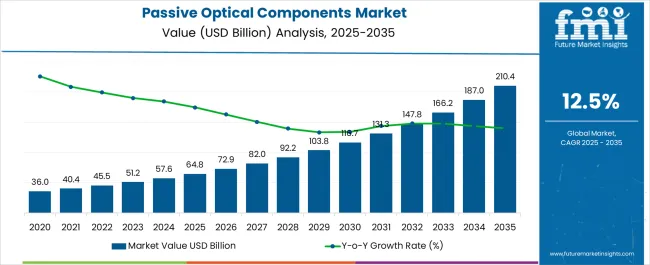

The Passive Optical Components Market is estimated to be valued at USD 64.8 billion in 2025 and is projected to reach USD 210.4 billion by 2035, registering a compound annual growth rate (CAGR) of 12.5% over the forecast period.

| Metric | Value |

|---|---|

| Passive Optical Components Market Estimated Value in (2025 E) | USD 64.8 billion |

| Passive Optical Components Market Forecast Value in (2035 F) | USD 210.4 billion |

| Forecast CAGR (2025 to 2035) | 12.5% |

The passive optical components market is experiencing steady expansion supported by rapid adoption of high speed internet services, growing demand for fiber to the home connectivity, and increased investments in advanced communication infrastructure. Rising data traffic volumes, driven by video streaming, cloud services, and enterprise digitalization, are accelerating the need for reliable and cost efficient passive optical solutions.

Technological advancements in optical cables, splitters, and connectors are enhancing signal quality, durability, and network efficiency. Regulatory encouragement for broadband penetration in emerging economies, coupled with government backed initiatives for smart city development, is further driving deployment.

The outlook remains positive as enterprises and telecom operators prioritize long term scalability, low latency, and sustainable energy efficient solutions that align with the digital transformation of industries worldwide.

The optical cables segment is projected to account for 48.70% of total revenue by 2025 within the component category, making it the leading segment. This dominance is attributed to the rapid expansion of high bandwidth services and the requirement for reliable infrastructure that supports long distance transmission with minimal signal loss.

Optical cables offer superior durability, scalability, and energy efficiency compared to traditional alternatives, which has positioned them as the backbone of modern communication networks. Their widespread use in broadband rollouts, enterprise connectivity, and high capacity data centers has strengthened market penetration.

As demand for seamless and high speed connectivity accelerates globally, optical cables continue to drive growth, securing their leading position in the component segment.

The interoffice application segment is expected to capture 46.20% of total revenue by 2025, making it the dominant application area. This growth is being driven by increasing demand for robust interoffice communication networks that ensure uninterrupted data transfer across multiple sites.

Enterprises and service providers are prioritizing interoffice connectivity to support unified communication, real time collaboration, and distributed data processing. Passive optical components enable reduced maintenance costs, improved energy efficiency, and higher reliability for these networks, which has reinforced their adoption.

As organizations expand geographically and data volumes grow, the role of interoffice optical networks becomes more critical, cementing this segment as the leading application area in the passive optical components market.

Future Market Insights, in its new report, mentioned that the global market for passive optical components exhibited a CAGR of 15.5% in the historical period from 2020 to 2024. It is anticipated to surge at a CAGR of 12.5% in the projected period from 2025 to 2035.

Governments are also implementing programs such as smart city initiatives with fiber-rich networks to facilitate the efficient flow of internet of things equipment. Utilities, including communication, water, surveillance, energy, wastewater management, and sewage can all be powered by technology thanks to fiber optic networks.

By 2050, the United Nation forecasts that more than 68% of the world's population will reside in urban areas. It will further encourage the development of additional smart city initiatives around the world. Owing to the aforementioned factors, sales of passive optical components are expected to skyrocket in the next ten years.

Rising Internet Penetration to Fuel Passive Fiber Splitter Sales

Passive optical components are the basic components of an optical network system. These components are widely used in fiber to the home networks in which video signals are generated with optical signals. These components are used in applications such as synchronous optical network (SONET), interoffice, hybrid fiber coaxial (HFC), loop feeder, fiber in the loop (FITL), and synchronous digital hierarchy (SDH).

Increasing penetration of telecom and internet services is likely to trigger the passive optical components demand worldwide. Need of high bandwidth by individuals for usage of internet would also create a rising demand of such components.

Ethernet passive optical network (EPON) equipment would also propel demand for data intensive applications such as voice over internet protocol, video on demand, and video conferencing. As per the Internet and Mobile Association of India-Kantar International Consortium of Universities for the Study of Biodiversity and the Environment (iCUBE) 2024, in 2024, there were 64.8 million active internet users in India. Till 2025, the number is expected to surge to be 900 million, up by 45%.

In passive optical network, there is a growing need to increase the speed, as well as efficiency of networks. Efforts are made to increase the existing gigabit Ethernet passive optical network from 2.5 Gbit/s and 1.25 Gbit/s to XGS-PON’s 10Gbit/s symmetric speeds. Rapid growth in consumer IP traffic is expected to stimulate expansion of components. For instance, global data volumes of consumer internet protocols (IP) in 2020 were 166 Exabyte per month and it expanded to become 211 Exabyte in 2024.

Despite the fact that passive optical components’ inherent configuration has numerous benefits, there are a few drawbacks as well. Disadvantages are not, however, large enough to dissuade one from selecting passive optical components as the ideal arrangement.

Information dissemination from the optical line terminal to various optical network termination points is one of the first drawbacks to be taken into account. A divisor reduces network efficiency since it sends information from the optical line terminal to every optical network termination linked to the same phase or dissemination tree.

Passive optical network architecture is also vulnerable to external sabotage in terms of security. The architecture of data transmission itself causes this issue. All communication is muted by the injection of steady light at a specific wavelength, and service generally declines.

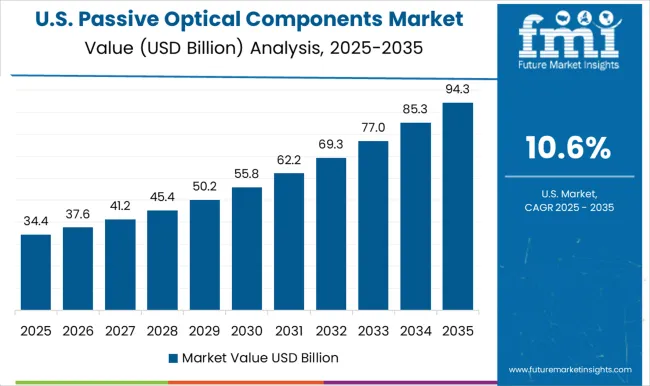

Need for High-speed Broadband Services in the USA to Push Passive Optical Receiver Sales

The USA passive optical components market is anticipated to reach a valuation of USD 210.4 billion by 2035. From 2025 to 2035, the market is likely to exhibit a CAGR of 11.3%, says Future Market Insights.

In February 2025, USA-based Calix Incorporation, a passive optical components and passive optical network manufacturer, for instance, announced that Lit Fiber has selected Intelligent Access EDGE.

It is powered by a network innovation platform in order to build 10G XGS-PON. The network is expected to deliver high-speed broadband services to over 500,000 houses by 2025. Such novel initiatives by renowned companies in the USA are likely to propel sales.

Government Investments to Install Broadband in the United Kingdom to Spur Passive Optical Networks Demand

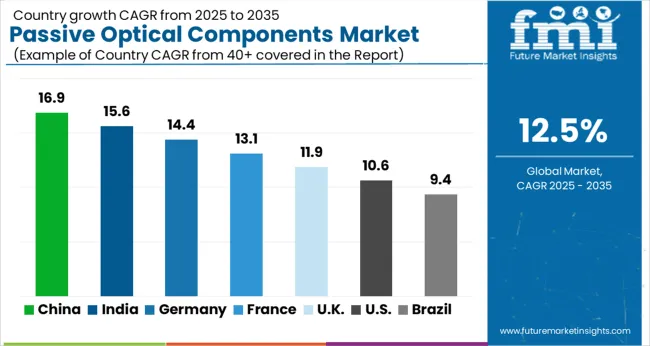

The United Kingdom passive optical components market is expected to surge at a CAGR of 11.7% from 2025 to 2035. It is likely to reach a valuation of USD 7.4 billion by 2035 and create an incremental opportunity of USD 5.0 billion in the forecast period.

In August 2024, government of the United Kingdom announced that it has planned to fund USD 36 billion of public investment for public gigabit broadband for people in the country. Through this initiative, half a million premises have received connections to broadband since 2020. Almost 26% of houses and business have access to gigabit service in the United Kingdom.

Installation of Passive Optical Devices in China to Surge amid Need for Lowering Risk of Electric Sparks

China passive optical components market is expected to be worth USD 13.2 billion by 2035. It is set to create an absolute dollar opportunity of USD 36 billion in the estimated time frame. Passive optical components industry in China has surged at a CAGR of 17.1% from 2020 to 2024. It is expected to escalate at a CAGR of 13.5% from the year 2025 to 2035.

In April 2025, Huawei Technologies Company Ltd, a China-based technology company announced that it is offering passive optical networks (PON) technological solutions for coal mines. In the aggregation level, passive optical components are used to minimize the hazard of electrical sparks that is produced because of network devices. It would also help in improving production efficiency, as well as initiate safe production and improve working environments.

Need for Fiber to the Home in Japan to Boost Demand for Variable Fiber Optic Attenuators

Japan passive optical components market is likely to surge at a CAGR of 11.9% from 2025 to 2035. It is set to reach a valuation of USD 11.1 billion by 2035. From 2020 to 2024, the country exhibited a CAGR of 14.7%, says Future Market Insights.

In June 2025, the government of Japan announced its plans to cover 99.9% households by fiber to the home before March 2035. As per the Prime Minister’s plan, key cities and regional places are expected to have access to fiber to the home. Around 58% of households in Japan currently have access to fiber optic networks.

Need for High-capacity Optical Communications to Drive Demand for Wavelength Division Multiplexing

Wavelength division multiplexing/windows display driver model of passive optical components in semiconductor manufacturing is projected to witness rapid growth. The segment is anticipated to surge at a CAGR of 12.4% in the forecast period from 15.4% CAGR witnessed throughout the historical period.

By varying wavelengths of laser beams, the wavelength division multiplexer (WDM) technology in fiber-optic communications multiplexes multiple optical carrier signals over a single optical fiber channel. It also makes the fiber cable's communication possible in both directions.

These days, network operators must accommodate growing bandwidth needs due to a huge increase in terms of internet usage across all industries. Network providers use wavelength division multiplexing, the essential building block for high-capacity optical communications networks, to meet rising demand and produce high capacity.

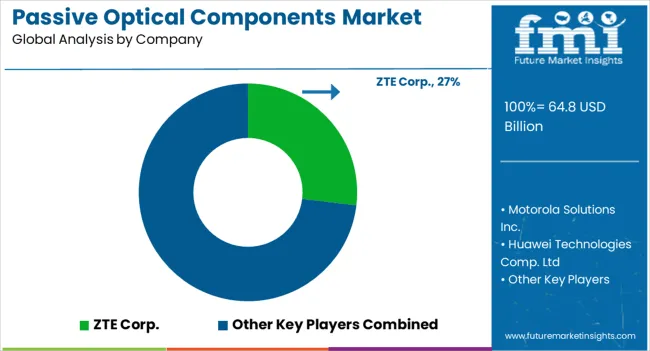

A few key players in the passive optical components market are AT&T Inc., Huawei Technologies Comp. Ltd, ZTE Corp., Ericsson Inc., Calix Inc., Motorola Solutions Inc., Broadcom Corporation Inc., Tellabs Inc., Alcatel-Lucent S.A., and Adtran Inc. among others.

These firms have carried out a wide range of important business initiatives, including growth of regional and client bases and introduction of new products. They are also engaging in the formation of collaborative relationships and joint projects for extension of product lines across international markets.

Few of the recent developments in the passive optical components industry are:

| Attribute | Details |

|---|---|

| Estimated Market Size (2025) | USD 64.8 billion |

| Projected Market Valuation (2035) | USD 210.4 billion |

| Value-based CAGR (2025 to 2035) | 12.5% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2024 |

| Market Analysis | Value (USD billion) |

| Key Regions Covered | North America; Latin America; Europe; East Asia; South Asia; Middle East & Africa |

| Key Countries Covered | USA, Canada, Brazil, Mexico, Germany, United Kingdom, France, Italy, Spain, Nordic, Russia, Poland, China, India, Thailand, Indonesia, Australia and New Zealand, Japan, Gulf Cooperation Council Countries, North Africa, South Africa, Others |

| Key Segments Covered | Component, Application, Region |

| Key Companies Profiled | ZTE Corp; Motorola Solutions Inc.; Huawei Technologies Comp. Ltd; Tellabs Inc.; Adtran Inc.; Alcatel-Lucent S.A.; Calix Inc.; Broadcom Corporation Inc.; Ericsson Inc.; AT&T Inc. |

| Report Coverage | Market Forecast, Company Share Analysis, Competitive Landscape, Market Dynamics and Challenges, Strategic Growth Initiatives |

The global passive optical components market is estimated to be valued at USD 64.8 billion in 2025.

The market size for the passive optical components market is projected to reach USD 210.4 billion by 2035.

The passive optical components market is expected to grow at a 12.5% CAGR between 2025 and 2035.

The key product types in passive optical components market are optical cables, optical power splitters, optical couplers, optical encoders, optical connectors, patch-cords and pigtails, optical amplifiers, fixed and variable optical attenuators, optical transceivers, optical circulators, optical filters, wavelength division multiplexing/ windows display driver model and others.

In terms of application, interoffice segment to command 46.2% share in the passive optical components market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Passive Temperature-Controlled Packaging Solutions Market Size and Share Forecast Outlook 2025 to 2035

Passive Fire Protection Market Size and Share Forecast Outlook 2025 to 2035

Passive Fire Protection Materials Market Size and Share Forecast Outlook 2025 to 2035

Passive Infrared Sensor Market Size and Share Forecast Outlook 2025 to 2035

Passive Prosthetics Market

Passive Tunable Integrated Circuits Market

Passive and Interconnecting Electronic Components Market Size and Share Forecast Outlook 2025 to 2035

Passive Optical Network Market Size and Share Forecast Outlook 2025 to 2035

Gigabit Passive Optical Network (GPON) Market Size and Share Forecast Outlook 2025 to 2035

Gigabit Passive Optical Network Equipment Market Size and Share Forecast Outlook 2025 to 2035

Integrated Passive Devices (IPDs) Market

Optical Spectrum Analyzer Market Size and Share Forecast Outlook 2025 to 2035

Optical Extinction Analyzer Market Size and Share Forecast Outlook 2025 to 2035

Optical Character Recognition Market Forecast and Outlook 2025 to 2035

Optical Satellite Market Size and Share Forecast Outlook 2025 to 2035

Optical Imaging Market Size and Share Forecast Outlook 2025 to 2035

Optical Whitening Agents Market Size and Share Forecast Outlook 2025 to 2035

Optical Fingerprint Collector Market Size and Share Forecast Outlook 2025 to 2035

Optical Lens Materials Market Size and Share Forecast Outlook 2025 to 2035

Optical Microscope Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA