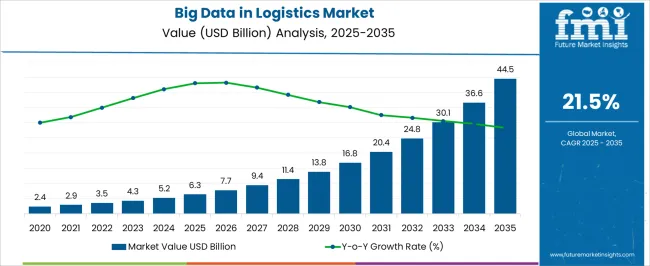

The big data in logistics industry is forecasted to advance from USD 6.3 billion in 2025 to USD 44.5 billion in 2035 at a CAGR of 21.5%. The curve illustrates aggressive value accumulation as figures move from USD 6.3 billion in 2025 to USD 11.4 billion in 2027 and USD 16.8 billion in 2029. This accelerated rise emphasizes the growing reliance on data-driven logistics planning, predictive route optimization, and warehouse analytics. Analysts argue that the slope of the curve underscores a transformative phase where data platforms are not optional but necessary.

Momentum is being shaped by complex supply chain dependencies requiring real-time intelligence. By 2030, the industry value climbs to 20.4 billion, advancing to USD 24.8 billion in 2031 and USD 30.1 billion in 2032. Growth intensifies with USD 36.6 billion in 2034 before closing at USD 44.5 billion in 2035, marking a near sevenfold expansion within a decade. The long-term accumulation curve signals a pronounced shift toward integration of big data tools in freight scheduling, inventory forecasting, and demand sensing. Industry experts suggest the steep trajectory highlights competitive advantage gained through visibility, speed, and analytical precision. The pattern validates big data in logistics as a cornerstone investment that enhances efficiency and strategic control.

| Metric | Value |

|---|---|

| Big Data in Logistics Market Estimated Value in (2025 E) | USD 6.3 billion |

| Big Data in Logistics Market Forecast Value in (2035 F) | USD 44.5 billion |

| Forecast CAGR (2025 to 2035) | 21.5% |

The big data in logistics segment is estimated to account for around 9% of the big data analytics market, close to 11% of the supply chain management market, nearly 13% of the logistics technology market, about 8% of the transportation management systems market, and nearly 10% of the freight and cargo management market. In total, this translates into an aggregated share of roughly 51% across its parent sectors. Such a proportion underscores the centrality of big data in logistics as an enabler of predictive insights, operational transparency, and efficiency in complex distribution networks.

Its value has been recognized in accelerating demand forecasting, fleet optimization, and warehouse efficiency, making it indispensable for businesses facing mounting competitive pressures. Analysts consider it a defining factor that reshapes decision-making by transforming raw operational information into actionable intelligence, thereby influencing profitability and resilience. The reliance on data-driven logistics is not regarded as a temporary phenomenon but rather a long-term industry shift, as companies increasingly embed analytics into both strategic and tactical operations.

With real-time data collection from telematics, sensors, and transactional records, the domain of big data in logistics is seen as a strategic lever that directly strengthens customer service, reduces costs, and secures greater agility across the global freight ecosystem.

The big data in logistics market is expanding rapidly as supply chain operations increasingly rely on data-driven decision-making to enhance efficiency, reduce costs, and improve customer satisfaction. Industry reports and corporate disclosures have highlighted the growing integration of IoT devices, telematics, and advanced analytics platforms into logistics workflows, enabling real-time tracking, predictive maintenance, and route optimization.

The surge in e-commerce and global trade has accelerated demand for scalable big data solutions capable of handling complex, high-volume datasets. Additionally, the need for compliance with evolving trade regulations and sustainability goals is driving the adoption of advanced data analytics in transportation, warehousing, and inventory management.

Strategic investments by logistics providers in both infrastructure and talent have strengthened analytics capabilities, while partnerships with technology firms are broadening solution offerings. The market is expected to maintain strong momentum, driven by on-premises infrastructure adoption for security-sensitive operations, large enterprise-led investments, and ongoing hardware advancements to support high-performance data processing in logistics networks.

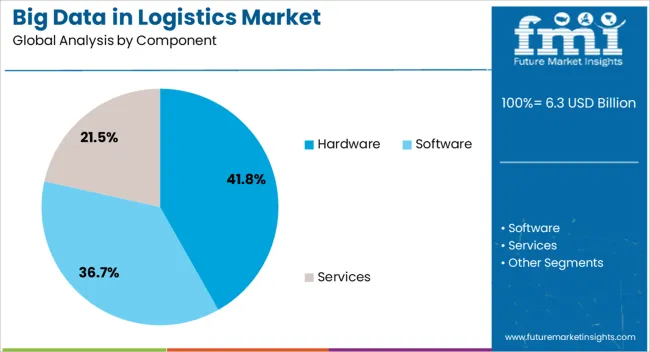

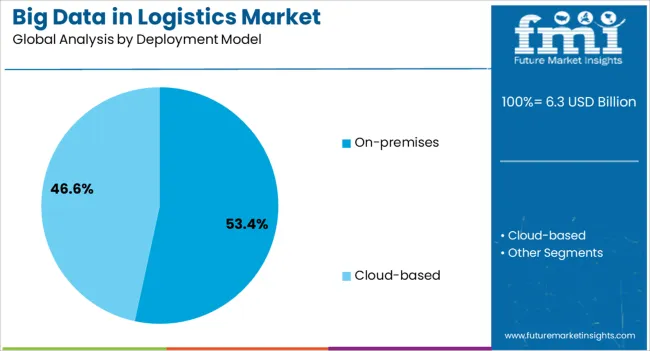

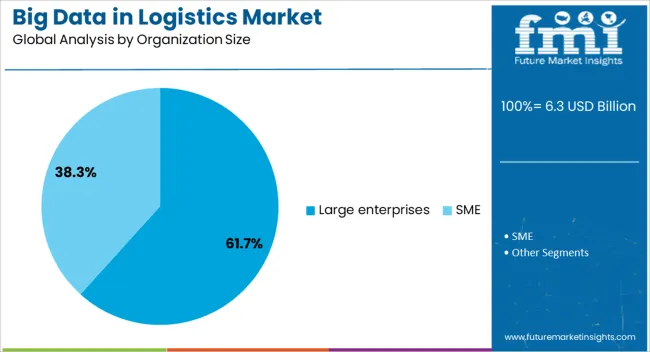

The big data in logistics market is segmented by component, deployment model, organization size, application, end user, and geographic regions. By component, big data in logistics market is divided into Hardware, Software, and Services. In terms of deployment model, big data in logistics market is classified into On-premises and Cloud-based. Based on organization size, big data in logistics market is segmented into Large enterprises and SME. By application, big data in logistics market is segmented into Supply chain optimization, Warehouse management, Fleet management, Predictive analytics, and Others. By end user, big data in logistics market is segmented into Transportation & shipping companies, Manufacturing, Retail, Third-party logistics, and Others. Regionally, the big data in logistics industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The hardware segment is projected to hold 41.80% of the big data in logistics market revenue in 2025, reflecting the continued importance of physical infrastructure in supporting advanced analytics. Growth in this segment has been driven by the increasing deployment of high-performance servers, storage systems, and networking equipment to process and store large-scale logistics data.

Industry updates have pointed to the expanding use of IoT-enabled devices, RFID readers, and telematics units, which require robust hardware support for data capture and transfer. Large logistics hubs and distribution centers are investing in scalable hardware solutions to accommodate growing data volumes and to ensure low-latency processing for time-sensitive operations.

The integration of edge computing hardware has further enhanced real-time analytics capabilities, allowing faster decision-making in dynamic logistics environments. With ongoing advancements in processing power and storage efficiency, the hardware segment is expected to remain a core enabler of big data adoption in logistics.

The on-premises segment is projected to account for 53.40% of the big data in logistics market revenue in 2025, maintaining its lead due to heightened demand for data security, control, and compliance. Logistics companies handling sensitive shipment data, proprietary algorithms, and client information have favored on-premises deployments to maintain full control over their data infrastructure.

This model also enables customization of analytics environments to meet specific operational needs and integrate seamlessly with legacy systems. Reports from technology integrators have indicated that large-scale logistics operations often prioritize on-premises solutions for their ability to deliver consistent performance without dependency on external connectivity.

Additionally, on-premises infrastructure mitigates cybersecurity risks associated with multi-tenant cloud environments. As regulatory frameworks around data protection continue to evolve, the preference for secure, in-house analytics systems is expected to sustain the dominance of the on-premises segment in the logistics sector.

The large enterprises segment is projected to contribute 61.70% of the big data in logistics market revenue in 2025, underscoring its dominant role in driving adoption and investment. Large-scale logistics operators have greater financial capacity to implement sophisticated analytics infrastructure, integrate IoT networks, and deploy advanced data visualization platforms.

Corporate filings and industry case studies have shown that these enterprises leverage big data to optimize multi-modal transportation, improve warehouse efficiency, and enhance last-mile delivery accuracy. Their complex, high-volume operations generate significant datasets, necessitating robust analytics capabilities to derive actionable insights.

Large enterprises also lead in experimenting with AI-driven predictive models and digital twins to simulate supply chain scenarios. Furthermore, strategic partnerships with technology vendors and research institutions allow them to remain at the forefront of innovation. This combination of operational scale, investment capacity, and strategic focus is expected to keep large enterprises at the forefront of big data adoption in logistics.

The big data in logistics market is set to expand as enterprises prioritize predictive analytics, supply chain visibility, and intelligent decision-making. Demand is being fueled by the push for real-time monitoring of fleet operations and warehouse efficiency. Opportunities are opening through integration with IoT-enabled devices, cross-border trade flows, and demand forecasting tools. Key trends include digital twins, route optimization platforms, and AI-driven predictive maintenance. Challenges such as fragmented data sources, infrastructure constraints, and high implementation costs remain barriers to broad-scale adoption across the sector.

Demand for big data in logistics has been driven by the growing emphasis on predictive analytics and real-time monitoring. Logistics operators and third-party providers have leaned on big data to streamline warehousing, inventory management, and fleet scheduling. The ability to anticipate demand surges, reduce downtime, and optimize delivery schedules has been viewed as a competitive necessity. In an opinionated perspective, companies unable to incorporate big data solutions risk being outpaced by rivals who achieve higher efficiency. Demand has also been reinforced by the rising complexity of cross-border operations where real-time tracking and compliance monitoring are mandatory. As shippers and freight forwarders seek to lower operational risks while enhancing service reliability, the demand for big data-driven logistics solutions has become a fundamental part of digital supply chain strategies.

Opportunities for big data in logistics are unfolding through expanding trade corridors, integration with IoT systems, and advanced demand forecasting tools. Companies have explored connected sensors in fleets and warehouses to generate actionable insights from real-time data streams. Cross-border trade growth has provided new opportunities for predictive compliance monitoring and customs clearance optimization. Opinions suggest that the strongest opportunities lie in combining big data with digital twin models to simulate entire logistics networks for risk planning. Opportunities also exist in last-mile delivery, where customer-centric analytics are helping logistics providers fine-tune service reliability. As enterprises prioritize faster and more transparent supply chains, big data solutions are positioned to capture a larger role in decision-making. This expansion signals a long-term opportunity for firms that can deliver integrated and industry-specific analytics capabilities.

Trends in the big data in logistics market have centered on advanced analytics adoption, route optimization, and AI-driven predictive maintenance. Logistics firms have adopted digital twin models to visualize network performance and simulate disruptions. Predictive maintenance of vehicles and handling equipment has been prioritized as downtime directly impacts delivery reliability. Opinions point to the trend of customer-focused analytics, with firms using big data to predict consumer demand and personalize services. The rise of cloud-based analytics platforms has also supported this trend, offering scalable and flexible solutions for enterprises of different sizes. Regional logistics hubs are adopting advanced data platforms to handle surging volumes from e-commerce and cross-border trade. Collectively, these trends highlight how big data is transitioning from a supplementary tool to an essential backbone of logistics operations.

Challenges have been evident in the big data in logistics market due to fragmented data sources, infrastructure limitations, and high costs of deployment. Integration of data across diverse systems has proven complex, with many organizations struggling to standardize inputs from fleets, warehouses, and third-party providers. Limited digital infrastructure in developing regions has restricted the scaling of analytics platforms, creating regional disparities in adoption. Opinions suggest that cost remains a pressing barrier, with small and mid-sized logistics firms often excluded from advanced solutions due to affordability concerns. Cybersecurity and data governance issues have also posed challenges as sensitive logistics data becomes vulnerable to breaches. These structural barriers highlight that while big data holds transformative potential, its widespread adoption will require coordinated efforts in infrastructure, affordability, and regulatory compliance.

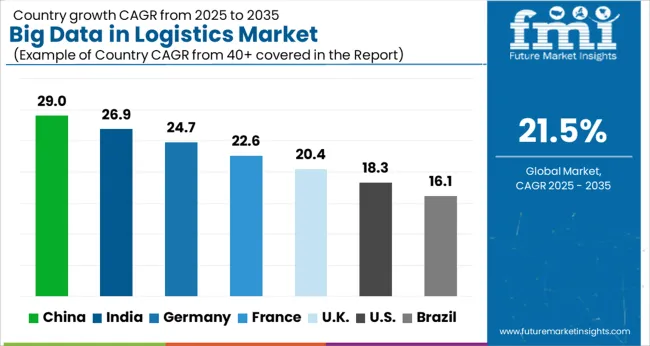

| Countries | CAGR |

|---|---|

| China | 29.0% |

| India | 26.9% |

| Germany | 24.7% |

| France | 22.6% |

| UK | 20.4% |

| USA | 18.3% |

| Brazil | 16.1% |

The global big data in logistics market is projected to grow at a CAGR of 21.5% from 2025 to 2035. China is expected to dominate expansion at 29.0%, followed by India at 26.9% and Germany at 24.7%. The United Kingdom is projected at 20.4%, while the United States posts the slowest growth at 18.3%. Rising adoption of predictive analytics, AI driven supply chain intelligence, and real time tracking is reshaping logistics efficiency. Asian economies show faster growth due to large scale investments in smart freight corridors, manufacturing exports, and digital logistics platforms. European regions adopt advanced analytics for multimodal transport and sustainability compliance, while the USA reflects mature systems and incremental upgrades in a competitive logistics landscape. This report includes insights on 40+ countries; the top markets are shown here for reference.

The big data in logistics market in China is projected to grow at a CAGR of 29.0%. Expansion is propelled by rapid deployment of AI powered freight platforms, smart port management, and high volume e commerce delivery systems. Data integration across road, rail, and maritime modes enhances efficiency and lowers costs. National initiatives supporting intelligent transport corridors further boost analytics adoption. China’s ability to leverage scale, combined with government backed digitization programs, secures its leadership in this space.

The big data in logistics market in India is forecast to expand at a CAGR of 26.9%. Adoption is being driven by digital freight matching platforms, warehouse automation, and demand for predictive supply chain visibility. Policy frameworks encouraging digital infrastructure and unified logistics platforms strengthen the ecosystem. Integration of big data with IoT devices in transport fleets improves route optimization and cost management. India’s strong base of IT expertise and startup activity further accelerates innovation in logistics analytics.

The big data in logistics market in Germany is expected to grow at a CAGR of 24.7%. Industrial exporters, automotive OEMs, and logistics providers invest heavily in advanced analytics for multimodal networks. Big data supports predictive maintenance, warehouse robotics, and real time shipment visibility across EU trade corridors. Germany’s role as a central logistics hub in Europe ensures consistent adoption, while compliance with regulatory frameworks pushes firms to optimize operations. Efficiency and transparency gains sustain growth momentum.

The big data in logistics market in the UK is projected to grow at a CAGR of 20.4%. Demand is being shaped by e commerce fulfillment, urban logistics optimization, and cross border trade management. Companies prioritize customer centric delivery services that rely on analytics for efficiency and transparency. Ports and distribution centers integrate big data platforms for predictive scheduling and resource allocation. Though growth is moderate compared to Asia, the UK’s focus on digital logistics networks ensures steady adoption.

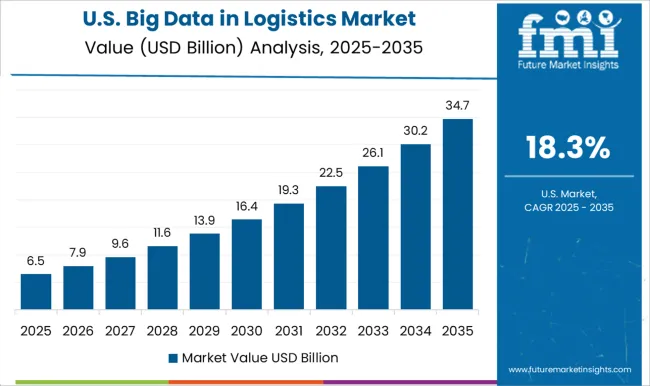

The big data in logistics market in the US is forecast to grow at a CAGR of 18.3%. Adoption is steady as logistics firms focus on fleet management, warehouse automation, and supply chain risk mitigation. While mature infrastructure limits headline growth, significant opportunities exist in applying advanced analytics to intermodal transport and cross country freight corridors. Investments in AI and cloud platforms strengthen predictive capabilities for cargo visibility and route optimization. USA providers focus on improving service differentiation through data driven insights.

Competition in big data for logistics has been built around how convincingly solution brochures translate analytics into operational savings. IBM pushes its Sterling and Watson based offerings with brochures that stress predictive insights, inventory accuracy, and real time freight visibility. Microsoft Corporation promotes Azure logistics stacks, highlighting in brochures the ability to integrate Power BI dashboards and AI modules into warehouse and fleet operations. Oracle presents logistics cloud brochures with detailed reference architectures, explaining how predictive analytics, order orchestration, and supplier collaboration can be executed within one ecosystem. SAP competes with logistics specific S/4HANA extensions, using brochures to show shipment tracking, route optimization, and digital twin models that cut operational cost. AWS focuses its brochures on scalable data lakes and AI services for logistics, emphasizing elastic cost models and machine learning driven supply chain forecasting. Each competitor sells not just software but a published promise of speed, visibility, and lower cost per shipment. Specialist providers sharpen the narrative by tailoring brochures to industry verticals. Blue Yonder emphasizes demand sensing and transportation management, with brochures that detail advanced analytics, Luminate Control Tower, and embedded machine learning for disruption handling. Teradata positions itself with brochures on data warehousing for logistics, stressing query speed, multi source data integration, and analytics at scale for carriers and shippers. Strategy has been straightforward: frame big data not as an abstract tool but as logistics specific outcomes written into product literature. Buyers compare brochures for dashboard clarity, integration ease, AI capability, and industry references rather than brand names alone. Competitive edge is therefore secured when product literature offers dense visuals, case driven metrics, and tangible ROI markers. In this market, the brochure acts as the battleground where complex platforms are simplified into practical, trusted logistics solutions.

| Item | Value |

|---|---|

| Quantitative Units | USD 6.3 Billion |

| Component | Hardware, Software, and Services |

| Deployment Model | On-premises and Cloud-based |

| Organization Size | Large enterprises and SME |

| Application | Supply chain optimization, Warehouse management, Fleet management, Predictive analytics, and Others |

| End User | Transportation & shipping companies, Manufacturing, Retail, Third-party logistics, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | IBM, Microsoft Corporation, Oracle Corporation, SAP, AWS, Blue Yonder, and Teradata |

| Additional Attributes | Dollar sales by application (route optimization, predictive maintenance, demand forecasting, inventory management, risk & compliance), Dollar sales by deployment type (on-premise, cloud-based, hybrid), Trends in AI-driven logistics analytics and real-time visibility, Role in enhancing supply chain resilience and warehouse automation, Growth of e-commerce logistics and last-mile delivery optimization, Regional adoption patterns across North America, Europe, and Asia Pacific. |

The global big data in logistics market is estimated to be valued at USD 6.3 billion in 2025.

The market size for the big data in logistics market is projected to reach USD 44.5 billion by 2035.

The big data in logistics market is expected to grow at a 21.5% CAGR between 2025 and 2035.

The key product types in big data in logistics market are hardware, software, services, _professional services and _managed services.

In terms of deployment model, on-premises segment to command 53.4% share in the big data in logistics market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Big Data Security Market Size and Share Forecast Outlook 2025 to 2035

Big Data Analytics in Construction Market Size and Share Forecast Outlook 2025 to 2035

Tourism Industry Big Data Analytics Market Analysis by Application, by End, by Region – Forecast for 2025 to 2035

Data Security Posture Management (DSPM) Solutions Market Size and Share Forecast Outlook 2025 to 2035

Data Loss Prevention (DLP) Services Market Size and Share Forecast Outlook 2025 to 2035

Data Pipeline Observability Solutions Market Size and Share Forecast Outlook 2025 to 2035

Logistics Packaging Market Size and Share Forecast Outlook 2025 to 2035

Data Center Market Forecast and Outlook 2025 to 2035

DataOps Platform Market Size and Share Forecast Outlook 2025 to 2035

Datacenter Infrastructure Services Market Size and Share Forecast Outlook 2025 to 2035

Data Acquisition Hardware Market Size and Share Forecast Outlook 2025 to 2035

Data Center Automatic Transfer Switches and Switchgears Market Size and Share Forecast Outlook 2025 to 2035

Data Discovery Market Size and Share Forecast Outlook 2025 to 2035

Data Masking Technology Market Size and Share Forecast Outlook 2025 to 2035

Data Centre Rack Server Market Size and Share Forecast Outlook 2025 to 2035

Data Center Power Management Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Data Center Power Management Industry Analysis in Korea Size and Share Forecast Outlook 2025 to 2035

Data Center Liquid Cooling Market Size and Share Forecast Outlook 2025 to 2035

Data Business in Oil & Gas Market Size and Share Forecast Outlook 2025 to 2035

Data Centre Colocation Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA