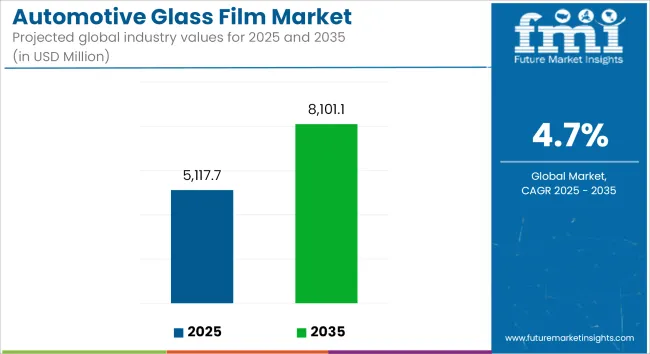

The global automotive glass film market is expected to expand from USD 5,117.7 million in 2025 to USD 8,101.1 million by 2035, registering a CAGR of 4.7% over the forecast period. Growth has been influenced by evolving thermal comfort standards, increased focus on passenger protection, and expanding film applications in both OEM and aftermarket channels.

In February 2025, Avery Dennison introduced its Encore™ Series, developed using nanotechnology to support solar performance and UV shielding. According to Avery Dennison’s product release, over 99% of UV rays can be blocked by the films, while up to 93% of infrared heat is rejected. Glare reduction of approximately 94% was also highlighted. The product range was created to suit newer vehicle electronics without interfering with digital signal reception.

Meanwhile, Al-Rabiya Auto Accessories launched a carbon-based window film line in early 2025 under the Luminous brand. The product was developed for the Middle East region, where internal cabin temperatures frequently exceed 45°C. As noted in the company’s announcement, high-temperature resistance and improved opacity levels were included to address visibility and interior fading concerns.

In 2024, Hyundai Motor Company and Kia introduced Nano Cooling Film across selected vehicle platforms. As per the official release, this film technology was engineered to reduce interior temperatures by more than 12°C under sunlight. Passive thermal regulation was prioritized, particularly for electric vehicle models, where HVAC load directly affects battery performance and range.

A rise in UV-related health advisories and solar load concerns has been observed across global automotive safety programs. To meet these evolving guidelines, non-metallic film technologies with minimal radio-frequency interference have been prioritized. Additionally, increased deployment of these films has been observed across public transport vehicles and private fleets in tropical markets.

The integration of tinted films during OEM production cycles has also been expanded. According to regional distributors, factory-prepped windows with embedded films are now being supplied in mid-segment and electric vehicle lines, driven by demand for higher cabin efficiency. In the aftermarket, digitally pre-cut kits and self-healing coatings are being adopted to reduce installation time and maintenance costs.

As regulatory frameworks evolve, and cabin safety remains under scrutiny, demand for functional automotive glass film is expected to remain strong through 2035. Manufacturers are expected to focus on durability, clarity, and compatibility with future vehicle connectivity systems.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 5,117.7 million |

| Industry Value (2035F) | USD 8,101.1 million |

| CAGR (2025 to 2035) | 4.7% |

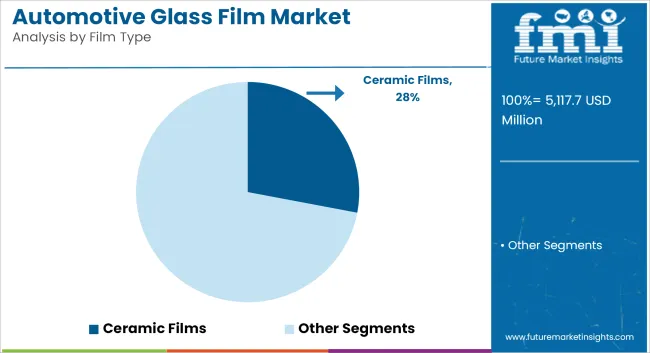

Ceramic films accounted for 28% of the global automotive window film market in 2025 and are projected to grow at a CAGR of 4.9% through 2035. Adoption was driven by the demand for high infrared (IR) rejection, low reflectivity, and compatibility with modern in-vehicle electronics such as GPS, mobile networks, and toll sensors.

In 2025, ceramic films were widely installed in premium passenger cars and electric vehicles, where thermal comfort and electronic signal clarity were critical. These films offered a durable, non-metallic solution that maintained clear visibility while blocking UV and IR radiation, improving cabin insulation without interfering with wireless communication.

Manufacturers emphasized ceramic-based multilayer constructions to enhance scratch resistance, glare control, and aesthetic uniformity. Adoption continued to increase in markets such as North America, Japan, and the Middle East, where solar load reduction and vehicle cooling efficiency were prioritized.

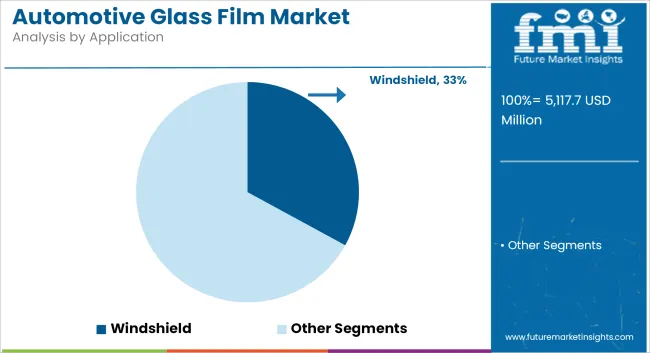

Windshields held 33% of the global market share by application in 2025 and are expected to grow at a CAGR of 4.8% through 2035. Film application on windshields was driven by rising consumer demand for interior temperature regulation, glare reduction, and UV protection without compromising driver visibility.

In 2025, regulatory clarity in key markets such as the USA, Germany, and South Korea enabled the use of high-visibility films with legally permissible visible light transmission (VLT) values. OEMs and aftermarket service providers applied advanced films on front windshields to complement factory-installed laminated glass, improving solar performance and reducing HVAC loads.

The use of nano-ceramic and clear ceramic films gained momentum in high-temperature regions, where day-time driving comfort and dashboard protection were emphasized. Advancements in adhesive formulations and contour-matching film designs further supported installation efficiency and optical clarity in the windshield segment.

Regulatory Inconsistencies and Tinting Restrictions

The variability of legislation on window tinting and visibility results in a severe obstacle for the expansion of the market on a global level. In many countries, strict implementation of the minimum VLT (Visible Light Transmission) threshold levels results in dark-tinted films, especially those for the front windshield and driver-side window prohibiting their use.

The regulations vary drastically from state to state or from from one country to another, causing installer confusion and cross-market product standardization limitations. For instance, India once banned all windows with sun control films installed, and only a few states have recently made partial changes.

The inconsistent practices dissuade OEMs from mass integration, while the aftermarket players face legal troubles and cease product sales. This fragmentation system, in turn, consumes the resources and affects the consumer’sconfidence.

Heat Rejection Performance vs. Optical Clarity Trade-Off

The trading off of heat rejection ability for good optical clarity is what makes it particularly difficult for car manufacturers and customers to find the films that have high infrared (IR) and UV rejection. Some types of films, which are metalized, although they are good for heat rejecting, are against GPS, mobile signals, and RFID systems, the latest issues concerning the connected vehicles.

Whereas the films used in lower grade clothes often break down with age leading to 'blurring', 'discoloration', and 'delamination', which actually are not good for safety. Nano-ceramic films are one possible solution, but they come with a relatively higher price that discourages their use in budget markets. The confrontation of technicality in maintaining optical clarity and solar rejection, which are not affected by cost, has been a market challenge.

EV and Hybrid Vehicles Driving Demand for Thermal Efficiency

The steep increase in the number of electric and hybrid vehicles causes strong demand for thermal insulating glass films that not only reduce the cabin load but also enable the battery to work longer. Due to the lack of traditional engine heat in EVs, the cabin temperature is maintained with the help of electrified HVAC systems that, in turn, use power from the battery.

The primary benefit of applying high-IR rejection materials on the windshields, sunroofs, and side glass configurations are the lower cabin heat, energy savings, and increasing occupant's comfort. In 2023, multiple EV manufacturers in Asia and Europe have begun utilizing nano-ceramic films in their factory glass packages, especially for panoramic roofs. This is a high-end product-opportunity trend in line with the principles of sustainable mobility.

Advanced Films Enabling Multi-Functional Glass Performance

Smart and multifunctional glass films are encroaching on automotive windshields, creating a smart, responsive surface. The new generation of glass films is coming equipped with features such as UV protection, anti-glare, shatter resistance, anti-fogging, and even switchable tint (electrochromic whichever).

Nano-ceramic films are being developed to support integrated sensors and heads-up display (HUD) compatibility, making them valuable in ADAS-enabled vehicles. Some OEMs are even experimenting with self-healing and hydrophobic coatings, which are embedded in window films.

These breakthroughs elevate film glass roles from mere accessories to being core functional elements in smart vehicles. Those who decide to invest in multi-layer, multi-performance films are the first ones to take the automotive glass innovation to the next level.

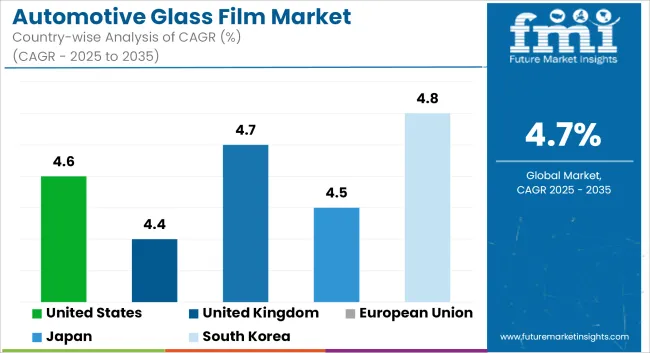

The automotive glass film market in the United States is fostering robust expansion, thanks to the growing awareness of UV protection, heat rejection, and privacy enhancement in vehicles. Demand for ceramic and nano-ceramic films is particularly spiking in luxury and electric vehicles, while dyed and metalized films are still dominant in aftermarket installations. Exhibiting growth are all glazing applications, comprising windshields, side windows, and sunroofs.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 4.6% |

The automotive glass film market in the United Kingdom is progressing healthily, spurred on by the increased interest for privacy, thermal control, and glare reduction in both private and fleet vehicles. The ceramic films are entering the market while being non-metallic and being more efficient in infrared blocking. The applications of the films are different while they are used in the standard glass and panoramic roofs.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 4.4% |

The automotive glass film market in the European Union is evolving, propelled by environmental regulations, energy efficiency targets, and increased individuality of vehicles. In countries such as Germany, France, and Italy, there is a significant demand for nano-ceramic and metal films both in OEMs and in the aftermarket. The applications go from the windshield rejection of heat to the moonroof UV filtration.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 4.7% |

The automotive glass film market in Japan is propelled by the country’s strong automotive industry and a culture of privacy, comfort, and longevity. Ceramic and nano-ceramic films are being introduced into both the OEM and the aftermarket programs. Particularly the compact and mid-size cars are the benefactors through the application of films on sunroofs, door glass, and windshields.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.5% |

In the South Korean automotive glass film market, there is a solid increase being driven by the choice of consumers for UV protection, and interior preservation while obtaining an advanced styling of vehicles. Both the OEMs and the aftermarket providers are prioritizing long-term films for windshields and side glass. Also, with the introduction of electric and connected vehicles, the usage of nano-ceramic films in premium trims is transforming into a standard.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.8% |

Market Overview The automotive glass film market is gaining traction as the carmakers and drivers are ever more interested in reducing heat, improving UV protection, glare control, and privacy in vehicles. Glass films also help to keep the air conditioning system energy efficient besides being functional and aesthetic.

Ceramic and nano-ceramic technologies have progressed, which makes visibility better and infrared rejection possible without signal interference. The automotive glass film sector is an ongoing process of growing both in OEM and aftermarket channels with a special focus in the premium vehicle segment and legislative support in hot and sunny areas.

3M Company

3M is the world's number one company in the field of automotive window films. The company introduces nanotechnology-based products which have the features of superior heat and UV protection. There are many films utilized in this brand both in OEM applications and in preference because of their non-composition that avoids electronic interference.

Eastman Chemical Company

Eastman, utilizing its LLumar brand, is the supplier of a wide range of film technologies, such as metalized and nano-ceramic types. Its partnerships with OEMs and advances in the fields of sustainability and endurance are the reasons for its outstanding position in the global market.

Saint-Gobain Performance Plastics

Saint-Gobain focuses on manufacturing very light and superior materials. Wit...

Johnson Window Films

Johnson Window Films is a company mainly dealing with the aftermarket segment. This company is largely concentrating on customization and affordability. It offers dependable solutions for privacy, solar control, and aesthetic enhancements across different vehicle types.

Avery Dennison Corporation

Avery Dennison presents a mix of functional and cool automotive glass films which are of interest both to OEM and aftermarket consumers. Its films are specifically designed to support energy savings, comfort, and vehicle personalization.

Dyed Films, Metalized Films, Ceramic Films, Nano-Ceramic Films, Others.

Windshield, Back Glass (Safety Window), Door Glass (Side Window), Quarter Glass, Vent Glass, Moon/Sun Roof.

The overall market size for the Automotive Glass Film Market was USD 5,117.7 Million in 2025.

The Automotive Glass Film Market is expected to reach USD 8,101.1 Million in 2035.

Rising demand for UV protection, cabin comfort, fuel efficiency, and customization will drive market growth globally.

The top 5 countries driving the development of the Automotive Glass Film Market are the USA, China, India, Japan, and Brazil.

Nano-Ceramic Films are expected to lead due to their superior heat rejection, optical clarity, and compatibility with modern in-car technologies.

Table 01: Global Market Volume (Million. Sq. Mt) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Film Type

Table 02: Global Market Volume (Million. Sq. Mt) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Film Type

Table 03: Global Market Value (US$ Million) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Film Type

Table 04: Global Market Value (US$ Million) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Film Type

Table 05: Global Market Volume (Million. Sq. Mt) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Application

Table 06: Global Market Value (US$ Million) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Application

Table 07: Global Market Size Volume (Million. Sq. Mt) Analysis and Forecast By Region, 2023 to 2033

Table 08: Global Market Size (US$ Million) Analysis and Forecast By Region, 2018 to 2033

Table 09: North America Market Volume (Th. Sq. Mt) Analysis and Forecast By Country, 2018 to 2033

Table 10: North America Market Size (US$ Million) Analysis and Forecast By Country, 2018 to 2033

Table 11: North America Market Volume (Th. Sq. Mt) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Film Type

Table 12: North America Market Volume (Th. Sq. Mt) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Film Type

Table 13: North America Market Value (US$ Million) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Film Type

Table 14: North America Market Value (US$ Million) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Film Type

Table 15: North America Market Volume (Million. Sq. Mt) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Application

Table 16: North America Market Value (US$ Million) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Application

Table 17: Latin America Market Volume (Th. Sq. Mt) Analysis and Forecast By Country, 2018 to 2033

Table 18: Latin America Market Size (US$ Million) Analysis and Forecast By Country, 2018 to 2033

Table 19: Latin America Market Volume (Th. Sq. Mt) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Film Type

Table 20: Latin America Market Volume (Th. Sq. Mt) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Film Type

Table 21: Latin America Market Value (US$ Million) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Film Type

Table 22: Latin America Market Value (US$ Million) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Film Type

Table 23: Latin America Market Volume (Million. Sq. Mt) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Application

Table 24: Latin America Market Value (US$ Million) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Application

Table 25: Western Europe Market Size Volume (Th. Sq. Mt) Analysis and Forecast By Country, 2018 to 2033

Table 26: Western Europe Market Size (US$ Million) Analysis and Forecast By Country, 2018 to 2033

Table 27: Western Europe Market Volume (Th. Sq. Mt) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Film Type

Table 28: Western Europe Market Volume (Th. Sq. Mt) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Film Type

Table 29: Western Europe Market Value (US$ Million) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Film Type

Table 30: Western Europe Market Value (US$ Million) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Film Type

Table 31: Western Europe Market Volume (Million. Sq. Mt) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Application

Table 32: Western Europe Market Value (US$ Million) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Application

Table 33: Eastern Europe Market Size Volume (Th. Sq. Mt) Analysis and Forecast By Country, 2018 to 2033

Table 34: Western Europe Market Size (US$ Million) Analysis and Forecast By Country, 2018 to 2033

Table 35: Eastern Europe Market Volume (Th. Sq. Mt) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Film Type

Table 36: Eastern Europe Market Volume (Th. Sq. Mt) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Film Type

Table 37: Eastern Europe Market Value (US$ Million) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Film Type

Table 38: Eastern Europe Market Value (US$ Million) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Film Type

Table 39: Eastern Europe Market Volume (Million. Sq. Mt) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Application

Table 40: Eastern Europe Market Value (US$ Million) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Application

Table 41: East Asia Market Size Volume (Th. Sq. Mt) Analysis and Forecast By Country, 2018 to 2033

Table 42: East Asia Market Size (US$ Million) Analysis and Forecast By Country, 2018 to 2033

Table 43: East Asia Market Volume (Th. Sq. Mt) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Film Type

Table 44: East Asia Market Volume (Th. Sq. Mt) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Film Type

Table 45: East Asia Market Value (US$ Million) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Film Type

Table 46: East Asia Market Value (US$ Million) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Film Type

Table 47: East Asia Market Volume (Th. Sq. Mt) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Application

Table 48: East Asia Market Value (US$ Million) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Application

Table 49: South Asia Pacific Market Size Volume (Th. Sq. Mt) Analysis and Forecast By Country, 2018 to 2033

Table 50: South Asia Pacific Market Size (US$ Million) Analysis and Forecast By Country, 2018 to 2033

Table 51: South Asia & Pacific Market Volume (Th. Sq. Mt) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Film Type

Table 52: South Asia & Pacific Market Volume (Th. Sq. Mt) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Film Type

Table 53: South Asia & Pacific Market Value (US$ Million) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Film Type

Table 54: South Asia & Pacific Market Value (US$ Million) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Film Type

Table 55: South Asia & Pacific Market Volume (Million. Sq. Mt) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Application

Table 56: South Asia & Pacific Market Value (US$ Million) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Application

Table 57: Middle East & Africa Market Size Volume (Th. Sq. Mt) Analysis and Forecast By Country, 2018 to 2033

Table 58: Middle East & Africa Market Size (US$ Million) Analysis and Forecast By Country, 2018 to 2033

Table 59: Middle East & Africa Market Volume (Th. Sq. Mt) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Film Type

Table 60: Middle East & Africa Market Volume (Th. Sq. Mt) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Film Type

Table 61: Middle East & Africa Market Value (US$ Million) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Film Type

Table 62: Middle East & Africa Market Value (US$ Million) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Film Type

Table 63: Middle East & Africa Market Volume (Million. Sq. Mt) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Application

Table 64: Middle East & Africa Market Value (US$ Million) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Application

Figure 01: Global Market Historical Volume (Th. Sq. Mt), 2018 to 2022

Figure 02: Global Market Current and Forecast Volume (Th. Sq. Mt), 2023 to 2033

Figure 03: Global Market Historical Value (US$ Million), 2018 to 2022

Figure 04: Global Market Current and Forecast Value (US$ Million), 2023 to 2033

Figure 05: Global Market Incremental $ Opportunity (US$ Million), 2023 to 2033

Figure 06: Global Market Share and BPS Analysis By Film Type, 2023 & 2033

Figure 07: Global Market Y-o-Y Growth Projections By Film Type, 2023 to 2033

Figure 08: Global Market Attractiveness Analysis By Film Type, 2023 to 2033

Figure 09: Global Market Absolute $ Opportunity by Dyed Film Segment, 2018 to 2033

Figure 10: Global Market Absolute $ Opportunity by Metalized Tints Segment, 2018 to 2033

Figure 11: Global Market Absolute $ Opportunity by Ceramic Film Segment, 2018 to 2033

Figure 12: Global Market Absolute $ Opportunity by Nano Ceramic Films Segment, 2018 to 2033

Figure 13: Global Market Absolute $ Opportunity by Others Segment, 2018 to 2033

Figure 14: Global Market Share and BPS Analysis By Application, 2023 & 2033

Figure 15: Global Market Y-o-Y Growth Projections By Application, 2023 to 2033

Figure 16: Global Market Attractiveness Analysis By Application, 2023 to 2033

Figure 17: Global Market Absolute $ Opportunity by Windshield Segment, 2018 to 2033

Figure 18: Global Market Absolute $ Opportunity by Back Glass (Safety Window) Segment, 2018 to 2033

Figure 19: Global Market Absolute $ Opportunity by Door Glass (Side Window) Segment, 2018 to 2033

Figure 20: Global Market Absolute $ Opportunity by Quarter Glass Segment, 2018 to 2033

Figure 21: Global Market Absolute $ Opportunity by Vent Glass Segment, 2018 to 2033

Figure 22: Global Market Absolute $ Opportunity by Moon/Sun Roof Segment, 2018 to 2033

Figure 23: Global Market Value Share and BPS Analysis By Region, 2023 & 2033

Figure 24: Global Market Y-o-Y Growth Projections By Region, 2023 to 2033

Figure 25: Global Market Attractiveness Analysis By Region, 2023 to 2033

Figure 26: Global Market Absolute $ Opportunity by North America Segment, 2018 to 2033

Figure 27: Global Market Absolute $ Opportunity by Latin America Segment, 2018 to 2033

Figure 28: Global Market Absolute $ Opportunity by Western Europe Segment, 2018 to 2033

Figure 29: Global Market Absolute $ Opportunity by Eastern Europe Segment, 2018 to 2033

Figure 30: Global Market Absolute $ Opportunity by South Asia & Pacific Segment, 2018 to 2033

Figure 31: Global Market Absolute $ Opportunity by East Asia Segment, 2018 to 2033

Figure 32 Global Market Absolute $ Opportunity by Middle East & Africa Segment, 2018 to 2033

Figure 33: North America Market Share and BPS Analysis By Country, 2023 & 2033

Figure 34: North America Market Y-o-Y Growth Projections By Country, 2023 to 2033

Figure 35: North America Market Attractiveness Analysis By Country, 2023 to 2033

Figure 36: North America Market Share and BPS Analysis By Film Type, 2023 & 2033

Figure 37: North America Market Y-o-Y Growth Projections By Film Type, 2023 to 2033

Figure 38: North America Market Attractiveness Analysis By Film Type, 2023 to 2033

Figure 39: North America Market Share and BPS Analysis By Application, 2023 & 2033

Figure 40: North America Market Y-o-Y Growth Projections By Application, 2023 to 2033

Figure 41: North America Market Attractiveness Analysis By Application, 2023 to 2033

Figure 42: Latin America Market Share and BPS Analysis By Country, 2023 & 2033

Figure 43: Latin America Market Y-o-Y Growth Projections By Country, 2023 to 2033

Figure 44: Latin America Market Attractiveness Analysis By Country, 2023 to 2033

Figure 46: Latin America Market Share and BPS Analysis By Film Type, 2023 & 2033

Figure 47: Latin America Market Y-o-Y Growth Projections By Film Type, 2023 to 2033

Figure 48: Latin America Market Attractiveness Analysis By Film Type, 2023 to 2033

Figure 49: Latin America Market Share and BPS Analysis By Application, 2023 & 2033

Figure 50: Latin America Market Y-o-Y Growth Projections By Application, 2023 to 2033

Figure 51: Latin America Market Attractiveness Analysis By Application, 2023 to 2033

Figure 52: Western Europe Market Share and BPS Analysis By Country, 2023 & 2033

Figure 53: Western Europe Market Y-o-Y Growth Projections By Country, 2023 to 2033

Figure 53: Western Europe Market Attractiveness Analysis By Country, 2023 to 2033

Figure 54: Western Europe Market Share and BPS Analysis By Film Type, 2023 & 2033

Figure 55: Western Europe Market Y-o-Y Growth Projections By Film Type, 2023 to 2033

Figure 56: Western Europe Market Attractiveness Analysis By Film Type, 2023 to 2033

Figure 57: Western Europe Market Share and BPS Analysis By Application, 2023 & 2033

Figure 58: Western Europe Market Y-o-Y Growth Projections By Application, 2023 to 2033

Figure 59: Western Europe Market Attractiveness Analysis By Application, 2023 to 2033

Figure 60: Eastern Europe Market Share and BPS Analysis By Country, 2023 & 2033

Figure 61: Eastern Europe Market Y-o-Y Growth Projections By Country, 2023 to 2033

Figure 62: Eastern Europe Market Attractiveness Analysis By Country, 2023 to 2033

Figure 63: Eastern Europe Market Share and BPS Analysis By Film Type, 2023 & 2033

Figure 64: Eastern Europe Market Y-o-Y Growth Projections By Film Type, 2023 to 2033

Figure 65: Eastern Europe Market Attractiveness Analysis By Film Type, 2023 to 2033

Figure 66: Eastern Europe Market Share and BPS Analysis By Application, 2023 & 2033

Figure 67: Eastern Europe Market Y-o-Y Growth Projections By Application, 2023 to 2033

Figure 68: Eastern Europe Market Attractiveness Analysis By Application, 2023 to 2033

Figure 69: East Asia Market Share and BPS Analysis By Country, 2023 & 2033

Figure 70: East Asia Market Y-o-Y Growth Projections By Country, 2023 to 2033

Figure 71: East Asia Market Attractiveness Analysis By Country, 2023 to 2033

Figure 72: East Asia Market Share and BPS Analysis By Film Type, 2023 & 2033

Figure 73: East Asia Market Y-o-Y Growth Projections By Film Type, 2023 to 2033

Figure 74: East Asia Market Attractiveness Analysis By Film Type, 2023 to 2033

Figure 75: East Asia Market Share and BPS Analysis By Application, 2023 & 2033

Figure 76: East Asia Market Y-o-Y Growth Projections By Application, 2023 to 2033

Figure 77: East Asia Market Attractiveness Analysis By Application, 2023 to 2033

Figure 78: South Asia Pacific Market Share and BPS Analysis By Country, 2023 & 2033

Figure 79: South Asia Pacific Market Y-o-Y Growth Projections By Country, 2023 to 2033

Figure 80: South Asia Pacific Market Attractiveness Analysis By Country, 2023 to 2033

Figure 81: South Asia & Pacific Market Share and BPS Analysis By Film Type, 2023 & 2033

Figure 82: South Asia & Pacific Market Y-o-Y Growth Projections By Film Type, 2023 to 2033

Figure 83: South Asia & Pacific Market Attractiveness Analysis By Film Type, 2023 to 2033

Figure 84: South Asia & Pacific Market Share and BPS Analysis By Application, 2023 & 2033

Figure 85: South Asia & Pacific Market Y-o-Y Growth Projections By Application, 2023 to 2033

Figure 86: South Asia & Pacific Market Attractiveness Analysis By Application, 2023 to 2033

Figure 87: Middle East & Africa Market Share and BPS Analysis By Country, 2023 & 2033

Figure 88: Middle East & Africa Market Y-o-Y Growth Projections By Country, 2023 to 2033

Figure 89: Middle East & Africa Market Attractiveness Analysis By Country, 2023 to 2033

Figure 90: Middle East & Africa Market Share and BPS Analysis By Film Type, 2023 & 2033

Figure 91: Middle East & Africa Market Y-o-Y Growth Projections By Film Type, 2023 to 2033

Figure 92: Middle East & Africa Market Attractiveness Analysis By Film Type, 2023 to 2033

Figure 93: Middle East & Africa Market Share and BPS Analysis By Application, 2023 & 2033

Figure 94: Middle East & Africa Market Y-o-Y Growth Projections By Application, 2023 to 2033

Figure 95: Middle East & Africa Market Attractiveness Analysis By Application, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Roof Rails Market Size and Share Forecast Outlook 2025 to 2035

Automotive Active Safety System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Diagnostic Scan Tool Market Size and Share Forecast Outlook 2025 to 2035

Automotive Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Dynamic Map Data Market Size and Share Forecast Outlook 2025 to 2035

Automotive Green Tires Market Size and Share Forecast Outlook 2025 to 2035

Automotive E-Tailing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Interior Market Forecast Outlook 2025 to 2035

Automotive Key Market Size and Share Forecast Outlook 2025 to 2035

Automotive Appearance Chemical Market Forecast and Outlook 2025 to 2035

Automotive Seating Market Forecast and Outlook 2025 to 2035

Automotive Domain Control Module Market Forecast and Outlook 2025 to 2035

Automotive Remote Diagnostic Market Forecast and Outlook 2025 to 2035

Automotive-grade Inertial Navigation System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Thin IGBT Module Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hydrogen Leak Detection Sensors Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hybrid IGBTs Market Size and Share Forecast Outlook 2025 to 2035

Automotive Exhaust Extraction Hose Reels Market Size and Share Forecast Outlook 2025 to 2035

Automotive Electroplating Service Market Size and Share Forecast Outlook 2025 to 2035

Automotive Manufacturing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA