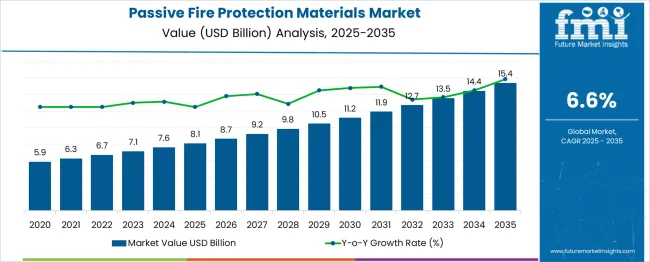

The Passive Fire Protection Materials Market is estimated to be valued at USD 8.1 billion in 2025 and is projected to reach USD 15.4 billion by 2035, registering a compound annual growth rate (CAGR) of 6.6% over the forecast period. Growth momentum analysis shows a cumulative addition of USD 9.5 billion across the timeline, with the early phase contributing moderate gains before acceleration in later years. By 2030, the market is estimated to reach around USD 10.5 billion, capturing 43% of the total incremental value, while the subsequent five years will add USD 4.9 billion, driven by increased adoption of fire-resistant materials in complex infrastructure and industrial projects. Year-on-year increments progress from USD 0.4 billion initially to nearly USD 0.9 billion toward the end of the forecast period, highlighting a rising growth curve as compliance standards tighten globally.

Expansion in urban infrastructure, oil and gas facilities, data centers, and transportation hubs remains the key force behind demand escalation. With innovation in intumescent coatings, fire-rated boards, and sealants becoming a core focus for manufacturers, the segment demonstrates resilience supported by regulatory enforcement and diversified application. The data indicates a balanced growth trajectory that ensures scalability and profitability for companies aligning their portfolios with emerging performance benchmarks.

| Metric | Value |

|---|---|

| Passive Fire Protection Materials Market Estimated Value in (2025 E) | USD 8.1 billion |

| Passive Fire Protection Materials Market Forecast Value in (2035 F) | USD 15.4 billion |

| Forecast CAGR (2025 to 2035) | 6.6% |

The passive fire protection materials market holds strategic importance across multiple segments tied to building and industrial safety engineering. Within the specialized realm of passive fire protection solutions, these materials dominate with a 40–45% share, constituting the essential product set used to prevent fire spread through fireproofing boards, intumescent coatings, seals, and modular barriers. In the broader life safety and fire protection systems market, they emerge as a significant portion, approximately 20–22%, next to active systems like sprinklers, fire alarms, and suppression units.

Their footprint in the construction and industrial safety materials market is moderate at 8–10%, where they serve as key components alongside insulation and structural safety supplies. Within the expansive building materials and infrastructure market, they represent around 5–6%, largely serving retrofit and high-compliance construction projects compared to mainstream structural materials.

Importantly, in the fire-resistant coatings and sealants market, passive materials capture about 30–32%, given their centrality to building fire integrity. Overall, demand is propelled by stringent building codes, high-rise construction growth, and heightened safety regulations—making passive fire protection materials a core pillar for ensuring structural resilience and occupant safety across industrial and commercial infrastructure.

Stricter fire safety norms, rising infrastructure investments, and increasing awareness of structural resilience in fire events are driving the passive fire protection materials market. Regulatory shifts mandating compartmentalization, fire containment, and smoke control have created a strong compliance-led demand.

Passive materials are being preferred due to their long-term protection capability without human intervention, reducing fire spread in both residential and industrial environments. Additionally, insurance standards and risk mitigation protocols are pushing real estate and manufacturing sectors to integrate certified fire-resistant materials into their designs.

Emphasis on energy-efficient construction and retrofitting of older buildings further accelerates product deployment. Continued investments in R&D to enhance thermal endurance and material versatility are expected to expand use cases across multiple verticals.

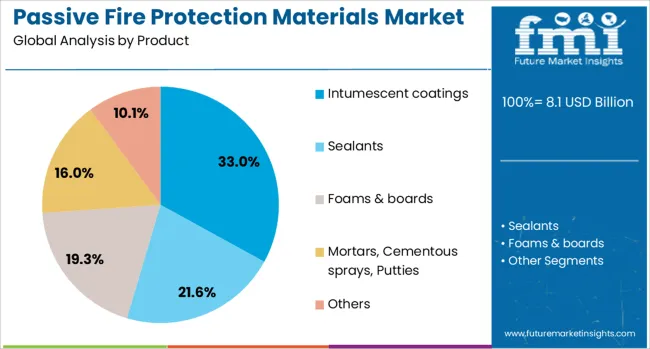

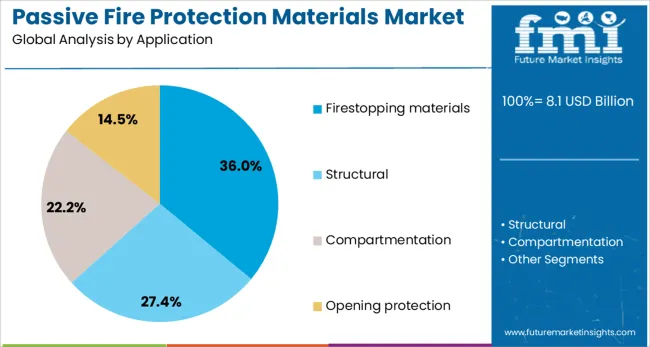

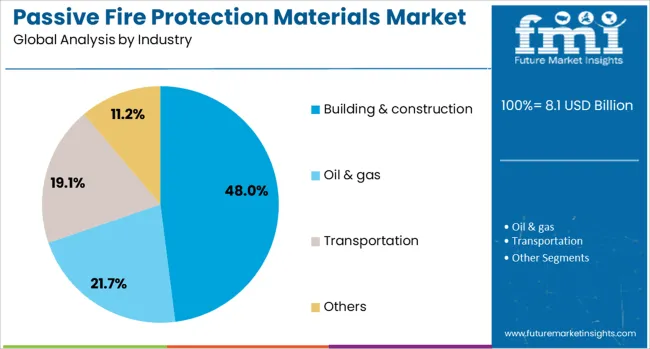

The passive fire protection materials market is segmented by product, application, industry, and geographic regions. The passive fire protection materials market is divided into Intumescent coatings, Sealants, Foams & boards, Mortars, Cementous sprays, Putties, and Others. In terms of application, the passive fire protection materials market is classified into Firestopping materials, Structural, Compartmentation, and Opening protection. The passive fire protection materials market is segmented into Building & construction, Oil & gas, Transportation, and Others. Regionally, the passive fire protection materials industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Intumescent coatings are projected to lead the product category with 33.0% revenue share in 2025. This segment's dominance is supported by its aesthetic compatibility with modern architectural designs and ease of application over steel and other structural surfaces.

These coatings offer an effective fire barrier by expanding into a charred layer under high temperatures, which insulates substrates during fire exposure. Their growing acceptance in high-rise construction and industrial facilities, where space and design flexibility are critical, has further driven their use.

Technological advancements, enhancing coating thickness uniformity and drying times, have improved their practicality, positioning them as a preferred alternative to bulkier protective systems.

Firestopping materials are estimated to account for 36.0% of market revenue by 2025, making it the largest application segment. Growth in this segment is driven by regulatory mandates for sealing penetrations in fire-rated walls and floors to prevent flame and smoke migration.

The rise in MEP (mechanical, electrical, plumbing) installations in commercial infrastructure necessitates reliable firestop solutions, particularly in hospitals, offices, and data centers. Increased adoption of modular construction has also heightened demand for factory-integrated passive protection systems, where firestop sealants and wraps offer flexible deployment.

Compatibility with a range of materials, including concrete, wood, and gypsum, continues to expand the application spectrum.

The building & construction industry is anticipated to dominate with a 48.0% market share in 2025. This leadership stems from stringent safety codes across residential, commercial, and mixed-use structures requiring passive fire protection as part of base building design.

Government-led urban development programs, especially in emerging economies, are accelerating the use of certified fireproofing materials during the planning phase. Renovation and green building certifications like LEED and BREEAM are also driving retrofitting initiatives, wherein passive fire systems contribute to code compliance.

Furthermore, increasing awareness among architects and project developers around liability reduction and occupant safety is fostering a proactive approach to integrating fire-resistant materials.

Passive fire protection materials are integral components in building safety systems, designed to prevent the spread of flames and maintain structural integrity during fire incidents. These materials include fire-resistant boards, coatings, sealants, sprays, and mortars used across industrial, commercial, and residential applications. Growth has been driven by stringent fire safety regulations, increasing infrastructure development, and the rising adoption of compartmentalization strategies in modern construction. Manufacturers are focusing on advanced formulations, compliance certifications, and easy-to-apply solutions to meet performance standards while supporting large-scale construction projects in developed and emerging markets.

Adoption of passive fire protection materials has been driven by strict building codes and enforcement of fire safety standards across commercial and industrial facilities. The rising need to protect structural components such as steel, concrete, and composite assemblies has reinforced demand for intumescent coatings and fireproof boards. Large-scale urban infrastructure projects, including transportation hubs and high-rise buildings, require fire-rated compartments, boosting product utilization. Insurance mandates and growing focus on minimizing operational risk in oil and gas facilities have also supported market growth. Increasing awareness among developers and contractors regarding life safety and property protection measures continues to accelerate material adoption.

Market growth has been limited by high upfront costs associated with the installation of passive fire protection systems, particularly in large or complex structures. Achieving compliance with regional fire resistance ratings and undergoing rigorous certification processes adds time and expense for manufacturers and contractors. Variability in raw material availability and fluctuations in pricing create challenges for cost management. Limited awareness among small-scale builders and retrofit segments has slowed adoption. Compatibility issues between different protective systems within a single structure can lead to additional design complexities and inspection requirements, extending project timelines and increasing overall cost burdens.

Significant opportunities exist in the development of advanced intumescent coatings and lightweight fireproof panels designed for high-performance applications. Growth in industrial sectors such as oil and gas, petrochemicals, and power generation creates strong demand for fire-rated sealing and compartmentalization systems. Expansion of airports, tunnels, and mass transit systems provides a continuous pipeline for specialized passive fire protection solutions. Integration of digital inspection tools and automated application technologies can improve efficiency and ensure compliance in large-scale projects. Strategic collaborations between material suppliers and EPC firms to provide turnkey fire protection packages offer additional revenue streams in global infrastructure development.

Recent trends include the adoption of high-durability intumescent coatings that deliver extended fire resistance with reduced application thickness. Prefabricated fireproofing solutions are gaining traction in modular construction projects to reduce installation time. Use of cementitious sprays with enhanced adhesion and crack resistance is becoming common in industrial structures. Growing preference for hybrid materials combining acoustic insulation with fire protection is influencing product development strategies. Digital modeling tools such as BIM are increasingly being integrated to validate fire protection layouts and ensure compliance early in design stages. Manufacturers are also prioritizing environmentally safe formulations to meet evolving health and safety standards.

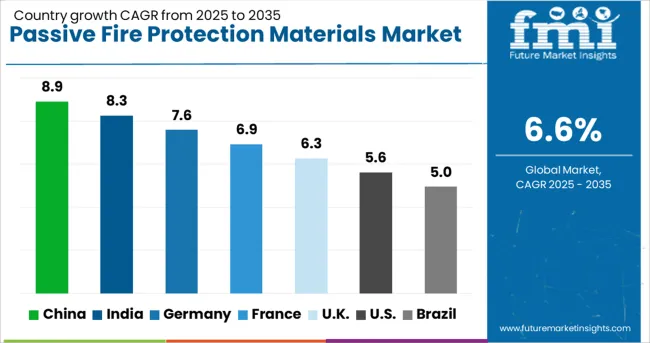

| Country | CAGR |

|---|---|

| China | 8.9% |

| India | 8.3% |

| Germany | 7.6% |

| France | 6.9% |

| UK | 6.3% |

| USA | 5.6% |

| Brazil | 5.0% |

Passive fire protection materials demand is projected to rise at a CAGR of 8.1% from 2025 to 2035. Among the top five profiled markets, China leads at 8.9%, followed by India at 8.3%, while France posts 6.9%, the United Kingdom records 6.3%, and the United States stands at 5.6%. These growth rates represent a premium of +10% for China and +2% for India compared to the global baseline, whereas France and the UK fall slightly behind at –15% and –22%, and the United States trails by –31%. The divergence reflects distinct regional drivers: rapid urban construction and industrial expansion in BRICS economies like China and India, while OECD nations such as France, the UK, and the US show steady adoption aligned with regulatory compliance and infrastructure retrofitting. The analysis spans over 40 countries, with the leading markets detailed below.

India is projected to grow at a CAGR of 8.3% through 2035, supported by large-scale infrastructure development, metro projects, and rapid urban expansion in commercial and residential construction. Adoption of passive fire safety systems is increasing in industrial facilities, high-rise buildings, and public spaces. Regulatory enforcement on fire safety norms in construction and oil & gas sectors has strengthened market penetration. Local manufacturers are focusing on cost-effective coatings, intumescent paints, and fire-rated boards, while global players introduce advanced formulations for critical structures. The oil & gas, power, and transportation sectors also contribute significantly to demand, given the increasing focus on minimizing operational fire risks.

China is expected to achieve a CAGR of 8.9% through 2035, driven by its dominant position in construction, energy infrastructure, and heavy industry. Stringent building codes and enhanced enforcement of fire safety standards support large-scale adoption of passive fire protection systems in commercial and industrial facilities. Major demand arises from high-rise developments, petrochemical complexes, and power plants. Domestic manufacturers are scaling operations to cater to rising needs for intumescent coatings, cementitious sprays, and advanced fire-rated sealants. Investments in offshore oil & gas and renewable power facilities further strengthen market potential. International players continue to expand partnerships with Chinese firms to deliver high-performance solutions for critical sectors.

France is forecasted to grow at a CAGR of 6.9% through 2035, supported by strong demand from aerospace, industrial manufacturing, and energy projects. Fireproofing solutions are increasingly integrated into high-rise construction, rail systems, and nuclear facilities where safety regulations are stringent. Domestic players are advancing high-density coatings and spray-applied solutions to meet fire endurance and thermal performance requirements. Increased refurbishment activity in public infrastructure and expansion of energy storage projects drive incremental demand. Partnerships between construction firms and specialty chemical suppliers continue to shape the adoption of innovative, high-efficiency passive fire protection systems.

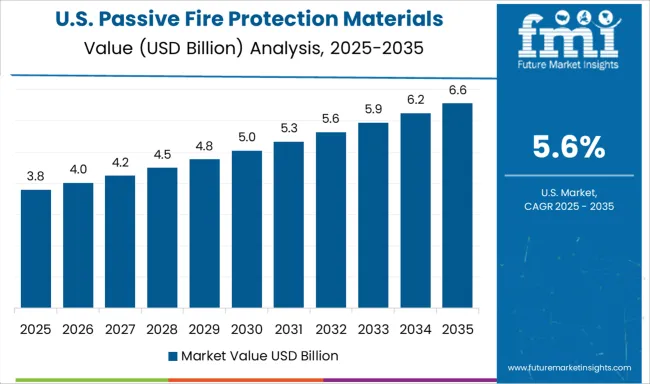

The United States is forecasted to grow at a CAGR of 5.6% through 2035, supported by modernization of industrial infrastructure, stringent NFPA standards, and retrofitting of aging buildings. Oil & gas installations, aviation hangars, and manufacturing plants are major contributors to demand for fire-rated boards, intumescent coatings, and cementitious materials. Domestic manufacturers are investing in advanced spray systems and eco-compliant coatings to address environmental norms and lifecycle durability requirements. Growth is reinforced by state-level mandates for passive fireproofing in commercial and healthcare facilities. Despite market maturity, opportunities exist in energy storage systems and large-scale renewable projects that require fire-resilient designs.

The United Kingdom is projected to post a CAGR of 6.3% through 2035, driven by enforcement of updated building safety regulations and redevelopment of commercial spaces. Rising use of passive fireproofing materials in transportation hubs, healthcare infrastructure, and high-rise refurbishments creates new opportunities. Manufacturers are focusing on fire-rated boards and advanced coatings to meet thermal performance and durability benchmarks. Demand from the oil & gas sector, particularly in offshore platforms and energy projects, adds to growth. Investments in modular construction methods and compliance-driven procurement practices are influencing product design, leading to development of lightweight and easily installable fireproofing systems.

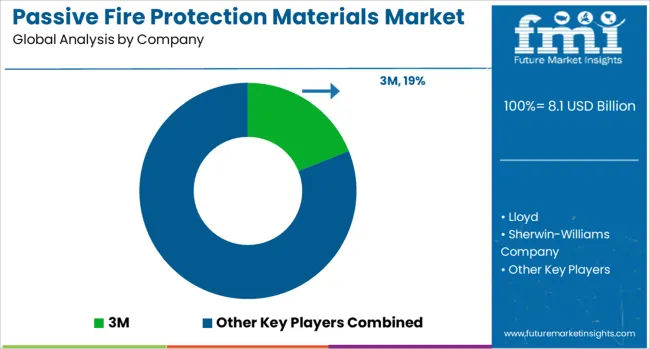

The passive fire protection (PFP) materials market is driven by global manufacturers and specialty solution providers delivering coatings, boards, sealants, and composite systems to enhance fire resistance in construction and industrial applications. 3M leads the market with a broad portfolio of firestop systems, sealants, and wraps designed for commercial buildings, infrastructure, and industrial facilities. Sherwin-Williams Company and Hempel dominate in intumescent coatings for structural steel protection, offering products with extended fire ratings and compliance with international standards. Nullifire, a brand under Tremco CPG, specializes in advanced fire-resistant sealants and coatings tailored for high-rise and industrial projects. Etex SA, along with its subsidiary Promat International, is a major player in fire-resistant boards and insulation materials widely used in partition systems and critical infrastructure.

Saint-Gobain and its brand Siniat International strengthen their presence with gypsum-based fire-rated boards integrated into drywall and partition systems for commercial and residential buildings. Lloyd provides niche PFP solutions for industrial and oil & gas applications, emphasizing durability and environmental resistance. Competitive differentiation hinges on product performance under fire conditions, ease of application, certification compliance (EN, UL, ASTM), and compatibility with modern building systems. Barriers to entry include rigorous testing requirements, regulatory approvals, and the need for specialized distribution networks. Strategic priorities involve developing eco-friendly, low-VOC coatings, integrating digital fire safety solutions for compliance monitoring, and expanding lightweight fireproofing materials for modular and prefabricated construction.

| Item | Value |

|---|---|

| Quantitative Units | USD 8.1 Billion |

| Product | Intumescent coatings, Sealants, Foams & boards, Mortars, Cementous sprays, Putties, and Others |

| Application | Firestopping materials, Structural, Compartmentation, and Opening protection |

| Industry | Building & construction, Oil & gas, Transportation, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | 3M, Lloyd, Sherwin-Williams Company, Hempel, Nullifire, Etex SA, Saint-Gobain, Siniat International, and Promat International |

| Additional Attributes | Dollar sales by material type (intumescent coatings, fire-resistant boards, sealants, sprays) and application (structural steel, walls & partitions, mechanical & electrical systems). Demand dynamics are driven by stricter fire safety regulations, rapid urban development, and the growing preference for high-rise and industrial structures requiring advanced fireproofing. Regional trends highlight Europe as a leading market due to strong building codes, while Asia-Pacific exhibits the fastest growth owing to extensive infrastructure development. Innovation trends include hybrid intumescent formulations for faster curing, integration of insulation with fireproofing systems for energy efficiency, and recyclable fire protection boards aligned with green building certifications. |

The global passive fire protection materials market is estimated to be valued at USD 8.1 billion in 2025.

The market size for the passive fire protection materials market is projected to reach USD 15.4 billion by 2035.

The passive fire protection materials market is expected to grow at a 6.6% CAGR between 2025 and 2035.

The key product types in passive fire protection materials market are intumescent coatings, sealants, foams & boards, mortars, cementous sprays, putties and others.

In terms of application, firestopping materials segment to command 36.0% share in the passive fire protection materials market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Passive Temperature-Controlled Packaging Solutions Market Size and Share Forecast Outlook 2025 to 2035

Passive and Interconnecting Electronic Components Market Size and Share Forecast Outlook 2025 to 2035

Passive Optical Components Market Size and Share Forecast Outlook 2025 to 2035

Passive Optical Network Market Size and Share Forecast Outlook 2025 to 2035

Passive Infrared Sensor Market Size and Share Forecast Outlook 2025 to 2035

Passive Prosthetics Market

Passive Tunable Integrated Circuits Market

Passive Fire Protection Market Size and Share Forecast Outlook 2025 to 2035

Gigabit Passive Optical Network (GPON) Market Size and Share Forecast Outlook 2025 to 2035

Gigabit Passive Optical Network Equipment Market Size and Share Forecast Outlook 2025 to 2035

Integrated Passive Devices (IPDs) Market

Fire Resistant Apron Market Size and Share Forecast Outlook 2025 to 2035

Firefighter Tapes Market Size and Share Forecast Outlook 2025 to 2035

Fire Pump Test Meter Market Size and Share Forecast Outlook 2025 to 2035

Fire Sprinkler System Market Size and Share Forecast Outlook 2025 to 2035

Fire Extinguisher Market Size and Share Forecast Outlook 2025 to 2035

Fire Stopping Material Market Size and Share Forecast Outlook 2025 to 2035

Fireproof Insulation Market Size and Share Forecast Outlook 2025 to 2035

Fire Tube Chemical Boiler Market Size and Share Forecast Outlook 2025 to 2035

Firefighting Foam Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA