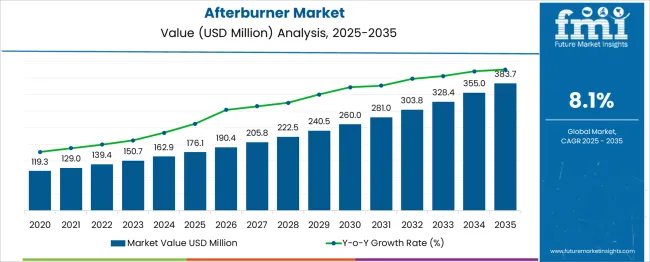

The Afterburner Market is estimated to be valued at USD 176.1 million in 2025 and is projected to reach USD 383.7 million by 2035, registering a compound annual growth rate (CAGR) of 8.1% over the forecast period. A Growth Rate Volatility Index (GRVI) analysis reveals moderate fluctuations in growth rates, reflecting a steady market expansion with periodic acceleration. Between 2025 and 2030, the market grows from USD 176.1 million to USD 260.0 million, adding USD 83.9 million in growth, with a CAGR of 9.3%. This early-phase growth shows a higher level of volatility, driven by increased demand in aerospace applications, particularly in military aviation and high-performance aircraft. The volatility is influenced by defense budgets, technological advancements, and shifts in global military needs.

From 2030 to 2035, the market continues to grow from USD 260.0 million to USD 383.7 million, contributing USD 123.7 million in growth, with a slightly lower CAGR of 7.5%. The GRVI shows a deceleration in growth, indicating a stabilization phase as the market matures. The slowdown reflects a more mature defense industry and a shift toward other emerging technologies. Despite the deceleration, growth remains robust, driven by continuous technological improvements, increasing demand for advanced propulsion systems, and the modernization of military fleets. The overall GRVI highlights steady growth with fluctuations due to changes in global defense spending and technological shifts.

| Metric | Value |

|---|---|

| Afterburner Market Estimated Value in (2025 E) | USD 176.1 million |

| Afterburner Market Forecast Value in (2035 F) | USD 383.7 million |

| Forecast CAGR (2025 to 2035) | 8.1% |

The Afterburner market is experiencing robust growth as demand for advanced propulsion technologies continues to rise within the defense aviation sector. The current market scenario is shaped by the increasing need for superior thrust capabilities, improved maneuverability, and enhanced mission readiness of modern fighter jets. Annual reports from defense contractors and statements from air forces globally have highlighted the strategic importance of afterburners in maintaining air dominance.

Technological advancements in fuel efficiency and thermal management are also contributing to the development of next-generation afterburners, which are being adopted across a wider range of aircraft platforms. Future growth is expected to be driven by modernization programs, expanding defense budgets, and escalating geopolitical tensions prompting investments in high-performance combat aircraft.

Press releases and investor communications from aerospace firms have further underscored the shift towards modular, more sustainable designs that extend operational life and reduce maintenance costs. These dynamics collectively support a positive growth trajectory for the Afterburner market worldwide.

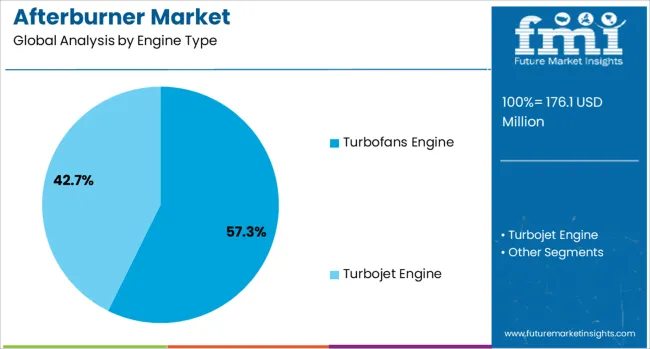

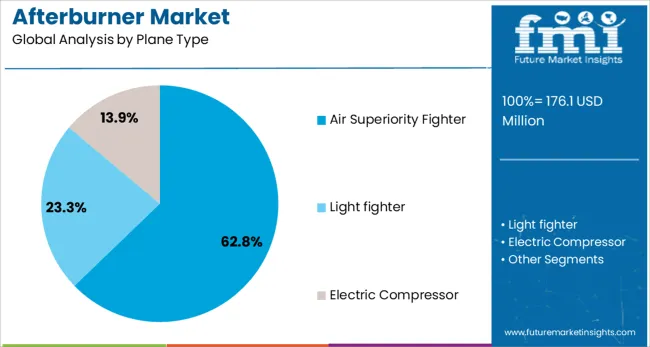

The afterburner market is segmented by engine type, plane type, and geographic regions. By engine type, the afterburner market is divided into Turbofan Engine and Turbojet Engine. In terms of plane type, the afterburner market is classified into Air Superiority Fighter, Light Fighter, and Electric Compressor. Regionally, the afterburner industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The turbofans engine segment is expected to account for 57.3% of the Afterburner market revenue share in 2025, positioning it as the leading engine type. This dominance is being driven by the inherent efficiency, high thrust-to-weight ratio, and reliability offered by turbofans, as observed in manufacturer disclosures and technical briefings.

Turbofans equipped with afterburners have been widely adopted in modern fighter jets owing to their ability to deliver sustained supersonic performance while optimizing fuel consumption during subsonic flight. Defense industry updates have emphasized the compatibility of turbofan engines with advanced thermal coatings and materials, enabling higher operational endurance under extreme conditions.

The segment’s leadership is also attributed to its adaptability to next-generation stealth aircraft and its support for integration with digital engine control systems. These capabilities have reinforced its strategic value and ensured its prominence in defense aviation programs globally, sustaining its commanding position in the market.

The air superiority fighter segment is projected to hold 62.8% of the Afterburner market revenue share in 2025, establishing itself as the leading plane type segment. This leadership has been reinforced by the increasing emphasis on achieving air dominance and countering emerging aerial threats, as highlighted in defense strategy papers and military procurement announcements.

Air superiority fighters equipped with afterburners have been favored for their unmatched agility, rapid acceleration, and ability to sustain high-speed engagements, essential in modern aerial combat. Aerospace industry publications have noted that these fighters benefit from the afterburner’s capability to deliver instantaneous thrust during dogfights and interception missions.

Furthermore, the segment’s growth has been supported by ongoing fleet modernization initiatives and the induction of next-generation fighters designed to maintain superiority against adversaries. These factors collectively have solidified the air superiority fighter segment’s commanding share in the market, reflecting its critical role in national defense strategies and tactical air operations.

The afterburner market is expanding due to increasing demand for high-performance propulsion systems in military and commercial aerospace applications. Afterburners, used in jet engines to increase thrust and efficiency, are essential for supersonic flight and high-speed maneuverability. The growing demand for defense aircraft, supersonic commercial flights, and advanced aerospace technologies is driving market growth. Despite challenges like high fuel consumption and environmental concerns, the market presents opportunities through technological innovations and the rising adoption of supersonic air travel, offering advancements in afterburner efficiency and performance.

The growth of the afterburner market is primarily driven by the increasing demand for high-performance aerospace engines. Afterburners are crucial components in military and defense aircraft, providing the additional thrust needed for supersonic speeds and improved maneuverability. As global defense spending rises, particularly in the development of next-generation fighter jets, there is an increased focus on optimizing aircraft engines for higher performance. The growing interest in supersonic air travel for commercial aviation is also contributing to the demand for afterburners. These propulsion systems are essential for supersonic commercial aircraft, offering increased speed and efficiency, which is further driving market growth.

A significant challenge in the afterburner market is the high fuel consumption associated with their operation. Afterburners, while effective in increasing thrust, are often less fuel-efficient compared to other propulsion methods. This leads to higher operational costs and increased emissions, which can be a concern, particularly with growing emphasis on environmental sustainability in aviation. As governments and industries focus on reducing carbon footprints, the environmental impact of afterburners, especially in defense applications, is coming under scrutiny. These challenges necessitate advancements in afterburner technology to enhance efficiency, reduce fuel consumption, and meet environmental regulations without compromising performance.

The afterburner market offers substantial opportunities for growth through technological innovations and the development of commercial supersonic travel. Advances in afterburner technology, such as improved fuel efficiency, noise reduction, and reduced emissions, are opening new avenues for adoption in both military and commercial sectors. The resurgence of interest in supersonic commercial flights presents a unique opportunity for afterburner manufacturers, as these propulsion systems are integral to achieving the necessary speed and efficiency for supersonic travel. The increasing investments in aerospace defense systems and the development of advanced aircraft platforms present long-term growth opportunities for afterburner manufacturers.

A significant trend in the afterburner market is the focus on enhancing efficiency and integrating these systems with advanced aerospace technologies. Manufacturers are working on improving afterburner designs to optimize fuel usage and minimize environmental impact, addressing both operational cost concerns and regulatory pressures. There is also a growing trend toward integrating afterburners with cutting-edge technologies such as advanced materials, hybrid propulsion systems, and digital controls, enhancing their overall performance. As the aviation industry moves towards supersonic commercial aircraft and next-generation military jets, these advancements will continue to shape the development of afterburner systems, making them more efficient, sustainable, and effective.

| Country | CAGR |

|---|---|

| China | 10.9% |

| India | 10.1% |

| Germany | 9.3% |

| France | 8.5% |

| UK | 7.7% |

| USA | 6.9% |

| Brazil | 6.1% |

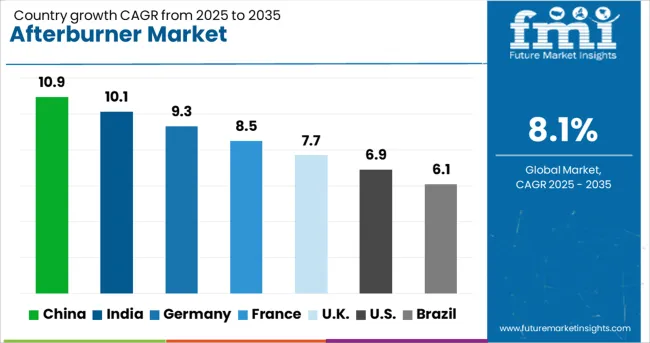

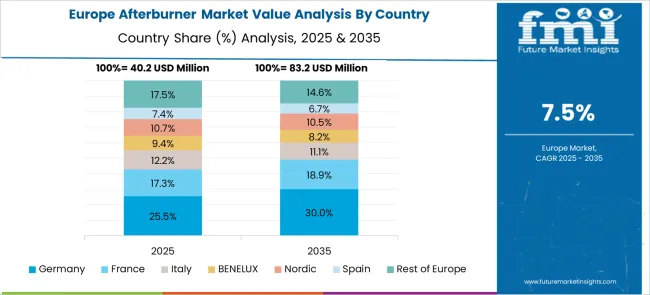

The afterburner market is projected to grow at a global CAGR of 8.1% from 2025 to 2035. China leads the market at 10.9%, followed by India at 10.1%, and Germany at 9.3%. France is expected to grow at 8.5%, while the United Kingdom grows at 7.7% and the United States at 6.9%. The market growth in China and India is driven by increasing demand from the military aviation sector, alongside the expansion of defense capabilities. In OECD countries like Germany, France, the UK, and the USA, steady growth is attributed to advancements in afterburner technology and the growing focus on performance enhancement for fighter jets and military aircraft. The analysis spans 40+ countries, with the leading markets shown below.

China is expected to expand at a 10.9% CAGR through 2035, fueled by its defense modernization efforts and strategic investments in military aviation. As demand for advanced fighter jets rises, afterburners become a crucial component of China’s expanding air force capabilities. The country’s commitment to self-reliance in defense production has led to local manufacturing of advanced aerospace technologies, reducing dependence on foreign suppliers. China's focus on technological advancements ensures that afterburners will play a pivotal role in future aircraft designs. The increasing investments in high-performance aircraft will significantly drive the demand for afterburners in the coming years.

India is anticipated to rise at a 10.1% CAGR through 2035, supported by ongoing defense investments and military aviation sector growth. The increasing demand for advanced fighter jets and high-performance aircraft is driving afterburner adoption in India. The Indian government's efforts to modernize its defense capabilities and focus on high-performance technology are fueling the market for advanced afterburners. As the Indian Air Force expands its fleet and upgrades its technological infrastructure, demand for afterburners is set to see significant growth. Local manufacturing and indigenization further contribute to this market trend.

Germany is forecast to develop at a 9.3% CAGR through 2035, bolstered by its investments in next-generation aircraft and ongoing defense modernization. As part of its NATO commitments, Germany continues to upgrade its military aviation fleet with aircraft that require advanced afterburners. The country’s aerospace sector focuses on environmentally friendly and efficient propulsion technologies, ensuring that afterburners remain a key component of military aircraft. Technological advancements in aerospace further drive the demand for afterburners, with the aim to achieve greater fuel efficiency and performance standards in modern aircraft.

The United Kingdom is set to advance at a 7.7% CAGR through 2035, driven by investments in high-performance military aircraft. The UK’s defense modernization efforts and focus on air superiority are fueling the demand for afterburners in next-generation fighter jets. With an emphasis on fuel efficiency and high-speed capabilities, the Royal Air Force is increasingly equipping its fleet with aircraft that integrate advanced propulsion systems. Active participation in NATO defense operations further amplifies the demand for cutting-edge aerospace technologies, including afterburners, to maintain the UK’s air defense capabilities.

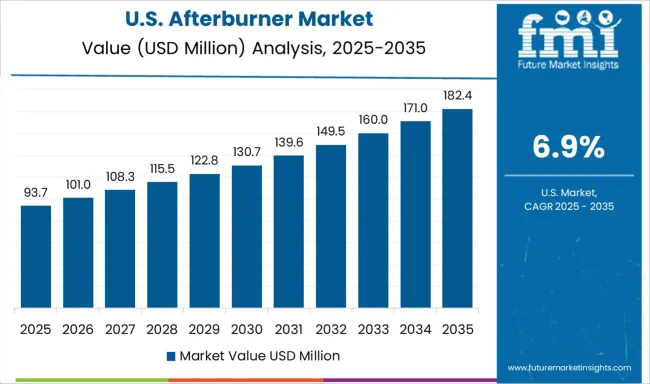

The United States is projected to rise at a 6.9% CAGR through 2035, driven by continued investments in air dominance strategies and technological advancements in military aviation. Afterburners remain essential for maintaining the performance of fighter jets and supersonic aircraft. The USA focus on energy-efficient propulsion systems has led to innovations aimed at reducing operational costs and improving fuel efficiency. The growing demand for advanced, high-performance aircraft ensures that afterburners will remain critical components in USA military aviation, further supported by private aerospace companies.

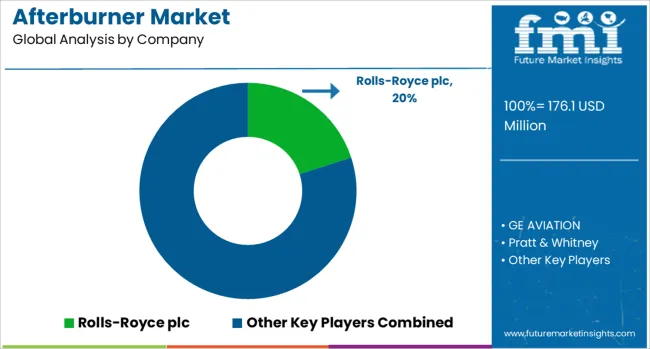

The afterburner market is driven by leading manufacturers specializing in the design, development, and production of advanced afterburner systems used in military and commercial aerospace applications. Rolls-Royce plc is a dominant player, providing cutting-edge afterburner solutions as part of its high-performance jet engine systems, particularly for military aircraft. GE Aviation and Pratt & Whitney are major competitors, offering afterburner technologies integrated into their gas turbine engines for both military and commercial aerospace applications, focusing on optimizing thrust and fuel efficiency. Honeywell Aerospace provides afterburner systems as part of its propulsion technologies, emphasizing innovation in reducing emissions and improving engine performance. Aviadvigatel and SE Ivchenko-Progress specialize in afterburner systems for military aviation, offering high-thrust solutions for advanced fighter jets and strategic bombers.

Their afterburner technology is crucial for high-speed, high-performance aircraft, focusing on thrust augmentation and fuel efficiency. Safran and Eurojet are key players offering advanced afterburner solutions for military aircraft, focusing on improving engine performance, reducing emissions, and increasing the operational range of fighter jets. MTU Aero Engines AG contributes to the market by providing high-efficiency afterburner systems integrated into its engine platforms, offering enhanced performance for both military and commercial applications. Competitive differentiation in the afterburner market is driven by factors such as thrust-to-weight ratio, fuel efficiency, integration with advanced propulsion systems, and compliance with environmental regulations. Barriers to entry include high R&D investment, technological complexity, and stringent military and aerospace standards. Strategic priorities include improving afterburner efficiency, reducing fuel consumption, and enhancing engine performance for military and commercial applications.

| Item | Value |

|---|---|

| Quantitative Units | USD 176.1 Million |

| Engine Type | Turbofans Engine and Turbojet Engine |

| Plane Type | Air Superiority Fighter, Light fighter, and Electric Compressor |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Rolls-Royce plc, GE AVIATION, Pratt & Whitney, Honeywell Aerospace, Aviadvigatel, SE Ivchenko-Progress, Safran, Eurojet, and MTU Aero Engines AG |

| Additional Attributes | Dollar sales by afterburner type (military, commercial) and end-use segments (fighter jets, bombers, transport aircraft, UAVs). Demand dynamics are driven by the increasing need for enhanced thrust in military aircraft, the growing demand for high-performance propulsion systems, and advancements in aerospace engineering. Regional trends show strong growth in North America and Europe due to the high demand for advanced military aircraft and engine systems, while Asia-Pacific is expanding with increasing investments in defense aviation. |

The global afterburner market is estimated to be valued at USD 176.1 million in 2025.

The market size for the afterburner market is projected to reach USD 383.7 million by 2035.

The afterburner market is expected to grow at a 8.1% CAGR between 2025 and 2035.

The key product types in afterburner market are turbofans engine and turbojet engine.

In terms of plane type, air superiority fighter segment to command 62.8% share in the afterburner market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA