, Online Retailers, Wholesale Distributors, and Direct Sales |

| Security Rating | Medium Security (Moderate Risks), Low Security (General Use), High Security (High Risks), and Superior Security (Specialized Applications) |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Clariant, Henkel, Tosaf, GabrielChemie, AlbisPlastic, and NanoBioMatters |

| Additional Attributes | Dollar sales, share, regional demand hotspots, competitor strategies, adoption trends in food, beverage, and pharma packaging, regulatory impact, technology integration, and growth opportunities. |

The global oxygen scavenger masterbatch market is estimated to be valued at USD 28.2 million in 2025.

The market size for the oxygen scavenger masterbatch market is projected to reach USD 58.1 million by 2035.

The oxygen scavenger masterbatch market is expected to grow at a 7.5% CAGR between 2025 and 2035.

The key product types in oxygen scavenger masterbatch market are keyed padlocks, combination padlocks, smart padlocks and biometric padlocks.

In terms of material used, steel padlocks segment to command 41.9% share in the oxygen scavenger masterbatch market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Oxygen-free Copper Market Size and Share Forecast Outlook 2025 to 2035

Oxygen Barrier Films And Coatings For Dry Food Market Size and Share Forecast Outlook 2025 to 2035

Oxygen Indicator Labels Market Size and Share Forecast Outlook 2025 to 2035

Oxygen Conservation Devices Market Analysis – Size, Share & Forecast 2025 to 2035

Market Leaders & Share in Oxygen Indicator Labels Manufacturing

Oxygen Therapy Equipment Market Insights – Trends & Forecast 2024 to 2034

Oxygen Barrier Films Market

Oxygen Delivery Units Market

Oxygen Market

Oxygen Scavenger Market

Trace Oxygen Analyzer Market Analysis - Size, Share & Forecast 2025-2035

Nasal Oxygen Cannula Market

Muscle Oxygen Monitors Market Size and Share Forecast Outlook 2025 to 2035

Active Oxygens Market Analysis by Product Type, Application and Region: Forecast for 2025 to 2035

Global Portable Oxygen Concentrator Market Analysis – Size, Share & Forecast 2024-2034

Aircraft Oxygen System Market

Dissolved Oxygen Meters and Controllers Market Size and Share Forecast Outlook 2025 to 2035

High-Flow Oxygen Therapy Devices Market Analysis – Size, Share & Growth 2025–2035

Hyperbaric Oxygen Therapy Devices Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Industrial Oxygen Market Report - Growth, Demand & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA