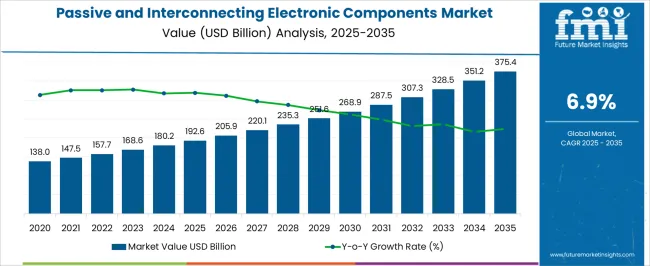

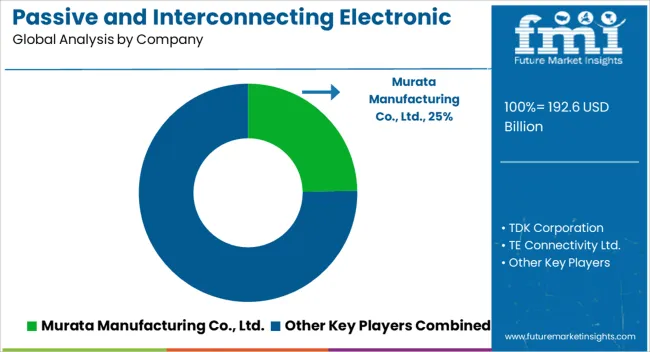

The passive and interconnecting electronic components market is expected to grow from USD 192.6 billion in 2025 to USD 375.4 billion by 2035, registering a 6.9% CAGR and generating an absolute dollar opportunity of USD 182.8 billion. Growth is driven by increasing demand for electronic devices, industrial automation, automotive electronics, and telecommunication systems. Advancements in miniaturization, reliability, and performance of components such as resistors, capacitors, connectors, and inductors further support adoption across global markets.

Market growth curve shape analysis provides insight into the trajectory of expansion over the forecast period. From 2025 to 2028, the curve rises steadily, reflecting early-stage adoption in North America, Europe, and East Asia, where industrial electronics, telecommunications infrastructure, and consumer electronics demand create incremental growth. Between 2029 and 2032, the curve steepens, indicating accelerated growth as Asia Pacific and Latin America expand manufacturing capacities, urban infrastructure, and automotive electronics production, driving higher demand for interconnecting components. From 2033 to 2035, the curve begins to moderate as mature markets reach higher penetration levels, with incremental revenue increasingly coming from replacements, upgrades, and advanced technology adoption rather than new installations.

The USD 182.8 billion opportunity reflects early gradual uptake, mid-period acceleration, and late-stage stabilization, illustrating the predictable and sustained growth trajectory of the global passive and interconnecting electronic components market between 2025 and 2035.

| Metric | Value |

|---|---|

| Passive and Interconnecting Electronic Components Market Estimated Value in (2025 E) | USD 192.6 billion |

| Passive and Interconnecting Electronic Components Market Forecast Value in (2035 F) | USD 375.4 billion |

| Forecast CAGR (2025 to 2035) | 6.9% |

The passive and interconnecting electronic components market is primarily driven by the consumer electronics sector, which accounts for around 42% of the market share, as devices such as smartphones, laptops, wearables, and home appliances rely on capacitors, resistors, connectors, and inductors for core functionality. The industrial automation and manufacturing segment contributes about 26%, using electronic components in robotics, control systems, and precision instrumentation. The automotive and transportation sector represents close to 16%, integrating components in electric vehicles, infotainment systems, and safety electronics. Telecommunications and networking account for roughly 10%, deploying components in routers, switches, and 5G infrastructure.

The remaining 6% comes from aerospace, defense, and medical electronics, where reliability and high-performance interconnections are critical. The passive and interconnecting electronic components market is evolving with innovations in miniaturization, high-frequency performance, and enhanced reliability. Ultra-compact capacitors, high-precision resistors, and advanced connectors are being developed to support smaller, lighter, and faster electronic devices. High-temperature and corrosion-resistant materials are gaining adoption for automotive, aerospace, and industrial applications. Advanced PCB design and surface-mount technology are improving assembly efficiency and signal integrity. Manufacturers are investing in automated production, quality assurance, and supply chain optimization to enhance their operations. Strategic collaborations with OEMs, telecom providers, and industrial equipment manufacturers are expanding deployment. Rising demand for IoT, 5G, electric vehicles, and smart devices continues to drive global market growth.

The passive and interconnecting electronic components market is experiencing consistent growth fueled by advancements in consumer technology, increasing device miniaturization, and rising integration of smart electronics across sectors. Demand has surged for compact and energy efficient components that can meet the performance requirements of rapidly evolving applications such as smartphones, wearables, automotive electronics, and industrial automation.

Technological innovation in material science and circuit design has enabled better component reliability, thermal stability, and operational efficiency. Regulatory focus on energy consumption and durability in electronics is further accelerating the adoption of advanced passive and interconnect solutions.

The outlook for the market remains positive as manufacturers increasingly rely on high performance passive and interconnecting components to support the next generation of connected and intelligent devices.

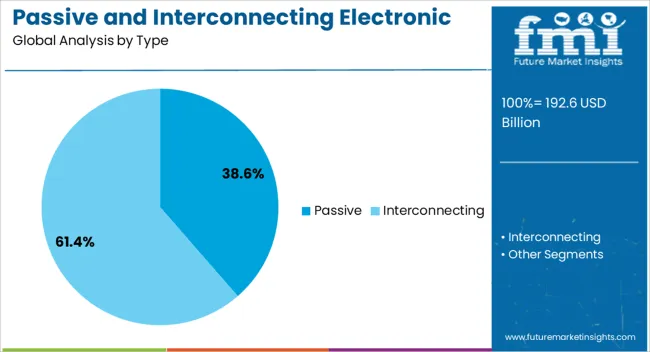

The passive and interconnecting electronic components market is segmented by type, application, and geographic regions. By type, passive and interconnecting electronic components market is divided into Passive and Interconnecting. In terms of application, passive and interconnecting electronic components market is classified into Consumer electronics, Automotive, Healthcare, IT & telecom, Telecom equipment, Networking devices, Industrial, Automation & robotics, Power generation, Industrial control systems, Others, Aerospace & defense, Military communications, Weaponry systems, Aircraft safety systems, Others, and Others. Regionally, the passive and interconnecting electronic components industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The passive segment is projected to contribute 38.60 % of the total market revenue by 2025 within the type category, making it the leading segment. This share is supported by the essential role that passive components such as resistors, capacitors, and inductors play in every electronic circuit.

These components are valued for their durability, compactness, and ability to maintain signal integrity and circuit stability. Increased demand for surface mount technology and multilayer designs has led to greater consumption of passive components in compact electronic assemblies.

As devices become more complex and power efficient, the need for stable and thermally resilient passive components continues to grow. The wide applicability across both high volume consumer goods and precision industrial systems has solidified the passive segment’s leadership in the market.

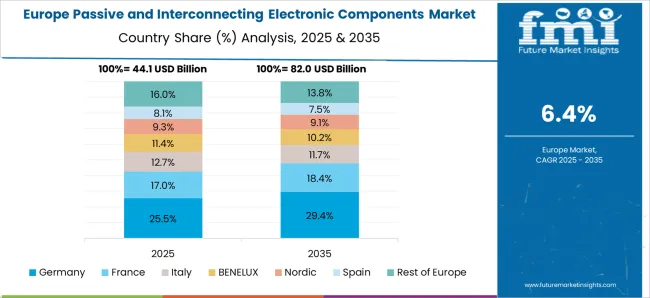

The passive and interconnecting electronic components market is expanding due to increasing electronics manufacturing, 5G deployment, and automotive electrification. Asia Pacific leads with USD 42 billion in 2024, driven by China (USD 25 billion), Japan (USD 10 billion), and South Korea (USD 7 billion). Europe accounts for USD 28 billion, led by Germany (USD 12 billion), France (USD 8 billion), and UK (USD 8 billion). North America holds USD 26 billion, primarily the USA, while the rest of the world represents USD 6 billion. Key components include resistors (30%), capacitors (25%), inductors (15%), connectors (20%), and passive interconnects (10%), deployed across consumer electronics, automotive, and industrial applications.

Market growth is driven by rising demand for miniaturized and high-performance electronic devices. Resistors account for 30% of adoption, capacitors 25%, inductors 15%, connectors 20%, and passive interconnects 10%. Asia Pacific leads with USD 42 billion, Europe USD 28 billion, and North America USD 26 billion. Increasing production of smartphones (1.5 billion units annually), tablets (400 million units), and automotive electronics (over 100 million EVs and hybrid vehicles by 2024) supports demand. Adoption of 5G infrastructure, industrial automation, and IoT devices further drives need for reliable, high-quality passive and interconnecting components to ensure performance and connectivity across applications.

Key trends include miniaturization, high-frequency connectors, and multi-layer capacitors. Approximately 30% of new devices incorporate ultra-compact resistors and capacitors, reducing PCB space by 20–25%. High-speed connectors supporting frequencies up to 50 GHz are increasingly used in 15% of telecom and data center applications. Multi-layer ceramic capacitors (MLCCs) dominate automotive and consumer electronics applications, representing USD 8–10 billion in 2024. Automated soldering and assembly processes enhance reliability, adopted in 25% of industrial manufacturing. Growth in high-power electronics and EV battery management systems is driving adoption of temperature-resistant and high-current passive components globally.

Opportunities exist in consumer electronics, automotive, industrial automation, telecom infrastructure, and data centers. Resistors account for 30% of adoption, capacitors 25%, inductors 15%, connectors 20%, and passive interconnects 10%. Asia Pacific is projected to reach USD 52 billion by 2027, Europe USD 33 billion, and North America USD 30 billion. Expansion of electric vehicles, smart home devices, wearable electronics, and 5G networks creates significant market potential. Growth in industrial robotics and automated factories further drives demand for high-reliability interconnecting components. Collaborations between component manufacturers and OEMs can accelerate deployment and reduce production lead times for high-volume applications.

High raw material costs, supply chain constraints, and miniaturization complexity limit market growth. MLCCs and high-frequency connectors cost USD 0.10–5 per unit depending on specifications, while inductors and resistors range from USD 0.05–1 per unit. Scarcity of high-purity ceramics and copper affects production timelines by 4–6 weeks. Integration into compact PCBs requires precision manufacturing, increasing assembly costs by 15–20%. Compliance with international standards for automotive, telecom, and industrial applications adds USD 50–150 per thousand units. Rapid technological evolution demands continuous R&D investment, approximately USD 200–300 million annually for leading manufacturers, to maintain performance and reliability standards.

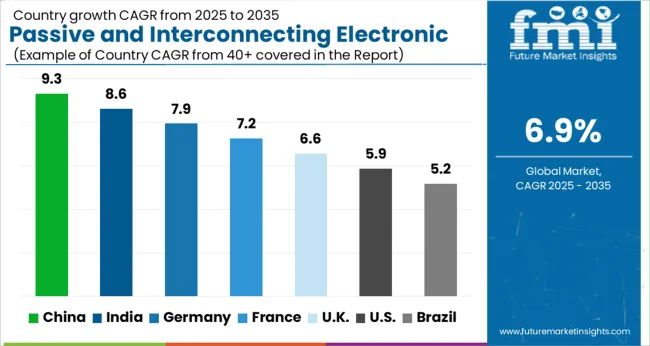

| Country | CAGR |

|---|---|

| China | 9.3% |

| India | 8.6% |

| Germany | 7.9% |

| France | 7.2% |

| UK | 6.6% |

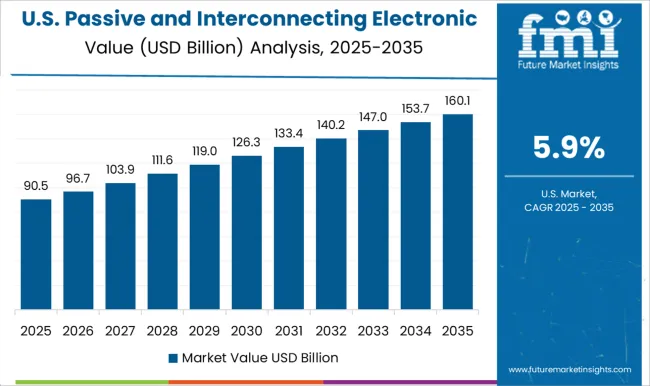

| USA | 5.9% |

| Brazil | 5.2% |

The passive and interconnecting electronic components market is projected to grow at a global CAGR of 6.9% through 2035, fueled by increasing demand for electronic devices, industrial automation, and telecommunication systems. China leads at 9.3%, a 1.35× multiple over the global benchmark, supported by BRICS-driven expansion in electronics manufacturing, IoT adoption, and industrial automation. India follows at 8.6%, a 1.25× multiple of the global rate, reflecting growth in consumer electronics, telecommunication networks, and electronic assembly industries. Germany records 7.9%, a 1.15× multiple of the benchmark, shaped by OECD-backed innovation in high-performance components, precision electronics, and automotive applications. The United Kingdom posts 6.6%, 0.96× the global rate, with adoption focused on industrial automation, commercial electronics, and niche telecommunication applications. The United States stands at 5.9%, 0.85× the benchmark, with steady uptake in consumer electronics, industrial electronics, and communication systems. BRICS economies drive the majority of market volume, OECD countries emphasize technological advancement and precision, while ASEAN nations contribute through growing electronics manufacturing and industrial automation.

The passive and interconnecting electronic components market in China is projected to grow at a CAGR of 9.3%, driven by increasing electronics manufacturing, automotive electronics, and industrial automation adoption. Domestic suppliers such as Murata, Yageo, and Samsung Electro-Mechanics provide capacitors, resistors, inductors, and connectors with high reliability and performance. Technological developments focus on miniaturization, higher efficiency, and improved signal integrity. Demand is concentrated in consumer electronics, automotive, and industrial automation applications.

The market in India is expected to grow at a CAGR of 8.6%, supported by expanding electronics manufacturing, automotive production, and industrial equipment sectors. Key suppliers such as EPCOS India and Vishay provide capacitors, resistors, and connectors with high performance, reliability, and energy efficiency. Technological improvements focus on compact designs, enhanced thermal performance, and integration into smart devices. Adoption is concentrated in consumer electronics, automotive, and industrial automation sectors.

Germany’s market is projected to grow at a CAGR of 7.9%, influenced by industrial automation, automotive electronics, and consumer electronics production. Suppliers such as Wurth Elektronik and TDK provide high-reliability capacitors, resistors, and connectors for industrial, automotive, and consumer applications. Technological focus includes miniaturization, energy efficiency, and enhanced signal integrity. Demand is concentrated in automotive electronics, industrial automation, and high-performance consumer devices.

The United Kingdom market is expected to grow at a CAGR of 6.6%, driven by demand from consumer electronics, automotive electronics, and industrial automation. Suppliers focus on capacitors, resistors, and connectors with high reliability, energy efficiency, and compact designs. Technological developments emphasize integration with smart devices, enhanced thermal performance, and signal integrity. Adoption is concentrated in automotive, industrial, and consumer electronics sectors.

The United States market is projected to grow at a CAGR of 5.9%, supported by consumer electronics, automotive electronics, and industrial automation sectors. Key suppliers such as Vishay, TE Connectivity, and Murata provide capacitors, resistors, inductors, and connectors with high performance, reliability, and energy efficiency. Technological improvements focus on miniaturization, thermal stability, and signal integrity. Adoption is concentrated in automotive electronics, industrial automation, and consumer devices.

Competition in the passive and interconnecting electronic components market is being shaped by component reliability, miniaturization, and electrical performance for consumer electronics, industrial systems, automotive, and telecommunications applications. Market positions are being reinforced through advanced materials, precision manufacturing, and global distribution networks that ensure consistent capacitance, resistance, inductance, and connectivity performance. Murata Manufacturing Co., Ltd. and TDK Corporation are being represented with capacitors, inductors, and resistors engineered for high stability, low losses, and broad frequency applications. TE Connectivity Ltd. and AVX Corporation are being promoted with connectors, terminals, and interconnect solutions structured for secure electrical pathways, vibration resistance, and thermal tolerance. Amphenol Corporation is being applied with interconnecting systems optimized for high-density applications, automotive electronics, and industrial control systems, ensuring reliable signal and power transfer. Components are being integrated into printed circuit boards, communication modules, and control units to enhance system performance and durability. Strategies in the market are being centered on product miniaturization, high-performance specifications, and compatibility with emerging electronics trends. Research and development are being allocated to improve electrical stability, thermal resistance, signal integrity, and environmental durability. Product brochures are being structured with specifications covering capacitance, resistance, inductance, voltage rating, connector type, and mechanical tolerance. Features such as compact design, high reliability, wide operating range, and low insertion loss are being emphasized to guide procurement and system design. Each brochure is being arranged to present technical performance, compliance standards, and handling guidelines. Information is being provided in a clear, evaluation-ready format to assist electronics manufacturers, integrators, and procurement teams in selecting passive and interconnecting components that meet performance, reliability, and operational requirements.

| Item | Value |

|---|---|

| Quantitative Units | USD 192.6 Billion |

| Type | Passive and Interconnecting |

| Application | Consumer electronics, Automotive, Healthcare, IT & telecom, Telecom equipment, Networking devices, Industrial, Automation & robotics, Power generation, Industrial control systems, Others, Aerospace & defense, Military communications, Weaponry systems, Aircraft safety systems, Others, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Murata Manufacturing Co., Ltd., TDK Corporation, TE Connectivity Ltd., AVX Corporation, and Amphenol Corporation |

| Additional Attributes | Dollar sales by component type and end use, demand dynamics across consumer electronics, automotive, and industrial sectors, regional trends in electronics manufacturing, innovation in miniaturization, reliability, and connectivity, environmental impact of electronic waste, and emerging use cases in IoT devices, wearables, and smart infrastructure. |

The global passive and interconnecting electronic components market is estimated to be valued at USD 192.6 billion in 2025.

The market size for the passive and interconnecting electronic components market is projected to reach USD 375.4 billion by 2035.

The passive and interconnecting electronic components market is expected to grow at a 6.9% CAGR between 2025 and 2035.

The key product types in passive and interconnecting electronic components market are passive, _resistors, _capacitors, _inductors, _transformers, _others, interconnecting, _pcb, _connectors, _switches & relays and _others.

In terms of application, consumer electronics segment to command 27.4% share in the passive and interconnecting electronic components market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Passive Temperature-Controlled Packaging Solutions Market Size and Share Forecast Outlook 2025 to 2035

Passive Optical Network Market Size and Share Forecast Outlook 2025 to 2035

Passive Fire Protection Market Size and Share Forecast Outlook 2025 to 2035

Passive Fire Protection Materials Market Size and Share Forecast Outlook 2025 to 2035

Passive Infrared Sensor Market Size and Share Forecast Outlook 2025 to 2035

Passive Prosthetics Market

Passive Tunable Integrated Circuits Market

Passive Optical Components Market Size and Share Forecast Outlook 2025 to 2035

Gigabit Passive Optical Network (GPON) Market Size and Share Forecast Outlook 2025 to 2035

Gigabit Passive Optical Network Equipment Market Size and Share Forecast Outlook 2025 to 2035

Integrated Passive Devices (IPDs) Market

Android Automotive OS (AAOS) Market Size and Share Forecast Outlook 2025 to 2035

Anderson Cascade Impactor Market Size and Share Forecast Outlook 2025 to 2035

Andersen-Tawil Syndrome Treatment Market Trends - Growth & Future Prospects 2025 to 2035

Andro Supplements Market

Candle Filter Cartridges Market Size and Share Forecast Outlook 2025 to 2035

Handheld Electrostatic Meter Market Size and Share Forecast Outlook 2025 to 2035

Hand Towel Automatic Folding Machine Market Size and Share Forecast Outlook 2025 to 2035

Handheld Ultrasound Scanner Market Size and Share Forecast Outlook 2025 to 2035

Handheld Tagging Gun Market Forecast and Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA