The industrial oxygen market is expected to undergo considerable growth, with the estimated size for the industry in 2025 at USD 82.9 billion projected to be USD 177.3 billion in 2035, at a CAGR of around 7.9%. The multitasking application of industrial oxygen for use in medical, chemicals, metal, and energy industries is fueling this huge growth.

A key industry driver is its pivotal function in the metal fabrication and steelmaking sectors, where oxygen is utilized in blast furnaces to enhance combustion temperatures and boost energy efficiency. The revival of automotive and construction industries worldwide is sustaining increased steel demand, thereby driving oxygen consumption.

A further major segment is healthcare. The COVID-19 pandemic highlighted oxygen as a key medical gas necessary for healthcare systems. Hospitals, home healthcare infrastructures, and emergency medical services now have enhanced oxygen supply capabilities as part of standard equipment, raising baseline demand permanently.

Industrial oxygen plays a crucial role in energy in waste-to-energy applications, gasification, and hydrogen production. As the world shifts to green hydrogen, oxygen generated as a by-product in the course of electrolysis presents new streams of revenue, enhancing the economics of renewable energy systems.

Innovation is overcoming such challenges. Pressure swing adsorption (PSA) and cryogenic distillation-based on-site generation systems are becoming increasingly popular in industries that require constant oxygen supply. Such systems reduce the cost of transportation and provide constant supply, particularly in isolated or high-altitude areas.

Advanced monitoring equipment and computerized control systems are enhancing oxygen plant efficiency and safety. Firms are also investigating integrating carbon capture with oxygen combustion uses to minimize heavy industry emissions-seizing gas industry and clean energy synergies.

| Market Metrics | Value |

|---|---|

| Industry Size (2025E) | USD 82.9 billion |

| Industry Value (2035F) | USD 177.3 billion |

| CAGR (2025 to 2035) | 7.9% |

The industry is shaped by evolving needs of diversified stakeholder groups, each having their own agenda that influences the supply chain and technology adoption. Manufacturers like high purity levels and regulatory compliance, as oxygen purity cannot be traded off in medical uses and high-precision industrial uses.

Industrial customers, such as metallurgy, manufacturing, and petrochemicals, prioritize cost-efficiency and the reliability of the supply to meet uninterrupted running needs. Increasingly, they search for on-site generation systems so as to ensure less downtime and take responsibility for supply. Ensuring simplicity with existing production assets is also a factor that goes into decision-making.

Regulatory agencies are concerned with environmental compliance, safety standards, and quality control procedures. Their impact inspires technological improvements and cleaner production processes. They also impose measures to ensure supply systems are resilient during times of crisis.

The industry between 2020 and 2024 witnessed steady growth as demands multiplied in healthcare, manufacturing, and construction industries. The COVID-19 pandemic served to further augment the requirement for medical-grade oxygen, which led to heavy investments in production and distributive facilities.

Steel manufacturing and chemical processing also drove demand - oxygen is used in oxidation reactions and burning. Specially, development of air separation technologies enhanced oxygen generation's efficiency and scalability to fulfil the diversified demands of the end-users.

During the years 2025 to 2035, the industry is expected to evolve as more energy-efficient and sustainable oxygen manufacturing processes are introduced. In utilization of renewable sources of energy in manufacturing processes and on-site generation systems, the carbon footprint of oxygen production is expected to decline.

Emerging economies of the Asia-Pacific region are expected to drive growth in the industry due to industrialization and infrastructure development. Apart from this, increasing focus on environmental legislation and demands for cleaner production methods will more likely fuel innovation and adoption of next-generation oxygen technologies.

Comparative Market Shift Analysis

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Healthcare, steel production, chemical processing | Increased applications in renewable energy, wastewater treatment, and electronics |

| Next-generation air separation technologies, improved distribution networks | Renewable energy integration in manufacturing, on-site generation systems |

| Pandemic-driven healthcare demand, industrial expansion | Sustainability, regulatory, and expansion in emerging industries |

| Leadership in North America and Europe | Huge growth in the Asia-Pacific and emerging industries |

| Severe centralization of big factory sites | Transitioning towards decentralized and modular manufacturing plants |

| First few steps towards carbon emission reduction | Acute focus on green manufacturing and circular economy concepts |

Risk assessment

The energy price fluctuations, especially electricity and natural gas on which oxygen production methods such as cryogenic air separation largely depend, make the industry price-sensitive. An increase in energy prices may raise production costs, tightening margins and possibly resulting in increased prices for end-users in different sectors.

Supply chain disruptions are particularly problematic. Specialized equipment and trained staff are needed to transport liquid oxygen. Any problems in the logistics, including driver shortages or bottlenecks in infrastructure, will cause delays in deliveries, affecting industries that depend on a continuous supply of oxygen such as healthcare, steel production, and chemical processing.

Technological innovations and advancements are essential in the industrial oxygen industry. Firms that do not invest in new production and distribution technologies risk becoming obsolete. The need for staying ahead is to continually research further efficiencies, minimize the environmental footprint, and address special requirements of various applications.

Overall, the industrial oxygen industry faces supply chain disruption, volatility of energy prices, regulatory issues, technological change, and intense competition. Successful strategies against these drivers are critical in ensuring long-term growth and competitiveness in this dynamic business.

The industry is predicted to be dominated by liquefied oxygen, with an industry share of 57%, while the rest will comprise compressed oxygen gas with 43%. Compressed gases hold a more prosaic advantage in transport; hence, liquefied gases rule in storage and the realm of large-scale applications such as industrial and medical fields, where high-volume delivery of oxygen is vital.

Owing to its cryogenic storage, liquefied oxygen is good for bulk transport, making it the preferred option for industries like steelmaking, petrochemicals, energy production, and large hospital networks. Companies such as Linde plc and Air Liquide have liquefaction plants operational at an industrial scale.

They are investing heavily in cryogenic tankers and the equivalent pipeline infrastructure to achieve an efficient supply to industrial zones and medical institutions. For example, liquefied oxygen is supplied for Refineries and Clean Energy Projects by Air Products and Chemicals, Inc., i.e., Hydrogen Production Units and Waste-to-Energy Plants, where oxygen is a key reactant in the gasification process.

In contrast, compressed oxygen gas assumes an equally important role in applications where portability and associated rapid deployment are very necessary, especially with regard to metal fabrications, automotive workshops, aerospace manufacturing, and field medical services.

Compressed gas is stored in high-pressure cylinders and is intended to be used in applications like oxy-fuel welding and cutting, with shipbuilding and maintenance enterprises being some major considerations. In the healthcare sector, compressed oxygen cylinders remain an indispensable entity in ambulances, remote clinics, and home care settings where centralized oxygen systems can't operate. NexAir, Messer Group, and GCE Healthcare are companies that specialize in providing solutions with regard to gas cylinders for localized and mobile applications.

Meanwhile, aquaculture, wastewater treatment, and the manufacture of glass applications depend on both liquor and gas, depending on operational scale and method of delivery. The arrangement of bulk efficiency, in contrast with deployment flexibility, ensures that both liquefied and gaseous oxygen will be in demand to satisfy the global need for various industrial and medical applications.

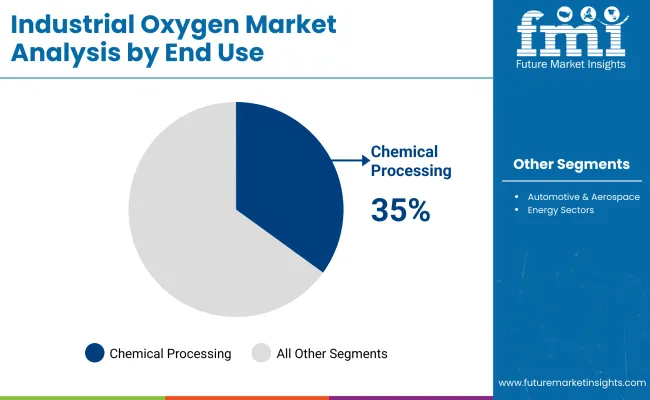

The industry is expected to garner major revenues from chemical processing and medical & healthcare end-use applications by 2025, with a share of 35% and 28%, respectively.

By the end of 2025, the industry will be predominantly accounted for by the chemical processing sector. Through this use, it is projected that the chemical processing industries, being an important reactant used to carry out numerous chemical processes, including oxidation, ethylene oxide manufacture, and synthesis of certain vital substances, will compound the use of oxygen to the amount of 35% of the total amount consumed in 2025.

High-purity oxygen is important for all chemical manufacturers, such as BASF, Dow Inc., and SABIC, for efficient and scalable operations. Oxygen is also vital for improving reaction rates and yields, as well as energy efficiency in large-scale chemical plants intended for fertilizers, plastics, and industrial solvents.

Medical and healthcare have a 28% industry share by 2025 because it is mostly implicated in clinical contexts. Oxygen is essential as a medical gas for respiratory aid in surgeries, emergencies, and intensive care units, as well as patients suffering from chronic respiratory conditions such as those with complications of COPD and COVID-19.

Demand for medical oxygen skyrocketed during the pandemic and is still rising with increased investments in healthcare infrastructure and public awareness in developing economies. Linde Healthcare, Air Liquide Healthcare, and Praxair generate liquid and compressed medical oxygen for hospitals, clinics, and home care settings. Additionally, home-based portable oxygen concentrators and oxygen cylinders are becoming popular in elderly respiratory assistance, propelling growth for the segment.

There are other demands, such as metallurgy, pulp & paper, water treatment, food processing, etc., but the industry share is not that big compared to others. Industrial oxygen is so versatile. It can be tailored by suppliers to form, purity, and deliver either in bulk liquid or compressed gas, thereby allowing applications in both these high-tech industrial ecosystems and health infrastructure.

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 6.1% |

| UK | 5.2% |

| France | 4.9% |

| Germany | 5.4% |

| Italy | 4.5% |

| South Korea | 5.6% |

| Japan | 4.8% |

| China | 6.9% |

| Australia | 4.6% |

| New Zealand | 3.8% |

The USA industry is set to record high growth by 2035, sustained by healthcare, manufacturing, and metal fabrication industries. Shifting towards low-carbon industrial processes, especially steelmaking and chemical synthesis, is stimulating high-purity oxygen demand.

Medical oxygen continues to be an absolute necessity in hospitals, laboratories, and emergency services, sustaining consistent consumption throughout the healthcare network. Large players like Air Products and Chemicals, Praxair Inc. (now Linde plc), and Matheson Tri-Gas are investing in refurbishing production units and enhancing distribution networks.

Integration of technology through automation and remote monitoring of gas supply systems is propelling operational efficiency. As industrial decarbonization gathers steam, oxygen demand as a combustion catalyst and chemical feedstock will grow in a number of verticals.

In the UK, industrial oxygen demand will grow steadily with increasing applications across the energy, waste, and healthcare sectors. The decarbonization of industrial manufacturing, especially the production of steel and the generation of hydrogen, is necessitating the take-up of oxygen-enriched technologies. Industrial oxygen is additionally becoming increasingly prominent in waste-to-energy facilities as well as gas treatment facilities in the flue.

Other industry leaders like Air Liquide and BOC, a part of the Linde Group, are still committed to local manufacturing and green technology integration. Clean production and energy-efficient schemes followed by the government are pushing oxygen usage in carbon-emitting industries. Further, well-developed healthcare infrastructure causes regular oxygen demand in therapeutics as well as in clinic usage, making the industry stable.

The French industry is expected to grow moderately as a result of ongoing investments in the chemical processing, healthcare services, and environmental technologies industries. Industrial oxygen is a key element of effluent treatment systems as well as oxidation process systems, hence forming the basis of circular economy and resource optimization strategies that are embraced by French industries.

Air Liquide, which is France-based, accounts for industry dominance in the home industry due to relentless innovation, research, and development in cryogenic air separation technology. Oxygen applications in the new manufacturing sector and fuel processing are gaining wider and wider recognition. Stringent environmental legislation is also nudging industrial operators toward the utilization of high-efficiency oxygen systems for emissions reduction and yield enhancement of production.

Germany's industry will develop robustly with a high concentration in highly developed manufacturing, automotive, and chemical industries. The applications of oxygen in fine welding and high-temperature metal processing align with the country's industrial focus. Industrial oxygen also forms the heart of syngas production and facilitates sustainable energy storage solutions.

Key players such as Linde AG and Messer Group are expanding their capacity to enable green hydrogen production and carbon capture operations. Oxygen-enriched combustion and gasification processes are increasingly being utilized in energy-intensive facilities. Germany's strong regulatory framework and interest in industrial efficiency provide a favorable climate for the expansion of the oxygen industry over the forecast period.

Italy's industry will grow moderately with the assistance of advances in metallurgy, pharmaceuticals, and waste treatment industries. Oxygen consumption increases for furnace processes that are high temperature and oxidation reactions that are part of manufacturing and chemical refining. Expansion in healthcare and diagnostic laboratories also drives medical oxygen consumption.

Companies such as SOL Group and SIAD S.p.A. are strengthening supply chains and focusing on tailored oxygen solutions for industrial processes in niche industries. Italy's increasing dependence on circular economy strategies is advancing oxygen application in waste gasification and water treatment plants. With production efficiency and emission control still a top priority, the industry should be able to gain incremental resilience.

South Korea's industry is likely to grow at a considerable rate, fueled by innovative demand from the shipbuilding, pharmaceutical, and electronics industries. Oxygen is essential for semiconductor and display manufacturing in etching and oxidation applications. The use of oxygen systems in clean energy production, like hydrogen and synfuels, fuels long-term industry growth.

Key producers such as SK Materials and Daedeok Gas are expanding capacity to meet growing domestic demand. The green industrial revolution and government support for digital manufacturing are driving increasing oxygen consumption in high-tech environments. Furthermore, the rising proportion of medical oxygen in urban and rural healthcare facilities underpins stability in demand.

Japan's industry is expected to grow continuously because of a highly advanced production setting and because high standards of quality dominate the health and electronics industries. Oxygen is a key product involved in microfabrication processes, primarily for the production of semiconductors and solar panels, and is a contributing factor to their growth.

Major suppliers like Taiyo Nippon Sanso and Nippon Gases are emphasizing energy-saving manufacturing technology for gases and digital monitoring. Decarbonized manufacturing is facilitating increasing reliance on oxygen-enriched combustion systems. Sustainability and precision will continue to be applicable to Japan, but industrial oxygen will still be a part of vital manufacturing processes.

China will lead the world's growth in the industry, driven by the increasing industrialization, acceleration of chemical production, and growing focus on sustainable development. Metallurgy, especially applications in blast furnace processes and steel refining, continues to be a dominant demand source. Additionally, increasing domestic investment in the healthcare and energy sectors underpins the oxygen demand in many industries.

Industry leaders such as Yingde Gases and Hangzhou Hangyang are aggressively chasing to increase production capacity and simplify distribution logistics. Green manufacturing, clean technology, and upgrading the healthcare industry initiatives of the government are directly influencing industry trends. Industry clusters in Jiangsu and Guangdong provinces are demonstrating accelerated use of sophisticated oxygen technologies, stimulating the development of the industry through 2035.

Australia's industry will keep growing steadily, with strong demand in mining, infrastructure, and health applications. Oxygen's use in the treatment of ore and metal recovery remains pivotal to operation efficiency in remote and high-volume mines. Water treatment plants and environmental remediation projects increasingly rely on oxygen for process intensification.

Companies such as Coregas and Air Liquide Australia are investing in local supply options and cylinder fleet expansion to enable access. Ongoing focus on infrastructure resilience and clean technology installations promises a healthy outlook. The medical sector, driven by national health schemes, continues to require ongoing oxygen supply, maintaining a stable industry condition.

New Zealand's industry will also rise moderately with the support of the demand for healthcare, agribusiness, and environmental services. There is limited industrial presence in the country, but certain usage of oxygen in dairy processing, aquaculture, and water treatment promotes ongoing usage. Hospital oxygen needs, and emergency system requirements form a strong base demand.

Local producers incorporate local distributors into close cooperation to provide reliable supply lines, especially for island and rural populations. Demands for clean water technology and sustainable agriculture are stimulating innovation within oxygen consumption in biotic treatment systems. Whereas industry development is limited by population and industrial scale, industry niches provide secure growth opportunities up to 2035.

The industryhas large multinational gas companies, regional gas suppliers, and specialized industrial gas producers. The leaders of the industry's major corporations like LINDE plc, Air Liquide, Air Products and Chemicals, Matheson Tri-Gas, and Messer Group govern the entire landscape, which houses- vertically integrated production plants, extensive distribution architecture, and advanced cryogenic air separation technologies.

These players safeguard their competitive positions by investing in on-site gas generation solutions, a high-purity oxygen supply, and custom gas delivery systems for diverse industrial applications. Mid-sized companies such as Gulf Cryo, SOL Spa, and Showa Denko K.K. find their place in this industry by providing reasonably priced oxygen solutions to regional industries, including metal treatment and chemical processing for healthcare.

These companies use partnerships with local industries, sustainable gas production, and flexible supply chain models to create competitiveness in an evolving scenario. On the other hand, new entrants Noble Gas Solutions, Air Water Inc., and Ellenbarrie Industrial Gases Ltd. are gaining prominence in the marketplace as a result of specialty gases, mobile oxygen supply solutions and industry-specific services.

Rapid deployment capabilities, efficient gas cylinder filling stations and specialization in niche industries allow these firms to serve relatively small to mid-sized industrial customers. Further changes in competition are occasioned by technology for the liquefaction of oxygen, expansion of sites for the generation of oxygen, and green initiatives. LINDE plc and Air Liquide are major players leading the development of low-emission oxygen production and integrating digital monitoring systems for industrial gas applications.

Market Share Analysis by Company

| Company Name | Market Share (%) |

|---|---|

| LINDE plc | 22-26% |

| Air Liquide | 18-22% |

| Air Products and Chemicals, Inc. | 14-18% |

| Matheson Tri-Gas Inc. | 10-14% |

| Messer Group GmbH | 8-12% |

| Others (combined) | 25-35% |

| Company Name | Key Offerings and Activities |

|---|---|

| LINDE plc | Provides high-purity industrial oxygen for metal processing, chemical manufacturing, and medical applications. |

| Air Liquide | Develops advanced oxygen production and distribution systems for industrial and energy sectors. |

| Air Products and Chemicals, Inc. | Focuses on on-site oxygen generation, gas supply chains, and liquefied oxygen solutions. |

| Matheson Tri-Gas Inc. | Specializes in industrial and medical oxygen supply with a strong focus on regional distribution. |

| Messer Group GmbH | Offers tailored industrial oxygen solutions for metal fabrication, welding, and healthcare. |

Key Company Insights

LINDE plc (22-26%)

Industry leader in industrial oxygen supply, investing in sustainable gas production, on-site generation, and digitalized gas monitoring solutions.

Air Liquide (18-22%)

Strong presence in oxygen liquefaction and gas delivery systems, catering to chemical, steel, and energy industries.

Air Products and Chemicals, Inc. (14-18%)

Expands in on-site oxygen generation and bulk supply, with a focus on high-purity gas solutions.

Matheson Tri-Gas Inc. (10-14%)

Enhancing its regional industrial gas distribution, targeting specialty manufacturing and healthcare clients.

Messer Group GmbH (8-12%)

Strengthens its presence in customized oxygen supply solutions, catering to localized industrial applications.

Other Key Players

By product, the industry is segmented into compressed oxygen gas and liquefied oxygen.

By end use, the industry is categorized into automotive & aerospace, chemical processing, and energy sectors.

By region, the industry spans North America, Latin America, Western Europe, Eastern Europe, South Asia & Pacific, East Asia, and the Middle East & Africa.

The industry is estimated to be worth USD 82.9 billion in 2025.

The industry sales are projected to grow significantly, reaching USD 177.3 billion by 2035.

China is expected to experience a CAGR of 6.9%, driven by industrial expansion, urbanization, and advancements in healthcare infrastructure.

Liquefied oxygen is leading the industry, commonly used in industries like steel manufacturing, chemical production, and medical applications due to its efficiency and versatility.

Prominent companies include LINDE plc, Air Liquide, Air Products and Chemicals, Inc., Matheson Tri-Gas Inc., Messer Group GmbH, Gulf Cryo, SOL Spa, Showa Denko K.K., Air Water Inc., and Ellenbarrie Industrial Gases Ltd.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2019 to 2034

Table 2: Global Market Volume (Tons) Forecast by Region, 2019 to 2034

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 4: Global Market Volume (Tons) Forecast by Product Type, 2019 to 2034

Table 5: Global Market Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 6: Global Market Volume (Tons) Forecast by End Use, 2019 to 2034

Table 7: North America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 8: North America Market Volume (Tons) Forecast by Country, 2019 to 2034

Table 9: North America Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 10: North America Market Volume (Tons) Forecast by Product Type, 2019 to 2034

Table 11: North America Market Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 12: North America Market Volume (Tons) Forecast by End Use, 2019 to 2034

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 14: Latin America Market Volume (Tons) Forecast by Country, 2019 to 2034

Table 15: Latin America Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 16: Latin America Market Volume (Tons) Forecast by Product Type, 2019 to 2034

Table 17: Latin America Market Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 18: Latin America Market Volume (Tons) Forecast by End Use, 2019 to 2034

Table 19: Western Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 20: Western Europe Market Volume (Tons) Forecast by Country, 2019 to 2034

Table 21: Western Europe Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 22: Western Europe Market Volume (Tons) Forecast by Product Type, 2019 to 2034

Table 23: Western Europe Market Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 24: Western Europe Market Volume (Tons) Forecast by End Use, 2019 to 2034

Table 25: Eastern Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 26: Eastern Europe Market Volume (Tons) Forecast by Country, 2019 to 2034

Table 27: Eastern Europe Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 28: Eastern Europe Market Volume (Tons) Forecast by Product Type, 2019 to 2034

Table 29: Eastern Europe Market Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 30: Eastern Europe Market Volume (Tons) Forecast by End Use, 2019 to 2034

Table 31: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 32: South Asia and Pacific Market Volume (Tons) Forecast by Country, 2019 to 2034

Table 33: South Asia and Pacific Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 34: South Asia and Pacific Market Volume (Tons) Forecast by Product Type, 2019 to 2034

Table 35: South Asia and Pacific Market Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 36: South Asia and Pacific Market Volume (Tons) Forecast by End Use, 2019 to 2034

Table 37: East Asia Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 38: East Asia Market Volume (Tons) Forecast by Country, 2019 to 2034

Table 39: East Asia Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 40: East Asia Market Volume (Tons) Forecast by Product Type, 2019 to 2034

Table 41: East Asia Market Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 42: East Asia Market Volume (Tons) Forecast by End Use, 2019 to 2034

Table 43: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 44: Middle East and Africa Market Volume (Tons) Forecast by Country, 2019 to 2034

Table 45: Middle East and Africa Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 46: Middle East and Africa Market Volume (Tons) Forecast by Product Type, 2019 to 2034

Table 47: Middle East and Africa Market Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 48: Middle East and Africa Market Volume (Tons) Forecast by End Use, 2019 to 2034

Figure 1: Global Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 2: Global Market Value (US$ Million) by End Use, 2024 to 2034

Figure 3: Global Market Value (US$ Million) by Region, 2024 to 2034

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2019 to 2034

Figure 5: Global Market Volume (Tons) Analysis by Region, 2019 to 2034

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2024 to 2034

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2024 to 2034

Figure 8: Global Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 9: Global Market Volume (Tons) Analysis by Product Type, 2019 to 2034

Figure 10: Global Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 11: Global Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 12: Global Market Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 13: Global Market Volume (Tons) Analysis by End Use, 2019 to 2034

Figure 14: Global Market Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 15: Global Market Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 16: Global Market Attractiveness by Product Type, 2024 to 2034

Figure 17: Global Market Attractiveness by End Use, 2024 to 2034

Figure 18: Global Market Attractiveness by Region, 2024 to 2034

Figure 19: North America Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 20: North America Market Value (US$ Million) by End Use, 2024 to 2034

Figure 21: North America Market Value (US$ Million) by Country, 2024 to 2034

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 23: North America Market Volume (Tons) Analysis by Country, 2019 to 2034

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 26: North America Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 27: North America Market Volume (Tons) Analysis by Product Type, 2019 to 2034

Figure 28: North America Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 29: North America Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 30: North America Market Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 31: North America Market Volume (Tons) Analysis by End Use, 2019 to 2034

Figure 32: North America Market Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 33: North America Market Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 34: North America Market Attractiveness by Product Type, 2024 to 2034

Figure 35: North America Market Attractiveness by End Use, 2024 to 2034

Figure 36: North America Market Attractiveness by Country, 2024 to 2034

Figure 37: Latin America Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 38: Latin America Market Value (US$ Million) by End Use, 2024 to 2034

Figure 39: Latin America Market Value (US$ Million) by Country, 2024 to 2034

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 41: Latin America Market Volume (Tons) Analysis by Country, 2019 to 2034

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 44: Latin America Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 45: Latin America Market Volume (Tons) Analysis by Product Type, 2019 to 2034

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 48: Latin America Market Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 49: Latin America Market Volume (Tons) Analysis by End Use, 2019 to 2034

Figure 50: Latin America Market Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 52: Latin America Market Attractiveness by Product Type, 2024 to 2034

Figure 53: Latin America Market Attractiveness by End Use, 2024 to 2034

Figure 54: Latin America Market Attractiveness by Country, 2024 to 2034

Figure 55: Western Europe Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 56: Western Europe Market Value (US$ Million) by End Use, 2024 to 2034

Figure 57: Western Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 58: Western Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 59: Western Europe Market Volume (Tons) Analysis by Country, 2019 to 2034

Figure 60: Western Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 61: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 62: Western Europe Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 63: Western Europe Market Volume (Tons) Analysis by Product Type, 2019 to 2034

Figure 64: Western Europe Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 65: Western Europe Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 66: Western Europe Market Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 67: Western Europe Market Volume (Tons) Analysis by End Use, 2019 to 2034

Figure 68: Western Europe Market Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 69: Western Europe Market Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 70: Western Europe Market Attractiveness by Product Type, 2024 to 2034

Figure 71: Western Europe Market Attractiveness by End Use, 2024 to 2034

Figure 72: Western Europe Market Attractiveness by Country, 2024 to 2034

Figure 73: Eastern Europe Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 74: Eastern Europe Market Value (US$ Million) by End Use, 2024 to 2034

Figure 75: Eastern Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 76: Eastern Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 77: Eastern Europe Market Volume (Tons) Analysis by Country, 2019 to 2034

Figure 78: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 79: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 80: Eastern Europe Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 81: Eastern Europe Market Volume (Tons) Analysis by Product Type, 2019 to 2034

Figure 82: Eastern Europe Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 83: Eastern Europe Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 84: Eastern Europe Market Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 85: Eastern Europe Market Volume (Tons) Analysis by End Use, 2019 to 2034

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 88: Eastern Europe Market Attractiveness by Product Type, 2024 to 2034

Figure 89: Eastern Europe Market Attractiveness by End Use, 2024 to 2034

Figure 90: Eastern Europe Market Attractiveness by Country, 2024 to 2034

Figure 91: South Asia and Pacific Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 92: South Asia and Pacific Market Value (US$ Million) by End Use, 2024 to 2034

Figure 93: South Asia and Pacific Market Value (US$ Million) by Country, 2024 to 2034

Figure 94: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 95: South Asia and Pacific Market Volume (Tons) Analysis by Country, 2019 to 2034

Figure 96: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 97: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 98: South Asia and Pacific Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 99: South Asia and Pacific Market Volume (Tons) Analysis by Product Type, 2019 to 2034

Figure 100: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 101: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 102: South Asia and Pacific Market Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 103: South Asia and Pacific Market Volume (Tons) Analysis by End Use, 2019 to 2034

Figure 104: South Asia and Pacific Market Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 105: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 106: South Asia and Pacific Market Attractiveness by Product Type, 2024 to 2034

Figure 107: South Asia and Pacific Market Attractiveness by End Use, 2024 to 2034

Figure 108: South Asia and Pacific Market Attractiveness by Country, 2024 to 2034

Figure 109: East Asia Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 110: East Asia Market Value (US$ Million) by End Use, 2024 to 2034

Figure 111: East Asia Market Value (US$ Million) by Country, 2024 to 2034

Figure 112: East Asia Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 113: East Asia Market Volume (Tons) Analysis by Country, 2019 to 2034

Figure 114: East Asia Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 115: East Asia Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 116: East Asia Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 117: East Asia Market Volume (Tons) Analysis by Product Type, 2019 to 2034

Figure 118: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 119: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 120: East Asia Market Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 121: East Asia Market Volume (Tons) Analysis by End Use, 2019 to 2034

Figure 122: East Asia Market Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 123: East Asia Market Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 124: East Asia Market Attractiveness by Product Type, 2024 to 2034

Figure 125: East Asia Market Attractiveness by End Use, 2024 to 2034

Figure 126: East Asia Market Attractiveness by Country, 2024 to 2034

Figure 127: Middle East and Africa Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 128: Middle East and Africa Market Value (US$ Million) by End Use, 2024 to 2034

Figure 129: Middle East and Africa Market Value (US$ Million) by Country, 2024 to 2034

Figure 130: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 131: Middle East and Africa Market Volume (Tons) Analysis by Country, 2019 to 2034

Figure 132: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 133: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 134: Middle East and Africa Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 135: Middle East and Africa Market Volume (Tons) Analysis by Product Type, 2019 to 2034

Figure 136: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 137: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 138: Middle East and Africa Market Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 139: Middle East and Africa Market Volume (Tons) Analysis by End Use, 2019 to 2034

Figure 140: Middle East and Africa Market Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 141: Middle East and Africa Market Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 142: Middle East and Africa Market Attractiveness by Product Type, 2024 to 2034

Figure 143: Middle East and Africa Market Attractiveness by End Use, 2024 to 2034

Figure 144: Middle East and Africa Market Attractiveness by Country, 2024 to 2034

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Industrial Grade Electrochemical CO Sensor Market Size and Share Forecast Outlook 2025 to 2035

Industrial Bench Scale Market Size and Share Forecast Outlook 2025 to 2035

Industrial Low Profile Floor Scale Market Size and Share Forecast Outlook 2025 to 2035

Industrial Sand Mill Market Size and Share Forecast Outlook 2025 to 2035

Industrial Control Network Modules Market Size and Share Forecast Outlook 2025 to 2035

Industrial Precision Oven Market Size and Share Forecast Outlook 2025 to 2035

Industrial Water Chiller for PCB Market Size and Share Forecast Outlook 2025 to 2035

Industrial & Commercial HVLS Fans Market Size and Share Forecast Outlook 2025 to 2035

Industrial Robot Controller Market Size and Share Forecast Outlook 2025 to 2035

Industrial Wired Routers Market Size and Share Forecast Outlook 2025 to 2035

Industrial Evaporative Condensers Market Size and Share Forecast Outlook 2025 to 2035

Industrial Energy Management System Market Size and Share Forecast Outlook 2025 to 2035

Industrial Insulation Market Size and Share Forecast Outlook 2025 to 2035

Industrial Safety Gloves Market Size and Share Forecast Outlook 2025 to 2035

Industrial Cleaner Market Size and Share Forecast Outlook 2025 to 2035

Industrial Dust Treatment System Market Size and Share Forecast Outlook 2025 to 2035

Industrial Vertical Washing Tower Market Size and Share Forecast Outlook 2025 to 2035

Industrial Pepper Market Size and Share Forecast Outlook 2025 to 2035

Industrial Electronics Packaging Market Forecast and Outlook 2025 to 2035

Industrial Absorbent Market Forecast and Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA