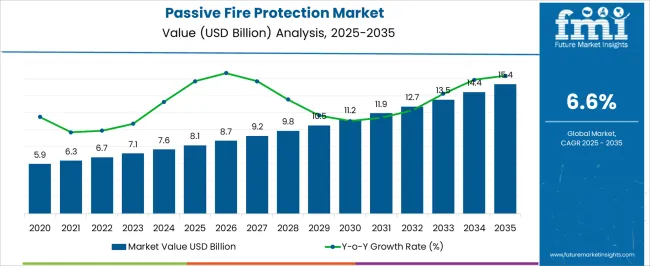

The passive fire protection market is projected to grow from USD 8.1 billion in 2025 to USD 15.4 billion by 2035, with a CAGR of 6.6%. A compound absolute growth analysis reveals a steady increase in market value, driven by stringent fire safety regulations, increasing construction activities, and rising awareness of fire protection measures. Between 2025 and 2030, the market grows from USD 8.1 billion to USD 11.2 billion, contributing an incremental USD 3.1 billion. This represents a CAGR of 7.2%, reflecting an early-phase acceleration due to the growing emphasis on fire safety in industries such as construction, manufacturing, and oil and gas. From 2030 to 2035, the market continues to expand, moving from USD 11.2 billion to USD 15.4 billion, contributing USD 4.2 billion in growth, with a slightly lower CAGR of 6.0%. This phase indicates more stable, incremental growth, driven by the continued implementation of fire safety standards, technological advancements in passive fire protection materials, and an increasing number of retrofit projects. The compound absolute growth analysis demonstrates that while the market experiences a higher rate of growth in the first half, the second phase continues to show steady expansion as the market matures, with ongoing demand for advanced fire-resistant coatings, insulation, and barriers in multiple sectors.

| Metric | Value |

|---|---|

| Passive Fire Protection Market Estimated Value in (2025 E) | USD 8.1 billion |

| Passive Fire Protection Market Forecast Value in (2035 F) | USD 15.4 billion |

| Forecast CAGR (2025 to 2035) | 6.6% |

The passive fire protection market is expanding steadily as regulatory standards tighten across infrastructure, industrial, and energy sectors. Emphasis on life safety, asset protection, and regulatory compliance is pushing demand for non-invasive fire resistance systems that prevent the spread of flames and smoke.

Urbanization and vertical infrastructure development have increased the reliance on building materials and coatings that comply with updated fire resistance codes. Additionally, insurance incentives and structural safety audits are accelerating adoption across public infrastructure and commercial real estate projects.

Investments in non-combustible and thermal insulating materials, along with innovations in lightweight, eco-friendly coatings, are reshaping material selection criteria. As construction markets in Asia-Pacific and the Middle East mature, demand for scalable and standards-aligned passive systems is anticipated to further support long-term growth.

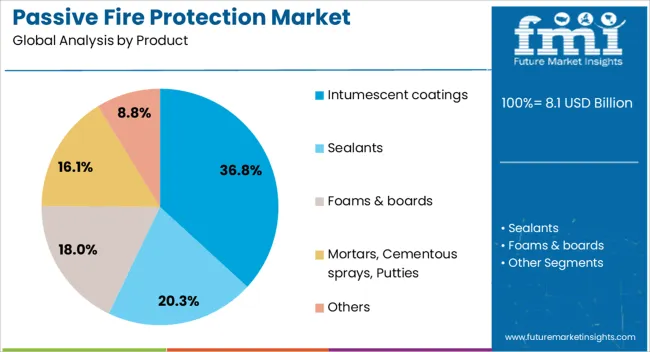

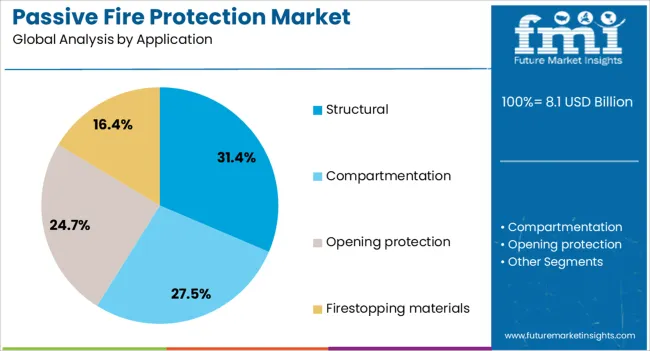

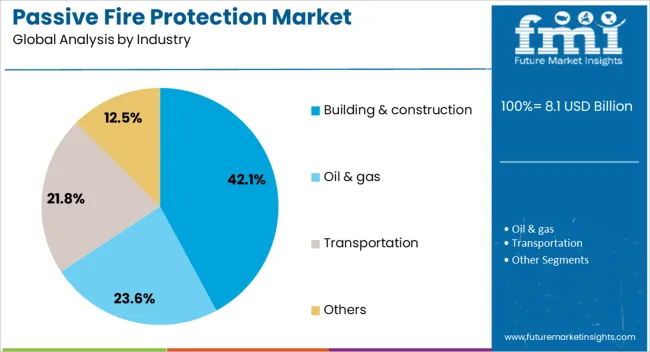

The passive fire protection market is segmented by product, application, industry, and region. By product, it includes intumescent coatings, sealants, foams & boards, mortars, cementitious sprays, putties, and others. In terms of application, the market is classified into structural, compartmentation, opening protection, and firestopping materials. Based on industry, it is divided into building & construction, oil & gas, transportation, and others. Regionally, the passive fire protection market is categorized into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Intumescent coatings are projected to account for 36.8% of the passive fire protection market revenue in 2025, establishing them as the leading product segment. This leadership is being driven by their ability to expand and insulate substrates during high-temperature exposure, delaying structural failure.

These coatings offer flexibility for both retrofitting and new construction, particularly in steel-intensive buildings. Their ease of application, compatibility with architectural aesthetics, and compliance with evolving fire-resistance standards have contributed to increased usage.

Ongoing R&D in water-based and low-VOC formulations is also improving their environmental profile and adoption in green-certified projects. As construction projects seek both structural efficiency and fire resilience, intumescent coatings are being specified more frequently across a broad range of industries.

Structural applications are anticipated to contribute 31.4% of the total revenue in 2025, making it the dominant application segment. This dominance is attributed to the rising need for fireproofing load-bearing components in high-rise buildings, industrial plants, and transport infrastructure.

Passive systems integrated into structural elements are being mandated by building codes to delay collapse and enable safe evacuation. Intumescent and cementitious solutions are increasingly being incorporated into beams, columns, and floors to achieve extended fire-resistance ratings.

Greater awareness among project stakeholders regarding the consequences of fire-induced structural failure has reinforced demand in this segment. As fire safety audits become more stringent, structural fire protection is being prioritized early in the design process across private and public sector developments.

The building and construction industry is forecast to hold 42.1% of the total market share in 2025, making it the largest end-use industry for passive fire protection solutions. This lead is being supported by mandatory fire safety compliance across residential, commercial, and institutional developments.

Increasing construction of high-density housing, smart buildings, and transport hubs has created demand for passive systems integrated at the material and design level. Fire protection has become a key differentiator in developer portfolios, particularly in premium and urban real estate projects.

Government policies promoting fire-resilient infrastructure and disaster risk reduction are further incentivizing adoption. As contractors and architects aim to balance design flexibility with safety requirements, passive fire protection systems are being embedded across diverse construction phases.

The passive fire protection market is experiencing growth due to the increasing demand for fire safety solutions across industries such as construction, oil and gas, automotive, and manufacturing. Passive fire protection (PFP) materials and systems are crucial for preventing the spread of fire and protecting lives and property. Regulatory frameworks and stricter building codes are driving the adoption of PFP systems, particularly in commercial and residential buildings. While challenges such as high installation costs and the need for regular maintenance exist, the market offers significant opportunities in emerging economies and technological innovations in fire-resistant materials.

The growing need for safety in buildings and infrastructure is a key driver for the passive fire protection market. As fire safety regulations become stricter, especially in commercial, industrial, and residential buildings, the demand for effective fire prevention systems is rising. Passive fire protection solutions such as fire-resistant coatings, barriers, and fireproof materials are essential in maintaining the structural integrity of buildings during a fire, providing critical time for evacuation and firefighting efforts. Increased awareness of fire hazards and the importance of adhering to building safety codes further propels the market for PFP systems. The demand for better safety standards in high-risk industries, such as oil and gas, also fuels market growth, pushing for the adoption of advanced fire protection solutions.

One of the primary challenges facing the passive fire protection market is the high installation costs of fireproof materials and systems. PFP systems often require significant initial investment, particularly when retrofitting existing structures or installing complex fire-resistant coatings and barriers. Additionally, these systems require regular maintenance to ensure their effectiveness over time, adding further operational costs. The complexity of integrating PFP systems with other building services and structures can also lead to increased installation time and costs. Furthermore, limited awareness in certain regions about fire protection systems and their long-term benefits can impede market growth. These challenges must be addressed through cost-effective solutions and improved awareness of the long-term advantages of fire prevention.

The passive fire protection market presents substantial opportunities due to the expansion of construction and industrial sectors. The growing construction of commercial and residential buildings, particularly in emerging markets, is creating increased demand for fire-resistant solutions. As urbanization continues, the adoption of passive fire protection systems is becoming more critical in ensuring building safety. Furthermore, industries such as oil and gas, chemical manufacturing, and power generation are experiencing growth and require specialized fire protection solutions due to the high-risk nature of their operations. Innovations in fire-resistant materials, such as intumescent coatings and advanced fire barriers, present opportunities for manufacturers to offer more effective and cost-efficient solutions to meet the needs of these sectors.

A significant trend in the passive fire protection market is the increasing integration of advanced technologies and the focus on sustainable materials. Innovations in fire-resistant coatings, intumescent materials, and fireproof barriers are enhancing the performance and effectiveness of PFP systems. Additionally, manufacturers are developing eco-friendly fire protection solutions that meet stringent environmental regulations while maintaining high safety standards. The growing adoption of green building standards and energy-efficient designs in construction is driving the demand for sustainable fire protection materials that align with these initiatives. These trends indicate a shift toward more efficient, cost-effective, and environmentally responsible solutions in the passive fire protection sector, contributing to the market's growth.

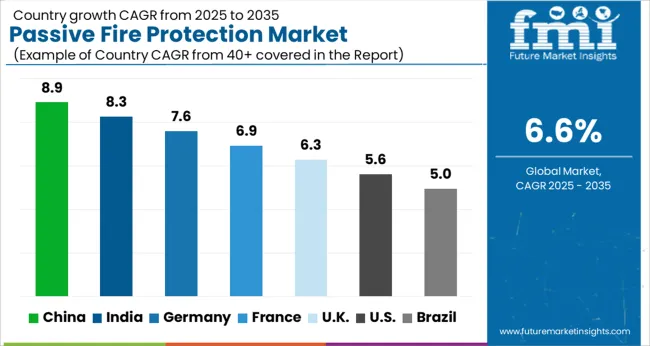

The passive fire protection market is projected to grow at a global CAGR of 6.6% from 2025 to 2035. China leads at 8.9%, followed by India at 8.3%, and France at 6.9%. The United Kingdom records 6.3%, while the United States stands at 5.6%. The growing construction, industrialization, and safety regulations in China and India drive significant demand for fire protection materials. In contrast, OECD nations such as France, the UK, and the USA show steady growth, driven by the rising need for fire protection systems in commercial, residential, and industrial buildings. The analysis spans over 40+ countries, with the leading markets shown below.

China is projected to grow at a CAGR of 8.9% through 2035, with a rapidly expanding construction sector and stricter fire safety regulations driving the demand for passive fire protection solutions. The demand for fire-resistant materials is particularly strong in China’s burgeoning residential, commercial, and industrial sectors. The growing focus on improving infrastructure and reducing fire hazards has led to increased use of passive fire protection systems. China’s government has implemented stricter fire safety codes and standards for the construction industry, which further contributes to the adoption of fireproof coatings, fire barriers, and other fire-resistant materials in building designs.

India is projected to grow at a CAGR of 8.3% through 2035, driven by increasing urbanization, construction activities, and rising safety regulations. The demand for passive fire protection systems is accelerating in the country’s residential, commercial, and industrial sectors. As the construction industry in India expands rapidly, fire protection materials are being increasingly integrated into building designs to meet regulatory standards. Government regulations and the growing awareness of fire safety further drive market growth. The rising adoption of fireproof coatings, fire-resistant panels, and other fire-resistant materials in construction are expected to continue to fuel demand.

France is projected to grow at a CAGR of 6.9% through 2035, driven by the increasing adoption of fire protection measures in the growing construction sector. The French government’s focus on improving fire safety regulations and building codes has led to an increased demand for passive fire protection systems. These systems, including fire-resistant doors, panels, and coatings, are becoming standard in both new construction and renovation projects. The expanding commercial and residential infrastructure in urban centers further fuels market growth. Additionally, rising awareness of fire hazards in industrial applications is driving demand for fireproofing solutions.

The United Kingdom is projected to grow at a CAGR of 6.3% through 2035, driven by the rising demand for fire protection systems in commercial, residential, and industrial buildings. The UK government has set stringent building codes and safety standards that encourage the use of passive fire protection materials. These materials are increasingly used in new constructions as well as retrofitting existing buildings to meet fire safety regulations. The rising number of fire incidents and increased awareness of fire hazards further support the growth of passive fire protection solutions. Additionally, the market benefits from advancements in fire-resistant coatings and fireproofing materials.

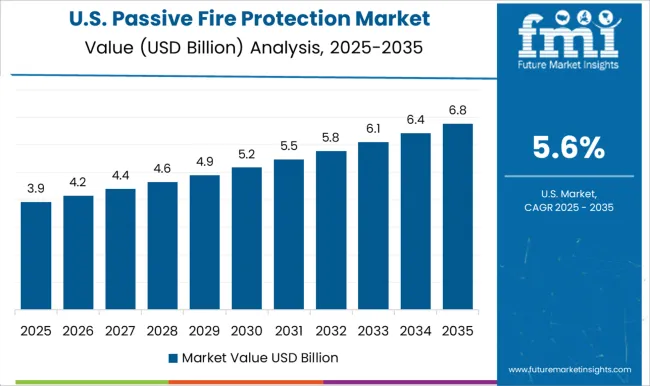

The United States is projected to grow at a CAGR of 5.6% through 2035, with increased demand for fire protection systems driven by growing safety concerns and regulations in residential, commercial, and industrial buildings. The market for passive fire protection solutions is expected to grow steadily due to stringent fire codes and regulations in the USA The demand for fire-resistant coatings, doors, panels, and insulation materials in construction projects will continue to rise. The growing focus on sustainable building practices and materials that offer better fire resistance properties is contributing to market expansion in the USA

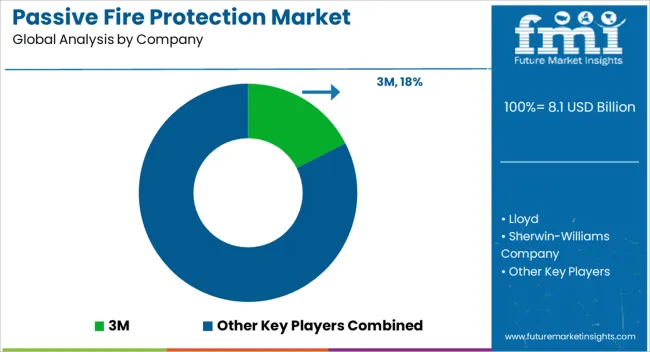

The passive fire protection market is driven by leading companies specializing in fire-resistant materials and solutions for buildings, industrial applications, and infrastructure. 3M is a major player, offering a broad range of fire protection products, including firestopping, insulation, and intumescent coatings, focused on enhancing building safety and ensuring compliance with fire safety regulations.

Etex SA offers advanced fire protection systems for construction projects, focusing on creating fireproof materials that maintain structural integrity during a fire event. Saint-Gobain provides passive fire protection materials for the building industry, focusing on innovation in fire-resistant insulation and fire-rated wall systems. Siniat International and Promat International specialize in fire-resistant insulation systems and materials used in walls, ceilings, and floors, ensuring that structures can withstand high temperatures and contain fires.

| Item | Value |

|---|---|

| Quantitative Units | USD Billion |

| Product | Intumescent coatings, Sealants, Foams & boards, Mortars, Cementous sprays, Putties, and Others |

| Application | Structural, Compartmentation, Opening protection, and Firestopping materials |

| Industry | Building & construction, Oil & gas, Transportation, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | 3M, Lloyd, Sherwin-Williams Company, Hempel, Nullifire, Etex SA, Saint-Gobain, Siniat International, and Promat International |

| Additional Attributes | Dollar sales by product type (intumescent coatings, fire-resistant boards, firestopping materials, fireproof insulation) and end-use segments (commercial, residential, industrial, infrastructure). Demand dynamics are driven by increasing fire safety regulations, growing infrastructure projects, and the need for advanced fireproofing solutions in high-risk areas. Regional trends indicate strong growth in North America and Europe due to stringent fire safety codes, with emerging markets in Asia-Pacific experiencing demand driven by rapid urbanization and construction growth. |

The global passive fire protection market is estimated to be valued at USD 8.1 billion in 2025.

The market size for the passive fire protection market is projected to reach USD 15.4 billion by 2035.

The passive fire protection market is expected to grow at a 6.6% CAGR between 2025 and 2035.

The key product types in passive fire protection market are intumescent coatings, sealants, foams & boards, mortars, cementous sprays, putties and others.

In terms of application, structural segment to command 31.4% share in the passive fire protection market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Passive Fire Protection Materials Market Size and Share Forecast Outlook 2025 to 2035

Fire Protection Materials Market Size and Share Forecast Outlook 2025 to 2035

Fire Protection System Pipes Market Size and Share Forecast Outlook 2025 to 2035

Fire Protection Systems for Industrial Cooking Market Growth - Trends & Forecast 2025 to 2035

Automated Fire Protection Market Growth – Trends & Forecast 2024-2034

Fire Resistant Apron Market Size and Share Forecast Outlook 2025 to 2035

Passive Temperature-Controlled Packaging Solutions Market Size and Share Forecast Outlook 2025 to 2035

Firefighter Tapes Market Size and Share Forecast Outlook 2025 to 2035

Fire Pump Test Meter Market Size and Share Forecast Outlook 2025 to 2035

Fire Sprinkler System Market Size and Share Forecast Outlook 2025 to 2035

Fire Extinguisher Market Size and Share Forecast Outlook 2025 to 2035

Fire Stopping Material Market Size and Share Forecast Outlook 2025 to 2035

Fireproof Insulation Market Size and Share Forecast Outlook 2025 to 2035

Passive and Interconnecting Electronic Components Market Size and Share Forecast Outlook 2025 to 2035

Fire Tube Chemical Boiler Market Size and Share Forecast Outlook 2025 to 2035

Firefighting Foam Market Size and Share Forecast Outlook 2025 to 2035

Fire Resistant Cable Market Size and Share Forecast Outlook 2025 to 2035

Fire Suppression System Market Size and Share Forecast Outlook 2025 to 2035

Fire Stopping Materials Market Size and Share Forecast Outlook 2025 to 2035

Firefighting Drone Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA