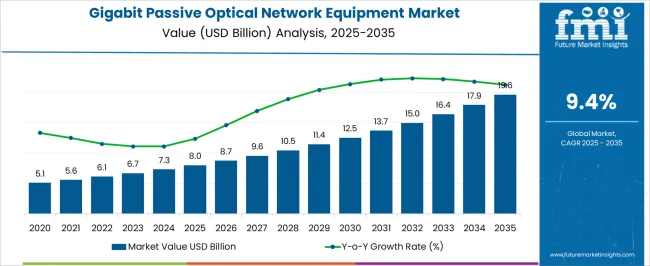

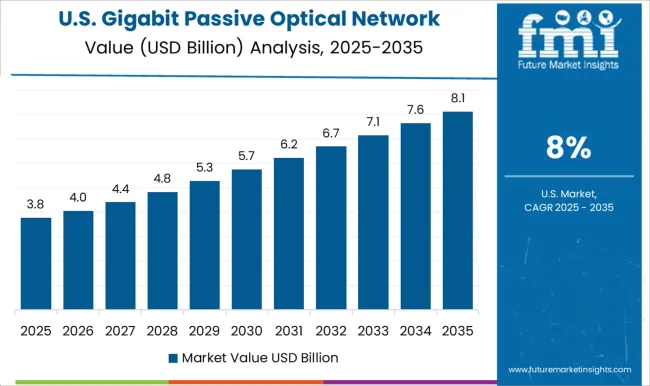

The Gigabit Passive Optical Network Equipment Market is estimated to be valued at USD 8.0 billion in 2025 and is projected to reach USD 19.6 billion by 2035, registering a compound annual growth rate (CAGR) of 9.4% over the forecast period. During the early adoption phase (2020–2024), the market expanded from USD 5.1 billion to USD 7.3 billion as telecom operators and internet service providers began investing in fiber-optic infrastructure to meet rising broadband demand. Early adopters focused on pilot deployments in urban centers and high-demand regions, seeking faster, more reliable connectivity. Market growth was initially limited by high capital expenditure, network integration challenges, and gradual awareness of GPON’s operational advantages.

From 2025 to 2030, the market enters a scaling phase, with revenues rising from USD 8.0 billion to approximately USD 12.5 billion. Adoption accelerated due to government initiatives promoting fiber broadband, increasing consumer demand for high-speed internet, and falling equipment costs. Telecom operators expanded deployments to suburban and semi-urban areas, while upgrades to existing networks enabled higher bandwidth capacity, driving strong market momentum. Between 2030 and 2035, the market transitions into consolidation, reaching USD 19.6 billion by 2035. Leading equipment vendors strengthened market positions through strategic partnerships, product standardization, and incremental innovations in network efficiency, bandwidth management, and integration capabilities. Growth stabilized as GPON technology became mainstream, reflecting a mature, competitive, and technologically advanced broadband infrastructure landscape.

| Metric | Value |

|---|---|

| Gigabit Passive Optical Network Equipment Market Estimated Value in (2025 E) | USD 8.0 billion |

| Gigabit Passive Optical Network Equipment Market Forecast Value in (2035 F) | USD 19.6 billion |

| Forecast CAGR (2025 to 2035) | 9.4% |

Government-led initiatives promoting fiber-to-the-premises connectivity in both urban and rural areas are further accelerating deployments. Equipment vendors are scaling production of interoperable, cost-effective hardware to support bandwidth-hungry applications across residential, commercial, and industrial zones. Adoption of fiber as a long-term infrastructure asset is increasing, with telecom operators prioritizing GPON systems for scalability, low latency, and high reliability.

Shifts toward cloud computing, 4K/8K streaming, and IoT-based smart city development are fueling technology upgrades to next-generation variants. Demand is expected to intensify as digital transformation agendas push toward full-fiber migration and convergence of fixed and mobile broadband services.

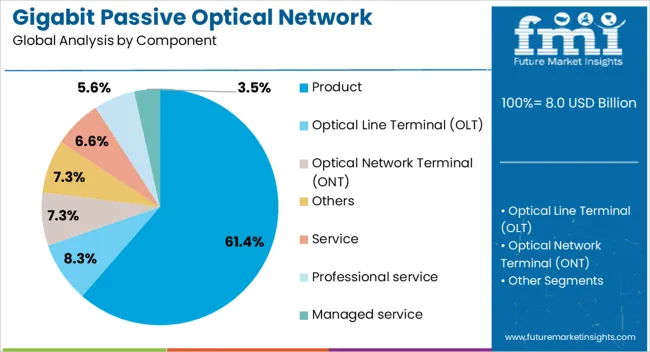

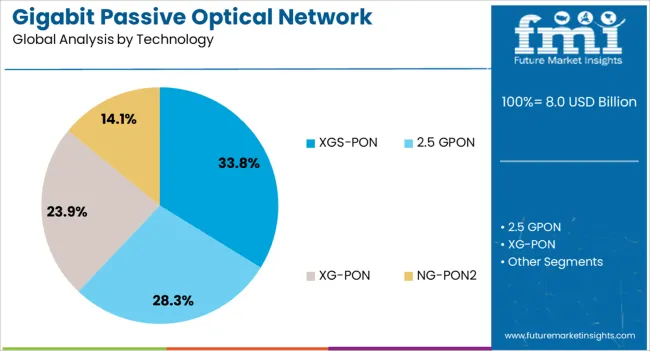

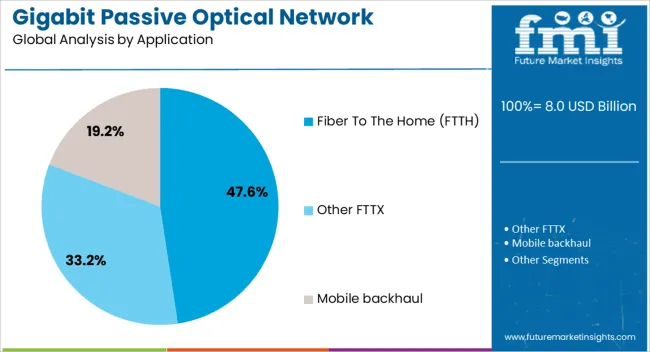

The gigabit passive optical network equipment market is segmented by component, technology, application, end use, and geographic regions. By component, the gigabit passive optical network equipment market is divided into Product, Optical Line Terminal (OLT), Optical Network Terminal (ONT), Others, Service, Professional service, and Managed service. In terms of technology, the gigabit passive optical network equipment market is classified into XGS-PON, 2.5 GPON, XG-PON, and NG-PON2. Based on the application, the gigabit passive optical network equipment market is segmented into Fiber To The Home (FTTH), Other FTTX, and Mobile backhaul. The gigabit passive optical network equipment market is segmented by end use into Residential and Business. Regionally, the gigabit passive optical network equipment industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The product segment is projected to lead the GPON equipment market with a 61.40% revenue share in 2025. This leadership is being attributed to the widespread deployment of Optical Line Terminals (OLTs), Optical Network Terminals (ONTs), and splitters required to build core passive optical infrastructure.

Continuous upgrades and demand for high-capacity ports, along with modular configurations, are reinforcing growth in this category. Network operators are expanding last-mile fiber coverage to meet subscriber bandwidth expectations, which has led to accelerated procurement of hardware products.

The shift from copper-based networks to fiber-optic systems is further increasing reliance on robust, scalable GPON components. Enhanced interoperability with emerging technologies and integration of monitoring systems are making these products more efficient and adaptable, sustaining their dominant market position.

XGS-PON technology is expected to contribute 33.80% of the total revenue share in 2025, establishing it as the leading GPON variant. This growth is being driven by the need for symmetric 10 Gbps speeds to support bandwidth-heavy services across enterprises, smart homes, and connected cities.

XGS-PON enables seamless scalability and coexistence with legacy GPON networks, allowing operators to upgrade without replacing entire infrastructures. Increased demand for low-latency connectivity to power cloud applications, UHD content delivery, and remote working tools has amplified its adoption.

Carriers are prioritizing XGS-PON due to its higher capacity and long-term cost efficiency, particularly in regions undergoing digital ecosystem expansion. As data demand outpaces legacy capabilities, XGS-PON continues to be deployed as a future-ready access solution.

Fiber To The Home (FTTH) is forecast to dominate the application segment with a 47.60% revenue share in 2025. This segment’s strength stems from growing consumer expectations for uninterrupted high-speed internet, driven by work-from-home culture, e-learning, and streaming media.

National broadband programs and private investments are facilitating last-mile fiber rollouts, directly benefiting FTTH installations. Telecom operators are deploying GPON architecture to reach residential customers more cost-effectively while improving service quality.

Increasing use of smart home devices and real-time entertainment platforms has created a robust demand for high-throughput, low-latency connections. FTTH is further supported by regulatory mandates encouraging digital inclusion and network modernization, reinforcing its position as the preferred application for GPON infrastructure deployment.

The GPON equipment market is growing rapidly as telecom operators and enterprises seek high-speed, reliable broadband solutions. GPON enables gigabit-level data transmission over fiber networks, supporting residential, commercial, and industrial connectivity needs. Increasing internet penetration, cloud adoption, and demand for bandwidth-intensive applications drive expansion. Service providers invest in fiber-to-the-home (FTTH) and fiber-to-the-building (FTTB) deployments, while manufacturers focus on scalable, energy-efficient, and compact GPON solutions. Rising digital communication requirements and infrastructure modernization initiatives globally continue to propel the market forward.

Fiber optic infrastructure expansion is the main driver for GPON equipment adoption. Telecom operators are deploying GPON in residential areas, enterprise campuses, and smart city projects to meet growing demand for high-speed internet. The scalability of GPON networks allows operators to upgrade bandwidth without overhauling existing infrastructure. Governments in developing and developed regions support fiber rollout through policy incentives and funding, accelerating market growth. As fiber coverage increases, demand for GPON optical line terminals (OLTs), optical network units (ONUs), and associated splitters continues to rise, providing seamless broadband connectivity for multiple end-users.

Manufacturers focus on reducing energy consumption and improving space efficiency in GPON equipment. Compact OLTs and ONUs simplify deployment in dense urban and enterprise environments, minimizing operational complexity. Enhanced signal quality, low latency, and support for multiple service types including voice, video, and data enhance network reliability. Efficient designs also reduce maintenance requirements and operational costs for service providers. These benefits appeal to telecom operators aiming to expand network reach while keeping capital and operating expenditures manageable. High-performance, compact, and energy-conscious equipment becomes a key differentiator in a competitive GPON market.

Residential broadband demand, driven by video streaming, online gaming, and remote work, supports GPON market growth. Simultaneously, enterprises require high-speed, secure, and reliable connectivity for cloud services, virtual meetings, and IoT applications. GPON networks provide a cost-effective solution by enabling multiple endpoints on a single fiber infrastructure, reducing deployment costs compared to traditional point-to-point networks. The convergence of residential and enterprise requirements pushes service providers to invest in next-generation GPON deployments, ensuring sufficient bandwidth, performance, and scalability. This multi-segment demand reinforces the adoption of GPON solutions globally.

Telecom operators are actively upgrading legacy copper-based networks to fiber-optic infrastructure to meet growing consumer expectations for high-speed connectivity. Investments in GPON networks reduce long-term maintenance costs, improve data transmission reliability, and support future bandwidth demands. Collaborative efforts between equipment manufacturers and service providers help in testing, deployment, and standardization, accelerating market penetration. Regions focusing on digital inclusion initiatives and smart city projects create significant growth opportunities for GPON equipment. As network upgrades continue worldwide, demand for GPON OLTs, ONUs, and splitters will rise steadily, ensuring continuous market expansion.

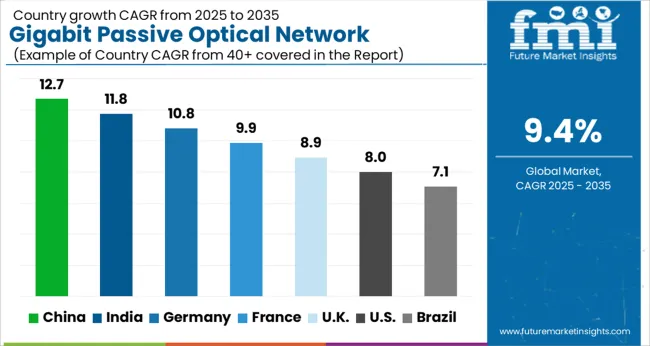

The global gigabit passive optical network (GPON) equipment market is projected to grow at a CAGR of 9.4%, driven by rising demand for high-speed internet, digital infrastructure, and telecom network expansion. China leads with a growth rate of 13%, supported by extensive fiber-optic deployments and smart city initiatives. India follows at 12%, fueled by rapid broadband penetration and government-backed digital infrastructure projects. Germany shows steady growth at 11%, leveraging advanced telecom networks and enterprise adoption. The UK and USA record growth rates of 9% and 8%, respectively, reflecting ongoing network modernization and increasing demand for high-speed connectivity. This report includes insights on 40+ countries; the top countries are shown here for reference.

China dominates the GPON equipment market with a 13% growth rate. Expanding broadband infrastructure, increasing fiber-to-the-home (FTTH) deployments, and government initiatives to enhance digital connectivity drive demand. Telecom operators are investing in high-speed networks to support 5G rollouts, smart city projects, and enterprise applications. Advanced GPON equipment provides high bandwidth, low latency, and reliability. Manufacturers are focusing on scalable, cost-effective, and energy-efficient solutions. The growing demand for remote work, online education, and cloud services further fuels market adoption. Strategic collaborations between domestic and international technology providers strengthen market presence. Continuous technological innovation in optical networking maintains competitive advantage and drives faster adoption rates.

India’s GPON market grows at 12%, supported by government initiatives for nationwide broadband connectivity and smart city projects. Telecom service providers are heavily investing in optical fiber networks to meet rising internet demand. The adoption of high-speed data services, cloud-based applications, and digital learning drives market growth. Suppliers are focusing on scalable, reliable, and cost-effective GPON solutions for diverse deployment scenarios. Strategic partnerships with global technology providers enhance market penetration. The expansion of enterprise networks and digital infrastructure further supports growth. Increasing consumer demand for seamless connectivity strengthens adoption in both residential and commercial segments.

GPON equipment market in Germany is expanding at 11%, fueled by digital infrastructure upgrades and government support for high-speed broadband. Telecom operators are investing in GPON systems to improve urban and rural connectivity. Energy-efficient, scalable, and high-capacity optical network solutions are driving adoption. Integration with 5G networks and enterprise solutions enhances market growth. Manufacturers focus on quality, reliability, and advanced technological features. Smart city initiatives and growing cloud service usage reinforce network expansion. Collaboration between European suppliers and technology providers ensures seamless deployment. Rising residential and commercial internet requirements accelerate GPON adoption across Germany.

The UK GPON market grows at 9%, driven by broadband expansion, urban fiber deployments, and increased demand for high-speed connectivity. Telecom providers invest in scalable, reliable, and energy-efficient GPON systems for residential and commercial users. Cloud services, remote work, and smart infrastructure increase adoption. Strategic partnerships with international suppliers strengthen market presence. Government initiatives to improve internet accessibility further support market growth. Continuous fiber network upgrades enhance capacity and reliability. Operators focus on advanced GPON solutions to maintain competitive advantage and meet rising consumer expectations.

The USA GPON market is growing at 8%, supported by expanding broadband networks, 5G integration, and enterprise connectivity solutions. Telecom operators and ISPs invest in reliable and scalable GPON equipment to deliver high-speed, low-latency services. Growing residential and commercial demand for cloud computing, streaming, and online education boosts market growth. Equipment manufacturers focus on advanced technology, quality, and seamless network integration. Smart city projects and government broadband programs encourage network expansion. Rising internet penetration and digital transformation across sectors strengthen the adoption of GPON solutions.

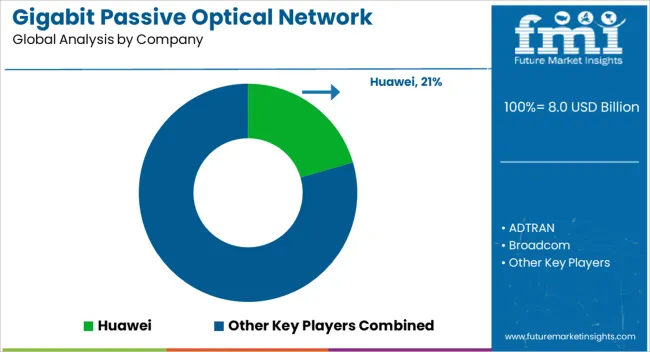

The Gigabit Passive Optical Network (GPON) Equipment Market is witnessing substantial growth as global demand for high-speed broadband and fiber-to-the-home (FTTH) solutions accelerates. GPON technology enables efficient, scalable, and high-bandwidth data transmission over optical fibers, supporting the surge in internet traffic, streaming services, cloud applications, and smart city initiatives. The increasing deployment of next-generation networks by telecom operators and service providers is driving the adoption of GPON equipment worldwide. Key players in this market include Huawei, a leading provider of comprehensive GPON solutions and end-to-end optical networking technologies, and ADTRAN, known for its scalable and cost-effective fiber access solutions.

Broadcom delivers advanced semiconductor components that power GPON systems, while Calix focuses on software-defined access networks and cloud-managed GPON platforms. Cisco provides high-performance GPON equipment integrated with enterprise and service provider networks. DASAN Zhone Solutions, Ericsson, NEC, and Nokia offer robust GPON solutions tailored for telecom operators and large-scale deployments, enhancing network reliability and efficiency. Additionally, Verizon represents an example of service providers actively deploying GPON networks to meet growing subscriber demands. Market trends include the integration of GPON with next-generation PON technologies, enhanced network management software, and support for ultra-broadband applications such as 4K/8K streaming and IoT. The rising emphasis on fiber optic infrastructure, coupled with government initiatives promoting broadband connectivity, is expected to fuel market growth. As the demand for high-speed, reliable, and scalable broadband solutions continues to expand, the GPON equipment market is poised for significant global growth in the coming years.

| Item | Value |

|---|---|

| Quantitative Units | USD 8.0 Billion |

| Component | Product, Optical Line Terminal (OLT), Optical Network Terminal (ONT), Others, Service, Professional service, and Managed service |

| Technology | XGS-PON, 2.5 GPON, XG-PON, and NG-PON2 |

| Application | Fiber To The Home (FTTH), Other FTTX, and Mobile backhaul |

| End Use | Residential and Business |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Huawei, ADTRAN, Broadcom, Calix, Cisco, DASAN Zhone Solutions, Ericsson, NEC, Nokia, and Verizon |

| Additional Attributes | Dollar sales vary by type including optical line terminals, optical network units, and splitters, application across telecom operators, enterprises, and data centers, and region covering North America, Europe, and Asia-Pacific. Growth is driven by rising demand for high-speed broadband, expanding fiber optic infrastructure, and increasing adoption of next-generation network technologies. |

The global gigabit passive optical network equipment market is estimated to be valued at USD 8.0 billion in 2025.

The market size for the gigabit passive optical network equipment market is projected to reach USD 19.6 billion by 2035.

The gigabit passive optical network equipment market is expected to grow at a 9.4% CAGR between 2025 and 2035.

The key product types in gigabit passive optical network equipment market are product, optical line terminal (olt), optical network terminal (ont), others, service, professional service and managed service.

In terms of technology, xgs-pon segment to command 33.8% share in the gigabit passive optical network equipment market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Gigabit Interface Converter Market Size and Share Forecast Outlook 2025 to 2035

Gigabit Wi-Fi Access Point Market Analysis – Size, Trends & Forecast 2024-2034

Gigabit Passive Optical Network (GPON) Market Size and Share Forecast Outlook 2025 to 2035

Wireless Gigabit Market Growth - Trends & Industry Forecast 2025 to 2035

Passive and Interconnecting Electronic Components Market Size and Share Forecast Outlook 2025 to 2035

Passive Fire Protection Market Size and Share Forecast Outlook 2025 to 2035

Passive Fire Protection Materials Market Size and Share Forecast Outlook 2025 to 2035

Passive Infrared Sensor Market Size and Share Forecast Outlook 2025 to 2035

Passive Temperature-Controlled Packaging Solutions Market from 2024 to 2034

Passive Prosthetics Market

Passive Tunable Integrated Circuits Market

Passive Optical Components Market Size and Share Forecast Outlook 2025 to 2035

Passive Optical Network Market Size and Share Forecast Outlook 2025 to 2035

Integrated Passive Devices (IPDs) Market

Equipment Management Software Market Size and Share Forecast Outlook 2025 to 2035

Equipment cases market Size and Share Forecast Outlook 2025 to 2035

Golf Equipment Market Size and Share Forecast Outlook 2025 to 2035

Port Equipment Market Size and Share Forecast Outlook 2025 to 2035

Farm Equipment Market – Advanced Agricultural Machinery 2024-2034

Pouch Equipment Market Growth – Demand, Trends & Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA