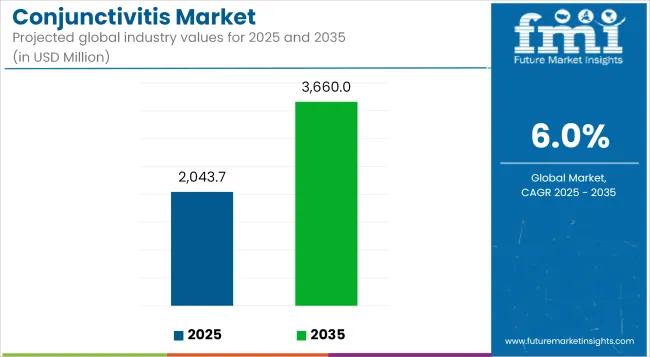

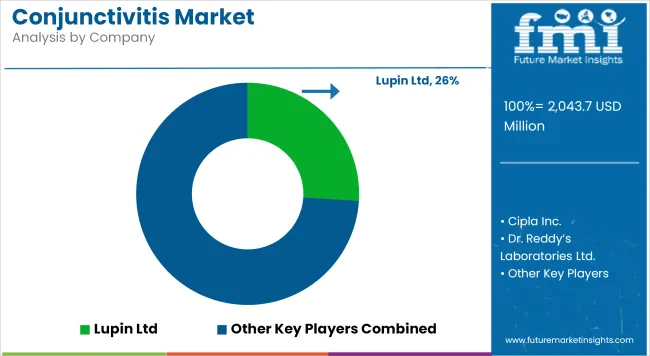

The global Conjunctivitis Market is estimated to be valued at USD 2,043.7 million in 2025 and is projected to reach USD 3,660.0 million by 2035, registering a compound annual growth rate of 6.0% over the forecast period.

| Metric | Value |

|---|---|

| Market Size (2025E) | USD 2,043.7 Million |

| Market Value (2035F) | USD 3,660.0 Million |

| CAGR (2025 to 2035) | 6.0% |

The conjunctivitis market is evolving with the rising incidence of allergic, viral, and bacterial eye infections driven by pollution, seasonal allergies, and increased screen exposure. Enhanced patient awareness and early diagnosis, along with growing adoption of advanced ophthalmic treatments, are reshaping clinical practices.

Pharmaceutical companies are actively developing novel drug formulations and delivery systems to improve efficacy and patient compliance. Healthcare infrastructure expansion in emerging economies is creating new distribution opportunities. Strategic collaborations and pipeline investments are increasing, particularly among leading ophthalmic brands. With a global uptick in ocular conditions and improved access to eye care, the conjunctivitis market is set for steady growth, supported by a strong innovation pipeline and a patient-centric approach to treatment.

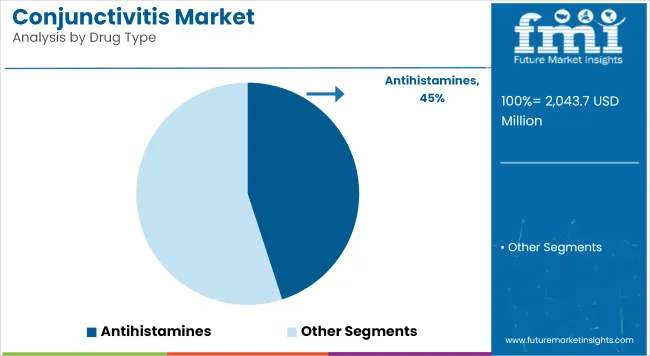

Antihistamines are estimated to account for 45.0% of total revenue share in 2025, positioning the segment as the most dominant by drug type. This leadership is attributed to the rapid symptom relief provided in cases of allergic conjunctivitis, particularly in addressing itching, redness, and inflammation.

Preference for non-invasive, over-the-counter accessibility has also enhanced their market penetration. The segment has been supported by the continued launch of dual-action antihistamines with mast cell-stabilizing properties, promoting better compliance among pediatric and geriatric populations.

Moreover, a favorable safety profile and widespread prescriptive use in both acute and seasonal conditions have contributed significantly. Increased awareness of ocular allergies and rising environmental triggers have further reinforced antihistamine dominance across both developed and emerging markets.

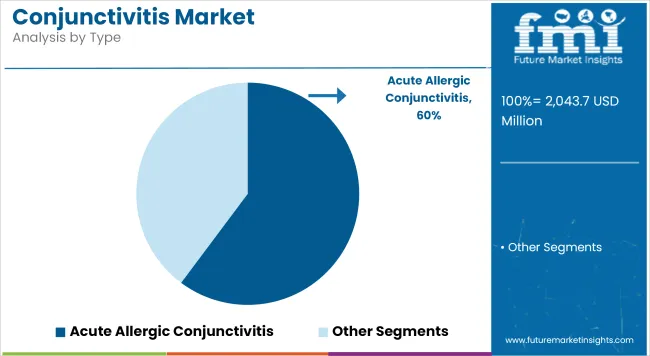

Acute allergic conjunctivitis is projected to hold a 60.2% revenue share in 2025 under the Type segmentation. The segment’s leading position is underpinned by the high global incidence of seasonal allergic reactions triggered by environmental allergens such as pollen, dust, and pollutants. Its episodic nature demands rapid, short-course treatment primarily with antihistamines and NSAIDs which supports higher prescription volumes annually.

Additionally, acute episodes are more commonly self-diagnosed and managed, driving OTC product sales. Increased exposure to climate volatility and urban pollution has contributed to spikes in seasonal flare-ups. The ease of diagnosis, combined with increasing public awareness about allergic eye conditions, has played a crucial role in driving segment demand. These factors continue to position acute allergic conjunctivitis as the most commercially significant subtype.

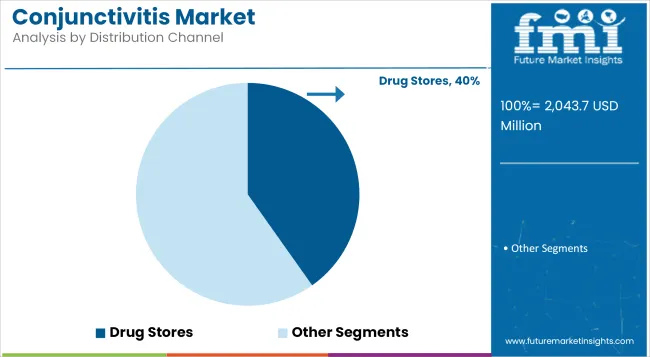

The drug stores and retail pharmacies segment is expected to capture 40.21% of the total conjunctivitis treatment market revenue in 2025. This prominence is attributed to their central role in over-the-counter (OTC) drug availability and convenience in urban and semi-urban settings.

Consumer preference for self-medication in mild to moderate conjunctivitis cases has led to higher footfall in these outlets. Enhanced product visibility, pharmacist-led recommendations, and easy access to antihistamines and lubricants have strengthened their commercial influence.

Retail chains are also increasingly involved in promoting seasonal allergy products during peak times, contributing to revenue acceleration. Additionally, the growing presence of chain pharmacies in developing regions has expanded accessibility to ophthalmic products without the need for prescriptions, making them a pivotal distribution point in the current landscape.

Lack of Awareness and Diagnostic Barriers

One of the factors limiting conjunctivitis market growth is lack of knowledge of various types of conjunctivitis and its effective treatment method among population in most of developing countries, especially in rural parts.

Finally, since it is often impossible to distinguish whether the conjunctivitis is physical (viral or bacterial) or allergic, diagnoses may be incorrect, leading to delays in appropriate treatment. Another challenge is the ally of antibiotic resistance, especially in bacterial conjunctivitis is against topical antibiotics to bear with the emergence of new generations of therapeutic interventions.

Advancements in Treatment and Preventive Measures

The increasing emphasis on research and development in ophthalmology, particularly targeted therapies and vaccines, poses lucrative prospects for the conjunctivitis market. Combination therapies to cure viral and bacterial conjunctivitis as well as effective therapeutics to restore eyes from allergic conjunctivitis is anticipated to spur market growth.

As well prophylactic measures, like vaccines for viral strains, and growing access to over-the-counter medicines are giving us chances to broaden treatment around the world.

The USA conjunctivitis market is growing at a steady rate, the growing incidence of eye infections, especially, viral and allergic conjunctivitis is the major driver for the market. More cases of conjunctivitis are on the rise; this can be linked to the increase of contact lens wear, environmental causes, and seasonal allergies.

The USA Food and Drug Administration (FDA) is responsible for the regulation of medications pertaining to eye care, and the continuous development of various antibiotic and anti-inflammatory eye drops is anticipated to help the eye care medications market grow. Furthermore, rising concerns towards eye health and market demand for over-the-counter eye care products will also support market growth.

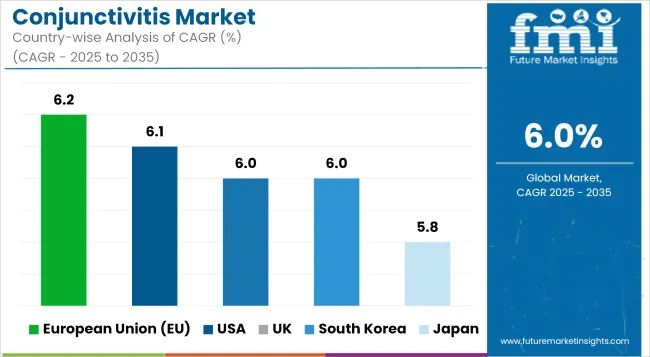

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 6.1% |

Due to more cases of seasonal allergies and colds, the conjunctivitis market in the UK is set to grow. The UK market is helped by a strong healthcare system like the NHS, which offers treatments for many eye problems, including pink eye.

The market should benefit from more people wanting products and supplements to keep their eyes healthy and from over-the-counter eye drops that treat pink eye. There is also greater awareness of the problem. Additionally, the market is expected to grow more due to new self-care treatments and eye care products in the UK.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 6.0% |

The EU conjunctivitis market is also growing steadily with an increasing incidence of eye infections reported across the member states. Allergies and viral outbreaks are major drivers of demand for both prescription and over-the-counter treatments.

Regulatory authorities, such as the European Medicines Agency (EMA), help ensure the safety and efficacy of eye care products that support market growth. Growing awareness regarding eye health and the wide range of treatment options available are driving market growth in the long term.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 6.2% |

The conjunctivitis market in Japan is growing due to the rising awareness of eye health, especially taking into Japan's increasing aging population, which is at a higher risk of contracting several eye infections. Allergic conjunctivitis Season conjunctivitis is very common in spring months.

MHLW is one of the several regulatory bodies that ensure that eye care products meet high standards. The marketplace can also benefit from the growing acceptance of self-care products as well as the rising availability of treatment for bacterial and allergic conjunctivitis.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.8% |

The South Korea conjunctivitis market growth is driven due to rising cases of eye allergies and viral infections. The demand for over-the-counter eye care products, especially eye drops and ointments, is increasing due to awareness campaigns and greater public health outreach.

The adoption of new eye care treatments in South Korea is immensely driven by high end healthcare infrastructure available in the country coupled with the emphasis put on preventive health by the country. The growth of the market is attributed to the high prevalence of conjunctivitis among children and young adults and the rising contact lens usage.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.0% |

The conjunctivitis treatment market is witnessing heightened competition, driven by growing demand for faster-acting, broad-spectrum therapies and improved drug delivery mechanisms. Key players are intensifying efforts in R&D to introduce next-generation antibiotics, antiviral formulations, and combination therapies that offer enhanced efficacy with minimal side effects.

There is a visible trend of companies entering strategic partnerships with biotech firms and research institutions to accelerate innovation pipelines and shorten time-to-market. In addition, several companies are expanding their product portfolios through regulatory approvals and acquisitions, targeting both prescription and over-the-counter segments. Digital engagement strategies and direct-to-consumer awareness campaigns are also gaining traction to build brand loyalty in an increasingly crowded marketplace.

Key Development

The overall market size for the conjunctivitis market was USD 2,043.7 million in 2025.

The conjunctivitis market is expected to reach USD 3,660.0 million in 2035.

Key drivers include the increasing prevalence of eye infections, allergic conjunctivitis, rising awareness about eye health and hygiene and the growing adoption of over-the-counter treatments.

The United States, China, India, Japan, and Germany are expected to be the top contributors, driven by large patient populations, increased healthcare access, and high adoption of treatment options.

The pharmaceutical treatment segment is expected to lead, driven by the demand for prescription eye drops and antibiotics.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Vernal Keratoconjunctivitis Market Size and Share Forecast Outlook 2025 to 2035

Epidemic Keratoconjunctivitis Treatment Market Overview – Growth, Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA