The global epidemic keratoconjunctivitis (EKC) treatment market is poised for steady growth as awareness of this highly contagious eye condition increases and healthcare systems worldwide strive to address it more effectively. EKC, often caused by adenovirus infections, can lead to significant discomfort, reduced vision, and even long-term ocular complications if left untreated.

The growing prevalence of EKC outbreaks and the demand for targeted therapies, such as antiviral agents, anti-inflammatory treatments, and innovative drug delivery systems, are fueling market expansion. Additionally, advancements in diagnostic methods and an increased focus on infection control measures are driving the development and adoption of more effective treatment options. As research efforts continue and more therapies reach the market, the EKC treatment landscape is expected to grow consistently through 2035.

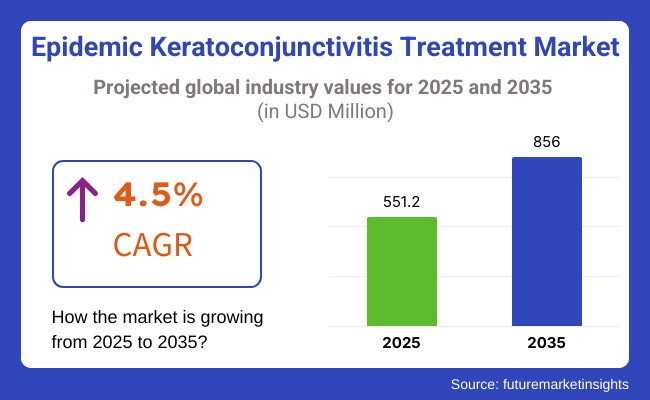

In 2025, the epidemic keratoconjunctivitis treatment market was valued at approximately USD 551.2 Million. By 2035, it is projected to grow to around USD 856.0 Million, reflecting a compound annual growth rate (CAGR) of 4.5%. This steady growth is driven by heightened awareness, improved diagnostic tools, and the ongoing development of more effective treatment options.

North America continues to dominate the EKC treatment market, backed by an advanced healthcare infrastructure, growing public awareness campaigns, and a high burden of adenoviral eye infections. Research and development of antiviral and anti-inflammatory therapies and diagnostic innovations are receiving increased investment in the United States and Canada.

The region’s increasing attention toward enhanced patient outcomes and reduced long-term complications are expected to further boost market growth.

Another critical market for EKC treatments is Europe, which is characterized by an established healthcare system, a substantial investment in research related to ophthalmology, and increasing awareness among both healthcare providers and patients. Leading nations in advanced diagnostic technologies and treatment protocols are Germany, the United Kingdom, and France. Focus on early diagnosis, preventive measures in addition to increased access to treatment support the regional market growth.

The Asia-Pacific is anticipated to be the fastest-growing market for EKC treatments due to a high incidence of viral eye infections, quickening healthcare infrastructure, and increasing public health initiative. The growing EKC treatment demand for more effective and accessible therapies is being seen in countries such as China, India, and Japan.

Challenges

Lack of Specific Antiviral Treatment, High Transmission Rates, and Diagnostic Limitations

One of the main challenges in the epidemic keratoconjunctivitis (EKC) treatment market is the absence of certain effective antiviral drugs that could be employed for the treatment of adenoviral infections (the causative agent for EKC). At present, management is focused on symptomatic relief (artificial tears, corticosteroids, and antiseptics), and there are no targeted antiviral therapies to date.

The high transmission rate of EKC is another challenge: the virus is highly contagious and KD occurs in hospitals, schools, and workplaces, making outbreaks very frequent. Moreover, limitations in diagnostics lead to misdiagnosis or a delay in treatment because the clinical manifestation of EKC is similar to those of other conjunctivitis, making it difficult to institute preventive measures.

Opportunities

Growth in Antiviral Drug Development, AI-Powered Diagnostics, and Preventive Therapeutics

The EKC treatment market is predicted to experience robust growth opportunities due to the development of antiviral drugs, AI-enabled diagnostics and preventive eye care solutions. Novel antiviral eye drops, immune-enhancing therapies, and nanoparticle carrier-based systems to deliver drugs also improve treatment outcomes.

Furthermore, AI-driven diagnostic aids are improving early detection and differential diagnosis, leading to quicker and more precise treatment choices. The increase in hygiene awareness campaigns, hospital infection control guidelines and vaccine research for adenoviral infections will continue to lower the prevalence of EKC and further boost demand for preventative treatments.

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with ophthalmic drug safety standards, hospital hygiene regulations, and over-the-counter (OTC) product approvals. |

| Consumer Trends | Demand for symptom-relief treatments, lubricating eye drops, and corticosteroid-based therapies. |

| Industry Adoption | High use of topical corticosteroids, artificial tears, and antiseptic eye solutions. |

| Supply Chain and Sourcing | Dependence on ophthalmic drug manufacturers and hospital infection control products. |

| Market Competition | Dominated by ophthalmic pharmaceutical companies, antiseptic eye care brands, and hospital hygiene product manufacturers. |

| Market Growth Drivers | Growth fueled by frequent outbreaks, high transmission rates, and increasing awareness of eye infections. |

| Sustainability and Environmental Impact | Moderate adoption of eco-friendly ophthalmic packaging and sustainable drug formulations. |

| Integration of Smart Technologies | Early adoption of digital ophthalmology tools, AI-assisted screening apps, and mobile health consultations. |

| Advancements in Ophthalmic Treatments | Development of combination therapies with corticosteroids and antiviral agents. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter clinical trials for antiviral eye drops, AI-based diagnostic validation, and infection prevention guidelines. |

| Consumer Trends | Growth in targeted antiviral treatments, AI-powered diagnostic solutions, and vaccine-based prevention strategies. |

| Industry Adoption | Expansion into biotech-driven antiviral therapies, RNA-based treatments, and AI-assisted conjunctivitis screening tools. |

| Supply Chain and Sourcing | Shift toward nanotechnology-based drug delivery, AI-assisted telemedicine solutions, and bioengineered antiviral molecules. |

| Market Competition | Entry of biotech firms specializing in antiviral ophthalmic treatments, AI-driven diagnostic startups, and vaccine developers. |

| Market Growth Drivers | Accelerated by next-gen antiviral eye drops, AI-based early detection, and smart drug delivery innovations. |

| Sustainability and Environmental Impact | Large-scale shift toward biodegradable eye drop containers, AI-powered treatment tracking, and green pharmaceutical manufacturing. |

| Integration of Smart Technologies | Expansion into AI-driven self-diagnosis for EKC, smart eye care wearables, and predictive analytics for outbreak monitoring. |

| Advancements in Ophthalmic Treatments | Evolution toward gene therapy-based antiviral solutions, targeted monoclonal antibodies, and long-lasting immune-boosting eye treatments. |

USA epidemic keratoconjunctivitis (EKC) treatment market is growing at a rapid pace owing to the growing awareness of viral eye infections coupled with the increasing number of cases of adenoviral conjunctivitis. Growing availability of advanced diagnostic techniques and clinical trials for antiviral therapies and supportive care solutions is driving the market growth.

Moreover, the growing presence of key pharmaceutical players in targeted EKC treatment development is accelerating industry growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.6% |

Across the United Kingdom, the EKC treatment market is growing, driven by increasing healthcare initiatives to improve eye disease management. Demand for effective antiviral drugs and lubricating eye drops is being propelled by the growing number of cases linked to adenoviral outbreaks, particularly in the hospitals and the public realm. The growing support for ophthalmic research and development by the government is also propelling the growth of the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.4% |

In the EU region, the EKC treatment market represents steady growth due to various government/public health bodies emphasizing viral conjunctivitis awareness along with prevention strategies. Over-the-counter (OTC) treatments including artificial tears, anti-inflammatory eye drops, and specialized antiviral formulations are making EKC management more accessible. Moreover, the growing investment on ophthalmic drug development is developing regulatory approval process in market.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 4.5% |

Japan EKC treatment market is growing moderately due to viral eye infections and developments in ophthalmic drugs along with increasing elderly population. The market growth can be attributed to the rising adoption of preservative free artificial tears & new antiviral eye drops. Moreover novel drug delivery systems such as nanotechnology-based eye drops are the need in the market and will help enhance the long-term market potential.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.4% |

The expansion of the EKC treatment market in South Korea will be driven by increasing investments in ophthalmic healthcare and the rising incidence of viral eye infections. Demand for EKC treatments is influenced by the availability of prescription and OTC eye drops, as well as increasing awareness of hygiene and infection control. Besides, government-driven technology initiatives and the rising availability of busts in tele ophthalmology solutions are augmenting the industry expansion.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.6% |

Due to the highly contagious viral disease that affects the cornea and conjunctiva, ophthalmologists and healthcare providers are showing increasing interest in developing effective EKC treatment platforms using antiviral and anti-inflammatory therapy which in turn is contributing towards the growth of epidemic keratoconjunctivitis (EKC) treatment market.

EKC, most frequently induced by adenoviral infections, results in conjunctival redness, swelling, irritation, and compromised vision, necessitating effective pharmacological therapeutics. Among the factors contributing to the growth are increasing cases of viral eye infections, advancements in ophthalmic drug formulations, and improved accessibility to topical treatments. The market could be segmented on the basis of Drug Class (Antihistamines, Anti-Inflammatory, and Corticosteroids) and Route of Administration (Topical, Oral).

By drug class, the corticosteroids segment accounted for the largest share of the antiviral market due to the efficacy of these drugs in producing strong anti-inflammatory effects to alleviate corneal damage, inflammation, and discomfort from EKC. In the case of severe keratoconjunctivitis, corticosteroids are routinely given to patients to treat the disease, prevent scarring and hasten recovery.

The rise in clinical research in ophthalmology and the advancement of corticosteroid eye drops and controlled-release formulations are spurring adoption. To help control significant inflammation, while keeping the risk of side effects like increased intraocular pressure (IOP) low, health care providers push for short-term use of corticosteroids.

The anti-inflammatory segment is also achieving healthy growth, especially in mild to moderate indirect cases of EKC. Anti-inflammatory drugs, including NSAIDs (nonsteroidal anti-inflammatory agents), reduce pain and irritation and swelling without the risk associated with the long-term use of corticosteroids. This is mainly driving demand for ophthalmic NSAIDs and novel anti-inflammatory agents. The growing trend in steroid sparing treatments has led to a significant increase in demand for such drug classes.

Segmentation by Product Type: The topical segment accounts for the highest share in the EKC treatment market, since eye drops and ophthalmic solutions provide targeted, rapid relief with low systemic absorption. Topical formulations such as corticosteroids, antihistamines, and NSAIDs are extensively used in ophthalmic clinics, hospitals, and OTC (over-the-counter) treatment for viral conjunctivitis.

Ongoing improvements of ocular drug delivery technologies drive manufacturers to facilitate easy patient compliance and maximize efficacy with preservative-free, extended-release, and nanoparticle-based eye drops. Market growth is also driven by the increasing adoption of combination therapies comprising antiviral and anti-inflammatory eye drops.

The oral component continues to be important, especially when managing systemic effects in patients with severe EKC, who are treated with oral anti-inflammatory agents and corticosteroids for long-lasting symptoms or secondary bacterial infections. Topical treatment is the primary route of administration, although oral drugs have been used as adjunctive therapy in cases of more severe or recurrent EKC.

The epidemic keratoconjunctivitis (EKC) treatment market is driving owing to the surging prevalence of adenoviral eye infections, increasing awareness of contagious eye diseases and development of the antiviral ophthalmic therapy market. Companies are working on AI-powered drug development, new antiviral formulations, and better patient compliance to improve treatment data, control infections, and relieve symptoms quickly.

As per the several types of market players, this group is consisted of pharmaceutical companies, ophthalmic drugs, and biopharmaceuticals, which allows developing technologies in EKC therapeutics, AI powered diagnostic and enhanced system of delivering antiviral to the market.

Market Share Analysis by Key Players & EKC Treatment Drug Manufacturers

| Company Name | Estimated Market Share (%) |

|---|---|

| Novartis AG (Alcon) | 18-22% |

| Bausch + Lomb (Bausch Health Companies Inc.) | 12-16% |

| Allergan (AbbVie Inc.) | 10-14% |

| Santen Pharmaceutical Co., Ltd. | 8-12% |

| Nicox S.A. | 5-9% |

| Other Ophthalmic Drug Manufacturers (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Novartis AG (Alcon) | Develops AI-optimized antiviral ophthalmic solutions, broad-spectrum lubricating eye drops, and targeted anti-inflammatory treatments for EKC. |

| Bausch + Lomb | Specializes in antiviral and lubricating eye drops, AI-powered infection tracking, and ocular surface protection solutions. |

| Allergan (AbbVie Inc.) | Provides advanced steroid-based EKC management, AI-assisted drug delivery, and infection-prevention eye care solutions. |

| Santen Pharmaceutical Co., Ltd. | Focuses on antiviral ophthalmic solutions, AI-driven tear film stabilization, and inflammation control medications. |

| Nicox S.A. | Offers ophthalmic anti-inflammatory therapies, AI-powered corneal health monitoring, and EKC symptom relief formulations. |

Key Market Insights

Novartis AG (Alcon) (18-22%)

Novartis leads the EKC treatment market, offering AI-powered antiviral drug research, ophthalmic formulations, and broad-spectrum inflammation control therapies.

Bausch & Lomb (12-16%)

Bausch & Lomb specializes in lubricating and anti-inflammatory eye drops, ensuring AI-driven infection control and rapid relief for EKC patients.

Allergan (AbbVie Inc.) (10-14%)

Allergan provides topical steroid-based EKC treatments, optimizing AI-assisted drug absorption and long-term corneal healing solutions.

Santen Pharmaceutical Co., Ltd. (8-12%)

Santen focuses on antiviral ophthalmic drugs, integrating AI-powered patient response tracking and tear film stabilization techniques.

Nicox S.A. (5-9%)

Nicox develops anti-inflammatory ophthalmic formulations, ensuring AI-driven EKC treatment personalization and enhanced ocular surface protection.

Other Key Players (30-40% Combined)

Several ophthalmic drug manufacturers, biotechnology firms, and specialty eye care companies contribute to next-generation EKC treatment innovations, AI-powered infection monitoring, and targeted antiviral therapies. These include:

The overall market size for the epidemic keratoconjunctivitis (EKC) treatment market was USD 551.2 Million in 2025.

The epidemic keratoconjunctivitis (EKC) Treatment market is expected to reach USD 856.0 Million in 2035.

The demand for the epidemic keratoconjunctivitis (EKC) treatment market is expected to rise due to the increasing prevalence of viral conjunctivitis, growing awareness about eye infections, advancements in antiviral drug formulations, and the rising adoption of corticosteroids and immunomodulators for effective symptom management. Additionally, expanding healthcare infrastructure and increasing ophthalmology consultations are further boosting market growth.

The top 5 countries driving the development of the epidemic keratoconjunctivitis (EKC) treatment market are the USA, Germany, Japan, China, and India.

Corticosteroids and Topical Administration are expected to command a significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Route of Administration, 2018 to 2033

Table 4: Global Market Value (US$ Million) Forecast by Distribution Channel , 2018 to 2033

Table 5: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Route of Administration, 2018 to 2033

Table 8: North America Market Value (US$ Million) Forecast by Distribution Channel , 2018 to 2033

Table 9: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: Latin America Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 11: Latin America Market Value (US$ Million) Forecast by Route of Administration, 2018 to 2033

Table 12: Latin America Market Value (US$ Million) Forecast by Distribution Channel , 2018 to 2033

Table 13: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Europe Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 15: Europe Market Value (US$ Million) Forecast by Route of Administration, 2018 to 2033

Table 16: Europe Market Value (US$ Million) Forecast by Distribution Channel , 2018 to 2033

Table 17: South Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: South Asia Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 19: South Asia Market Value (US$ Million) Forecast by Route of Administration, 2018 to 2033

Table 20: South Asia Market Value (US$ Million) Forecast by Distribution Channel , 2018 to 2033

Table 21: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: East Asia Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 23: East Asia Market Value (US$ Million) Forecast by Route of Administration, 2018 to 2033

Table 24: East Asia Market Value (US$ Million) Forecast by Distribution Channel , 2018 to 2033

Table 25: Oceania Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Oceania Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 27: Oceania Market Value (US$ Million) Forecast by Route of Administration, 2018 to 2033

Table 28: Oceania Market Value (US$ Million) Forecast by Distribution Channel , 2018 to 2033

Table 29: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 30: MEA Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 31: MEA Market Value (US$ Million) Forecast by Route of Administration, 2018 to 2033

Table 32: MEA Market Value (US$ Million) Forecast by Distribution Channel , 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Route of Administration, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Distribution Channel , 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 9: Global Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 10: Global Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 11: Global Market Value (US$ Million) Analysis by Route of Administration, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Route of Administration, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Route of Administration, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Distribution Channel , 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Distribution Channel , 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Distribution Channel , 2023 to 2033

Figure 17: Global Market Attractiveness by Drug Class, 2023 to 2033

Figure 18: Global Market Attractiveness by Route of Administration, 2023 to 2033

Figure 19: Global Market Attractiveness by Distribution Channel , 2023 to 2033

Figure 20: Global Market Attractiveness by Region, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 22: North America Market Value (US$ Million) by Route of Administration, 2023 to 2033

Figure 23: North America Market Value (US$ Million) by Distribution Channel , 2023 to 2033

Figure 24: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 25: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 26: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 27: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 28: North America Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 29: North America Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 30: North America Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 31: North America Market Value (US$ Million) Analysis by Route of Administration, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Route of Administration, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Route of Administration, 2023 to 2033

Figure 34: North America Market Value (US$ Million) Analysis by Distribution Channel , 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Distribution Channel , 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Distribution Channel , 2023 to 2033

Figure 37: North America Market Attractiveness by Drug Class, 2023 to 2033

Figure 38: North America Market Attractiveness by Route of Administration, 2023 to 2033

Figure 39: North America Market Attractiveness by Distribution Channel , 2023 to 2033

Figure 40: North America Market Attractiveness by Country, 2023 to 2033

Figure 41: Latin America Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 42: Latin America Market Value (US$ Million) by Route of Administration, 2023 to 2033

Figure 43: Latin America Market Value (US$ Million) by Distribution Channel , 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 45: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 49: Latin America Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 50: Latin America Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) Analysis by Route of Administration, 2018 to 2033

Figure 52: Latin America Market Value Share (%) and BPS Analysis by Route of Administration, 2023 to 2033

Figure 53: Latin America Market Y-o-Y Growth (%) Projections by Route of Administration, 2023 to 2033

Figure 54: Latin America Market Value (US$ Million) Analysis by Distribution Channel , 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Distribution Channel , 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Distribution Channel , 2023 to 2033

Figure 57: Latin America Market Attractiveness by Drug Class, 2023 to 2033

Figure 58: Latin America Market Attractiveness by Route of Administration, 2023 to 2033

Figure 59: Latin America Market Attractiveness by Distribution Channel , 2023 to 2033

Figure 60: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 61: Europe Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 62: Europe Market Value (US$ Million) by Route of Administration, 2023 to 2033

Figure 63: Europe Market Value (US$ Million) by Distribution Channel , 2023 to 2033

Figure 64: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 65: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 66: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 67: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 68: Europe Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 69: Europe Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 70: Europe Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 71: Europe Market Value (US$ Million) Analysis by Route of Administration, 2018 to 2033

Figure 72: Europe Market Value Share (%) and BPS Analysis by Route of Administration, 2023 to 2033

Figure 73: Europe Market Y-o-Y Growth (%) Projections by Route of Administration, 2023 to 2033

Figure 74: Europe Market Value (US$ Million) Analysis by Distribution Channel , 2018 to 2033

Figure 75: Europe Market Value Share (%) and BPS Analysis by Distribution Channel , 2023 to 2033

Figure 76: Europe Market Y-o-Y Growth (%) Projections by Distribution Channel , 2023 to 2033

Figure 77: Europe Market Attractiveness by Drug Class, 2023 to 2033

Figure 78: Europe Market Attractiveness by Route of Administration, 2023 to 2033

Figure 79: Europe Market Attractiveness by Distribution Channel , 2023 to 2033

Figure 80: Europe Market Attractiveness by Country, 2023 to 2033

Figure 81: South Asia Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 82: South Asia Market Value (US$ Million) by Route of Administration, 2023 to 2033

Figure 83: South Asia Market Value (US$ Million) by Distribution Channel , 2023 to 2033

Figure 84: South Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 85: South Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 86: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 87: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 88: South Asia Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 89: South Asia Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 90: South Asia Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 91: South Asia Market Value (US$ Million) Analysis by Route of Administration, 2018 to 2033

Figure 92: South Asia Market Value Share (%) and BPS Analysis by Route of Administration, 2023 to 2033

Figure 93: South Asia Market Y-o-Y Growth (%) Projections by Route of Administration, 2023 to 2033

Figure 94: South Asia Market Value (US$ Million) Analysis by Distribution Channel , 2018 to 2033

Figure 95: South Asia Market Value Share (%) and BPS Analysis by Distribution Channel , 2023 to 2033

Figure 96: South Asia Market Y-o-Y Growth (%) Projections by Distribution Channel , 2023 to 2033

Figure 97: South Asia Market Attractiveness by Drug Class, 2023 to 2033

Figure 98: South Asia Market Attractiveness by Route of Administration, 2023 to 2033

Figure 99: South Asia Market Attractiveness by Distribution Channel , 2023 to 2033

Figure 100: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 101: East Asia Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 102: East Asia Market Value (US$ Million) by Route of Administration, 2023 to 2033

Figure 103: East Asia Market Value (US$ Million) by Distribution Channel , 2023 to 2033

Figure 104: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 105: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 106: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 107: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 108: East Asia Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 109: East Asia Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 110: East Asia Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 111: East Asia Market Value (US$ Million) Analysis by Route of Administration, 2018 to 2033

Figure 112: East Asia Market Value Share (%) and BPS Analysis by Route of Administration, 2023 to 2033

Figure 113: East Asia Market Y-o-Y Growth (%) Projections by Route of Administration, 2023 to 2033

Figure 114: East Asia Market Value (US$ Million) Analysis by Distribution Channel , 2018 to 2033

Figure 115: East Asia Market Value Share (%) and BPS Analysis by Distribution Channel , 2023 to 2033

Figure 116: East Asia Market Y-o-Y Growth (%) Projections by Distribution Channel , 2023 to 2033

Figure 117: East Asia Market Attractiveness by Drug Class, 2023 to 2033

Figure 118: East Asia Market Attractiveness by Route of Administration, 2023 to 2033

Figure 119: East Asia Market Attractiveness by Distribution Channel , 2023 to 2033

Figure 120: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 121: Oceania Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 122: Oceania Market Value (US$ Million) by Route of Administration, 2023 to 2033

Figure 123: Oceania Market Value (US$ Million) by Distribution Channel , 2023 to 2033

Figure 124: Oceania Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: Oceania Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 127: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 128: Oceania Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 129: Oceania Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 130: Oceania Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 131: Oceania Market Value (US$ Million) Analysis by Route of Administration, 2018 to 2033

Figure 132: Oceania Market Value Share (%) and BPS Analysis by Route of Administration, 2023 to 2033

Figure 133: Oceania Market Y-o-Y Growth (%) Projections by Route of Administration, 2023 to 2033

Figure 134: Oceania Market Value (US$ Million) Analysis by Distribution Channel , 2018 to 2033

Figure 135: Oceania Market Value Share (%) and BPS Analysis by Distribution Channel , 2023 to 2033

Figure 136: Oceania Market Y-o-Y Growth (%) Projections by Distribution Channel , 2023 to 2033

Figure 137: Oceania Market Attractiveness by Drug Class, 2023 to 2033

Figure 138: Oceania Market Attractiveness by Route of Administration, 2023 to 2033

Figure 139: Oceania Market Attractiveness by Distribution Channel , 2023 to 2033

Figure 140: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 141: MEA Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 142: MEA Market Value (US$ Million) by Route of Administration, 2023 to 2033

Figure 143: MEA Market Value (US$ Million) by Distribution Channel , 2023 to 2033

Figure 144: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 145: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 146: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 147: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 148: MEA Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 149: MEA Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 150: MEA Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 151: MEA Market Value (US$ Million) Analysis by Route of Administration, 2018 to 2033

Figure 152: MEA Market Value Share (%) and BPS Analysis by Route of Administration, 2023 to 2033

Figure 153: MEA Market Y-o-Y Growth (%) Projections by Route of Administration, 2023 to 2033

Figure 154: MEA Market Value (US$ Million) Analysis by Distribution Channel , 2018 to 2033

Figure 155: MEA Market Value Share (%) and BPS Analysis by Distribution Channel , 2023 to 2033

Figure 156: MEA Market Y-o-Y Growth (%) Projections by Distribution Channel , 2023 to 2033

Figure 157: MEA Market Attractiveness by Drug Class, 2023 to 2033

Figure 158: MEA Market Attractiveness by Route of Administration, 2023 to 2033

Figure 159: MEA Market Attractiveness by Distribution Channel , 2023 to 2033

Figure 160: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Vernal Keratoconjunctivitis Market Size and Share Forecast Outlook 2025 to 2035

Treatment-Resistant Hypertension Management Market Size and Share Forecast Outlook 2025 to 2035

Treatment-Resistant Depression Treatment Market Size and Share Forecast Outlook 2025 to 2035

Treatment Pumps Market Insights Growth & Demand Forecast 2025 to 2035

Pretreatment Coatings Market Size and Share Forecast Outlook 2025 to 2035

Air Treatment Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

CNS Treatment and Therapy Market Insights - Trends & Growth Forecast 2025 to 2035

Seed Treatment Materials Market Size and Share Forecast Outlook 2025 to 2035

Acne Treatment Solutions Market Size and Share Forecast Outlook 2025 to 2035

Scar Treatment Market Overview - Growth & Demand Forecast 2025 to 2035

Soil Treatment Chemicals Market

Water Treatment Chemical Market Size and Share Forecast Outlook 2025 to 2035

Algae Treatment Chemical Market Forecast and Outlook 2025 to 2035

Water Treatment Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Equipment Market Size and Share Forecast Outlook 2025 to 2035

Burns Treatment Market Overview – Growth, Demand & Forecast 2025 to 2035

CRBSI Treatment Market Insights - Growth, Trends & Forecast 2025 to 2035

Water Treatment Polymers Market Growth & Demand 2025 to 2035

Water Treatment System Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA