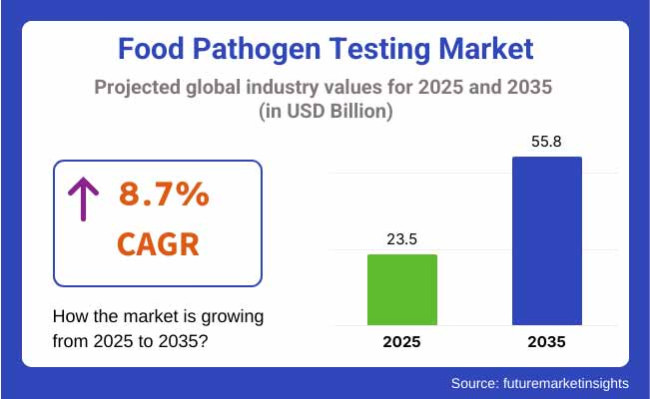

The global Food Pathogen Testing Market is estimated to be worth USD 23.5 billion in 2025 and is projected to reach USD 55.8 billion by 2035, expanding at a CAGR of 8.7% over the assessment period 2025 to 2035. Food pathogen testing is on the rise due to the increasing focus on food safety, health regulations, and consumer health.

These contribute to rapid pathogen testing, an important technology for the prevention of foodborne illnesses. The rates of people wanting to get fast and accurate cures for infections caused by the pathogens in foods are increasing.

Pathogen testing, on the other hand, is the exercise of detecting strains of microbes that are damaging to health in food items. Without this technology, it would be nearly impossible to ensure food quality and prevent foodborne illnesses. The rapid growth is a result of the inevitable increase in the number of tests for waterborne illness in the population.

The sales expansion is mainly powered by the steady legislative pressure on food safety from local and international organizations such as the USDA, FDA, and EFSA agencies. Food and beverage manufacturers, meal producers, and retailers are putting up money for extra pathogen testing equipment to follow the rules of the game and keep the customers satisfied.

The additional transmission of food products increases due to the ascendance of the food exchange business and the accelerating rate of food contamination. Thus, the spate of food safety issues has catalyzed the demand for stringent food safety management practices in the sector.

The entrance of various testing technologies like polymerase chain reaction (PCR), immunoassays, next-generation sequencing (NGS), and biosensors have an impact on the sector of food pathogen testing. They offer faster detection times, higher accuracy, and improved sensitivity that push real-time monitoring of food production and preventive quality controls. Furthermore, the trend to shift towards automating and AI pathogen detection laying surveillance on the food testing labs is enhancing productivity.

The major factor influencing the trend is the increasing consumer knowledge of food safety issues. An example of this is the growing demand of customers for transparent food sourcing and processing, which has led companies to implement strict pathogen testing protocols. The other factor, the demand for organic and minimally processed food, is raising the need for advanced microbial testing to check food safety without artificial chemicals added.

The industry faces several challenges, such as high testing prices, complicated sample preparation methods, and the different detection variability of each food matrix. In addition, the financial and technical implications of introducing the leading pathogen testing systems are likely to act as limiting factors for small and medium-sized food companies.

Between 2020 and 2024, there was a steady growth owing to regulatory food safety measures and increasing contamination risks in supply chains. Increased consumer concern regarding foodborne illness pushed food makers to adopt high-speed pathogen detection platforms like PCR-based testing, biosensors, and next-generation sequencing (NGS).

Demand for AI-powered and automatic detection systems for the period promoted the need for quicker microbial identification among the meat-processing, dairy, seafood, and ready-to-consume food companies. Companies welcomed preventive contamination more than embracing reaction methodologies, driving the development of fast-testing options and their effectiveness in enhancing improved food safety governance worldwide.

Between 2025 and 2035, the market will grow at a higher rate because of real-time tracking, laboratory automation, and predictive analytics with the aid of Artificial Intelligence. Increased use of alternative proteins, plant foods, and fermented foods will create new test requirements, especially Listeria, Salmonella, and E. coli in minimally processed food.

Globalized food trade will increasingly propel demand for internationally standardized pathogen testing solutions to meet changing safety regulations in major industries like the USA, EU, and Asia-Pacific.

A Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Regulatory pressure surged demand for pathogen testing. | Real-time monitoring and AI-based analytics become prominent. |

| Adoption of PCR, biosensors, and NGS for high-speed detection. | Automation and intelligent lab technologies transform pathogen testing. |

| AI-enabled pathogen detection has gained momentum in critical industries. | The emergence of alternative proteins and plant-based food testing. |

| Shifting attention from reactive to proactive contamination prevention. | Increased food trade across the world drives standard testing. |

| Growing demand for rapid and precise microbial identification. | Stringent safety compliance requirements in major world markets. |

Globally, the industry is growing because of factors such as increasing food safety regulations, foodborne illness outbreaks, and consumer calls for transparency. The meat and poultry, seafood, and dairy industries prioritize pathology testing to avoid contamination from Salmonella, Listeria, and E. coli.

Speed and precision are paramount buying considerations, with companies demanding quick, real-time PCR and immunoassay-based testing technologies to allow early detection and prevention. The food and beverage processing industries are also incorporating automated and high throughput testing solutions to remain compliant with international food safety standards (e.g., FDA, HACCP, and ISO 22000).

Sustainability issues are promoting the use of environmentally friendly test kits and non-toxic reagents. With on-site pathogen detection technologies rapidly evolving in laboratories, food manufacturers are increasingly shifting to faster, less expensive, and more efficient alternatives to improve food safety and lower levels of product recall.

Globally, there is an increase in foodborne illnesses, and tight food safety regulations are on the rise. Nevertheless, the ever-changing global standards like HACCP, FDA, and EU food safety laws that result from the food safety challenge are particularly problematic. Therefore, companies are required to conduct testing in accordance with strict protocols and incorporate any changes in the regulations in order to uphold their credibility.

Supply chain complexities, such as sample contamination risks, testing accuracy, and time-sensitive logistics, are some obstacles affecting stability. Dependence on advanced diagnostic tools and laboratory infrastructure increases costs. However, businesses can achieve reliability through the testing of high-performance, low-energy equipment and automation, thus improving operational efficiency.

Concerns over consumer safety and the demand for more transparency and traceability from food products strengthen manufacturers' need to utilize rapid testing solutions. Traditional testing equipment supports the industry, which has developed real-time PCR, biosensors, and AI-driven detection, which requires businesses to adapt.

Challenging affordability due to the price of high-end pathogen testing tools and infrastructure has left many small and medium-sized enterprises out. Companies that are laterally oriented in their strategy must typically find the right balance between saving expenses and spending in the right places.

Economic fluctuations, technological advancements, and shifting consumer awareness are among the forces affecting sales consequently. For businesses to determine if they are stable and healthy, they should focus on the invention of the next generation of pathogen detection technology. They should collaborate with regulatory entities to provide solutions that are compatible with global food safety standards.

| Segment | Value Share (2025) |

|---|---|

| Salmonella | 42.6% |

By contaminants, the segmentation is into Salmonella, E. coli, Listeria, and Campylobacter. Salmonella is poised to lead with a 42.6% share by 2025 due to the pathogen's high prevalence in meat, Poultry, eggs, and fresh produce. Increasing incidences of outbreaks and recalls have put regulatory factors under pressure, with agencies such as the USDA and EFSA introducing compulsory routine testing.

Diagnostic solutions such as PCR and ELISA kits are provided by major organizations such as Eurofins Scientific and Neogen Corporation, which facilitate fast and precise detection of pathogens, contributing to food safety compliance levels in processing and packaging plants.

Escherichia coli, especially the pathogenically virulent O157:H7 strain, is expected to comprise 30% of the overall industry due to its linkage to serious foodborne diseases associated with undercooked meat, particularly beef, leafy greens, and unpasteurized dairy products. The meat and ready-to-eat food industries are closely regulated, and for good reason: regulatory authorities require long, detailed monitoring protocols.

Bio-Rad Laboratories, 3M Food Safety, etc. that provide integrated testing solutions (enrichment media, culture media, rapid assay systems, etc.) are commonly used in industrial and applied research situations for early detection of pathogens and help in estimating risk. These systems prevent contamination-related recalls by food producers, maintaining consumer trust.

| Segment | Value Share (2025) |

|---|---|

| Meat and Poultry | 49.6% |

The segmentation is into Meat & Poultry, Dairy, Processed Food, Fruits & Vegetables, and Others. Meat & Poultry will be the largest controlling segment in 2025, with a 49.6% share due to the high pathogenesis of the meat products (pathogens like Salmonella, E. coli, and Listeria).

Frequent outbreaks in meat processing facilities have resulted in stringent regulatory action in the USA, EU, and Asia-Pacific regions in particular. Firms such as Neogen Corporation and Eurofins Scientific provide specialized testing kits and laboratory services designed specifically for the meat processing industry, with a focus on prompt detection and adherence to food safety regulations such as HACCP and FSMA.

Dairy products are likely to make up 24.6% of the total share due to the vulnerability of traditional dairy products, including milk, cheese, and yogurt, to pathogens such as Listeria monocytogenes and E. coli. With rising global dairy consumption, particularly in emerging markets, producers need to understand the need for pathogen testing in order to ensure product safety and shelf stability.

Specialty testing solutions for dairy applications, including on-site rapid tests and lab-based PCR analysis, are supplied by companies like IDEXX Laboratories and Bio-Rad Laboratories to help producers achieve quality control and comply with regulatory requirements. In these key food segments, growing consumer demand for safe and high-quality food, along with stringent global food safety regulations, continues to drive investments in pathogen detection.

| Countries | Projected CAGR |

|---|---|

| USA | 8.5% |

| UK | 8.3% |

| France | 8.2% |

| Germany | 8.1% |

| Italy | 8.0% |

| South Korea | 8.4% |

| Japan | 8.3% |

| China | 8.6% |

| Australia | 8.2% |

| New Zealand | 8.1% |

The USA is likely to witness growth at a rate of 8.5% CAGR during the forecast period. The increasing demand for AI-based detection of pathogens in packaged and processed food is one of the major drivers. As one of the largest consumers and producers of pre-packaged snacks, frozen food, and ready-to-eat food, the USA needs sophisticated food safety solutions to keep pace with more stringent FDA and USDA regulations.

Food manufacturers are turning to automated microbial risk assessment technology and blockchain traceability systems to catch up. The increase in contamination cases, especially Listeria and Salmonella, has prompted the use of next-generation sequencing and biosensor technology. Also, the move towards clean-label, preservative-free foods presents new microbial safety issues, further requiring new, non-invasive pathogen detection technologies.

The UK is anticipated to grow to a CAGR of 8.3%, with growth fueled by increasing adoption of on-site portable testing kits, primarily in meat and dairy. Post-Brexit food safety has sped up to a quicker implementation rate of fast on-site testing compared to reliant lab work for real-time detection of pathogens. Meat and dairy plants are also increasingly implementing lateral flow immunoassays and field-use PCR kits to avoid microbial contamination.

The nation has seen increased interest in controlling Campylobacter in poultry and Listeria in milk products and dairy, driven by high traceability requirements and web-based food safety technology. Smart lab automation and cloud-based microbial traceability solutions facilitate greater contamination control, keeping with the UK's food safety regulatory needs.

France is expected to grow at an 8.2% CAGR. Due to stringent food safety protocols in the country, there has been an increase in the adoption of sophisticated microbial testing technologies by the dairy and bakery sectors. In the event of coli and Salmonella outbreaks, there is growing demand for precision pathogen detection technology.

The French food industry is relying on enzyme-linked immunosorbent assays (ELISA) and mass spectrometry-based bacterial profiling to improve microbial identification. Moreover, the organic food production trend has triggered demand for non-chemical testing methods that provide safety without reducing the quality of foods. The use of automated laboratory testing machines and electronic monitoring of contaminations is also enhancing food safety compliance throughout the nation.

Germany is likely to see growth at 8.1% CAGR, driven by innovation in fermentation-based pathogen detection for plant proteins. As plant-based meats, cultured dairy foods, and precision-fermented foods are growing, specialized microbial analysis is gaining traction. As opposed to conventional animal-based foods, alternative proteins are vulnerable to yeast, mold, and bacterial contamination, making customized safety measures necessary.

Regulators in Germany have also strengthened microbiological testing mandates, leading to more utilization of genetic marker-based pathogen detection and artificial intelligence-enabled microbial risk prediction. Demand for green environmental food production has also spurred next-generation sequencing and biosensor-enabled testing applications with the aim of maintaining high levels of food safety in Germany.

Italy will have a CAGR of 8.0% since Italy is dependent on premium food exports and boasts a booming tourism sector. The growing need for microbiological safety in seafood, dairy products, and processed meats has compelled the use of rapid testing technology. The regulatory authorities in Italy for food safety are investing in advanced contamination monitoring tools to meet rigorous European requirements.

Moreover, the growing demand for minimally processed food products and artisanal foods has fueled the demand for chemical-free pathogen testing methods. Growing demand for sophisticated food safety analytics in the nation allows manufacturers to explore contamination risk more effectively.

South Korea is expected to progress at a CAGR of 8.4% due to the country's emphasis on the safety of its packaged foods, fermented foods, and seafood. The government's high food safety standards have led to the augmented use of fast pathogen detection technologies such as immunoassay-based test kits and biosensors.

Due to the vast consumption of kimchi and fermented soy products, the risk of microbial contamination has resulted in the adoption of smart microbial surveillance systems. The demand for export-quality food safety analysis has also driven South Korean producers to invest in digital traceability technology alongside AI-based contamination detection devices.

Japan is set to increase at an 8.3% CAGR in the forecast period since Japan focuses additional attention on elevated food safety measures. Foodborne disease has been on the rise in Japan, and therefore, government-regulated pathogen testing of meat, seafood, and processed food has increased.

Automated microbial screening platforms and real-time PCR have enhanced food safety surveillance. Moreover, Japan's consumer preference for convenience and minimally processed foods has enhanced the emphasis on contamination control procedures. Implementation of blockchain-enabled food traceability and AI-powered predictive contamination analysis is also further strengthening the country's pathogen testing leadership.

China is projected to develop at a CAGR of 8.6%, the fastest among the nations in this report. The nation has experienced a string of prominent food safety mishaps, forcing regulatory agencies to implement stricter microbial testing guidelines.

AI-based detection of pathogens in poultry, seafood, and processed foods is quickly gaining ground. China's food industry is investing heavily in cutting-edge microbial screening technology like biosensors and genetic sequencing. Growth in food exports has also facilitated the use of globally accepted practices for pathogen testing in compliance with global food safety regulations.

Australia is expected to grow at a CAGR of 8.2% with the government's strong efforts in controlling the risk of Salmonella and E. coli contamination. The government has strengthened the regulations on microbial testing across the meat, dairy, and seafood sectors. Rapid testing kits and automated pathogen detection technologies are widely used to ensure compliance with food safety regulations.

The increasing demand for organic and clean-label food has also led to the uptake of chemical-free technologies for pathogen detection, boosting the confidence level of consumers about food safety.

New Zealand is projected to grow with a CAGR of 8.1% during the forecast period. As one of the largest exporters of seafood, meat, and dairy products, New Zealand is concerned with rigorous food safety controls to maintain its reputation in foreign industries.

Advanced microbial testing, such as PCR and biosensor detection, has enhanced the prevention of contamination. New Zealand's emphasis on sustainable food production while ensuring that food quality is upheld at a minimum has spurred increased investment in non-destructive food quality inspection technology.

Globally, there is a rapid pace of growth currently, and all these factors are triggering concerns related to foodborne diseases and stricter regulatory compliance. The rise in consumer awareness and the complex nature of the global food trade are driving new demands for advanced pathogen detection solutions.

Top players in the market include Eurofins Scientific, SGS SA, Bureau Veritas, Intertek Group, and Neogen Corporation. These firms utilize state-of-the-art testing techniques such as PCR-based detection, immunoassays, and next-generation sequencing. These firms focus their efforts on high-throughput testing capability and automation, as well as AI-led analytics, which increase accuracy and efficiency overall.

Thus, the growth in market progress results primarily from increased regulatory scrutiny, improvements in rapid detection methods, and the desire for real-time monitoring of food production and distribution networks. The latter seems to strengthen movements toward point-of-care testing and mobile pathogen detection.

The importance assigned to mergers and acquisitions, the expansion of laboratory networks, and partnerships with food producers in efforts to attract customized safety programs largely shape the competition. Also, investment in AI-powered diagnostics, blockchain for traceability, and predictive analytics are contributing to the transformation in this competitive environment of lively and sound solutions for food safety.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Eurofins Scientific | 20-24% |

| SGS SA | 15-19% |

| Bureau Veritas | 12-16% |

| Intertek Group | 10-14% |

| Neogen Corporation | 8-12% |

| Other Companies (Combined) | 20-30% |

| Company Name | Key Offerings & Activities |

|---|---|

| Eurofins Scientific | Leading global provider of comprehensive pathogen testing services, leveraging cutting-edge molecular diagnostic techniques. |

| SGS SA | Specializes in regulatory compliance testing, food safety audits, and rapid detection solutions. |

| Bureau Veritas | Offers microbiological and chemical food safety testing with an emphasis on global regulatory compliance. |

| Intertek Group | Provides advanced pathogen detection solutions, including PCR-based and ELISA technologies. |

| Neogen Corporation | Focuses on rapid food safety testing solutions, including lateral flow and DNA-based pathogen detection. |

Key Company Insights

Eurofins Scientific (20-24%)

As a global leader, Eurofins Scientific consistently enhances its capabilities through acquisitions and investment in innovative pathogen detection methodologies, including PCR and whole-genome sequencing.

SGS SA (15-19%)

SGS provides complete food safety solutions by partnering with food producers and retailers to ensure compliance with international food safety regulations.

Bureau Veritas (12-16%)

Bureau Veritas's role has enabled it to procure more microbiological testing services in the market and enhanced its marketing role to include rapid screening technologies for pathogens.

Intertek Group (10-14%)

The advanced laboratory infrastructure and food pathogen risk assessment investment have certainly helped Intertek enhance its global presence.

Neogen Corporation (8-12%)

Neogen Corporation is a leading entity in rapid food pathogen testing with fast turnaround detection kits and diagnostic solutions.

Other Key Players

The segmentation is into Food Pathogen Testing for E. coli contamination, Salmonella Contamination, Listeria Contamination, Campylobacter Contamination, Pesticide Contamination, Genetically Modified Contamination, Toxin Contamination, and Other Contamination.

This segmentation is into Food Pathogen Testing by Conventional Methods (further categorized into Agar Culturing Technology, Polymerase Chain Reaction (PCR) Technology, and Other Technologies) and by Rapid Methods (further categorized into Biosensor-Based Technology, Immunological-Based Technology, and Other Technologies).

This segment is further categorized into food pathogen testing for fruits and vegetables, grains and cereals, processed foods, dairy products, meat, poultry and seafood products, and other products.

The report covers North America, Latin America, Eastern Europe, Western Europe, East Asia, South Asia and the Pacific, Central Asia, Balkan and Baltic Countries, Russia and Belarus, and the Middle East and Africa.

The industry is slated to reach USD 23.5 billion in 2025.

The industry is predicted to reach a size of USD 55.8 billion by 2035.

Key companies include Eurofins Scientific, SGS SA, Bureau Veritas, Intertek Group, Neogen Corporation, 3M Food Safety, Microbac Laboratories, Romer Labs, Bio-Rad Laboratories, and Charm Sciences.

China, slated to grow at 8.6% CAGR during the forecast period, is poised for the fastest growth.

Meat and Poultry testing is among the most widely used segments.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Contaminant, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 4: Global Market Value (US$ Million) Forecast by Food Type, 2018 to 2033

Table 5: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by Contaminant, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 8: North America Market Value (US$ Million) Forecast by Food Type, 2018 to 2033

Table 9: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: Latin America Market Value (US$ Million) Forecast by Contaminant, 2018 to 2033

Table 11: Latin America Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 12: Latin America Market Value (US$ Million) Forecast by Food Type, 2018 to 2033

Table 13: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Europe Market Value (US$ Million) Forecast by Contaminant, 2018 to 2033

Table 15: Europe Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 16: Europe Market Value (US$ Million) Forecast by Food Type, 2018 to 2033

Table 17: South Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: South Asia Market Value (US$ Million) Forecast by Contaminant, 2018 to 2033

Table 19: South Asia Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 20: South Asia Market Value (US$ Million) Forecast by Food Type, 2018 to 2033

Table 21: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: East Asia Market Value (US$ Million) Forecast by Contaminant, 2018 to 2033

Table 23: East Asia Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 24: East Asia Market Value (US$ Million) Forecast by Food Type, 2018 to 2033

Table 25: Oceania Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Oceania Market Value (US$ Million) Forecast by Contaminant, 2018 to 2033

Table 27: Oceania Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 28: Oceania Market Value (US$ Million) Forecast by Food Type, 2018 to 2033

Table 29: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 30: MEA Market Value (US$ Million) Forecast by Contaminant, 2018 to 2033

Table 31: MEA Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 32: MEA Market Value (US$ Million) Forecast by Food Type, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Contaminant, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Technology, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Food Type, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Contaminant, 2018 to 2033

Figure 9: Global Market Value Share (%) and BPS Analysis by Contaminant, 2023 to 2033

Figure 10: Global Market Y-o-Y Growth (%) Projections by Contaminant, 2023 to 2033

Figure 11: Global Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Food Type, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Food Type, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Food Type, 2023 to 2033

Figure 17: Global Market Attractiveness by Contaminant, 2023 to 2033

Figure 18: Global Market Attractiveness by Technology, 2023 to 2033

Figure 19: Global Market Attractiveness by Food Type, 2023 to 2033

Figure 20: Global Market Attractiveness by Region, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Contaminant, 2023 to 2033

Figure 22: North America Market Value (US$ Million) by Technology, 2023 to 2033

Figure 23: North America Market Value (US$ Million) by Food Type, 2023 to 2033

Figure 24: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 25: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 26: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 27: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 28: North America Market Value (US$ Million) Analysis by Contaminant, 2018 to 2033

Figure 29: North America Market Value Share (%) and BPS Analysis by Contaminant, 2023 to 2033

Figure 30: North America Market Y-o-Y Growth (%) Projections by Contaminant, 2023 to 2033

Figure 31: North America Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 34: North America Market Value (US$ Million) Analysis by Food Type, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Food Type, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Food Type, 2023 to 2033

Figure 37: North America Market Attractiveness by Contaminant, 2023 to 2033

Figure 38: North America Market Attractiveness by Technology, 2023 to 2033

Figure 39: North America Market Attractiveness by Food Type, 2023 to 2033

Figure 40: North America Market Attractiveness by Country, 2023 to 2033

Figure 41: Latin America Market Value (US$ Million) by Contaminant, 2023 to 2033

Figure 42: Latin America Market Value (US$ Million) by Technology, 2023 to 2033

Figure 43: Latin America Market Value (US$ Million) by Food Type, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 45: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Contaminant, 2018 to 2033

Figure 49: Latin America Market Value Share (%) and BPS Analysis by Contaminant, 2023 to 2033

Figure 50: Latin America Market Y-o-Y Growth (%) Projections by Contaminant, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 52: Latin America Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 53: Latin America Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 54: Latin America Market Value (US$ Million) Analysis by Food Type, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Food Type, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Food Type, 2023 to 2033

Figure 57: Latin America Market Attractiveness by Contaminant, 2023 to 2033

Figure 58: Latin America Market Attractiveness by Technology, 2023 to 2033

Figure 59: Latin America Market Attractiveness by Food Type, 2023 to 2033

Figure 60: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 61: Europe Market Value (US$ Million) by Contaminant, 2023 to 2033

Figure 62: Europe Market Value (US$ Million) by Technology, 2023 to 2033

Figure 63: Europe Market Value (US$ Million) by Food Type, 2023 to 2033

Figure 64: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 65: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 66: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 67: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 68: Europe Market Value (US$ Million) Analysis by Contaminant, 2018 to 2033

Figure 69: Europe Market Value Share (%) and BPS Analysis by Contaminant, 2023 to 2033

Figure 70: Europe Market Y-o-Y Growth (%) Projections by Contaminant, 2023 to 2033

Figure 71: Europe Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 72: Europe Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 73: Europe Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 74: Europe Market Value (US$ Million) Analysis by Food Type, 2018 to 2033

Figure 75: Europe Market Value Share (%) and BPS Analysis by Food Type, 2023 to 2033

Figure 76: Europe Market Y-o-Y Growth (%) Projections by Food Type, 2023 to 2033

Figure 77: Europe Market Attractiveness by Contaminant, 2023 to 2033

Figure 78: Europe Market Attractiveness by Technology, 2023 to 2033

Figure 79: Europe Market Attractiveness by Food Type, 2023 to 2033

Figure 80: Europe Market Attractiveness by Country, 2023 to 2033

Figure 81: South Asia Market Value (US$ Million) by Contaminant, 2023 to 2033

Figure 82: South Asia Market Value (US$ Million) by Technology, 2023 to 2033

Figure 83: South Asia Market Value (US$ Million) by Food Type, 2023 to 2033

Figure 84: South Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 85: South Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 86: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 87: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 88: South Asia Market Value (US$ Million) Analysis by Contaminant, 2018 to 2033

Figure 89: South Asia Market Value Share (%) and BPS Analysis by Contaminant, 2023 to 2033

Figure 90: South Asia Market Y-o-Y Growth (%) Projections by Contaminant, 2023 to 2033

Figure 91: South Asia Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 92: South Asia Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 93: South Asia Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 94: South Asia Market Value (US$ Million) Analysis by Food Type, 2018 to 2033

Figure 95: South Asia Market Value Share (%) and BPS Analysis by Food Type, 2023 to 2033

Figure 96: South Asia Market Y-o-Y Growth (%) Projections by Food Type, 2023 to 2033

Figure 97: South Asia Market Attractiveness by Contaminant, 2023 to 2033

Figure 98: South Asia Market Attractiveness by Technology, 2023 to 2033

Figure 99: South Asia Market Attractiveness by Food Type, 2023 to 2033

Figure 100: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 101: East Asia Market Value (US$ Million) by Contaminant, 2023 to 2033

Figure 102: East Asia Market Value (US$ Million) by Technology, 2023 to 2033

Figure 103: East Asia Market Value (US$ Million) by Food Type, 2023 to 2033

Figure 104: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 105: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 106: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 107: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 108: East Asia Market Value (US$ Million) Analysis by Contaminant, 2018 to 2033

Figure 109: East Asia Market Value Share (%) and BPS Analysis by Contaminant, 2023 to 2033

Figure 110: East Asia Market Y-o-Y Growth (%) Projections by Contaminant, 2023 to 2033

Figure 111: East Asia Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 112: East Asia Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 113: East Asia Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 114: East Asia Market Value (US$ Million) Analysis by Food Type, 2018 to 2033

Figure 115: East Asia Market Value Share (%) and BPS Analysis by Food Type, 2023 to 2033

Figure 116: East Asia Market Y-o-Y Growth (%) Projections by Food Type, 2023 to 2033

Figure 117: East Asia Market Attractiveness by Contaminant, 2023 to 2033

Figure 118: East Asia Market Attractiveness by Technology, 2023 to 2033

Figure 119: East Asia Market Attractiveness by Food Type, 2023 to 2033

Figure 120: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 121: Oceania Market Value (US$ Million) by Contaminant, 2023 to 2033

Figure 122: Oceania Market Value (US$ Million) by Technology, 2023 to 2033

Figure 123: Oceania Market Value (US$ Million) by Food Type, 2023 to 2033

Figure 124: Oceania Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: Oceania Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 127: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 128: Oceania Market Value (US$ Million) Analysis by Contaminant, 2018 to 2033

Figure 129: Oceania Market Value Share (%) and BPS Analysis by Contaminant, 2023 to 2033

Figure 130: Oceania Market Y-o-Y Growth (%) Projections by Contaminant, 2023 to 2033

Figure 131: Oceania Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 132: Oceania Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 133: Oceania Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 134: Oceania Market Value (US$ Million) Analysis by Food Type, 2018 to 2033

Figure 135: Oceania Market Value Share (%) and BPS Analysis by Food Type, 2023 to 2033

Figure 136: Oceania Market Y-o-Y Growth (%) Projections by Food Type, 2023 to 2033

Figure 137: Oceania Market Attractiveness by Contaminant, 2023 to 2033

Figure 138: Oceania Market Attractiveness by Technology, 2023 to 2033

Figure 139: Oceania Market Attractiveness by Food Type, 2023 to 2033

Figure 140: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 141: MEA Market Value (US$ Million) by Contaminant, 2023 to 2033

Figure 142: MEA Market Value (US$ Million) by Technology, 2023 to 2033

Figure 143: MEA Market Value (US$ Million) by Food Type, 2023 to 2033

Figure 144: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 145: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 146: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 147: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 148: MEA Market Value (US$ Million) Analysis by Contaminant, 2018 to 2033

Figure 149: MEA Market Value Share (%) and BPS Analysis by Contaminant, 2023 to 2033

Figure 150: MEA Market Y-o-Y Growth (%) Projections by Contaminant, 2023 to 2033

Figure 151: MEA Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 152: MEA Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 153: MEA Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 154: MEA Market Value (US$ Million) Analysis by Food Type, 2018 to 2033

Figure 155: MEA Market Value Share (%) and BPS Analysis by Food Type, 2023 to 2033

Figure 156: MEA Market Y-o-Y Growth (%) Projections by Food Type, 2023 to 2033

Figure 157: MEA Market Attractiveness by Contaminant, 2023 to 2033

Figure 158: MEA Market Attractiveness by Technology, 2023 to 2033

Figure 159: MEA Market Attractiveness by Food Type, 2023 to 2033

Figure 160: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Food Grade Crosslinked Polyvinylpolypyrrolidone (PVPP) Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Cassia Gum Powder Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Dry Film Lubricant Market Size and Share Forecast Outlook 2025 to 2035

Foodservice Equipment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Food Basket Market Forecast and Outlook 2025 to 2035

Food Grade Tremella Polysaccharide Market Size and Share Forecast Outlook 2025 to 2035

Food Sorting Machine Market Size and Share Forecast Outlook 2025 to 2035

Foodservice Paper Bag Market Size and Share Forecast Outlook 2025 to 2035

Food Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Food Packaging Film Market Size and Share Forecast Outlook 2025 to 2035

Food Certification Market Size and Share Forecast Outlook 2025 to 2035

Food Tray Market Size and Share Forecast Outlook 2025 to 2035

Food & Beverage Industrial Disinfection and Cleaning Market Size and Share Forecast Outlook 2025 to 2035

Food Technology Market Size and Share Forecast Outlook 2025 to 2035

Food Tourism Sector Market Size and Share Forecast Outlook 2025 to 2035

Food Processing Boiler Market Size and Share Forecast Outlook 2025 to 2035

Food Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Food Minerals Market Size and Share Forecast Outlook 2025 to 2035

Food And Beverage Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Food and Beverage Industry Software Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA