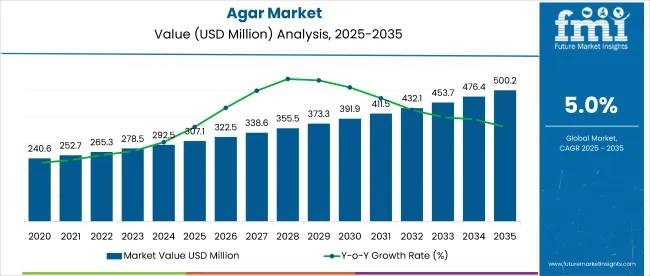

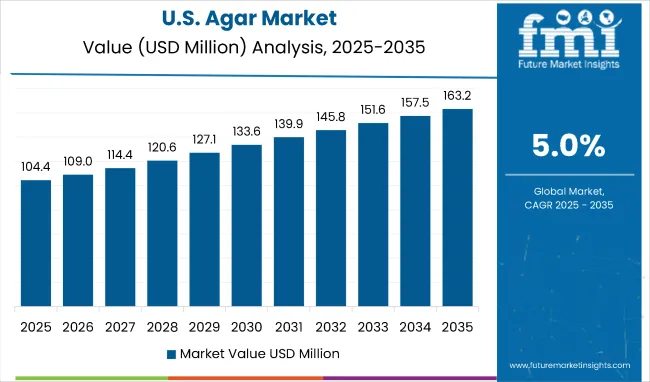

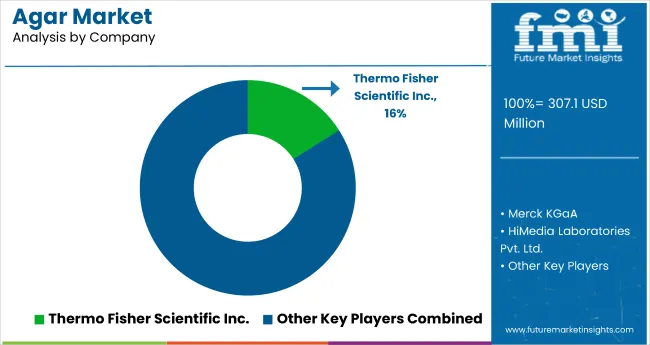

The global agar market is valued at USD 307.1 million in 2025 and is expected to reach USD 500.2 million by 2035, registering a CAGR of 5%. Market expansion is driven by rising demand for plant-based and vegan alternatives, increased agar applications in functional foods, and the growing importance of clean-label products across food, pharmaceutical, and cosmetic sectors. Additionally, expanding seaweed cultivation in Southeast Asia and rising use of agar as a gelatin substitute have supported overall market expansion.

| Metric | Value |

|---|---|

| Estimated Size (2025E) | USD 307.1 million |

| Projected Value (2035F) | USD 500.2 million |

| CAGR (2025 to 2035) | 5% |

The market accounts for 4%, attributed to its specialized gelling capabilities. Within the functional food ingredients sector, it comprises about 2.5%, spurred by its increasing use in plant-based and clean-label product formulations. In the microbiological culture media industry, agar commands nearly 8% of the market, reflecting its essential role in laboratory and diagnostic purposes. In plant-based ingredients and food additives markets, agar constitutes around 1.5% to 2%, highlighting its function as a natural additive and gelatin alternative in specialized product segments.

Government regulations impacting the market focus on favorable regulations promoting sustainable and plant-derived ingredients. Recent innovations include tissue engineering applications and novel agar formulations for culture media. Government-backed initiatives in countries like India and Indonesia to expand seaweed farming are also expected to increase raw material availability.

Continuous advancements in biotechnology and microbiology will further unlock value across the agar supply chain. Additionally, strategic collaborations between agar processors and end-use industries are likely to accelerate customized product development and market penetration.

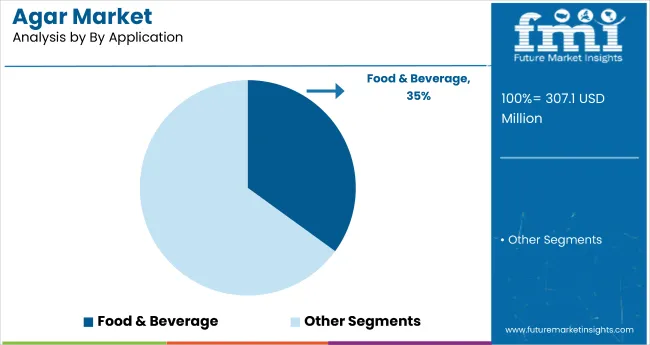

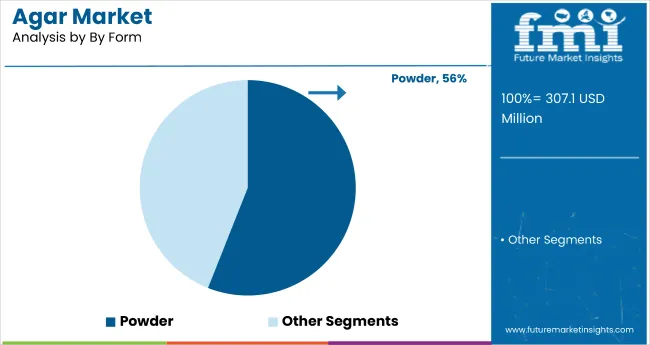

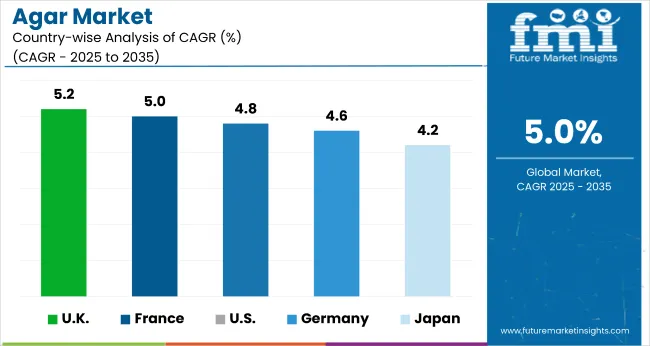

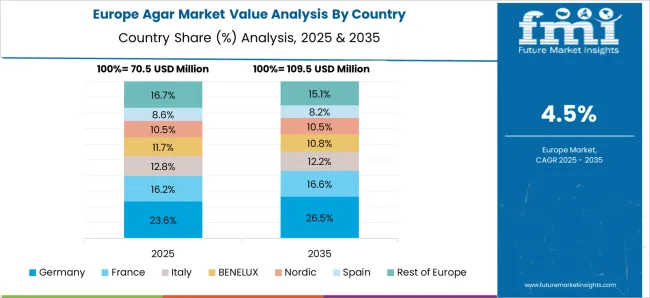

The UK is projected to be the fastest-growing market, expanding at a CAGR of 5.2% from 2025 to 2035. Powder will lead the form segment with a 56% share, while food & beverage will dominate the application segment with a 35% market share in 2025. France and the USA markets are also expected to grow at CAGRs of 5.0% and 4.8% respectively.

The agar market is segmented by application, form, and region. By application, the market is categorized into food & beverages (bakery, confectionery, dairy, canned meat/poultry products, beverages, sauces/creams/dressings, dietetic products, others), bacteriological (culture media and microbiology), technical applications (cosmetology and medical), and others (agriculture and animal feed additives). Based on form, the market is bifurcated into splits and powders. Regionally, the market is classified into North America, Latin America, Europe, Asia Pacific, and Middle East & Africa.

Food & beverages are projected to lead the application segment, accounting for 35% of the global market share in 2025. Their expanding role as a gelling and stabilizing agent, particularly in plant-based and clean-label food formulations, establishes them as the dominant choice for manufacturers. The versatility of agar supports its widespread use in vegan confectionery, jellies, puddings, dairy alternatives, and sauces, making it the preferred additive for non-animal-based product lines.

Powder is projected to dominate the form segment. is projected to account for 56% of the global market share in 2025. Its superior solubility, ease of handling, and consistent performance in gelling and stabilizing make it the preferred form across food, pharmaceutical, and cosmetic applications. Manufacturers value their ability to integrate easily into liquid formulations without altering product texture or color.

Recent Trends in the Agar Market

Key Challenges in the Agar Market

The UK leads the agar market in growth projections, driven by a rising demand for plant-based ingredients, expanding vegan and clean-label trends, and increased industrial adoption across food, nutraceutical, and pharmaceutical sectors. Strong local processing capabilities and innovation in hydrocolloid formulations further support its market expansion. The USA and France follow closely, with growth rates of 5% and 4.8%, respectively, supported by growing applications in dairy alternatives, desserts, and microbiological culture media.

Germany is projected to grow at a CAGR of 4.6%, backed by demand in confectionery and processed foods. Japan, a mature market, is expected to witness a CAGR of 4.2%, owing to its long-standing use of agar in traditional cuisine and scientific research. Other countries such as China, Spain, and South Korea are also emerging as key suppliers, driven by expanding seaweed harvesting, improved extraction technologies, and growing export-oriented production capabilities.

The report covers an in-depth analysis of 40+ countries; with the five top-performing OECD nations highlighted below.

The USA agar revenue is growing at a CAGR of 4.8% from 2025 to 2035. Expansion is supported by the growing use of agar in food applications such as dairy alternatives, bakery, and confectionery. The country’s established pharmaceutical and microbiological industries also significantly contribute to demand, with agar used in tissue culture and laboratory diagnostics.

The sales of agar in the UK are expanding at a CAGR of 5.2% during the forecast period. Growth is driven by rising consistent demand for agar in the functional foods and dietary products categories. Veganism and sustainable food production practices are major influencers behind the rising agar adoption. British cosmetic and pharmaceutical manufacturers also prefer agar in technical applications for its natural and biodegradable properties.

The demand for agar market in Germany is projected to grow at a CAGR of 4.6% from 2025 to 2035. Expansion is supported by increasing use of agar in German confectionery, dairy, and microbiological testing applications. As one of the leading markets in Europe, Germany benefits from a mature food processing industry and rigorous food safety standards. The country’s pharmaceutical and cosmetic industries also leverage agar in specialized formulations.

The French agar market is projected to grow at a CAGR of 5% from 2025 to 2035. Growth is driven by thriving bakery and patisserie sectors, where agar is extensively used as a vegan-friendly alternative. France has also embraced agar in dairy products, sauces, and organic snacks. Regulatory alignment with clean-label and natural additive trends has boosted agar’s appeal.

The Japan agar market is expected to grow at a CAGR of 4.2% from 2025 to 2035. Growth in the Japan agar market is supported by strong dietary familiarity, traditional use in food and pharmaceuticals, and continued applications in biotechnology and tissue engineering. The country has a long-standing tradition of agar use, locally known as "kanten," in food, cosmetics, and pharmaceuticals. Japan's advanced biotechnology sector continues to utilize agar in tissue engineering and as a microbial growth medium.

The agar market is moderately fragmented, with numerous regional and global players competing across food, pharmaceutical, cosmetic, and microbiological sectors. Key suppliers like Merck KGaA, Thermo Fisher Scientific Inc., Neogen Corporation, and HiMedia Laboratories are leveraging R&D, pricing strategies, and international distribution partnerships to strengthen their positions. These firms emphasize innovation in bacteriological-grade agar, medical-grade formulations, and sustainable sourcing practices.

Top companies are actively investing in expanding production capacity, forming strategic alliances, and launching application-specific agar products to cater to growing demand from biotech and clean-label food industries. For instance, Thermo Fisher is focusing on microbiology media enhancements, while Neogen and HiMedia are expanding their offerings across Asia and North America through localized production and exports. Sustainability, regulatory compliance, and application precision remain central to supplier differentiation in this sector.

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 307.1 million |

| Projected Market Size (2035) | USD 500.2 million |

| CAGR (2025 to 2035) | 5% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Market Analysis Parameters | Revenue in USD millions / Volume in metric tons |

| By Application | Food & Beverages, Bacteriological (Culture Media, Microbiology), Technical Applications (Cosmetology, Medical), and Others (Agriculture, Animal Feed) |

| By Form | Splits and Powders |

| Regions Covered | North America, Latin America, Europe, Asia Pacific, and MEA (Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia and 40+ countries |

| Key Players | Amcor, Winpak, Berry Global, Mondi, Uflex, Coveris, Cosmo Films |

| Additional Attributes | Dollar sales by product type, share by functionality, regional demand growth, regulatory influence, clean-label trends, competitive benchmarking |

The global agar market is estimated to be valued at USD 307.1 million in 2025.

The market size for the agar market is projected to reach USD 500.2 million by 2035.

The agar market is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types in agar market are food & beverages, _bakery, _confectionery, _dairy, _canned meat/poultry products, _beverages, _sauces, creams, & dressings, _others, bacteriological, _culture media, _microbiology, technical applications, _cosmetology, _medical applications and others.

In terms of form, splits segment to command 55.7% share in the agar market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Agar Resin Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA