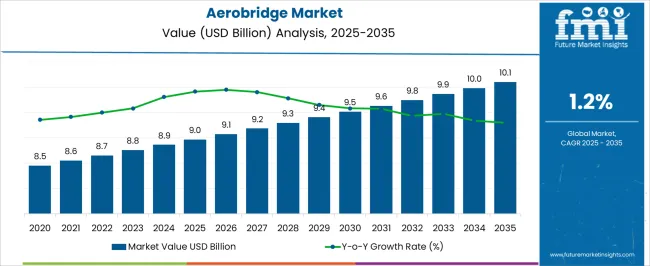

The Aerobridge Market is estimated to be valued at USD 9.0 billion in 2025 and is projected to reach USD 10.1 billion by 2035, registering a compound annual growth rate (CAGR) of 1.2% over the forecast period. From 2020 to 2024, the market grew from USD 8.5 billion to USD 8.9 billion, with annual growth rates ranging between 0.9% and 1.2%. This early phase shows gradual adoption across airports and airline operators, where fleet expansions and the replacement of older systems drive procurement. Year-on-year growth reflects steady infrastructure investments and incremental upgrades. The period establishes a baseline, with predictable demand and incremental increases in procurement across key regions.

Between 2025 and 2030, the market enters a slow scaling phase, rising from USD 9.0 billion to USD 9.5 billion, with YoY growth averaging around 1.0–1.3%. Adoption spreads steadily across medium and large airports, supported by incremental maintenance and expansion programs. From 2030 to 2035, growth continues to USD 10.1 billion, with annual increases of approximately 1.1–1.3%. The YoY analysis highlights predictable, steady expansion, with recurring replacements, modest fleet expansions, and gradual integration across global airports. The market demonstrates stability, reflecting low but consistent growth and reliable procurement patterns.

| Metric | Value |

|---|---|

| Aerobridge Market Estimated Value in (2025 E) | USD 9.0 billion |

| Aerobridge Market Forecast Value in (2035 F) | USD 10.1 billion |

| Forecast CAGR (2025 to 2035) | 1.2% |

Increasing investments in modernizing airport facilities to enhance passenger safety, comfort, and operational efficiency are contributing to the growing demand for advanced aerobridge systems. The integration of automated control systems, improved materials, and precision docking technology is enhancing performance and reducing turnaround times for airlines.

Additionally, strict aviation safety regulations are prompting airport authorities to adopt high-quality aerobridges that ensure secure and efficient boarding and deboarding operations. Growth is also being driven by expanding airline fleets and the construction of new terminals in emerging economies to accommodate rising air travel demand.

Manufacturers are focusing on developing modular and adaptable designs to meet diverse operational requirements while optimizing maintenance efficiency. As air connectivity improves and airport service standards rise, the aerobridge market is expected to witness sustained growth, with technological advancements and infrastructure upgrades acting as primary growth enablers.

The aerobridge market is segmented by wall structure, elevation system, movement, tunnel sections, product type, and geographic regions. By wall structure, aerobridge market is divided into Steel and Glass. In terms of elevation system, aerobridge market is classified into Hydraulic and Electromechanical. Based on movement, aerobridge market is segmented into Movable and Fixed. By tunnel sections, aerobridge market is segmented into Three and Two. By product type, aerobridge market is segmented into Apron drive, Noseloader, T-bridge, Commuter bridge, and Others. Regionally, the aerobridge industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

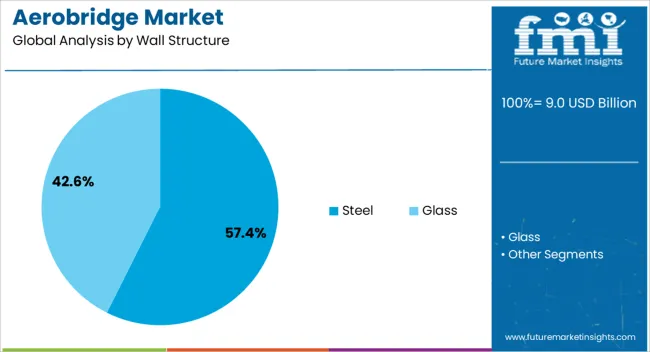

The steel wall structure segment is projected to account for 57.4% of the aerobridge market revenue share in 2025, establishing itself as the dominant wall structure type. This leadership is being driven by steel’s superior strength, durability, and ability to withstand heavy operational loads while ensuring structural integrity over long service lifecycles.

The material’s high resistance to weather conditions and mechanical stress makes it ideal for continuous airport operations, particularly in regions with varying climatic conditions. Steel structures also allow for precise fabrication and customization, enabling aerobridge designs that meet specific terminal layouts and aircraft compatibility requirements.

The cost-effectiveness of steel in terms of installation and long-term maintenance further reinforces its preference among airport authorities and construction contractors. As airports continue to prioritize safety, reliability, and long-term value, the adoption of steel wall structures in aerobridge manufacturing is expected to remain high, supported by its proven performance and compliance with stringent aviation engineering standards.

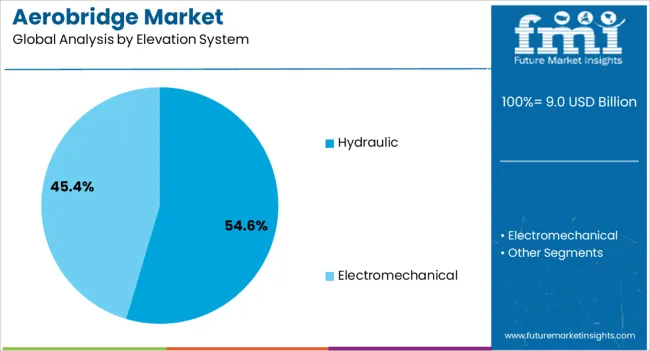

The hydraulic elevation system segment is anticipated to represent 54.6% of the aerobridge market revenue share in 2025, making it the leading elevation system type. This dominance is being reinforced by the system’s proven ability to provide smooth, precise, and reliable height adjustments during passenger boarding and deboarding operations.

Hydraulic systems offer superior load-bearing capacity and stability, which is critical for accommodating a wide range of aircraft door heights while ensuring passenger safety. The ease of operation, coupled with lower susceptibility to mechanical wear compared to alternative systems, enhances their appeal for airport operations that demand minimal downtime.

The segment’s growth is further supported by advancements in hydraulic technology, including the integration of energy-efficient pumps and improved sealing mechanisms that reduce maintenance requirements. As airports seek equipment that delivers consistent performance and operational efficiency, hydraulic elevation systems are expected to maintain their leadership due to their adaptability, reliability, and alignment with international safety standards.

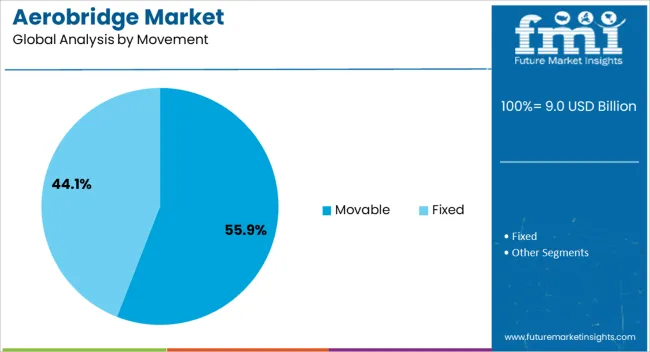

The movable movement segment is expected to capture 55.9% of the aerobridge market revenue share in 2025, positioning it as the dominant movement category. This preference is being driven by the operational flexibility offered by movable aerobridges, which can be adjusted to accommodate different aircraft types, parking positions, and terminal configurations.

Movable systems allow airports to maximize gate utilization and optimize turnaround times, which is increasingly important in handling growing passenger volumes. The segment benefits from technological enhancements such as automated docking guidance, precision alignment sensors, and remote-control operation, all of which contribute to improved efficiency and reduced operational risks.

Additionally, movable aerobridges provide long-term adaptability, enabling airports to adjust infrastructure usage without major structural changes. As air traffic expands and airport layouts evolve, the demand for versatile and reconfigurable passenger boarding solutions is expected to sustain the segment’s dominance, driven by its ability to deliver operational efficiency and long-term cost savings.

The aerobridge market is expanding due to the growing volume of air passengers and the need for efficient, safe, and comfortable boarding at airports. Aerobridges improve operational efficiency, reduce turnaround times, and enhance passenger convenience by providing direct boarding from terminal to aircraft. Airports in Asia-Pacific and the Middle East are adopting modern aerobridge solutions rapidly. Manufacturers focus on durable materials, adjustable designs, weather resistance, and compatibility with multiple aircraft types to meet diverse airport infrastructure requirements.

Rising global air passenger numbers, particularly in Asia-Pacific and the Middle East, drive demand for aerobridges to manage high-volume boarding efficiently. Airports expanding terminals and upgrading infrastructure prefer aerobridges to reduce boarding delays, enhance safety, and improve passenger experience. Efficient aerobridge operations minimize aircraft turnaround time, allowing airlines to optimize schedules and increase flight frequency. Airports investing in multiple aerobridge installations benefit from operational flexibility, enabling simultaneous boarding of several aircraft types. Until alternative boarding solutions such as remote boarding buses or advanced jetways match the convenience and efficiency of aerobridges, their adoption will continue to grow alongside airport expansion.

Aerobridges are required to adapt to varying aircraft sizes, door positions, and boarding heights. Telescopic and pivoting designs allow bridges to adjust length and angle for different models, from regional jets to wide-body aircraft. Advanced aerobridges integrate rotating cabins and extendable corridors to accommodate multiple fuselage configurations. Manufacturers focusing on universal compatibility, smooth adjustment mechanisms, and structural durability gain preference among airports and ground handling operators. Until alternative boarding infrastructure solutions can provide similar adaptability for diverse aircraft fleets, aerobridges remain essential for airports seeking to maintain operational efficiency and passenger comfort across multiple airline types.

Aerobridges must withstand high winds, rain, snow, and temperature extremes while ensuring passenger safety. They require robust materials, anti-slip flooring, and reliable locking mechanisms to prevent accidents during boarding and disembarking. Corrosion-resistant coatings and mechanical reliability reduce maintenance and prolong operational life. Airports prioritize aerobridge suppliers offering products certified to international safety standards. Until alternative boarding methods can match the combined benefits of weather resistance, safety, and durability, aerobridges remain the preferred solution for maintaining passenger security and minimizing operational disruptions in diverse climatic conditions.

Modern aerobridges are integrated with airport management systems, allowing remote operation, monitoring, and automated alignment with aircraft doors. Sensors, control panels, and telemetry systems help operators adjust the bridge precisely while ensuring safety. This technological integration reduces the need for manual intervention and minimizes human error, leading to faster turnaround times. Airports adopting aerobridges with real-time monitoring systems gain efficiency advantages and can optimize gate usage. Until alternative boarding technologies provide comparable automation, monitoring, and integration with airport operations, aerobridges will continue to play a critical role in supporting efficient aircraft handling and enhancing the passenger boarding experience.

| Country | CAGR |

|---|---|

| China | 1.6% |

| India | 1.5% |

| Germany | 1.4% |

| France | 1.3% |

| UK | 1.1% |

| USA | 1.0% |

| Brazil | 0.9% |

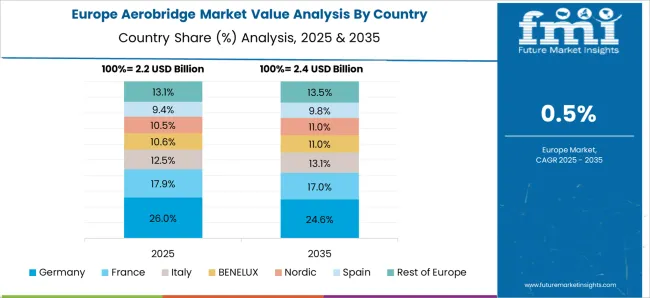

The global aerobridge market is projected to grow at a CAGR of 1.2% through 2035, supported by increasing demand across airport infrastructure, aviation, and passenger boarding operations. Among BRICS nations, China has been recorded with 1.6% growth, driven by large-scale production and deployment in airport terminals and aviation facilities, while India has been observed at 1.5%, supported by rising utilization in commercial and international airports. In the OECD region, Germany has been measured at 1.4%, where production and adoption for aviation and airport boarding systems have been steadily maintained. The United Kingdom has been noted at 1.1%, reflecting consistent use in airport and aviation infrastructure, while the USA has been recorded at 1.0%, with production and utilization across airport terminals and boarding operations being steadily increased. This report includes insights on 40+ countries; the top five markets are shown here for reference.

The aerobridge market in China is growing at a CAGR of 1.6%, driven by expanding airport infrastructure and modernization initiatives. Rising air passenger traffic and cargo handling requirements are pushing airports to adopt aerobridges for efficient boarding and disembarking processes. Investments in smart airport facilities and enhanced passenger experience support steady demand for modern aerobridge systems. Chinese manufacturers are also focusing on technologically advanced solutions, such as automated control systems, extended reach designs, and energy-efficient operations. Adoption is further encouraged by airport expansion projects in tier-1 and tier-2 cities, aiming to meet domestic and international travel demands. Safety standards, operational efficiency, and regulatory compliance remain critical considerations for aerobridge implementation. The combination of infrastructural development, technological improvements, and growing air traffic ensures gradual but stable growth in the aerobridge market in China.

The aerobridge market in India is expanding at a CAGR of 1.5%, supported by rapid airport development and increasing air passenger traffic. Modern airports in metropolitan cities and regional hubs are adopting aerobridges to improve operational efficiency and passenger comfort. Government programs promoting airport infrastructure upgrades and the expansion of both domestic and international terminals create consistent demand for aerobridge installations. Advanced aerobridge systems with automated control, extended reach, and energy-saving technologies are being deployed to enhance airport operations. Safety, regulatory adherence, and reduced turnaround time for aircraft are key factors driving adoption. As India continues to experience air travel growth, the demand for aerobridges in new and refurbished airports ensures steady expansion of the market.

The aerobridge market in Germany is growing at a CAGR of 1.4%, driven by modernization of airport terminals and increasing passenger expectations. Airports in major cities such as Frankfurt and Munich are upgrading facilities to incorporate energy-efficient, automated aerobridge solutions. Demand is supported by airline requirements for faster boarding, improved passenger experience, and operational efficiency. Manufacturers are introducing advanced control systems, flexible designs, and integration with airport management technologies. Compliance with European aviation safety standards ensures reliable operations. Germany’s focus on sustainable airport infrastructure and operational safety contributes to steady aerobridge market growth. Continuous investment in both new airport projects and terminal refurbishments ensures gradual adoption of modern aerobridge systems.

The aerobridge market in the United Kingdom is expanding at a CAGR of 1.1%, with adoption driven by airport upgrades and passenger comfort requirements. Airports are incorporating aerobridges to streamline aircraft boarding and disembarking, improving turnaround times and operational efficiency. Technological enhancements include automated positioning systems, extended reach designs, and energy-efficient operations. Government and airport authority initiatives focus on modernization and compliance with aviation safety standards, supporting market growth. Additionally, regional airports are installing aerobridges to accommodate increasing domestic and international air traffic. Safety, operational reliability, and reduced turnaround times remain key drivers for market expansion. The UK market experiences gradual growth in aerobridge adoption due to these infrastructural and technological advancements.

The aerobridge market in the United States is advancing at a CAGR of 1.0%, influenced by airport modernization and operational efficiency goals. Major airports across the country are retrofitting terminals with automated aerobridges to enhance passenger experience, reduce boarding time, and improve turnaround efficiency. Technological advancements include energy-efficient designs, automated positioning, and integration with airport management systems. Federal and state regulations emphasize safety and operational reliability, guiding installations. Expansion of both domestic and international airports, along with refurbishment of aging terminals, ensures continuous market demand. With a focus on automation, safety compliance, and enhanced passenger flow, the USA aerobridge market is poised for gradual but steady growth.

The aerobridge market is essential for modern airport operations, enabling safe, efficient, and weather-protected boarding and deboarding of passengers. Aerobridges, also known as passenger boarding bridges (PBBs), are critical for improving airport turnaround times, enhancing passenger comfort, and ensuring compliance with international aviation safety standards. Rising air travel, expansion of airport infrastructure, and increasing demand for automated and adaptable boarding solutions are driving the growth of this market globally.

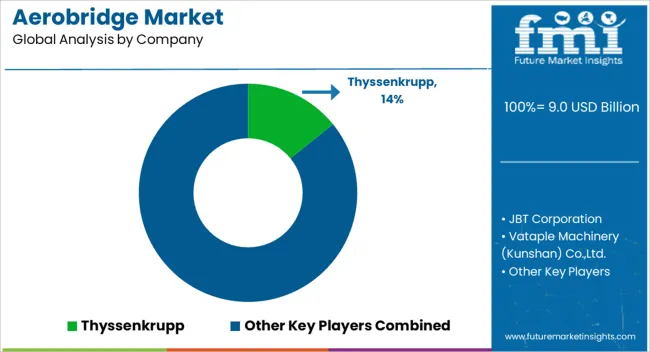

Thyssenkrupp is a major player, offering advanced aerobridge systems designed for durability, flexibility, and smooth integration with airport terminal operations. JBT Corporation provides technologically advanced boarding solutions, emphasizing safety, operational efficiency, and ease of maintenance. Vataple Machinery (Kunshan) Co., Ltd. and ADELTE–The Boarding Company specialize in customizable and automated aerobridge systems for diverse aircraft types, ensuring compatibility across global airports. PT Bukaka Teknik Utama Tbk and ShinMaywa Industries, Ltd. contribute with robust engineering solutions, catering to both emerging and mature aviation markets.

Other notable manufacturers include Airport Equipment, Muhibbah Airline Support Industries Sdn Bhd (MASI), FMT Sweden AB, and CIMC-TianDa, which provide comprehensive aerobridge portfolios for commercial and cargo aviation sectors. These companies focus on enhancing operational efficiency, safety, and passenger experience while innovating with modular, energy-efficient, and automated aerobridge designs. Collectively, these industry leaders are shaping the global aerobridge market, meeting the evolving needs of modern airports, and supporting the growth of international air travel.

| Item | Value |

|---|---|

| Quantitative Units | USD 9.0 Billion |

| Wall Structure | Steel and Glass |

| Elevation System | Hydraulic and Electromechanical |

| Movement | Movable and Fixed |

| Tunnel Sections | Three and Two |

| Product Type | Apron drive, Noseloader, T-bridge, Commuter bridge, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Thyssenkrupp, JBT Corporation, Vataple Machinery (Kunshan) Co.,Ltd., ADELTE–The Boarding Company, PT Bukaka Teknik Utama Tbh, ShinMaywa Industries,Ltd., Airport Equipment, Muhibbah Airline Support Industries Sdn Bhd (MASI), FMT Sweden AB, and CIMC-TianDa |

| Additional Attributes | Dollar sales vary by type, including telescopic, fixed, and mobile aerobridges; by application, such as commercial airports, cargo terminals, and military airbases; by aircraft type, spanning narrow-body, wide-body, and regional aircraft; by region, led by North America, Europe, and Asia-Pacific. Growth is driven by increasing air passenger traffic, airport modernization, and demand for improved boarding efficiency and passenger safety. |

The global aerobridge market is estimated to be valued at USD 9.0 billion in 2025.

The market size for the aerobridge market is projected to reach USD 10.1 billion by 2035.

The aerobridge market is expected to grow at a 1.2% CAGR between 2025 and 2035.

The key product types in aerobridge market are steel and glass.

In terms of elevation system, hydraulic segment to command 54.6% share in the aerobridge market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA