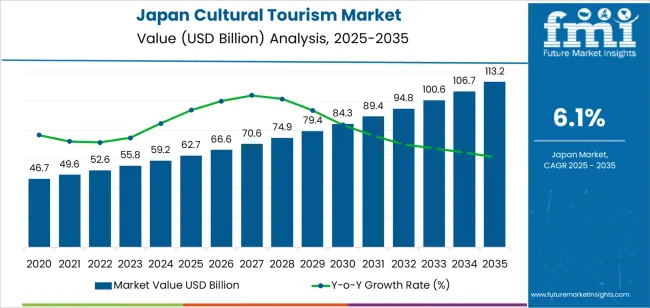

The Japan cultural tourism demand is valued at USD 62.7 billion in 2025 and is projected to reach USD 113.2 billion by 2035, corresponding to a CAGR of 6.1%. Growth is supported by sustained interest in traditional arts, historic sites, architectural heritage, and region-specific cultural experiences. Expanded domestic travel, renewed international visitor inflows, and structured government programmes that promote preservation and cultural revitalization further influence demand. Increased participation in museums, heritage districts, cultural festivals, and craft-based learning activities also contributes to the sector’s expansion.

Heritage tourism leads the tourism landscape. Travellers select heritage-focused experiences for their emphasis on historical interpretation, cultural identity, and educational value. Rising preference for curated tours, guided museum experiences, and interactive exhibitions continues to shape visitor behaviour. Digital mapping tools, multilingual resources, and improved accessibility at cultural sites reinforce participation across diverse demographic groups.

Kyushu & Okinawa, Kanto, and Kinki account for the highest concentration of cultural tourism activity due to their dense networks of museums, heritage landmarks, and historically significant urban centres. These regions also benefit from large transportation hubs, strong hospitality infrastructure, and government-supported cultural conservation initiatives. Key institutions include the National Museum of Western Art, 21_21 Design Sight, National Museum of Ethnology, Kyoto National Museum, and the Hakone Open-Air Museum. These entities host permanent collections, rotating exhibitions, and educational programmes that support sustained cultural engagement across domestic and international audiences.

The acceleration-deceleration pattern in Japan’s cultural-tourism segment reflects a stable but evolving growth trajectory across the forecast horizon. Early-period acceleration is shaped by renewed inbound travel, expansion of heritage-site programming, and modernization of museums, galleries, and cultural districts. Broader use of multilingual digital guides and expanded infrastructure around major destinations supports faster initial gains as both domestic and international visitors increase engagement with cultural attractions.

Mid-period growth maintains a similar rhythm but begins to level as visitation patterns stabilize across key regions. Cultural institutions deepen program quality rather than expand capacity, creating steady but more measured growth. The integration of digital ticketing, curated cultural routes, and coordinated regional initiatives sustains momentum while reducing fluctuations in annual activity.

In the later period, deceleration gradually emerges as the segment reaches a more mature adoption phase. Major destinations achieve stable visitor baselines, and incremental growth is shaped by periodic upgrades, targeted cultural events, and diversification into niche heritage experiences. Demand remains resilient, but annual expansion becomes more uniform as infrastructure and programming saturation increases. The overall pattern shows early acceleration, mid-cycle steadiness, and a controlled deceleration phase consistent with a maturing cultural-tourism ecosystem.

| Metric | Value |

|---|---|

| Japan Cultural Tourism Sales Value (2025) | USD 62.7 billion |

| Japan Cultural Tourism Forecast Value (2035) | USD 113.2 billion |

| Japan Cultural Tourism Forecast CAGR (2025-2035) | 6.1% |

Demand for cultural tourism in Japan is increasing as domestic and international visitors seek deeper engagement with heritage sites, traditional arts and regional cultural practices. Travellers show strong interest in temples, shrines, historic districts, craft workshops and culinary traditions that reflect Japan’s regional identity. Local governments and tourism associations promote cultural routes, community festivals and preservation projects that attract visitors to rural areas as well as major cities.

Growth in experiential travel, including guided heritage walks, tea-ceremony sessions and artisan studio visits, supports rising demand among younger travellers and repeat visitors. Improved multilingual information, transport access and digital booking tools also encourage participation in cultural activities. Constraints include limited capacity at certain heritage sites, seasonal crowding in major destinations and preservation requirements that restrict infrastructure changes. Some rural areas face staffing shortages or limited hospitality facilities, which slows expansion of cultural programmes.

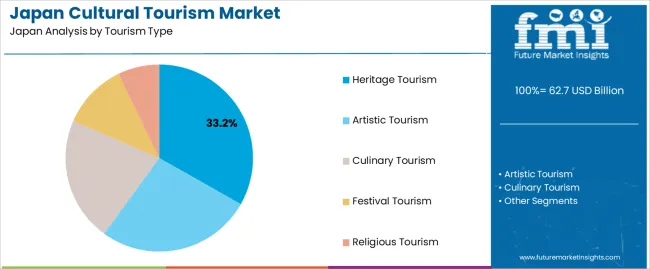

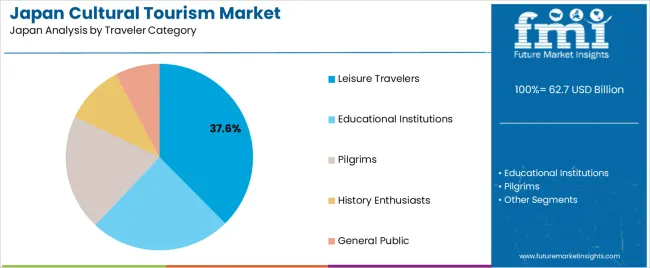

Demand for cultural tourism in Japan reflects participation in heritage sites, artistic activities, culinary experiences, religious locations, and regional festivals. Tourist preferences vary by cultural interest, travel motivation, and access to curated experiences across rural and urban settings. Traveler-category patterns outline how leisure visitors, educational groups, and pilgrims participate in structured or independent cultural itineraries. Domestic and international tourist proportions highlight how Japan’s cultural attractions serve residents and visitors arriving from overseas.

Heritage tourism holds 33.2% of national demand and represents the leading tourism type in Japan. Visitors engage with castles, shrines, temples, museums, preserved districts, and archaeological locations that document historical development across regions. Artistic tourism accounts for 26.8%, covering galleries, craft centers, traditional performing arts, and contemporary cultural spaces. Culinary tourism represents 21.5%, reflecting interest in regional dishes, food tours, and culturally significant ingredients. Festival tourism holds 11.3%, driven by seasonal celebrations and traditional events. Religious tourism accounts for 7.2%, involving pilgrimages and shrine or temple visits. Tourism-type distribution reflects cultural depth, regional heritage, and food traditions.

Key drivers and attributes:

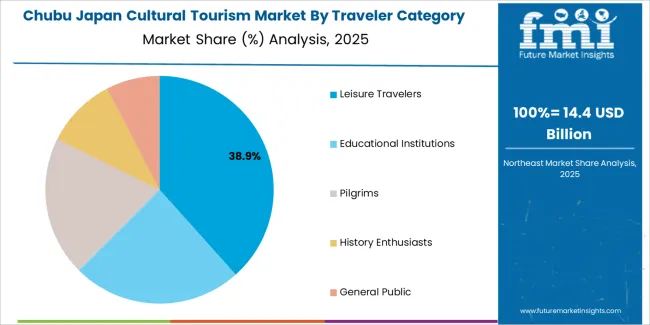

Leisure travelers hold 37.6% of national demand and represent the most active group in Japanese cultural tourism. Their participation reflects independent sightseeing, weekend travel, and visits to culturally significant regional locations. Educational institutions account for 24.4%, including school excursions, university programs, and organized cultural study tours. Pilgrims represent 20.1%, reflecting participation in temple routes, shrine visits, and long-established pilgrimage circuits. History enthusiasts account for 10.2%, engaging in focused exploration of heritage districts and historic artefacts. The general public holds 7.7%, participating in cultural experiences during routine travel. Distribution aligns with Japan’s interest in educational travel, heritage engagement, and spiritual routes.

Key drivers and attributes:

Domestic travelers hold 58.9% of national demand and represent the leading tourist type within Japanese cultural tourism. Residents visit cultural sites due to accessibility, short-distance routes, and familiarity with regional attractions. International travelers account for 41.1%, participating in cultural circuits involving heritage districts, culinary experiences, festivals, and traditional crafts. Tourist-type distribution reflects travel patterns shaped by local tourism infrastructure, intra-Japan mobility, and strong domestic interest in cultural destinations. International participation remains notable due to Japan’s preserved heritage environments and diverse cultural offerings across major cities and regional areas.

Key drivers and attributes:

Growth of inbound travel focused on heritage districts, domestic interest in traditional crafts and strong municipal investment in cultural preservation are driving demand.

In Japan, cultural tourism expands as international visitors concentrate on historic areas such as Kyoto, Nara, Kanazawa and Kamakura, where temple precincts, machiya streets and tea-ceremony districts remain well preserved. Domestic travellers also show strong interest in regional crafts such as lacquerware from Ishikawa, pottery from Arita and textile traditions in Kyoto and Okinawa. Municipal governments fund preservation of castle sites, townscapes and cultural festivals, which increases accessibility and visitor engagement. Rail networks including JR regional lines support convenient movement to secondary cultural destinations, strengthening nationwide cultural-tourism activity.

Labour shortages in heritage management, seasonal congestion in major sites and limited multilingual content in rural areas restrain demand.

Japan faces staffing shortages in museums, cultural centres and historical-preservation offices, especially in prefectures with aging populations. Major cultural sites such as Arashiyama, Fushimi Inari and central Kyoto experience severe congestion during peak seasons, reducing visitor satisfaction and discouraging repeat visits. Rural areas with rich cultural assets often lack multilingual signage, guide services or structured visitor programs, creating barriers for foreign tourists who wish to explore lesser-known regions. These constraints slow the distribution of cultural tourism beyond heavily visited urban centres.

Expansion of community-led cultural experiences, increased use of digital guides and AR tools, and stronger promotion of regional heritage corridors define key trends.

Local communities in Japan are developing hands-on cultural programs such as washi-paper workshops, traditional dyeing sessions and sake-brewery tours to appeal to experiential travellers. Digital tools including QR-based museum guides, AR-supported historical reconstructions and multilingual audio guides are gaining adoption in both public and private cultural institutions. Regional governments are promoting heritage corridors linking multiple cultural towns, such as Nakasendo post-town routes and Hokuriku craft circuits, to disperse visitor flow and increase stays in smaller municipalities. These trends support continued growth and diversification of cultural tourism across Japan.

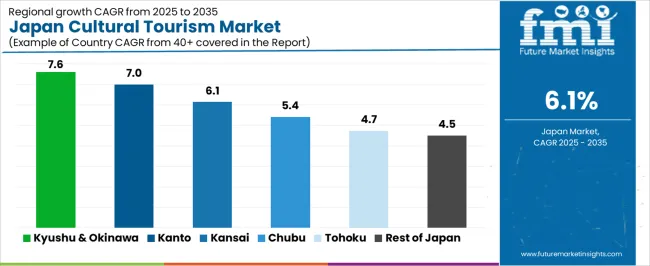

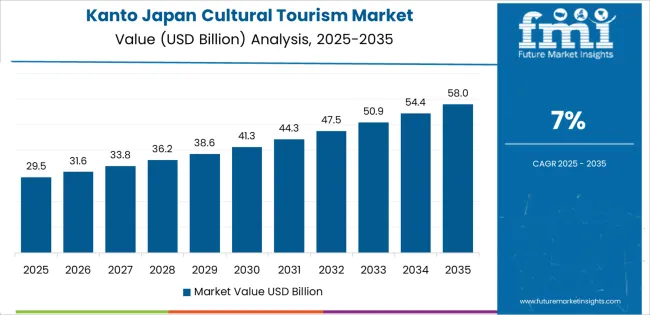

Demand for cultural tourism in Japan is increasing through 2035 as domestic travelers and inbound visitors seek heritage sites, traditional festivals, regional crafts, and historically significant districts. Regional tourism authorities expand preservation programs, improve accessibility, and upgrade transportation links to support cultural-site visitation. Differences in cultural assets, visitor infrastructure, and local heritage clusters influence regional growth patterns. Kyushu & Okinawa leads at 7.6%, followed by Kanto (7.0%), Kinki (6.1%), Chubu (5.4%), Tohoku (4.7%), and Rest of Japan (4.5%). Demand reflects interest in temples, shrines, performing arts, craft workshops, preserved districts, and regional food traditions.

| Region | CAGR (2025-2035) |

|---|---|

| Kyushu & Okinawa | 7.6% |

| Kanto | 7.0% |

| Kinki | 6.1% |

| Chubu | 5.4% |

| Tohoku | 4.7% |

| Rest of Japan | 4.5% |

Kyushu & Okinawa grows at 7.6% CAGR, supported by historic districts, shrine networks, and strong festival traditions across Fukuoka, Kumamoto, Nagasaki, Kagoshima, and Okinawa. Visitors engage with castle remains, samurai-era sites, and craft workshops specializing in pottery, textiles, and lacquerware. Okinawa draws demand through Ryukyu-heritage locations, performing arts, and preserved castle complexes. Coastal areas host cultural routes linking temples, regional museums, and traditional food districts. Tourism infrastructure expansion in Fukuoka increases access to cultural neighborhoods and heritage industries. Local governments invest in preservation programs for wooden structures, festival grounds, and historical archives, strengthening cultural-route continuity across the region.

Kanto grows at 7.0% CAGR, driven by dense visitor traffic to historic temples, preserved neighborhoods, and major museums across Tokyo, Kanagawa, Chiba, Saitama, and Ibaraki. Tokyo’s cultural districts draw interest through traditional performing arts, craft exhibitions, and Edo-period structures. Kanagawa offers heritage coastal towns, temple routes, and historical gardens. Regional museums in Chiba and Saitama curate long-term cultural collections that reinforce steady visitation. Local tourism programs promote traditional festivals, regional cuisine, and craft demonstrations. Transport networks support year-round access to cultural sites across metropolitan and suburban areas.

Kinki grows at 6.1% CAGR, supported by major heritage concentrations, temple complexes, traditional performing arts, and preserved districts across Kyoto, Osaka, Hyogo, Nara, Wakayama, and Shiga. Kyoto generates substantial demand through temples, shrines, artisanal workshops, and geocultural districts. Nara attracts visitors through early Buddhist heritage sites, ancient routes, and museum collections. Osaka contributes through cultural neighborhoods and regional performing-arts centers. Shiga and Wakayama maintain castle districts, historic shrines, and pilgrimage routes. Local authorities invest in preservation, signage, and restoration efforts to maintain cultural assets.

Chubu grows at 5.4% CAGR, shaped by castle towns, heritage villages, craft traditions, and mountainous cultural corridors across Aichi, Shizuoka, Gifu, Mie, Nagano, and Toyama. Gifu and Toyama maintain preserved villages, traditional wooden houses, and craft centers producing paper, ceramics, and woodworking items. Aichi offers castle sites, samurai-era districts, and cultural institutions with regional historical collections. Shizuoka draws visitors to cultural routes linking temples, historic tea-production areas, and coastal heritage zones. Tourism programs highlight regional crafts, seasonal festivals, and local artisanal workshops.

Tohoku grows at 4.7% CAGR, supported by historic festivals, traditional crafts, shrine clusters, and preserved rural landscapes across Miyagi, Aomori, Fukushima, Akita, Iwate, and Yamagata. Regional festivals attract visitors seeking traditional performances and community rituals. Craft villages produce lacquerware, textiles, and wooden goods tied to local heritage. Shrines and temple networks draw steady cultural tourism linked to long-distance pilgrimage routes. Rural districts maintain preserved settlements, historic farmhouses, and cultural museums. Local authorities promote cultural itineraries connecting natural landscapes with historical sites.

Rest of Japan grows at 4.5% CAGR, supported by regional museum networks, smaller heritage districts, traditional craft clusters, and community-based festivals across prefectures outside major cultural hubs. Local museums curate regional histories and archaeological collections. Small towns maintain preserved streetscapes, traditional merchant houses, and historic shrines. Craft centers produce ceramics, textiles, and woodworking that attract experiential tourism. Regional festivals continue to draw domestic travelers seeking local traditions. Transportation improvements increase accessibility to rural cultural assets.

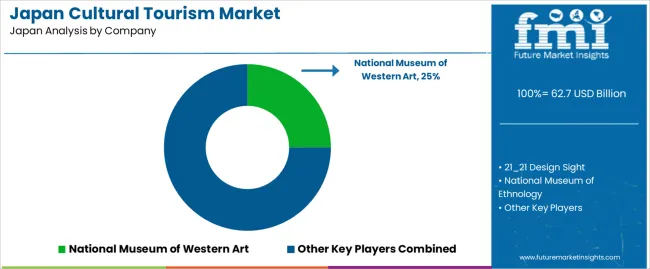

Demand for cultural tourism in Japan is shaped by nationally recognized museums and design institutions that attract sustained domestic and international visitation. The National Museum of Western Art holds an estimated 25.0% share, supported by its central location in Tokyo, its extensive Western-art collection, and consistent visitor flows linked to permanent exhibitions and government-backed cultural programming. Its position is reinforced by stable attendance levels and strong integration with Japan’s national museum network.

21_21 Design Sight maintains notable influence through design-focused exhibitions that draw steady urban audiences. Its programming emphasizes contemporary design and visual culture, supporting continuous visitation from both residents and international travellers interested in modern Japanese creativity. National Museum of Ethnology, located in Osaka, contributes significant engagement with exhibitions on global cultures and anthropological research, attracting academic and general visitors seeking structured interpretive content.

Kyoto National Museum plays a central role in cultural tourism within the Kansai region through its historic art collections and regular thematic exhibitions that align with Kyoto’s broader heritage appeal. Hakone Open-Air Museum supports additional demand by combining sculpture installations with a natural setting, offering predictable domestic visitation across leisure, educational, and family-tourism groups.

Competition across this segment centers on exhibition quality, cultural relevance, educational programming, facility accessibility, multilingual resources, and year-round visitor capacity. Demand remains steady as travellers continue seeking art institutions, heritage collections, and design-focused experiences that provide consistent interpretive value across major Japanese cultural destinations.

| Items | Values |

|---|---|

| Quantitative Units | USD billion |

| Tourism Type | Heritage Tourism, Artistic Tourism, Culinary Tourism, Festival Tourism, Religious Tourism |

| Traveler Category | Leisure Travelers, Educational Institutions, Pilgrims, History Enthusiasts, General Public |

| Tourist Type | Domestic, International |

| Booking Channel | Online, Phone Booking, In-Person Booking |

| Regions Covered | Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, Rest of Japan |

| Key Companies Profiled | National Museum of Western Art, 21_21 Design Sight, National Museum of Ethnology, Kyoto National Museum, Hakone Open-Air Museum |

| Additional Attributes | Dollar spending by tourism type, traveler category, booking channel, and tourist segment; regional tourism flow patterns across Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, and Rest of Japan; competitive landscape of museums, cultural sites, and tourism institutions; insights into heritage preservation programs, festival tourism development, culinary tourism experiences, and educational travel initiatives; integration with local tourism boards, digital booking platforms, cultural heritage networks, and international visitor promotion strategies. |

The demand for cultural tourism in japan is estimated to be valued at USD 62.7 billion in 2025.

The market size for the cultural tourism in japan is projected to reach USD 113.2 billion by 2035.

The demand for cultural tourism in japan is expected to grow at a 6.1% CAGR between 2025 and 2035.

The key product types in cultural tourism in japan are heritage tourism, artistic tourism, culinary tourism, festival tourism and religious tourism.

In terms of traveler category, leisure travelers segment is expected to command 37.6% share in the cultural tourism in japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cultural Tourism Market Analysis by Tourism Type, By Traveler Category, by Tourist Type, by Booking Channel, and by Region - Forecast for 2025 to 2035

Japan Golf Tourism Market Analysis

Japan Halal Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Space Tourism Market Trends – Innovations, Demand & Growth 2025-2035

Japan Sports Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Diving Tourism Market Analysis – Size, Share & Industry Trends 2025-2035

Japan Outbound Tourism Market Analysis – Growth & Forecast 2025 to 2035

Japan Adventure Tourism Market Report – Demand, Size & Forecast 2025–2035

Japan Faith-based Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Special Interest Tourism Market Trends – Innovations, Growth & Forecast 2025-2035

Tourism Industry Analysis in Japan - Size, Share, & Forecast Outlook 2025 to 2035

Demand for Cultural Tourism in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Ecotourism in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Medical Tourism in Japan Size and Share Forecast Outlook 2025 to 2035

Japan Respiratory Inhaler Devices Market Size and Share Forecast Outlook 2025 to 2035

Tourism Independent Contractor Model Market Size and Share Forecast Outlook 2025 to 2035

Japan Automated People Mover Industry Size and Share Forecast Outlook 2025 to 2035

Japan Automotive Load Floor Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Japan Food Cling Film Market Size and Share Forecast Outlook 2025 to 2035

Japan Polypropylene Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA